Global Mixed Xylene Market Size, Share, And Business Benefit By Grade (Isomer Grade, Solvent Grade), By Application (Fuel Blending, Solvents, Thinners, Raw Material, Others), By End Use (Paints and Coatings, Pesticides, Chemicals, Gasoline, Printing, Rubber and Leather, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166995

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

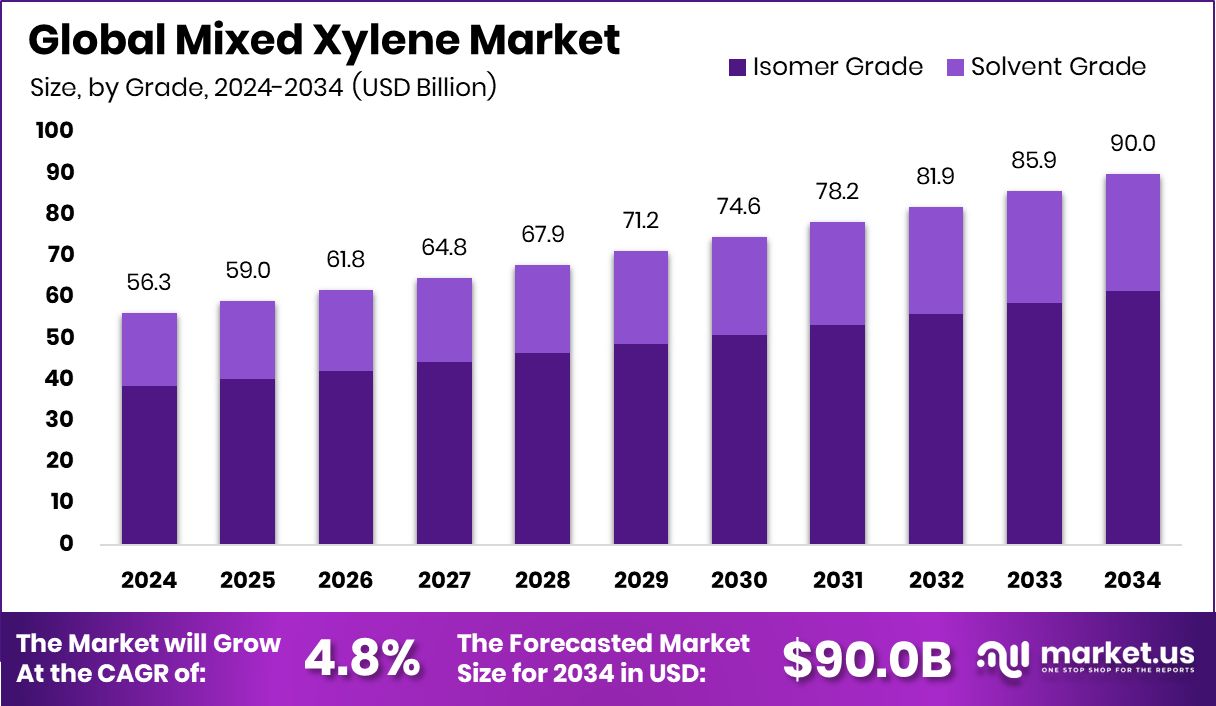

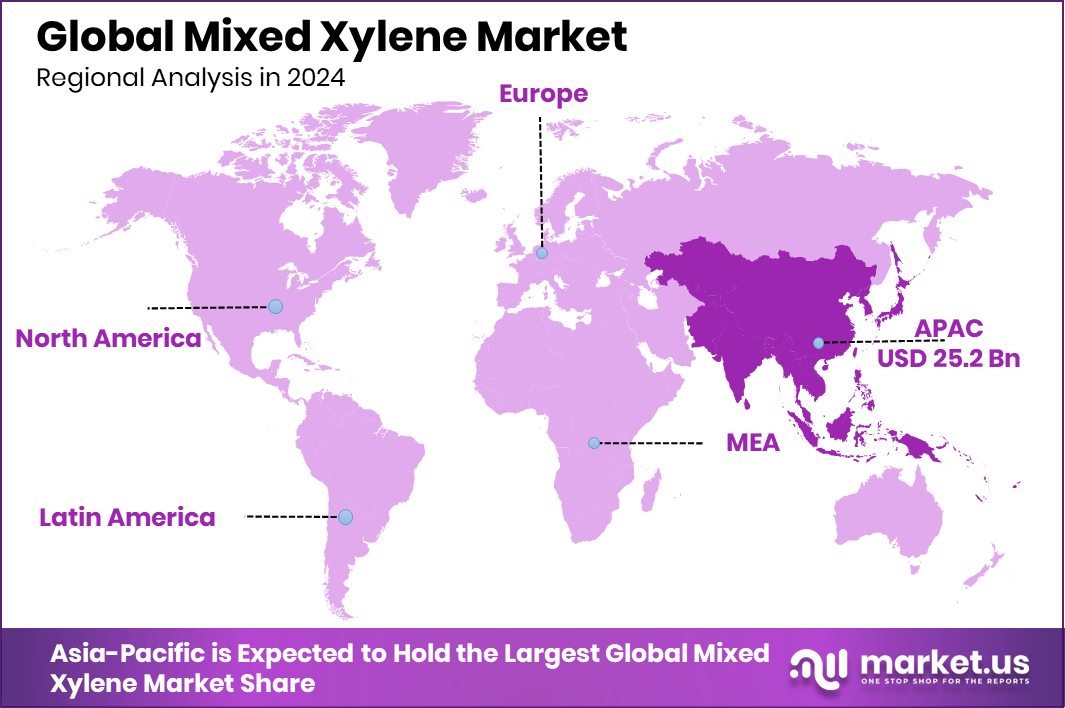

The global mixed xylene market is expected to be worth around USD 90.0 billion by 2034, up from USD 56.3 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. Expanding coatings demand keeps Asia-Pacific leading with 44.90% and USD 25.2 Bn.

Mixed xylene is a colourless, sweet-smelling blend of ortho, meta-, and para-xylene, along with small amounts of ethylbenzene. It is widely used as a solvent in paints, coatings, adhesives, and printing inks because it evaporates evenly and dissolves resins effectively. In industry, it also serves as a feedstock for manufacturing isomers and derivatives used in plastics, fibres, and chemical intermediates.

The mixed xylene market reflects the steady demand for high-performance solvents across construction, automotive refinishing, packaging inks, and industrial maintenance. Its role in producing downstream chemicals keeps the market linked to overall manufacturing activity and infrastructure growth. As industries move toward cleaner formulations and regulated solvent systems, mixed xylene remains important due to its consistency and compatibility.

Growth in this market is supported by rising construction and coating activities worldwide. The push toward new paint technologies also creates fresh demand. Recent funding, such as Ecoat securing €21 million, signals strong innovation in next-generation coatings, where solvent performance remains crucial.

Demand is further lifted by consolidation and investment in the coatings and speciality chemicals space. Moves like BASF advancing its €6 billion coatings division sale and Distil raising $7.7 million strengthen supply chains and expand solvent-based product portfolios.

Opportunities also emerge from strategic deals, such as Nippon Paint Holdings’ $2.3 billion agreement with AOC, reflecting broader investment momentum. These shifts create room for upgraded formulations, better solvent management, and higher-value applications that rely on consistent mixed xylene quality.

Key Takeaways

- The Global Mixed Xylene Market is expected to be worth around USD 90.0 billion by 2034, up from USD 56.3 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- In the mixed xylene market, isomer grade holds a 68.3% share due to high purity.

- In the mixed xylene market, solvents dominate with a 55.2% share across major industries.

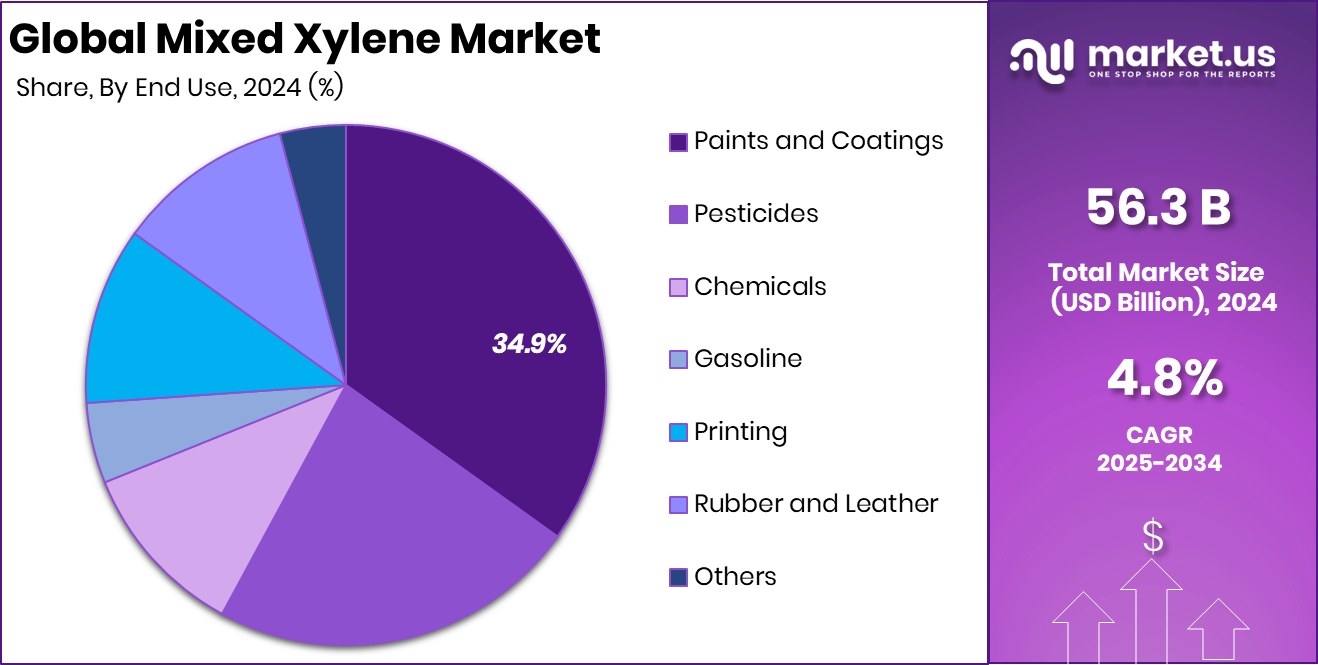

- In the mixed xylene market, paints and coatings lead with a 34.9% end-use share.

- Strong industrial growth in Asia-Pacific supports its 44.90% share worth USD 25.2 Bn.

By Grade Analysis

Isomer grade dominates the mixed xylene market with a strong 68.3% share.

In 2024, Isomer Grade held a dominant market position in the By Grade segment of the Mixed Xylene Market, with a 68.3% share. This grade remained the preferred choice because it supports large-scale production of downstream chemicals used across coatings, plastics, and industrial intermediates.

Its consistent purity, stable performance in solvent systems, and compatibility with high-volume manufacturing processes helped maintain its strong lead. Industries relying on reliable aromatic feedstocks continued to prioritise Isomer Grade as it ensures predictable output quality and smooth processing.

The dominance of this segment also reflects steady demand from sectors upgrading coating technologies and expanding speciality chemical capabilities, keeping Isomer Grade firmly positioned as the market’s primary growth driver.

By Application Analysis

Solvents lead the mixed xylene market with a 55.2% share globally.

In 2024, Solvents held a dominant market position in the By Application segment of the Mixed Xylene Market, with a 55.2% share. This leadership reflects the strong use of mixed xylene as a key solvent in paints, coatings, inks, and industrial cleaning formulations. Its ability to dissolve resins effectively and provide smooth evaporation profiles kept it central to manufacturing processes that require consistency and high-performance blending.

The segment’s dominance also aligns with the steady growth of construction, automotive refinishing, and packaging activities, all of which rely heavily on solvent-based systems. As industries continued to prioritise reliable aromatic solvents for formulation stability, the Solvents segment maintained its clear advantage in overall market demand.

By End Use Analysis

Paints and coatings hold a 34.9% share in the mixed xylene market.

In 2024, Paints and Coatings held a dominant market position in the By End Use segment of the Mixed Xylene Market, with a 34.9% share. This strong lead came from the continued reliance on mixed xylene as a primary solvent for achieving smooth film formation, controlled evaporation, and resin compatibility in coating formulations. Growing activities in construction, infrastructure upgrades, and industrial maintenance further strengthened its usage across decorative paints and protective coatings.

As manufacturers focused on performance consistency and reliable solvent properties, mixed xylene remained essential for producing high-quality finishes. This firm demand from paint and coating applications kept the segment at the forefront of overall market consumption during the year.

Key Market Segments

By Grade

- Isomer Grade

- Solvent Grade

By Application

- Fuel Blending

- Solvents

- Thinners

- Raw Material

- Others

By End Use

- Paints and Coatings

- Pesticides

- Chemicals

- Gasoline

- Printing

- Rubber and Leather

- Others

Driving Factors

Growing Demand from Agrochemicals Boosts Market Use

The Mixed Xylene Market is gaining momentum as agrochemical makers continue to expand production of crop protection products that rely on stable aromatic solvents. Mixed xylene plays a key role in helping formulators create uniform pesticide blends that spread well and remain effective in different field conditions. This demand is getting stronger as global investment in next-generation agricultural solutions rises.

Recent funding signals this shift clearly. BiocSol securing €5.2M in Seed funding to advance microbial pesticides shows how active the sector has become. Similarly, SOLASTA Bio raising £4M in Pre-Seed funding for nature-inspired pesticides highlights the steady push toward innovative, high-performance formulations. These developments indirectly support the continued use of mixed xylene in agrochemical processing and blending.

Restraining Factors

Rising Shift Toward Safer Formulations Limits Growth

The Mixed Xylene Market faces restrictions as many industries move toward safer and lower-emission formulations. Stricter rules on volatile organic compounds are encouraging paint, coating, and agrochemical makers to explore alternatives that reduce environmental and worker exposure risks. This shift is becoming more visible as digital platforms and new supply-chain models make it easier for farmers and small manufacturers to access modern inputs.

A recent example is India’s Agrim raising $17.3M to help farmers source seeds and pesticides more efficiently. Such funding accelerates the adoption of newer, cleaner products, which can gradually reduce the demand for traditional mixed xylene–based formulations.

Growth Opportunity

Rising Need for Cleaner Agrochemicals Creates Opportunity

The Mixed Xylene Market is seeing a fresh opportunity as the agrochemical sector pushes for better, more efficient formulations to address environmental concerns. Mixed xylene remains valuable in producing stable pesticide blends that spread evenly and maintain performance in challenging conditions. This opportunity is strengthened by growing public-sector funding aimed at improving environmental quality.

Recent support, such as nearly $1.5M in EPA grants awarded to FSU researchers to study pollution in South Florida waterways, shows how seriously regulators view chemical impacts. At the same time, Brazil’s tax exemptions on pesticides worth US$2.2 billion per year keep demand strong for agrochemical production. These combined forces create space for improved mixed xylene–based solutions that meet both performance and compliance needs.

Latest Trends

Growing Shift Toward Bio-Based Crop Solutions Emerges

A key trend shaping the Mixed Xylene Market is the steady shift toward bio-based and nature-derived crop protection solutions. While mixed xylene continues to play a major role in pesticide formulations, the sector is exploring cleaner technologies that pair traditional solvents with improved, environmentally conscious actives. This momentum is visible in the funding landscape, where innovation in natural alternatives is accelerating quickly.

A strong example is the significant $116 million raised by AgBiome, a startup developing natural pesticide solutions. Such investment signals how fast the agricultural industry is evolving toward eco-friendly and performance-driven options. As these solutions scale, mixed xylene’s role adapts toward supporting more advanced, stable, and targeted formulations aligned with modern farming needs.

Regional Analysis

Asia-Pacific holds 44.90% of the Mixed Xylene Market, reaching USD 25.2 Bn.

Asia-Pacific dominated the Mixed Xylene Market with a strong 44.90% share, valued at USD 25.2 Bn, reflecting the region’s expanding coatings, construction, and chemical manufacturing base. This leadership is supported by steady industrial output and continuous investment in downstream aromatic applications. Strong demand from paints, solvents, and resin processing keeps Asia-Pacific firmly positioned as the primary growth hub within the global landscape.

North America shows stable consumption driven by industrial maintenance, automotive refinishing, and steady adoption of high-performance coating systems. Its mature manufacturing ecosystem supports consistent use of mixed xylene in speciality chemical formulations. Europe follows with demand anchored in regulated solvent systems, where producers focus on balanced usage aligned with environmental compliance and advanced coating technologies.

In the Middle East & Africa, refinery expansions and growing petrochemical activity contribute to moderate demand, particularly in solvent blending and regional construction segments. Latin America maintains steady use supported by agricultural and industrial applications, where mixed xylene remains relevant in coatings and agrochemical processing. Across all regions, the market structure reflects Asia-Pacific’s clear dominance, while other regions continue to show stable, application-driven consumption patterns in line with their manufacturing and infrastructure needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ExxonMobil Corporation continued to play a significant role in the global Mixed Xylene Market due to its strong aromatics production network and integrated refining assets. The company’s large-scale manufacturing capability supports stable volumes of mixed xylene used across coatings, solvents, and chemical intermediates. Its ongoing focus on operational efficiency and value-chain integration helped maintain a consistent supply to downstream users.

Shell plc remained another important participant with its established presence in aromatics and solvent-grade hydrocarbons. Shell’s strategy of optimising refinery output and enhancing energy-efficient operations contributed to the reliable production of mixed xylene. The company’s emphasis on cleaner processes and balanced product portfolios aligned with shifting demand in regulated solvent applications, ensuring steady engagement in the market.

Reliance Industries Ltd. strengthened its position through its world-scale petrochemical complexes, which provide competitive production of aromatics, including mixed xylene. Its fully integrated operations—from refining to downstream chemicals—allow efficient cost structures and high output flexibility. The company’s strong domestic demand base and export capability support its relevance in global supply chains.

Top Key Players in the Market

- ExxonMobil Corporation

- Shell plc

- Reliance Industries Ltd.

- Total Energies SE

- BASF SE

- Chevron Phillips Chemical Company LLC

- China National Petroleum Corporation (CNPC)

- Formosa Chemicals & Fibre Corp.

- Sinopec Corporation

- Idemitsu Kosan Co., Ltd.

Recent Developments

- In March 2025, Shell announced it is formulating a strategy to sell parts of its chemicals business in Europe and the United States, including its chemical assets base, to sharpen its focus on its core petroleum operations.

- In October 2024, RIL raised the selling price of mixed xylene for its domestic market in India. This indicates the company is actively managing its mixed-xylene output and market supply.

Report Scope

Report Features Description Market Value (2024) USD 56.3 Billion Forecast Revenue (2034) USD 90.0 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Isomer Grade, Solvent Grade), By Application (Fuel Blending, Solvents, Thinners, Raw Material, Others), By End Use (Paints and Coatings, Pesticides, Chemicals, Gasoline, Printing, Rubber and Leather, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ExxonMobil Corporation, Shell plc, Reliance Industries Ltd., Total Energies SE, BASF SE, Chevron Phillips Chemical Company LLC, China National Petroleum Corporation (CNPC), Formosa Chemicals & Fibre Corp., Sinopec Corporation, Idemitsu Kosan Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ExxonMobil Corporation

- Shell plc

- Reliance Industries Ltd.

- Total Energies SE

- BASF SE

- Chevron Phillips Chemical Company LLC

- China National Petroleum Corporation (CNPC)

- Formosa Chemicals & Fibre Corp.

- Sinopec Corporation

- Idemitsu Kosan Co., Ltd.