Global Mining Chemicals Market Size, Share, And Business Benefits By Product Type (Grinding Aids, Frothers, Flocculants, Collectors, Solvent Extractants), By Mineral Type (Base Metals, Non-Metallic Minerals, Precious Metals, Rare Earth Metals), By Application (Mineral Processing, Explosives and Drilling, Water and Wastewater Treatment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151263

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

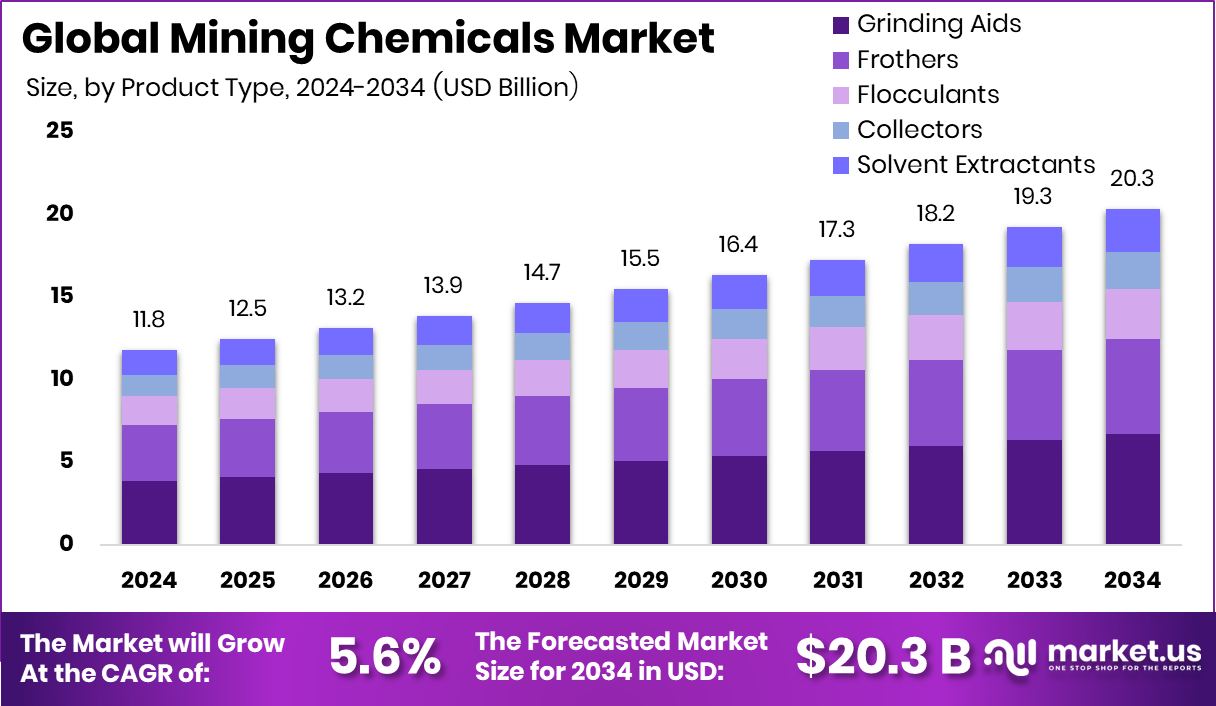

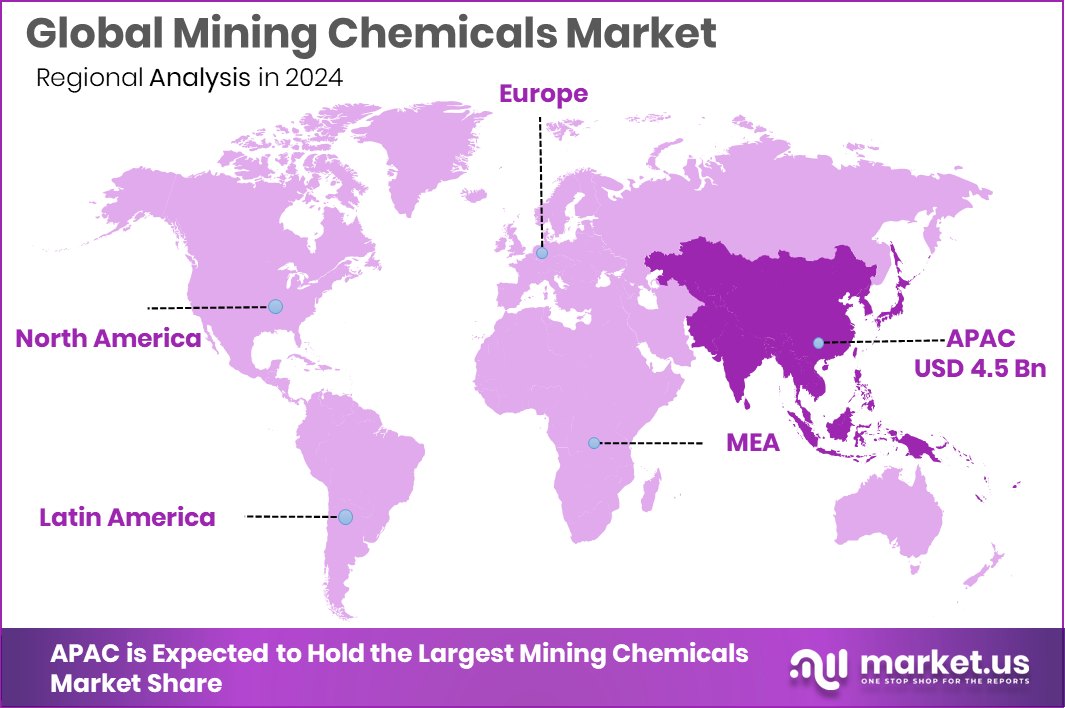

The Global Mining Chemicals Market is expected to be worth around USD 20.3 billion by 2034, up from USD 11.8 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034. Strong mining activity in Asia-Pacific supports its USD 4.5 billion market value.

Mining chemicals are specialized substances used in various stages of mining operations to improve efficiency, recovery rates, and overall productivity. These chemicals include reagents for mineral processing, such as collectors, frothers, flocculants, and depressants, as well as explosives, solvents, and pH regulators. Their main role is to facilitate the separation of valuable minerals from ores and to streamline processes like extraction, flotation, and leaching.

The mining chemicals market refers to the industry and trade of chemicals specifically developed for mining operations. This market serves a critical function in the global mining ecosystem, supplying products that support mineral extraction and metal purification. According to industry report, Michigan lawmakers approve $247M in subsidies, exclude copper mine funding.

Several factors are fueling the growth of the mining chemicals market. These include rising global demand for metals and minerals driven by industrialization, urban development, and the growth of renewable energy technologies. As mines become deeper and ore grades decline, the need for advanced chemical solutions increases, pushing innovation and market expansion. According to an industry report, Michigan legislature backs $300M aid package, drops copper mine support.

Demand for mining chemicals is steadily rising due to the increasing complexity of ore bodies and the need for more effective extraction techniques. Industries such as construction, automotive, and electronics rely heavily on mined resources, which indirectly stimulates the chemical demand. According to an industry report, Australia’s Orica finalizes $640M acquisition of U.S.-based chemical maker Cyanco.

Key Takeaways

- The Global Mining Chemicals Market is expected to be worth around USD 20.3 billion by 2034, up from USD 11.8 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034.

- Grinding aids hold a 32.9% share in the mining chemicals market, enhancing ore processing efficiency.

- Base metals drive 43.7% of the mining chemicals market demand due to industrial and manufacturing growth.

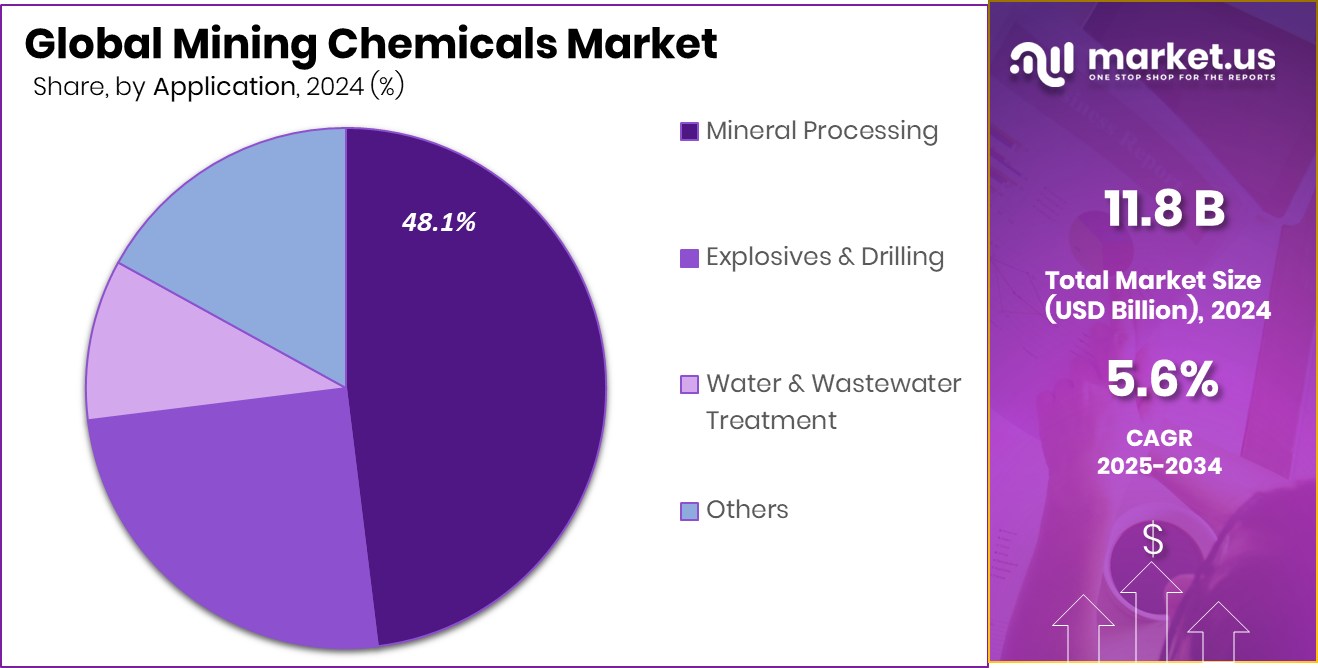

- Mineral processing leads with a 48.1% share, reflecting its core role in mining chemical applications.

- Asia-Pacific dominated globally, holding a significant 38.3% share of the total market.

By Product Type Analysis

Grinding aids hold a 32.9% share in the Mining Chemicals Market segment.

In 2024, Grinding Aids held a dominant market position in the By Product Type segment of the Mining Chemicals Market, with a 32.9% share. This significant share highlights the crucial role grinding aids play in enhancing the efficiency of the grinding process, which is a key step in mineral processing. Grinding aids are commonly used to reduce energy consumption, improve mill performance, and increase throughput, which contributes directly to cost savings and operational efficiency in mining operations.

The widespread adoption of grinding aids can be attributed to their ability to minimize agglomeration of particles and improve the flow characteristics of the material being processed. This helps in achieving finer grind sizes, which are essential for better mineral liberation and downstream recovery processes. The high share also reflects growing awareness and adoption of these products in both developing and mature mining regions.

Furthermore, as ore grades continue to decline globally, mining companies are increasingly relying on chemical solutions like grinding aids to maintain productivity. The focus on cost optimization and process improvement across the mining industry further supports the dominance of this segment.

By Mineral Type Analysis

Base metals dominate with 43.7% in the Mining Chemicals Market by mineral type.

In 2024, Base Metals held a dominant market position in the By Mineral Type segment of the Mining Chemicals Market, with a 43.7% share. This strong market presence highlights the continued importance of base metals such as copper, zinc, lead, and nickel, which are essential for a wide range of industrial applications, including construction, electrical infrastructure, and manufacturing.

The high demand for base metals has sustained mining activity across various regions, thereby driving the consumption of mining chemicals tailored for their extraction and processing. Chemicals used in base metal mining are critical in facilitating processes such as flotation, leaching, and tailing treatment, all of which contribute to improving metal recovery rates and ensuring cost-effective operations. The 43.7% share underscores the scale and consistency of these operations in the global mining landscape.

Moreover, the dominance of base metals in the market reflects their foundational role in supporting economic development and technological progress. As industries continue to depend heavily on these materials, the demand for efficient chemical solutions to optimize their production remains strong.

By Application Analysis

Mineral processing accounts for 48.1% in the Mining Chemicals Market application segment.

In 2024, Mineral Processing held a dominant market position in the By Application segment of the Mining Chemicals Market, with a 48.1% share. This leading position emphasizes the central role of mineral processing in the overall mining operation, where chemicals are extensively used to separate valuable minerals from the ore. The significant share reflects the high volume and consistent demand for reagents such as collectors, frothers, flocculants, and dispersants used in this stage.

Mineral processing involves critical steps like flotation, concentration, and separation, where chemical efficiency directly impacts recovery rates and overall output quality. The 48.1% share indicates that nearly half of the mining chemicals consumption is centered around these processes, underlining their operational importance across global mining sites.

The dominance of mineral processing is also tied to its role in maximizing yield from declining ore grades, a growing concern in the industry. As mining operations face increasing pressure to improve efficiency and reduce waste, the use of effective chemical solutions during mineral processing becomes even more essential.

Key Market Segments

By Product Type

- Grinding Aids

- Frothers

- Flocculants

- Collectors

- Solvent Extractants

By Mineral Type

- Base Metals

- Non-Metallic Minerals

- Precious Metals

- Rare Earth Metals

By Application

- Mineral Processing

- Explosives and Drilling

- Water and Wastewater Treatment

- Others

Driving Factors

Rising Demand for Metals in Key Industries

One of the main driving factors for the mining chemicals market is the growing demand for metals across various industries. Sectors such as construction, transportation, electronics, and energy rely heavily on metals like copper, aluminum, and zinc. As urbanization continues and infrastructure projects expand globally, the need for raw materials increases.

This creates more mining activities, which in turn boost the demand for mining chemicals used to extract and process these metals efficiently. Additionally, the shift towards renewable energy technologies, including electric vehicles and solar panels, also requires more metals. To keep up with this rising demand, mining companies depend on chemical solutions that improve productivity, reduce waste, and ensure higher recovery of valuable minerals.

Restraining Factors

Strict Environmental Rules Limit Chemical Usage Scope

A major restraining factor for the mining chemicals market is the increasing pressure from environmental regulations. Many countries are enforcing strict rules to limit the use of harmful or toxic chemicals in mining operations. These regulations are aimed at reducing pollution, protecting ecosystems, and ensuring the safety of workers and nearby communities.

As a result, mining companies often face challenges in using certain chemical products, which can slow down operations or require costly changes to processes. Companies may need to invest in safer alternatives or treatment systems to meet compliance standards.

Growth Opportunity

Booming Demand for Eco-Friendly Mining Chemical Solutions

The biggest growth opportunity in the mining chemicals market lies in eco-friendly, biodegradable, and non-toxic chemical formulations. As environmental awareness grows and regulations become stricter, mining companies are under increasing pressure to reduce their ecological footprint. By developing and supplying greener alternatives, chemical providers can fulfill this critical need. These sustainable products can help mining firms minimize water pollution, soil contamination, and harmful by‑products during extraction and processing.

Additionally, companies that adopt cleaner chemicals often gain a positive reputation, opening doors to new contracts and markets. With both regulators and customers now favoring environmentally responsible solutions, suppliers who pivot quickly to offer safe, high-performing eco-chemicals are likely to experience strong demand, giving this segment robust growth potential.

Latest Trends

Digital Automation and IoT Revolutionize Mining Chemical Use

One of the most noteworthy trends in the mining chemicals market is the integration of digital technologies—like IoT, real-time data monitoring, and automation—directly into chemical application processes. Sensors now monitor chemical dosing, slurry properties, and environmental conditions in real time, enabling more precise adjustments and reducing waste.

This digitalization not only improves recovery rates and process efficiency but also enhances safety and compliance by flagging deviations early. As mines evolve toward automation and smart operations, chemical suppliers are responding with smart-compatible products and systems.

Regional Analysis

In Asia-Pacific, the mining chemicals market reached USD 4.5 billion in 2024.

In 2024, the Asia‑Pacific region emerged as the dominant force in the Mining Chemicals Market, capturing a commanding 38.3% share, which translates to an impressive USD 4.5 billion in market value. This robust performance reflects the region’s intensifying mining activities, driven by rapid industrialization and growing demand for minerals across countries such as China, India, and Australia.

The sizeable investment in expansion and modernization of mining infrastructure in these nations directly fuels the consumption of mining chemicals designed for extraction, processing, and waste management.

Although specific data for North America, Europe, the Middle East & Africa, and Latin America were not provided, these regions continue contributing to the global market through established mining industries and ongoing resource development.

North America maintains consistent demand linked to mineral-rich operations, while Europe focuses on efficiency and regulatory-compliant chemical solutions. The Middle East & Africa and Latin America cater to local and export markets, leveraging their abundant natural reserves.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global mining chemicals market observed strong contributions from key players such as AECI Mining Chemicals, BASF SE, Ashland, and Dow. These companies have continued to influence the industry with a focus on performance-driven chemical solutions, innovation in formulations, and enhanced supply chain capabilities.

AECI Mining Chemicals maintained its presence through specialized mining solutions tailored to various mineral processing needs. The company’s product adaptability and operational focus in mining-intensive regions allowed it to remain relevant in both mature and emerging markets. Its regional customization and on-ground technical support helped strengthen its market positioning.

BASF SE leveraged its global reach and R&D strength to deliver efficient and environmentally conscious mining chemical solutions. Its emphasis on sustainable product development and partnerships with mining firms supported its standing in key markets, particularly in Asia-Pacific and South America, where demand for greener chemicals is growing.

Ashland offered a more niche yet effective range of mining chemicals, focusing on value-added specialty solutions. Its continued focus on product performance and customer-specific applications allowed it to sustain demand, especially where precision and efficiency were prioritized in mining operations.

Dow contributed through its broad chemical expertise and technical services. Its well-established infrastructure and integration across chemical segments gave it a strategic edge in providing comprehensive mining solutions that enhanced both productivity and environmental compliance.

Top Key Players in the Market

- AECI Mining Chemicals

- BASF SE

- Ashland

- Dow

- Kimleigh Chemicals SA (Pty) Ltd

- Arkema

- Clariant

- Nowata

- Kemira

- Shell Chemicals

- Quaker Chemical Corporation

- Akzo Nobel N.V.

- Solenis

- Sasol

Recent Developments

- In September 2024, Dow reported a significant unplanned shutdown at its Texas ethylene cracker, impacting chemical supply chains, including raw materials used in mining reagents. While revenue was affected, the company emphasized improved pricing and efficiency in North America to stabilize supplies for key chemical segments.

- In July 2024, BASF reached an agreement for Solenis to buy its flocculants line used in mining applications. This included well-known brands such as Magnafloc®, Rheomax®, Alclar®, Alcotac®, Jetwet®, Aerowet®, and Alcotech®. BASF made this move to simplify its business focus and concentrate on core areas like flotation and solvent extraction products.

Report Scope

Report Features Description Market Value (2024) USD 11.8 Billion Forecast Revenue (2034) USD 20.3 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Grinding Aids, Frothers, Flocculants, Collectors, Solvent Extractants), By Mineral Type (Base Metals, Non-Metallic Minerals, Precious Metals, Rare Earth Metals), By Application (Mineral Processing, Explosives and Drilling, Water and Wastewater Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AECI Mining Chemicals, BASF SE, Ashland, Dow, Kimleigh Chemicals SA (Pty) Ltd, Arkema, Clariant, Nowata, Kemira, Shell Chemicals, Quaker Chemical Corporation, Akzo Nobel N.V., Solenis, Sasol Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AECI Mining Chemicals

- BASF SE

- Ashland

- Dow

- Kimleigh Chemicals SA (Pty) Ltd

- Arkema

- Clariant

- Nowata

- Kemira

- Shell Chemicals

- Quaker Chemical Corporation

- Akzo Nobel N.V.

- Solenis

- Sasol