Global Milking Automation Market Size, Share Analysis Report By Offering (Hardware, Software, and Services), By System Type (Fully Automatic Milking Systems and Automatic Milking Parlors), By Farm Type (Dairy Cattle Farms and Goat And Sheep Dairy Farms), By Farm Size (Small Farms, Medium Farms, and Large Farms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169033

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

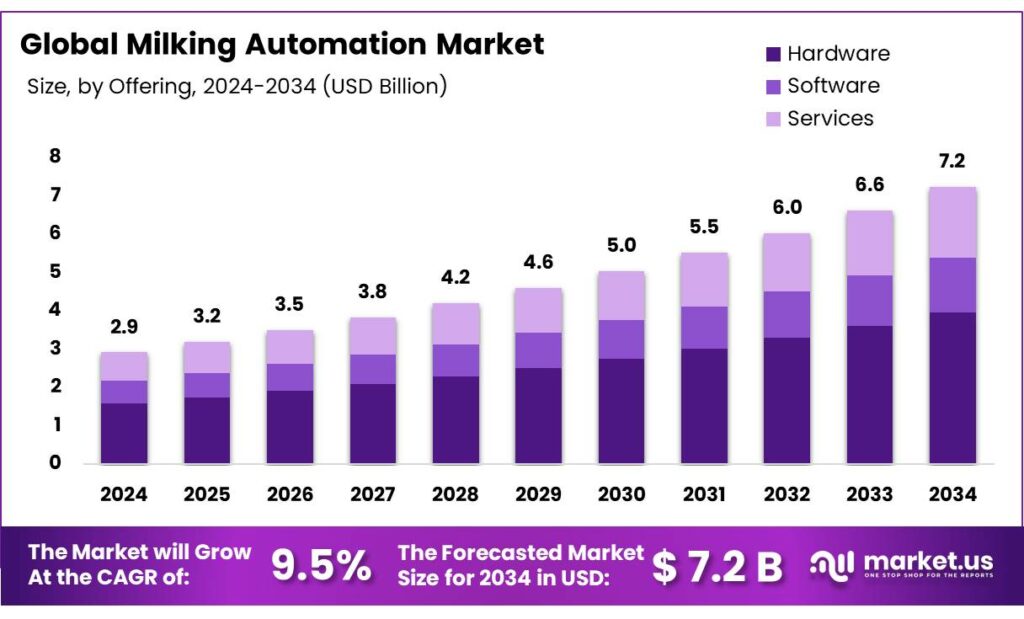

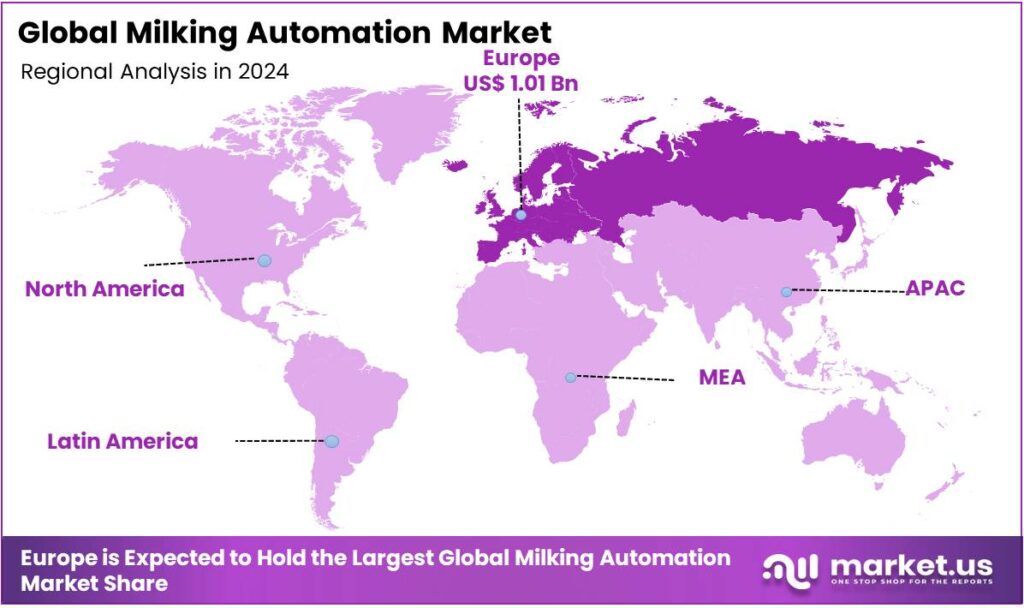

The Global Milking Automation Market size is expected to be worth around USD 7.2 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 34.5% share, holding USD 1.01 Billion revenue.

Milking automation, known as automatic milking systems (AMS) or robotic milking, is the use of robotic technology to milk dairy animals without human labor. In milking automation systems, cows voluntarily approach a robotic unit when they choose, and the machine automatically washes the udder, attaches the milking cups, and milks the cow. The milking automation market has seen significant growth, driven by the need for greater efficiency, reduced labor costs, and improved productivity in dairy farming. Automation systems, such as robotic milking machines, allow farmers to milk cows on demand, reducing reliance on manual labor and optimizing milking schedules.

Larger dairy farms are particularly well-suited to these systems, as they can substantiate the high initial investment through increased milk production and reduced operational costs. However, small and medium-sized farms may face challenges due to the upfront cost, making it harder to adopt such technologies. While hardware components dominate the market, data integration for predictive analysis is becoming increasingly important, allowing farmers to monitor cow health and optimize milk yield. Despite these hurdles, the demand for milking automation is expected to continue growing, particularly in regions with large dairy industries.

- The global milk production reached approximately 782 million tons of milk in 2023, with cow’s milk accounting for 81.1% of total milk production. More than 80% of the world’s population, approximately 6.5 billion people, regularly consume milk or dairy products, underscoring dairy’s universal appeal and nutritional value.

- In 2023, there were an estimated 133 million dairy farms worldwide, supporting the livelihoods of over 600 million people, including 80 million women, with around 37 million women heading their own farms. Additionally, approximately 9% of global milk production is traded internationally each year.

Key Takeaways

- The global milking automation market was valued at USD 2.9 Billion in 2024.

- The global milking automation market is projected to grow at a CAGR of 9.5% and is estimated to reach USD 7.2 billion by 2034.

- On the basis of offerings, hardware dominated the milking automation market, constituting 54.6% of the total market share.

- Based on the system type of milking automation, fully automatic milking systems dominated the market, with a substantial market share of around 56.1%.

- Based on the farm size, large farms led the milking automation market, comprising 42.3% of the total market.

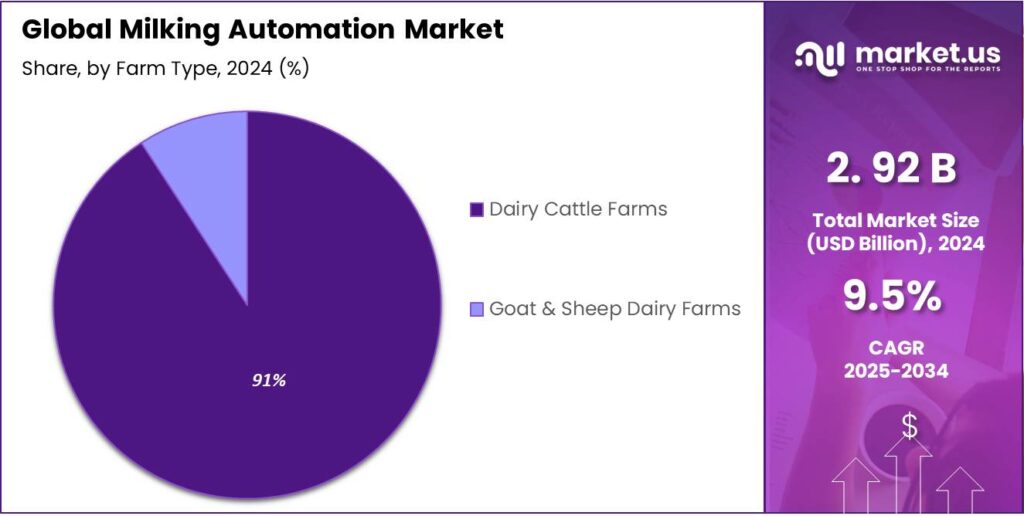

- Among the farm types, dairy cattle farms held a major share in the milking automation market, 90.8% of the market share.

- In 2024, Europe was the most dominant region in the milking automation market, accounting for 34.5% of the total global consumption.

Offering Analysis

Hardware Components of Milking Automation are a Prominent Segment in the Market.

The milking automation market is segmented based on offerings into hardware, software, and services. The hardware components of milking automation led the market, comprising 54.6% of the market share. The hardware components of milking automation systems tend to be more widely used than software or services due to the fundamental need for physical equipment to perform the core tasks of milking, monitoring, and processing.

Automated milking machines, robotic arms, sensors, and conveyors are essential for actually milking cows, collecting milk, and tracking herd health. These hardware components directly impact the efficiency, productivity, and consistency of milking operations. While software and services, such as herd management tools and data analytics, enhance the system’s performance, they are often viewed as secondary to the physical infrastructure required for day-to-day operations. Additionally, the upfront cost and complexity of hardware installation are more immediately tangible to farmers, making them the primary investment. Software and services are valuable, however, often perceived as ongoing enhancements or upgrades rather than essential components.

System Type Analysis

Fully Automatic Milking Systems Dominated the Milking Automation Market.

On the basis of the system type, the milking automation market is segmented into fully automatic milking systems and automatic milking parlors. The fully automatic milking systems dominated the milking automation market, comprising 56.1% of the market share, as they offer greater flexibility, efficiency, and scalability for dairy farmers. Unlike automatic milking parlors, which require cows to be herded into a fixed milking line at scheduled times, fully automatic systems allow cows to be milked individually at their own pace and on demand. This reduces the need for human intervention and allows farmers to operate with fewer labor hours.

Additionally, the fully automated systems can be integrated with advanced monitoring tools to track cow health, milk quality, and production patterns, offering a more data-driven approach to herd management. Similarly, fully automatic systems are better suited to smaller and more diverse farms, where flexibility and cost-effectiveness are key, while automatic milking parlors are often better suited to larger, high-output operations with more standardized milking schedules.

Farm Type Analysis

Milking Automation Are Mostly Utilized in Dairy Cattle Farms.

Based on the farm types, the milking automation market is divided into dairy cattle farms and goat & sheep dairy farms. Dairy cattle farms dominated the market, with a notable market share of 90.8%. Milking automation systems are more commonly used in dairy cattle farms than in goat and sheep dairy farms, primarily due to differences in herd size, milking frequency, and the scale of operations. Dairy cattle farms often have larger herds, making automation a more cost-effective and labor-saving solution.

- The global cattle population was approximately 1.576 billion in 2023, a steady increase from about 1.427 billion in 2012.

In contrast, goat and sheep dairy farms tend to have smaller herds, which may not produce enough milk to offset the high costs of automation. Additionally, the physical differences in the size and shape of goats and sheep compared to cows make designing and implementing automated milking systems more challenging. Similarly, the more variable and less standardized milking behavior of smaller animals makes automation less practical and less reliable for smaller-scale dairy operations.

Farm Size Analysis

Large Farms Held a Major Share of the Milking Automation Market.

Among the farm sizes, 42.3% of the total global consumption of milking automation is utilized for large farms. Milking automation systems are more commonly used in large farms than in small or medium-sized farms due to the high upfront cost and the scale of benefits they provide. Large farms with higher herd sizes and greater milk production volumes can more easily justify the high initial investment in automated systems, as these systems improve efficiency and reduce labor costs over time.

Additionally, automation can help large farms manage milking schedules more effectively, optimize milk yield, and maintain consistent quality, making it a crucial tool for large-scale operations. In contrast, smaller farms with fewer cows may not see the same return on investment, as the costs of installation, maintenance, and operation might outweigh the benefits. Similarly, smaller farms often have more manageable labor requirements and may not face the same labor shortages or productivity challenges that larger farms do, making automation less essential.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By System Type

- Fully Automatic Milking Systems

- Automatic Milking Parlors

By Farm Type

- Dairy Cattle Farms

- Goat & Sheep Dairy Farms

By Farm Size

- Small Farms

- Medium Farms

- Large Farms

Drivers

Labor Shortages and Reduced Labor Costs Drive the Milking Automation Market.

Labor shortages and the rising costs of manual labor are significant drivers of the milking automation market, as farmers and dairy operations seek more efficient, cost-effective solutions.

- According to the US Department of Agriculture, on average, labor costs (including contract labor, hired labor, and worker benefits, such as insurance) accounted for about 13% of total farm cash expenses in 2022. Furthermore, by 2030, it is predicted that there will be a global talent and labor shortage of around 85 million people, resulting in revenue losses of approximately US$8.5 trillion across every industry.

With a shrinking workforce in rural areas and the increasing difficulty of enticing workers to physically demanding farm tasks, automated milking systems offer a solution to maintain productivity while reducing reliance on human labor. For instance, robotic milking machines that work without human intervention have become particularly popular in regions facing labor shortages.

These systems reduce the need for staff and optimize the milking process, improving milk yield and quality. In addition to labor savings, automation helps address issues such as inconsistent milking schedules and human error, leading to better animal welfare and higher overall efficiency. In countries such as the Netherlands and New Zealand, dairy farmers have increasingly adopted automation to counteract these challenges and streamline operations.

Restraints

High Initial Investment Costs Might Pose a Challenge to the Milking Automation Market.

One of the major challenges facing the milking automation market is the high initial investment required for advanced systems. Automated milking machines, robotic arms, and data integration technologies can be costly, with prices often exceeding hundreds of thousands of dollars for a full installation.

- For instance, according to a study by the Iowa State University Extension and Outreach, automatic milking systems (AMS) are very expensive, with initial costs averaging around US$200,000 per robot.

For several smaller or family-owned farms, this upfront cost can be a significant barrier to adoption. While these systems promise long-term savings through reduced labor costs and increased efficiency, the financial strain of purchasing and installing the equipment can be difficult, particularly in markets where profit margins are thin. Additionally, ongoing maintenance and software updates add to the expense.

For instance, in countries such as the United States and Germany, some dairy farmers have opted to delay or scale back automation implementation due to financial constraints. Despite the long-term benefits, the high cost of entry remains a critical factor that limits the widespread adoption of milking automation, particularly in regions with less financial support for innovation in agriculture.

Opportunity

Increased Efficiency and Productivity Create Opportunities in the Milking Automation Market.

Increased efficiency and productivity are key factors driving the adoption of milking automation, offering significant benefits to dairy farms. For instance, robotic milking systems allow cows to be milked more frequently and with greater precision, leading to higher milk production per cow. Farms using automated systems have reported up to 10-20% increases in milk yield, as these machines can operate around the clock, optimizing milking times and reducing downtime.

Furthermore, automation streamlines herd management, with advanced sensors and software monitoring cow health, milking frequency, and milk quality. This data-driven approach allows farmers to make more informed decisions, improving herd performance and preventing issues such as mastitis or underproduction. In countries such as Denmark and Canada, where automation adoption is high, dairy farms are experiencing reduced labor costs, fewer human errors, and more consistent milk quality, positioning automation as a solution for farms seeking sustainable growth and operational efficiency.

Trends

Focus on Data Integration that Allows Predictive Analysis.

Data integration and predictive analysis are transforming the milking automation market, allowing farmers to make more proactive decisions and improve herd management. Automated milking systems are integrated with sensors and software that track vital metrics, such as milk yield, cow health, and even behavioral patterns. For instance, wearable devices or in-line sensors collect data on individual cows, alerting farmers to early signs of health issues such as mastitis or lameness before they become critical. When analyzed, this data can predict trends in milk production, detect anomalies, and optimize milking schedules.

In addition, farmers can use this information to adjust feeding, manage breeding cycles, or even automate veterinary care, leading to better animal welfare and more efficient operations. Farms that implement these systems report higher milk quality and production, and reduced veterinary costs and labor time. For instance, countries such as the UK and Australia have observed success in integrating data-driven solutions to enhance farm productivity and animal care.

Geopolitical Impact Analysis

Geopolitical Tensions Have Increased the Prices of the Milking Automation Technology.

The geopolitical tensions around the world are having a significant impact on the milking automation market, particularly in terms of supply chains, international trade, and the cost of technology. For instance, disruptions in global supply chains, particularly in the semiconductor and machinery sectors due to conflicts in European countries, have led to delays and higher costs for automated milking systems, which rely on sophisticated components such as sensors, robotic arms, and software.

Moreover, trade restrictions and sanctions between major economies, such as the US and China, have limited the availability of key parts, increasing the lead times and production costs for milking automation systems. In some areas, these geopolitical challenges have affected financing and investment in agricultural technology, as economic uncertainty makes investors more cautious.

In contrast, geopolitical instability has driven some countries, such as India, to focus more on food security, encouraging governments to support automation in agriculture as a way to increase domestic food production and reduce reliance on foreign labor. For instance, in countries such as the U.S. and Canada, where labor shortages are a concern, milking automation is becoming critical to maintain production levels amidst uncertain global conditions.

Regional Analysis

Europe Held the Largest Share of the Global Milking Automation Market.

In 2024, Europe dominated the global Milking Automation market, holding about 34.5% of the total global consumption. The region has consistently dominated the global milking automation market due to a combination of advanced agricultural practices, high dairy production rates, and a strong focus on technological innovation. Countries such as Germany, France, and the Netherlands lead in adopting automated milking systems, driven by the need to improve operational efficiency and meet stringent animal welfare regulations.

- According to a study, in 2020, nearly 40% of the world’s automated milking systems were installed in Europe.

Additionally, many key industry players such as Lely, DeLaval, and GEA, which have helped streamline milking processes through robotics, sensors, and data analytics, reside in the region. For instance, the Netherlands has one of the highest densities of robotic milking systems. As of early 2024, approximately 34.8% of dairy farms in the Netherlands, or over 5,000 farms, used milking automation systems (robotic milking). This widespread adoption reflects Europe’s strong commitment to precision farming, reduced labor costs, and enhanced milk quality, making it the largest shareholder in the global market for milking automation.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

To increase sales and gain a competitive edge, companies in the milking automation market focus on several key strategies. The companies invest heavily in product innovation, continuously improving the technology to enhance efficiency, reduce maintenance costs, and offer more user-friendly systems. Various companies offer customization options to cater to the unique needs of different farm sizes and types, including large dairy cattle farms and smaller operations.

Furthermore, to address the issue of high initial costs, several companies provide financing options and leasing models, making the systems more accessible to a wider range of customers, leading to fast adoption. Additionally, after-sales service, including technical support, training, and maintenance packages, helps build customer loyalty and trust. Moreover, the players focus on expanding their reach in emerging markets by leveraging partnerships with local distributors and agricultural organizations to promote their products more effectively.

The Major Players in The Industry

- DeLaval

- Lely

- GEA Group Aktiengesellschaft

- BouMatic

- Nedap Livestock Management

- Fullwood JOZ

- AMS Galaxy USA

- Dairymaster

- System Happel GmbH

- Waikato Milking Systems NZ LP.

- Yaskawa Europe GmbH

- Milkomax, Solutions laitières Inc.

- Afimilk Ltd.

- Merck & Co., Inc.

- Other Key Players

Key Development

- In January 2025, DeLaval launched a series of milking automation control systems designed to meet the evolving needs of dairy farmers milking in parlor systems. It had been built to deliver proper connectivity, flexibility, and performance. These systems help producers optimize their operations with features such as real-time data insights, scalable functionality, and cloud connectivity.

- In July 2025, BouMatic and SAC announced the merger of both brands and to continue under the BouMatic brand name. This merger aims to unify their product lines, strengthen their market presence, and improve operational efficiency. The two companies are family-owned with a long history in milking expertise.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Bn Forecast Revenue (2034) USD 7.2 Bn CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, and Services), By System Type (Fully Automatic Milking Systems and Automatic Milking Parlors), By Farm Type (Dairy Cattle Farms and Goat & Sheep Dairy Farms), By Farm Size (Small Farms, Medium Farms, and Large Farms) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape DeLaval, Lely, GEA Group AG, BouMatic, Nedap Livestock Management, Fullwood JOZ, AMS Galaxy USA, Dairymaster, System Happel GmbH, Waikato Milking Systems NZ LP, Yaskawa Europe GmbH, Milkomax Solutions laitières, Afimilk Ltd., Merck & Co., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- DeLaval

- Lely

- GEA Group Aktiengesellschaft

- BouMatic

- Nedap Livestock Management

- Fullwood JOZ

- AMS Galaxy USA

- Dairymaster

- System Happel GmbH

- Waikato Milking Systems NZ LP.

- Yaskawa Europe GmbH

- Milkomax, Solutions laitières Inc.

- Afimilk Ltd.

- Merck & Co., Inc.

- Other Key Players