Global Micronized Salt Market Size, Share Analysis Report By Purity (Purity 98% To 99.5%, Purity Above 99.5%), By Application (Bakery and Confectionery Products, Meat, Poultry and Sea Food, Milk and Dairy Products, Beverages, Others), By End Use ( Food Industry, Household, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152120

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

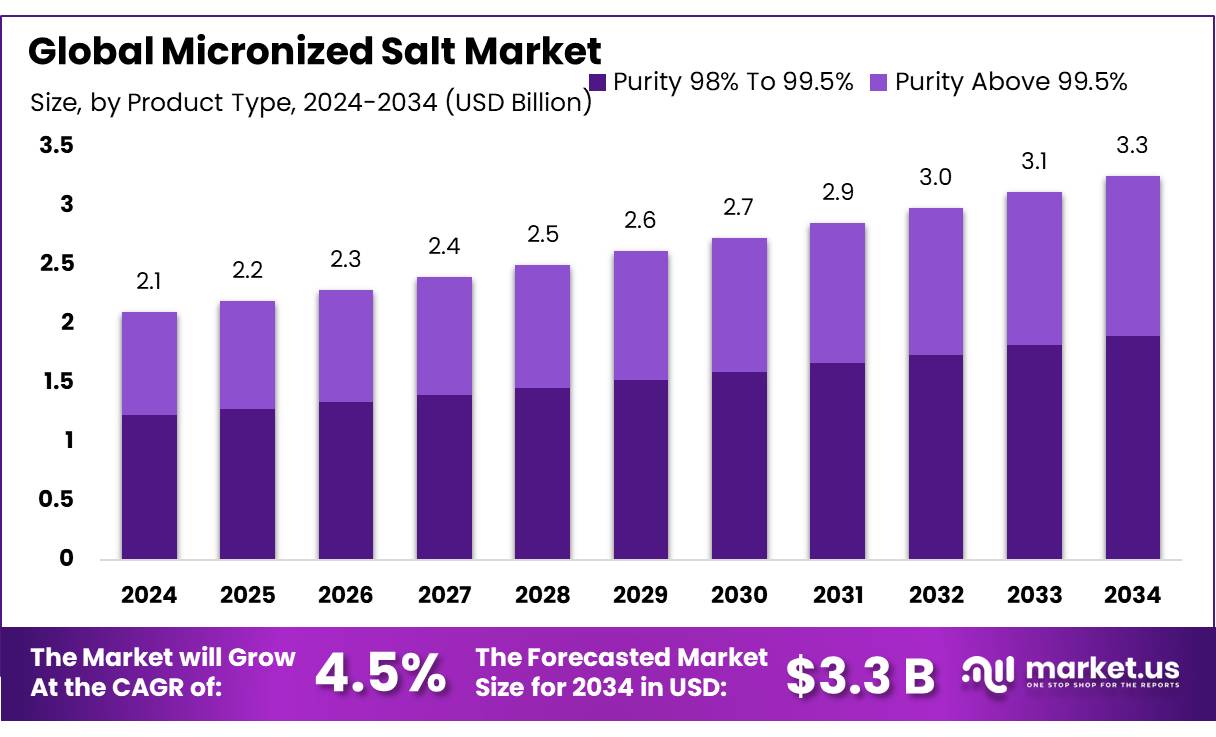

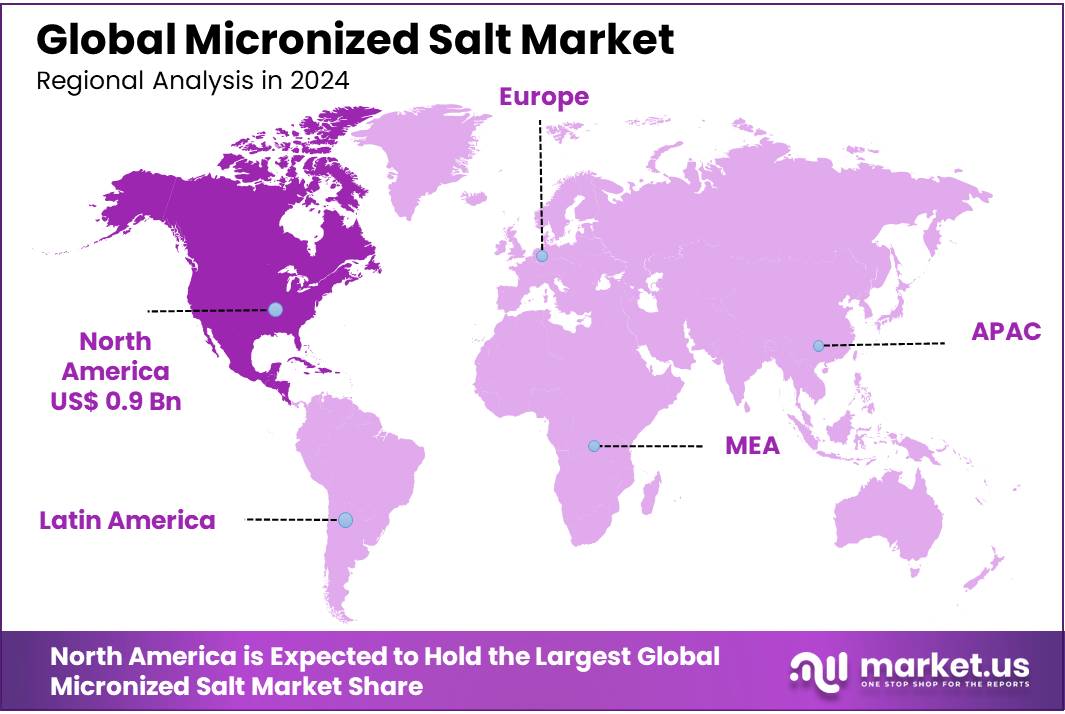

The Global Micronized Salt Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.9% share, holding USD 0.9 billion revenue.

Micronized salt concentrates—typically sodium chloride refined to over 98 percent purity and finely milled—have gained prominence across food processing, pharmaceutical, cosmetic, water treatment, and industrial applications. The market’s appeal stems from enhanced solubility, uniform distribution, controlled purity, and functional benefits such as textural refinement and flavor codification.

India stands as a significant player in the global salt industry, ranking third in salt production, contributing approximately 8.9% to the world’s total output. The country produces about 20.31 million tonnes of salt annually, with Gujarat, Rajasthan, and Tamil Nadu being the leading states in production.

The Indian government has implemented several initiatives to bolster the salt industry. The Salt Commissioner, under the Ministry of Commerce and Industry, oversees the regulation and control of salt production and distribution in India. Additionally, the government has introduced the Paper Import Monitoring System (PIMS) to monitor and regulate the import of paper, which indirectly affects the packaging materials used in the salt industry.

Governments and health agencies globally are initiating sodium reduction programs, reinforcing demand for micronized salt. The U.S. National Minerals Information Center (USGS) emphasizes sodium chloride’s critical role as feedstock in chlorine-caustic soda industries, which extend to plastics and pulp production. Public health bodies, such as WHO and U.S. agencies, support food salt reduction to curb hypertension and cardiovascular disease.

For example, WHO aims for a 30 percent reduction in global population sodium intake by 2025, encouraging food manufacturers to reformulate products using optimized salt forms such as micronized concentrates. Similarly, U.S. Dietary Guidelines recommend consumption limits of 2,300 mg sodium/day, prompting industry reformulations.

Key Takeaways

- Micronized Salt Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 4.5%.

- Purity 98% to 99.5% held a dominant market position, capturing more than a 58.3% share in the global micronized salt market.

- Bakery & Confectionery Products held a dominant market position, capturing more than a 31.9% share in the global micronized salt market.

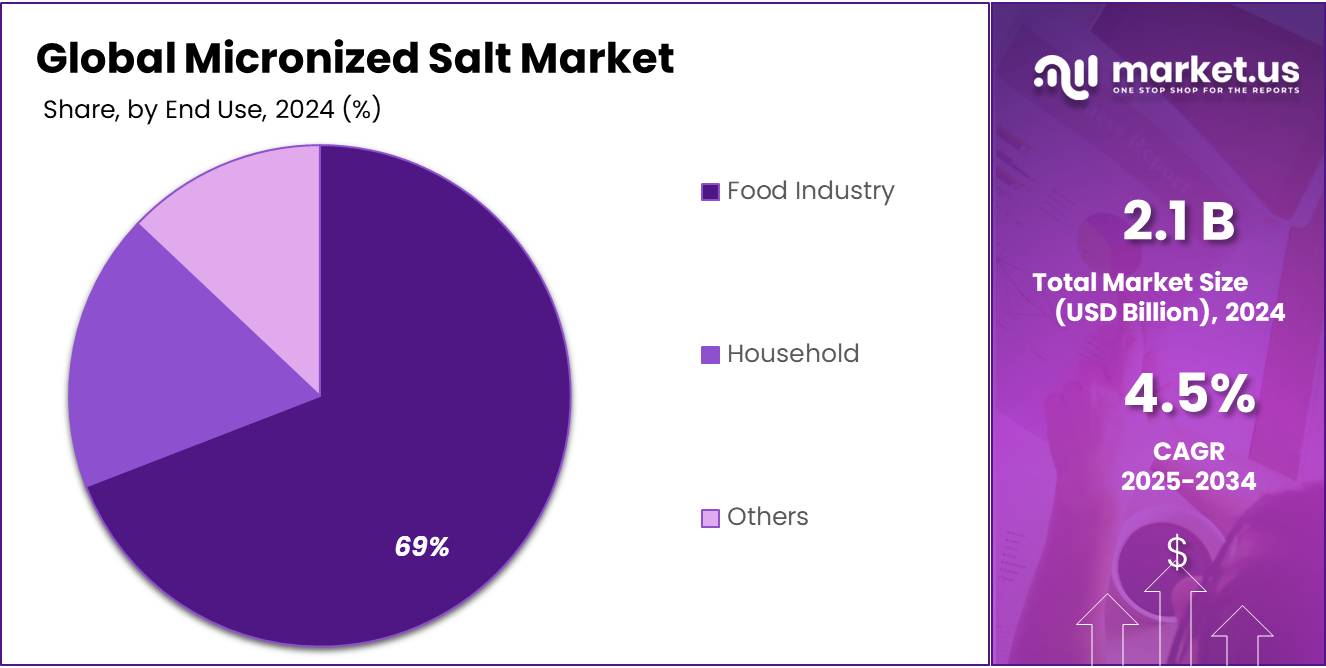

- Food Industry held a dominant market position, capturing more than a 69.4% share in the global micronized salt market.

- North America held a dominant position in the global micronized salt market, capturing more than a 42.9% share and reaching a market valuation of approximately USD 0.9 billion.

By Purity Analysis

Purity 98% to 99.5% leads with 58.3% share due to broad industrial use and food-grade reliability.

In 2024, Purity 98% to 99.5% held a dominant market position, capturing more than a 58.3% share in the global micronized salt market. This segment’s strong hold can be linked to its wide applicability across food processing, dairy, bakery, pharmaceuticals, and water treatment sectors. Salt within this purity range is considered ideal for food-grade applications, offering the right balance between performance and cost-effectiveness. It meets essential safety standards while maintaining the texture and solubility required for consistent quality in processed foods and functional applications.

Manufacturers often prefer this grade due to its compatibility with automated blending and its ability to dissolve quickly in formulations. By 2025, the demand for this segment is expected to remain stable, driven by its use in packaged and ready-to-eat foods, as well as increased adoption in emerging economies where food infrastructure is expanding. Furthermore, its suitability for hygiene-sensitive environments such as medical-grade formulations and cosmetic products is expected to contribute to continued market dominance.

By Application Analysis

Bakery & Confectionery Products dominate with 31.9% share driven by taste consistency and smooth blending.

In 2024, Bakery & Confectionery Products held a dominant market position, capturing more than a 31.9% share in the global micronized salt market. This segment’s strength comes from the critical role micronized salt plays in enhancing flavor, controlling fermentation, and improving shelf life in baked goods and sweets. Its fine particle size ensures even distribution, which is especially important in dough-based items like bread, biscuits, and cakes, where consistency in taste and texture is essential.

Micronized salt also supports better blending with sugar and flour, making it a preferred choice for large-scale bakery operations and commercial confectionery manufacturing. In 2025, demand is expected to remain strong as consumption of packaged and ready-to-eat bakery products continues to grow globally, especially in urban regions where consumer preference leans toward convenience foods. Rising health awareness is also pushing brands to reformulate products with precise sodium content, and micronized salt allows for controlled usage without compromising flavor.

By End Use Analysis

Food Industry dominates with 69.4% share as demand for processed and packaged foods grows.

In 2024, the Food Industry held a dominant market position, capturing more than a 69.4% share in the global micronized salt market. This strong lead is mainly due to the wide use of micronized salt in processed foods, snacks, dairy, meat products, and bakery items. The fine particle size of micronized salt helps ensure uniform distribution, better solubility, and controlled flavoring, which are essential in modern food production where consistency and taste precision matter greatly.

The increasing consumption of convenience foods, especially in urban areas, has been a major driver for this segment. Food manufacturers prefer micronized salt not only for its functionality but also because it supports clean-label trends by reducing overall sodium content without altering taste.

Key Market Segments

By Purity

- Purity 98% To 99.5%

- Purity Above 99.5%

By Application

- Bakery & Confectionery Products

- Meat, Poultry & Sea Food

- Milk & Dairy Products

- Beverages

- Others

By End Use

- Food Industry

- Household

- Others

Emerging Trends

Increased Adoption in Processed and Ready-to-Eat Foods

A significant trend in the micronized salt market is its growing integration into processed and ready-to-eat food products. This shift is largely driven by consumer demand for convenience and longer shelf life, coupled with heightened awareness of health and wellness. Micronized salt, with its fine particle size and high purity, offers enhanced solubility and uniform distribution, making it an ideal ingredient for such applications.

In the United States, the packaged food market exceeds $1.03 trillion, with a significant portion of this market utilizing micronized salt to improve taste, texture, and shelf life across various products, including baked goods, snacks, and processed meats. Similarly, in Europe, the food processing sector comprises over 294,000 companies, accounting for 15.2% of the entire European industry, with micronized salt playing a crucial role in enhancing food quality and safety.

This trend is also evident in Asia-Pacific, where rapid industrialization and urbanization are driving the demand for processed foods. Countries like China and India are witnessing increased consumption of ready-to-eat meals, presenting opportunities for the adoption of micronized salt in food processing.

Drivers

Increasing Consumer Demand for Healthier Food Products Drives Micronized Salt Market Growth

In recent years, the growing demand for healthier food options has been a significant driving factor for the micronized salt market. As consumers become more health-conscious, they are increasingly opting for food products with lower sodium content without sacrificing taste. Micronized salt, which has smaller and more evenly distributed crystals, allows for reduced sodium levels in food products while maintaining the desired flavor profile.

According to a report from the World Health Organization (WHO), global sodium intake remains higher than the recommended levels, contributing to increased risks of hypertension and cardiovascular diseases. The WHO recommends a daily intake of less than 2,000 mg of sodium, but the average global intake is much higher. To address this, food manufacturers are turning to innovative ingredients like micronized salt, which enhances the flavor while allowing for a reduction in the overall sodium content of processed foods.

For instance, in 2024, global demand for reduced-sodium products is anticipated to rise, with a 15% year-on-year increase in the use of alternative salts in processed foods, as per the Global Food Safety Initiative (GFSI). This trend is reflected in the increasing number of health-conscious consumers seeking sodium reduction without compromising on taste, thus driving the demand for micronized salt in various food applications.

Restraints

High Production Costs Limit the Widespread Adoption of Micronized Salt

One of the major factors restraining the growth of the micronized salt market is the high production cost associated with its manufacturing process. Micronized salt requires specialized technology to produce finely ground particles with uniform distribution. This process involves additional steps such as grinding, sieving, and coating, which significantly increase production costs when compared to conventional salt. As a result, the price of micronized salt can be up to 30% higher than regular salt, which limits its appeal, especially for price-sensitive consumers and manufacturers.

The Food and Agriculture Organization (FAO) reports that while sodium reduction in foods is becoming increasingly important for health reasons, cost remains a significant barrier for many food manufacturers. For instance, in 2023, a survey conducted by the FAO revealed that nearly 60% of food manufacturers in emerging markets were hesitant to adopt micronized salt due to its higher cost, even though it offers benefits such as better flavor enhancement and reduced sodium content.

Moreover, the technology required for micronized salt production involves significant capital investment, which makes it less accessible for small and medium-sized enterprises (SMEs) in the food industry. These businesses often struggle to absorb the increased production costs, which may lead them to opt for more affordable, less innovative alternatives.

Opportunity

Government Initiatives and Support Fuel Micronized Salt Market Expansion

Government initiatives aimed at reducing sodium consumption are significantly driving the growth of the micronized salt market. As health concerns related to excessive salt intake rise, regulatory bodies are implementing measures to encourage the use of lower-sodium alternatives in food products.

For instance, in the United States, the Food and Drug Administration (FDA) has established voluntary sodium reduction targets for the food industry. These targets aim to gradually decrease sodium levels in processed and prepared foods, aligning with public health objectives to reduce the risk of hypertension and cardiovascular diseases. The FDA’s approach includes setting achievable benchmarks and monitoring progress, allowing time for product reformulation and consumer taste adaptation.

Similarly, the World Health Organization (WHO) has recommended that adults consume less than 2,000 mg of sodium per day. This guideline has prompted many countries to adopt national strategies for salt reduction, influencing food manufacturers to seek alternatives like micronized salt. Micronized salt, due to its fine granulation, enhances flavor more efficiently, allowing for reduced sodium content without compromising taste.

Regional Insights

North America leads the global micronized salt market with 42.9% share, valued at USD 0.9 billion in 2024.

In 2024, North America held a dominant position in the global micronized salt market, capturing more than a 42.9% share and reaching a market valuation of approximately USD 0.9 billion. This leadership is largely attributed to the region’s well-established food processing industry, stringent regulatory standards, and widespread adoption of high-purity ingredients across both food and pharmaceutical applications.

Micronized salt is widely used in processed meats, snacks, bakery products, and canned goods in the U.S. and Canada. Its fine granularity ensures precise dosing and uniform flavor distribution, which is essential for large-scale industrial food operations. Moreover, regulatory guidance from agencies such as the U.S. Food and Drug Administration (FDA) has encouraged reduced sodium content in food products, thereby increasing the demand for functional salt alternatives that allow controlled usage—such as micronized salt.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Akzo Nobel N.V. is a leading global producer of high-purity salt, catering to various industries including food, pharmaceuticals, and cosmetics. The company offers micronized salt products that meet stringent quality standards, ensuring consistency and reliability for its customers. Akzo Nobel’s commitment to innovation and sustainability positions it as a significant player in the micronized salt market.

Compass Minerals America, Inc. is a major producer of salt and other essential minerals in North America. The company offers a range of salt products, including micronized salt, which are utilized in various applications such as food processing, de-icing, and industrial uses. Compass Minerals’ extensive distribution network and commitment to quality make it a key player in the salt industry.

Cargill Inc. is a global leader in food production and agricultural services, offering a wide array of products including micronized salt. The company’s micronized salt offerings are designed to meet the needs of the food industry, providing solutions that enhance flavor, texture, and shelf life of food products. Cargill’s dedication to innovation and customer satisfaction solidifies its position in the micronized salt market.

Top Key Players Outlook

- Akzo Nobel N.V.

- Compass Minerals America, Inc.

- Cargill Inc.

- GHCL Ltd.

- ICL Group

- INEOS Ltd.

- J.C. Peacock & Co. Ltd.

- Kutch Brine Chem Industries

- Morton Salt, Inc. (A K+S Group Company)

- TATA Chemicals Ltd. ICL Group

- Wilson Salt Company

Recent Industry Developments

In 2024 GHCL Ltd, reported a total operating income of ₹3,447 crore, with a profit after tax of ₹794 crore, reflecting a strategic focus on high-value products like micronized salt.

In 2024, ICL initiated the construction of a lithium iron phosphate (LFP) production facility in St. Louis, Missouri, with phase one expected to be completed by the end of 2024 and full production of 30,000 metric tonnes anticipated by 2025.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 3.3 Bn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Purity 98% To 99.5%, Purity Above 99.5%), By Application (Bakery and Confectionery Products, Meat, Poultry and Sea Food, Milk and Dairy Products, Beverages, Others), By End Use ( Food Industry, Household, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel N.V., Compass Minerals America, Inc., Cargill Inc., GHCL Ltd., ICL Group, INEOS Ltd., J.C. Peacock & Co. Ltd., Kutch Brine Chem Industries, Morton Salt, Inc. (A K+S Group Company), TATA Chemicals Ltd. ICL Group, Wilson Salt Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Akzo Nobel N.V.

- Compass Minerals America, Inc.

- Cargill Inc.

- GHCL Ltd.

- ICL Group

- INEOS Ltd.

- J.C. Peacock & Co. Ltd.

- Kutch Brine Chem Industries

- Morton Salt, Inc. (A K+S Group Company)

- TATA Chemicals Ltd. ICL Group

- Wilson Salt Company