Global Methylene Chloride Market Size, Share, And Business Benefits By Purity Level (High Purity, Industrial Grade, Technical Grade), By Form (Liquid, Aerosol), By Application (Adhesives and Sealants, Paint Removers and Coatings, Chemical Processing and Solvent Use, Foam Manufacturing, Metal Cleaning and Degreasing, Pharmaceutical Extraction/Formulation , Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149716

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

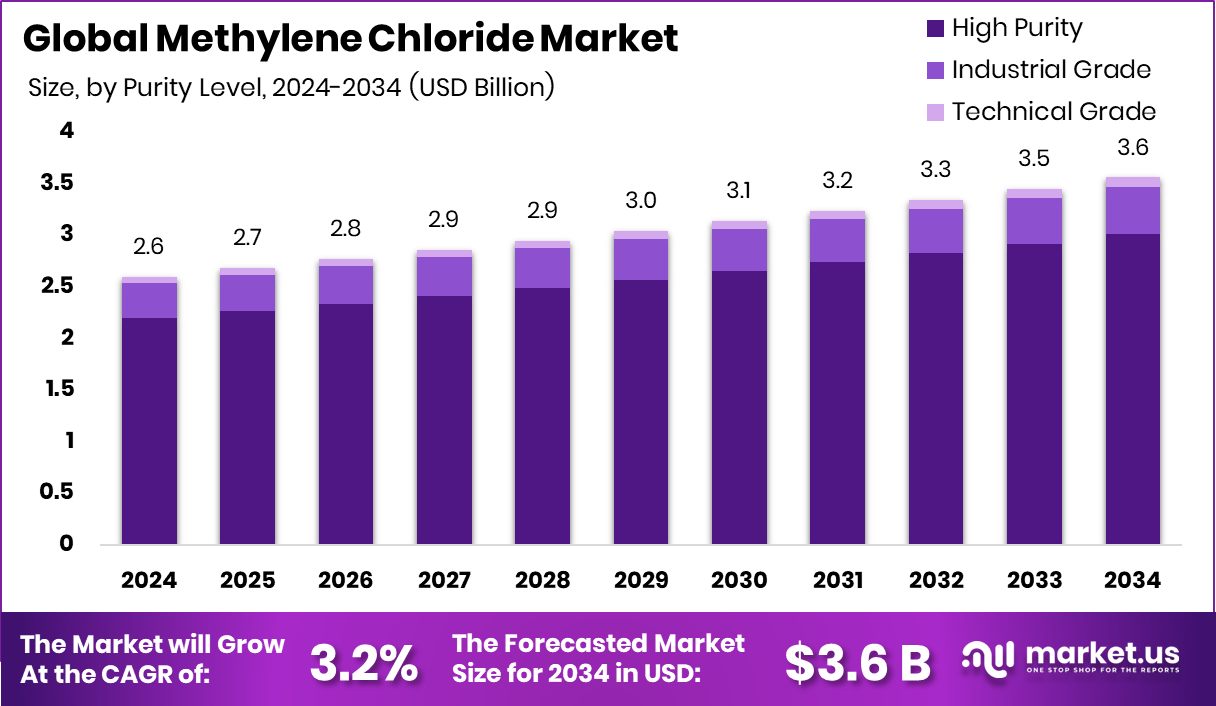

The Global Methylene Chloride Market is expected to be worth around USD 3.6 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 3.2% from 2025 to 2034. Strong industrial use in North America drives USD 1.1 billion methylene chloride demand.

Methylene chloride, dichloromethane (DCM), is a volatile, colorless liquid with a slightly sweet aroma. Due to its excellent solvency and rapid evaporation, it is widely used as a solvent in paint removers, adhesives, aerosol formulations, and cleaning applications. It is also used in the pharmaceutical and food industries, particularly for decaffeinating coffee and preparing flavor extracts.

The methylene chloride market refers to the global trade and usage of this compound across various industries such as construction, pharmaceuticals, automotive, electronics, and food processing. The market is shaped by changing regulations, demand from end-use sectors, and substitution trends. Growth in downstream industries often directly influences the demand and supply of methylene chloride, with production concentrated in regions with robust chemical manufacturing infrastructure.

One of the major growth factors for this market is its strong demand from the paint and coating removal sector, especially in emerging economies where industrial maintenance and refurbishment are expanding rapidly. The compound’s fast-acting chemical properties make it a preferred choice in these applications.

Demand is also driven by rising consumption in the foam manufacturing and electronics sectors. As these industries grow globally, methylene chloride finds extended application in polymer processing and cleaning electronic components. It also plays a role in refrigerant blends and aerosol propellants, contributing to its industrial relevance.

Key Takeaways

- The Global Methylene Chloride Market is expected to be worth around USD 3.6 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 3.2% from 2025 to 2034.

- In 2024, high purity methylene chloride accounted for 84.5% of the global market share.

- Liquid form dominated the methylene chloride market in 2024, capturing a significant 91.4% revenue share.

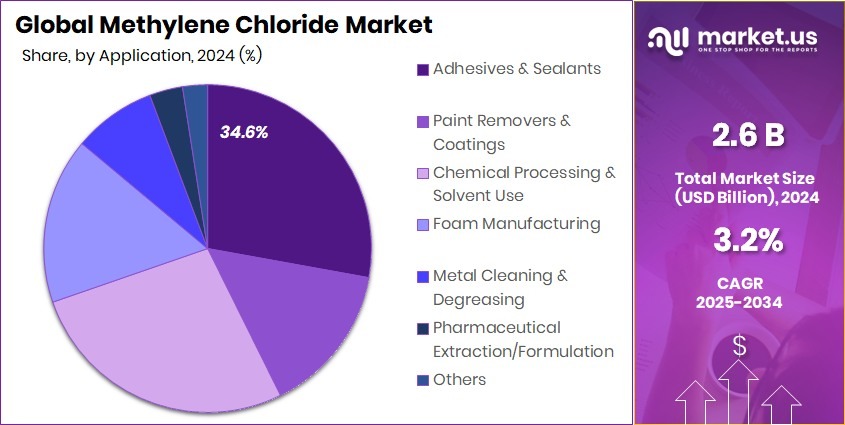

- Adhesives and sealants application led demand, representing a 34.6% share in the methylene chloride market segment.

- The North American methylene chloride market reached USD 1.1 billion in 2024.

By Purity Level Analysis

High-purity methylene chloride holds an 84.5% share, driven by pharmaceutical-grade demand.

In 2024, High Purity held a dominant market position in the By Purity Level segment of the Methylene Chloride Market, with an 84.5% share. This strong dominance is primarily attributed to the increasing demand for high-grade solvents across pharmaceutical, electronics, and specialty chemical sectors, where purity standards are critical.

High-purity methylene chloride is widely utilized in processes such as pharmaceutical formulations, electronic cleaning, and as a carrier solvent in precision industries, where impurities could affect product performance or safety.

Industries prefer high-purity grades to ensure compliance with stringent regulatory and quality control norms, especially in sectors where chemical residue and contamination pose risks. The consistent preference for cleaner, more refined solvents is also driven by global quality certifications and rising adoption of Good Manufacturing Practices (GMP), further pushing the demand for high-purity formulations.

By Form Analysis

Liquid form dominates with a 91.4% share due to easy handling and versatility.

In 2024, Liquid held a dominant market position in the By Form segment of the Methylene Chloride Market, with a 91.4% share. This overwhelming dominance is primarily due to the compound’s natural physical state, which is a clear, volatile liquid, making it ideal for direct use across industrial applications. The liquid form ensures ease of storage, transfer, and application in processes such as paint stripping, metal cleaning, pharmaceutical manufacturing, and foam production.

Its fluid nature allows for precise measurement and efficient blending into formulations, which is critical in sectors requiring solvent consistency and reactivity. Additionally, industries working with adhesives, degreasers, and aerosol-based products rely heavily on methylene chloride in liquid form due to its rapid evaporation and effective solvency characteristics. The ease of handling and direct usability of the liquid form further enhances its operational advantage, particularly in large-scale manufacturing environments.

The 91.4% market share also reflects the infrastructure and equipment compatibility built around the liquid phase, minimizing the need for conversions or specialized processing. As demand remains steady from core end-use industries, the liquid form of methylene chloride is expected to retain its dominant share, supported by its established utility, regulatory familiarity, and application efficiency.

By Application Analysis

Adhesives and sealants application leads with a 34.6% share in the methylene chloride market.

In 2024, Adhesives and Sealants held a dominant market position in the By Application segment of the Methylene Chloride Market, with a 91.4% share. This significant share reflects the compound’s widespread use as a solvent in the formulation of industrial adhesives and sealants, where it enhances spreadability, bonding strength, and evaporation control. Methylene chloride’s strong solvency power and compatibility with a variety of polymers make it an essential component in adhesive systems used across construction, packaging, automotive, and consumer goods industries.

The dominance of this application segment is also linked to the growing demand for high-performance bonding agents in structural and non-structural settings, where precision and durability are critical. Methylene chloride helps achieve uniform application and quick drying times, especially in contact adhesives and solvent-based sealants. Its role is especially vital in producing flexible and rigid bonding agents used for insulation panels, furniture laminates, and automotive interior components.

Moreover, manufacturers continue to rely on this solvent due to its efficiency in dissolving complex resin systems, which other substitutes may not achieve as effectively. With the adhesives and sealants industry projected to maintain consistent demand, the application of methylene chloride in this segment is expected to remain firmly established, reinforcing its 91.4% market share.

Key Market Segments

By Purity Level

- High Purity

- Industrial Grade

- Technical Grade

By Form

- Liquid

- Aerosol

By Application

- Adhesives and Sealants

- Paint Removers and Coatings

- Chemical Processing and Solvent Use

- Foam Manufacturing

- Metal Cleaning and Degreasing

- Pharmaceutical Extraction/Formulation

- Others

Driving Factors

Strong Solvency Power Driving Industrial Product Demand

One of the biggest driving factors for the methylene chloride market is its strong solvency ability. Methylene chloride can dissolve a wide range of substances quickly and effectively. This makes it very useful in many industrial applications such as adhesives, sealants, paint removers, and degreasers. Industries prefer it because it helps improve product performance by allowing better blending and smooth application.

Its fast evaporation rate also supports quicker drying in manufacturing lines. The chemical’s ability to clean, strip, or dissolve tough substances has kept its demand high in construction, automotive, electronics, and pharmaceutical sectors.

Restraining Factors

Strict Health Regulations Limit Market Growth Scope

One major factor holding back the methylene chloride market is strict health and safety regulations. Methylene chloride is known to pose health risks when inhaled or exposed to the skin for long periods. Because of this, many countries have set strong rules or even banned their use in consumer products like paint strippers. Companies are now required to follow tight safety measures during handling, storage, and usage, which increases operational costs.

These regulatory pressures make industries consider safer or eco-friendly alternatives. As awareness about workplace safety and environmental impact rises, such restrictions may become even stricter in the future. This creates a challenge for methylene chloride’s long-term growth, especially in regions with strong environmental laws.

Growth Opportunity

Rising Demand from the Developing Countries’ Manufacturing Sector

A major growth opportunity for the methylene chloride market lies in the rising demand from developing countries. Nations in Asia, Latin America, and parts of Africa are rapidly expanding their manufacturing sectors, especially in industries like construction, automotive, pharmaceuticals, and furniture. These industries use methylene chloride for tasks like cleaning, bonding, and solvent-based production.

As local production increases and industrial infrastructure improves, more companies are expected to use methylene chloride in their processes. Additionally, these regions often have fewer restrictions compared to developed markets, making it easier for manufacturers to use the chemical at scale.

Latest Trends

Shifting Towards Safer and Sustainable Solvent Alternatives

A notable trend in the methylene chloride market is the increasing shift towards safer and more sustainable solvent alternatives. This change is largely driven by growing environmental concerns and stringent regulations aimed at reducing the use of hazardous chemicals. Industries are actively seeking solvents that offer similar efficacy but with lower toxicity and environmental impact.

This has led to the development and adoption of bio-based and less harmful chemical substitutes in various applications, including paint stripping, adhesive formulation, and metal cleaning. The trend reflects a broader commitment to environmental responsibility and worker safety, influencing manufacturers to innovate and adapt their product offerings accordingly.

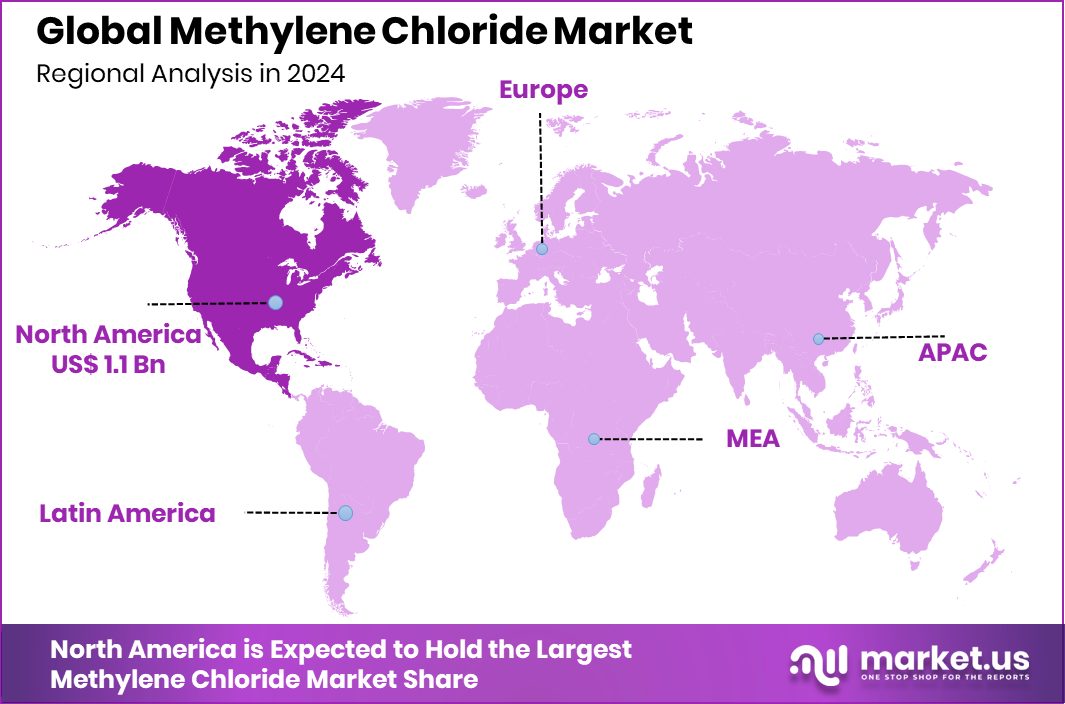

Regional Analysis

In 2024, North America held 42.4% market share in the methylene chloride industry.

In 2024, North America emerged as the leading region in the global Methylene Chloride Market, accounting for 42.4% of the total share, equivalent to USD 1.1 billion. The dominance of North America is primarily driven by the region’s well-established industrial base, strong demand from the adhesives and sealants sector, and consistent usage in pharmaceutical and electronics applications. The United States, in particular, continues to be a key contributor due to its robust manufacturing and construction industries, where methylene chloride is widely used as a solvent and cleaning agent.

Europe follows as a significant market, supported by demand in specialty chemical and pharmaceutical processing, although regulatory restrictions have limited growth to an extent. Asia Pacific is witnessing a gradual expansion in usage, especially in industrial economies within Southeast Asia, where manufacturing and construction activities are picking up pace.

However, market share details beyond North America are not specified. The Middle East & Africa and Latin America represent emerging markets for methylene chloride, with increasing investment in infrastructure and growing demand from local manufacturing sectors. Still, their market shares remain smaller compared to the dominant North American region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global methylene chloride market witnessed significant contributions from key players such as AkzoNobel N.V., Dow Chemical Company, Eastman Chemical Company, and Ercros S.A., each leveraging their unique strengths to navigate the evolving landscape.

AkzoNobel N.V. demonstrated a strong presence in the market, capitalizing on its extensive experience in specialty chemicals and coatings. The company’s commitment to innovation and sustainability enabled it to meet the growing demand for high-quality solvents across various industries.

Dow Chemical Company continued to be a pivotal player, utilizing its vast chemical production capabilities to supply methylene chloride for diverse applications, including pharmaceuticals, adhesives, and industrial cleaning. Dow’s emphasis on research and development facilitated the introduction of advanced formulations, aligning with industry needs.

Eastman Chemical Company maintained its market position by focusing on delivering reliable and efficient solvent solutions. The company’s strategic initiatives aimed at enhancing product performance and environmental compliance resonated well with customers seeking effective and responsible chemical options.

Ercros S.A. faced challenges in 2024, reporting a contribution of EUR 225 million and an adjusted EBITDA of EUR 29 million, alongside a net loss of EUR 12 million. Despite these hurdles, Ercros achieved notable milestones, including obtaining the ISCC Plus certification for sustainable production at its Vila-seca I facility and expanding its pharmaceutical manufacturing capabilities at the Aranjuez factory.

Top Key Players in the Market

- AkzoNobel N.V.

- Dow Chemical Company

- Eastman Chemical Company

- Ercros S.A.

- Gujarat Alkalies & Chemicals Ltd.

- Ineos Group

- KEM ONE

- LOTTE Fine Chemical

- Occidental Petroleum Corporation

- Olin Corporation

- PPG Industries Inc.

- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- Tokuyama Corporation

- MC Chemicals Ltd

Recent Developments

- In May 2025, GACL’s Board of Directors approved the installation of a new Hydrochloric Acid (HCl) synthesis unit at its Dahej facility in Gujarat. The unit, with a capacity of 90–120 metric tons per day, is intended for captive consumption and will utilize an additional 80 to 100 tons of chlorine per day.

- In December 2024, Dow entered into a definitive agreement to sell a 40% equity stake in select U.S. Gulf Coast infrastructure assets to a fund managed by Macquarie Asset Management. This partnership, named Diamond Infrastructure Solutions, aims to provide comprehensive services to industrial customers, potentially impacting Dow’s operational efficiency and resource allocation.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Level (High Purity, Industrial Grade, Technical Grade), By Form (Liquid, Aerosol), By Application (Adhesives and Sealants, Paint Removers and Coatings, Chemical Processing and Solvent Use, Foam Manufacturing, Metal Cleaning and Degreasing, Pharmaceutical Extraction/Formulation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AkzoNobel N.V., Dow Chemical Company, Eastman Chemical Company, Ercros S.A., Gujarat Alkalies & Chemicals Ltd., Ineos Group, KEM ONE, LOTTE Fine chemical, Occidental Petroleum Corporation, Olin Corporation, PPG industries Inc., Shin-Etsu Chemical Co. Ltd., Solvay S.A., Tokuyama Corporation, MC Chemicals Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AkzoNobel N.V.

- Dow Chemical Company

- Eastman Chemical Company

- Ercros S.A.

- Gujarat Alkalies & Chemicals Ltd.

- Ineos Group

- KEM ONE

- LOTTE Fine Chemical

- Occidental Petroleum Corporation

- Olin Corporation

- PPG Industries Inc.

- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- Tokuyama Corporation

- MC Chemicals Ltd