Global Methyl Formate Market Size, Share, And Business Benefit By Source of Production (Synthetic Production, Biobased Production), By Application (Solvent in Chemical Processes, Intermediate in Esters Production, Agricultural Chemicals, Pharmaceuticals, Plasticizers, Others), By End-Use (Chemicals Industry, Agriculture, Pharmaceuticals, Automotive, Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 163934

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

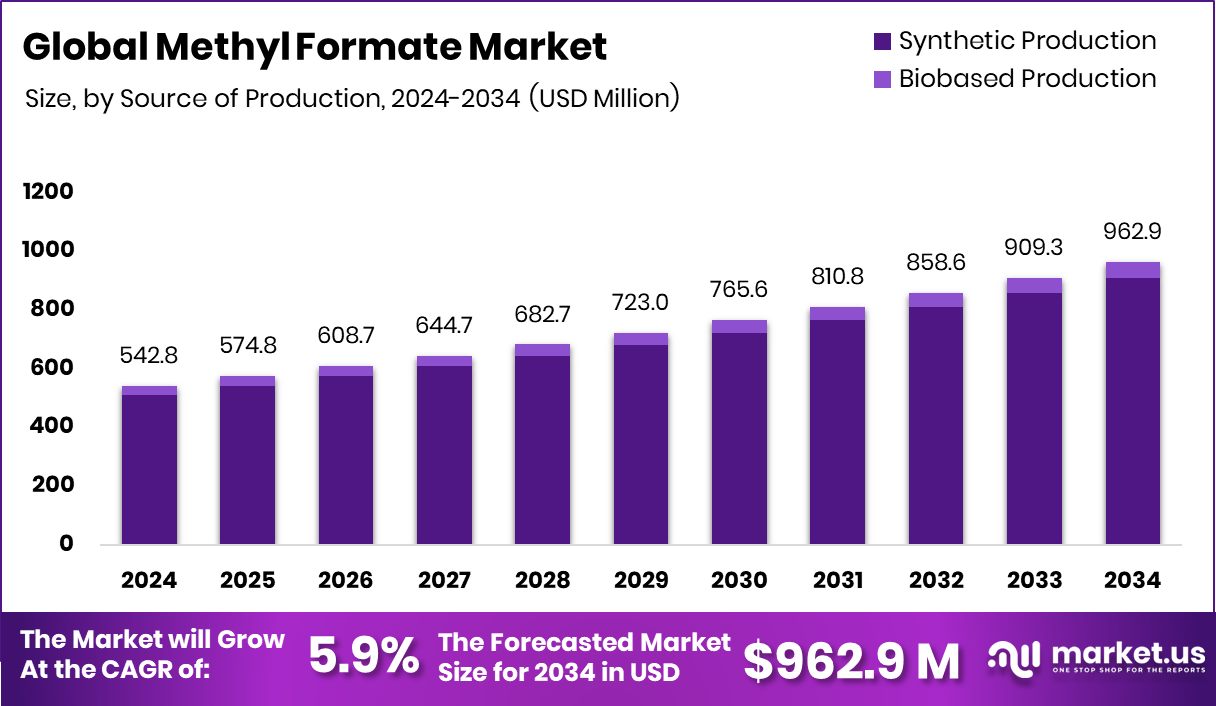

The Global Methyl Formate Market is expected to be worth around USD 962.9 million by 2034, up from USD 542.8 million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Strong chemical manufacturing growth in Asia-Pacific continues to strengthen its 39.70% market leadership.

Methyl Formate is a clear, flammable liquid with a pleasant ether-like smell, mainly used as a chemical intermediate and solvent. It is produced through the reaction of methanol and carbon monoxide, forming a compound widely used in manufacturing formic acid, dimethylformamide, and polyurethane foams. Because of its low toxicity and eco-friendly characteristics, it is gaining attention as a sustainable blowing agent and an alternative to ozone-depleting chemicals in insulation and foam production.

The Methyl Formate Market revolves around its growing applications across industrial, agricultural, and chemical sectors. The market benefits from advancements in cleaner production methods, increasing regulatory push for sustainable solvents, and the rapid shift toward environmentally responsible materials. The ongoing industrial expansion in Asia and rising investments in chemical infrastructure are helping methyl formate producers to strengthen their manufacturing base and cater to diverse downstream applications.

The increasing demand for eco-friendly blowing agents and chemical intermediates drives the growth of the methyl formate market. Its ability to replace high-GWP compounds makes it ideal for foams, coatings, and adhesives. Additionally, growing investments in chemical manufacturing, such as KLJ Group’s Rs. 1,200 Cr facility for plasticizers and phthalic anhydride, are expected to boost feedstock availability for methyl formate synthesis. Such capital inflows and the push for low-emission manufacturing processes continue to fuel steady growth.

The demand for methyl formate is rising due to its wide application range across polymers, coatings, and agriculture. Its increasing adoption as a solvent and binder in foams and resins has created significant market momentum. The agrochemical sector, supported by India Agri Business Fund II’s US$15 M investment, adds further strength as the compound plays a part in synthesis processes. With industrial expansion and agricultural modernization, the demand outlook for methyl formate remains optimistic.

New opportunities are emerging in advanced chemical and synthetic fuel technologies where methyl formate can serve as a sustainable intermediate. Companies like Rivan, securing US$13 M to develop synthetic fuels, and Ansa, raising US$54.4 M for DNA synthesis, highlight the potential integration of methyl formate into next-generation fuel and biotech applications.

Key Takeaways

- The Global Methyl Formate Market is expected to be worth around USD 962.9 million by 2034, up from USD 542.8 million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- In 2024, the Methyl Formate Market was dominated by synthetic production, capturing 94.3% share.

- The Methyl Formate Market saw a 31.2% share from its use as a solvent in chemical processes.

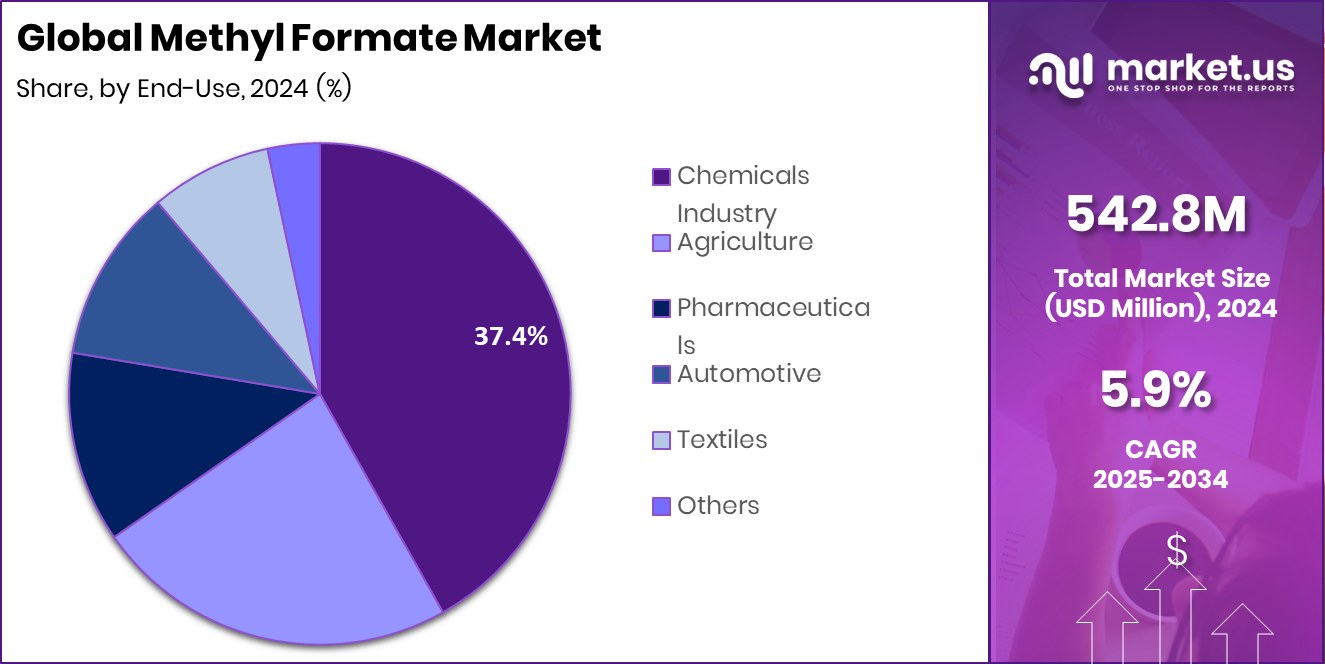

- In 2024, the chemicals industry led the Methyl Formate Market with 37.4% overall market share.

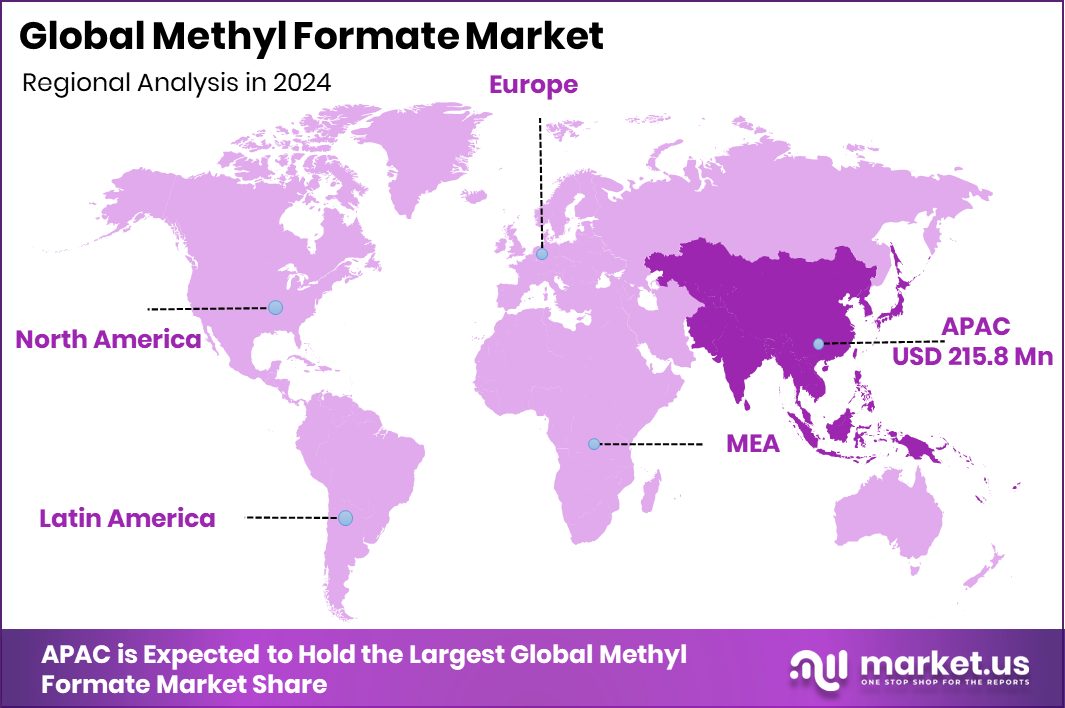

- The Asia-Pacific market value reached USD 215.8 million, driven by industrial expansion.

By Source of Production Analysis

Synthetic production accounted for 94.3%, reflecting large-scale industrial chemical synthesis processes.

In 2024, Synthetic Production held a dominant market position in the By Source of Production segment of the Methyl Formate Market, capturing a 94.3% share. This dominance is driven by its efficient large-scale manufacturing process using methanol and carbon monoxide, which ensures consistent purity and cost-effectiveness. Synthetic routes enable better control over reaction conditions and yield, supporting the growing demand from industries such as polymers, coatings, and agrochemicals.

The method’s scalability and adaptability to modern chemical infrastructure further enhance its market share. With continued investments in chemical facilities and sustainable process technologies, synthetic production remains the preferred route for meeting the global demand for high-quality methyl formate.

By Application Analysis

The Methyl Formate Market saw solvents in chemical processes hold a 31.2% share.

In 2024, Solvent in Chemical Processes held a dominant market position in the By Application segment of the Methyl Formate Market, accounting for a 31.2% share. Its dominance stems from the compound’s excellent solvency, fast evaporation rate, and compatibility with a wide range of resins and polymers. Industries prefer methyl formate as a cost-effective and environmentally safer solvent alternative to traditional volatile organic compounds.

Its role in producing coatings, adhesives, and chemical intermediates has strengthened its market position. The compound’s efficiency in reaction media and blending applications also supports industrial process optimization. As sustainable chemical formulations gain traction, methyl formate’s solvent application continues to lead demand within the overall market landscape.

By End-Use Analysis

The chemicals industry captured a 37.4% share of the global methyl formate market.

In 2024, the Chemicals Industry held a dominant market position in the By End-Use segment of the Methyl Formate Market, capturing a 37.4% share. This leadership is attributed to its extensive utilization as an intermediate in the production of formic acid, dimethylformamide, and other downstream derivatives. The chemical sector relies heavily on methyl formate for its versatility, purity, and efficiency in multiple synthesis processes.

Its suitability for large-scale manufacturing and compatibility with sustainable chemical formulations further strengthen its prominence. The steady growth of industrial chemical production and rising emphasis on cleaner synthesis pathways have reinforced the chemical industry’s dominant share, making it a key consumer of methyl formate across various process applications.

Key Market Segments

By Source of Production

- Synthetic Production

- Biobased Production

By Application

- Solvent in Chemical Processes

- Intermediate in Esters Production

- Agricultural Chemicals

- Pharmaceuticals

- Plasticizers

- Others

By End-Use

- Chemicals Industry

- Agriculture

- Pharmaceuticals

- Automotive

- Textiles

- Others

Driving Factors

Rising Use of Eco-Friendly Solvents in Manufacturing

One major driving factor for the Methyl Formate Market is the increasing shift toward eco-friendly and sustainable solvents in industrial manufacturing. Methyl formate’s low toxicity, high solvency, and minimal environmental impact make it an attractive alternative to traditional solvents. Industries are steadily adopting it for coatings, adhesives, and polymer production to meet global environmental standards. The push for greener chemistry has also attracted new investments and innovations in synthetic processes.

For example, Solena raised $6.7 million to develop next-generation textiles using AI and synthetic biology, reflecting the broader industrial transition toward sustainable and bio-based materials. This movement aligns closely with the growing adoption of methyl formate as industries worldwide aim for cleaner and more efficient chemical solutions.

Restraining Factors

High Production Costs and Feedstock Price Volatility

One key restraining factor for the Methyl Formate Market is the high production cost linked to fluctuating feedstock prices, particularly methanol and carbon monoxide. These raw materials are sensitive to global energy trends and supply chain instability, which can directly affect manufacturing margins. The dependence on fossil-derived feedstocks adds further uncertainty in cost management for producers. Moreover, the need for specialized equipment and safety protocols increases operational expenses, limiting small-scale adoption.

Recent industrial funding, such as NOVONIX Limited securing up to $95 million to expand synthetic graphite production in Chattanooga, highlights how capital-intensive chemical expansions can be. Similar high investment requirements in methyl formate production often slow down scalability and reduce competitiveness in cost-sensitive markets.

Growth Opportunity

Emerging Potential in Sustainable Chemical Alternatives Production

A major growth opportunity for the Methyl Formate Market lies in its expanding role as a sustainable chemical alternative. With industries increasingly moving toward low-carbon and bio-based solutions, methyl formate offers a cleaner pathway for producing solvents, intermediates, and eco-friendly foaming agents. Its potential integration into renewable chemical processes positions it as a valuable building block for next-generation materials.

The growing focus on sustainable industrial inputs is further supported by new funding activities, such as GrainCorp’s venture capital arm backing a synthetic palm oil startup’s

pre-seed round. Such investments highlight the global shift toward renewable chemistry, where methyl formate could play a critical role in enabling cleaner, safer, and more sustainable production systems.

Latest Trends

Integration of Synthetic Biology in Chemical Manufacturing Processes

One of the latest trends in the Methyl Formate Market is the integration of synthetic biology and advanced chemistry to develop cleaner and more efficient production routes. Companies are exploring bio-based synthesis methods that reduce carbon emissions while maintaining high product purity. This shift toward biotechnology-driven manufacturing aims to replace traditional fossil-based methods with renewable alternatives.

The growing collaboration between biotechnology and chemical industries reflects a long-term move toward sustainability and innovation. Recently, a synthetic genomics startup secured $58 million in funding and welcomed a Nobel Laureate to its board, underscoring the increasing importance of scientific advancements in redefining chemical manufacturing. Such developments are paving the way for bio-engineered methyl formate production with improved efficiency and lower environmental impact.

Regional Analysis

In 2024, Asia-Pacific dominated the Methyl Formate Market with a 39.70% share.

In the regional analysis of the Methyl Formate market, Asia-Pacific emerged as the dominating region, capturing 39.70 % share corresponding to USD 215.8 million of market value in the timeline considered. This predominance is supported by rapid industrialisation in countries such as India and China, strong chemical manufacturing bases, and growing agrochemical usage.

In North America, the market reflects mature demand driven by established chemical and solvent industries, though it trails Asia-Pacific in growth momentum and share. Europe holds a steady position, underpinned by stringent environmental regulations and increasing uptake of low-emission solvents, contributing a significant but smaller share compared to Asia-Pacific.

In the Middle East & Africa, although the chemical sector is expanding, the methyl formate market is somewhat limited due to lower downstream manufacturing diversification and infrastructure. Latin America likewise shows growing but modest activity, driven by expansion in coatings, agrochemicals, and chemical intermediates in emerging economies. Collectively, while each region offers distinct market potential, Asia-Pacific currently leads by a clear margin.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF focused on advancing sustainable chemistry and process efficiency, leveraging its large-scale chemical infrastructure to improve methyl formate production through environmentally responsible methods.

Eastman emphasized innovation in chemical intermediates and solvents, optimizing methyl formate applications within coatings and polymer manufacturing. The company’s efforts toward circular chemical solutions supported the market’s transition to low-emission production routes.

Triveni Chemicals, with its growing presence in specialty chemicals, strengthened supply chains through reliable production of high-purity methyl formate for industrial and agricultural applications.

Collectively, these companies demonstrate a shared direction toward sustainability, product quality, and cost-effective production, enabling the methyl formate market to expand steadily in line with the global movement toward cleaner and more efficient chemical manufacturing practices.

Top Key Players in the Market

- BASF

- Eastman

- Triveni Chemicals

- Tradex Corporation

- Rao A. Group

- Mitsubishi Gas Chemical

- Chevron Chemical Company

- Others

Recent Developments

- In May 2024, BASF agreed with International Process Plants (IPP) to market and relocate production plants for ammonia (380 kt/yr), methanol (165 kt/yr), and melamine (51 kt/yr) at its Ludwigshafen site in Germany. This structural move supports BASF’s evolving production setup in Europe, freeing capacity and optimizing its chemical infrastructure.

- In March 2024, Eastman announced that its new molecular recycling facility in Kingsport, Tennessee achieved on-spec production and was generating revenue. This facility is designed to break down plastic waste using methanolysis technology and convert it into virgin-quality material, reinforcing Eastman’s push into circular economy solutions.

Report Scope

Report Features Description Market Value (2024) USD 542.8 Million Forecast Revenue (2034) USD 962.9 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source of Production (Synthetic Production, Biobased Production), By Application (Solvent in Chemical Processes, Intermediate in Esters Production, Agricultural Chemicals, Pharmaceuticals, Plasticizers, Others), By End-Use (Chemicals Industry, Agriculture, Pharmaceuticals, Automotive, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Eastman, Triveni Chemicals, Tradex Corporation, Rao A. Group, Mitsubishi Gas Chemical, Chevron Chemical Company, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF

- Eastman

- Triveni Chemicals

- Tradex Corporation

- Rao A. Group

- Mitsubishi Gas Chemical

- Chevron Chemical Company

- Others