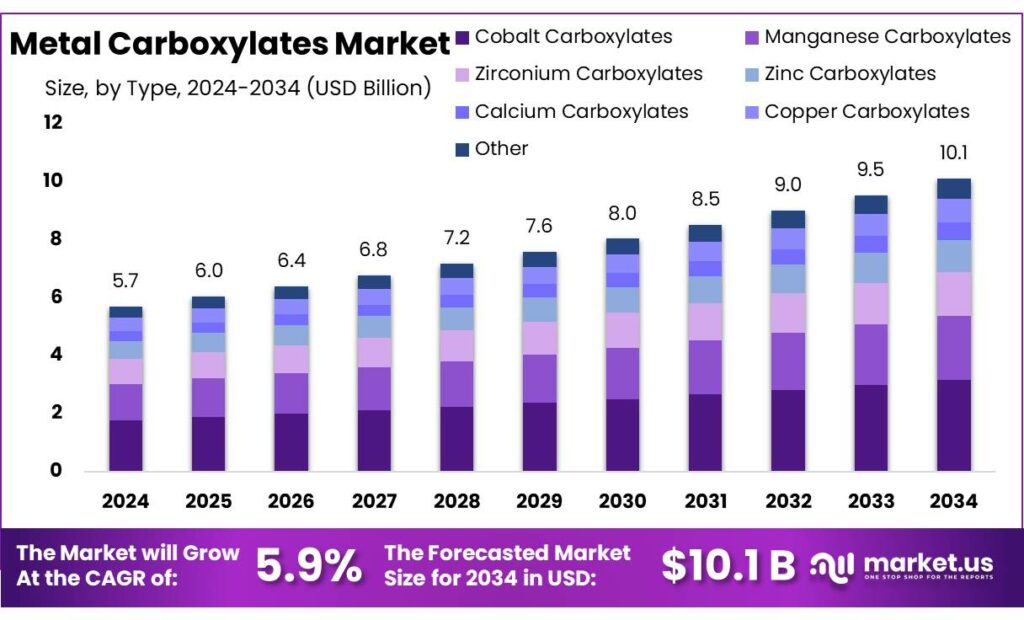

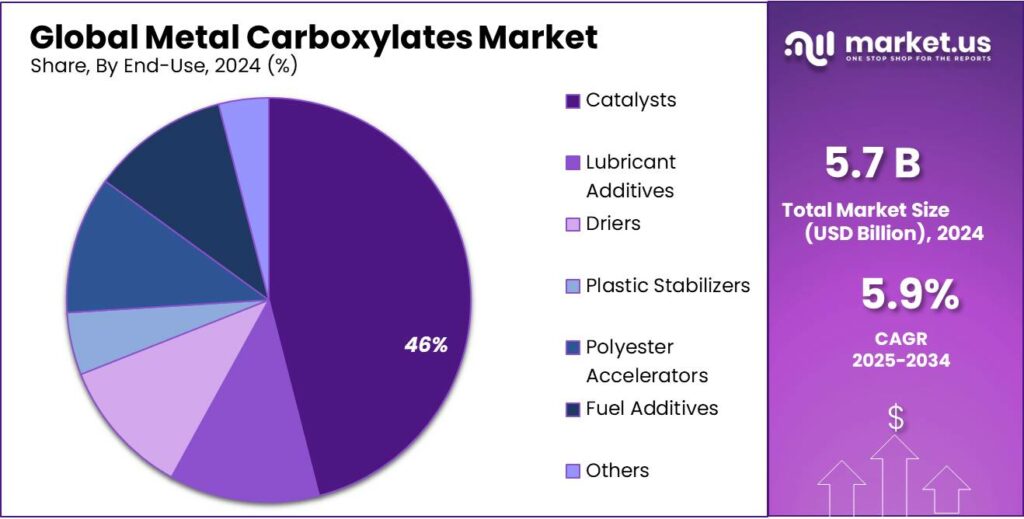

Global Metal Carboxylates Market Size, Share Analysis Report By Metal Type (Cobalt Carboxylates, Manganese Carboxylates, Zirconium Carboxylates, Zinc Carboxylates, Calcium Carboxylates, Copper Carboxylates, Other), By Function (Driers and Catalysts, Lubricants and Stabilizers, Corrosion Inhibitors, Others), By End-use (Catalysts, Lubricant Additives, Driers, Plastic Stabilizers, Polyester Accelerators, Fuel Additives, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159046

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

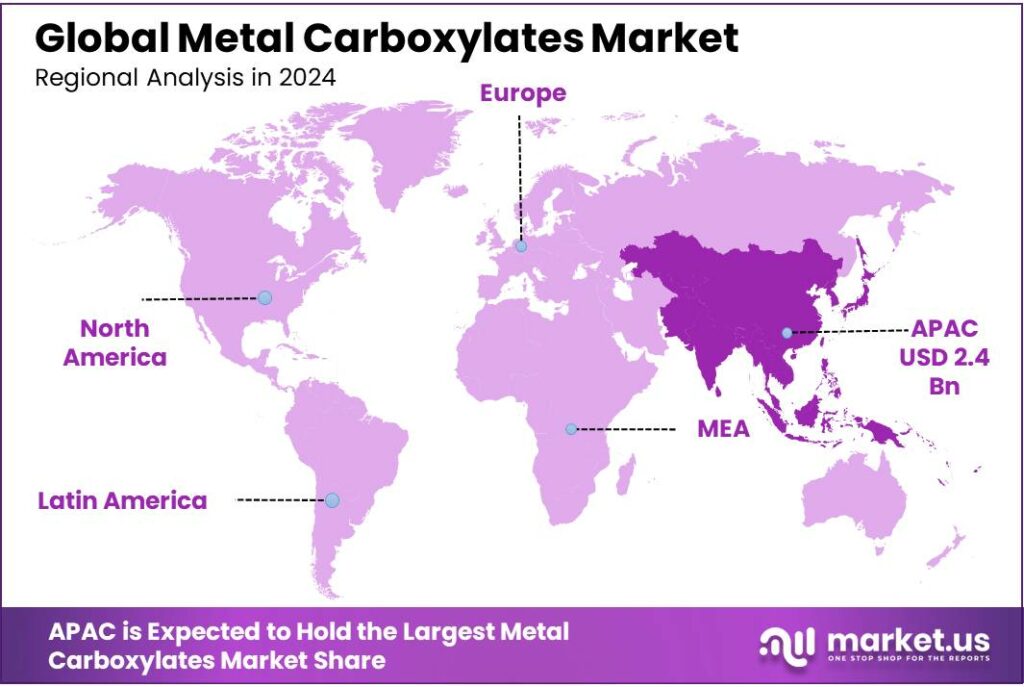

The Global Metal Carboxylates Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 5.7 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.80% share, holding USD 2.4 Billion in revenue.

The metal carboxylates industry encompasses a diverse range of chemical compounds formed by the reaction of metal ions with carboxylic acids. These compounds serve as catalysts, stabilizers, driers, and lubricants across various industrial applications, including coatings, paints, polymers, lubricants, and chemical synthesis. Their key characteristics—high solubility in organic solvents, thermal stability, and catalytic efficiency—make them essential in polymerization, oxidation reactions, and curing processes.

From an industrial standpoint, metal carboxylates sit inside mature end-markets — paints & coatings, printing inks and specialty polymers — that are tied to broader chemical and manufacturing cycles. The global chemical industry recorded world chemical sales of approximately €5,195 billion in 2023, underscoring the scale of end-market demand feeding additive consumption.

In the United States alone, chemical shipments were valued at $639 billion in 2022, while the U.S. chemical sector directly employs roughly 529,000 people, highlighting the economic footprint and downstream demand potential for specialty additives such as metal carboxylates. These macro figures indicate that even modest percentage penetration into coatings and inks can represent meaningful volumes and revenues for suppliers of metal carboxylates.

Future growth opportunities lie in (a) substitution of legacy driers with lower-toxicity or bio-based alternatives, (b) demand growth in emerging-market construction and industrial coatings, and (c) value-added services such as customized complexed metal carboxylates that deliver controlled cure kinetics for high-performance coatings and 3D printing resins. Suppliers who can demonstrate regulatory compliance, provide application engineering data and scale low-metal or cobalt-free chemistries will be best positioned.

Given the size of the chemical sector, targeted innovations that capture even 0.1–0.5% incremental additive penetration in relevant coatings segments could translate into meaningful incremental sales for specialty producers. For technical details and manufacturer guidance on formulation and safe handling, see the manufacturer technical notes and product literature.

Key Takeaways

- Metal Carboxylates Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 5.7 Billion in 2024, growing at a CAGR of 5.9%.

- Cobalt Carboxylates held a dominant market position, capturing more than 31.2% of the total Metal Carboxylates market share.

- Driers and Catalysts held a dominant market position, capturing more than 62.7% of the total Metal Carboxylates market share.

- Catalysts held a dominant market position, capturing more than 46.9% of the total Metal Carboxylates market share.

- Asia Pacific is poised to dominate the global Metal Carboxylates market, capturing a significant share of 43.80%, valued at approximately USD 2.4 billion.

By Metal Type Analysis

Cobalt Carboxylates dominate the market with 31.2% share in 2024

In 2024, Cobalt Carboxylates held a dominant market position, capturing more than 31.2% of the total Metal Carboxylates market share. This market leadership can be attributed to the widespread use of cobalt carboxylates in industrial applications, particularly in coatings, catalysts, and drying agents. The demand for cobalt-based formulations is expected to remain strong in 2025, with continued growth driven by increasing industrial production and advancements in automotive coatings. As the industry seeks to enhance product performance and durability, Cobalt Carboxylates are anticipated to retain their position as the most preferred choice. With a stable growth trajectory, the market share is expected to slightly expand, contributing to further advancements in cobalt-based technologies.

By Function Analysis

Driers and Catalysts lead the market with 62.7% share in 2024

In 2024, Driers and Catalysts held a dominant market position, capturing more than 62.7% of the total Metal Carboxylates market share. This strong market presence is largely due to their critical role in enhancing the performance of coatings, paints, and inks, where they accelerate the curing process and improve product quality. The growing demand for high-performance coatings in industries like automotive, construction, and packaging is expected to drive further growth in this segment in 2025. As manufacturing processes continue to evolve and require more efficient solutions, the demand for Driers and Catalysts is likely to remain robust, securing their dominant market position for the foreseeable future.

By End-use Analysis

Catalysts dominate with 46.9% share in 2024

In 2024, Catalysts held a dominant market position, capturing more than 46.9% of the total Metal Carboxylates market share. This strong market dominance is primarily driven by their essential role in various industrial processes, particularly in the chemical, automotive, and petrochemical sectors, where they enable efficient reactions and enhance product yields. The ongoing trend towards sustainable manufacturing and process optimization further fuels the demand for metal carboxylates as catalysts. Looking into 2025, the growth trajectory for this segment remains positive, supported by increasing investments in green technologies and high-performance manufacturing processes, ensuring that Catalysts continue to hold a significant share of the market.

Key Market Segments

By Metal Type

- Cobalt Carboxylates

- Manganese Carboxylates

- Zirconium Carboxylates

- Zinc Carboxylates

- Calcium Carboxylates

- Copper Carboxylates

- Other

By Function

- Driers and Catalysts

- Lubricants and Stabilizers

- Corrosion Inhibitors

- Others

By End-use

- Catalysts

- Lubricant Additives

- Driers

- Plastic Stabilizers

- Polyester Accelerators

- Fuel Additives

- Others

Emerging Trends

Sustainability and Eco-friendly Solutions Drive Metal Carboxylates Demand

The growing focus on sustainability and eco-friendly solutions is one of the key trends influencing the Metal Carboxylates market. As industries across the globe are prioritizing greener technologies and reducing their environmental impact, the demand for sustainable metal carboxylates, particularly those used in coatings, catalysts, and driers, has risen significantly. In 2024, for instance, various governments and regulatory bodies have implemented stricter environmental standards, which has led to increased innovation in the production of eco-friendly metal carboxylates.

The food industry has also seen a shift towards sustainable packaging, which indirectly supports the growth of metal carboxylates. For example, the use of metal carboxylates in food-grade coatings for packaging materials is becoming increasingly common. These coatings enhance the shelf life of products, which contributes to reducing food waste—an issue that’s crucial in today’s global sustainability agenda.

According to the U.S. Department of Agriculture (USDA), approximately 30-40% of food produced in the United States is wasted annually, and sustainable packaging solutions like those using metal carboxylates can help mitigate this problem.

Governments around the world are also offering incentives to industries that adopt sustainable practices. For instance, the U.S. Environmental Protection Agency (EPA) has been working on promoting green chemistry by supporting the development of new sustainable materials, including eco-friendly metal carboxylates. The EPA’s Safer Choice program, which recognizes products that are safer for human health and the environment, is a key initiative helping industries move toward greener chemicals.

Drivers

Government Regulations and Safety Standards for Metal Carboxylates in Food

Metal carboxylates, such as calcium benzoate and sodium benzoate, are widely utilized in the food industry as preservatives and flavor enhancers. These compounds are particularly effective in acidic foods and beverages, where they inhibit the growth of mold and yeast, thereby extending shelf life and maintaining product quality. For instance, calcium benzoate is commonly used in soft drinks, fruit juices, concentrates, soy milk, soy sauce, and vinegar. It is also the most widely used preservative in making bread and other bakery products.

The safety and permissible levels of metal carboxylates in food products are strictly regulated by various governmental bodies worldwide. In the United States, the Food and Drug Administration (FDA) has established guidelines under 21 CFR Part 172, which prescribes conditions under which food additive substances may be safely used. These regulations ensure that the quantity of any substance added to food does not exceed the amount reasonably required to accomplish its intended physical, nutritive, or other technical effect, and that the substance is of appropriate food grade and is prepared and handled as a food ingredient.

In addition to regulatory standards, industry organizations often provide guidelines and best practices for the use of metal carboxylates in food applications. For example, the Food Chemicals Codex (FCC), published by the U.S. Pharmacopeia, offers monographs that specify the identity, purity, and quality standards for food ingredients, including preservatives like metal carboxylates.

These stringent regulations and standards play a crucial role in ensuring that metal carboxylates used in food products are safe for consumption and do not pose any health risks to consumers. By adhering to these guidelines, manufacturers can contribute to the production of safe and high-quality food products that meet the expectations of both regulatory authorities and consumers.

Restraints

Environmental Concerns and Regulatory Challenges

One significant challenge facing the use of metal carboxylates in the food industry is their potential environmental impact. These compounds, often used as preservatives and stabilizers, can persist in the environment and pose risks to ecosystems. For instance, certain metal carboxylates may leach into soil and water systems, leading to contamination.

Regulatory bodies worldwide have recognized these concerns and have implemented measures to mitigate the environmental risks associated with metal carboxylates. In the United States, the Environmental Protection Agency (EPA) has established guidelines for the use and disposal of chemicals, including metal carboxylates, to prevent environmental contamination. Similarly, the European Union has stringent regulations under the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) framework, which assesses the environmental impact of chemicals used within its member states.

These regulations require manufacturers to conduct thorough environmental impact assessments and to seek approval before introducing new metal carboxylates into the market. The approval process involves evaluating the chemical’s persistence, bioaccumulation potential, and toxicity to aquatic and terrestrial organisms. Only those compounds that meet safety criteria are permitted for use in food products.

Moreover, there is a growing trend towards the development and adoption of alternative preservatives that are more environmentally friendly. Natural preservatives, such as certain plant extracts and organic acids, are gaining popularity due to their biodegradability and lower environmental footprint. This shift is driven by both consumer demand for cleaner labels and the increasing regulatory pressure on industries to reduce their environmental impact.

Opportunity

Growth Opportunities for Metal Carboxylates in Food Preservation

The global demand for food preservatives is steadily increasing, driven by the need to extend shelf life, reduce food waste, and maintain food safety. Metal carboxylates, such as calcium benzoate and sodium benzoate, are widely utilized in the food industry for these purposes. These compounds are particularly effective in acidic foods and beverages, where they inhibit the growth of mold and yeast, thereby extending shelf life and maintaining product quality. For instance, calcium benzoate is commonly used in soft drinks, fruit juices, concentrates, soy milk, soy sauce, and vinegar. It is also the most widely used preservative in making bread and other bakery products.

Similarly, the European Union has set maximum residue limits (MRLs) for food additives, including metal carboxylates, to ensure consumer safety. These MRLs are established based on scientific evaluations and are enforced through legislation to protect public health.

In addition to regulatory standards, industry organizations often provide guidelines and best practices for the use of metal carboxylates in food applications. For example, the Food Chemicals Codex (FCC), published by the U.S. Pharmacopeia, offers monographs that specify the identity, purity, and quality standards for food ingredients, including preservatives like metal carboxylates.

Regional Insights

Asia Pacific Metal Carboxylates Market Overview

In 2024, Asia Pacific is poised to dominate the global Metal Carboxylates market, capturing a significant share of 43.80%, valued at approximately USD 2.4 billion. This region’s market leadership is primarily driven by rapid industrialization, a booming manufacturing sector, and a strong demand for advanced materials in automotive, coatings, and agriculture industries. Asia Pacific’s burgeoning economies, including China, India, and Southeast Asia, are major contributors to this growth, with China being the largest consumer of metal carboxylates, especially for automotive coatings and industrial applications.

The demand for metal carboxylates in Asia Pacific is further bolstered by stringent environmental regulations, encouraging the shift to more sustainable and performance-enhancing materials. Countries like Japan and South Korea are increasingly adopting high-performance metal carboxylates in their aerospace and automotive sectors, benefiting from government initiatives aimed at reducing emissions and increasing energy efficiency.

In the agricultural sector, the region’s growing demand for sustainable farming practices is also driving the adoption of copper and zinc-based metal carboxylates, which are used in fertilizers and plant protection products. According to the Food and Agriculture Organization (FAO), Asia’s agricultural sector is expected to grow at a compound annual rate of 5.2%, with metal carboxylates playing a pivotal role in improving crop yield and soil health.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a leading player in the Metal Carboxylates market, offering a wide range of metal-based additives for coatings, lubricants, and agriculture. The company’s extensive portfolio includes high-performance carboxylates such as cobalt, zinc, and calcium-based compounds. BASF’s strong presence in Europe and North America, along with its commitment to sustainability and product innovation, positions it as a key market leader. In 2023, BASF generated EUR 87.3 billion in global sales, solidifying its market dominance.

Dow is another major contributor to the Metal Carboxylates market, providing cutting-edge solutions for industrial coatings, plastics, and automotive sectors. The company’s offerings focus on enhancing the performance and durability of materials. Dow’s carboxylates are used in applications requiring high stability and efficiency, such as catalysis and lubrication. With a global revenue of USD 58.4 billion in 2023, Dow’s innovative approach to chemical solutions ensures continued growth in the metal carboxylates segment.

Arkema Group, a prominent player in the specialty chemicals sector, produces a variety of metal carboxylates, particularly for use in the coatings, adhesives, and agriculture industries. Arkema focuses on high-quality zinc and cobalt-based carboxylates that enhance performance and environmental sustainability. With its global footprint and technological expertise, Arkema achieved sales of EUR 10.5 billion in 2023, positioning it for growth in emerging markets. The company is committed to sustainable chemistry and innovation, ensuring market expansion.

Top Key Players Outlook

- BASF SE

- Dow

- Arkema Group

- PMC Group, Inc.

- Valtris Specialty Chemicals

- DIC Corporation

- Ege Kimya San. ve Tic. A.S

- Borchars

- Umicore

- NICHIA CORPORATION

Recent Industry Developments

In 2023, Arkema reported global sales of EUR 10.5 billion, with a continued upward trajectory in 2024. The company’s strategic investments in R&D and focus on sustainable chemistry are expected to boost its presence in key markets such as Europe and Asia.

In 2023, PMC Group generated a revenue of approximately USD 1.2 billion, with continued growth projected in 2024 due to increased demand for sustainable and advanced chemical solutions.

Report Scope

Report Features Description Market Value (2024) USD 5.7 Bn Forecast Revenue (2034) USD 10.1 Bn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Metal Type (Cobalt Carboxylates, Manganese Carboxylates, Zirconium Carboxylates, Zinc Carboxylates, Calcium Carboxylates, Copper Carboxylates, Other), By Function (Driers and Catalysts, Lubricants and Stabilizers, Corrosion Inhibitors, Others), By End-use (Catalysts, Lubricant Additives, Driers, Plastic Stabilizers, Polyester Accelerators, Fuel Additives, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Dow, Arkema Group, PMC Group, Inc., Valtris Specialty Chemicals, DIC Corporation, Ege Kimya San. ve Tic. A.S, Borchars, Umicore, NICHIA CORPORATION Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Dow

- Arkema Group

- PMC Group, Inc.

- Valtris Specialty Chemicals

- DIC Corporation

- Ege Kimya San. ve Tic. A.S

- Borchars

- Umicore

- NICHIA CORPORATION