Global Membrane Bioreactor (MBR) Market Size, Share Analysis Report By Product (Hollow Fiber, Flat Sheet, Multi-tubular), By Configuration (Submerged, Side Stream), By Application (Industrial, Municipal, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153355

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

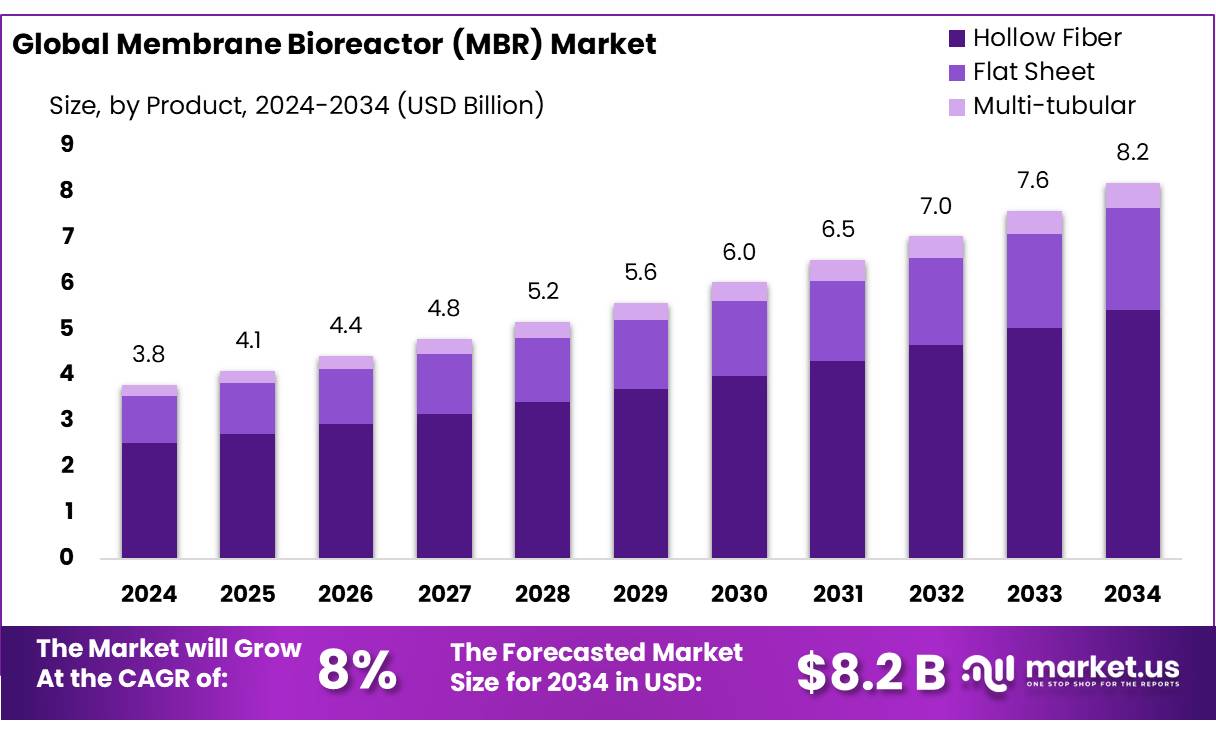

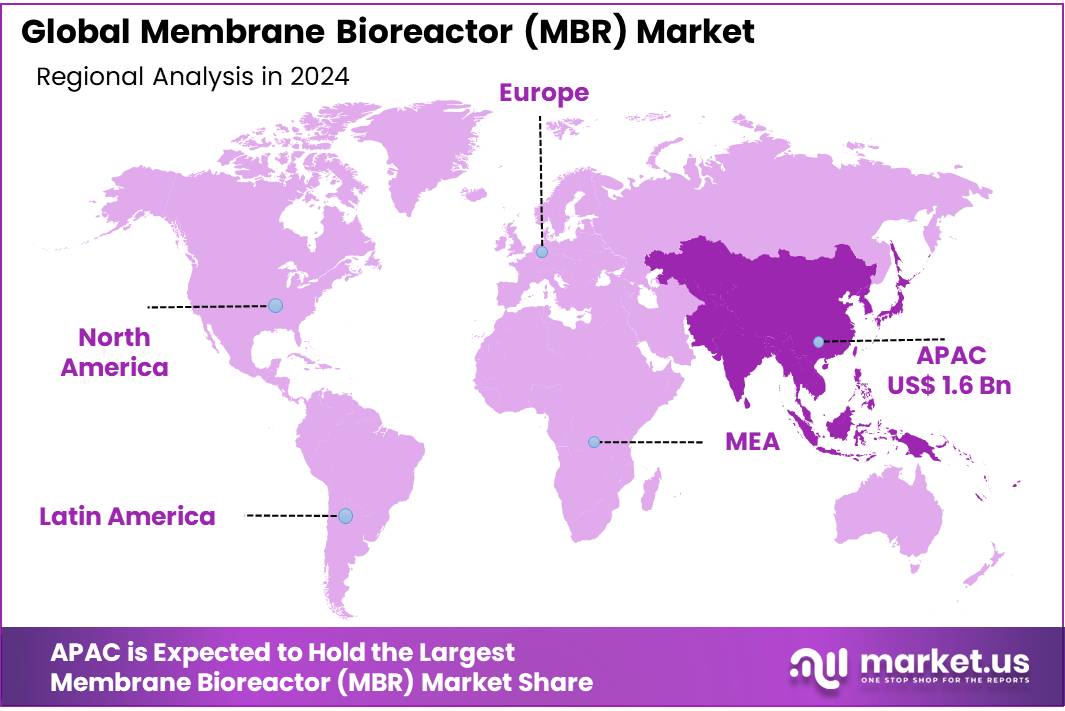

The Global Membrane Bioreactor (MBR) Market size is expected to be worth around USD 8.2 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 43.1% share, holding USD 1.6 Billion revenue.

Membrane bioreactor (MBR) technology integrates membrane filtration—typically microfiltration or ultrafiltration—with conventional activated sludge processes. The result is high-quality effluent and compact plant designs, enabling MBR systems to treat both municipal and industrial wastewater within reduced footprints.

Key driving factors include increasingly stringent discharge regulations, rapid urbanization, and growing water scarcity. For example, the EU allocates roughly 0.8 % of its total energy consumption to wastewater treatment and has identified a need for €90 billion in water and waste infrastructure investment by 2030 to meet climate and energy objectives.

Energy optimization and hybridization present future growth avenues. Recent peer-reviewed advances highlight integration of MBRs with forward osmosis, membrane distillation, and desalination stages, yielding lower energy consumption and heightened permeate quality for wastewater reuse. Additionally, published research on large-scale industrial MBR applications documents over 182 systems with treatment capacities exceeding 5,000 m³/day, demonstrating the maturity and scalability of these technologies for process water reuse and zero-liquid discharge configurations.

Government and regulatory initiative support is evident globally. In India, for instance, the Delhi Jal Board is commissioning a 564 MLD sewage treatment plant that includes advanced treatment stages—likely MBR or equivalent membrane-based systems—slated to be operational in late 2022. The EU has earmarked an approximate €90 billion investment in water and waste infrastructure by 2030, explicitly aimed at achieving climate, energy, and circular economy targets.

In India, the Delhi Jal Board is finalizing a 564 MLD sewage treatment plant, set to significantly reduce untreated effluent discharge into the Yamuna. National initiatives such as India’s 24×7 Water Supply guidelines emphasize optimizing MBR energy efficiency and sludge handling.

Key Takeaways

- Membrane Bioreactor (MBR) Market size is expected to be worth around USD 8.2 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 8.0%

- Hollow Fiber held a dominant market position, capturing more than a 66.2% share in the global Membrane Bioreactor (MBR) market.

- Submerged held a dominant market position, capturing more than a 67.9% share in the global Membrane Bioreactor (MBR) market.

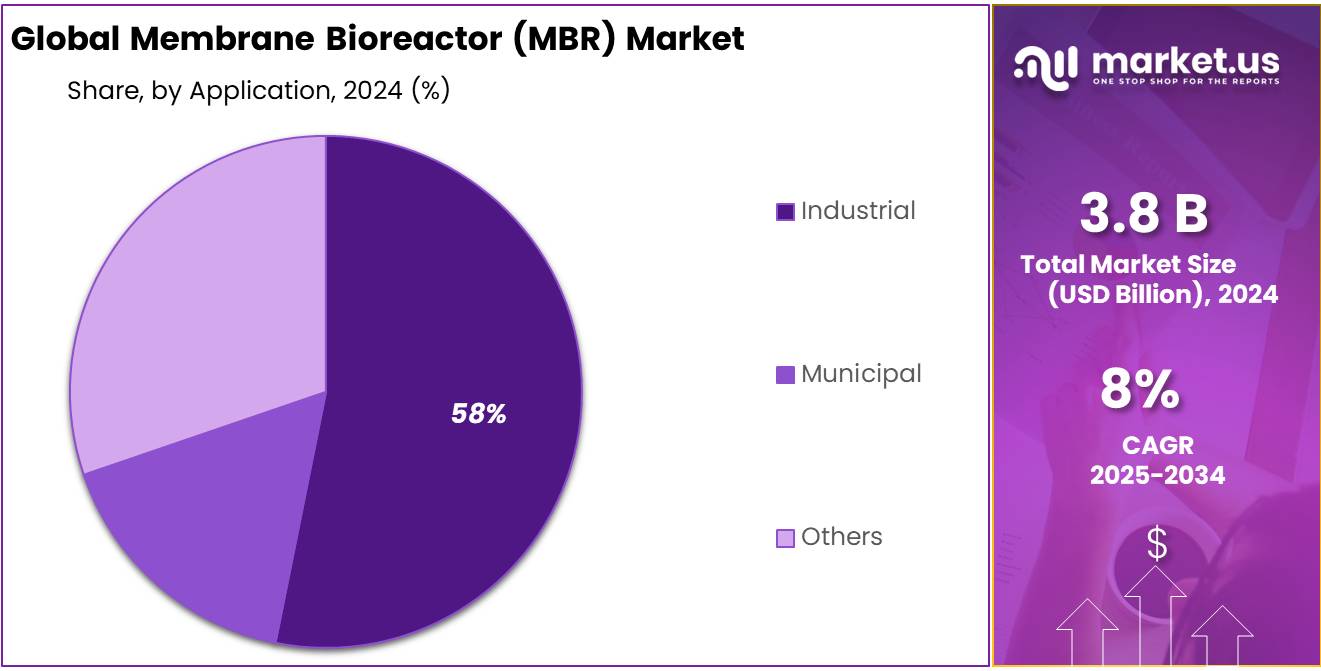

- Industrial held a dominant market position, capturing more than a 58.5% share in the global Membrane Bioreactor (MBR) market.

- Asia-Pacific (APAC) region emerged as the dominant force in the global Membrane Bioreactor (MBR) market, accounting for a commanding 43.1% share, equivalent to a market value of approximately USD 1.6 billion.

By Product Analysis

Hollow Fiber leads with 66.2% due to its strong filtration efficiency and lower cost.

In 2024, Hollow Fiber held a dominant market position, capturing more than a 66.2% share in the global Membrane Bioreactor (MBR) market by product. This significant lead is mainly driven by its higher surface area-to-volume ratio, which allows for efficient separation in compact spaces, making it ideal for both municipal and industrial wastewater treatment. Hollow fiber modules are favored for their durability, ease of maintenance, and relatively lower operational costs compared to other membrane configurations.

Their simple modular design supports scalability, which is especially beneficial for retrofitting older treatment plants or expanding capacity in growing urban areas. As water scarcity becomes a more pressing issue globally, the demand for efficient and cost-effective filtration systems like hollow fiber membranes is expected to remain strong in 2025. The segment’s continued dominance reflects its balance between performance, affordability, and operational flexibility.

By Configuration Analysis

Submerged MBR dominates with 67.9% due to its energy efficiency and easy installation.

In 2024, Submerged held a dominant market position, capturing more than a 67.9% share in the global Membrane Bioreactor (MBR) market by configuration. This leading share is mainly supported by the configuration’s energy-efficient design, lower operating costs, and ease of integration into existing treatment systems. Submerged MBRs, where membranes are directly placed within the bioreactor tank, eliminate the need for high-pressure pumps, making them more cost-effective and suitable for large-scale municipal wastewater projects.

Their compact design also allows space-saving installation, which is highly valued in densely populated urban areas. By 2025, demand for submerged systems is expected to grow further, as environmental regulations tighten and more cities invest in advanced water recycling infrastructure. The segment’s strong performance reflects its practical benefits, user-friendly design, and consistent ability to meet strict water quality standards.

By Application Analysis

Industrial application leads with 58.5% due to rising wastewater from manufacturing units.

In 2024, Industrial held a dominant market position, capturing more than a 58.5% share in the global Membrane Bioreactor (MBR) market by application. This strong position is largely driven by the increasing need for effective wastewater treatment in industries such as chemicals, pharmaceuticals, food processing, and textiles. As environmental regulations grow stricter worldwide, industries are being pushed to adopt more efficient and reliable water treatment technologies.

MBR systems are widely chosen in the industrial sector due to their ability to handle high organic loads and deliver consistent effluent quality. Their compact design and reduced sludge generation also make them suitable for space-constrained industrial sites. By 2025, industrial use of MBR systems is expected to rise further, as companies invest in cleaner processes and sustainable water reuse strategies. The segment’s growth highlights a practical response to growing environmental pressures and operational needs across major manufacturing regions.

Key Market Segments

By Product

- Hollow Fiber

- Flat Sheet

- Multi-tubular

By Configuration

- Submerged

- Side Stream

By Application

- Industrial

- Municipal

- Others

Emerging Trends

Smart & Food-Waste-Focused MBR Systems Gain Momentum

In recent years, a powerful trend has emerged in the Membrane Bioreactor (MBR) sector: the integration of smart monitoring technologies with targeted treatment for food-industry wastewater. As food and beverage processors produce massive wastewater volumes—dairy plants discharge between 264–2,642 gallons per ton of product and meat facilities produce 1,585–3,698 gallons per ton—the need for precise, efficient treatment has become urgent.

To address this, MBR systems are being equipped with real-time sensors and data analytics platforms that continuously track parameters like pH, turbidity, and biological oxygen demand (BOD). This enables adjustments in aeration, circulation, and cleaning cycles, reducing energy use and preventing membrane fouling. A recent report noted that smart MBR solutions can cut energy consumption by 15–20%, boosting cost savings and reliability.

Governments are supporting this evolution. The European Union’s updated Urban Waste Water Treatment Directive (EU 2024/3019), effective January 1, 2025, now requires removal of micropollutants from wastewater—endocrine disruptors, pharmaceuticals, and PFAS—by treatment plants. Smart MBR systems help meet these stricter standards in industrial zones and food-processing sites by allowing continuous tracking of trace contaminants and enabling advanced cleaning strategies before discharge.

This development is a human-centred advance. Workers at food plants gain dependable, low-maintenance technology; communities benefit from cleaner local water; and regulators see a path to compliance without disrupting production. By 2025, the trend is expected to accelerate, with more food-processing facilities adopting intelligent, sensor‑enhanced MBRs that not only treat large volumes of wastewater effectively but also respond dynamically to changing loads and regulatory demands.

Drivers

Rising Demand for Water Treatment Solutions

The growing global demand for efficient and sustainable water treatment solutions has significantly driven the adoption of Membrane Bioreactor (MBR) technology in various industries, particularly in the food and beverage sector. According to the Food and Agriculture Organization (FAO), water scarcity is one of the most pressing global challenges, with over 2 billion people living in countries experiencing high water stress. This has led to an increased focus on water recycling and reuse across industries, including food production.

In the food industry, water is crucial not only for processing but also for sanitation and cleaning. With stringent environmental regulations and rising operational costs, companies are turning to MBR systems to ensure effective treatment of wastewater. The adoption of MBR systems helps these industries meet water quality standards, reduce water consumption, and lower discharge costs. The World Health Organization (WHO) reports that efficient wastewater treatment technologies, including MBR, can reduce the environmental impact of industries by effectively removing contaminants, making it suitable for reuse in various processes.

For example, Coca-Cola’s water stewardship initiatives aim to replenish more water than they use, and they have adopted advanced wastewater treatment systems, including MBR technologies, to treat their wastewater. According to Coca-Cola’s sustainability report, their water use efficiency has improved by 20% in the last decade, showcasing the growing importance of water treatment technologies like MBR in the food industry.

Government initiatives worldwide also support the expansion of water treatment infrastructure. In the United States, the Environmental Protection Agency (EPA) has been actively funding projects for water quality improvement, including the implementation of advanced treatment technologies like MBR, through its Clean Water State Revolving Fund (CWSRF). This not only assists in water conservation but also promotes sustainability in industries, including food processing.

Restraints

High Initial Capital Investment

One of the major restraining factors limiting the widespread adoption of Membrane Bioreactor (MBR) technology is the high initial capital investment required for its installation and setup. For many small and medium-sized food processing industries, the upfront costs associated with MBR systems can be a significant barrier. The Food and Agriculture Organization (FAO) highlights that industries in emerging markets, particularly in developing countries, struggle with the financial burden of implementing advanced water treatment technologies. In addition to the purchase of the MBR system itself, there are also costs related to installation, maintenance, and skilled labor required for operation.

For example, a study published by the United Nations Industrial Development Organization (UNIDO) states that MBR systems can cost 30-40% more than conventional wastewater treatment methods, making them less appealing to companies that are hesitant to invest in such high-cost solutions. This is especially true in industries like food and beverage, where companies operate on tight margins and need to ensure a fast return on investment (ROI).

To address these concerns, government initiatives and funding programs have been established to support industries transitioning to more sustainable practices. In the European Union, the LIFE Program, which provides financial assistance for environmental projects, has supported various water treatment projects that utilize MBR technology.

The U.S. Environmental Protection Agency (EPA) also provides grants to help industries improve water efficiency, thus helping offset the high costs associated with MBR systems. However, despite these initiatives, the initial financial burden remains a critical hurdle, particularly for smaller enterprises that lack the resources for such significant capital outlays.

Opportunity

Increasing Focus on Sustainability and Water Recycling

One of the most promising growth opportunities for Membrane Bioreactor (MBR) technology lies in the increasing global emphasis on sustainability and water recycling, particularly in industries such as food and beverage processing. As water scarcity becomes an ever-growing issue worldwide, more companies are looking for innovative ways to reduce water consumption and reuse water in their operations. The food industry, a major consumer of water, is increasingly adopting MBR technology to improve water treatment processes, reduce water waste, and ensure compliance with stringent environmental regulations.

For instance, in 2023, Nestlé reported a 10% improvement in its water efficiency across its global operations, thanks to the implementation of advanced water treatment technologies like MBR. The company’s commitment to water stewardship includes significant investments in sustainable water management practices, which have resulted in considerable savings in water usage and operational costs.

Government support is also playing a key role in driving the adoption of MBR technology. The United States, through the Environmental Protection Agency (EPA), has been actively promoting water efficiency and wastewater treatment innovations. In 2021, the EPA announced funding for projects that support water recycling technologies, including MBR, through its Clean Water State Revolving Fund (CWSRF). This initiative has helped numerous food processing companies integrate water-saving solutions into their operations, further highlighting the potential for growth in the MBR market.

Regional Insights

In 2024, the Asia-Pacific (APAC) region emerged as the dominant force in the global Membrane Bioreactor (MBR) market, accounting for a commanding 43.1% share, equivalent to a market value of approximately USD 1.6 billion. This leadership position can be attributed to several key factors, including rapid urbanization, rising population density, growing industrial discharge, and increasing government investment in sustainable wastewater treatment infrastructure.

Countries such as China, India, Japan, and South Korea have made significant progress in adopting advanced water purification technologies, particularly in urban and industrial clusters where water pollution and scarcity issues are intensifying.

China has been at the forefront of MBR deployment due to its stringent regulatory framework under the “Water Ten Plan” and the push toward ecological civilization, which mandates enhanced wastewater treatment performance across municipalities and industrial parks. India, on the other hand, is experiencing growing demand for decentralized and modular MBR systems, supported by initiatives under the Swachh Bharat Mission and Smart Cities Program. The Ministry of Housing and Urban Affairs (MoHUA) in India has emphasized energy-efficient wastewater management, further driving MBR adoption in urban sanitation projects.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

General Electric (GE) has been a key player in the Membrane Bioreactor (MBR) market through its water treatment division, offering advanced membrane technologies for municipal and industrial wastewater reuse. GE’s MBR systems are recognized for high throughput and energy efficiency. The company’s ZeeWeed membrane technology is widely used globally for its robust performance and long service life. GE continues to focus on innovations in hollow fiber membranes, supporting sustainable water management in regions facing water scarcity and stricter wastewater regulations.

CITIC Envirotech Ltd., headquartered in Singapore, is one of Asia’s leading environmental engineering firms, heavily involved in the deployment of MBR systems across China and Southeast Asia. The company focuses on integrated water solutions, particularly for large-scale municipal and industrial wastewater treatment plants. CITIC’s membrane bioreactor systems are known for high-capacity processing and strong pollutant removal. Backed by strong governmental partnerships, CITIC continues to expand its footprint in water-scarce and heavily urbanized regions.

MANN+HUMMEL Water & Fluid Solutions, formerly known as Microdyn-Nadir, is a global leader in membrane technology. The company offers a wide range of MBR products, including flat sheet and hollow fiber membranes used in industrial and municipal applications. Known for their reliability and ease of maintenance, their membrane solutions help reduce operational costs and extend system life. With production facilities in Germany, the U.S., and Asia, MANN+HUMMEL serves a diverse global customer base committed to sustainable water treatment.

Top Key Players Outlook

- General Electric

- B&P Water Technologies S.r.l.

- CITIC Envirotech Ltd.

- MANN+HUMMEL Water & Fluid Solutions

- Suez

- Calgon Carbon Corporation

- Veolia

- Reynolds Culligan

- Kemira

- Buckman

- Mitsubishi Chemical Corporation

- Aquatech International LLC

- Danaher Corporation

- Toray Industries

- Kubota Corporation

Recent Industry Developments

In November 2024 CITIC Envirotech Ltd., secured the RMB 490 million Phase I renovation of the Jiaxing United Wastewater Treatment Plant, deploying an MBR membrane system designed to handle 100,000m³/day and upgrading existing capacity from 150,000m³/day to ensure high-quality effluent for industrial and domestic sources.

In 2024 General Electric, introduced its LEAPmbr system, engineered to reduce energy use by around 15% compared to earlier models.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Bn Forecast Revenue (2034) USD 8.2 Bn CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Hollow Fiber, Flat Sheet, Multi-tubular), By Configuration (Submerged, Side Stream), By Application (Industrial, Municipal, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape General Electric, B&P Water Technologies S.r.l., CITIC Envirotech Ltd., MANN+HUMMEL Water & Fluid Solutions, Suez, Calgon Carbon Corporation, Veolia, Reynolds Culligan, Kemira, Buckman, Mitsubishi Chemical Corporation, Aquatech International LLC, Danaher Corporation, Toray Industries, Kubota Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Membrane Bioreactor (MBR) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Membrane Bioreactor (MBR) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- General Electric

- B&P Water Technologies S.r.l.

- CITIC Envirotech Ltd.

- MANN+HUMMEL Water & Fluid Solutions

- Suez

- Calgon Carbon Corporation

- Veolia

- Reynolds Culligan

- Kemira

- Buckman

- Mitsubishi Chemical Corporation

- Aquatech International LLC

- Danaher Corporation

- Toray Industries

- Kubota Corporation