Global Medium Voltage Switchgears Market Size, Share, And Enhanced Productivity By Type (Compact Switchgear, Metal Clad Switchgear, Metal Enclosed Switchgear, Pad Mounted Switchgear, Others), By Insulation Medium (Air, Gas, Fluid, Others), By Voltage (Below 3kV, 3-9kV, 9-15kV, 15-21kV, 21-33kV, Above 33kV), By Application (Residential, Commercial, Industrial and Utility), By End User (Power Station, Substation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168951

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

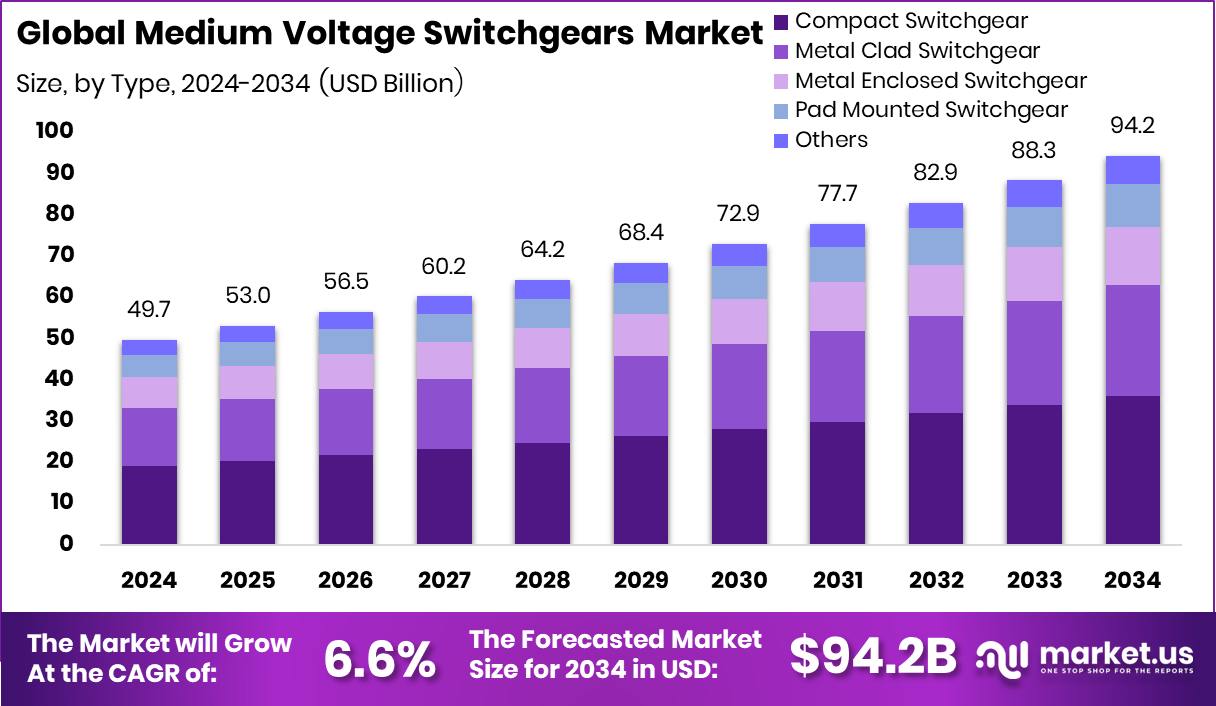

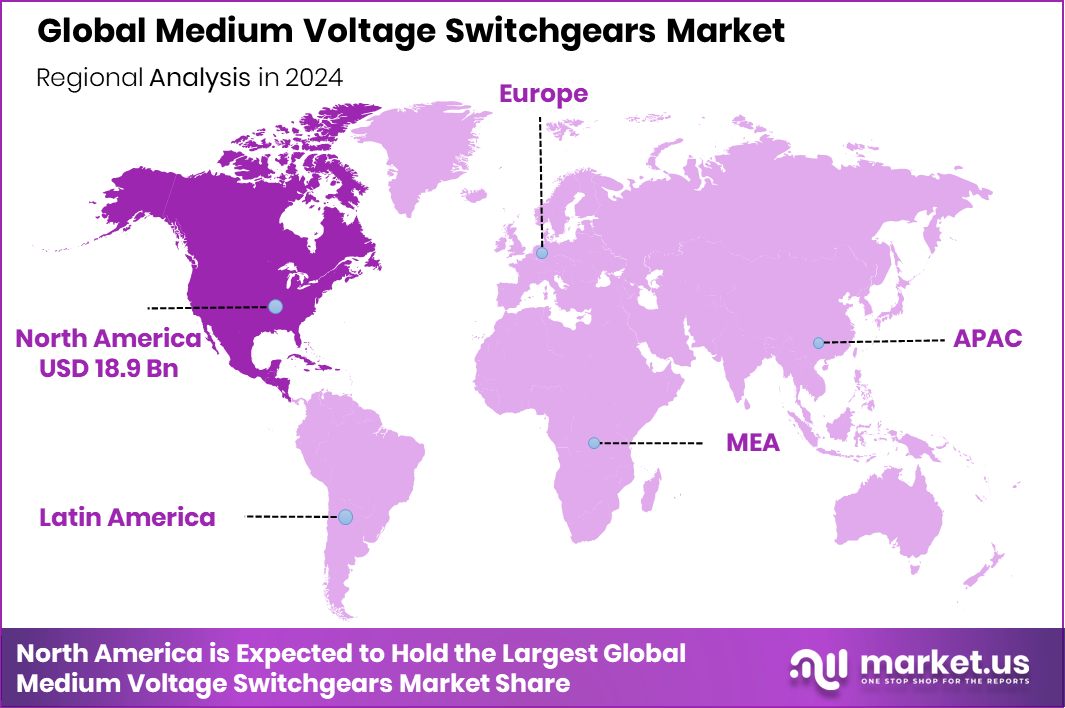

The Global Medium Voltage Switchgears Market is expected to be worth around USD 94.2 billion by 2034, up from USD 49.7 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034. Medium Voltage Switchgears Market in North America reaches 38.20% share, totalling USD 18.9 Bn value.

Medium voltage switchgears are electrical devices used to control, protect, and isolate power equipment operating typically between 1 kV and 36 kV. They play a key role in keeping electrical networks safe by managing faults, switching loads, and ensuring stable power flow in industrial plants, utilities, buildings, and renewable energy systems.

The medium voltage switchgear market refers to the production and deployment of these systems across power generation, transmission, and distribution networks. This market grows alongside electricity demand, grid expansion, and the need for reliable power infrastructure in both urban and industrial settings.

One major growth factor is strong capital investment in manufacturing and clean technologies. CG Power announced a ₹748 crore investment to build a new switchgear plant in western India, signalling capacity expansion. At the same time, Berlin-based Nuventura raised €25 million in Series A funding to develop greenhouse-gas-free switchgear technologies.

Rising demand comes from renewable energy and grid modernisation projects. RMC Switchgears gained approval to set up a renewable energy park, reflecting how grid-connected solar and wind projects depend on medium-voltage systems. These installations require safe and flexible switching solutions.

A key opportunity lies in consolidation and advanced technology adoption. Siemens acquired C&S Electric for ₹2,100 crore, while Pekat bought a 60% stake in a local switchgear supplier for RM96 million. Such deals highlight long-term confidence in cleaner, smarter, and locally manufactured switchgear solutions.

Key Takeaways

- The Global Medium Voltage Switchgears Market is expected to be worth around USD 94.2 billion by 2034, up from USD 49.7 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

- In the Medium Voltage Switchgears Market, compact switchgear dominates by type with a 38.4% share.

- Within the Medium Voltage Switchgears Market, air insulation leads insulation mediums, accounting for 49.1% overall.

- In the Medium Voltage Switchgears Market, below 3kV systems hold 31.5% voltage segment share today.

- Across the Medium Voltage Switchgears Market, industrial and utility applications together contribute a dominant 57.8%.

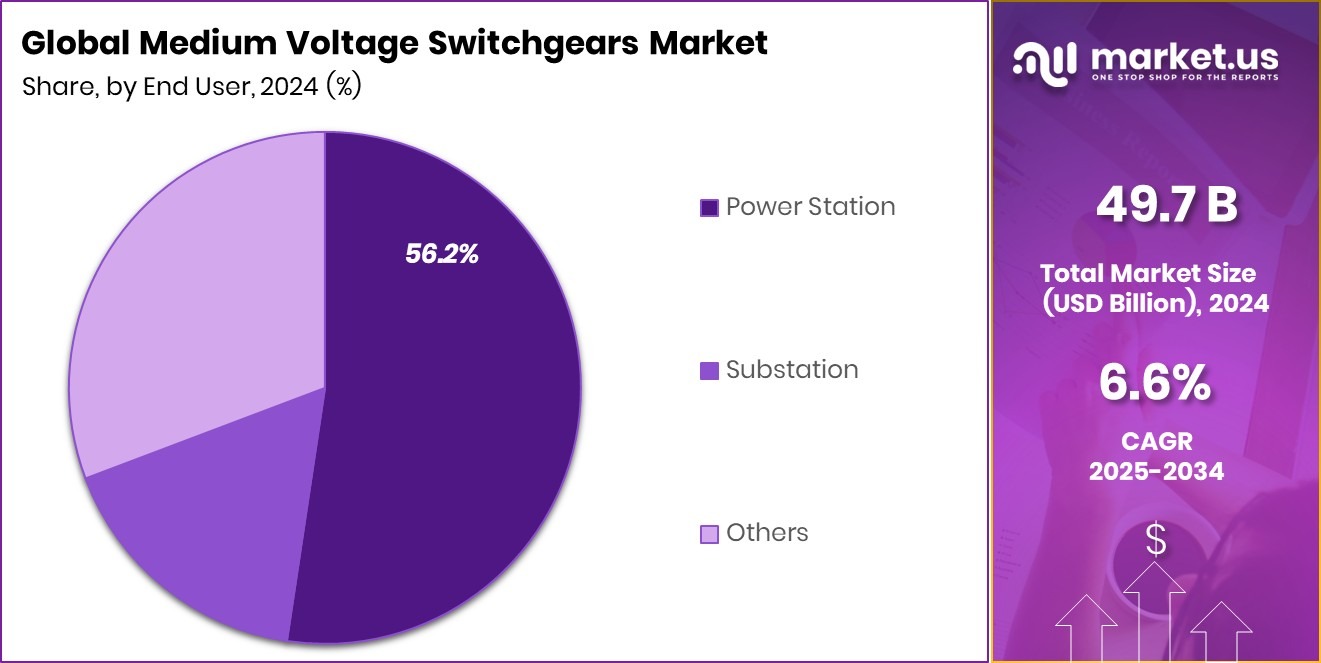

- In the Medium Voltage Switchgears Market, substations lead end users with a strong 56.2% share.

- North America accounts for 38.20% of the Medium Voltage Switchgears Market, worth USD 18.9 Bn regionally today.

By Type Analysis

Compact switchgear leads the Medium Voltage Switchgears Market by type with 38.4% share.

In 2024, Compact Switchgear held a dominant market position in the By Type segment of the Medium Voltage Switchgears Market, with a 38.4% share. This strong position was mainly driven by its space-saving design and suitability for modern electrical infrastructure.

Compact switchgear is widely preferred in urban substations, commercial buildings, and industrial facilities where space availability is limited but operational reliability is critical. Its integrated construction reduces installation time and simplifies maintenance, making it a practical choice for fast-developing power networks.

Utilities and industrial users also favour compact switchgear for its enhanced safety features and ease of expansion within confined layouts. As power distribution networks become denser and more technologically advanced, compact switchgear continues to remain a preferred solution within medium voltage applications.

By Insulation Medium Analysis

Air insulation dominates the medium voltage switchgear market with a 49.1% share across installations.

In 2024, Air held a dominant market position in the By Insulation Medium segment of the Medium Voltage Switchgears Market, with a 49.1% share. This dominance was largely supported by air insulation being a well-established and widely accepted technology across power distribution networks.

Air-insulated switchgear is valued for its straightforward design, ease of operation, and proven reliability under varied operating conditions. It allows simpler inspection and maintenance practices, which help utilities and industrial users manage long-term operating costs efficiently.

Additionally, air insulation supports high adaptability in conventional substations where space constraints are moderate. As utilities continue to prioritise dependable and easily serviceable systems, air-insulated switchgear maintained a strong presence within medium voltage installations.

By Voltage Analysis

Below 3kV voltage category holds a medium voltage switchgear market share of 31.5.

In 2024, Below 3kV held a dominant market position in the By Voltage segment of the Medium Voltage Switchgears Market, with a 31.5% share. This segment’s leadership was supported by its widespread use in localised power distribution systems where controlled voltage handling is essential.

Switchgears operating below 3 kV are commonly installed in small industrial units, commercial complexes, and utility distribution points that require stable and safe power management. Their simpler configuration contributes to easier installation and operational reliability, making them suitable for applications with steady load requirements. Consistent adoption across routine power distribution networks helped the below 3kV segment maintain a strong and stable presence within the market.

By Application Analysis

Industrial and utility applications drive the medium voltage switchgear market, accounting for 57.8%.

In 2024, Industrial and Utility held a dominant market position in the By Application segment of the Medium Voltage Switchgears Market, with a 57.8% share. This dominance was driven by the heavy reliance of industrial facilities and utility networks on stable and efficient power distribution systems.

Medium voltage switchgears are widely used in manufacturing plants, process industries, and utility substations to manage high load operations and ensure system protection. Their role in supporting continuous operations and minimising power interruptions makes them essential in these applications.

Ongoing infrastructure upgrades and the need for dependable grid connectivity further reinforced the strong adoption of medium voltage switchgears across industrial and utility segments, sustaining their leadership within the market.

By End User Analysis

Substation end users dominate the Medium Voltage Switchgears Market, representing 56.2 overall demand.

In 2024, Substation held a dominant market position in the By End User segment of the Medium Voltage Switchgears Market, with a 56.2% share. This leadership reflects the critical role substations play in controlling and distributing electricity across transmission and distribution networks.

Medium voltage switchgears are essential within substations for switching, protection, and fault isolation, ensuring stable power flow and system safety. Their consistent deployment across grid expansion and modernisation projects supports reliable electricity delivery to downstream users.

The need for dependable infrastructure to manage increasing power loads and maintain network continuity reinforced the strong position of substations as the leading end user within the medium voltage switchgear market.

Key Market Segments

By Type

- Compact Switchgear

- Metal Clad Switchgear

- Metal Enclosed Switchgear

- Pad Mounted Switchgear

- Others

By Insulation Medium

- Air

- Gas

- Fluid

- Others

By Voltage

- Below 3kV

- 3-9kV

- 9-15kV

- 15-21kV

- 21-33kV

- Above 33kV

By Application

- Residential

- Commercial

- Industrial and Utility

By End User

- Power Station

- Substation

- Others

Driving Factors

Grid Expansion And Power Infrastructure Investments Drive Growth

One major driving factor for the medium voltage switchgears market is the rapid expansion of power infrastructure to support growing electricity needs. As cities expand and industries scale up, utilities require reliable systems to control and protect electricity flow across networks.

Medium voltage switchgears play a key role in substations, industrial units, and transmission nodes by ensuring safe switching and fault isolation. Large energy investments further strengthen this demand. Centrica’s acquisition of a 15% stake in the Sizewell C nuclear power station highlights its long-term commitment to stable, high-capacity power generation.

Such large-scale projects require robust grid connections and dependable switchgear systems to manage power distribution efficiently. Continuous upgrades in power networks and investments in energy security keep driving steady adoption of medium voltage switchgears across regions.

Restraining Factors

High Project Costs And Capital-Intensive Installations

One major restraining factor for the medium voltage switchgears market is the rising cost of large power infrastructure projects. Installing medium voltage switchgears requires high upfront spending on equipment, engineering, and skilled labour.

When overall project budgets increase, utilities and developers often delay or rescale investments in electrical systems. The Sizewell C nuclear power plant, with total costs rising to £38 billion, highlights how escalating expenses can put pressure on related power infrastructure spending.

As project owners focus on managing cost overruns, investment decisions become more cautious. This financial strain can slow new substation development and grid expansion plans, directly affecting switchgear demand. High capital intensity remains a key challenge, especially in markets with tighter funding and longer approval cycles.

Growth Opportunity

Rising Private Investments In Decentralised Power Projects

A strong growth opportunity for the medium voltage switchgears market is the rising investment in decentralised and mid-scale power plants. These projects need reliable switching and protection systems to connect generation units safely with local grids.

The Coronation Infrastructure Fund backing Elektron Energy’s 30 MW power plant shows increasing private interest in new power generation capacity. Such plants rely on medium voltage switchgears to manage load flow, ensure safety, and support uninterrupted operations.

As more independent power producers enter the market, demand grows for compact, efficient switchgear solutions that suit flexible power layouts. This trend opens opportunities for wider deployment of medium voltage switchgears across distributed energy projects and regional substations, supporting steady market expansion.

Latest Trends

Integration Of High-Capacity Power Stations

One of the latest trends in the medium voltage switchgears market is the growing integration of high-capacity power stations into regional grids. As new power projects come online, utilities need dependable systems to manage higher loads and maintain grid stability.

Medium voltage switchgears are increasingly used to handle power flow between generation units and distribution networks efficiently and safely. The recent funding secured by QPM Energy for the 112 MW Isaac Power Station development reflects this trend toward larger generation assets.

Such projects require advanced switching, monitoring, and protection systems. This shift is pushing wider adoption of medium voltage switchgears that support reliable operations, faster fault response, and smoother grid connectivity.

Regional Analysis

North America leads the Medium Voltage Switchgears Market with a 38.20% share valued at USD 18.9 Bn.

North America dominated the Medium Voltage Switchgears Market, holding a 38.20% share valued at USD 18.9 Bn. This leadership is strongly linked to continuous upgrades in ageing power infrastructure, expansion of utility substations, and rising investments in grid reliability. The region’s strong focus on power system automation and network safety further supports steady demand for medium voltage switchgears across industrial and utility applications.

Europe represents a mature and technologically advanced market, driven by grid modernisation efforts and the integration of renewable energy sources into national power networks. Utilities across the region emphasise system efficiency, operational safety, and compliance with evolving grid standards, supporting consistent deployment of medium voltage switchgears in substations and industrial facilities.

Asia Pacific remains a rapidly developing regional market due to expanding urban infrastructure and rising electricity consumption. Ongoing industrialisation and large-scale power distribution projects drive demand for reliable switching and protection equipment to support growing load requirements.

Middle East & Africa show gradual growth supported by investments in power transmission and distribution networks. Expansion of substations and efforts to improve grid stability contribute to steady adoption of medium voltage switchgears.

Latin America continues to progress with infrastructure improvements and regional electrification initiatives. Utility network expansion and modernisation projects support long-term demand across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ABB Ltd. continues to hold a strong position in the global medium voltage switchgears market due to its deep engineering expertise and long-standing focus on power infrastructure solutions. The company’s strength lies in delivering reliable, safe, and technologically advanced switchgear systems that support utilities, industries, and large infrastructure projects. ABB’s global manufacturing footprint and emphasis on digitalised power equipment help meet evolving grid reliability and efficiency needs.

Eaton Corporation plc remains a key player by focusing on energy management and electrical safety across medium voltage applications. Its portfolio supports industrial facilities, commercial buildings, and utility networks that demand dependable power control and protection. Eaton’s strategic focus on innovation and system integration enables customers to improve operational efficiency while maintaining grid stability. The company’s experience in electrical systems strengthens its role in long-term infrastructure projects.

Schneider Electric SE stands out in 2024 through its strong emphasis on smart energy management and sustainable power distribution. The company integrates medium voltage switchgears with digital monitoring and automation technologies, helping users optimise power usage and enhance system visibility. Schneider Electric’s commitment to grid efficiency and resilient electrical infrastructure supports its steady presence across global medium voltage applications.

Top Key Players in the Market

- ABB Ltd.

- Eaton Corporation plc

- Schneider Electric SE

- Siemens AG

- Mitsubishi Electric Corporation

- CHINT Group Corporation

- Fuji Electric Co., Ltd.

- Powell Industries, Inc.

- Hyundai Electric & Energy Systems Co., Ltd.

- CG Power and Industrial Solutions Limited

Recent Developments

- In October 2025, Eaton announced the completion of a US$100 million expansion at its Nacogdoches, Texas, facility. The upgrade doubled its U.S. production capacity for voltage regulators and three-phase transformers — essential components in grid and power infrastructure — strengthening its ability to meet rising global demand for grid-modernisation and stable power distribution.

- In 2024, ABB inaugurated a new factory in Nashik, India, which doubled its capacity to manufacture gas-insulated switchgear (GIS). This expansion strengthens ABB’s ability to supply primary and secondary distribution switchgear for utilities, metro systems, data centres, tunnels, ports, and other infrastructure projects.

Report Scope

Report Features Description Market Value (2024) USD 49.7 Billion Forecast Revenue (2034) USD 94.2 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Compact Switchgear, Metal Clad Switchgear, Metal Enclosed Switchgear, Pad Mounted Switchgear, Others), By Insulation Medium (Air, Gas, Fluid, Others), By Voltage (Below 3kV, 3-9kV, 9-15kV, 15-21kV, 21-33kV, Above 33kV), By Application (Residential, Commercial, Industrial and Utility), By End User (Power Station, Substation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Eaton Corporation plc, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, CHINT Group Corporation, Fuji Electric Co., Ltd., Powell Industries, Inc., Hyundai Electric & Energy Systems Co., Ltd., CG Power and Industrial Solutions Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medium Voltage Switchgears MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Medium Voltage Switchgears MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Eaton Corporation plc

- Schneider Electric SE

- Siemens AG

- Mitsubishi Electric Corporation

- CHINT Group Corporation

- Fuji Electric Co., Ltd.

- Powell Industries, Inc.

- Hyundai Electric & Energy Systems Co., Ltd.

- CG Power and Industrial Solutions Limited