Global Malic Acid Market Size, Share, And Business Benefits By Form (Powder, Liquid, Granular), By Product (L-Malic Acid, D-Malic Acid, DL-Malic Acid), By End Use (Food and Beverage, Pharmaceuticals, Personal Care and Cosmetics, Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152848

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

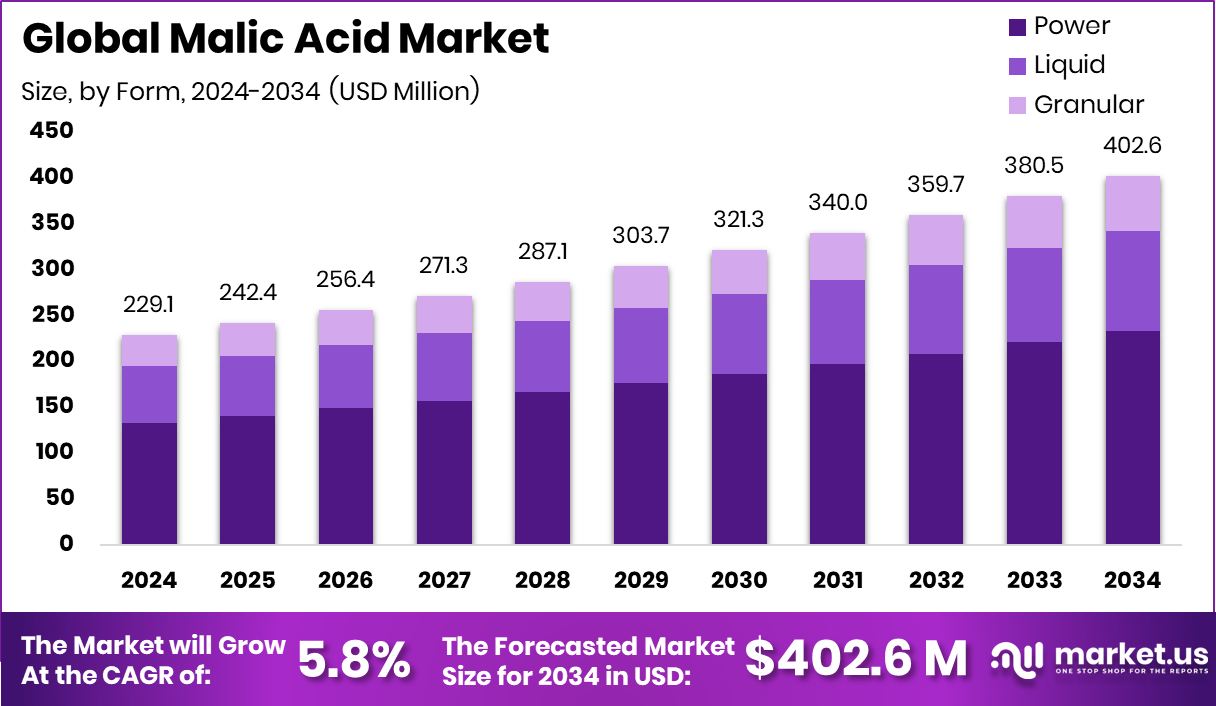

Global Malic Acid Market is expected to be worth around USD 402.6 Million by 2034, up from USD 229.1 Million in 2024, and grow at a CAGR of 5.8% from 2025 to 2034. Strong food and beverage demand supported North America’s USD 98.2 million market leadership.

Malic acid is a naturally occurring organic compound found in various fruits, especially apples. It plays a key role in the Krebs cycle, a process that helps the body generate energy. Known for its sour taste, malic acid is widely used in the food and beverage industry as an acidulant to enhance flavor, extend shelf life, and stabilize pH.

The malic acid market refers to the global trade and usage of malic acid across multiple industries, driven by rising demand in food processing, cosmetics, and wellness products. It is produced synthetically or derived from natural sources, and is supplied in different grades to suit specific applications.

The growth of the malic acid market is primarily supported by its increasing applications in processed food and beverages. As consumers shift toward healthier, flavor-enhanced products with reduced sugar and synthetic additives, malic acid becomes a preferred ingredient.

A strong driver for demand is the growing personal care and cosmetics industry. Malic acid is used in skincare products for exfoliation and pH adjustment. Its ability to improve skin texture and support cell turnover makes it suitable for anti-aging and brightening formulations.

Key Takeaways

- Global Malic Acid Market is expected to be worth around USD 402.6 Million by 2034, up from USD 229.1 Million in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- In the Malic Acid market, powder form dominates with a 58.3% share due to versatility.

- L-Malic Acid accounts for 56.2%, favored for its natural taste and enhanced solubility in applications.

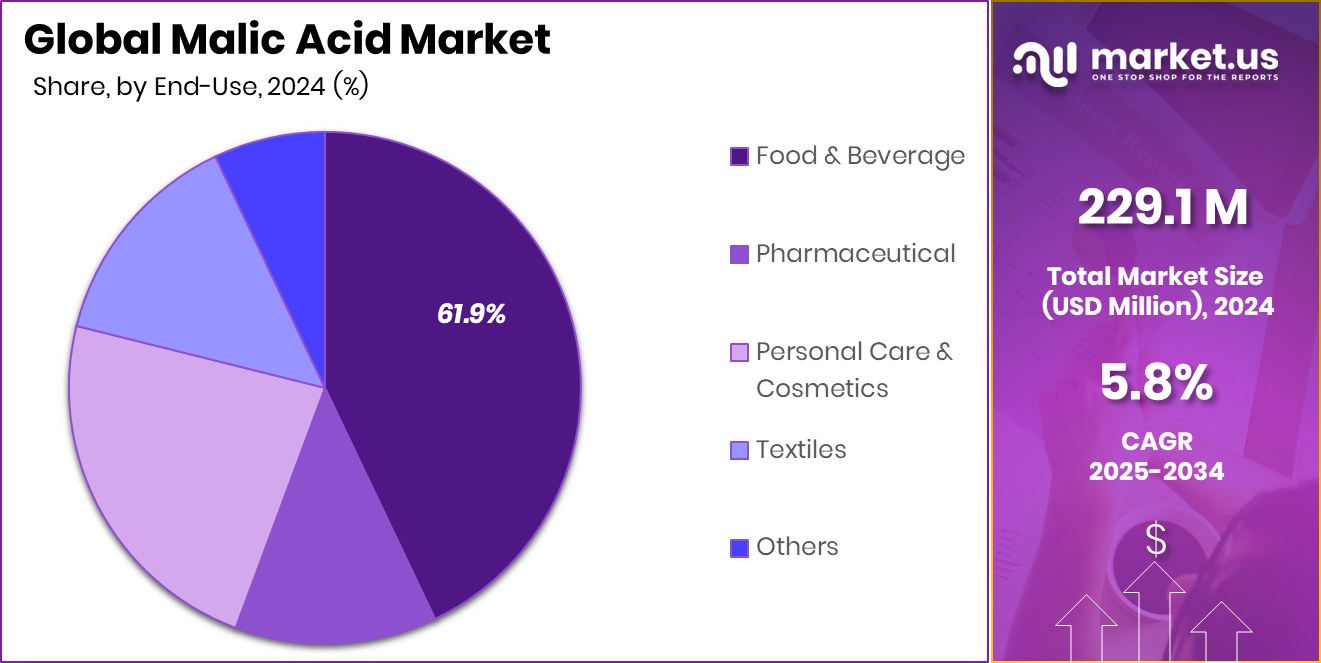

- The food and beverage sector leads end-use demand, capturing a 61.9% share owing to flavor enhancement properties.

- The North American market was valued at USD 98.2 million during the same year.

By Form Analysis

Powder form dominates the malic acid market with a 58.3% share.

In 2024, Powder held a dominant market position in the By Form segment of the Malic Acid Market, with a 58.3% share. This strong preference for powder form can be attributed to its stability, ease of storage, and compatibility with a wide range of food and beverage formulations.

Powdered malic acid is widely used for its ability to blend smoothly into dry mixes, beverages, and processed foods without altering texture or appearance. Its longer shelf life compared to liquid alternatives also makes it a cost-effective choice for manufacturers aiming to optimize logistics and reduce product spoilage.

The powdered form is especially favored in applications requiring controlled acidity and consistent flavor delivery, making it suitable for high-volume production in packaged goods. The fine crystalline structure of the powder allows for uniform dispersion, which is essential for maintaining taste consistency across batches.

Additionally, the convenience of transportation and lower risk of leakage or contamination further strengthen its position in the market. With manufacturers increasingly seeking functional ingredients that meet both operational efficiency and quality requirements, the dominance of powdered malic acid is expected to remain strong.

By Product Analysis

L-Malic acid holds 56.2% of global malic acid consumption.

In 2024, L-Malic Acid held a dominant market position in the By Product segment of the Malic Acid Market, with a 56.2% share. This form is naturally occurring and biologically active, making it the preferred choice for food, beverage, and health-focused applications.

Its dominance is supported by its superior solubility and better taste profile compared to other forms, which enables smoother integration into formulations where both flavor enhancement and functional benefits are required.

L-Malic Acid is commonly utilized in acidulant systems to deliver a clean, crisp tartness in products such as beverages, confectioneries, and flavored snacks. Its ability to closely mimic the natural sourness found in fruits has increased its appeal among manufacturers aiming for more natural and appealing taste profiles.

Furthermore, the human body readily metabolizes L-Malic Acid, making it suitable for health-related products that prioritize bioavailability and natural ingredients. The growing preference for clean-label ingredients has further supported the shift toward L-form variants in product development strategies.

By End Use Analysis

The food and beverage sector leads with 61.9% malic acid usage.

In 2024, Food and Beverage held a dominant market position in the By End Use segment of the Malic Acid Market, with a 61.9% share. This leading share reflects the widespread use of malic acid as a flavor enhancer and acidulant in processed foods and beverages.

Its ability to deliver a sharp, clean tartness makes it a preferred ingredient in fruit-flavored products, carbonated drinks, candies, jams, and bakery fillings. The rising demand for flavor-intense, shelf-stable, and reduced-sugar formulations has further strengthened malic acid’s presence across this segment.

Food and beverage manufacturers rely on malic acid not only for taste modification but also for pH control and product preservation, ensuring stability and consumer safety. As consumers continue to favor products with recognizable and functional ingredients, malic acid has become essential in developing formulas that align with both taste expectations and clean-label preferences.

The ability of malic acid to reduce the need for additional artificial additives adds to its value in food innovation. The 61.9% share in 2024 clearly indicates that food and beverage applications remain the key driver of malic acid consumption, with consistent demand from both mass-market and premium product lines contributing to this dominant market position.

Key Market Segments

By Form

- Powder

- Liquid

- Granular

By Product

- L-Malic Acid

- D-Malic Acid

- DL-Malic Acid

By End Use

- Food and Beverage

- Pharmaceuticals

- Personal Care and Cosmetics

- Textiles

- Others

Driving Factors

Rising Use in Food and Drinks Products

One of the main driving factors behind the growth of the malic acid market is its increasing use in food and beverage products. Malic acid is widely added to items such as soft drinks, candies, fruit-flavored snacks, jams, and bakery goods to give a sharp, fruity taste. It helps improve flavor, balances sweetness, and extends shelf life.

As more consumers look for products with bold flavors and fewer artificial ingredients, malic acid is becoming a preferred choice for food makers. Its natural sourness makes it suitable for low-sugar and health-focused items.

Restraining Factors

Fluctuating Raw Material Prices Affecting Production Stability

One major restraining factor in the malic acid market is the fluctuation in raw material prices. Malic acid is commonly produced using maleic anhydride, which is derived from petrochemical sources. Any changes in crude oil prices or supply disruptions can directly impact the cost and availability of maleic anhydride, making production more expensive and less predictable.

These price fluctuations create challenges for manufacturers in maintaining stable profit margins and consistent product pricing. Additionally, this uncertainty can discourage long-term planning and investment, especially for small and medium-scale producers.

Growth Opportunity

Growing Demand for Natural and Plant-Based Ingredients

A key growth opportunity in the malic acid market lies in the rising demand for natural and plant-based ingredients. As consumers become more health-conscious and environmentally aware, they are choosing products made from renewable and plant-derived sources.

This shift has opened new doors for naturally sourced malic acid, especially in clean-label food, beverages, and personal care items. Manufacturers are now exploring bio-based production methods using fruits and fermentation processes to meet this demand.

This not only helps reduce dependence on synthetic chemicals but also aligns with global sustainability goals. With more people preferring natural products, companies that invest in producing plant-based malic acid have a strong chance to grow and gain a competitive edge in the market.

Latest Trends

Shift Toward Clean-Label and Minimal Ingredient Formulations

A major trend shaping the malic acid market is the growing shift toward clean-label and minimal ingredient products. Consumers are now paying close attention to what goes into their food, beverages, and personal care items.

They prefer products with short ingredient lists, natural sources, and recognizable names. Malic acid, especially when derived from fruits like apples, fits well into this clean-label movement. It is used not just for its sour flavor but also for its role in replacing synthetic additives.

As brands work to reformulate products to meet clean-label expectations, the demand for natural and simple ingredients like malic acid is increasing. This trend is expected to continue as consumers seek healthier, more transparent product options.

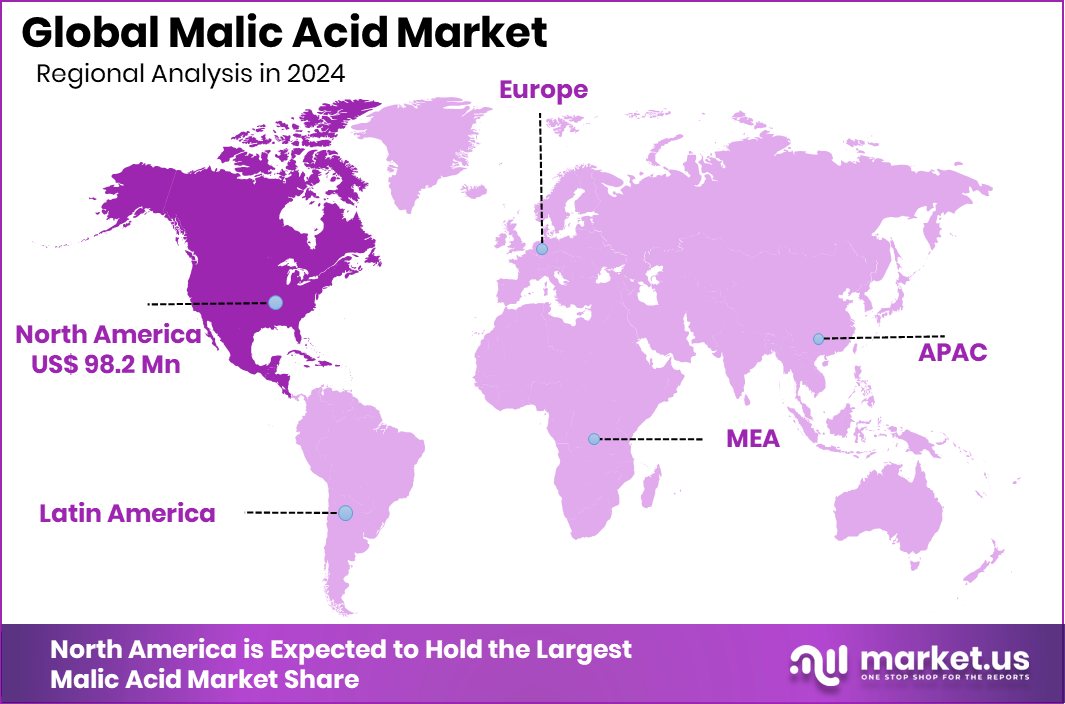

Regional Analysis

In 2024, North America led the malic acid market with a 42.90% share.

In 2024, North America held a dominant position in the global malic acid market, capturing 42.90% of the total share, equivalent to a market value of USD 98.2 million. This leadership is largely driven by the region’s strong presence in the food and beverage sector, where malic acid is widely used for flavor enhancement and pH control.

North America’s high demand for processed and packaged foods, combined with rising consumer preference for clean-label ingredients, has significantly boosted the use of malic acid in various formulations. In Europe, steady demand has been observed due to increasing applications in personal care and functional food products.

Meanwhile, Asia Pacific continues to develop as a promising market with growing consumption of flavored beverages and sour candies. The Middle East & Africa and Latin America regions are witnessing gradual uptake of malic acid, supported by expanding food industries and urbanization.

However, North America remained the leading contributor in 2024, both in volume and value terms, indicating its strong industrial base and consumer-driven demand for quality, taste-enhanced food products. The region’s advanced production capabilities and stringent quality standards further support its dominant share in the malic acid market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Anhui Sealong has emerged as a prominent producer within the global market, leveraging its strong manufacturing capacity and focus on high-purity malic acid. The company’s expertise in biotechnology-driven synthesis enables it to offer both food-grade and pharmaceutical-grade products, meeting stringent quality standards. Sealong’s investment in R&D and process optimization has allowed it to maintain cost-efficient production, supporting competitive pricing while ensuring consistent product quality.

Bartek Ingredients has distinguished itself through its broad product portfolio and deep engagement with North American food and beverage manufacturers. By aligning closely with clean-label trends, Bartek emphasizes transparent sourcing and high documentation standards, which resonate with both large-scale and niche brand customers. The company’s strong focus on customer service and flexible supply chain solutions has elevated its reputation as a reliable long-term supplier across diverse formulation needs.

Changmao Biochemical Engineering plays a vital role in the market as a vertically integrated producer with facilities optimized for bulk malic acid production. Its scale offers advantages in both cost-efficiency and supply stability. Changmao’s strategic investments in downstream capabilities, including blending and formulation services, enable it to serve clients requiring customized ingredient delivery.

Fuso Chemical occupies a niche position through its commitment to quality control and compliance with global regulatory requirements. While its production volumes are more modest compared to larger peers, Fuso’s specialization in technical-grade malic acid and minor variants allows it to serve specific markets such as pharmaceuticals, cosmetics, and dietary supplements.

Top Key Players in the Market

- Anhui Sealong Biotechnology Co., Ltd. rel=”nofollow”

- Bartek Ingredients Inc.

- Changmao Biochemical Engineering

- FUSO CHEMICAL CO., LTD

- Guangzhou ZIO Chemical Co., Ltd.

- Isegen

- Jinhu Lile Biotechnology Industry Co., Ltd

- Nacalai Tesque, Inc.

- Polynt

- Prinova Group LLC

- Sealong Biotechnology

- Tate & Lyle

- Thirumalai Chemicals

Recent Developments

- In April 2025, Prinova Group LLC acquired Brazilian ingredient distributor Aplinova, enhancing its global ingredient distribution network. This move strengthens Prinova’s reach in food-grade and beverage-grade ingredients, indirectly supporting its malic acid supply infrastructure.

- In July 2024, Bartek Ingredients introduced EasyAcid Malic Solution, a liquid form of malic acid. The new product reduces dust, ensures uniform blending, and improves handling efficiency—offering manufacturers a cleaner, more consistent formulation process.

Report Scope

Report Features Description Market Value (2024) USD 229.1 Million Forecast Revenue (2034) USD 402.6 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid, Granular), By Product (L-Malic Acid, D-Malic Acid, DL-Malic Acid), By End Use (Food and Beverage, Pharmaceuticals, Personal Care and Cosmetics, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anhui Sealong Biotechnology Co., Ltd., Bartek Ingredients Inc., Changmao Biochemical Engineering, FUSO CHEMICAL CO., LTD, Guangzhou ZIO Chemical Co., Ltd., Isegen, Jinhu Lile Biotechnology Industry Co., Ltd, Nacalai Tesque, Inc., Polynt, Prinova Group LLC, Sealong Biotechnology, Tate & Lyle, Thirumalai Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anhui Sealong Biotechnology Co., Ltd. rel="nofollow"

- Bartek Ingredients Inc.

- Changmao Biochemical Engineering

- FUSO CHEMICAL CO., LTD

- Guangzhou ZIO Chemical Co., Ltd.

- Isegen

- Jinhu Lile Biotechnology Industry Co., Ltd

- Nacalai Tesque, Inc.

- Polynt

- Prinova Group LLC

- Sealong Biotechnology

- Tate & Lyle

- Thirumalai Chemicals