Global Magnesium Hydroxide Market By Form (Liquid Magnesium Hydroxide, Powder Magnesium Hydroxide), By Applications (Flame Retardants, Wastewater Treatment, Pharmaceuticals, Chemicals, Fuel Additives, Food and Feed, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150181

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

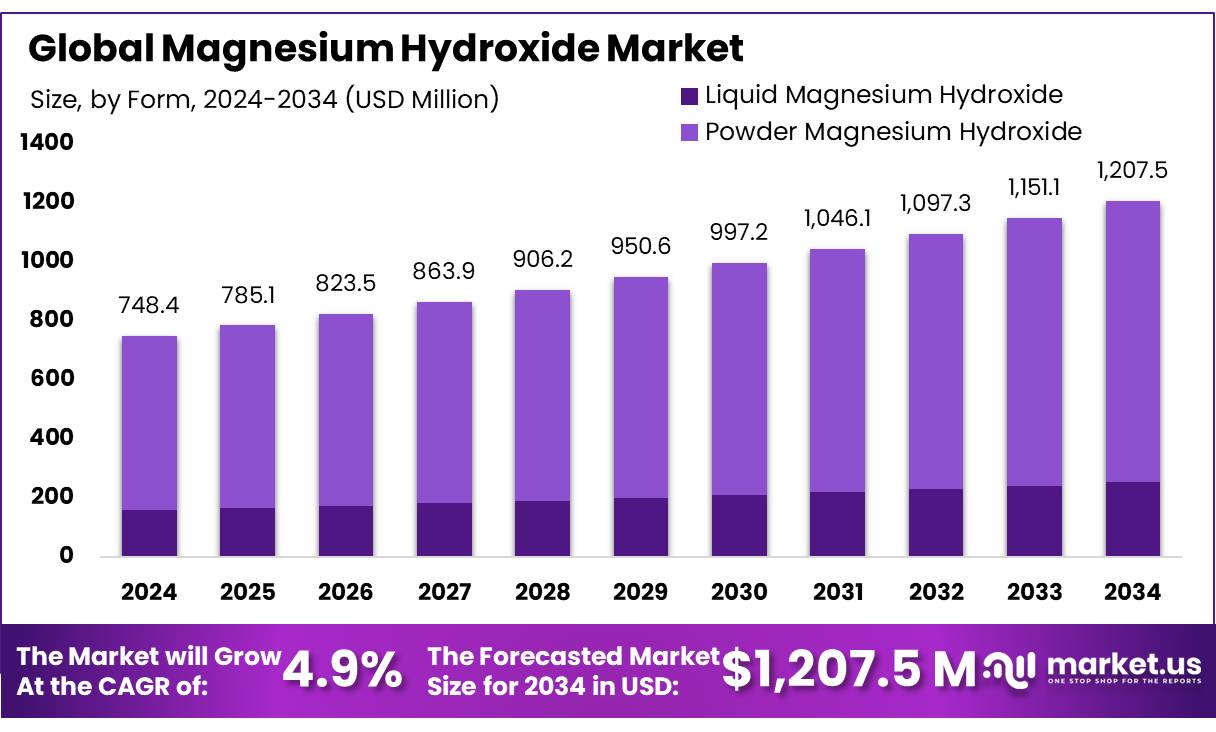

The Global Magnesium Hydroxide Market size is expected to be worth around USD 1207.5 Million by 2034, from USD 748.4 Million in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Magnesium Hydroxide and Cellulose Concentrates have emerged as pivotal compounds within the industrial and food sectors, driven by their multifunctional applications and alignment with sustainability trends. Magnesium Hydroxide is extensively utilized in environmental protection, flame retardancy, and pharmaceuticals, while Cellulose Concentrates, particularly food-grade variants, are integral to the food industry for their texturizing and stabilizing properties.

Government initiatives further bolster market growth. In the United States, the Environmental Protection Agency (EPA) has implemented regulations that encourage the use of safer, non-toxic flame retardants, indirectly promoting magnesium hydroxide’s adoption. Similarly, the European Union’s REACH regulation emphasizes the use of environmentally friendly substances, aligning with the properties of both magnesium hydroxide and cellulose. In India, the National Programme for Organic Production (NPOP) recognizes certain cellulose derivatives as permissible additives in organic food processing, reflecting a regulatory environment conducive to the use of these compounds.

In the United States, the magnesium hydroxide market is experiencing significant growth due to heightened environmental awareness and regulatory measures. The U.S. Environmental Protection Agency (EPA) has implemented stricter regulations on wastewater treatment and air pollution control, leading to increased adoption of magnesium hydroxide in these applications. Furthermore, the U.S. Geological Survey (USGS) reported that domestic production of magnesium compounds, including magnesium hydroxide, was approximately 350,000 metric tons in 2024, underscoring the material’s industrial significance.

Key Takeaways

- Magnesium Hydroxide Market size is expected to be worth around USD 1207.5 Million by 2034, from USD 748.4 Million in 2024, growing at a CAGR of 4.9%.

- Powder Magnesium Hydroxide held a dominant market position, capturing more than a 79.4% share.

- Industrial Grade held a dominant market position, capturing more than a 37.9% share in the Magnesium Hydroxide market.

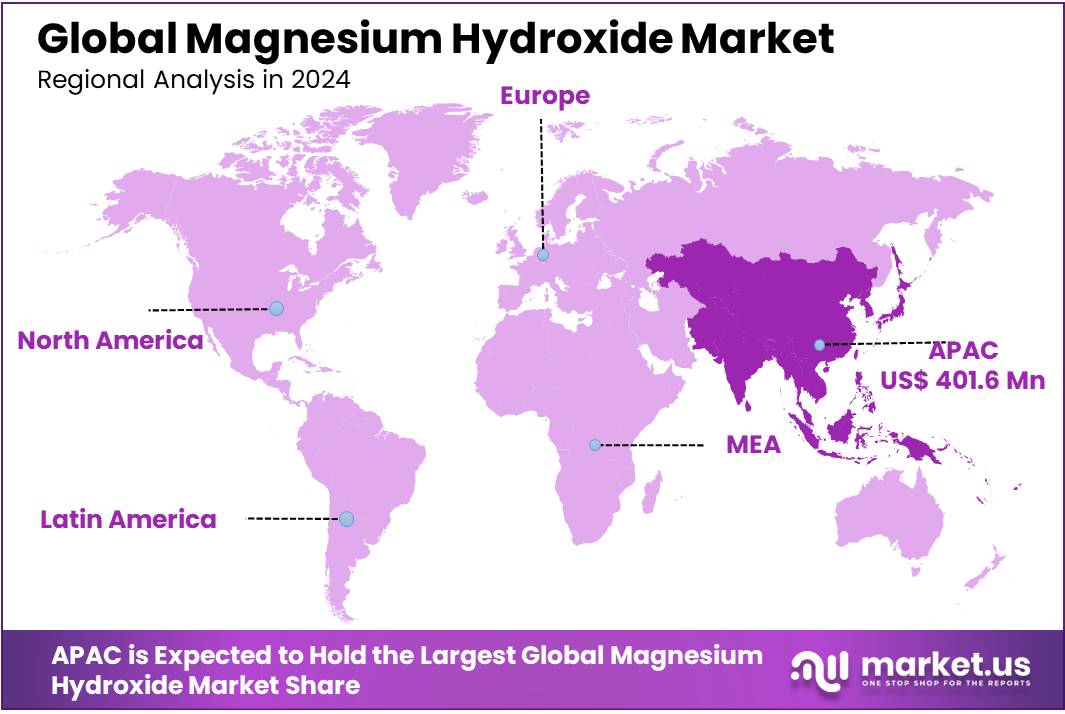

- Asia-Pacific (APAC) region emerged as the leading market for magnesium hydroxide, capturing 51.2% of the global share, equivalent to approximately USD 401.6 million.

By Form

Powder Magnesium Hydroxide leads with 79.4% share due to its versatile usage across industries

In 2024, Powder Magnesium Hydroxide held a dominant market position, capturing more than a 79.4% share. This leading form is widely used across environmental, pharmaceutical, and industrial applications due to its high surface area, consistent particle size, and ease of dispersion in formulations. The powdered form is especially favored in wastewater treatment and flame retardant applications, where fine particulate magnesium hydroxide reacts efficiently and uniformly.

Its popularity is also linked to its stable storage properties and compatibility with automated dosing systems. As regulatory frameworks push for cleaner, non-toxic substitutes in chemical processes, the demand for powdered variants has remained consistently high. Moving into 2025, the powdered form is expected to retain its top position, driven by ongoing investments in industrial safety, clean energy, and pharmaceutical formulations.

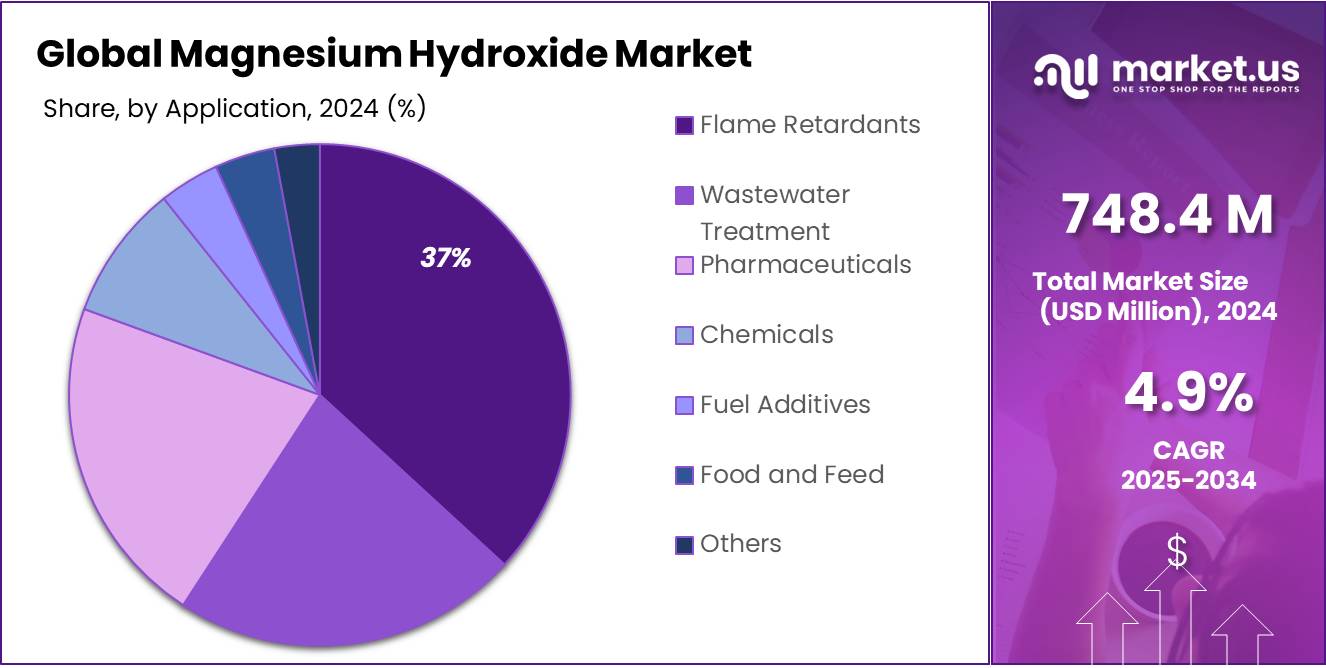

By Applications

Industrial Grade leads with 37.9% share in 2024, fueled by its strong role in flame retardant applications

In 2024, Industrial Grade held a dominant market position, capturing more than a 37.9% share in the Magnesium Hydroxide market. This segment gained traction primarily due to the increasing demand for non-toxic, halogen-free flame retardants across construction, electronics, and automotive sectors. Industrial Grade magnesium hydroxide is preferred for its stable performance at high temperatures and its ability to suppress smoke and reduce heat release during combustion.

The growing shift toward fire-safe materials, especially in infrastructure and public transport systems, further supported its uptake. In 2025, the segment is expected to maintain strong momentum as more countries adopt stringent fire safety regulations and encourage the use of eco-friendly retardants.

Key Market Segments

By Form

- Liquid Magnesium Hydroxide

- Powder Magnesium Hydroxide

By Applications

- Flame Retardants

- Wastewater Treatment

- Pharmaceuticals

- Chemicals

- Fuel Additives

- Food and Feed

- Others

Drivers

Rising Demand for Magnesium Hydroxide in Food and Pharmaceutical Applications

One of the major driving factors for the magnesium hydroxide market is its increasing use in the food and pharmaceutical industries. Magnesium hydroxide is widely recognized for its role as an antacid and laxative, making it a staple in over-the-counter digestive health products. The U.S. Food and Drug Administration (FDA) affirms magnesium hydroxide as generally recognized as safe (GRAS) when used in accordance with good manufacturing practices. In the food industry, it is designated as E528 and is utilized as a food additive, primarily for its acid-neutralizing properties.

The growing prevalence of gastrointestinal disorders, such as acid reflux and constipation, has led to an increased demand for magnesium hydroxide-based products. According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), approximately 20% of the U.S. population experiences symptoms of gastroesophageal reflux disease (GERD), highlighting the need for effective antacid solutions.

In the pharmaceutical sector, magnesium hydroxide’s role extends beyond antacids. It is also employed in the formulation of various medications due to its buffering capacity and ability to stabilize active pharmaceutical ingredients. The compound’s versatility and safety profile make it a preferred choice among pharmaceutical manufacturers.

Government initiatives and regulatory frameworks further support the growth of magnesium hydroxide applications. For instance, the European Food Safety Authority (EFSA) has evaluated magnesium hydroxide and concluded that its use as a food additive does not pose safety concerns at the proposed levels of intake.

Restraints

Regulatory Constraints in the Food Industry Impacting Magnesium Hydroxide Market Growth

A significant factor restraining the growth of the magnesium hydroxide market is the stringent regulatory environment governing its use in the food industry. While magnesium hydroxide is recognized for its applications as an antacid and laxative, its incorporation as a food additive is subject to rigorous scrutiny by food safety authorities worldwide.

In the United States, the Food and Drug Administration (FDA) classifies magnesium hydroxide as “Generally Recognized as Safe” (GRAS) when used in accordance with good manufacturing practices. However, its application in food products is limited, and manufacturers must adhere to strict guidelines regarding its concentration and usage. Similarly, the European Food Safety Authority (EFSA) has established maximum permissible levels for magnesium hydroxide in food items, emphasizing the need for comprehensive safety assessments before approval.

These regulatory constraints pose challenges for food manufacturers seeking to utilize magnesium hydroxide as a functional ingredient. The necessity for extensive documentation, safety evaluations, and compliance with varying international standards can deter companies from incorporating magnesium hydroxide into their products. Additionally, the potential for adverse effects, such as gastrointestinal disturbances when consumed in excess, further complicates its acceptance in the food industry.

Opportunity

Expanding Role of Magnesium Hydroxide in Pharmaceutical Applications

A significant growth opportunity for the magnesium hydroxide market lies in its increasing utilization within the pharmaceutical sector. Known for its efficacy as an antacid and laxative, magnesium hydroxide is a key ingredient in various over-the-counter medications. The compound’s ability to neutralize stomach acid and alleviate constipation has made it a staple in digestive health products.

This upward trend is further supported by the compound’s recognized safety profile. The U.S. Food and Drug Administration (FDA) affirms magnesium hydroxide as generally recognized as safe (GRAS) when used in accordance with good manufacturing practices. Its designation as E528 in the food industry also underscores its acceptability for consumption.

Moreover, the pharmaceutical industry’s focus on developing effective and safe treatments aligns with the properties of magnesium hydroxide. Its non-toxic nature and compatibility with other pharmaceutical ingredients make it an ideal choice for formulation in various medicinal products.

Trends

Growing Demand for Eco-Friendly Flame Retardants Boosts Magnesium Hydroxide Market

A notable trend in the magnesium hydroxide market is its increasing use as an environmentally friendly flame retardant. Traditional flame retardants often contain halogens, which can release toxic gases when burned. Magnesium hydroxide, in contrast, decomposes upon heating to release water vapor, which helps to cool the material and suppress flames without emitting harmful substances.

This shift is driven by stricter fire safety regulations and a growing emphasis on sustainable materials in industries such as construction, electronics, and automotive manufacturing. For instance, the European Union’s Restriction of Hazardous Substances (RoHS) directive limits the use of certain hazardous materials in electrical and electronic equipment, encouraging the adoption of safer alternatives like magnesium hydroxide.

Manufacturers are also investing in research and development to enhance the flame-retardant properties of magnesium hydroxide, making it more effective and versatile for various applications. These innovations aim to improve the material’s performance while maintaining its environmental benefits.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region emerged as the leading market for magnesium hydroxide, capturing 51.2% of the global share, equivalent to approximately USD 401.6 million. This dominance is attributed to the region’s robust industrialization, stringent environmental regulations, and expanding pharmaceutical sector.

The APAC region’s growth is further bolstered by its focus on environmental sustainability. Magnesium hydroxide is extensively used in wastewater treatment and flue-gas desulphurization processes, aligning with the region’s environmental protection initiatives. Additionally, the compound’s application as a flame retardant in the construction and automotive industries supports the region’s commitment to safety and regulatory compliance.

The APAC region’s substantial share in the magnesium hydroxide market is a result of its industrial growth, environmental initiatives, and expanding pharmaceutical needs. With continued investment and regulatory support, the region is poised to maintain its leading position in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Albemarle Corporation is a major player in the magnesium hydroxide market, supplying high-purity grades used in flame retardants, wastewater treatment, and pharmaceutical formulations. Headquartered in the U.S., Albemarle benefits from its integrated operations and global distribution network. In 2024, the company reported strong demand for its environmentally friendly additives. Its focus on sustainable chemistry and investment in R&D supports innovations in non-halogenated flame retardant solutions, a key growth area for magnesium hydroxide applications globally.

Elementis operates with a strong specialty chemicals portfolio, and its magnesium hydroxide offerings are widely used in industrial and environmental applications. The company focuses on supplying materials for water treatment, pulp and paper processing, and polymer industries. In 2024, Elementis enhanced its production capabilities to meet rising demand in Asia and Europe. Through its commitment to green chemistry, the company continues to expand its presence in regulatory-compliant and eco-conscious markets for magnesium-based compounds.

Huber Engineered Materials (HEM), a division of J.M. Huber Corporation, specializes in flame retardant and smoke suppressant additives, with magnesium hydroxide as a flagship product. In 2024, Huber reported expanded operations in Georgia (USA) to boost capacity and meet global demand. The company is known for its high-quality grades tailored to electrical, construction, and transport sectors. HEM maintains a strong reputation for sustainability and compliance with fire safety standards in critical end-use industries.

Top Key Players in the Market

- Albemarle Corporation

- Elementis

- Huber Engineered Materials

- Israel Chemicals Ltd (ICL)

- Kisuma Chemicals B.V.

- Konoshima Chemical Co. Ltd

- Kyowa Chemical Industry

- Loba Chemie Pvt. Ltd.

- Martin Marietta Materials Ltd.

- Nedmag Industries.

- NikoMag

- Osian Marine Pvt Ltd.

- Premier Magnesia LLC

- Tateho Chemicals Industries Co., Ltd.

- TIMAB Magnesium

Recent Developments

In 2024, Albemarle Corporation, a leading specialty chemicals company headquartered in Charlotte, North Carolina, reported total net sales of $1.2 billion in the fourth quarter, a 48% decrease from the previous year, primarily due to lower pricing and volumes in its Energy Storage segment.

In 2024, Huber Engineered Materials (HEM), a division of J.M. Huber Corporation, continued to strengthen its position in the magnesium hydroxide market. A significant development was the acquisition of the remaining 50% stake in MAGNIFIN Magnesiaprodukte GmbH & Co., a move that expanded HEM’s capabilities in producing high-purity magnesium hydroxide flame retardants.

Report Scope

Report Features Description Market Value (2024) USD 748.4 Mn Forecast Revenue (2034) USD 1207.5 Mn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid Magnesium Hydroxide, Powder Magnesium Hydroxide), By Applications (Flame Retardants, Wastewater Treatment, Pharmaceuticals, Chemicals, Fuel Additives, Food and Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Albemarle Corporation, Elementis, Huber Engineered Materials, Israel Chemicals Ltd (ICL), Kisuma Chemicals B.V., Konoshima Chemical Co. Ltd, Kyowa Chemical Industry, Loba Chemie Pvt. Ltd., Martin Marietta Materials Ltd., Nedmag Industries., NikoMag, Osian Marine Pvt Ltd., Premier Magnesia LLC, Tateho Chemicals Industries Co., Ltd., TIMAB Magnesium Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Magnesium Hydroxide MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Magnesium Hydroxide MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Albemarle Corporation

- Elementis

- Huber Engineered Materials

- Israel Chemicals Ltd (ICL)

- Kisuma Chemicals B.V.

- Konoshima Chemical Co. Ltd

- Kyowa Chemical Industry

- Loba Chemie Pvt. Ltd.

- Martin Marietta Materials Ltd.

- Nedmag Industries.

- NikoMag

- Osian Marine Pvt Ltd.

- Premier Magnesia LLC

- Tateho Chemicals Industries Co., Ltd.

- TIMAB Magnesium