Global Low Speed Vehicle Market Size, Share, Growth Analysis By Vehicle (Golf Cart, Commercial Utility Vehicle, Industrial Utility Vehicle, Personal Mobility Vehicle), By Propulsion (Electric, ICE), By Power Output (6-15 KW, >15 KW, 15 KW), By Speed Class (15-25 mph, Up to 15 mph, Above 25 mph), By Application (Golf Courses, Hotels & Resorts, Airports, Industrial Facilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178418

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

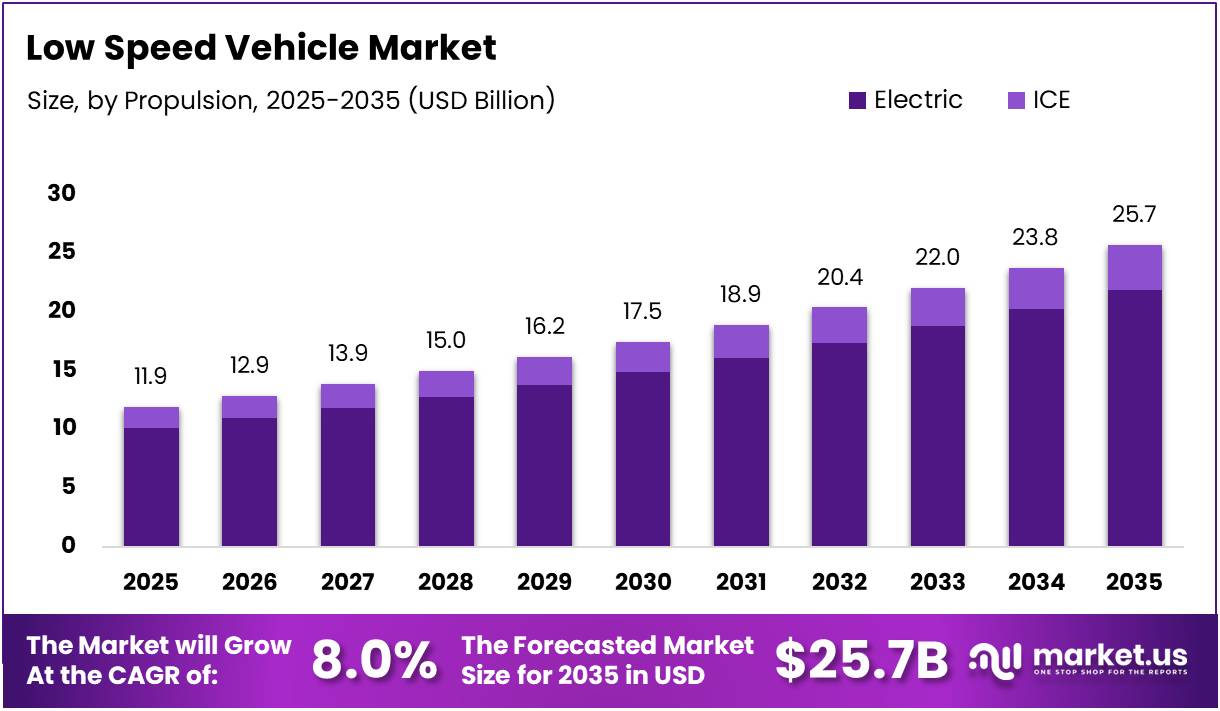

The Global Low Speed Vehicle Market size is expected to be worth around USD 25.7 Billion by 2035 from USD 11.9 Billion in 2025, growing at a CAGR of 8.0% during the forecast period 2026 to 2035.

The low speed vehicle (LSV) market covers a range of motorized vehicles designed to operate at limited speeds, typically below 25 mph. These vehicles serve diverse purposes across golf courses, resorts, airports, campuses, and industrial facilities. They are widely adopted for short-distance mobility and last-mile transportation needs.

LSVs include personal mobility vehicles, commercial utility vehicles, industrial utility vehicles, golf carts and NEV. Moreover, they are powered by either electric or internal combustion engines. Electric variants are increasingly preferred due to lower operating costs and reduced environmental impact.

The market is expanding rapidly as urban congestion increases demand for compact mobility alternatives. Gated communities, corporate campuses, and hospitality venues are deploying LSV fleets at scale. Consequently, manufacturers are investing in purpose-built platforms to meet growing fleet requirements.

Government initiatives promoting clean transportation are also contributing to market growth. Several countries have updated regulations to allow street-legal LSVs on public roads within specified speed limits. Additionally, incentives for electric vehicle adoption are accelerating transitions away from ICE-based low-speed models.

Sustainability goals in tourism and logistics sectors are further expanding commercial deployment. Hotels, resorts, and airports are replacing conventional transport with eco-friendly LSV fleets. Therefore, demand from the hospitality and airport segments is expected to grow significantly through 2035.

According to WiTricity, 46% of NEV owners use their LSV daily for short trips, and 45% reported frequent usage for daily errands covering 2 to 5 miles typically. Furthermore, 55% charge their LSV nightly, indicating consistent ownership patterns and strong utilization rates across user segments.

Key Takeaways

- The Global Low Speed Vehicle Market is valued at USD 11.9 Billion in 2025 and is projected to reach USD 25.7 Billion by 2035.

- The market is growing at a CAGR of 8.0% during the forecast period 2026 to 2035.

- By Vehicle, Golf Cart holds the dominant share at 47.8% in 2025.

- By Propulsion, Electric leads the market with a share of 85.3% in 2025.

- By Power Output, the 6-15 KW segment holds the largest share at 49.6% in 2025.

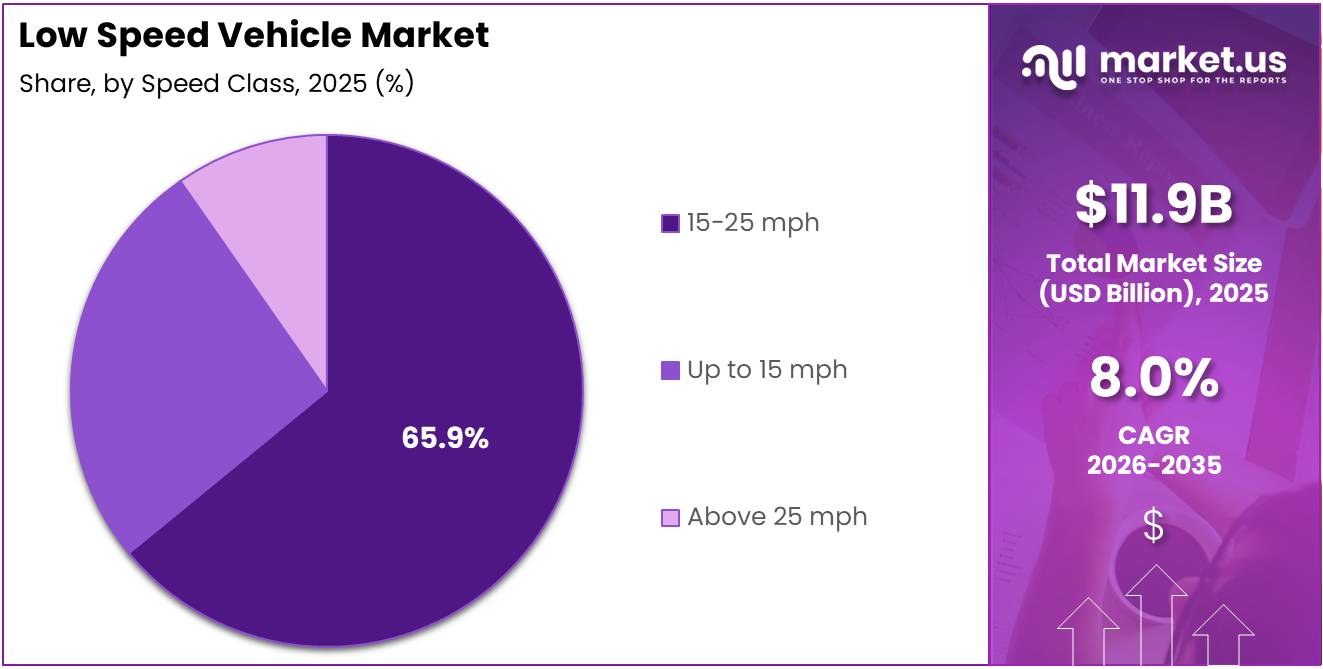

- By Speed Class, the 15-25 mph segment dominates with a 65.9% share in 2025.

- By Application, Golf Courses account for the highest share at 44.4% in 2025.

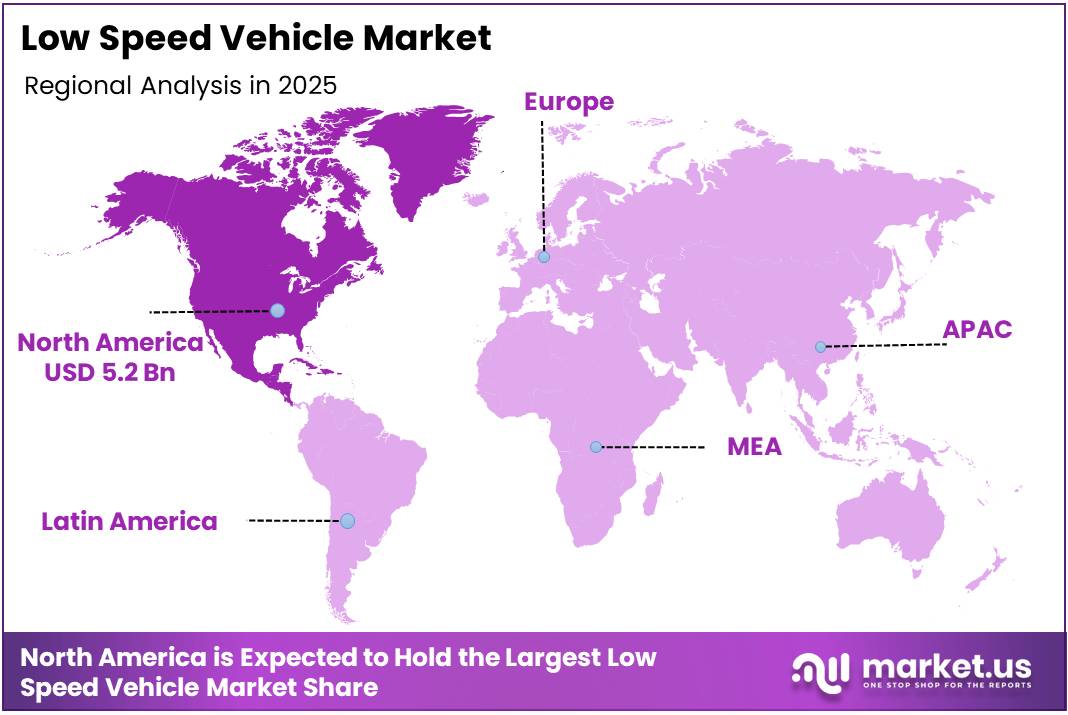

- North America leads the global market with a share of 43.70%, valued at USD 5.2 Billion in 2025.

By Vehicle Analysis

Golf Cart dominates with 47.8% due to widespread adoption across golf courses, resorts, and hospitality venues globally.

In 2025, Golf Cart held a dominant market position in the By Vehicle segment of the Low Speed Vehicle Market, with a 47.8% share. Golf carts are deployed extensively across golf courses, hotels, and campus environments. Their compact design, ease of operation, and low maintenance requirements make them the most preferred vehicle type in this segment.

Commercial Utility Vehicles represent a growing sub-segment driven by logistics, warehousing, and airport ground support needs. These vehicles are designed for cargo transport and multi-purpose use in controlled environments. Additionally, fleet operators favor them for their higher payload capacity and operational durability compared to standard golf carts.

Industrial Utility Vehicles serve manufacturing plants, distribution centers, and large facilities requiring rugged, heavy-duty transport. These vehicles support internal material movement and workforce mobility within industrial campuses. Consequently, demand from factory and warehouse operators continues to grow alongside industrial expansion globally.

Personal Mobility Vehicles cater to individual users in gated communities, retirement villages, and urban micro-mobility settings. Moreover, rising interest in eco-friendly personal transport is supporting adoption in residential zones where conventional vehicles are restricted.

By Propulsion Analysis

Electric dominates with 85.3% due to strong sustainability mandates and lower total cost of ownership.

In 2025, Electric held a dominant market position in the By Propulsion segment of the Low Speed Vehicle Market, with an 85.3% share. Electric LSVs are favored for zero tailpipe emissions, quiet operation, and compatibility with indoor and enclosed environments. Therefore, they are widely adopted across golf courses, airports, and commercial campuses globally.

ICE (Internal Combustion Engine) vehicles retain a smaller but persistent share, particularly in regions with limited charging infrastructure. These vehicles offer extended range and fueling convenience in remote or off-grid applications. However, tightening emission regulations and rising fuel costs are gradually reducing their market presence over the forecast period.

By Power Output Analysis

6-15 KW dominates with 49.6% due to its suitability for standard LSV applications across most use cases.

In 2025, 6-15 KW held a dominant market position in the By Power Output segment of the Low Speed Vehicle Market, with a 49.6% share. This power range balances performance and energy efficiency for everyday low-speed applications. Moreover, it covers the majority of golf carts and personal mobility vehicles currently deployed worldwide.

The >15 KW segment supports heavier commercial and industrial utility vehicles requiring greater torque and load-carrying capacity. These higher-output vehicles are increasingly used in airport ground support, logistics hubs, and large industrial facilities. Additionally, growing demand for multi-function utility platforms is expected to drive this segment higher through 2035.

The 15 KW category serves as a transition tier between standard and high-output applications. Vehicles in this bracket are commonly used in mid-duty commercial applications. Consequently, they offer a practical solution for operators needing more capability than standard models without moving to full heavy-duty specifications.

By Speed Class Analysis

15-25 mph dominates with 65.9% as this range aligns with street-legal LSV standards in most jurisdictions.

In 2025, 15-25 mph held a dominant market position in the By Speed Class segment of the Low Speed Vehicle Market, with a 65.9% share. Vehicles in this range comply with NEV and LSV regulations that permit use on public roads with speed limits up to 35 mph. Therefore, they offer the broadest operational flexibility for fleet and personal use.

Up to 15 mph vehicles are suited for highly controlled environments such as warehouses, manufacturing floors, and indoor facilities. These ultra-low-speed vehicles prioritize safety and pedestrian coexistence in confined spaces. Moreover, they are commonly deployed in industrial utility and material-handling applications globally.

Above 25 mph vehicles occupy a niche at the upper boundary of the low-speed category, bridging the gap toward neighborhood electric vehicles with expanded road access. Additionally, some jurisdictions are updating regulations to accommodate this class on broader road networks, potentially opening new deployment opportunities.

By Application Analysis

Golf Courses dominate with 44.4% due to their long-established reliance on golf carts for course management and player transport.

In 2025, Golf Courses held a dominant market position in the By Application segment of the Low Speed Vehicle Market, with a 44.4% share. Golf courses represent the most mature and consistent end-use market for LSVs. Moreover, fleet replacement cycles and growing global golf participation continue to sustain strong demand in this segment.

Hotels & Resorts are expanding LSV fleets for guest transport, luggage handling, and property management. Large resort properties require reliable short-range mobility solutions that are quiet and environmentally friendly. Consequently, this segment is one of the fastest-growing application areas for electric LSVs globally.

Airports deploy LSVs for passenger assistance, baggage transport, and ground crew mobility across terminals and tarmac areas. These environments demand reliable, low-emission vehicles capable of continuous operation. Additionally, airport authorities are prioritizing electric fleet transitions to meet sustainability and noise-reduction targets.

Industrial Facilities use LSVs for intra-facility logistics, worker transport, and material movement across large production floors. The segment benefits from rising automation and lean manufacturing trends. Others, including educational campuses and government sites, further contribute to diversified application demand.

Key Market Segments

By Vehicle

- Golf Cart

- Commercial Utility Vehicle

- Industrial Utility Vehicle

- Personal Mobility Vehicle

By Propulsion

- Electric

- ICE

By Power Output

- 6-15 KW

- >15 KW

- 15 KW

By Speed Class

- 15-25 mph

- Up to 15 mph

- Above 25 mph

By Application

- Golf Courses

- Hotels & Resorts

- Airports

- Industrial Facilities

- Others

Drivers

Rising Urban Congestion and Electric Mobility Adoption Drive Low Speed Vehicle Market Growth

Growing urban congestion is pushing municipalities, campuses, and commercial operators to adopt compact, low-speed mobility alternatives. Low speed vehicles offer practical solutions for short-distance travel without adding to traffic or emissions. Moreover, rising fuel costs are reinforcing the shift toward more economical and operationally efficient transport options.

The expanding adoption of electric mobility for last-mile and short-distance transportation is a key market driver. Electric LSVs offer lower operating costs, zero tailpipe emissions, and quiet performance suited to indoor and outdoor environments. Consequently, fleet operators across multiple sectors are transitioning from conventional vehicles to electric-powered LSV alternatives.

Additionally, the growing development of gated communities, resorts, and campus-based environments is creating consistent demand for managed LSV fleets. These controlled settings are ideal for low-speed vehicle deployment due to restricted road access and defined route structures. Therefore, real estate and hospitality developers are increasingly incorporating LSV infrastructure into new project designs.

Restraints

Speed Limitations and Regulatory Complexity Restrain Broader Low Speed Vehicle Market Adoption

The limited speed capability of LSVs is a significant restraint, as these vehicles cannot operate on highways or roads with higher speed limits. This restricts their usability to specific zones and controlled environments. Consequently, operators requiring versatile, multi-road transport solutions often find LSVs insufficient for broader mobility needs.

Safety compliance remains a persistent challenge, as LSVs must meet varying standards across different regional and national regulatory frameworks. Manufacturers must adapt vehicle designs and certifications for each market, increasing development and compliance costs. Moreover, inconsistent regulations create barriers for global fleet operators seeking standardized procurement and deployment strategies.

These regulatory differences also slow market entry for new manufacturers targeting international expansion. Additionally, end-users in regions with unclear LSV road-use laws may delay purchasing decisions due to legal uncertainty. Therefore, harmonized international LSV standards would significantly reduce compliance burdens and accelerate broader market adoption.

Growth Factors

Smart City Integration and Commercial Fleet Expansion Accelerate Low Speed Vehicle Market Growth

The integration of low speed vehicles into smart city and sustainable mobility programs represents a major growth opportunity. City planners are incorporating LSV lanes, charging hubs, and shared fleet stations into urban infrastructure projects. Moreover, government sustainability targets are incentivizing municipalities to adopt clean, low-emission mobility solutions at the community level.

Fleet deployment expansion in commercial logistics and micro-delivery services is creating new demand for purpose-built LSVs. Last-mile delivery operators are evaluating LSVs as cost-effective alternatives for short-range urban parcel and grocery distribution. Consequently, manufacturers are developing purpose-designed cargo platforms to meet the specific requirements of commercial delivery fleets.

Rising demand for eco-friendly transportation in tourism and hospitality sectors also presents strong growth potential. Resorts, heritage sites, and eco-tourism destinations are replacing conventional shuttle vehicles with electric LSV fleets. Additionally, traveler preferences for sustainable experiences are encouraging hospitality operators to invest in green mobility infrastructure to enhance guest satisfaction.

Emerging Trends

Electrification, Connected Features, and Shared Mobility Models Reshape the Low Speed Vehicle Market

The increasing electrification of neighborhood and compact utility vehicles is the most prominent trend shaping the LSV market. Battery technology improvements are extending vehicle range and reducing charge times, making electric LSVs more practical for daily fleet operations. Moreover, falling battery costs are improving the economic case for electric over ICE-powered low-speed alternatives.

Adoption of connected vehicle features and telematics integration is transforming LSV fleet management capabilities. Operators can now monitor vehicle location, battery status, usage patterns, and maintenance needs in real time. Consequently, telematics-enabled LSV fleets are delivering improved operational efficiency and lower total cost of ownership for commercial and institutional operators.

Additionally, growing preference for shared and subscription-based mobility models is influencing how LSVs are purchased and deployed. Fleet-as-a-service and rental models are emerging in resort, campus, and urban micro-mobility settings. Therefore, manufacturers and mobility operators are developing flexible ownership and usage structures to meet evolving customer expectations in the low-speed vehicle segment.

Regional Analysis

North America Dominates the Low Speed Vehicle Market with a Market Share of 43.70%, Valued at USD 5.2 Billion

North America holds the leading position in the global low speed vehicle market, accounting for 43.70% of total revenue, valued at USD 5.2 Billion in 2025. The region benefits from a high concentration of golf courses, gated communities, and resort developments. Moreover, supportive federal and state-level regulations for street-legal LSVs and NEVs continue to drive fleet adoption across commercial and residential sectors.

Europe Low Speed Vehicle Market Trends

Europe represents a significant and growing market for low speed vehicles, supported by stringent emission reduction targets and urban mobility policies. Several European countries are expanding permissible zones for electric LSV operation on low-speed public roads. Additionally, the hospitality and tourism sectors across southern Europe are actively deploying electric LSV fleets to support sustainability commitments and reduce resort carbon footprints.

Asia Pacific Low Speed Vehicle Market Trends

Asia Pacific is the fastest-growing regional market, driven by rapid urbanization, expanding industrial activity, and growing golf and tourism infrastructure. China plays a central role, supported by strong domestic manufacturing capacity and government electric vehicle incentives. Consequently, demand from industrial campuses, airports, and resort developments across the region is accelerating low speed vehicle fleet investments.

Middle East and Africa Low Speed Vehicle Market Trends

The Middle East and Africa market is gradually expanding, led by luxury resort developments, large-scale industrial projects, and international airport expansions. Gulf countries are investing in sustainable transport infrastructure as part of broader economic diversification initiatives. Therefore, demand for electric LSVs in hospitality and government facility applications is expected to rise through the forecast period.

Latin America Low Speed Vehicle Market Trends

Latin America presents emerging growth potential driven by expanding tourism infrastructure and growing interest in eco-friendly mobility solutions. Brazil and Mexico lead regional demand, supported by resort development and increasing industrial activity. Moreover, rising awareness of sustainable transport alternatives among urban developers and hospitality operators is gradually building a stronger LSV market foundation across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

ACG Inc. is a notable player in the low speed vehicle market, recognized for developing battery-electric LSVs that combine retro-inspired design with modern NEV compliance standards. The company’s product portfolio addresses both personal and commercial mobility segments. Moreover, its focus on street-legal electric vehicles positions it well within the growing NEV and LSV regulatory framework across North America.

Club Car has established itself as one of the most recognized brands in the golf cart and utility vehicle space globally. The company offers a broad range of electric and gas-powered vehicles for golf, hospitality, and industrial applications. Additionally, its strong dealer network and fleet management solutions provide a competitive advantage in serving large commercial and institutional customers worldwide.

Polaris Inc. brings deep engineering expertise to the low speed vehicle segment through its lineup of electric and multi-terrain utility vehicles. The company serves commercial, government, and recreational end markets with purpose-built platforms. Consequently, its investment in electric powertrain development and smart vehicle connectivity is strengthening its position in the evolving LSV and utility vehicle marketplace.

Deere & Company leverages its extensive agricultural and industrial equipment heritage to serve the utility vehicle segment of the low speed market. Its product range supports campus, municipal, and industrial fleet applications requiring durability and high payload performance. Therefore, the company’s established distribution network and service infrastructure give it strong reach across diverse commercial and institutional end-user segments globally.

Key Players

- ACG Inc.

- American Landmaster

- Bintelli Electric Vehicles

- Club Car

- Columbia Vehicle Group Inc.

- Deere & Company

- Kubota Corporation

- Polaris Inc.

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd.

- The Toro Company

Recent Developments

- September 2025 – Waev Inc. launched the GEM eX, a new all-electric, street-legal utility UTV meeting LSV standards, designed for fleets in industrial and government settings. The vehicle combines on-road low-speed compliance with off-road and commercial work capabilities, expanding the functional range of street-legal electric utility platforms.

- August 2025 – ACG Inc. launched the 2025 MOKE NEV, a new battery-electric low-speed vehicle inspired by the classic Moke design. The vehicle targets personal and resort mobility segments, combining retro aesthetics with full NEV compliance and modern electric drivetrain performance for street-legal operation.

Report Scope

Report Features Description Market Value (2025) USD 11.9 Billion Forecast Revenue (2035) USD 25.7 Billion CAGR (2026-2035) 8.0% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Golf Cart, Commercial Utility Vehicle, Industrial Utility Vehicle, Personal Mobility Vehicle), By Propulsion (Electric, ICE), By Power Output (6-15 KW, >15 KW, 15 KW), By Speed Class (15-25 mph, Up to 15 mph, Above 25 mph), By Application (Golf Courses, Hotels & Resorts, Airports, Industrial Facilities, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ACG Inc., American Landmaster, Bintelli Electric Vehicles, Club Car, Columbia Vehicle Group Inc., Deere & Company, Kubota Corporation, Polaris Inc., Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd., The Toro Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ACG Inc.

- American Landmaster

- Bintelli Electric Vehicles

- Club Car

- Columbia Vehicle Group Inc.

- Deere & Company

- Kubota Corporation

- Polaris Inc.

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd.

- The Toro Company