Global Logistics Robots Market Size, Share, Growth Analysis By Type (Automated Guided Vehicles, Autonomous Mobile Robots, Robot Arms, Others), By Application (Transportation, Palletizing & De-palletizing, Pick & Place, Others), By End Use (Retail, Healthcare, Food & Beverages, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173510

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

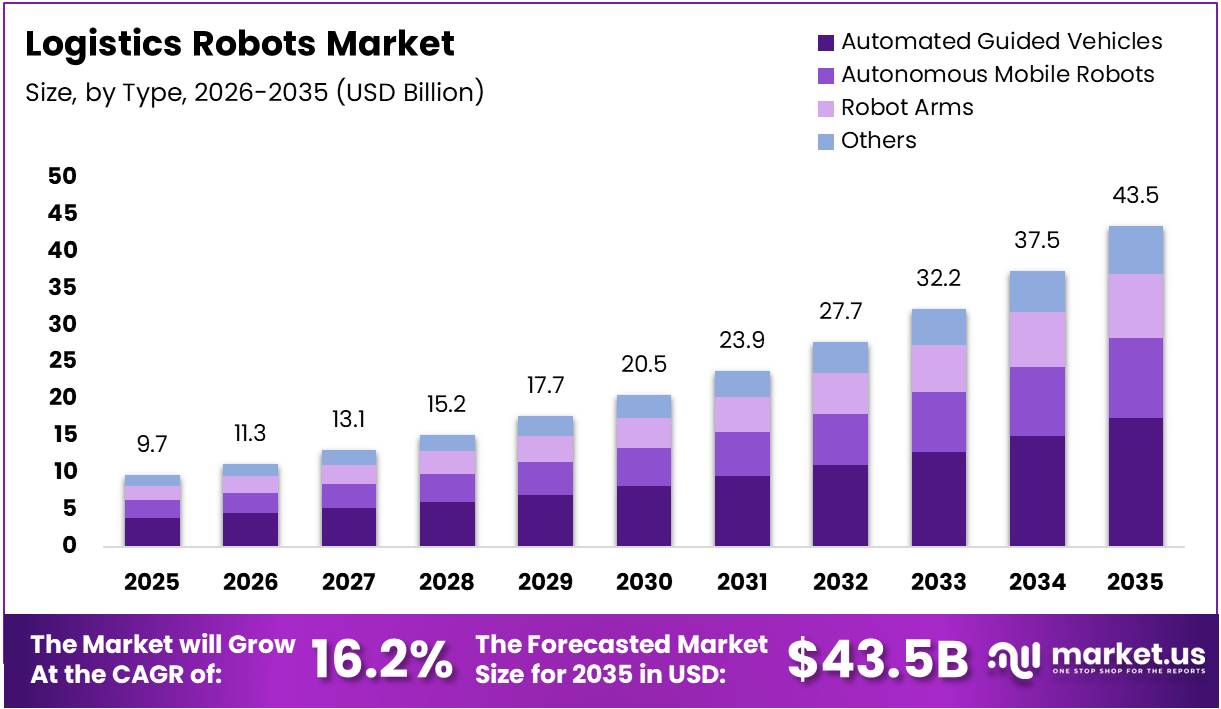

The Global Logistics Robots Market size is expected to be worth around USD 43.5 Billion by 2035, from USD 9.7 Billion in 2025, growing at a CAGR of 16.2% during the forecast period from 2026 to 2035.

The logistics robots market encompasses automated solutions designed for material handling, warehousing, and distribution operations. These technologies include autonomous mobile robots, automated guided vehicles, and self-driving forklifts. Consequently, businesses are transforming their supply chain operations through intelligent automation and enhanced operational efficiency across global logistics networks.

Logistics robots represent advanced automation systems that perform material movement, sorting, picking, and transportation tasks within warehouses and distribution centers. These robotic solutions integrate artificial intelligence, sensors, and navigation technologies. Therefore, they enable seamless coordination between different warehouse processes, ultimately reducing manual labor dependency and improving overall operational accuracy.

The market demonstrates robust expansion driven by e-commerce growth and increasing demand for warehouse automation solutions. Organizations are actively pursuing automation investments to address labor shortages and rising operational costs. Moreover, technological advancements in machine learning and sensor technologies continue enhancing robot capabilities, thereby creating substantial opportunities for market participants.

Government initiatives are significantly supporting logistics automation adoption through favorable policies and infrastructure development programs. Regulatory frameworks are evolving to accommodate autonomous systems while ensuring workplace safety standards. Furthermore, various countries are implementing incentive programs encouraging businesses to adopt advanced robotics technologies, thus accelerating market penetration across diverse industry verticals.

The operational benefits of logistics robots are compelling businesses toward widespread adoption. Advanced navigation systems are delivering 40-60% reduction in material movement travel time while achieving 20-30% increase in warehouse space utilization. Additionally, industry surveys indicate that more than 70% of respondents have adopted or plan to adopt Autonomous Mobile Robots or Automated Guided Vehicles, with 21% currently utilizing self-driving forklifts.

Financial implications further strengthen the business case for logistics automation. Robotics adoption in logistics operations is expected to reduce logistics costs by up to 40%, representing substantial savings for organizations. These efficiency gains, combined with improved accuracy and productivity, are driving accelerated investment decisions across the logistics sector, positioning automated solutions as essential components of modern supply chain infrastructure.

Key Takeaways

- Global Logistics Robots Market size is expected to reach USD 43.5 Billion by 2035, from USD 9.7 Billion in 2025, at a CAGR of 16.2%.

- Automated Guided Vehicles dominate the By Type segment with 36.6% market share in 2025.

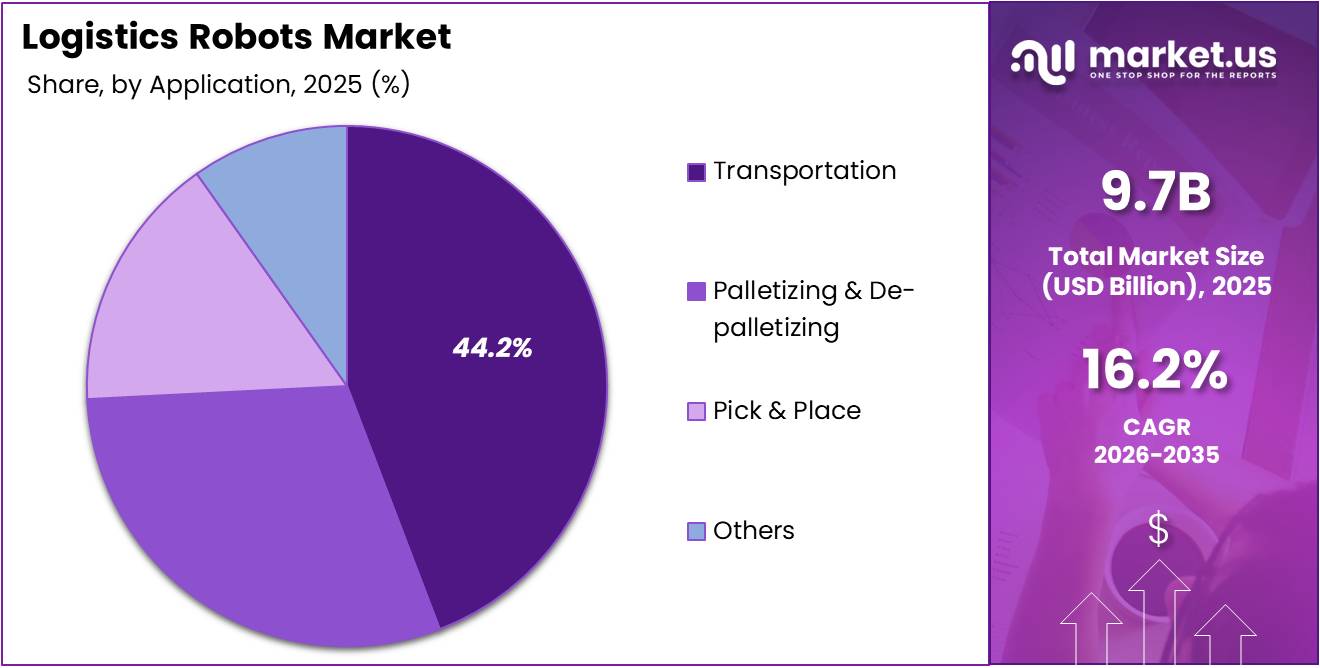

- Transportation leads the By Application segment with 44.2% market share in 2025.

- Retail is the largest By End Use segment with 39.1% share in 2025.

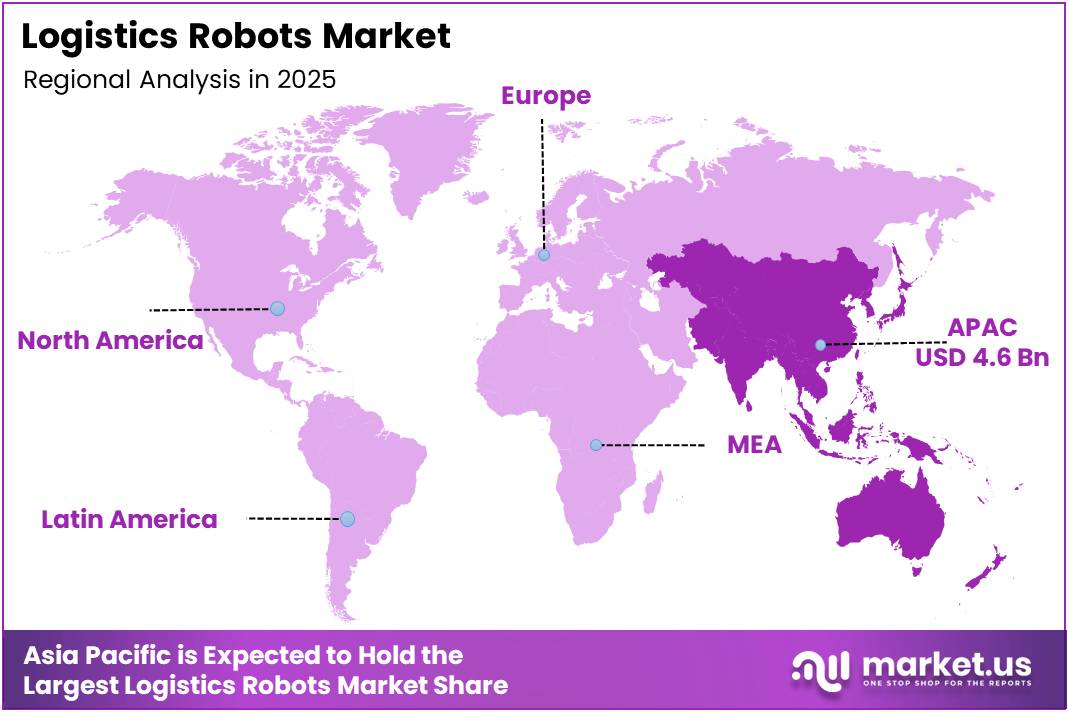

- Asia Pacific holds the highest regional market share of 47.5%, valued at USD 4.6 Billion.

Type Analysis

Automated Guided Vehicles dominate with 36.6% due to their proven reliability and established infrastructure compatibility.

In 2025, Automated Guided Vehicles held a dominant market position in the By Type Analysis segment of Logistics Robots Market, with a 36.6% share. These systems excel in structured warehouse environments where predefined paths and magnetic tape guidance enable consistent performance. Their integration capabilities with existing warehouse management systems make them preferred choices for large-scale distribution centers. Manufacturing facilities appreciate their load-carrying capacity and predictable operational patterns for material handling tasks.

Autonomous Mobile Robots represent the emerging technology segment with advanced navigation capabilities using sensors and artificial intelligence. These robots dynamically adjust routes in real-time, offering superior flexibility compared to traditional systems. Their ability to operate without fixed infrastructure appeals to facilities requiring adaptable automation solutions. Growing adoption across e-commerce fulfillment centers drives their market expansion significantly.

Robot Arms serve specialized functions in logistics operations, particularly excelling in sorting, packaging, and quality inspection applications. Their precision and repeatability make them indispensable for tasks requiring consistent accuracy. Integration with vision systems enhances their capabilities in complex manipulation operations across various industries. The versatility of robot arms enables customization for diverse product handling requirements in modern logistics facilities.

Others encompass emerging robotic technologies including drones for inventory management and collaborative robots for human-assisted operations. These solutions address niche applications where conventional logistics robots face limitations, gradually expanding their presence in specialized logistics environments. Innovation in this segment continues as manufacturers develop novel solutions for unique operational challenges.

Application Analysis

Transportation dominates with 44.2% due to increasing demand for efficient material movement across facilities.

In 2025, Transportation held a dominant market position in the By Application Analysis segment of Logistics Robots Market, with a 44.2% share. Material movement constitutes the foundational requirement in warehousing and distribution operations, making transportation robots essential infrastructure components. Their ability to reduce manual labor costs while increasing throughput efficiency drives widespread adoption.

Palletizing & De-palletizing applications require robust robotic systems capable of handling heavy loads with precision and speed. These operations traditionally demanded significant manual labor, creating strong economic incentives for automation adoption. Modern robotic solutions offer programmable flexibility to accommodate varying product dimensions and stacking patterns efficiently.

Pick & Place operations benefit tremendously from robotic automation, especially in order fulfillment processes requiring rapid item selection. Advanced vision systems enable robots to identify and grasp diverse products accurately. Growing demand for mixed-SKU order processing enhances the value proposition of pick-and-place robotic solutions. The technology significantly reduces order processing times while maintaining high accuracy rates essential for customer satisfaction.

Others include specialized applications such as sorting, packaging, labeling, and quality inspection tasks. These functions complement primary logistics operations, creating comprehensive automated workflows. Integration of multiple robotic applications within facilities optimizes overall operational efficiency and productivity substantially. Emerging applications continue expanding as technology capabilities advance and operational requirements evolve.

End Use Analysis

Retail dominates with 39.1% due to explosive e-commerce growth and omnichannel fulfillment demands.

In 2025, Retail held a dominant market position in the By End Use Analysis segment of Logistics Robots Market, with a 39.1% share. The dramatic expansion of online shopping creates unprecedented pressure on fulfillment operations to deliver faster service. Retailers invest heavily in robotic automation to meet consumer expectations for same-day and next-day delivery options. Warehouse space optimization through vertical storage systems and robotic retrieval maximizes facility productivity significantly.

Healthcare increasingly relies on logistics robots for pharmaceutical distribution, medical supply management, and hospital internal transportation needs. Stringent regulatory requirements for tracking and traceability make automated systems particularly valuable. The sector prioritizes reliability and precision, driving adoption of proven robotic technologies for critical supply chain operations.

Food & Beverages operations face unique challenges including temperature-controlled environments and hygiene standards that specialized logistics robots address effectively. Automated systems reduce contamination risks while maintaining cold chain integrity. Perishable product handling benefits from reduced processing times enabled by robotic efficiency.

Automotive manufacturing historically pioneered industrial robotics adoption and continues expanding logistics automation throughout supply chains. Just-in-time manufacturing principles require precise material delivery coordination that robotic systems provide consistently. The complexity of automotive supply chains with thousands of components necessitates sophisticated automated logistics solutions.

Others encompass diverse industries including electronics, pharmaceuticals, chemicals, and third-party logistics providers implementing robotic solutions for competitive differentiation and operational excellence. Each industry brings unique requirements that drive customization and innovation in logistics robotics applications and capabilities.

Key Market Segments

By Type

- Automated Guided Vehicles

- Autonomous Mobile Robots

- Robot Arms

- Others

By Application

- Transportation

- Palletizing & De-palletizing

- Pick & Place

- Others

By End Use

- Retail

- Healthcare

- Food & Beverages

- Automotive

- Others

Drivers

Increasing Adoption of Automation in Warehousing and Distribution Centers Drives Market Growth

The logistics robots market is experiencing strong growth driven by the widespread shift toward warehouse automation. Companies are investing heavily in robotic solutions to replace manual processes and improve operational efficiency. Modern warehouses are adopting automated guided vehicles, sorting robots, and picking systems to handle increasing order volumes.

The demand for faster and error-free order fulfillment is pushing businesses to implement robotic systems. E-commerce growth has created pressure on logistics providers to deliver products quickly and accurately. Robots reduce human errors in picking, packing, and sorting operations, leading to higher customer satisfaction. These systems work continuously without fatigue, significantly improving productivity levels.

Technology improvements in AI and robotics are making automation easier to use. AI-powered robots can now navigate better, recognize objects, and make smart decisions. These systems learn and adapt to warehouse changes while sensors help them handle different products safely. These advances lower costs and improve performance, making robots a smart choice for businesses.

Restraints

Limited Skilled Workforce for Operating and Managing Advanced Logistics Robots Restrains Market Expansion

The logistics robots market faces problems because there aren’t enough trained workers to operate complex robotic systems. Many companies cannot find people with the right technical skills to program and maintain these machines. This shortage makes businesses hesitant to invest in robots. Operating these systems needs special knowledge in software, mechanics, and integration, which is especially hard for smaller companies.

Rules and safety requirements create another big challenge. Different countries have different standards for using robots in warehouses, making things complicated. Companies must follow approval processes and meet safety rules. Worries about worker safety when humans and robots work together lead to strict regulations. Insurance needs and legal concerns add extra costs. These rule-based challenges slow down robot adoption, especially in places with tough regulations, limiting market growth.

Growth Factors

Integration of Collaborative Robots (Cobots) in Supply Chain Processes Creates Growth Opportunities

The logistics robots market offers substantial opportunities through collaborative robots working alongside humans. Cobots handle repetitive tasks while humans focus on complex decisions, combining automation benefits with human flexibility. This human-robot collaboration improves productivity without complete workforce replacement.

Emerging markets present tremendous expansion potential as developing economies increase automation investments. Countries in Asia, Latin America, and Africa are modernizing supply chain infrastructure. Rising labor costs make robotic automation increasingly cost-effective while government initiatives promoting smart manufacturing encourage adoption of advanced logistics technologies.

Autonomous mobile robots for complex logistics tasks represent a significant opportunity. New AMR technologies navigate dynamic environments and make independent decisions. These robots are becoming more affordable and accessible to broader markets. Advanced AMRs with improved AI capabilities effectively manage unpredictable warehouse scenarios.

Emerging Trends

Adoption of Cloud-Based Robotics and Real-Time Data Analytics Shapes Market Trends

The logistics robots market is moving toward cloud-based systems that allow remote monitoring and control. Cloud connection lets operators check robot performance, get maintenance warnings, and update software from anywhere. Real-time data analysis provides useful information about efficiency, enabling preventive maintenance and reducing downtime significantly.

Cold chain and perishable goods handling is emerging as a specialized application. Temperature-controlled warehouses require precise handling to maintain product quality. Robots with specialized sensors and climate-resistant designs manage pharmaceuticals and fresh foods, addressing growing demand for reliable cold chain logistics.

Swarm robotics technology is gaining attention for large-scale warehouse automation. Multiple robots working as coordinated systems handle massive order volumes more efficiently. These swarms use advanced algorithms to communicate and collaborate, dynamically adjusting based on real-time conditions and workload distribution.

Regional Analysis

Asia Pacific Dominates the Logistics Robots Market with a Market Share of 47.5%, Valued at USD 4.6 Billion

Asia Pacific leads the global logistics robots market with a commanding share of 47.5%, valued at USD 4.6 billion. The region’s dominance is driven by rapid e-commerce growth, extensive manufacturing activities, and aggressive warehouse automation adoption across China, Japan, and India. Government initiatives supporting Industry 4.0 and the need for labor cost optimization continue to accelerate robotics deployment in logistics operations.

North America Logistics Robots Market Trends

North America demonstrates strong market maturity with widespread adoption of logistics robots across fulfillment centers and distribution warehouses. The region’s growth is fueled by major e-commerce operations, labor shortages, and continuous investments in supply chain automation technologies to enhance operational efficiency and meet rising consumer delivery expectations.

Europe Logistics Robots Market Trends

Europe exhibits robust demand for logistics robots driven by advanced manufacturing infrastructure and stringent efficiency requirements. The region focuses on collaborative robotics and sustainable automation solutions, with significant adoption in automotive, pharmaceutical, and retail sectors seeking to optimize warehouse operations and address labor challenges.

Middle East and Africa Logistics Robots Market Trends

The Middle East and Africa region shows emerging potential in logistics robotics adoption, particularly in Gulf countries investing heavily in smart logistics infrastructure. Growing e-commerce penetration, expansion of logistics hubs, and diversification initiatives away from oil-dependent economies are gradually driving demand for automated material handling solutions.

Latin America Logistics Robots Market Trends

Latin America represents a developing market for logistics robots with gradual adoption primarily concentrated in Brazil and Mexico. The region’s growth is supported by expanding e-commerce activities, foreign manufacturing investments, and increasing awareness of automation benefits, though economic constraints and infrastructure limitations moderate the pace of technology deployment.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Logistics Robots Company Insights

In 2025, the global Logistics Robots Market is shaped by established automation leaders deploying strategic innovation and scalable solutions tailored to modern supply chains. These vendors are advancing capability sets across autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and integrated warehouse systems to meet rising demand for flexibility, efficiency and contact-free operations.

ABB Ltd continues to leverage its deep automation heritage to deliver robotics platforms that integrate seamlessly with industrial control systems, strengthening end-to-end material flow. The company’s ability to combine robotic manipulators with intelligent software enhances throughput and accuracy in high-volume, high-variability logistics environments, positioning it as a versatile partner for enterprise-grade implementations.

KUKA AG is driving growth through modular robot architectures that support rapid deployment and adaptive picking capabilities. Its emphasis on collaborative robots and flexible tooling responds to the increasing need for mixed SKU handling and dynamic order fulfillment, improving return on investment for mid-size to large logistics operations.

Toyota Industries Corporation capitalizes on its manufacturing and intralogistics expertise to scale autonomous solutions with strong safety and reliability credentials. By fusing automated guided transport with smart fleet management, Toyota’s offerings support continuous operations with minimized downtime, appealing to sectors prioritizing uptime and lean material movement.

Fanuc Corporation builds on a broad installed base of industrial robots to expand into logistics automation with rugged, high-performance units that excel in harsh and high-duty environments. Its global service network and standardized platforms help clients reduce integration complexity and maintain performance consistency across distributed facilities, reinforcing its competitive stance in the market.

Top Key Players in the Market

- ABB Ltd

- KUKA AG

- Toyota Industries Corporation

- Fanuc Corporation

- Yaskawa Electric Corporation

- Kion Group Ag

- Toshiba Corporation

- Krones AG

- Kawasaki Heavy Industries Ltd.

- Omron Corporation

Recent Developments

- In January 2026, Grab acquired the Chinese AI robotics firm Infermove to strengthen its last-mile delivery capabilities, aiming to improve operational efficiency and reduce delivery times in key markets.

- In January 2026, Mobileye signed a definitive agreement to acquire Mentee Robotics Ltd., an Israel-based company specializing in AI-powered humanoid robots, for US$612 million in cash and up to about 26.2 million Mobileye shares, expanding its presence in intelligent robotics solutions.

- In July 2025, Comau completed its acquisition of Automha, enhancing the combined companies’ leadership in advanced logistics automation and strengthening their portfolio for global industrial automation projects.

Report Scope

Report Features Description Market Value (2025) USD 9.7 Billion Forecast Revenue (2035) USD 43.5 Billion CAGR (2026-2035) 16.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Automated Guided Vehicles, Autonomous Mobile Robots, Robot Arms, Others), By Application (Transportation, Palletizing & De-palletizing, Pick & Place, Others), By End Use (Retail, Healthcare, Food & Beverages, Automotive, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB Ltd, KUKA AG, Toyota Industries Corporation, Fanuc Corporation, Yaskawa Electric Corporation, Kion Group Ag, Toshiba Corporation, Krones AG, Kawasaki Heavy Industries Ltd., Omron Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd

- KUKA AG

- Toyota Industries Corporation

- Fanuc Corporation

- Yaskawa Electric Corporation

- Kion Group Ag

- Toshiba Corporation

- Krones AG

- Kawasaki Heavy Industries Ltd.

- Omron Corporation