Global Liquid Detergents Market Size, Share Analysis Report By Nature (Organic, Inorganic), By Application (Household, Industrial And Institutional), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152809

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

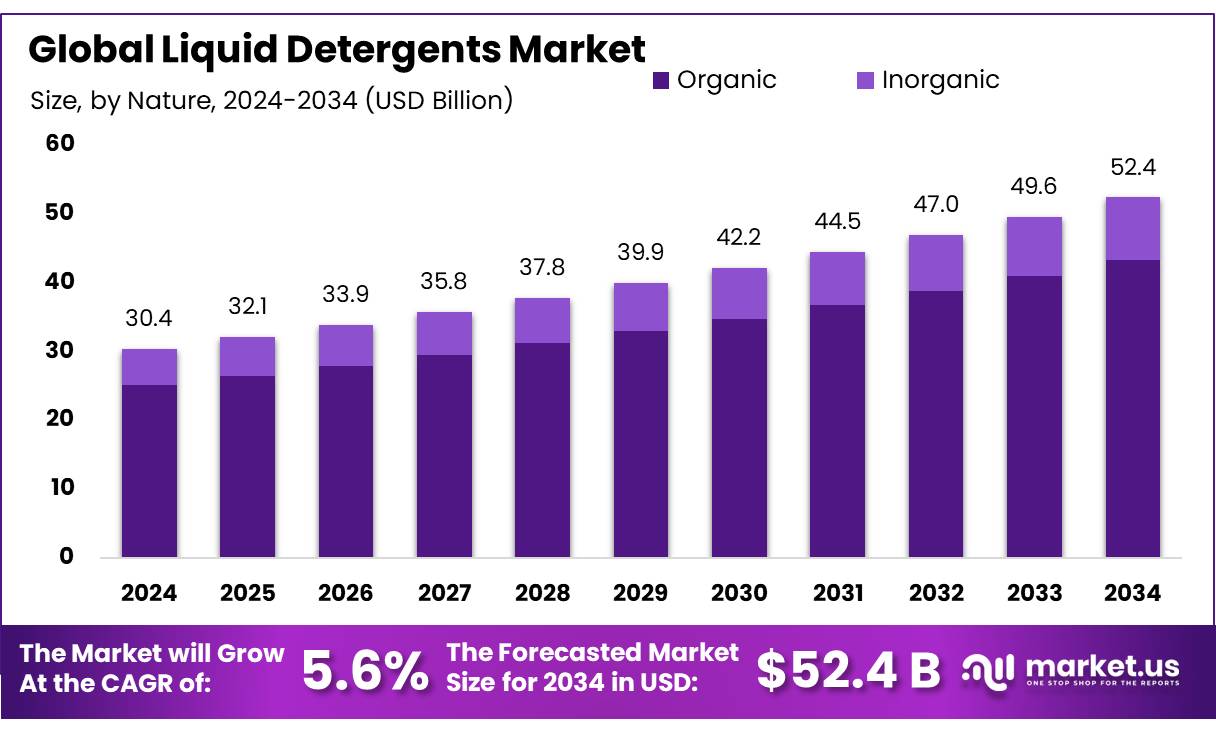

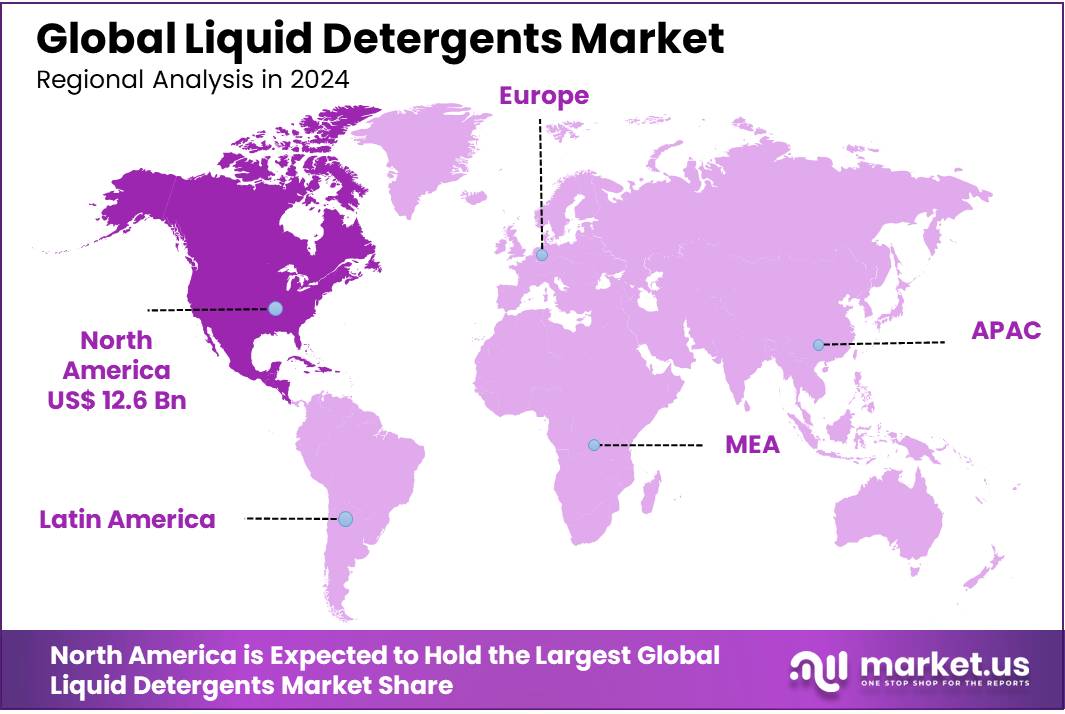

The Global Liquid Detergents Market size is expected to be worth around USD 52.4 Billion by 2034, from USD 30.4 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 41.7% share, holding USD 12.6 Billion revenue.

The liquid detergent concentrates industry has experienced significant transformation over recent decades following the emergence of ultra-concentrated formulations in the 1990s, most notably by companies such as P&G and Henkel. As reported by the U.S. EPA, these early ultras were introduced to reduce filler content and support space-saving packaging, driven by consumer preferences in markets like Japan and Europe.

This innovation laid foundational groundwork for today’s concentrated liquid detergents, which employ higher active surfactant levels and reduced water content, minimizing packaging waste while delivering equivalent cleaning performance.

Consumer preferences are shifting towards liquid and concentrated formats, driven by their convenience, superior solubility in cold water, and perceived efficacy. Between November 2020 and October 2021, liquid detergent launches accounted for 41% of new product introductions in India, compared to 27% from powder forms. Additionally, initiatives promoting hygiene awareness—amplified during the COVID-19 pandemic—have bolstered demand for liquid-based fabric care solutions.

In India, the chemical sector—including surfactants used in liquid detergents—is supported by multiple government schemes such as “Make in India” and “Atmanirbhar Bharat.” These measures permit 100% foreign direct investment (FDI) on the automatic route, subject to exceptions for specified hazardous chemicals.

Key drivers include shifting consumer preferences toward convenient, single-serve premium products; demand for natural and low-sugar ingredients; and health-focused innovations such as plant-based and probiotic concentrates. In the United States, although per-capita frozen dairy consumption declined from 20.3lb in 2021—6lb less than in 2000—interest persists in healthier alternatives. India’s per capita ice cream consumption remains low (~250 ml), indicating growth potential versus global averages of 2–3L.

Key Takeaways

- Liquid Detergents Market size is expected to be worth around USD 52.4 Billion by 2034, from USD 30.4 Billion in 2024, growing at a CAGR of 5.6%.

- Organic held a dominant market position, capturing more than an 82.5% share of the global liquid detergents market.

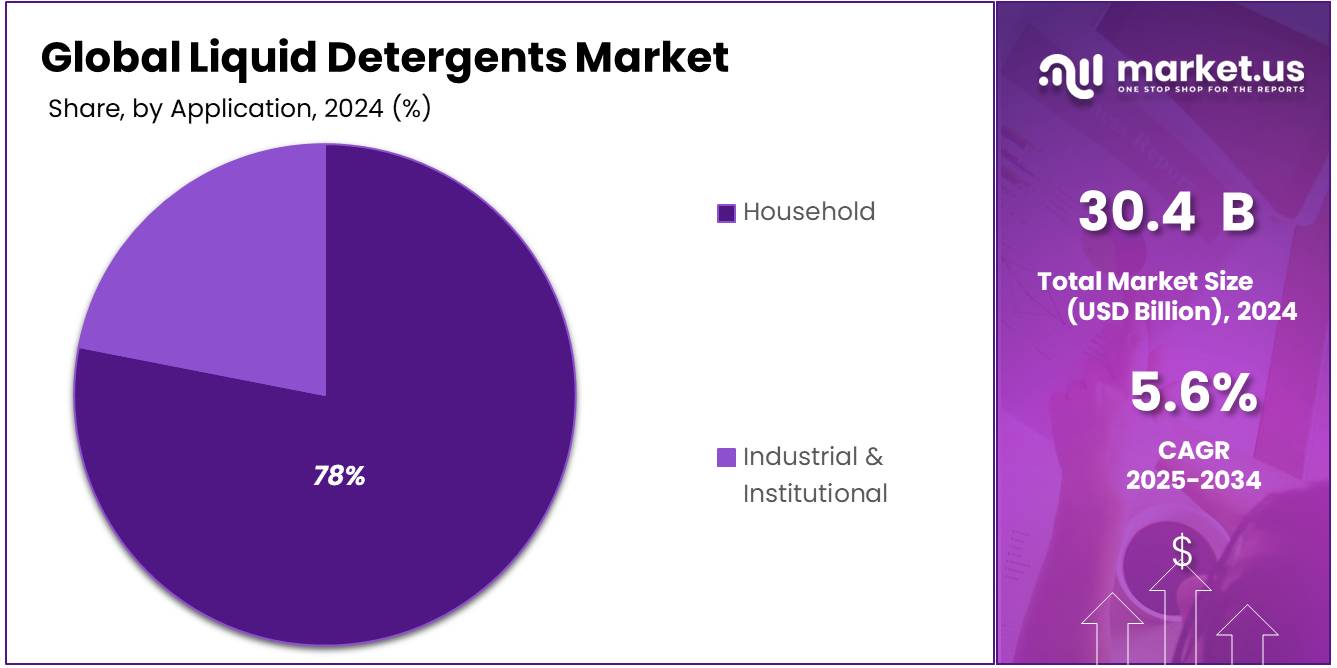

- Household held a dominant market position, capturing more than a 78.3% share of the global liquid detergents market.

- Supermarkets and Hypermarkets held a dominant market position, capturing more than a 45.5% share of the global liquid detergents market.

- North America continued to set the pace in the global liquid detergents market, contributing roughly 41.7% of worldwide revenue, equating to approximately USD 12.6 billion.

By Nature Analysis

Organic Liquid Detergents dominate with 82.5% share, driven by rising preference for plant-based and chemical-free formulations.

In 2024, Organic held a dominant market position, capturing more than an 82.5% share of the global liquid detergents market by nature. This strong performance is mainly supported by growing consumer awareness regarding harmful chemicals found in conventional detergents and the increasing demand for safer, eco-friendly cleaning solutions. Consumers today are more conscious of the ingredients used in daily-use household products, pushing the shift toward biodegradable, plant-based, and toxin-free formulations.

In particular, organic detergents appeal to families with infants or members with skin sensitivities, where fragrance-free and dye-free products are preferred. The rise of clean-label trends, coupled with stricter environmental and safety regulations in key regions like North America and Europe, is also helping organic variants maintain their lead. This market shift is further reinforced by the growing popularity of refill stations, compostable packaging, and concentrated formats—all aligned with the sustainability goals often associated with organic products.

By Application Analysis

Household Liquid Detergents dominate with 78.3% share, supported by daily cleaning needs and rising hygiene awareness.

In 2024, Household held a dominant market position, capturing more than a 78.3% share of the global liquid detergents market by application. This strong lead is largely attributed to the consistent and high-frequency usage of liquid detergents in daily household chores such as laundry, dishwashing, and general surface cleaning. As urban lifestyles continue to become faster and more convenience-driven, consumers increasingly prefer ready-to-use, easy-to-measure liquid detergents over powders or bars.

The surge in health and hygiene awareness—particularly post-pandemic—has also reinforced the habit of regular cleaning, making liquid detergents a staple product in most homes. Additionally, the growing demand for specialized detergents for babies, delicate fabrics, and allergy-sensitive users has expanded the product range within the household segment.

By Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 45.5% share, fueled by easy product access and wide brand variety.

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 45.5% share of the global liquid detergents market by distribution channel. This leadership is mainly driven by the convenience these retail formats offer, allowing consumers to compare various brands, sizes, and pricing in one location. These stores also frequently run promotional offers, bundle deals, and discounts on household essentials like liquid detergents, encouraging bulk purchases.

Moreover, the in-store experience—combined with the assurance of product authenticity—continues to attract a broad consumer base, especially in urban and semi-urban regions. As consumers increasingly seek quick access to trusted cleaning products, supermarkets and hypermarkets remain the go-to destinations for regular household replenishment.

Key Market Segments

By Nature

- Organic

- Inorganic

By Application

- Household

- Industrial & Institutional

- Laundry & Dry Cleaning Service

- Hotel & Other Lodging

- Healthcare

- Textile Industry

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online Stores

- Others

Emerging Trends

Ultra-Concentrated, Eco-Friendly Liquid Detergents

The detergent industry is undergoing a significant transformation, marked by the emergence of ultra‑concentrated liquid detergents that combine environmental sustainability with consumer convenience. This trend is underpinned by rigorous regulatory frameworks, consumer demand for eco-conscious products, and measurable environmental benefits. Analysis of recent developments reveals a shift in both product formulation and packaging aimed at reducing waste and carbon emissions.

First, product innovation is evident in ultra-concentrated formulations that drastically reduce packaging volume. The Surface Transportation Policy Project (STPP) reported that these compact detergents require “smaller and lighter packaging,” yielding cost efficiencies in transportation and storage, as well as “lower carbon emissions”. Such advancements align with growing consumer awareness: a survey by Aura in North America indicated that 37% of shoppers have abandoned purchases due to unsustainable packaging, with 80% believing brands often use excessive packaging

Second, stringent regulations and government initiatives are propelling manufacturers toward greener solutions. In India, detergents must comply with stricter biodegradability and chemical content norms, as mandated by environmental agencies and government policies aimed at reducing aquatic pollution. Globally, regulators are pushing for reduced plastic use and greater transparency in chemical ingredients, reinforcing corporate efforts to innovate responsibly.

In Europe and North America, these products are gaining particular traction. For instance, Germany’s Frosch brand now uses bottles made from 50% recycled yellow sack waste and plant-based surfactants compliant with EU eco-standards. Adoption is also supported by circular‑economy regulations that encourage reuse, refill, and recycling models in packaging.

Drivers

Rising Consumer Demand for Eco-Friendly Liquid Detergents

The growing consumer demand for eco-friendly and sustainable liquid detergents is a key driving factor in the market’s growth. As environmental concerns rise globally, consumers are increasingly prioritizing products that are both effective and environmentally friendly. The shift towards biodegradable ingredients, recyclable packaging, and products free from harmful chemicals is becoming more apparent. This growth is driven by increasing consumer awareness of sustainability issues and the environmental impact of traditional cleaning products.

Government initiatives supporting eco-friendly product development are also playing a significant role in this trend. The European Union’s Green Deal, for example, has been a major force in encouraging companies to reduce their carbon footprint and adopt sustainable practices. Additionally, in the United States, the Environmental Protection Agency’s Safer Choice program helps guide consumers towards cleaning products that have a lower environmental impact.

Moreover, liquid detergent brands are responding by introducing more concentrated formulas that use less water, reducing transportation costs and carbon emissions. For instance, Procter & Gamble’s Tide brand introduced a line of ultra-concentrated liquid detergents that use 30% less plastic, thus reducing packaging waste. This innovation aligns with the increasing regulatory and consumer demand for reduced environmental impact. As more brands embrace these eco-conscious trends, the demand for sustainable liquid detergents is expected to continue its upward trajectory.

Restraints

High Production Costs and Raw Material Prices

One of the major restraining factors for the liquid detergents market is the rising production costs, driven primarily by the increasing prices of raw materials. Key ingredients like surfactants, fragrances, and chemicals used in detergents are becoming more expensive due to global supply chain disruptions and inflationary pressures. According to the U.S. Department of Agriculture (USDA), the cost of raw materials in the cleaning products sector has risen by 8% in the last year alone, with some specific ingredients seeing price increases as high as 15%. This poses a challenge for manufacturers looking to keep prices competitive while maintaining profit margins.

The price volatility of petrochemical-derived ingredients, such as surfactants, also contributes to the cost pressure. These ingredients are heavily dependent on crude oil prices, which have been unpredictable due to geopolitical tensions and changes in demand from various industries. For instance, in 2022, crude oil prices increased by nearly 40%, directly impacting the cost of liquid detergent production. This increase in production costs often leads to higher retail prices, which could dampen demand, especially among price-sensitive consumers.

Governments worldwide have been pushing for stricter regulations around the use of chemicals in cleaning products. While these initiatives help ensure environmental and health safety, they also impose additional costs on manufacturers who need to comply with new standards. For example, in the European Union, the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation has required manufacturers to invest in reformulating their products to meet stricter safety and environmental standards. While these regulations are crucial for safety, they also add to the overall production cost.

Opportunity

Expansion into Emerging Markets

The liquid detergent market is experiencing significant growth, particularly in emerging economies where urbanization, increasing disposable incomes, and changing lifestyles are driving demand. According to the U.S. Environmental Protection Agency (EPA), the global detergent market has seen substantial growth, with regions like Eastern Europe, Latin America, and China representing major opportunities. For instance, between 1990 and 1993, annual growth in laundry detergent sales ranged from 4% in Mexico to 15% in Argentina, with market penetration of automatic washing machines increasing in these regions.

Governments in these regions are also supporting the growth of the detergent market through initiatives that promote hygiene and cleanliness. For example, in India, the government’s focus on sanitation and cleanliness under the Swachh Bharat Abhiyan has led to increased awareness and demand for cleaning products, including detergents. Such initiatives not only boost market growth but also contribute to improved public health standards.

Companies operating in the liquid detergent market can capitalize on these opportunities by expanding their presence in emerging markets, tailoring products to local preferences, and collaborating with governments to align with public health initiatives. By doing so, they can tap into a growing consumer base and contribute to the overall development of these regions.

Regional Insights

North America leads with a dominant 41.7% share, recording USD 12.6 billion in liquid detergents.

In 2024, North America continued to set the pace in the global liquid detergents market, contributing roughly 41.7% of worldwide revenue, equating to approximately USD 12.6 billion. This strong regional performance is underpinned by robust consumer preferences for convenient, high-performance cleaning solutions, particularly within the household sector.

Consumer awareness of health and hygiene has also influenced regional behavior. In the wake of global health events, North American households have increasingly turned to liquid detergents known for strong stain and bacteria removal, boosting market demand. Many brands now emphasize environmentally responsible formulations—such as Safer-Choice-certified liquids—which, in 2024, accounted for over 2.4 billion pounds of production in the U.S., reflecting a 150% increase since 2021.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amway reported USD 7.4 billion in global sales for the fiscal year ending December 31, 2024—reflecting a modest 3–4% decline from 2023, largely due to currency headwinds. Within household care, its Amway Home brand—including SA8 laundry detergent—continues to gain traction, especially in North America. Amway’s direct-selling model remains pivotal in distributing concentrated detergent formulas, reinforcing its presence in eco-conscious and performance-oriented consumer segments.

S.C.Johnson, a privately held U.S. firm, maintains a strong position in household cleaning products. While full liquid-detergent revenues are not publicly disclosed, the company is recognized for innovation in eco-friendly formulas, notably the Seventh Generation line, which emphasizes plant-based surfactants and biodegradable packaging. The brand’s growing popularity intersects with stricter regulations: for instance, it supports U.S. state-level bans on harmful surfactants, underlining Johnson’s alignment with emerging environmental standards.

Colgate-Palmolive’s portfolio in Latin America and North America includes liquid detergents under the Sorriso and Softlan brands. The company emphasizes sustainable development, reporting that 68% of its global product volume in 2024 met eco-efficiency criteria, such as concentrated refills and recyclable packaging. Although not broken out by detergent alone, this signals a clear strategic tilt toward environmentally conscious households and aligns with government drives to decrease packaging waste.

Top Key Players Outlook

- Amway Corporation

- S. C. Johnson & Son, Inc

- Colgate-Palmolive

- Church & Dwight

- Henkel Company KGaA

- Procter & Gamble

- The Clorox Company

- Kao Corporation

- Godrej Consumer Products

- Unilever Plc

- Reckitt Benckiser Group plc

Recent Industry Developments

Amway reported global sales of USD 7.4 billion for the year ending December 31, 2024, with its household-care division—led by the SA8 liquid laundry detergent—playing a key role in this performance.

In 2024, Henkel achieved €21.6 billion in overall revenues, with the Consumer Brands unit contributing €10.467 billion, nearly 48% of total sales.

Report Scope

Report Features Description Market Value (2024) USD 30.4 Bn Forecast Revenue (2034) USD 52.4 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Inorganic), By Application (Household, Industrial And Institutional), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amway Corporation, S. C. Johnson & Son, Inc, Colgate-Palmolive, Church and Dwight, Henkel Company KGaA, Procter and Gamble, The Clorox Company, Kao Corporation, Godrej Consumer Products, Unilever Plc, Reckitt Benckiser Group plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amway Corporation

- S. C. Johnson & Son, Inc

- Colgate-Palmolive

- Church & Dwight

- Henkel Company KGaA

- Procter & Gamble

- The Clorox Company

- Kao Corporation

- Godrej Consumer Products

- Unilever Plc

- Reckitt Benckiser Group plc