Global Liquid Chlorine Market Size, Share, And Business Benefits By Grade (Industrial, Food, Water Treatment, Other), By Application (Water Treatment, Bleaching, Disinfection, Deodorization, Others), By End-Use (Chemicals, Plastics, Pulp Paper, Food Beverages, Textiles, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152074

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

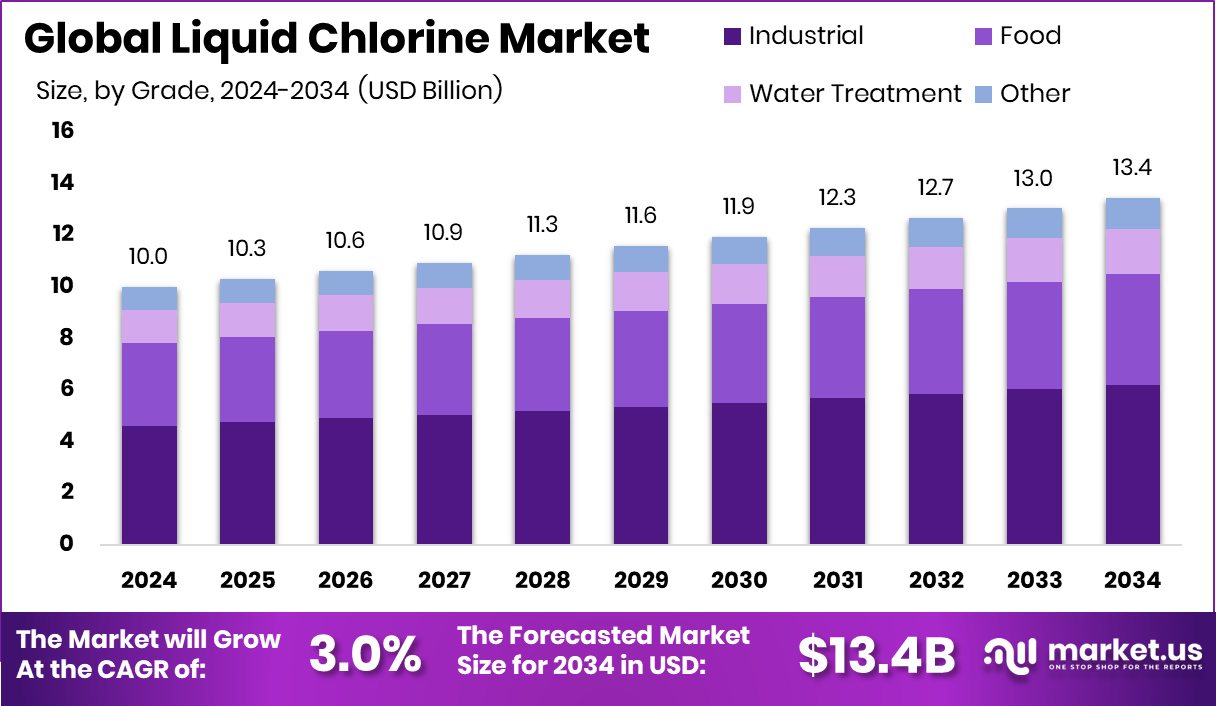

Global Liquid Chlorine Market is expected to be worth around USD 13.4 billion by 2034, up from USD 10.0 billion in 2024, and grow at a CAGR of 3.0% from 2025 to 2034. Strong water treatment demand supports North America’s 38.6% share, worth USD 3.8 billion.

Liquid chlorine is a clear amber-colored liquid produced by compressing chlorine gas at low temperatures. It is widely used for its strong disinfecting and oxidizing properties. In industrial settings, it plays a critical role in water purification, chemical manufacturing, and sanitation. When released, it quickly turns into a gas, making it highly effective for treatment applications.

The liquid chlorine market encompasses the global production, distribution, and application of liquid chlorine across various sectors, including water treatment, paper and pulp bleaching, plastics, and chemical processing. The demand for liquid chlorine is closely tied to sectors that require large-scale disinfection and chemical synthesis. With growing urbanization and increasing industrial output, the market continues to expand steadily across both developed and developing regions.

The rising need for clean and safe water supplies is one of the main growth drivers. Municipal bodies increasingly use liquid chlorine to treat drinking water and wastewater. Additionally, its essential role in producing polyvinyl chloride (PVC) and other chemicals continues to boost its consumption across the construction and packaging industries. According to an industry report, a Chemical firm is to invest $170 million in restoring the Westlake chlorine facility damaged by Hurricane Laura

Demand for liquid chlorine is heavily influenced by infrastructure development, urban water management systems, and rising public health standards. Countries facing waterborne disease outbreaks or pollution challenges are accelerating water disinfection programs, thereby increasing chlorine usage. According to an industry report, Cranbrook awarded $9.5 million to upgrade water treatment infrastructure

Key Takeaways

- Global Liquid Chlorine Market is expected to be worth around USD 13.4 billion by 2034, up from USD 10.0 billion in 2024, and grow at a CAGR of 3.0% from 2025 to 2034.

- Industrial grade dominates the Liquid Chlorine market, accounting for 46.2% due to widespread industrial applications.

- Water treatment holds a 38.6% share, driven by rising demand for safe municipal water supplies globally.

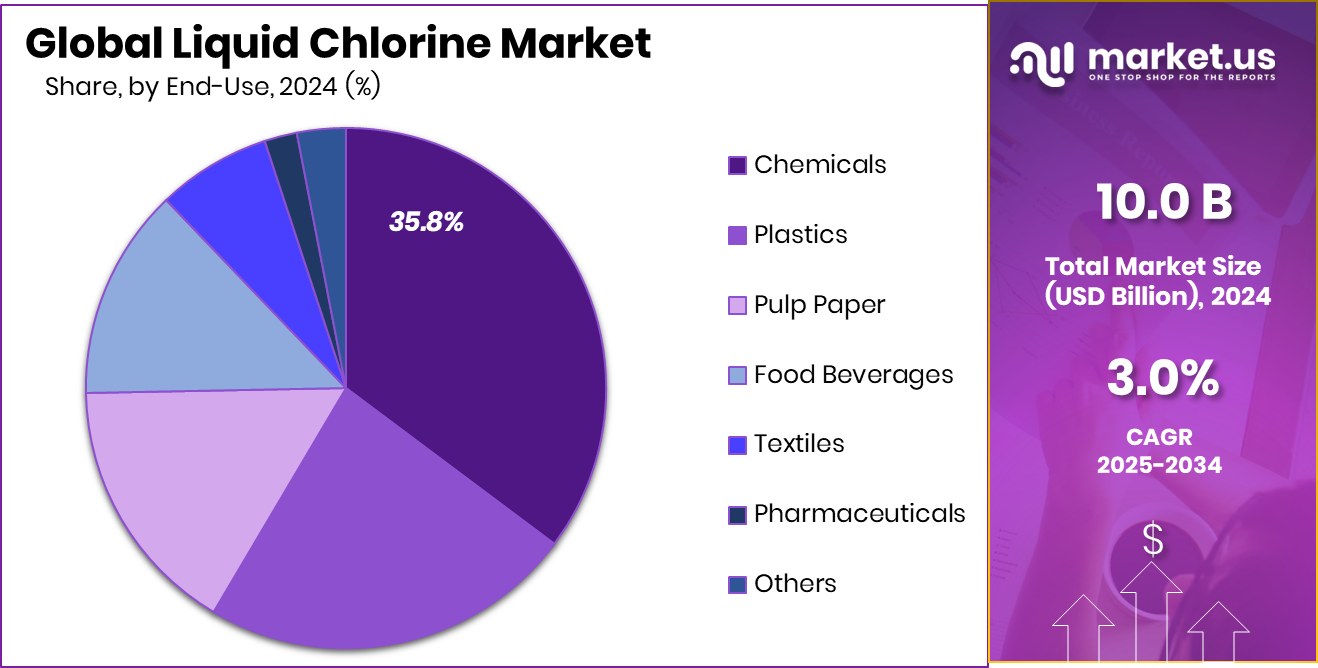

- The chemical sector leads end-use with 35.8%, supported by extensive use in manufacturing and processing chemical compounds.

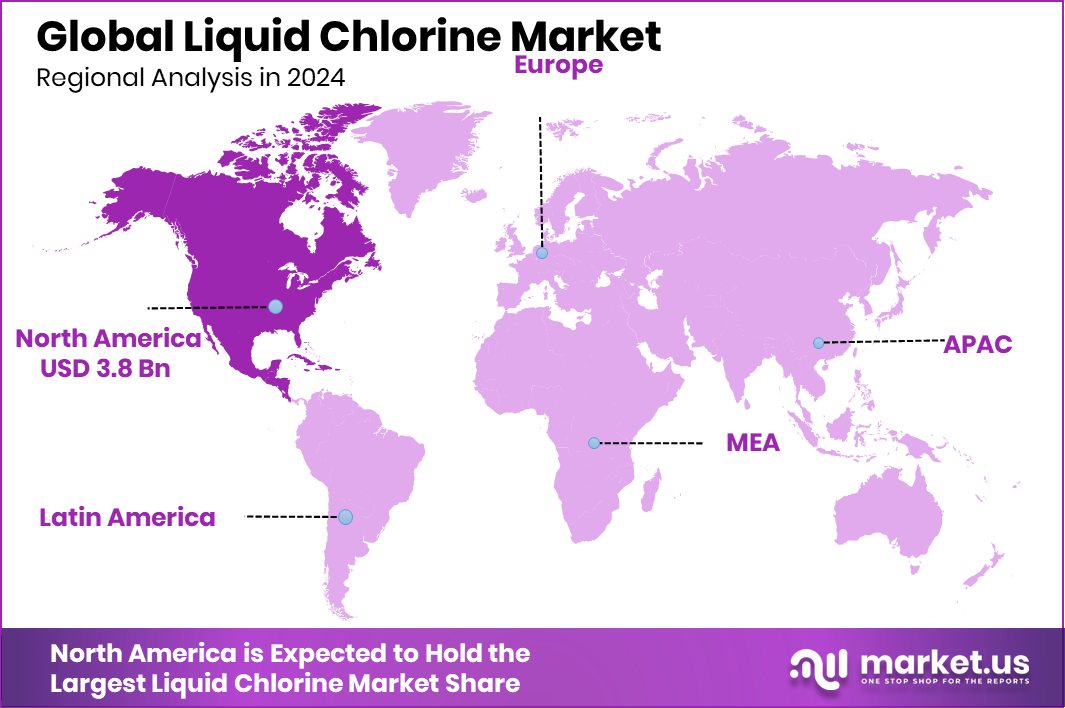

- The North American liquid chlorine market reached a value of USD 3.8 billion.

By Grade Analysis

Industrial grade dominates the liquid chlorine market with a 46.2% share.

In 2024, Industrial held a dominant market position in the By Grade segment of the Liquid Chlorine Market, with a 46.2% share. This significant share reflects the broad usage of industrial-grade liquid chlorine across multiple manufacturing and processing industries.

Its primary application includes chemical synthesis, where it serves as a crucial raw material for producing chlorinated compounds, solvents, and intermediates used in plastics, textiles, and pharmaceuticals. The strength of this segment is also supported by its vital role in treating industrial effluents and process water, where effective disinfection and oxidation are essential to meet environmental compliance standards.

The sustained growth in chemical manufacturing output and the expansion of heavy industries in emerging economies have contributed to the consistent demand for industrial-grade chlorine. Furthermore, this grade is preferred for its high purity and stability in handling large-scale operations where stringent quality is required.

In several regions, the shift toward improving industrial hygiene and water reuse systems is also reinforcing the importance of liquid chlorine in operational processes. The segment’s dominance in 2024 clearly illustrates its indispensable position within the value chain of numerous core industries, making it a central driver in the overall liquid chlorine market landscape.

By Application Analysis

Water treatment accounts for 38.6% of total liquid chlorine consumption globally.

In 2024, Water Treatment held a dominant market position in the By Application segment of the Liquid Chlorine Market, with a 38.6% share. This strong share reflects the continued reliance on liquid chlorine as a primary disinfectant in municipal and industrial water treatment systems. Liquid chlorine is widely used to eliminate pathogens, control microbial growth, and ensure safe drinking water, especially in densely populated urban areas where public health infrastructure requires robust chemical support.

The dominance of the water treatment segment is also supported by increasing governmental efforts to improve water quality standards and expand access to clean water. Municipal corporations and water utilities prefer liquid chlorine for its cost-effectiveness, ease of application, and proven efficiency in killing harmful microorganisms. Additionally, wastewater treatment plants use it extensively for final disinfection before water discharge or reuse, which adds to the overall consumption within this segment.

In regions facing waterborne diseases or limited clean water access, the use of liquid chlorine has become essential to support public health goals. The 38.6% market share recorded in 2024 underlines the critical role of water treatment as a primary application segment and highlights its influence in shaping demand patterns across the liquid chlorine industry.

By End-Use Analysis

The chemical industry holds a 35.8% share in the liquid chlorine market utilization.

In 2024, Chemicals held a dominant market position in the By End-Use segment of the Liquid Chlorine Market, with a 35.8% share. This leadership is primarily attributed to the critical role of liquid chlorine as a foundational raw material in the production of a wide range of chemical compounds. Within the chemical industry, liquid chlorine is extensively used for synthesizing chlorinated intermediates, solvents, acids, and polymers that serve various downstream applications, including pharmaceuticals, agrochemicals, and plastics.

The segment’s 35.8% market share highlights the growing dependence of the chemical sector on liquid chlorine for maintaining consistent production cycles and meeting industrial output requirements. Due to its strong oxidative properties and reactivity, it remains an essential ingredient in processes requiring sterilization, bleaching, and molecular transformation. Chemical plants utilize large volumes of liquid chlorine, not only for product development but also for internal process water treatment and waste stream management, ensuring both operational safety and regulatory compliance.

As manufacturing demand continues to rise, the chemical end-use segment’s consumption of liquid chlorine remains steady. The significant share recorded in 2024 confirms the segment’s central role in sustaining and expanding industrial chemical activities, further reinforcing its position as a key consumer within the liquid chlorine market.

Key Market Segments

By Grade

- Industrial

- Food

- Water Treatment

- Other

By Application

- Water Treatment

- Bleaching

- Disinfection

- Deodorization

- Others

By End-Use

- Chemicals

- Plastics

- Pulp Paper

- Food Beverages

- Textiles

- Pharmaceuticals

- Others

Driving Factors

Growing Demand for Clean and Safe Water Supply

One of the main driving forces behind the growth of the liquid chlorine market is the increasing need for clean and safe water. Liquid chlorine is widely used by municipalities and water treatment plants to disinfect drinking water and remove harmful bacteria and viruses. As urban populations grow and public health standards become stricter, the demand for reliable water purification methods continues to rise.

Many developing countries are investing in water infrastructure, and chlorine remains one of the most cost-effective and efficient solutions. Additionally, the rising concerns over waterborne diseases are pushing governments to adopt stronger disinfection systems, boosting the demand for liquid chlorine in both municipal and industrial water treatment processes.

Restraining Factors

Health Hazards and Handling Safety Concerns Rising

A key restraining factor for the liquid chlorine market is the growing concern over its health and safety risks. Liquid chlorine is highly reactive and toxic, and improper handling can lead to serious accidents such as leaks, explosions, or harmful gas release. These incidents pose significant health risks to workers and nearby communities.

Strict regulations and safety protocols are required during its storage, transport, and application, which increases operational complexity and cost for industries. Additionally, environmental organizations and health agencies are raising awareness about safer alternatives. These concerns often slow down adoption in certain regions, especially where safety infrastructure is limited, thereby affecting the overall growth potential of the liquid chlorine market.

Growth Opportunity

Expansion into Emerging Economies’ Water Treatment Programs

An important growth opportunity for the liquid chlorine market lies in the expansion of water treatment initiatives in emerging economies. Rapid urbanization in countries across Asia, Africa, and Latin America is driving a surge in demand for clean water. Governments and international aid organizations are investing heavily in building or upgrading water treatment facilities.

Liquid chlorine, known for its cost-effectiveness and proven disinfectant properties, is often selected as the preferred chemical for large-scale water purification. As infrastructure development accelerates, the use of liquid chlorine will likely see a significant increase. Furthermore, international funding for public health and safe water projects creates room for increased adoption.

Latest Trends

Shift Toward Automated Dosing and Monitoring Systems

A key emerging trend in the liquid chlorine market is the adoption of automated dosing and monitoring systems. These smart systems precisely control chlorine injection into water treatment processes, ensuring consistent disinfection levels while minimizing chemical waste. The technology includes real-time sensors, digital controllers, and remote monitoring features that allow operators to adjust chlorine dosing based on water quality data and flow rates.

This increases operational efficiency, enhances safety, and reduces the risk of accidental over-chlorination. Utilities and industrial users are increasingly using these automated solutions to meet stricter regulatory requirements and improve treatment outcomes. As digital transformation continues within water management, the integration of automation and monitoring tools offers a clear path toward smarter, safer, and more sustainable use of liquid chlorine.

Regional Analysis

In 2024, North America accounted for 38.6 of % market share in liquid chlorine.

In 2024, North America emerged as the leading region in the global Liquid Chlorine Market, capturing a dominant market share of 38.6%, valued at USD 3.8 billion. The region’s strong position is primarily driven by widespread applications in water treatment facilities and consistent industrial demand, supported by stringent environmental regulations and established infrastructure.

North America’s focus on maintaining high public health standards through effective disinfection solutions has reinforced the role of liquid chlorine in municipal water systems and industrial wastewater treatment. Europe also contributes notably to the market, reflecting its steady consumption across industrial and chemical sectors, although no specific values are provided.

The Asia Pacific region is recognized for growing market activity due to ongoing urbanization and infrastructure development, yet exact figures remain unspecified. Meanwhile, the Middle East & Africa and Latin America show emerging demand, particularly in water treatment and sanitation projects aligned with improving public utilities.

However, North America stands out as the most dominant region, both in percentage and value, underlining its mature infrastructure, strong regulatory framework, and high per capita usage of chlorine-based solutions. This regional leadership positions North America as a core driver in shaping global liquid chlorine consumption trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Dow Chemical Company maintained its influential presence in the global Liquid Chlorine market through its strong chlor-alkali production infrastructure. The company’s extensive integration of chlorine production with its downstream products ensured both supply consistency and cost efficiency. With facilities strategically located in North America, Dow leveraged its scale to meet the rising regional demand, particularly in water treatment and chemical processing sectors.

Formosa Plastics Corporation remained a prominent player in the liquid chlorine segment, with its operations heavily concentrated in Asia and North America. The company’s chlorine production is closely tied to its vinyl chain, where chlorine serves as a critical feedstock. In 2024, Formosa strengthened operational resilience through technological upgrades and reinforced supply chains, ensuring a stable output to meet industrial needs.

Hanwha Chemical Corporation continued to exhibit strong market participation in 2024, driven by robust domestic demand in South Korea and expanding exports to Southeast Asia. The company focused on optimizing its chlor-alkali capacity and efficiency to support growing demand in electronics, textiles, and pharmaceuticals. Strategic alignment with energy-efficient technologies and regional partnerships allowed Hanwha to improve cost competitiveness and environmental compliance.

Top Key Players in the Market

- AkzoNobel N.V.

- Dow Chemical Company

- Formosa Plastics Corporation

- Hanwha Chemical Corporation

- INEOS Group

- JSR Corporation

- Kemira Oyj

- Occidental Petroleum

- Olin Corporation

- Reliance Industries Limited

- Solvay

- Tata Chemicals

- Westlake Chemical Corporation

Recent Developments

- In May 2025, Dow’s Freeport facility experienced a Level 3 chlorine release, prompting a precautionary “shelter-in-place” order for nearby communities (Clute and Lake Jackson). The leak was effectively stopped by site teams, all employees were accounted for, and exposed individuals received medical attention.

- In February 2024, INEOS Inovyn introduced an Ultra Low Carbon (ULC) chlor‑alkali product line, which includes liquid chlorine, caustic soda, and caustic potash. The carbon footprint for these offerings was reduced by up to 70% compared to industry averages. Production uses renewable energy sources—hydropower in Norway and offshore wind in Belgium—to support sustainability goals for Scope 3 emission reduction.

Report Scope

Report Features Description Market Value (2024) USD 10.0 Billion Forecast Revenue (2034) USD 13.4 Billion CAGR (2025-2034) 3.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial, Food, Water Treatment, Other), By Application (Water Treatment, Bleaching, Disinfection, Deodorization, Others), By End-Use (Chemicals, Plastics, Pulp Paper, Food Beverages, Textiles, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AkzoNobel N.V., Dow Chemical Company, Formosa Plastics Corporation, Hanwha Chemical Corporation, INEOS Group, JSR Corporation, Kemira Oyj, Occidental Petroleum, Olin Corporation, Reliance Industries Limited, Solvay, Tata Chemicals, Westlake Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AkzoNobel N.V.

- Dow Chemical Company

- Formosa Plastics Corporation

- Hanwha Chemical Corporation

- INEOS Group

- JSR Corporation

- Kemira Oyj

- Occidental Petroleum

- Olin Corporation

- Reliance Industries Limited

- Solvay

- Tata Chemicals

- Westlake Chemical Corporation