Global Lignosulfonates Market Size, Share, And Business Benefit By Product (Sodium Lignosulfonate, Calcium Lignosulfonate, Magnesium Lignosulfonate, Others), By Application (Concrete Additives, Oil Well Additives, Animal Feed Binders, Dust Control, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162214

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

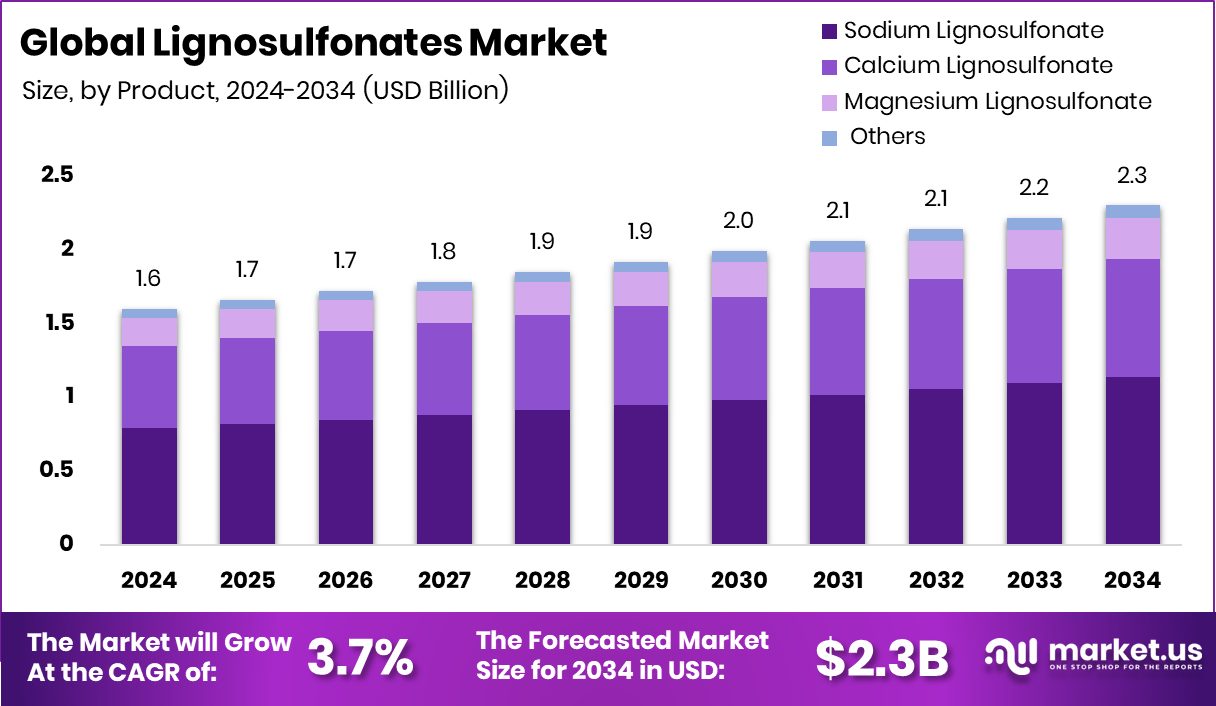

The Global Lignosulfonates Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034. Strong construction demand and eco-friendly policies continue to strengthen Europe’s 43.20% market leadership.

Lignosulfonates are water-soluble, sulfonated derivatives of lignin—the natural polymer that binds cellulose fibers in wood. They are produced primarily as a by-product of the sulfite pulping process in the paper and pulp industry, where lignin is cleaved and sulfonated to yield these anionic polyelectrolytes. They feature binder, dispersant, emulsifier, and chelating functionality, which has allowed them to find use across multiple industrial sectors.

One major growth factor arises from the increasing demand for sustainable and bio‐based materials. Because lignosulfonates derive from wood pulp processing (a renewable feedstock) and are biodegradable, they appeal in a circular economy and green materials context. Another growth driver is the robust expansion of construction and infrastructure activities globally; lignosulfonates are used as concrete plasticizers and dust suppressants in road work, thus when construction ramps up, demand follows. Finally, the diversification of applications also fuels growth—they are increasingly adopted in agriculture (soil amendments, seed coatings), animal feed, inks, and pigments, where their binding/dispersing properties are valued.

Driven by rapid urbanization and infrastructure development in emerging markets, demand for additives that improve the performance of building materials is strong; lignosulfonates help reduce water in concrete mixes and improve workability and strength, so construction growth feeds demand directly. Moreover, in agriculture, the push to improve soil health and utilize more sustainable amendments supports lignosulfonate uptake; their role in nutrient retention and soil structure enhancement makes them relevant.

There is opportunity in innovating new grades of lignosulfonates tailored for emerging uses—for example, in battery slurries, lithium-ion electrode dispersants, or as advanced chelating agents in soil remediation. Furthermore, as the global chemicals sector moves toward replacing petroleum-based polymers, lignosulfonates offer a bio-based alternative—this opens markets in coatings, composites, and advanced materials.

Combined with recent funding news in adjacent biomaterials and biotechnology (such as “Tender Food Evolves Into Lasso After $6.5 M Raise to Tackle UPFs with Fibre-Spun Proteins,” “Full Circle Biotechnology secures funding for 7,000-ton facility,” and “Canada funds $7.2 million microbial protein aquafeed project” as well as “Binder Park Zoo receives $4.6 K grant for giraffe health project”), the broader trend toward sustainable feedstocks and high-performance bio-based additives lends additional impetus for lignosulfonates to capture new use cases.

Key Takeaways

- The Global Lignosulfonates Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034.

- In 2024, Sodium Lignosulfonate dominated the Lignosulfonates Market with a 49.3% share, driven by construction applications.

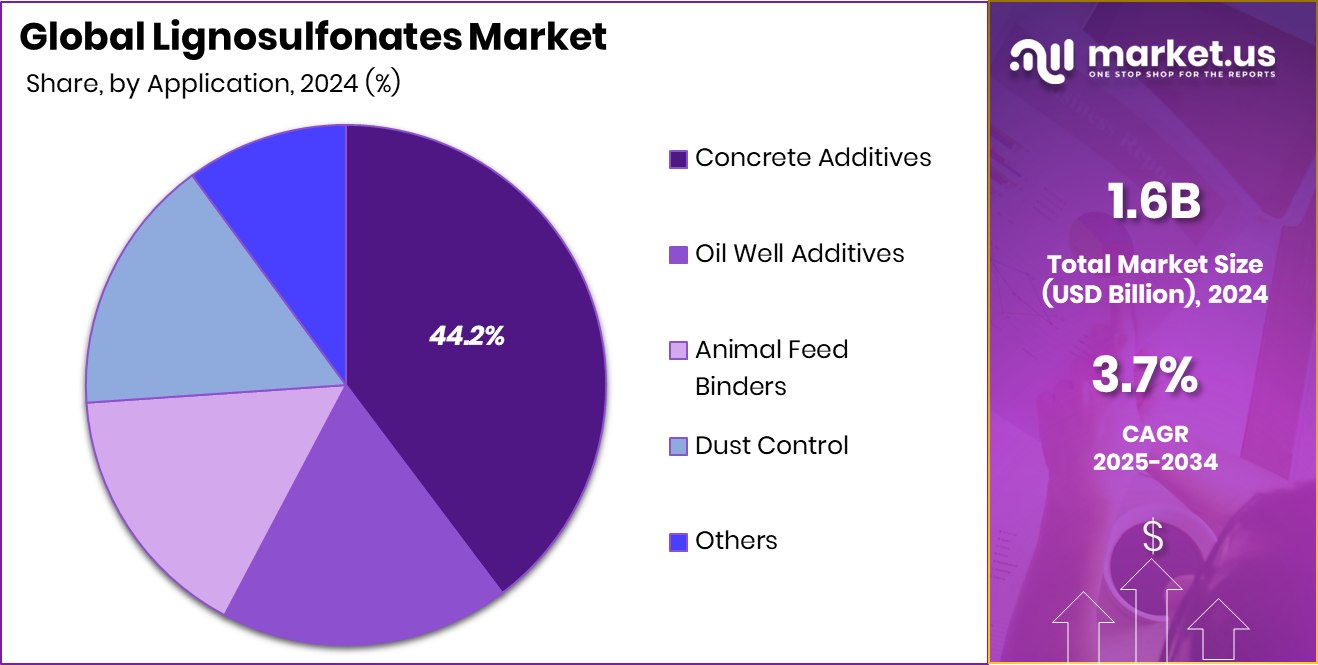

- Concrete Additives led the Lignosulfonates Market, holding a 44.2% share due to rising global infrastructure and urban development.

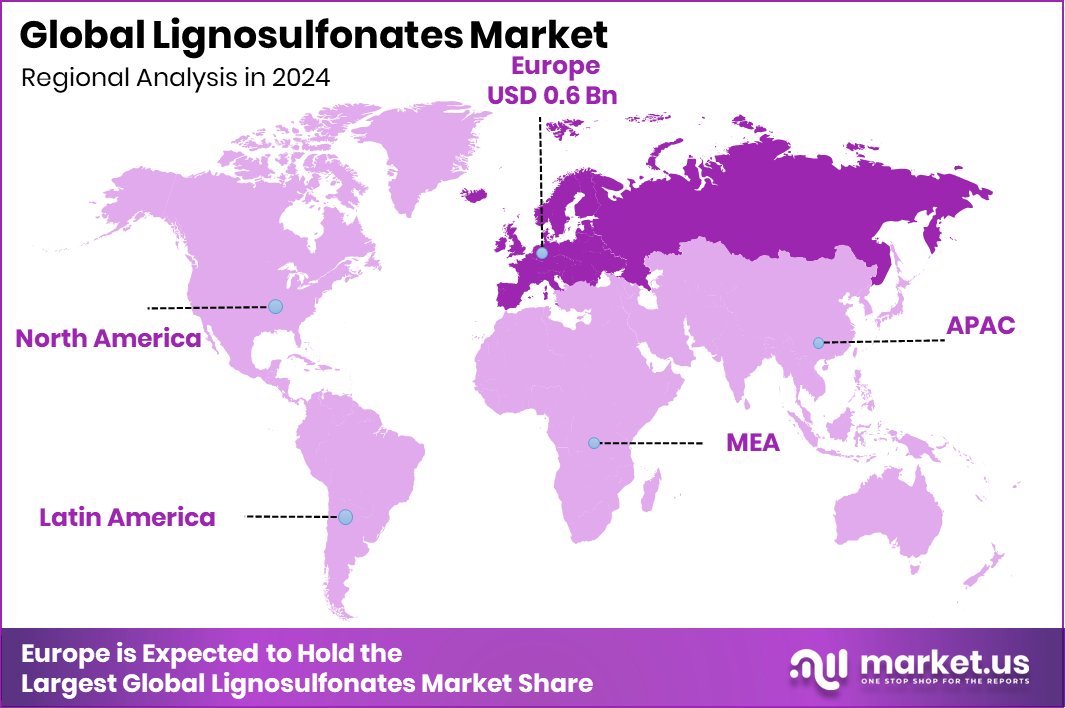

- The regional market in Europe reached a total valuation of USD 0.6 billion in 2024.

By Product Analysis

In 2024, sodium lignosulfonate held a 49.3% share in the lignosulfonate market.

In 2024, Sodium Lignosulfonate held a dominant market position in the By Product segment of the Lignosulfonates Market, with a 49.3% share. This dominance is attributed to its extensive use as a dispersing and binding agent across multiple industrial applications. Sodium lignosulfonate plays a vital role in the construction sector, primarily as a water-reducing agent in concrete mixtures, enhancing workability and strength.

It is also utilized in agriculture for improving soil conditioning and in animal feed as a natural binder. Its cost-effectiveness, water solubility, and biodegradability have made it the preferred variant among other lignosulfonate types. Continuous infrastructure development and the growing demand for eco-friendly additives are key factors supporting its substantial market presence in 2024.

By Application Analysis

The concrete additives segment dominated the lignosulfonates market with a 44.2% share globally in 2024.

In 2024, Concrete Additives held a dominant market position in the By Application segment of the Lignosulfonates Market, with a 44.2% share. This strong share is driven by the extensive use of lignosulfonates as effective water reducers and plasticizers in concrete mixtures. Their ability to improve workability, reduce water consumption, and enhance strength makes them highly valuable in modern construction. The ongoing expansion of infrastructure projects, residential complexes, and commercial buildings has further amplified the demand for lignosulfonate-based concrete additives.

Additionally, their eco-friendly and cost-efficient nature supports the shift toward sustainable building materials. The product’s proven performance in improving durability and flow properties continues to reinforce its dominance within the concrete additives segment.

Key Market Segments

By Product

- Sodium Lignosulfonate

- Calcium Lignosulfonate

- Magnesium Lignosulfonate

- Others

By Application

- Concrete Additives

- Oil Well Additives

- Animal Feed Binders

- Dust Control

- Others

Driving Factors

Rising Demand for Eco-Friendly Industrial Additives

One major driving factor for the lignosulfonates market is the growing global demand for eco-friendly and bio-based industrial additives. Lignosulfonates, derived from natural wood lignin, are increasingly preferred over synthetic chemicals due to their biodegradability and low environmental impact.

Industries such as construction, agriculture, and animal feed are adopting lignosulfonates to meet sustainability targets and reduce carbon footprints. Governments and manufacturers are also emphasizing green chemistry and renewable raw materials, further fueling adoption.

Additionally, innovation in bio-based solutions is gaining pace, reflected in funding such as the Israeli startup securing $8 million for its zero-waste, “butter-like” vegan fat technology, which highlights a global shift toward sustainable biomaterials—benefiting the wider lignosulfonates industry that aligns with these clean innovation trends.

Restraining Factors

Limited Purity and Performance Variability Challenge Growth

One major restraining factor for the Lignosulfonates Market is the inconsistent purity and performance levels of lignosulfonate products derived from different wood sources and production methods. These variations often affect quality parameters such as solubility, viscosity, and binding strength, limiting their suitability in high-performance applications like advanced polymers or specialty coatings. Industries requiring strict consistency often prefer synthetic alternatives, slowing lignosulfonate adoption in premium sectors.

Additionally, limited processing standardization and the cost of refining these bio-based additives further challenge scalability. However, global innovation in bioengineering offers promise—such as Geltor raising $93.1 million to expand its animal-free ingredients platform, signaling how advancements in biotechnology could inspire improvements in the uniformity and efficiency of lignosulfonate production in the future.

Growth Opportunity

Expanding Use in Bio-Based Industrial Applications

A key growth opportunity for the lignosulfonate market lies in their expanding use across bio-based and sustainable industrial applications. As industries transition toward renewable and circular solutions, lignosulfonates offer a natural, biodegradable alternative to petroleum-based additives.

They are increasingly being explored in advanced materials, bio-composites, coatings, and energy storage systems. Their strong binding, dispersing, and chelating properties make them suitable for innovative product formulations that align with green manufacturing goals.

Moreover, global investments in plant-derived and eco-friendly technologies are encouraging this trend. For instance, The Leaf Protein Co. secured $850K to unlock the highly nutritious Rubisco protein for food and beverage, reflecting a wider momentum toward bio-based innovations that also support lignosulfonate market expansion.

Latest Trends

Rising Focus on Circular and Sustainable Chemistry

One of the latest trends in the Lignosulfonates Market is the growing focus on circular and sustainable chemistry solutions. Industries are increasingly investing in renewable raw materials and low-carbon production to minimize environmental impact. Lignosulfonates, derived from wood-based sources, perfectly fit this trend as eco-friendly binders and dispersants for construction, agriculture, and industrial applications.

Companies are exploring ways to utilize waste lignin more efficiently, turning it into high-value lignosulfonate derivatives for bio-composites and energy materials. This aligns with the broader green innovation wave where start-ups and investors support sustainability transitions. For example, UK-based Carbon13 announced nearly £1 million investment in six startups through its accelerator, reinforcing global momentum toward carbon-neutral technologies that complement lignosulfonate-based advancements.

Regional Analysis

In 2024, Europe dominated the Lignosulfonates Market with 43.20% share, driving sustainability.

In 2024, the Lignosulfonates Market exhibited steady growth across major regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Europe dominated the global market with a 43.20% share, valued at USD 0.6 billion, driven by its strong emphasis on sustainable materials and well-established construction and agricultural industries. The region’s adoption of eco-friendly additives in concrete production and soil conditioning continues to support market expansion.

North America followed closely, supported by increased demand for lignosulfonates in industrial and agricultural applications. The Asia Pacific region is witnessing rapid growth due to infrastructure development and rising awareness of bio-based materials in emerging economies.

Meanwhile, the Middle East & Africa and Latin America are gradually expanding their use of lignosulfonates in construction and dust control applications, contributing to the market’s balanced regional presence.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Rayonier Advanced Materials, LignoStar, and Aditya Birla Chemicals played significant roles in shaping the global Lignosulfonates Market.

Rayonier Advanced Materials continued to strengthen its position through innovation in wood-based chemical solutions, leveraging its pulp and bio-refinery expertise to produce high-quality lignosulfonates used in concrete, agriculture, and industrial additives. The company’s focus on sustainability and circular production processes aligned well with global trends favoring renewable materials.

LignoStar, a specialist in lignosulfonate formulations, emphasized performance optimization through advanced dispersing and binding technologies, catering to growing needs in the construction and feed industries. Its tailored product solutions supported consistent client demand across Europe and North America.

Meanwhile, Aditya Birla Chemicals capitalized on its integrated chemical manufacturing strength to expand its lignosulfonate portfolio. The company’s wide distribution network and focus on bio-based industrial applications reinforced its presence in Asia and global export markets. Collectively, these companies underscored the market’s shift toward greener additives, performance consistency, and regional diversification, driving overall growth in 2024.

Top Key Players in the Market

- Rayonier Advanc

- LignoStar

- Aditya Birla Chemicals

- Nippon Paper Industries Co., Ltd.

- Borregaard AS

- GreenValue Technologies

- Stora Enso Oyj

- Others

Recent Developments

- In February 2025, Nippon Paper signed an agreement (with Sumitomo Corporation and Green Earth Institute Co., Ltd.) to establish a joint venture scheduled for March 2025 to produce bioethanol and biochemicals from woody biomass at its Iwanuma Mill in Miyagi Prefecture. The project emphasises converting lignin (a key component of woody biomass) into value-added chemicals.

- In January 2024, RYAM reported that part of its “Other sales” category in the High Purity Cellulose operating segment — which covers bio-based energy and lignosulfonates — totaled US $89 million. This reflected a decrease from US $98 million in 2023, due in part to the indefinite suspension of operations at its Temiscaming facility.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sodium Lignosulfonate, Calcium Lignosulfonate, Magnesium Lignosulfonate, Others), By Application (Concrete Additives, Oil Well Additives, Animal Feed Binders, Dust Control, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Rayonier Advanc, LignoStar, Aditya Birla Chemicals, Nippon Paper Industries Co., Ltd., Borregaard AS, GreenValue Technologies, Stora Enso Oyj, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rayonier Advanc

- LignoStar

- Aditya Birla Chemicals

- Nippon Paper Industries Co., Ltd.

- Borregaard AS

- GreenValue Technologies

- Stora Enso Oyj

- Others