Global Laser Projection Market Size, Share, Growth Analysis By Product Type (Laser Projector, CAD Laser Projection System), By Illumination Type (Laser Phosphor, Hybrid, RGB Laser, Laser Diode), By Resolution (HD, WXGA, 4K, Others), By Application (Media and Entertainment, Retail, Public Places, Enterprise, Healthcare, Education, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176114

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

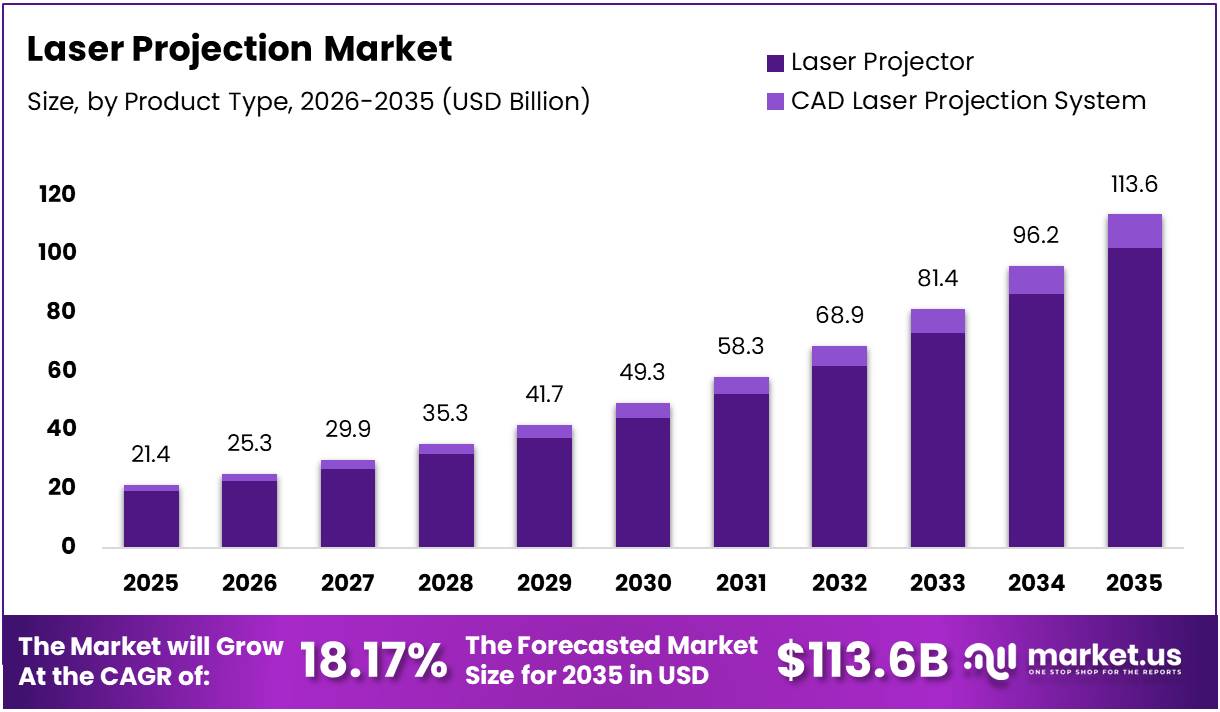

The Global Laser Projection Market size is expected to be worth around USD 113.6 Billion by 2035 from USD 21.40 Billion in 2025, growing at a CAGR of 18.17% during the forecast period 2026 to 2035.

The laser projection market encompasses advanced display technologies that utilize laser light sources to project images onto surfaces. These systems replace traditional lamp-based projectors with solid-state laser solutions, offering superior brightness, color accuracy, and operational longevity across diverse commercial and entertainment applications.

Laser projectors deliver exceptional performance through enhanced illumination capabilities and extended operational lifespans. Moreover, these systems provide maintenance-free operation for extended periods, reducing total cost of ownership. The technology enables vivid color reproduction and supports ultra-high-definition resolutions for premium viewing experiences.

Market growth accelerates through rapid digital transformation across corporate, educational, and entertainment sectors. Additionally, increasing demand for large-format displays drives adoption in public venues and enterprise environments. Technological advancements in miniaturization and cost reduction further expand accessibility for mid-market customers.

Government investments in smart infrastructure and digital education initiatives create substantial opportunities. Furthermore, regulatory frameworks supporting energy-efficient technologies favor laser projection adoption. Healthcare facilities increasingly deploy these systems for surgical visualization and medical training applications, expanding market reach.

The entertainment industry leads demand through cinema modernization and immersive experience venues. Consequently, museums, theme parks, and simulation centers invest heavily in laser projection capabilities. Corporate adoption grows as businesses embrace hybrid work models requiring advanced presentation technologies for collaboration.

According to Sharp Displays, laser projectors deliver typically more than 20,000 hours lifetime without a lamp replacement required. This exceptional durability reduces maintenance costs and operational downtime significantly. According to Screen Daily, about 13% of the approximately 200,000 cinema screens worldwide are equipped with laser projection systems.

According to Christie Digital, cinema laser projectors produce approximately 50% more lumens per watt than traditional xenon systems, significantly improving energy efficiency. Therefore, laser projectors reduced power consumption by up to approximately 49% compared to traditional lamp-based systems in educational environments, according to Times of India.

Key Takeaways

- Global Laser Projection Market projected to reach USD 113.6 Billion by 2035 from USD 21.40 Billion in 2025, at a CAGR of 18.17%

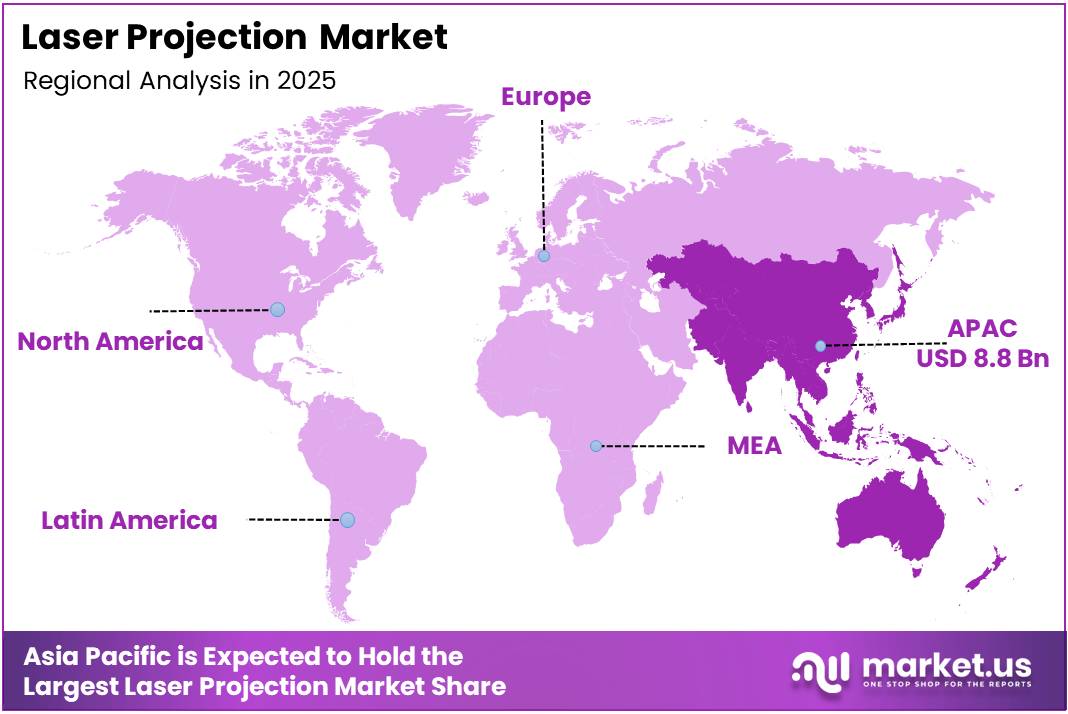

- Asia-Pacific dominates the market with 41.53% share, valued at USD 8.8 Billion in 2025

- Laser Projector segment leads By Product Type with 92.64% market share in 2025

- Laser Phosphor illumination type holds 65.28% market share in 2025

- HD Resolution segment dominates with 35.70% share in 2025

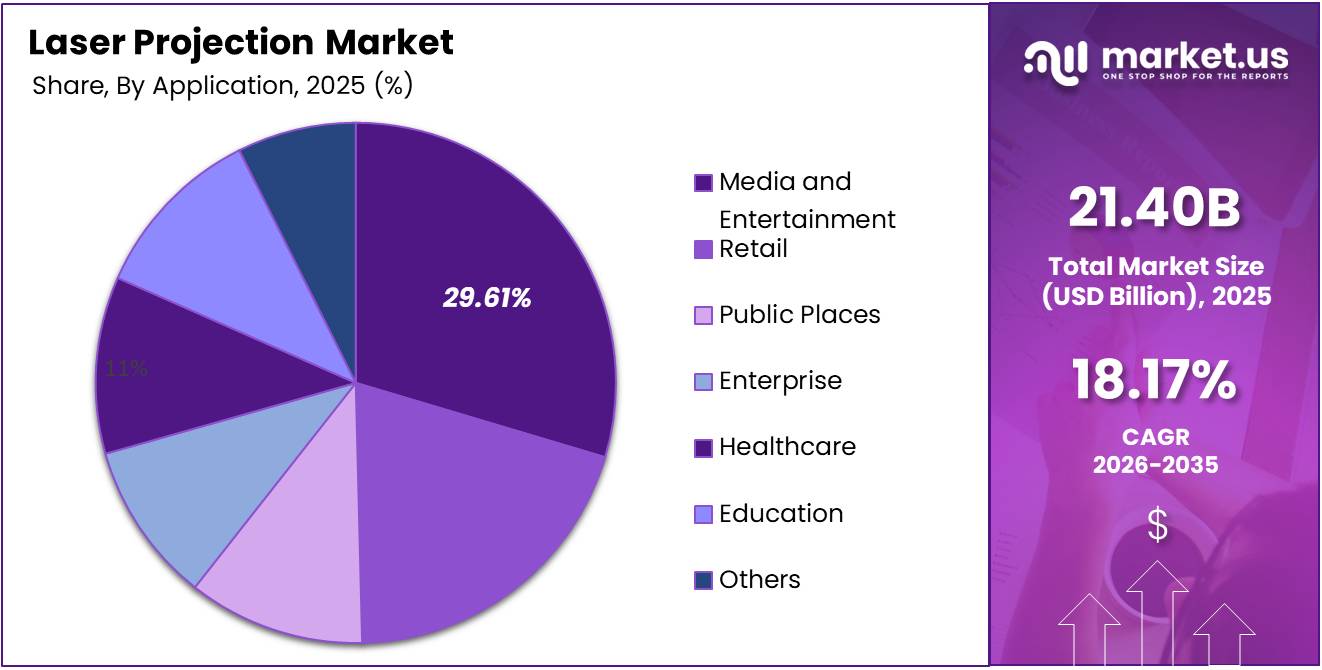

- Media and Entertainment application leads with 29.61% market share in 2025

- Laser projectors deliver over 20,000 hours operational lifetime without lamp replacement

- Approximately 13% of 200,000 global cinema screens utilize laser projection technology

Product Type Analysis

Laser Projector dominates with 92.64% due to superior performance and widespread commercial adoption.

In 2025, Laser Projector held a dominant market position in the By Product Type segment of Laser Projection Market, with a 92.64% share. These systems deliver exceptional brightness levels and color accuracy through solid-state laser technology. Moreover, they eliminate frequent lamp replacements, reducing maintenance costs significantly. Enterprise, education, and entertainment sectors drive adoption through requirements for reliable, high-performance display solutions.

CAD Laser Projection System serves specialized industrial and manufacturing applications requiring precision alignment and spatial accuracy. These systems project design templates directly onto physical surfaces for assembly guidance and quality control. Additionally, automotive and aerospace industries utilize this technology for complex component positioning. However, niche applications limit broader market penetration compared to conventional laser projectors.

Illumination Type Analysis

Laser Phosphor dominates with 65.28% due to cost-effectiveness and balanced performance characteristics.

In 2025, Laser Phosphor held a dominant market position in the By Illumination Type segment of Laser Projection Market, with a 65.28% share. This technology combines blue laser diodes with phosphor wheels to generate full-spectrum light output efficiently. Furthermore, it offers excellent color reproduction at lower cost points than pure RGB laser systems. Educational institutions and corporate environments prefer this solution for everyday presentation needs.

Hybrid illumination systems blend laser and LED technologies to optimize brightness and color performance across different operational scenarios. These configurations provide flexibility for varying ambient light conditions. Consequently, venues requiring adaptable display capabilities select hybrid solutions. However, complexity and cost considerations limit widespread adoption compared to single-technology approaches.

RGB Laser systems deliver the widest color gamut and highest brightness levels through separate red, green, and blue laser sources. Premium cinema installations and high-end entertainment venues demand this superior color accuracy. Additionally, professional visualization applications in design and medical imaging benefit from precise color reproduction. Nevertheless, higher acquisition costs restrict adoption to specialized premium segments.

Laser Diode technology provides compact, energy-efficient illumination for portable and small-format projectors. These systems enable miniaturization for mobile and consumer applications. Moreover, they consume significantly less power than traditional lamp-based alternatives. Growing demand for compact presentation devices drives steady adoption in business travel and education sectors.

Resolution Analysis

HD dominates with 35.70% due to widespread content availability and cost-effectiveness for mainstream applications.

In 2025, HD held a dominant market position in the By Resolution segment of Laser Projection Market, with a 35.70% share. High-definition resolution meets requirements for most corporate presentations, educational content, and general entertainment applications. Furthermore, HD projectors offer optimal price-performance ratios for mid-market customers. Extensive content ecosystem and compatibility ensure continued relevance despite emergence of higher resolutions.

WXGA resolution provides widescreen format suitable for business presentations and collaborative workspaces. This format matches native laptop and monitor aspect ratios perfectly. Consequently, corporate environments prefer WXGA for seamless content display without scaling artifacts. Additionally, competitive pricing positions these systems favorably for budget-conscious institutional buyers.

4K resolution delivers ultra-high-definition image quality demanded by premium cinema, simulation, and visualization applications. Professional design studios and medical imaging facilities require this exceptional detail level. Moreover, luxury home theater installations increasingly adopt 4K laser projection for immersive viewing experiences. However, higher costs and specialized content requirements limit mass-market penetration currently.

Others category encompasses specialized resolutions including 8K, WUXGA, and custom formats for niche applications. These systems serve specific professional requirements in research, defense, and advanced simulation environments. Additionally, emerging technologies and experimental formats fall within this classification. Limited production volumes and specialized nature restrict broader commercial availability.

Application Analysis

Media and Entertainment dominates with 29.61% due to cinema modernization and immersive experience venue expansion.

In 2025, Media and Entertainment held a dominant market position in the By Application segment of Laser Projection Market, with a 29.61% share. Cinema operators worldwide upgrade to laser projection for superior image quality and reduced operational costs. Additionally, theme parks and immersive attractions deploy large-format laser systems for engaging visitor experiences. Concert venues and live events utilize laser projection for dynamic visual displays and stage effects.

Retail environments leverage laser projection for digital signage, interactive displays, and promotional content presentation. Store designers create engaging customer experiences through projection mapping and dynamic visual merchandising. Furthermore, shopping centers deploy large-format projectors for advertising and wayfinding applications. Enhanced customer engagement and flexible content management drive steady adoption growth.

Public Places including transportation hubs, museums, and civic venues utilize laser projection for information display and artistic installations. Airports and train stations deploy these systems for wayfinding, advertising, and passenger information. Moreover, cultural institutions create immersive exhibitions through projection mapping technologies. Durability and low maintenance requirements suit high-traffic public environments perfectly.

Enterprise adoption grows through corporate boardrooms, training facilities, and collaborative workspaces requiring professional-grade presentation capabilities. Businesses invest in reliable, high-brightness systems for important client presentations and executive communications. Additionally, hybrid work environments demand flexible display solutions supporting remote collaboration. Consequently, enterprise segment demonstrates strong growth trajectory.

Healthcare facilities deploy laser projection for surgical visualization, medical training, and patient education applications. Operating rooms utilize high-resolution projectors for displaying diagnostic imaging during procedures. Furthermore, medical schools employ simulation systems incorporating laser projection for training purposes. Precise color reproduction and reliable performance meet stringent medical environment requirements.

Education sector represents substantial market opportunity through smart classroom implementations and distance learning infrastructure. Universities and K-12 institutions upgrade aging projection equipment with energy-efficient laser systems. Moreover, interactive projection technologies enhance student engagement and collaborative learning. Extended operational lifespans and reduced maintenance align with educational budget constraints.

Others category includes government, military, simulation, and specialized industrial applications requiring advanced projection capabilities. Defense organizations utilize laser projection for training simulators and command center displays. Additionally, industrial facilities deploy CAD projection systems for manufacturing guidance. Diverse specialized requirements drive continued innovation and segment growth.

Key Market Segments

By Product Type

- Laser Projector

- CAD Laser Projection System

By Illumination Type

- Laser Phosphor

- Hybrid

- RGB Laser

- Laser Diode

By Resolution

- HD

- WXGA

- 4K

- Others

By Application

- Media and Entertainment

- Retail

- Public Places

- Enterprise

- Healthcare

- Education

- Others

Drivers

Rapid Replacement of Lamp-Based Projectors with Solid-State Laser Systems Drives Market Expansion

Organizations across all sectors accelerate migration from traditional lamp-based projection to laser technology for superior performance and economics. Laser systems eliminate frequent lamp replacements that generate operational downtime and recurring maintenance expenses. Moreover, solid-state technology delivers consistent brightness throughout the operational lifecycle without gradual degradation. Enterprise and educational institutions realize total cost of ownership reductions through extended maintenance intervals.

Rising adoption of large-format displays in corporate and educational spaces creates substantial demand for high-brightness laser projection systems. Modern conference rooms and auditoriums require displays exceeding traditional projection capabilities for effective communication. Additionally, collaborative workspaces demand flexible display solutions supporting various content formats and room configurations. Consequently, businesses invest in premium laser projectors for professional presentation environments.

Growing demand for high-brightness projection in outdoor and public venues drives specialized laser projector development for challenging environments. Stadiums, outdoor events, and architectural projection mapping require exceptional brightness overcoming ambient light conditions. Furthermore, public installations demand weatherproof, reliable systems operating continuously without maintenance interventions. Therefore, laser technology addresses performance requirements unattainable with conventional projection solutions.

Restraints

Limited Technical Expertise for Installation and Long-Term Maintenance Restricts Market Penetration

Shortage of qualified technicians capable of installing and servicing advanced laser projection systems creates deployment barriers for potential customers. Complex optical alignment and calibration procedures require specialized training and equipment beyond traditional projector maintenance capabilities. Moreover, organizations in remote locations struggle accessing certified service providers for system support. Consequently, some customers hesitate adopting laser technology despite performance advantages.

Regulatory and safety compliance requirements for laser-based displays add complexity and cost to deployment projects across multiple jurisdictions. Different countries impose varying classifications and operational restrictions on laser light sources based on power output and wavelength characteristics. Additionally, venues must implement safety protocols including restricted access zones and emergency shutdown procedures. Therefore, compliance obligations increase implementation complexity for international installations.

High initial investment costs compared to traditional projection systems present budget constraints for price-sensitive customers and institutions. Although long-term operational savings offset higher acquisition prices, upfront capital requirements challenge organizations with limited technology budgets. Furthermore, economic uncertainty causes some potential buyers delaying major technology investments. Consequently, cost considerations slow adoption rates in developing markets and budget-constrained sectors.

Growth Factors

Expansion of Laser Projection in Simulation and Professional Training Environments Accelerates Market Growth

Military, aviation, and industrial sectors increasingly deploy laser projection systems for realistic training simulations requiring immersive visual environments. Flight simulators demand seamless dome projection with exceptional brightness and color accuracy for effective pilot training. Moreover, medical simulation facilities utilize high-resolution projection for surgical procedure training and emergency response scenarios. Consequently, specialized simulation applications drive premium product segment growth.

Increasing integration of laser projectors in smart classrooms and hybrid learning environments creates substantial educational market opportunities worldwide. Educational institutions modernize facilities supporting both in-person and remote student engagement through advanced display technologies. Additionally, interactive projection systems enable collaborative learning experiences enhancing student participation and knowledge retention. Therefore, education sector represents significant growth potential for laser projection manufacturers.

Rising demand from museums, theme parks, and immersive experience venues drives creative projection mapping and large-format display applications. Cultural institutions create engaging visitor experiences through projection-based exhibitions and interactive installations. Furthermore, entertainment venues compete for customer attention using spectacular visual displays and immersive environments. Consequently, experience economy growth fuels continued investment in premium laser projection capabilities.

Emerging Trends

Shift Toward Ultra-Short-Throw Laser Projection Systems Transforms Installation Flexibility

Ultra-short-throw laser projectors enable large-format displays in constrained spaces where traditional projection distances prove impractical. These systems mount directly adjacent to projection surfaces, eliminating shadow interference and ceiling mounting requirements. Moreover, compact installation footprints suit modern architectural designs with limited ceiling heights and flexible room configurations. Consequently, corporate and educational environments increasingly adopt ultra-short-throw solutions for versatile deployment options.

Growing adoption of 4K and higher-resolution laser projection responds to increasing content quality and viewer expectations across applications. Premium cinema installations universally transition to 4K laser projection for optimal image quality and competitive differentiation. Additionally, professional visualization applications in architecture, design, and medical imaging demand ultra-high-definition capabilities. Therefore, resolution progression drives product development and market segmentation strategies.

Integration of laser projection with interactive and immersive technologies creates entirely new application categories and user experiences. Touch-sensitive projection surfaces transform walls and tables into collaborative workspaces supporting multiple simultaneous users. Furthermore, projection mapping combines with spatial tracking for augmented reality experiences in retail and entertainment venues. Consequently, convergence with complementary technologies expands total addressable market beyond traditional projection applications.

Regional Analysis

Asia-Pacific Dominates the Laser Projection Market with a Market Share of 41.53%, Valued at USD 8.8 Billion

Asia-Pacific leads global laser projection adoption through rapid infrastructure development, expanding entertainment sectors, and substantial educational investments. China, Japan, and South Korea drive regional demand through cinema modernization programs and smart city initiatives. Moreover, manufacturing economies benefit from CAD projection systems supporting advanced production processes. The region’s 41.53% market share valued at USD 8.8 Billion reflects strong economic growth and technology adoption rates.

North America Laser Projection Market Trends

North America maintains strong market position through premium cinema installations, corporate technology investments, and advanced healthcare facilities. United States and Canada lead regional adoption in enterprise applications and educational institutions upgrading aging projection infrastructure. Additionally, entertainment industry concentration in major metropolitan areas drives high-end projection system deployments. Furthermore, regulatory support for energy-efficient technologies favors laser projection adoption.

Europe Laser Projection Market Trends

Europe demonstrates steady growth through cultural institution investments, corporate modernization projects, and sustainability initiatives favoring energy-efficient technologies. Germany, UK, and France lead regional markets through strong manufacturing sectors and established entertainment industries. Moreover, museums and heritage sites extensively utilize projection mapping for visitor engagement. Additionally, strict energy regulations accelerate replacement of traditional lamp-based systems.

Latin America Laser Projection Market Trends

Latin America shows emerging growth potential through cinema expansion, educational infrastructure development, and retail modernization in major markets. Brazil and Mexico lead regional adoption through growing middle-class populations and increasing entertainment consumption. However, economic volatility and budget constraints moderate adoption rates compared to developed regions. Nevertheless, long-term growth prospects remain positive through urbanization and digital transformation trends.

Middle East & Africa Laser Projection Market Trends

Middle East & Africa demonstrates selective growth concentrated in affluent markets investing heavily in tourism, entertainment, and smart infrastructure projects. GCC countries lead regional adoption through luxury hospitality developments and world-class entertainment venues. Additionally, South Africa shows growing corporate and educational sector interest. However, economic diversity and infrastructure limitations create uneven adoption patterns across the broader region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Panasonic maintains strong market presence through comprehensive product portfolios spanning cinema, corporate, and education segments with proven reliability and performance. The company leverages extensive distribution networks and established brand reputation for professional display solutions. Moreover, Panasonic invests heavily in laser technology development addressing diverse application requirements. Consequently, the manufacturer holds significant market share across multiple geographic regions and vertical markets.

Sony leads premium projection segment through cutting-edge 4K laser cinema projectors and professional visualization systems. The company’s SXRD technology delivers exceptional contrast ratios and color accuracy for demanding applications. Additionally, Sony’s entertainment industry relationships facilitate rapid adoption in theatrical exhibition and broadcast environments. Furthermore, continuous innovation in compact laser projector designs expands addressable market opportunities.

Epson dominates education and corporate segments through cost-effective 3LCD laser projectors offering excellent brightness and color reproduction. The company’s extensive product lineup addresses diverse customer requirements from portable presentations to large-venue installations. Moreover, Epson’s global service infrastructure ensures reliable support for institutional customers. Consequently, the manufacturer captures substantial market share in volume-driven segments.

Barco specializes in premium cinema, simulation, and control room applications requiring exceptional image quality and operational reliability. The company’s laser phosphor technology delivers superior performance for mission-critical visualization environments. Additionally, Barco’s engineering expertise in large-format display systems attracts high-end commercial customers. Furthermore, specialized vertical market focus enables premium pricing and strong margins.

Key players

- Panasonic

- Sony

- Epson

- Barco

- NEC Display Solutions

- Benq

- Casio

- Delta Electronics

- Optoma

- Ricoh Company

- Canon

- Christie Digital Systems

- Digital Projection

- Dell

- Faro

- Hitachi Digital

- Lap GmbH

- Viewsonic

- Others

Recent Developments

- January 2026 – SF Cinema acquires CineLife+ RGB and RBe projectors, expanding its laser projection capabilities for premium theatrical exhibition. This strategic acquisition enhances SF Cinema’s product portfolio with advanced RGB laser technology delivering superior color gamut and brightness performance.

- September 2025 – Tescan acquires FemtoInnovations and launches Laser Technology Business Unit, strengthening its position in precision laser applications. The new business unit combines femtosecond laser expertise with Tescan’s microscopy capabilities for advanced materials processing and scientific research applications.

- July 2025 – AMETEK completes acquisition of FARO Technologies, strengthening leadership in 3D metrology, laser projection and digital reality solutions. This strategic combination creates comprehensive portfolio serving industrial manufacturing, construction, and public safety markets with integrated measurement and visualization technologies.

Report Scope

Report Features Description Market Value (2025) USD 21.40 Billion Forecast Revenue (2035) USD 113.6 Billion CAGR (2026-2035) 18.17% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Laser Projector, CAD Laser Projection System), By Illumination Type (Laser Phosphor, Hybrid, RGB Laser, Laser Diode), By Resolution (HD, WXGA, 4K, Others), By Application (Media and Entertainment, Retail, Public Places, Enterprise, Healthcare, Education, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Panasonic, Sony, Epson, Barco, NEC Display Solutions, Benq, Casio, Delta Electronics, Optoma, Ricoh Company, Canon, Christie Digital Systems, Digital Projection, Dell, Faro, Hitachi Digital, Lap GmbH, Viewsonic, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Panasonic

- Sony

- Epson

- Barco

- NEC Display Solutions

- Benq

- Casio

- Delta Electronics

- Optoma

- Ricoh Company

- Canon

- Christie Digital Systems

- Digital Projection

- Dell

- Faro

- Hitachi Digital

- Lap GmbH

- Viewsonic

- Others