Global Lactose Powder Market Size, Share, And Business Benefits By Form (Powder, Granule), By Purity (Upto 99%, Above 99%), By Derivative Type (Lactose Monohydrate, Galactose, Lactulose, Tagatose, Others), By End Use (Food and Beverage, Pharmaceutical, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154287

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

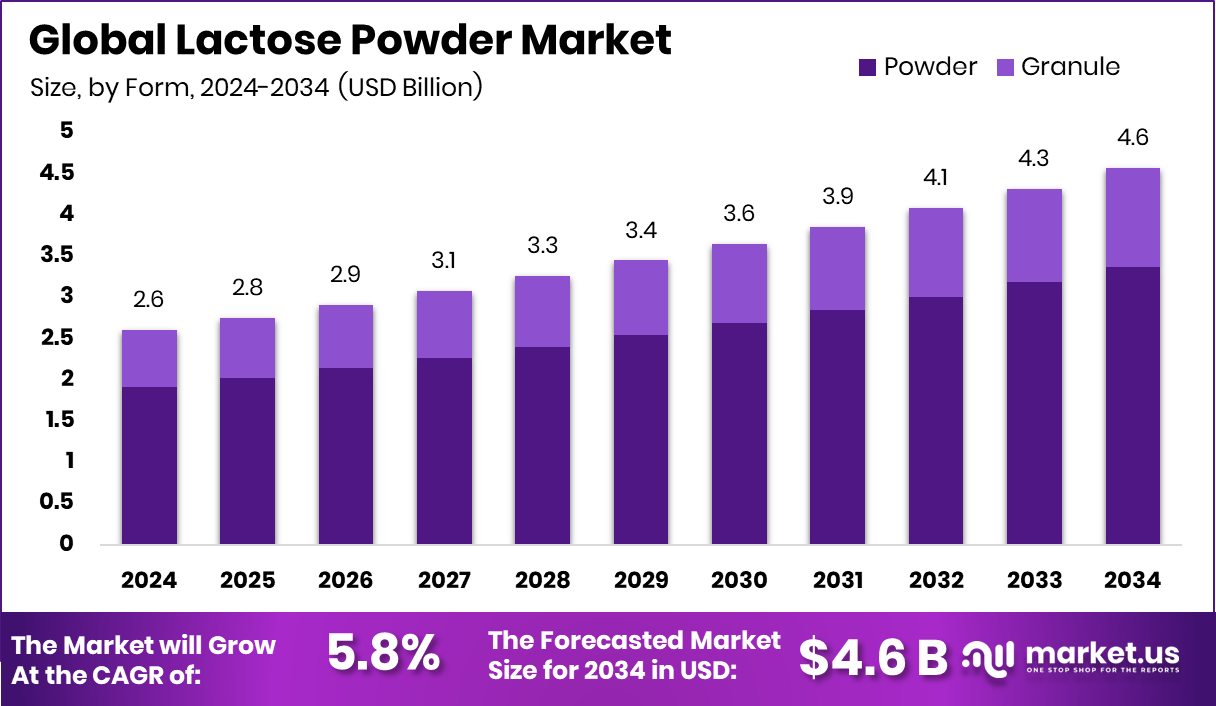

The Global Lactose Powder Market is expected to be worth around USD 4.6 billion by 2034, up from USD 2.6 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. In 2024, North America dominated with 32.9% due to stable lactose applications.

Lactose powder is a natural milk sugar derived from whey during the dairy processing process. It is a white to off-white, crystalline, and mildly sweet powder that contains a high percentage of carbohydrates, primarily lactose. This powder is widely used in food, beverages, pharmaceuticals, and infant nutrition due to its excellent solubility and low sweetness, which makes it suitable as a filler, stabilizer, or carrier in various formulations.

The lactose powder market refers to the global trade and usage of lactose-based dry powder across food, pharma, and nutritional sectors. It encompasses the production, processing, and distribution of lactose powder for various applications. The market is driven by rising demand from the infant formula industry, pharmaceutical excipients, and food manufacturing, especially in regions with strong dairy production capacities.

The segment is further shaped by innovations in alternative proteins and dairy-free solutions. For instance, Zero Cow Factory, a producer of animal-free protein, secured $4 million in funding, while Remilk, an Israeli food tech company, raised $120 million to advance cow-free milk innovations.

The market is supported by steady growth in the dairy industry and increasing use of lactose powder in processed food and pharmaceuticals. Rising health awareness and preference for clean-label ingredients have encouraged the use of lactose as a natural, non-GMO ingredient.

The rise of sustainable food technology is also contributing to the market dynamics, with companies like Enifer, a Finnish startup, receiving a $13.2 million grant to establish a mycoprotein production facility, and Perfect Day, a pioneer in animal-free dairy, raising up to $90 million and appointing a new executive team to enhance profitability efforts.

Key Takeaways

- The Global Lactose Powder Market is expected to be worth around USD 4.6 billion by 2034, up from USD 2.6 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In 2024, powder form dominated the Lactose Powder Market with a 73.7% share globally.

- Lactose Powder with up to 99% purity accounted for 53.1% of the total market demand.

- Lactose Monohydrate held the lead in the derivative segment, capturing a 44.1% market share.

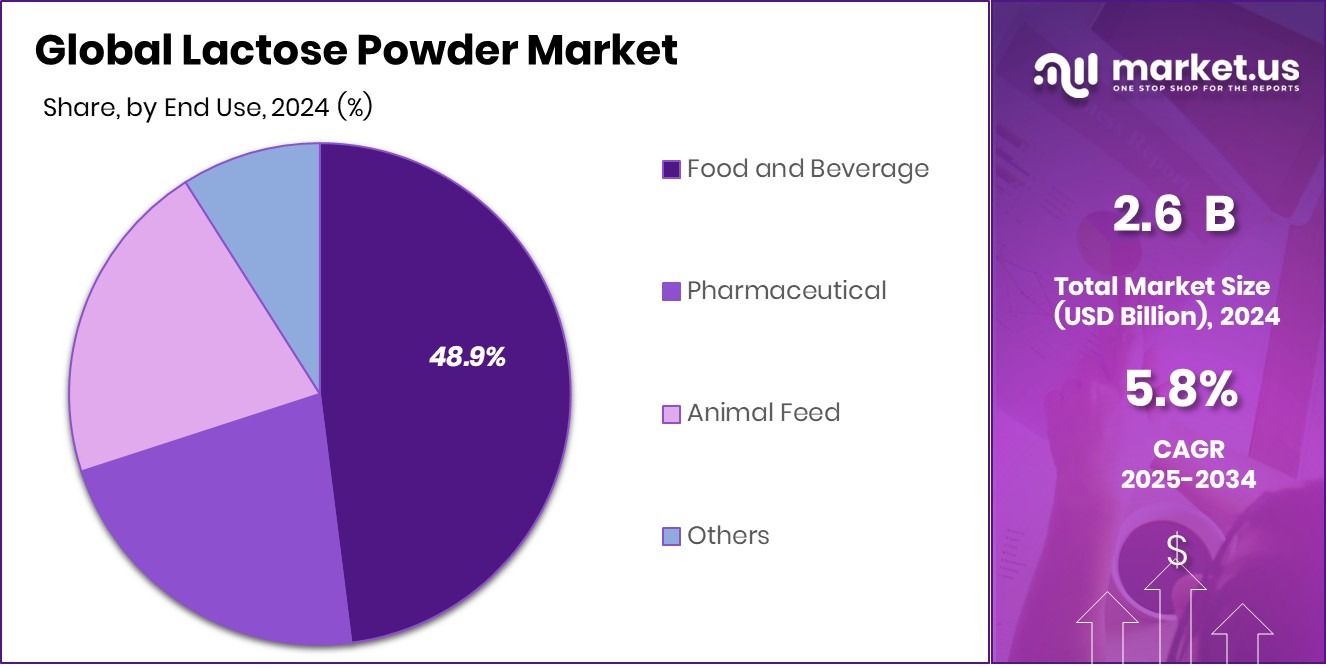

- The food and beverage industry remained the top consumer of lactose powder, contributing 48.9% market share.

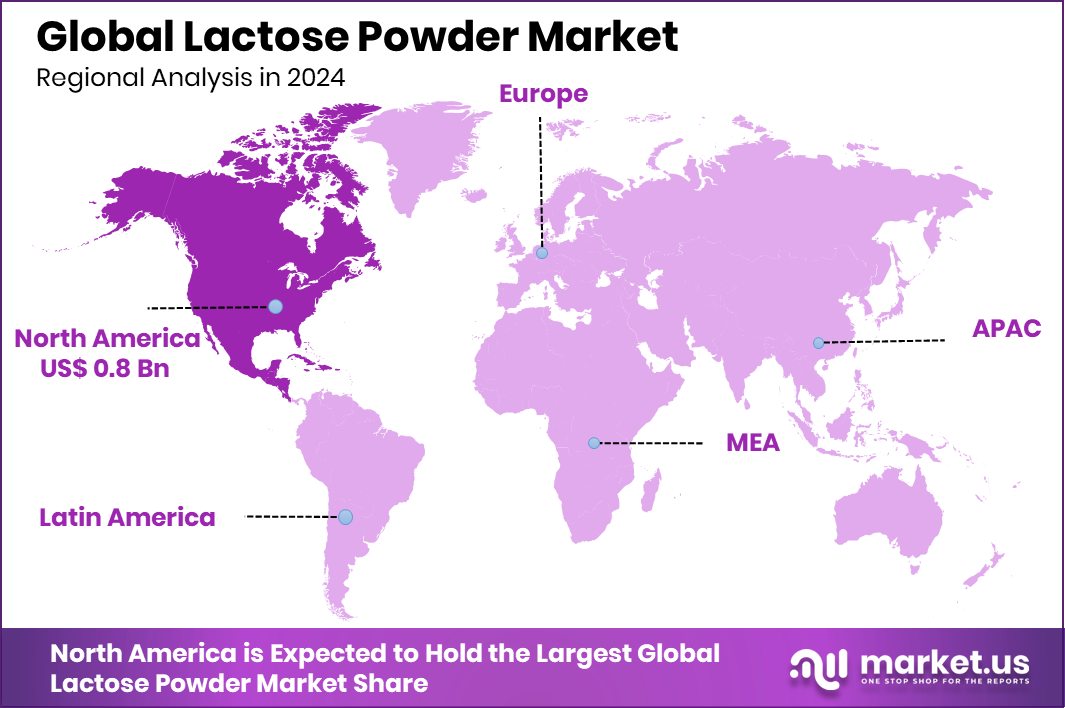

- Strong dairy processing and infant nutrition demand drove North America’s USD 0.8 billion market.

By Form Analysis

Powder form leads the Lactose Powder Market with 73.7% share dominance.

In 2024, Powder held a dominant market position in the By Form segment of the Lactose Powder Market, with a 73.7% share. This dominance can be attributed to its wide applicability across the food, pharmaceutical, and infant nutrition industries. Powder form offers excellent solubility, a long shelf life, and ease of handling and transportation, making it the preferred choice among manufacturers.

Its stable physical properties allow for consistent formulation in dry blends, tablets, and baby formula. Additionally, the powder format enables precise dosing and uniform dispersion in various applications, which is critical in pharmaceutical and food-grade usage.

The preference for powder form is further reinforced by its compatibility with automated processing systems in large-scale manufacturing environments. Food processors value its neutral taste and low hygroscopic nature, making it ideal for use in baked goods, dairy products, and dry mixes. In pharmaceuticals, the fine and free-flowing texture of lactose powder enhances compressibility in tablet production.

The consistent demand for dry ingredients in global supply chains also supports the prominence of powder in this market segment. Overall, the powder form continues to be the backbone of lactose-based applications, holding the largest market share due to its practicality, versatility, and process efficiency.

By Purity Analysis

Upto 99% purity holds 53.1% in lactose powder applications.

In 2024, up to 99% held a dominant market position in the By Purity segment of the Lactose Powder Market, with a 53.1% share. This segment’s leadership is primarily driven by its suitability across diverse end-use industries, where high purity is essential but not necessarily absolute. Lactose powder with up to 99% purity offers a reliable balance between quality and cost-efficiency, making it ideal for use in food, beverage, and pharmaceutical applications where ultra-high purity is not mandatory.

The widespread use of up to 99% purity lactose powder can be linked to its consistent performance in applications such as infant formula, bakery goods, and medicinal tablets. Its chemical stability, safety profile, and ease of blending with other ingredients allow manufacturers to meet regulatory and quality standards without incurring the higher processing costs associated with ultra-pure lactose grades. Furthermore, its ability to maintain functionality across a range of processing conditions supports its continued preference among industrial users.

This segment also benefits from strong demand in bulk ingredient supply chains, where dependable quality and high-volume production are key. The dominance of Upto 99% purity reflects its well-established role in delivering performance, versatility, and commercial viability across global lactose powder markets.

By Derivative Type Analysis

Lactose Monohydrate captures 44.1% share among derivative types.

In 2024, Lactose Monohydrate held a dominant market position in the By Derivative Type segment of the Lactose Powder Market, with a 44.1% share. This dominance is largely attributed to its widespread application in the pharmaceutical and food industries, where it is commonly used as a diluent, stabilizer, and bulking agent. Lactose Monohydrate is favored for its excellent flowability, compressibility, and chemical stability, making it ideal for use in tablet formulations and dry powder blends.

Its high compatibility with active pharmaceutical ingredients (APIs) and consistent performance under varied processing conditions have reinforced its position in pharmaceutical manufacturing. In the food industry, its mild sweetness, good solubility, and neutral flavor support its role in infant nutrition, bakery products, and functional foods. The monohydrate form also offers extended shelf life and moisture control, which is beneficial for maintaining product integrity in storage and transport.

Manufacturers prefer Lactose Monohydrate for its ease of handling in both manual and automated systems, contributing to efficiency in production lines. Its dominance in the market reflects its well-established functionality, regulatory acceptance, and suitability across a broad range of industrial applications, ensuring continued demand across global markets.

By End Use Analysis

The food and Beverage sector drives 48.9% of lactose powder demand.

In 2024, Food and Beverage held a dominant market position in the By End Use segment of the Lactose Powder Market, with a 48.9% share. This leading position is primarily driven by the extensive use of lactose powder in processed foods, dairy-based products, confectionery, and baked goods. Its mild sweetness, excellent solubility, and ability to enhance texture make it a preferred ingredient for food manufacturers seeking to improve product consistency and flavor while maintaining clean-label appeal.

Lactose powder also serves as a functional carbohydrate source in a wide range of dairy formulations such as yogurts, milk powders, and desserts. In baked products, it promotes browning and enhances the crust and flavor without overpowering sweetness. Additionally, its role as a carrier for flavors and seasonings has expanded its use in dry seasoning blends and instant food mixes.

The food and beverage industry continues to rely on lactose powder for its processing advantages, cost-effectiveness, and nutritional contributions. Its compatibility with high-volume production and broad application versatility supports consistent demand across various segments. The strong 48.9% market share reflects its essential role in modern food processing, driven by consumer preference for familiar, natural ingredients and the growing scale of global food manufacturing.

Key Market Segments

By Form

- Powder

- Granule

By Purity

- Upto 99%

- Above 99%

By Derivative Type

- Lactose Monohydrate

- Galactose

- Lactulose

- Tagatose

- Others

By End Use

- Food and Beverage

- Pharmaceutical

- Animal Feed

- Others

Driving Factors

Growing Infant Nutrition Demand Boosts Lactose Powder Use

One of the key driving factors for the lactose powder market is the rising global demand for infant nutrition products. Lactose is the primary carbohydrate found in human breast milk, and its presence in baby formula helps replicate the natural nutritional profile required for infant development. As more parents opt for infant formula due to changing lifestyles, urbanization, and increased female workforce participation, the need for lactose powder continues to grow.

Additionally, lactose is easily digestible for babies and plays a vital role in calcium absorption and energy supply. The steady rise in birth rates in developing countries and growing awareness about infant health are contributing to the continued expansion of lactose powder in this segment.

Restraining Factors

Lactose Intolerance Limits Consumer Acceptance and Use

A major restraining factor for the lactose powder market is the widespread prevalence of lactose intolerance. Many people, especially in regions such as Asia, Africa, and South America, lack the enzyme lactase needed to properly digest lactose. As a result, consumption of lactose-containing products can lead to discomfort, bloating, or digestive issues. This condition affects both adults and children, limiting the demand for lactose-based foods and beverages.

In response, food companies are increasingly offering lactose-free alternatives, which further reduces the usage of lactose powder in certain product lines. As awareness about digestive health grows, consumers are more likely to avoid lactose altogether, presenting a challenge for market growth in lactose-dependent industries.

Growth Opportunity

Expansion in Developing Markets Offers Major Opportunity

The lactose powder market presents a significant growth opportunity through expansion into developing countries. As economic conditions improve in regions like Southeast Asia, Africa, and Latin America, per capita income is increasing and consumer lifestyles are shifting. This shift is accompanied by greater demand for processed foods, fortified dairy products, and infant nutrition solutions—all of which rely on lactose powder as a key ingredient.

Urbanization and changes in dietary habits are driving households toward convenience foods, flavored beverages, and nutritional supplements. In turn, manufacturers seek reliable, cost-effective carbohydrate sources like lactose powder to meet these evolving needs. Additionally, local dairy production is on the rise in many emerging nations, creating opportunities for regional supply chains to incorporate lactose powder more efficiently.

Strategic entry into these markets, coupled with partnerships and product adaptation for regional tastes, can unlock latent demand. The growing middle class and expanding retail infrastructure offer a fertile environment for lactose powder companies to introduce and scale their products. This broader market reach can contribute meaningfully to overall industry growth.

Latest Trends

Clean‑Label Movement Spurs Demand for Natural Ingredients

A growing trend in the lactose powder market is the clean‑label movement, where consumers show a strong preference for products made from simple, recognizable, and natural ingredients. Lactose powder is being highlighted for its origin from milk whey and its minimal processing, which fits clean‑label criteria. In food and beverage manufacturing, lactose powder is increasingly used as a natural sweetener, texture enhancer, and bulking agent with no artificial additives. Brands are leveraging this trend to position their products as transparent and health‑focused.

This trend is driving formulators to choose lactose powder over synthetic sugars and fillers, particularly in health‑oriented snack bars, dairy products, and beverage mixes. Consumers are reading ingredient labels more carefully and favoring items with minimal, familiar components. As clean‑label demand strengthens globally, lactose powder is benefiting from its image as a naturally derived, simple carbohydrate source.

Regional Analysis

North America led the lactose powder market with a 32.9% share, reaching USD 0.8 billion.

In 2024, North America held the dominant position in the global Lactose Powder Market, accounting for 32.9% of the total market share and generating USD 0.8 billion in revenue. This leadership can be attributed to the region’s strong dairy processing infrastructure, rising demand for infant formula, and widespread use of lactose in pharmaceuticals and functional foods. The United States, in particular, supports steady lactose consumption due to its advanced food manufacturing capabilities and high awareness of nutritional supplementation.

In Europe, the market remained stable with consistent lactose demand in bakery, dairy, and pharmaceutical applications, supported by established dairy sectors in countries such as Germany and France. Asia Pacific showed steady lactose powder usage, especially in developing economies where processed food and infant nutrition categories are expanding.

While demand in the Middle East & Africa is relatively moderate, there is growing interest in lactose-based formulations driven by changing dietary habits. Latin America continues to adopt lactose powder primarily in food production and dairy enhancement, supported by regional supply chains.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Glanbia plc emerged as a central player in the lactose powder market, supported by its robust global dairy‑derived ingredients portfolio and continued financial strength. The company reported revenues of approximately USD 3.8 billion with adjusted EPS growth of 6.8% and a dividend increase of 10%.

Kerry Group plc leveraged its deep-rooted expertise in taste and nutrition to expand its lactose powder business. The company differentiated itself through product innovation and close collaboration with food brand customers. Its strength in blending lactose powder with other functional ingredients for optimized texture and mouthfeel improvements positioned it well in premium processed-food formulations.

Leprino Foods Company emerged as a key producer with a strong presence in value-added dairy ingredients. With a strong focus on pharmaceutical-grade lactose powder, Leprino capitalized on stringent quality control and regulatory compliance. Its operational infrastructure supported high-purity manufacturing, reinforcing credibility in tablet excipient markets.

German-based Meggle Group GmbH & Co. KG maintained a robust footprint by combining traditional dairy heritage with modern lactose processing. Its lactose powder offerings were consistently used in European markets for infant formula and bakery goods. Meggle’s strengths included product consistency and technical support services for industrial customers.

Milei GmbH focused on niche applications and customization, offering derivative-based lactose variants such as monohydrate and spray-dried forms. The company prioritized flexibility in batch sizes and formulation support, giving it appeal among specialty food manufacturers and smaller pharma contract developers.

Lactalisingredients, a company with an explicit focus on lactose-based ingredient innovation, emphasized research into lactose solubility and functionality. By refining particle size, hygroscopicity, and solubility characteristics, the company offered products tailored to specific process requirements. This approach drove adoption in sectors requiring high-performance characteristics, such as instant beverage mixes and high-concentration nutritional blends.

Top Key Players in the Market

- Novonesis Group

- Glanbia plc

- Hilmar Ingredients

- Kerry Group plc

- Leprino Foods Company

- Meggle Group GmbH & Co. KG

- Milei GmbH

- lactalisingredients

- Actus Nutrition

- Novozymes A/S

Recent Developments

- In February 2025, Glanbia plc reorganized its Nutritionals division into three focused segments: Performance Nutrition, Health & Nutrition, and Dairy Nutrition. The new Dairy Nutrition arm is expected to encompass lactose-based products, enabling greater clarity and focused investment in dairy-derived ingredient lines.

- In January 2024, Hilmar rolled out HilmarConnect® Global, a digital trading platform offering real‑time access to cheese product availability and pricing. Although focused on cheese, the platform supports global customers and contributes to transparency across the full dairy ingredients business, including lactose powder operations.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 4.6 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Granule), By Purity (Upto 99%, Above 99%), By Derivative Type (Lactose Monohydrate, Galactose, Lactulose, Tagatose, Others), By End Use (Food and Beverage, Pharmaceutical, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Novonesis Group, Glanbia plc, Hilmar Ingredients, Kerry Group plc, Leprino Foods Company, Meggle Group GmbH & Co. KG, Milei GmbH, lactalisingredients, Actus Nutrition , Novozymes A/S Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novonesis Group

- Glanbia plc

- Hilmar Ingredients

- Kerry Group plc

- Leprino Foods Company

- Meggle Group GmbH & Co. KG

- Milei GmbH

- lactalisingredients

- Actus Nutrition

- Novozymes A/S