Global Kennel Management Software Market Size, Share and Growth Report By Deployment Mode (Cloud-based, On-premises), By Application (Boarding & Daycare Management, Grooming & Training Scheduling, Veterinary & Medical Records, Breeding & Litter Management, Others), By End-User (Commercial Kennels & Boarding Facilities, Veterinary Clinics with Boarding, Animal Shelters & Rescue Organizations, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171486

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- AI-Led Growth Outlook

- Value Chain Overview

- U.S. Market Size

- Deployment Mode Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

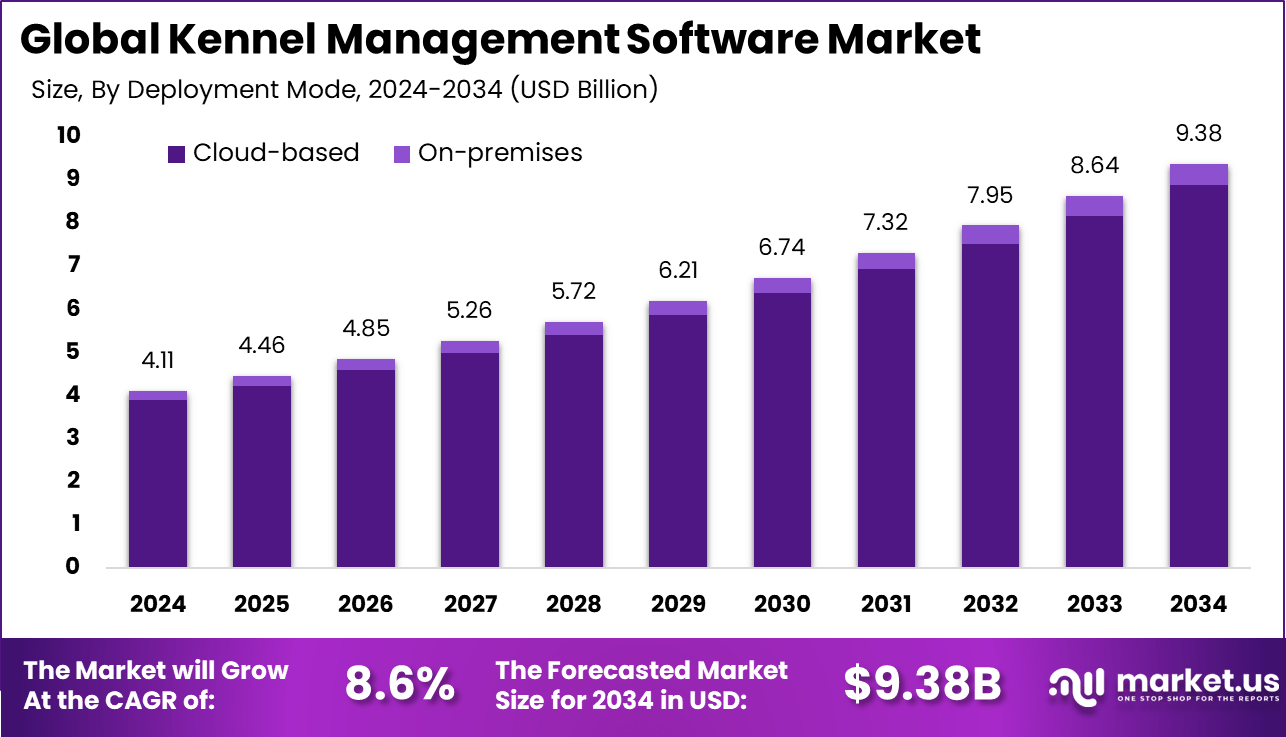

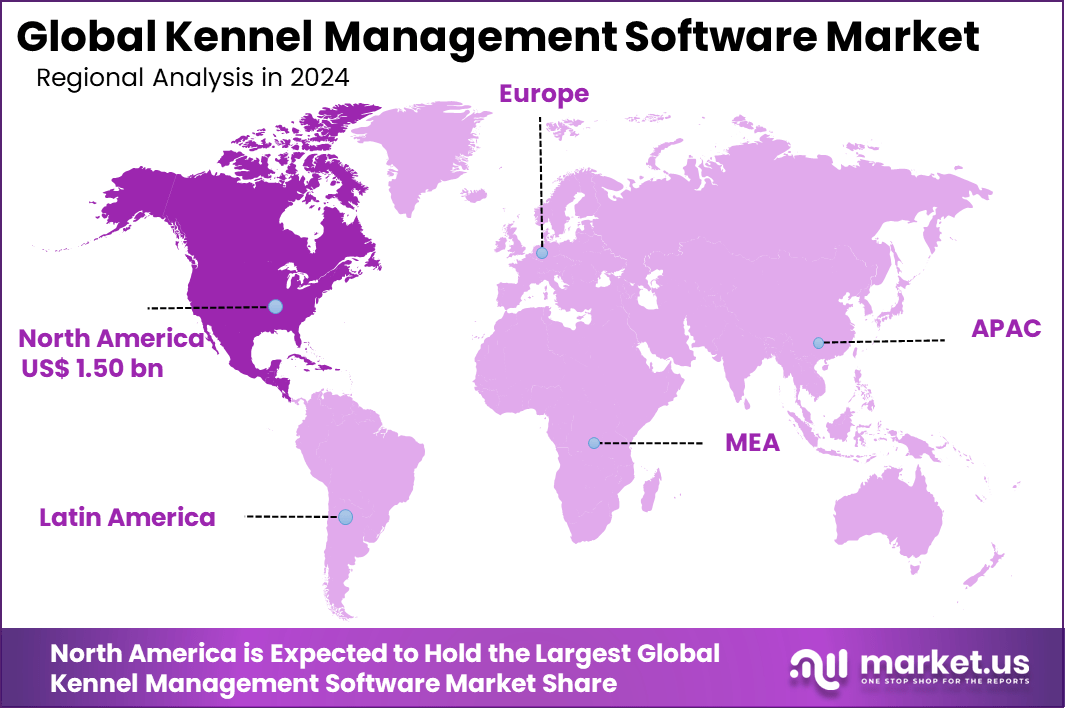

The Global Kennel Management Software Market size is expected to be worth around USD 9.38 billion by 2034, from USD 4.11 billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.5% share, holding USD 1.50 billion in revenue.

Kennel management software refers to digital tools designed to help pet boarding facilities, kennels, and daycare centres manage daily operations on a central platform. It typically enables scheduling, customer records, pet health logs, billing and invoicing, and related administrative workflows. This type of software replaces manual processes, such as paper records or spreadsheets, with automated and searchable digital systems.

The adoption of kennel management software has grown as kennels and pet care businesses aim to improve operational efficiency, enhance customer experience, and ensure better care for pets. The market includes both cloud-based systems that can be accessed from various devices and locally installed solutions tailored to specific business sizes.

The primary factors driving the adoption of kennel management software include the need to streamline and centralise administrative tasks and reduce time spent on manual record-keeping. Centralised scheduling, online booking portals, and automated reminder systems reduce errors and improve accuracy in day-to-day operations.

Another driving force is the demand for improved customer communication and experience. Kennel software often includes features such as automated SMS or email reminders, online payment options, and real-time updates, which contribute to greater customer satisfaction and repeat business.

For instance, in February 2025, Envision Pet Care Software launched grooming-specific updates with automated rewards programs and 24/7 client booking. These changes help smaller operations compete by boosting repeat visits through simple, personalized perks.

Key Takeaway

- Cloud-based deployment dominates kennel management software adoption with a 94.7% share, reflecting strong preference for remote access, lower upfront investment, and simplified system updates.

- Boarding and daycare management leads applications with 52.4%, as facilities focus on scheduling efficiency, pet tracking, and improved client communication.

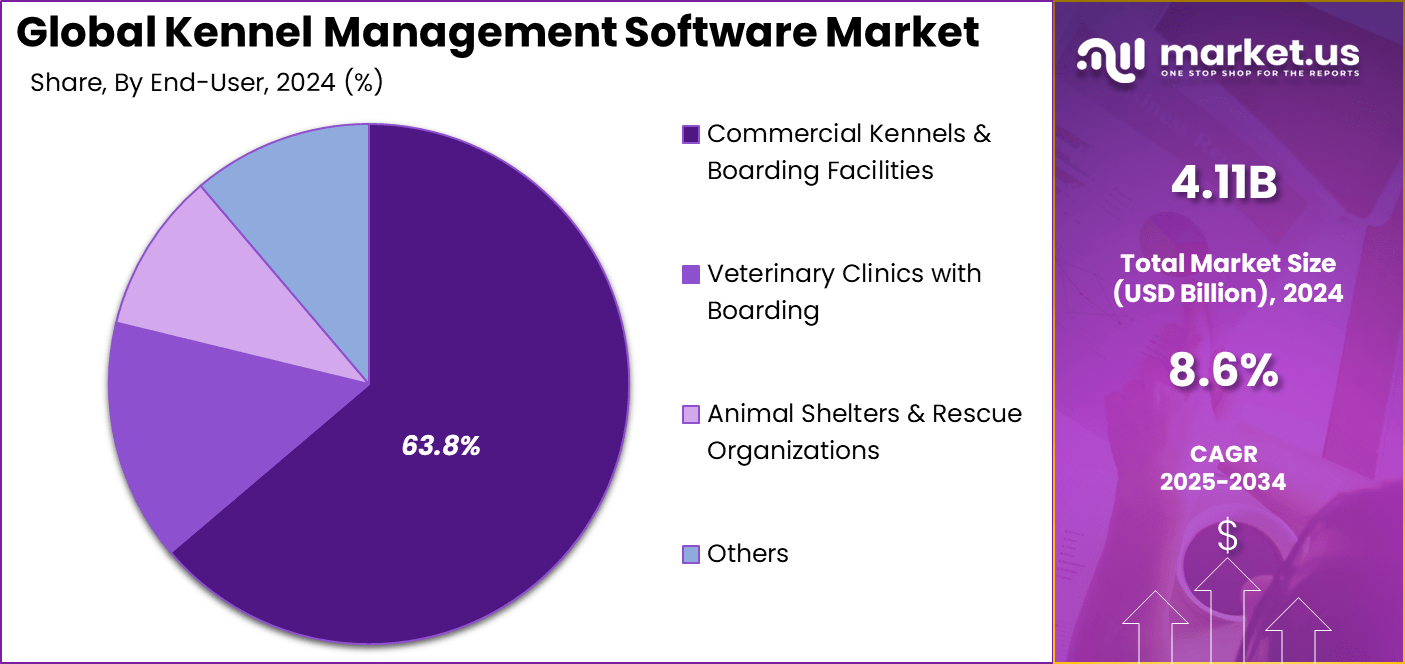

- Commercial kennels and boarding facilities represent 63.8% of end users, driven by higher operational complexity and the need for structured digital workflows.

- North America accounts for 36.5% share, supported by high pet ownership, advanced digital readiness, and a well-established commercial pet care ecosystem.

- The United States remains the key regional contributor, with growth supported by rising demand for professional pet boarding services and technology-enabled facility management.

AI-Led Growth Outlook

AI has the potential to enhance kennel management software by optimising scheduling, forecasting demand, and personalising customer interactions. For example, AI-powered analytics can predict peak booking periods and suggest pricing adjustments or staffing needs based on usage patterns. While not yet widespread, these technologies represent emerging growth areas.

In addition, AI-driven chat support equipped via online booking portals can improve customer engagement and reduce response times. Predictive analytics could further help identify client preferences or recommend tailored services, leading to higher customer lifetime value.

Value Chain Overview

In the kennel management software value chain, product development forms the foundation, involving software engineering, feature design, and user interface creation. These functions determine the core offerings of any software solution.

Distribution typically occurs through direct sales, online marketplaces, or subscription-based models. Cloud-based deployment allows for continuous updates and centralised support. At the operational level, kennels implement the software, during which training and customer support services become essential components of value delivery.

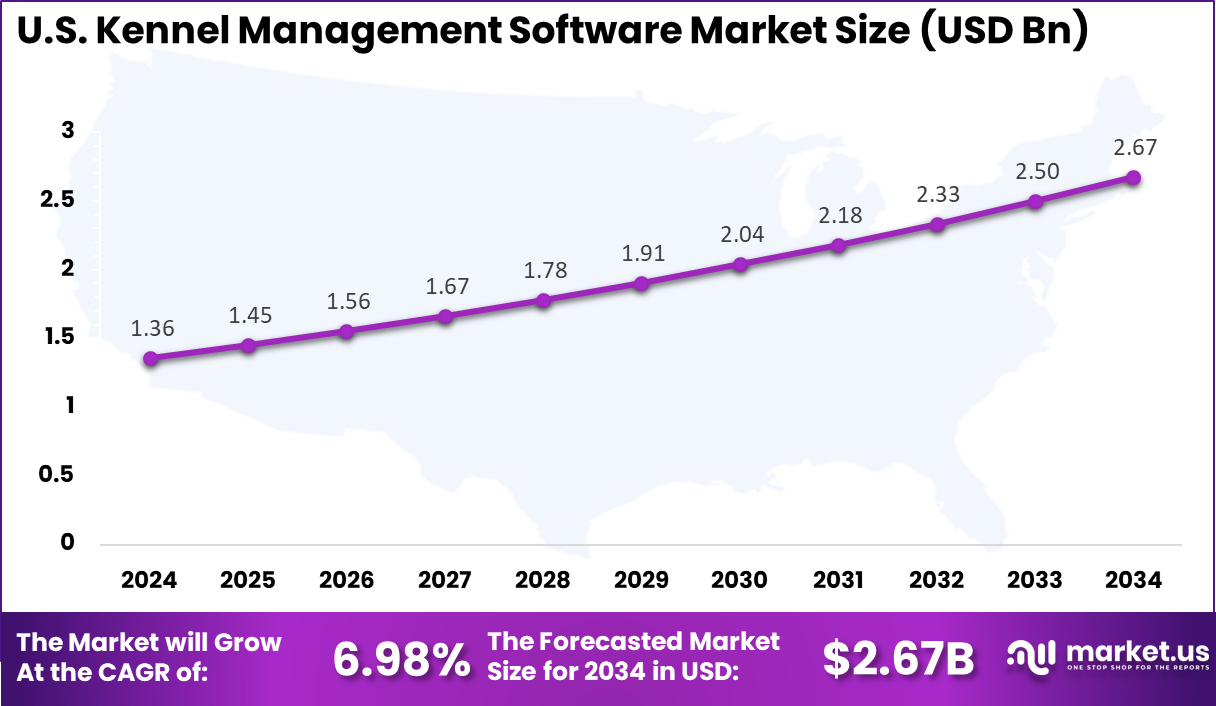

U.S. Market Size

The United States reached USD 1.36 Billion with a CAGR of 6.98%, reflecting gradual market growth. Expansion is driven by increased spending on pet services and facility modernization. Operators focus on improving customer experience and efficiency. Software adoption supports these goals.

For instance, In November 2025, Gingr, backed by Togetherwork, acquired PetExec to strengthen U.S. leadership in kennel management software and expand its reach to more than 7,000 pet care customers. The acquisition combines PetExec’s user base with Gingr’s cloud based tools for boarding, daycare, grooming, and training, improving operational efficiency and payment capabilities across North America.

In 2024, North America held a dominant market position in the Global Kennel Management Software Market, capturing more than a 36.5% share, holding USD 1.50 billion in revenue. High pet ownership rates fuel demand as families seek reliable boarding and daycare amid busy lives.

Commercial kennels thrive in urban areas, adopting cloud tools for real-time bookings and health logs. Strict animal welfare laws require detailed records that software provides easily. Tech-savvy owners expect app updates and photos, boosting efficiency. Travel surges fill facilities, pushing operators to scale operations smoothly.

For instance, In December 2025, Kennel Connection Daycare highlighted its fintech driven software innovations at the 2025 Pet Boarding and Daycare Expo in Hershey, Pennsylvania. Features such as advanced report cards and personalized pet updates via email and SMS demonstrated how California based solutions are improving customer trust and operational efficiency, reinforcing North American leadership in this segment.

Deployment Mode Analysis

In 2024, Cloud-based deployment accounts for 94.7%, showing overwhelming preference for online kennel management platforms. These systems allow kennel operators to manage bookings, customer records, and pet information through web-based access. Cloud platforms support real-time updates across devices. This improves operational efficiency for daily kennel activities.

The dominance of cloud-based solutions is driven by ease of access and low infrastructure requirements. Kennel operators benefit from automatic updates and reduced IT maintenance. Cloud systems also support remote management and data backup. These advantages make cloud deployment suitable for small and large facilities.

For Instance, in November 2024, Gingr enhanced its cloud platform with better mobile integration for daycare ops. Kennel owners report easier shifts between devices for booking updates and client notes. The focus stays on quick scaling for growing facilities, matching the high demand for flexible cloud tools.

Application Analysis

In 2024, the Boarding and daycare management represents 52.4%, making it the leading application segment. Kennel software is widely used to manage reservations, pet schedules, feeding routines, and activity tracking. These tools help staff maintain organized and consistent care routines. Accurate scheduling improves customer satisfaction.

Growth in this application is supported by rising demand for professional pet care services. Daycare and boarding facilities rely on software to manage high volumes of pets efficiently. Automated reminders and reporting reduce manual work. This supports smooth daily operations.

For instance, in December 2025, PetExec launched occupancy tools tailored for daycare and boarding rushes. Real-time slots prevent overbooking, with reports on daily throughput. Facilities use it to balance playtime and rest, meeting owner demands for structured care.

End-User Analysis

In 2024, the commercial kennels and boarding facilities account for 63.8%, highlighting their strong reliance on management software. These facilities handle frequent customer interactions and multiple pets daily. Software platforms help manage operations, billing, and compliance requirements. Centralized systems improve workflow visibility.

Adoption among commercial facilities is driven by the need for efficiency and service quality. Kennel software helps reduce booking errors and improve communication with pet owners. Data tracking supports better resource planning. These benefits continue to drive adoption.

For Instance, in October 2025, ProPet Software released updates for multi-site kennels, streamlining check-ins across locations. Commercial spots handle high volumes with one dashboard for payments and health logs. This keeps large boarding ops running smoothly amid client surges.

Emerging Trends

Movement Toward Cloud-Based and Mobile-Friendly Platforms

A major trend in the kennel management software market is the shift toward cloud-based platforms. Cloud systems allow staff to access records, schedule appointments, and manage operations from any connected device. This flexibility supports multi-location facilities and improves coordination between teams working in different areas of the property.

Another trend is the expansion of mobile-friendly features. Pet owners increasingly expect booking portals, real-time updates, and secure payments through their phones. Many kennel platforms now include mobile apps that allow staff to upload photos, send activity reports, and manage check-ins with ease. These features strengthen customer experience and encourage repeat bookings.

Growth Factors

Increase in Pet Ownership and Professional Boarding Services

A major growth factor is the rise in pet ownership worldwide. More households adopt dogs and cats each year, leading to increased demand for boarding and daycare services. As facility volumes increase, software platforms help manage bookings, reduce waiting time, and maintain consistent service quality.

Another growth factor is the professionalization of pet care services. Modern kennels focus on structured routines, safety checks, personalized care updates, and efficient communication with pet owners. Software tools allow facilities to maintain clear documentation of vaccinations, feeding schedules, cleaning routines, and staff assignments. This organized approach improves transparency and supports customer trust.

Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Application

- Boarding & Daycare Management

- Grooming & Training Scheduling

- Veterinary & Medical Records

- Breeding & Litter Management

- Others

By End-User

- Commercial Kennels & Boarding Facilities

- Veterinary Clinics with Boarding

- Animal Shelters & Rescue Organizations

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Need for Operational Efficiency and Clear Communication

A key driver for this market is the need for better operational efficiency. Manual scheduling and paper-based check-ins can lead to double bookings, misplaced records, and delayed customer service. Kennel management platforms automate these tasks and offer centralized dashboards that show current occupancy, upcoming reservations, and operational status in real time.

Another driver is the importance of clear communication with pet owners. Many facilities send daily activity reports that include photos, meals, medications, and behavioral notes. Software solutions make it easier to send these updates automatically. This improves customer satisfaction and strengthens long-term relationships.

Restraint Analysis

Adoption Barriers Among Small and Low-Budget Facilities

A major restraint is limited budgets among smaller kennel operations. Some facilities still rely on low-cost manual methods and may view software subscriptions as an additional expense. This slows adoption in regions where small, family-owned boarding services dominate.

Another restraint is resistance to technology change. Staff members accustomed to manual processes may hesitate to adopt new digital tools. Without proper training and support, the software may not be used effectively. This reduces the full benefit of the system and slows overall market growth.

Opportunity Analysis

Expansion of Integrated Tools and Add-On Services

There is strong opportunity in offering integrated solutions that combine scheduling, billing, grooming management, daycare activities, and point-of-sale features. Facilities prefer platforms that cover all operational needs rather than managing separate tools. Vendors providing comprehensive systems can attract larger customer bases.

Another opportunity lies in offering value-added services such as automated report cards, video updates, nutrition tracking, and customer loyalty programs. These features help facilities differentiate their services and improve the customer experience. As pet owners increasingly treat their pets as family members, demand for enriched digital services continues to rise.

Challenge Analysis

Data Security Requirements and Multi-Location Complexity

A major challenge is maintaining secure storage of customer data and payment information. Kennel software systems handle sensitive details including vaccination records, contact information, and billing data. Providers must follow strong security standards to maintain customer trust and comply with data protection rules.

Another challenge is managing multi-location operations. Larger kennel chains must coordinate bookings, staff assignments, and pet histories across different sites. Ensuring consistent record management and minimizing duplicate data requires strong system design. Vendors offering scalable multi-location tools can address this challenge and gain market advantage.

Key Players Analysis

Kennel Link, Precise Petcare, kennelOS, Gingr, and PetExec lead the kennel management software market by offering cloud based platforms for reservations, pet records, billing, and daily operations. Their solutions are widely used by boarding kennels, daycare centers, and grooming facilities. These companies focus on workflow automation, customer communication, and ease of use.

ProPet Software, iKennel, LeashTime, PawLoyalty, Kennel Connection, and Envision Pet Care Software strengthen the market with tools for scheduling, staff management, vaccination tracking, and loyalty programs. Their platforms help operators improve service quality and customer retention. These providers emphasize configurable features, mobile access, and integration with payment systems.

Animal Care Manager, 123Pet Software, KennelMaster, PowerPaws, and other players expand the landscape with affordable and niche focused kennel management systems. Their offerings address small and mid sized facilities seeking cost efficient digital solutions. These companies focus on simplicity, quick setup, and core operational functionality.

Top Key Players in the Market

- Kennel Link

- Precise Petcare

- kennelOS

- Gingr

- PetExec

- ProPet Software

- iKennel

- LeashTime

- PawLoyalty

- com (Kennel Connection)

- Envision Pet Care Software

- Animal Care Manager

- 123Pet Software

- KennelMaster

- PowerPaws

- Others

Recent Developments

- In December 2025, PetExec added sharper occupancy trackers and grooming pay splits to its lineup. Boarding teams close days faster with auto-reports on services done. Users note fewer mix-ups in busy seasons thanks to these. Mobile tweaks let staff snap pet pics on the go for owner shares. Reliable backups build trust for smaller kennels short on tech help.

- In October 2025, Precise Petcare boosted client portals with live journals and GPS notes for sits. Owners see pet days unfold with pics and sitter logs in one spot. Electronic payments speed up end-of-job billing nicely. Sitters grab shifts via mobile without desk time. Custom forms fit solo pros to teams handling dozens daily.

Report Scope

Report Features Description Market Value (2024) USD 4.11 Bn Forecast Revenue (2034) USD 9.38 Bn CAGR(2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud-based, On-premises), By Application (Boarding & Daycare Management, Grooming & Training Scheduling, Veterinary & Medical Records, Breeding & Litter Management, Others), By End-User (Commercial Kennels & Boarding Facilities, Veterinary Clinics with Boarding, Animal Shelters & Rescue Organizations, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kennel Link, Precise Petcare, kennelOS, Gingr, PetExec, ProPet Software, iKennel, LeashTime, PawLoyalty, Daycare.com (Kennel Connection), Envision Pet Care Software, Animal Care Manager, 123Pet Software, KennelMaster, PowerPaws, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Kennel Management Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Kennel Management Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-