Global Kefir Market Size, Share, Growth Analysis By Product (Animal-based, Plant-based), By Form (Organic, Conventional), By Product Type (Milk Kefir, Water Kefir), By Category (Flavoured, Unflavored), By Application (Food, Pharmaceutical), By Distribution Channel ( Convenience Store, Specialty Store, Supermarkets/Hypermarkets, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157892

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Analysis

- By Form Analysis

- By Product Type Analysis

- By Category Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Emerging Trends

- Drivers

- Restraints

- Opportunity

- Regional Insights

- Key Players Analysis

- Recent Industry Developments

- Report Scope

Report Overview

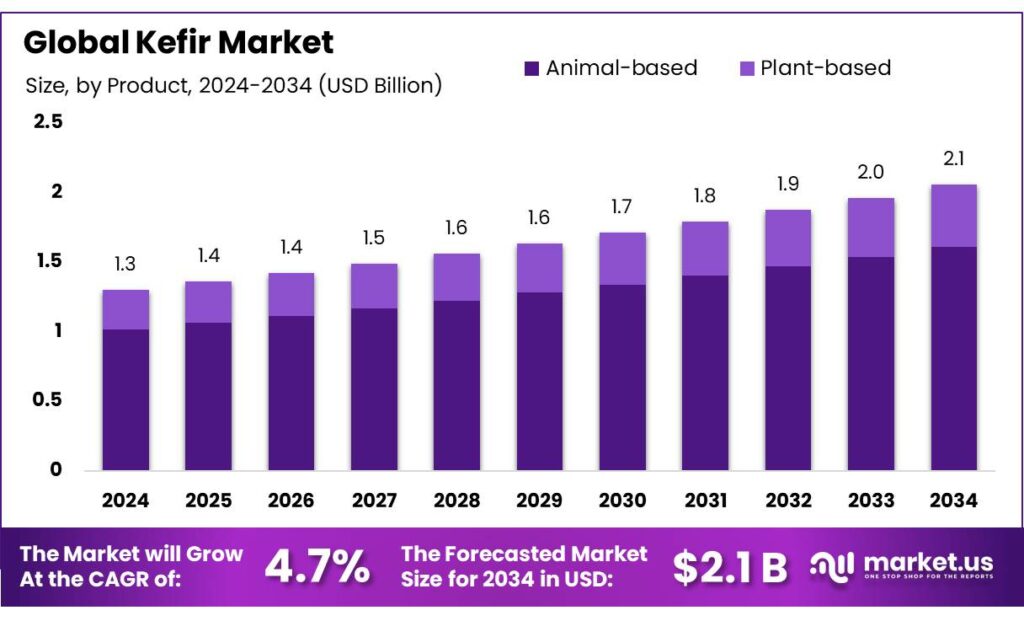

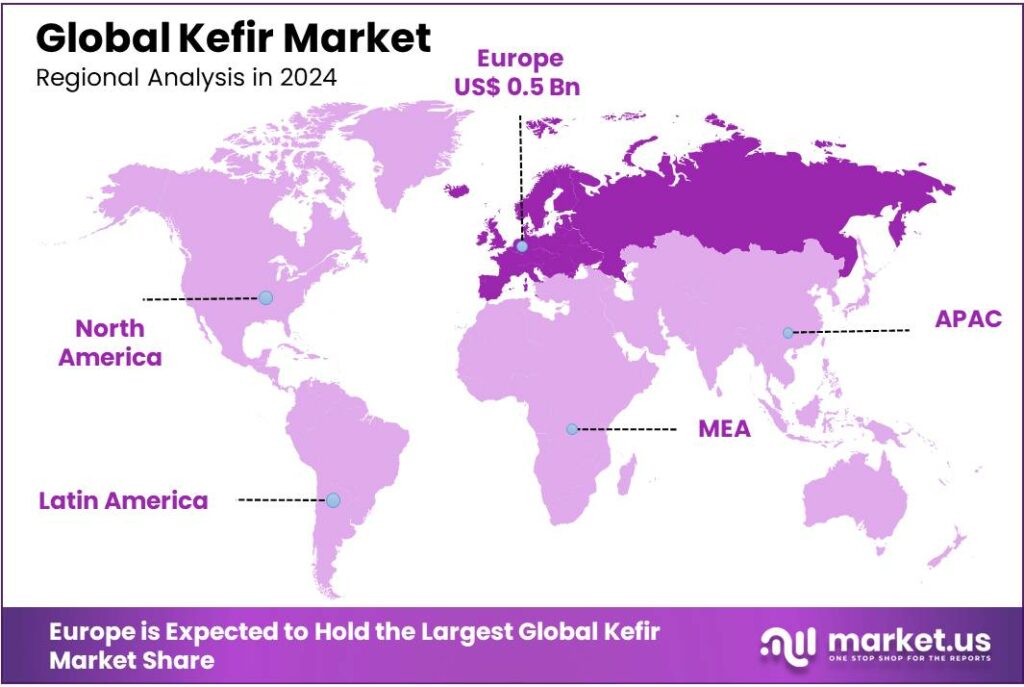

The Global Kefir Market size is expected to be worth around USD 2.1 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 43.8% share, holding USD 0.5 Billion in revenue.

Kefir, a fermented dairy product originating from the Caucasus region, has been gaining global recognition for its probiotic benefits and nutritional value. In India, kefir is emerging as a niche yet promising segment within the broader dairy and fermented foods market.

Government initiatives also play a crucial role in promoting the dairy sector. For instance, Gujarat is emerging as a significant agro-dairy hub, with investments in dairy value chains and infrastructure. The state’s dairy cooperatives, such as Banas Dairy, are supporting over 1,600 cooperatives and more than 300,000 farmers, contributing to the region’s dairy production. Such initiatives create an enabling environment for the growth of value-added dairy products like kefir.

Government initiatives such as the White Revolution 2.0 aim to enhance milk production and processing capabilities, thereby supporting the growth of value-added products like kefir. Additionally, the Revised National Program for Dairy Development (NPDD), approved in 2025, focuses on creating infrastructure for milk procurement and processing, ensuring better quality control, and improving supply chain efficiency.

Additionally, the government has set up a corpus fund of Rs 8,004 crore for the creation of dairy processing infrastructure under the scheme. These initiatives are expected to enhance milk production and processing capabilities, benefiting the kefir industry by ensuring a steady supply of quality milk.

Additionally, the Department of Animal Husbandry and Dairying’s Animal Husbandry Infrastructure Development Fund (AHIDF), established with a corpus of ₹15,000 crore, is designed to boost private sector investment in animal husbandry infrastructure, including dairy plants and animal feed units.

Key Takeaways

- Kefir Market size is expected to be worth around USD 2.1 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 4.7%.

- Animal-based kefir held a dominant market position, capturing more than a 78.3% share.

- Conventional kefir held a dominant market position, capturing more than a 71.5% share.

- Milk kefir held a dominant market position, capturing more than an 80.6% share.

- Flavoured kefir held a dominant market position, capturing more than a 61.2% share.

- Food application segment held a dominant market position, capturing more than an 82.7% share.

- Supermarkets and hypermarkets held a dominant market position in the kefir distribution channel, capturing more than a 37.4% share.

- Europe held a dominant position in the global kefir market, capturing more than a 43.8% share, valued at approximately USD 0.5 billion.

By Product Analysis

Animal-Based Kefir Leads the Market with 78.3% Share in 2024

In 2024, animal-based kefir held a dominant market position, capturing more than a 78.3% share. This segment’s robust performance is primarily attributed to its traditional roots, rich nutritional profile, and established consumption patterns in regions with a strong dairy culture.

Animal-based kefir is typically produced from cow, goat, or sheep milk, offering a creamy texture and a tangy flavor that closely resembles yogurt. Its popularity is further bolstered by its high content of protein, calcium, and essential vitamins, making it a preferred choice among health-conscious consumers. The probiotic properties of kefir, which support digestive health and boost the immune system, have also contributed to its widespread acceptance.

By Form Analysis

Conventional Kefir Dominates with 71.51% Market Share in 2024

In 2024, conventional kefir held a dominant market position, capturing more than a 71.5% share. This segment’s robust performance is primarily attributed to its traditional roots, rich nutritional profile, and established consumption patterns in regions with a strong dairy culture.

Conventional kefir is typically produced from cow, goat, or sheep milk, offering a creamy texture and a tangy flavor that closely resembles yogurt. Its popularity is further bolstered by its high content of protein, calcium, and essential vitamins, making it a preferred choice among health-conscious consumers. The probiotic properties of kefir, which support digestive health and boost the immune system, have also contributed to its widespread acceptance.

By Product Type Analysis

Milk Kefir Dominates the Market with 80.6% Share in 2024

In 2024, milk kefir held a dominant market position, capturing more than an 80.6% share. This segment’s robust performance is primarily attributed to its traditional roots, rich nutritional profile, and established consumption patterns in regions with a strong dairy culture.

Milk kefir is typically produced from cow, goat, or sheep milk, offering a creamy texture and a tangy flavor that closely resembles yogurt. Its popularity is further bolstered by its high content of protein, calcium, and essential vitamins, making it a preferred choice among health-conscious consumers. The probiotic properties of kefir, which support digestive health and boost the immune system, have also contributed to its widespread acceptance.

By Category Analysis

Flavoured Kefir Leads with 61.2% Market Share in 2024

In 2024, flavoured kefir held a dominant market position, capturing more than a 61.2% share. This segment’s robust performance is primarily attributed to its ability to cater to diverse taste preferences, making it more accessible to a broader consumer base.

Flavoured kefir offers a variety of options, including berry, vanilla, and citrus flavors, which enhance its appeal among consumers seeking enjoyable and health-conscious beverage choices. The incorporation of natural fruit flavors not only improves taste but also adds nutritional value, attracting health-conscious individuals.

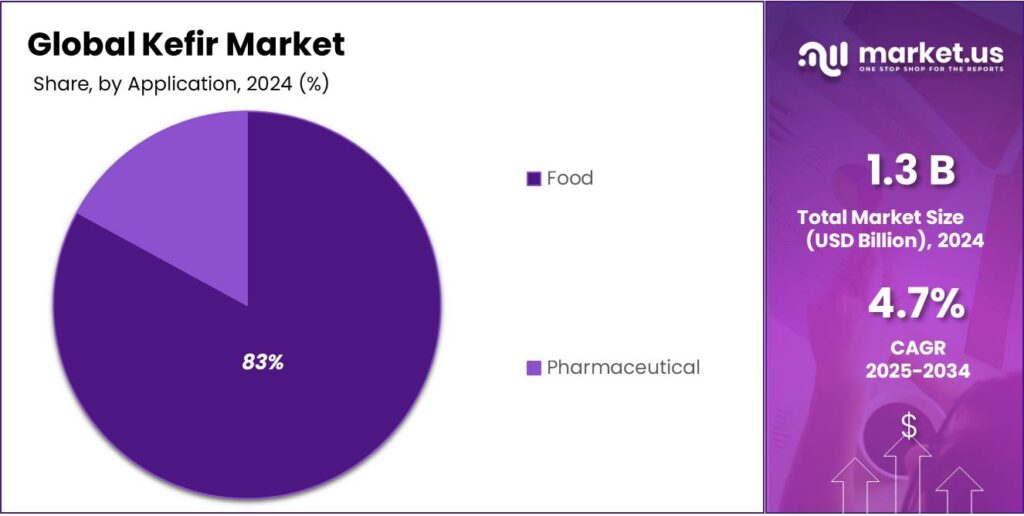

By Application Analysis

Food Applications Drive Kefir Market with 82.7% Share in 2024

In 2024, the food application segment held a dominant market position, capturing more than an 82.7% share. This dominance underscores kefir’s established role as a functional food ingredient, particularly in the dairy and beverage sectors.

Kefir’s rich probiotic content, combined with its creamy texture and tangy flavor, makes it a versatile addition to various food products. It is commonly used in smoothies, breakfast bowls, salad dressings, and as a base for dips, aligning with the growing consumer demand for functional and health-oriented foods. The increasing awareness of gut health and the benefits of probiotics has further fueled kefir’s incorporation into daily diets.

By Distribution Channel Analysis

Supermarkets/Hypermarkets Lead Kefir Distribution with 37.4% Share in 2024

In 2024, supermarkets and hypermarkets held a dominant market position in the kefir distribution channel, capturing more than a 37.4% share. This significant share highlights the pivotal role of large-scale retail outlets in making kefir accessible to a broad consumer base.

Supermarkets and hypermarkets offer a wide range of kefir products, including various flavors and packaging sizes, catering to diverse consumer preferences. The strategic placement of kefir in prominent sections, such as the dairy or health food aisles, enhances visibility and encourages impulse purchases. Additionally, these retail formats often provide promotional deals and discounts, further attracting price-sensitive consumers.

Key Market Segments

By Product

- Animal-based

- Plant-based

By Form

- Organic

- Conventional

By Product Type

- Milk Kefir

- Water Kefir

By Category

- Flavoured

- Unflavored

By Application

- Food

- Pharmaceutical

By Distribution Channel

- Convenience Store

- Specialty Store

- Supermarkets/Hypermarkets

- Others

Emerging Trends

Surge in Plant-Based Kefir Demand

Kefir, a fermented drink traditionally made from dairy, is experiencing a significant shift as consumers increasingly seek plant-based alternatives. This trend is driven by growing awareness of lactose intolerance, vegan lifestyles, and a desire for gut-friendly beverages. Plant-based kefir, often made from coconut, soy, or oat milk, is gaining popularity due to its probiotic content and suitability for those avoiding dairy.

- In the United States, Lifeway Foods, a leading producer of kefir, reported revenues of $186.8 million in 2024, with a significant portion attributed to plant-based product lines. This indicates a robust market demand for plant-based kefir options.

Plant-based kefir is typically made from non-dairy bases like coconut milk, oat milk, or almond milk, fermented with kefir grains. These alternatives offer the same probiotic benefits as traditional dairy-based kefir, including improved gut health and enhanced digestion, but without the lactose content. This makes them an attractive option for individuals with lactose sensitivities or those following plant-based diets.

Governments and health organizations worldwide are recognizing the importance of probiotics in maintaining gut health, leading to increased support for fermented foods like kefir. Initiatives promoting the consumption of functional foods are helping to raise awareness and drive demand for products that offer health benefits beyond basic nutrition.

Drivers

Increasing Consumer Awareness of Health and Wellness

One of the most significant drivers of kefir’s growth in India is the rising consumer awareness regarding health and wellness, particularly concerning gut health. As lifestyles become more health-conscious, individuals are increasingly seeking functional foods that offer health benefits beyond basic nutrition. Kefir, a fermented dairy product rich in probiotics, has gained popularity for its potential to improve digestion, boost immunity, and support overall well-being.

In 2023, India’s probiotics market was valued at ₹2,070 crore, nearly doubling from ₹1,016 crore in 2021. This growth reflects a 22% annual increase and underscores the expanding consumer interest in products that promote gut health. The demand for probiotic-rich foods like kefir is a direct response to the increasing prevalence of digestive disorders and a growing preference for preventive healthcare.

The government’s initiatives further bolster this trend. The White Revolution 2.0, launched in 2024, aims to increase milk procurement by 50% over five years, enhancing the availability of quality milk for dairy products, including kefir. Additionally, the Revised National Programme for Dairy Development (NPDD) focuses on strengthening dairy infrastructure, improving milk processing capacities, and ensuring better quality control, which collectively support the production of high-quality probiotic products.

Restraints

Infrastructure and Supply Chain Limitations

One of the primary challenges hindering the growth of kefir in India is the underdeveloped dairy infrastructure and fragmented supply chain. Despite being the world’s largest producer of milk, accounting for approximately 24% of global production, India’s dairy sector faces significant hurdles in terms of quality control, standardization, and distribution. A substantial portion of milk production, over 70%, occurs in the unorganized sector, which complicates efforts to ensure consistent quality and traceability of dairy products, including kefir.

The lack of adequate cold storage facilities exacerbates these issues. Inadequate refrigeration leads to milk spoilage, especially in rural areas where infrastructure is limited. This not only results in wastage but also affects the shelf life of perishable products like kefir. Without proper cold chain logistics, maintaining the probiotic quality of kefir becomes challenging, limiting its marketability and consumer trust.

Furthermore, the dairy supply chain in India is characterized by inefficiencies, including poorly constructed roads, traffic congestion, and inconsistent transportation networks. These logistical challenges hinder timely delivery and distribution of dairy products, impacting the availability and freshness of kefir in the market.

Opportunity

Leveraging Government Schemes to Strengthen the Kefir Supply Chain

A significant growth opportunity for the kefir industry in India lies in harnessing the government’s extensive support for dairy infrastructure development. With India being the world’s largest milk producer, accounting for 24.64% of global production in 2021-22, the dairy sector is poised for modernization and expansion.

The Revised National Programme for Dairy Development (NPDD), approved in March 2025, is a pivotal initiative in this regard. With an enhanced budget of ₹2,790 crore for the 15th Finance Commission period (2021-22 to 2025-26), the NPDD aims to bolster dairy infrastructure across the country.

Key components include the establishment of 10,000 new Dairy Cooperative Societies and the formation of two new Milk Producer Companies, particularly targeting remote and underserved regions. This expansion is expected to generate approximately 3.2 lakh direct and indirect employment opportunities, with a focus on empowering women, who constitute 70% of the dairy workforce.

Additionally, the Dairy Processing & Infrastructure Development Fund (DIDF) plays a crucial role in modernizing milk processing facilities. With a total project outlay of ₹10,005 crore, the DIDF provides loan assistance to State Dairy Federations, District Milk Unions, and Milk Producer Companies for upgrading processing plants and establishing value-added product facilities. This initiative aims to enhance the quality and shelf life of dairy products, including kefir, thereby expanding market reach.

Regional Insights

Europe Leads Global Kefir Market with 43.8% Share in 2024

In 2024, Europe held a dominant position in the global kefir market, capturing more than a 43.8% share, valued at approximately USD 0.5 billion. This substantial market share underscores Europe’s longstanding tradition of consuming fermented dairy products and its growing inclination towards functional foods.

The European kefir market is primarily driven by countries with deep-rooted dairy cultures, such as Russia, Germany, Poland, and the UK. In these regions, kefir is not just a beverage but a staple in daily diets, appreciated for its probiotic content and health benefits. The increasing awareness of gut health and the immune-boosting properties of probiotics have further fueled the demand for kefir.

The market is characterized by a preference for milk-based kefir, which accounted for a significant portion of the market share in 2024. Flavored variants are gaining popularity, catering to the evolving taste preferences of consumers. Distribution is predominantly through supermarkets and hypermarkets, ensuring wide accessibility and convenience for consumers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in 1986, Lifeway Foods is a leading U.S. producer of probiotic-rich kefir. Headquartered in Morton Grove, Illinois, the company offers a diverse range of kefir products, including low-fat, whole milk, organic, and flavored varieties. In 2024, Lifeway reported revenues of $186.8 million, with net income of $9 million. Despite internal family disputes, Lifeway maintains a dominant position in the U.S. kefir market, holding approximately 95% market share.

Established in 2003, Maple Hill Creamery specializes in 100% grass-fed organic dairy products, including kefir. The company emphasizes regenerative farming practices and animal welfare, sourcing milk from small family farms. Maple Hill’s kefir offerings include plain, vanilla, and strawberry flavors, all made with organic ingredients and live probiotics. The company is committed to sustainability and promoting the benefits of grass-fed dairy.

Nancy’s Probiotic Foods, based in Eugene, Oregon, has been producing probiotic-rich dairy products since the 1970s. Their kefir offerings include whole milk and low-fat varieties, all made with organic ingredients and live probiotic cultures. Each serving contains over 56 billion CFUs of probiotics, supporting digestive and immune health. Nancy’s products are certified organic, gluten-free, and non-GMO, reflecting the company’s commitment to quality and health-conscious consumers.

Top Key Players Outlook

- Lifeway Foods, Inc.

- MAPLE HILL

- Green Valley

- Nancy’s

- The Icelandic Milk and Skyr Corporation

- Forager Project

- KeVita

Recent Industry Developments

In 2024 Lifeway Foods Inc, reported net sales of $186.8 million, marking a 16.7% increase from the previous year, driven by higher volumes of its branded drinkable kefir.

In 2024, Nancy’s continued to uphold its commitment to quality and innovation. The company offers a diverse range of kefir products, including organic whole milk and low-fat varieties, available in flavors such as plain, vanilla, blueberry, and peach. Each serving contains over 56 billion live probiotic CFUs, featuring 12 distinct strains like Lactobacillus acidophilus and Bifidobacterium lactis, supporting digestive and immune health.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.1 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Animal-based, Plant-based), By Form (Organic, Conventional), By Product Type (Milk Kefir, Water Kefir), By Category (Flavoured, Unflavored), By Application (Food, Pharmaceutical), By Distribution Channel ( Convenience Store, Specialty Store, Supermarkets/Hypermarkets, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lifeway Foods, Inc., MAPLE HILL, Green Valley, Nancy’s, The Icelandic Milk and Skyr Corporation, Forager Project, KeVita Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lifeway Foods, Inc.

- MAPLE HILL

- Green Valley

- Nancy's

- The Icelandic Milk and Skyr Corporation

- Forager Project

- KeVita