Global Kaempferol Market Size, Share, And Enhanced Productivity By Grade (Pharma Grade, Food Grade, Technical Grade), By Application (Food and Beverages, Beauty and Personal Care, Textile Dyeing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168898

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

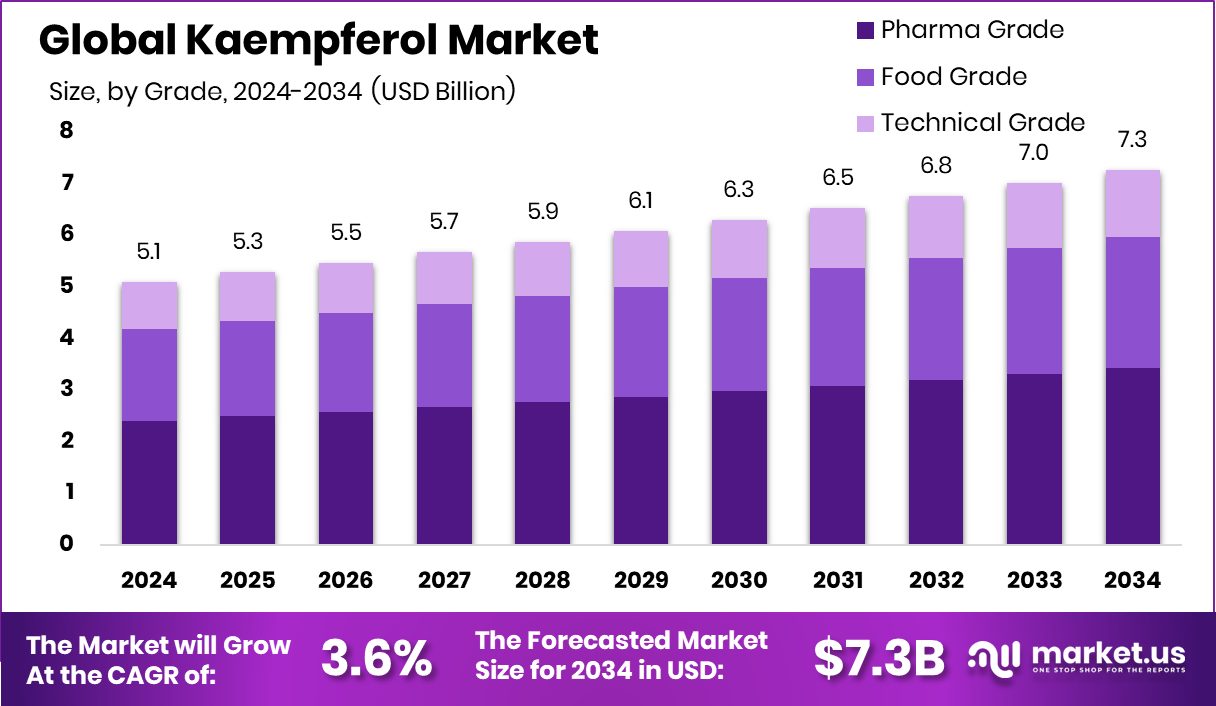

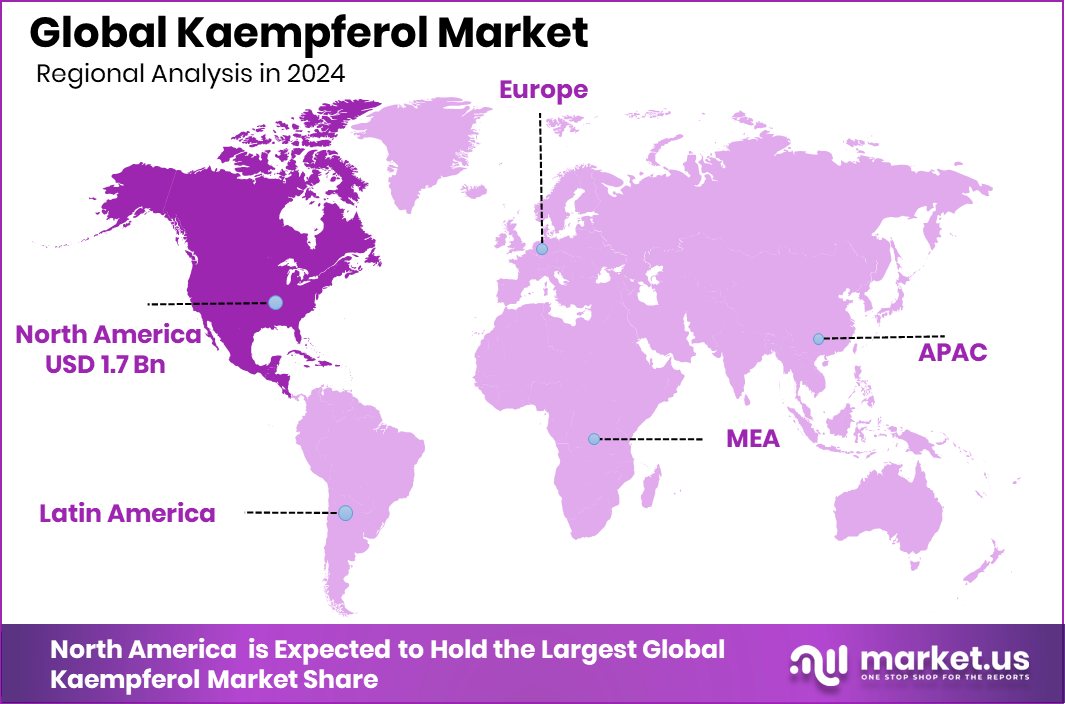

The Global Kaempferol Market is expected to be worth around USD 7.3 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034. North America commands 34.90% of the kaempferol market, accounting for USD 1.7 Bn revenue.

Kaempferol is a naturally occurring plant flavonoid found in tea, leafy greens, berries, and medicinal herbs. It is valued for its antioxidant, anti-inflammatory, and skin-protective properties, making it useful in nutrition, cosmetics, and preventive wellness formulations.

The Kaempferol market represents the commercial use of this compound across dietary supplements, functional foods, pharmaceuticals, and personal care products. It is increasingly positioned as a clean-label, plant-derived ingredient aligned with modern preferences for natural and science-backed wellness solutions.

Growth of the kaempferol market is supported by rising investment across wellness, beauty, and personal care ecosystems. Funding momentum is visible through deals such as Krieya Beauty & Wellness raising ₹7 crore, Pilgrim securing ₹200 crore, Protouch raising Rs 17.7 crore and $2 million, and Antithesis raising Rs 5 crore.

Demand for kaempferol is increasing as consumers actively seek botanical ingredients for skin health, anti-ageing, immunity, and metabolic balance. Brands are focusing on safer, plant-based alternatives, encouraging formulators to integrate flavonoid compounds into supplements, serums, and functional beauty products.

Market opportunities lie in advanced delivery systems, nutricosmetics, and hybrid beauty-nutrition products. Continued funding into beauty and wellness startups highlights strong commercial confidence, opening space for kaempferol-based innovations tailored to preventive health, daily nutrition, and sustainable personal care solutions.

Key Takeaways

- The Global Kaempferol Market is expected to be worth around USD 7.3 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

- Pharma Grade dominates the kaempferol market with 47.2%, driven by demand for standardised, high-purity compounds.

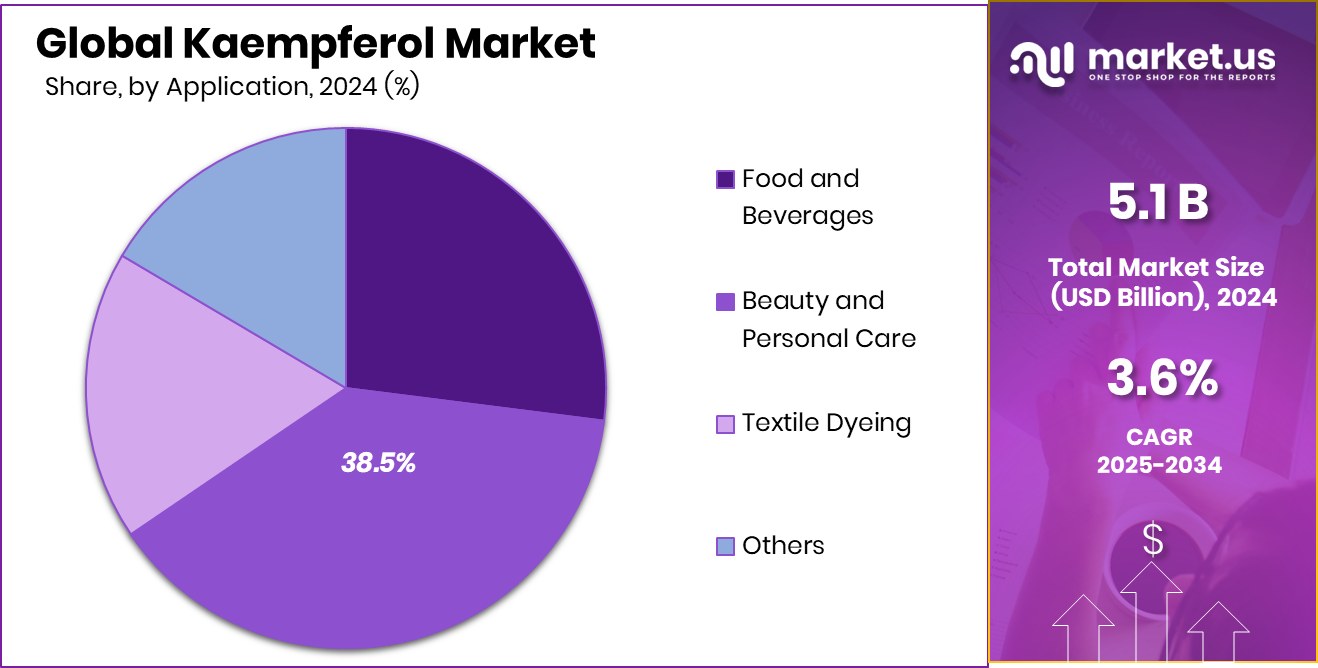

- Beauty and personal care lead kaempferol market applications with 38.5%, supported by natural skincare and wellness trends.

- In North America, the kaempferol market stands at USD 1.7 Bn, holding a 34.90% share.

By Grade Analysis

Pharma-grade leads Kaempferol Market, holding 47.2% share, driven by therapeutic purity demands.

In 2024, Pharma Grade held a dominant market position in the By Grade segment of the Kaempferol Market, with a 47.2% share, reflecting its strong relevance in regulated health applications. This dominance is driven by the rising use of high-purity kaempferol in pharmaceutical formulations focused on antioxidant, anti-inflammatory, and preventive therapeutic functions.

Pharma Grade kaempferol benefits from stringent quality standards, controlled purity levels, and consistent bioactive performance, which are essential for drug development and clinical usage. Additionally, growing interest in plant-derived active molecules supports their adoption in formulation pipelines targeting chronic health management.

Manufacturers also prefer pharma-grade inputs due to compliance with pharmacopoeial requirements and traceability expectations. As natural compounds continue gaining attention in medicine, Pharma Grade kaempferol remains strategically positioned within pharmaceutical value chains.

By Application Analysis

Beauty and personal care dominate the kaempferol market with 38.5%, supported by natural skincare adoption.

In 2024, Beauty and Personal Care held a dominant market position in the By Application segment of the Kaempferol Market, with a 38.5% share, supported by strong demand for plant-based active ingredients in skincare and personal wellness products.

Kaempferol’s antioxidant and soothing properties make it well-suited for formulations targeting skin protection, anti-ageing, and sensitivity management. The segment benefits from increasing consumer preference for naturally sourced, clean-label cosmetic ingredients that align with daily use beauty routines.

Product developers are incorporating kaempferol into creams, serums, and skin-support formulas due to its compatibility with botanical blends. As beauty brands continue shifting toward functional and nature-derived actives, the Beauty and Personal Care application segment maintains a leading role in overall kaempferol consumption.

Key Market Segments

By Grade

- Pharma Grade

- Food Grade

- Technical Grade

By Application

- Food and Beverages

- Beauty and Personal Care

- Textile Dyeing

- Others

Driving Factors

Growing Demand for Natural Antioxidant Ingredients

The Kaempferol market is strongly driven by rising demand for natural antioxidant ingredients across wellness, nutrition, and beauty products. Consumers are increasingly avoiding synthetic additives and choosing plant-based compounds that support long-term health and skin protection.

Kaempferol’s natural origin and multifunctional benefits make it attractive for clean-label formulations. This shift is further supported by growing startup activity in the beauty and wellness space. For instance, beauty & wellness startup Krieya secured Rs 7 Cr in seed funding, highlighting investor confidence in natural, science-backed ingredients.

Such funding allows emerging brands to invest in advanced formulations, ingredient sourcing, and product innovation. As brands expand portfolios focused on botanical actives, kaempferol gains steady adoption. This demand trend continues to shape product development strategies across health-focused consumer markets.

Restraining Factors

Complex Extraction and High Purity Costs

One key restraining factor in the Kaempferol market is the complexity involved in the extraction and purification processes. Producing high-quality kaempferol from plant sources requires advanced processing, careful handling, and strict quality controls, which increase overall production costs.

These challenges can limit price competitiveness, especially for brands targeting mass-market consumers. Smaller formulators may delay adoption due to cost pressures and supply consistency concerns. At the same time, funding activity in beauty-focused businesses highlights the need to balance innovation with affordability.

For example, Bessemer is set to lead a $15 Mn funding round in Moxie Beauty, signalling strategic investment aimed at scaling operations and improving cost efficiency. However, until processing methods become more economical, high costs remain a limiting factor for wider kaempferol adoption across product categories.

Growth Opportunity

Expanding Use in Premium Wellness Products

A major growth opportunity for the Kaempferol market lies in its expanding use within premium and luxury wellness products. High-end beauty and personal care brands are increasingly focused on botanical ingredients that offer both efficacy and natural positioning.

Kaempferol fits well into this strategy due to its skin-protective and antioxidant benefits, making it attractive for premium formulations. The opportunity is reinforced by strong investment activity in the luxury beauty segment. For instance, luxury beauty brand Kimirica raised $15M from Carnelian Ventures, led by Vikas Khemani, highlighting growing confidence in premium wellness offerings.

Such funding supports advanced formulation development and brand expansion. As consumers increasingly associate natural ingredients with quality and exclusivity, kaempferol stands to gain stronger adoption in high-value product lines.

Latest Trends

Integration into Science-Backed Clean Beauty Formulas

A key latest trend in the Kaempferol market is its integration into science-backed clean beauty formulations. Beauty brands are moving beyond basic botanical claims and focusing on ingredients with proven functional benefits.

Kaempferol is gaining attention for its antioxidant and skin-soothing properties, making it suitable for modern clean beauty products. This trend aligns with increasing startup activity in the beauty and personal care space.

For example, Beauty & Personal Care Brand Antithesis raised ₹5 crore in pre-seed funding led by Rukam Capital and V3 Ventures, supporting the development of ingredient-driven skincare solutions.

With new funding, brands are investing in better formulations and transparency. As a result, kaempferol is increasingly positioned as a credible, nature-derived active in sophisticated beauty applications.

Regional Analysis

North America leads the kaempferol market with a 34.90% share, reaching a USD 1.7 Bn value.

North America dominates the Kaempferol Market with a share of 34.90%, valued at USD 1.7 Bn. The region’s leading position is supported by strong demand for plant-based bioactives across pharmaceuticals, dietary supplements, and beauty applications. High consumer awareness around antioxidant ingredients, combined with well-established healthcare and personal care industries, continues to support steady adoption. The presence of advanced formulation capabilities and strict quality standards further strengthens regional consumption of kaempferol-derived products.

Europe represents a mature and regulation-driven market where demand is shaped by clean-label preferences and growing interest in plant-derived functional ingredients. The region benefits from a strong nutraceutical base and sustained innovation in skin health and preventive wellness products, supporting steady kaempferol utilisation across multiple end-use segments.

Asia Pacific shows emerging momentum, supported by growing use of botanical compounds in traditional wellness systems and modern functional formulations. Rising middle-class populations and increasing focus on natural ingredients in food supplements and cosmetics contribute to gradual market expansion.

Middle East & Africa remains an evolving market, driven by increasing awareness of health-supporting ingredients and the gradual expansion of premium personal care products. Adoption is primarily supported by urban consumer segments.

Latin America demonstrates developing demand, supported by growing interest in plant-based nutrition and natural beauty solutions, positioning the region for gradual kaempferol market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Aktin Chemicals is viewed as a focused supplier within the kaempferol value chain, benefiting from its specialisation in fine chemicals and research-oriented compounds. Its role is reinforced by consistent demand from laboratories and formulation developers seeking reliable plant-based flavonoids for downstream applications. The company’s emphasis on purity and controlled production supports its relevance in niche, quality-sensitive kaempferol uses.

FUJIFILM Wako Chemicals continues to hold strategic importance due to its strong background in reagents and speciality chemicals for scientific and industrial use. Within the kaempferol market, its strength lies in serving analytical, pharmaceutical, and research-driven demand, where consistency, traceability, and technical reliability are critical. This positions the company well for sustained engagement with advanced users.

MP Biomedicals maintains a steady presence in the kaempferol landscape through its broader life-science and biochemical portfolio. Its kaempferol offerings align with research, diagnostic, and formulation development needs, enabling continued adoption among academic, clinical, and early-stage commercial users.

Aktin Chemicals, Inc. complements the competitive environment by supporting tailored chemical solutions for specialised customers. Its operational focus on custom synthesis and small-batch speciality compounds makes it relevant for targeted kaempferol applications, especially where flexibility and specification-driven supply are required. Together, these players shape a market driven by quality, application precision, and scientific credibility.

Top Key Players in the Market

- Aktin Chemicals

- FUJIFILM Wako Chemicals

- MP Biomedicals

- Aktin Chemicals, Inc

Recent Developments

- In October 2025, MP Biomedicals launched the MagFlex-96 automated Nucleic Acid Purification System — a next-generation platform for high-throughput DNA/RNA purification.

- In May 2024, FUJIFILM Wako Chemicals installed new equipment to triple production capacity for GMP-compliant pharmaceutical raw materials.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 7.3 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Pharma Grade, Food Grade, Technical Grade), By Application (Food and Beverages, Beauty and Personal Care, Textile Dyeing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aktin Chemicals, FUJIFILM Wako Chemicals, MP Biomedicals, Aktin Chemicals, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aktin Chemicals

- FUJIFILM Wako Chemicals

- MP Biomedicals

- Aktin Chemicals, Inc