Global IT Support Services Market Size, Industry Analysis Report By Approach (Reactive IT Services, Proactive IT Services), By Type (Design & Implementation, Operations & Maintenance), By Application (Systems & Network Management, Data Management, Application Management, Security & Compliance Management, Others), By Technology (AI & Machine Learning, Big Data Analytics, Threat Intelligence, Others), By Deployment (On-premises, Cloud), By Enterprise Size (Small and Medium Enterprise (SMEs), Large Enterprise), By End Use (BFSI, Government, Healthcare, Manufacturing, Media & Communications, Retail, IT & Telecom, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159016

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of Generative AI

- US Market Size

- By Approach

- By Type

- By Application

- By Technology

- By Deployment

- By Enterprise Size

- By End Use

- Key Market Segments

- Emerging Trends

- Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunities Analysis

- Challenges Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

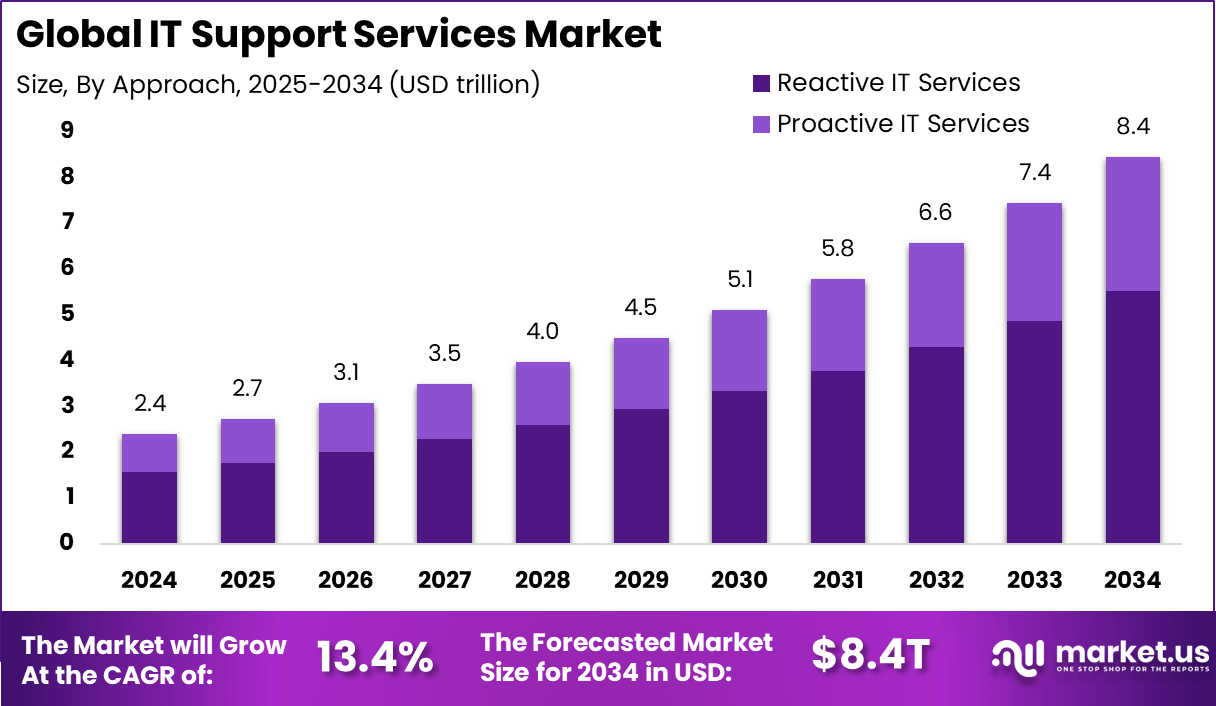

The Global IT Support Services Market size is expected to be worth around USD 8.44 Trillion

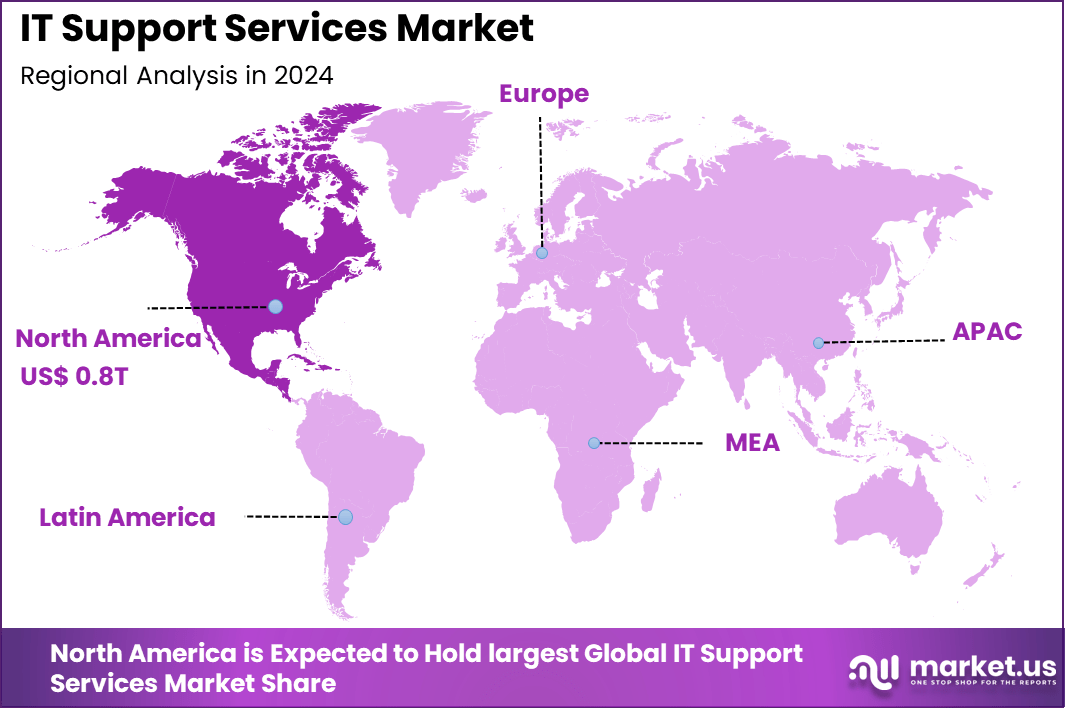

By 2034, from USD 2.4 Trillion in 2024, growing at a CAGR of 13.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 36.8% share, holding USD 0.8 Trillion revenue.The IT Support Services Market comprises services that help organizations maintain, operate, troubleshoot, and improve their IT infrastructure and user systems. These services include help desk support, remote diagnostics, on-site repair, managed services, monitoring and maintenance, security support, incident management, and system upgrades. Providers may serve everything from desktop workstations and networking equipment to servers, cloud environments, and enterprise applications.

One of the top driving factors for this market is the widespread adoption of cloud computing and remote work solutions. As companies shift to cloud-based platforms for greater flexibility and scalability, the need for reliable IT support to manage migrations, troubleshooting, and maintenance increases significantly. The expansion of remote work has further emphasized the importance of IT support in ensuring seamless virtual connectivity and collaboration.

Demand analysis indicates that increasing cybersecurity concerns also strongly influence IT support market growth. Organizations must protect sensitive data and comply with stringent regulations, which creates strong demand for IT security services such as monitoring, incident response, and risk assessment. Advanced technologies like AI and machine learning are increasingly adopted within IT support to enable predictive maintenance and faster problem resolution, improving system uptime and reducing operational losses.

Key Takeaways

- By approach, Reactive IT Services dominated with 65.4%, indicating organizations’ preference for troubleshooting-focused models.

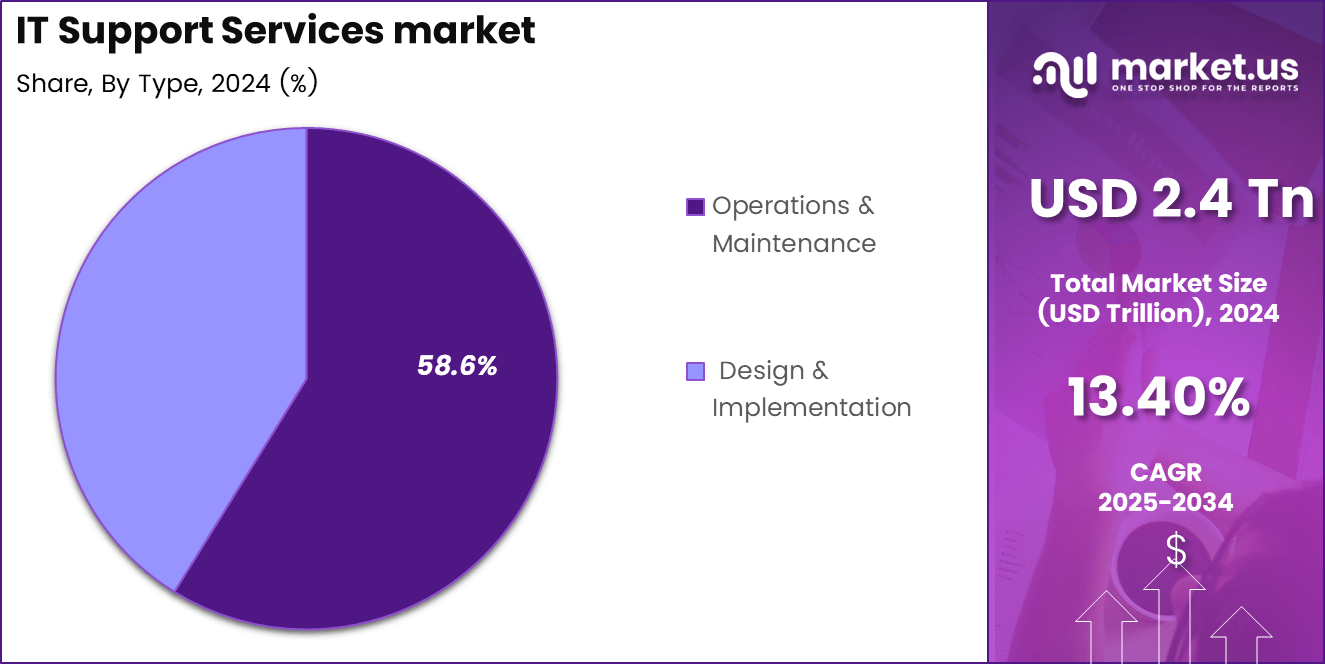

- By type, Operations & Maintenance held 58.6%, showing the central role of ongoing system upkeep in IT support.

- By application, Systems & Network Management led with 40.4%, underlining the importance of connectivity and infrastructure monitoring.

- By technology, AI & Machine Learning accounted for 42.6%, highlighting the rising role of intelligent automation in IT support.

- By deployment, On-premises solutions captured 60.6%, suggesting enterprises’ continued reliance on local setups despite cloud adoption.

- By enterprise size, Large Enterprises dominated with 74.7%, reflecting their heavy dependence on structured IT support systems.

- By end use, the BFSI sector held 30.3%, showing its strong demand for secure and reliable IT services.

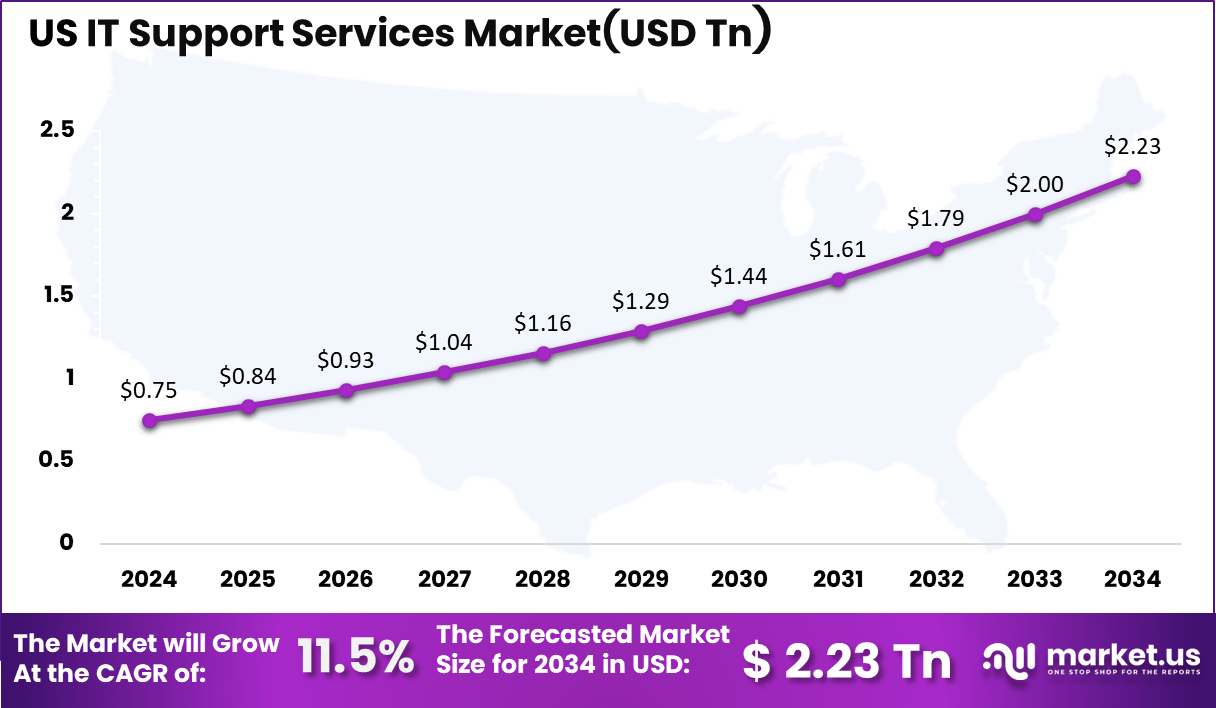

- Regionally, North America accounted for 36.8%, with the U.S. leading at around USD 0.75 trillion and supported by a CAGR of 11.5%.

Analysts’ Viewpoint

Technologies are reshaping IT support delivery. Artificial intelligence and machine learning are used to automate ticket triage, routing, and even first-level resolution. Remote monitoring and management (RMM) tools allow support providers to continuously track system health and proactively resolve issues. Self-service portals, chatbots, and virtual agents are increasingly expected features.

Investment opportunities in the IT Support Services market are abundant due to rapid digital transformation across industries. Investors focus on vendors offering cloud management, AI integration, and security solutions. Emerging markets in Asia-Pacific and Africa present strong growth potential due to increased digital adoption, along with venture capital interest in startups specializing in niche IT support offerings.

Businesses gain multiple benefits from IT support services. Apart from reducing downtime, organizations see boosts in employee satisfaction, as technical issues get resolved quickly, allowing staff to focus on core responsibilities. IT support enables better budget management by avoiding unpredictable costs and reducing the need for large in-house IT teams. Proactive monitoring prevents larger disruptions, and regular security audits lower the risk of data breaches.

Role of Generative AI

The role of generative AI in IT support services has become increasingly significant, with adoption rates doubling from 33% in 2023 to 71% in 2024. This surge highlights how organizations are leveraging AI-powered tools such as chatbots and virtual assistants to enhance customer interaction and speed up issue resolution.

Around 76% of companies considered integrating generative AI in their support functions in 2024, and about 42% of support leaders planned to use these solutions to optimize service delivery. Despite some concerns about data security and a talent gap in AI skills, generative AI is already helping service workers provide faster, more personalized assistance, making it a crucial factor in IT support modernization

US Market Size

The US IT Support Services market remains a dominant force globally, reflecting strong technological adoption and enterprise reliance on managed services. The market, valued at USD 0.75 trillion in 2024, is projected to reach USD 2.23 trillion by 2034, expanding at a CAGR of 11.5%.

In 2024, North America accounted for 36.8% of the global market, driven by its mature IT infrastructure and concentration of large enterprises. Strong adoption of advanced technologies, high digital dependency, and an emphasis on data security have positioned the region as a leading hub for IT support solutions.

By Approach

In 2024, the Reactive IT services accounted for 65.4% of the market. Many enterprises still rely on reactive models, where support is provided once issues arise. This approach remains common due to budgetary considerations and the perception that paying for services only when needed helps control costs. It is especially prevalent in organizations that have yet to transition fully toward proactive or predictive IT support frameworks.

However, growing system complexity is challenging the continued reliance on reactive services. As downtime directly impacts productivity and profitability, businesses are gradually reassessing reactive-only models. Over time, this may open more opportunities for blended approaches that combine reactive support with proactive monitoring to reduce disruptions.

By Type

In 2024, the Operations and maintenance represented 58.6% of the IT support services market. These functions form the backbone of IT support, covering areas like routine hardware upkeep, software patching, monitoring, and performance optimization. Organizations prioritize this segment to ensure ongoing business continuity and system reliability.

As digital transformation expands across industries, the operations and maintenance workload has multiplied. More applications, data streams, and connected devices require continuous monitoring. This growth has made operations and maintenance one of the most resource-heavy yet critical parts of IT support strategies.

By Application

In 2024, the Systems and network management commanded 40.4% of the market. Enterprises need effective network performance management to handle growing demands from cloud applications, remote work, and connected devices. The role of IT support here goes beyond troubleshooting to include traffic optimization, bandwidth allocation, and ensuring secure, fast communication channels.

The importance of this application is amplified by rising cyberthreats and compliance requirements. Continuous monitoring of systems and networks not only ensures performance but also strengthens resilience. This makes it one of the main areas where IT support teams allocate budgets and technical expertise.

By Technology

In 2024, the AI and machine learning accounted for 42.6% in IT support services. These technologies are being deployed for predictive analytics, chatbot-based help desks, and automated ticket resolutions. They allow organizations to resolve common queries faster, lower workloads on human agents, and identify issues before they impact end users.

The adoption of AI and machine learning in IT support is also tied to the pressure to optimize resources. Businesses increasingly see these tools as central to achieving scale while controlling costs. The focus is now shifting to aligning AI insights with human expertise to create more proactive and adaptive support environments.

By Deployment

In 2024, the On-premises deployment led with 60.6%. Many enterprises continue to favor this model for greater control, data security, and compliance with strict regulatory frameworks. Critical industries such as finance, defense, and healthcare often lean on on-premises deployment due to sensitivity of information and operational stability.

However, cloud-based models are gradually gaining traction. The flexibility and scalability of cloud support services are pushing some enterprises to adopt hybrid models. Yet, for now, the dominance of on-premises reflects the ongoing need for control over mission-critical systems.

By Enterprise Size

In 2024, the Large enterprises represented 74.7% of the IT support services market. These organizations typically operate complex IT infrastructure across global locations, which creates continuous demand for professional support at scale. Their heavy reliance on extensive data centers, networks, and mission-critical systems drives high spending on IT support.

The scale of requirements in large enterprises also pushes adoption of advanced support technologies like AI-driven monitoring. Smaller enterprises, while growing in adoption, still do not match this level of dependency. This explains why large enterprises dominate the market share.

By End Use

In 2024, the BFSI sector contributed 30.3%. Banking and financial institutions heavily depend on secure and uninterrupted digital operations. Any system downtime or vulnerabilities directly affect customer trust and transaction security, making IT support services indispensable in this sector.

Support requirements in BFSI have also grown with digital banking, mobile transactions, and regulatory mandates. With customer expectations for always-on services, BFSI continues to prioritize IT support for operational resilience and compliance

Key Market Segments

By Approach

- Reactive IT Services

- Proactive IT Services

By Type

- Design & Implementation

- Operations & Maintenance

By Application

- Systems & Network Management

- Data Management

- Application Management

- Security & Compliance Management

- Others

By Technology

- AI & Machine Learning

- Big Data Analytics

- Threat Intelligence

- Others

By Deployment

- On-premises

- Cloud

By Enterprise Size

- Small and Medium Enterprise (SMEs)

- Large Enterprise

By End Use

- BFSI

- Government

- Healthcare

- Manufacturing

- Media & Communications

- Retail

- IT & Telecom

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Emerging trends in IT support services for 2025 include a strong shift toward automation and AI-driven operations, which enable proactive and predictive support models. Automation reduces routine tasks and operational costs while enhancing service efficiency. Cloud computing remains another transformative factor, with hybrid infrastructures combining private and public cloud services to offer flexibility and scalability.

Cybersecurity has become a critical area, with more advanced threat detection and real-time monitoring solutions embedded in IT support agreements. Additionally, the rise of IoT and edge computing is poised to improve real-time data processing and reduce latency, further boosting IT operations’ agility and resilience.

Growth Factors

Several growth factors are driving the increasing demand for IT support services. The growing complexity of IT infrastructure and the rising frequency of cyber threats compel businesses to seek expert support to maintain uptime and safeguard assets. Small and medium-sized enterprises are increasingly outsourcing IT support to control costs while accessing specialized skills.

The continued migration to cloud environments intensifies the need for tailored support services to optimize cloud performance. Automation and AI integration into support workflows are expanding profitability for providers, and sectors like healthcare, fintech, and logistics create high-value demand due to their need for compliance and real-time system monitoring.

Driver Analysis

Increasing Reliance on Cloud and Remote IT Support

One key driver for the growth of IT support services is the rising dependence on cloud computing and remote IT infrastructure across industries. As businesses adopt cloud-based applications and remote work setups, their need for continuous, skilled IT support to maintain uptime and resolve technical issues promptly grows.

For instance, the expanding use of cloud platforms demands real-time monitoring and assistance, making IT support services essential for business continuity and operational efficiency. This driver significantly fuels demand as companies shift from in-house hardware to cloud services that require expert maintenance and troubleshooting.

Moreover, the trend toward remote work has intensified the need for 24/7 IT support accessible from anywhere. Organizations rely on support teams to manage issues ranging from software installation to cybersecurity threats remotely. This shift not only broadens the scope of IT support but also encourages service providers to enhance their offerings with intelligent tools and automation to handle remote service delivery efficiently.

Restraint Analysis

High Cost and Talent Shortage

A major restraint in the IT support services market is the high cost associated with hiring and retaining skilled IT professionals. Experienced technicians command rising salaries, and the limited availability of such talent, especially in cost-sensitive regions, hampers the scalability of IT support providers.

For example, small and medium businesses may find it financially challenging to afford quality IT support, slowing overall market adoption. This cost barrier restricts many companies from outsourcing or expanding their IT support operations.

Additionally, the shortage of experienced professionals impacts service quality and increases operational expenses as firms invest more in training and employee retention. The need to maintain competitive pay structures combined with rapid technological changes exacerbates this issue. This restraint leads to a gap between demand and supply of proficient support personnel, restraining the growth potential of the IT support services market.

Opportunities Analysis

Adoption of AI and Automation

The integration of artificial intelligence (AI) and automation in IT support services presents a significant opportunity for market expansion. AI-driven tools can automate routine tasks like ticket routing and initial diagnostics, which reduces response times and frees human support agents to focus on complex problems.

For instance, predictive analytics can foresee potential system failures before they occur, enabling proactive support and minimizing downtime. This opportunity allows IT service providers to improve efficiency while lowering costs, making support services more accessible to a broader range of businesses.

Advanced automation also boosts customer satisfaction through faster resolutions and more accurate problem identification. As digital transformation intensifies, AI-enabled support services are positioned to become standard practice, driving further growth and innovation within the IT support market.

Challenges Analysis

Handling High Volume and Complexity of Requests

One of the biggest challenges facing IT support services is managing the increasing volume and complexity of support requests. As organizations rely more on diverse technologies, the variety of issues reported grows, overwhelming support teams.

For example, support desks frequently receive requests from multiple communication channels, causing difficulties in prioritization and response management. This overload can lead to longer resolution times, missed tickets, and frustrated users. Without efficient ticketing systems and process automation, support personnel struggle to maintain quality service.

The challenge escalates further when support functions are spread across multiple vendors or geographies, creating coordination and accountability issues. Addressing this challenge requires investment in advanced management tools and streamlined workflows to maintain high service standards

Key Players Analysis

In the IT support services market, IBM, Microsoft, Amazon Web Services (AWS), and Oracle are recognized as dominant players. Their leadership is supported by broad service portfolios, global infrastructure, and strong enterprise adoption. These companies deliver cloud-based support, cybersecurity, and managed IT solutions that help businesses optimize performance, ensure reliability, and strengthen digital transformation efforts.

Other major contributors such as Cisco Systems, Hewlett Packard Enterprise (HPE), Huawei, and DXC Technology strengthen the market with specialized IT support services. These include network management, hardware maintenance, and integrated IT infrastructure solutions. By offering tailored support across industries, they play a critical role in helping enterprises modernize their IT operations while maintaining system efficiency and security.

Additional participants including Avaya, Fortinet, Juniper Networks, and Broadcom (Symantec) add depth to the competitive landscape. Their services focus on unified communications, threat management, and endpoint security support. These companies are especially important in addressing the rising demand for secure, scalable, and flexible IT environments.

Top Key Players

- Amazon Web Services, Inc.

- Avaya

- Cisco Systems, Inc.

- DXC Technology Company

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Juniper Networks, Inc.

- Microsoft

- Broadcom (Symantec Corporation)

- Oracle

- Others

Recent Development

- In January 2025, IBM announced its intent to acquire Applications Software Technology LLC, a consultancy specializing in Oracle Cloud Application transformations for public sector clients, enhancing IBM’s Oracle cloud capabilities and consulting services in regulated industries.

- In January 2024, Amazon Web Services (AWS) launched multiple new services including ECS Service Connect in Canada West and QuickSight expansions, focusing on cloud infrastructure and small-medium business solutions early in the year. AWS continued driving generative AI and cloud innovations as a priority.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Tn Forecast Revenue (2034) USD 8.44 Tn CAGR(2025-2034) 13.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Approach (Reactive IT Services, Proactive IT Services), By Type (Design & Implementation, Operations & Maintenance) By Application (Systems & Network Management, Data Management, Application Management, Security & Compliance Management, Others), By Technology (AI & Machine Learning, Big Data Analytics, Threat Intelligence, Others), By Deployment (On-premises, Cloud), By Enterprise Size (Small and Medium Enterprise (SMEs), Large Enterprise), By End Use (BFSI, Government, Healthcare, Manufacturing, Media & Communications, Retail, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Avaya, Cisco Systems, Inc., DXC Technology Company, Fortinet, Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM Corporation, Juniper Networks, Inc., Microsoft, Broadcom (Symantec Corporation), Oracle, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  IT Support Services MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

IT Support Services MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services, Inc.

- Avaya

- Cisco Systems, Inc.

- DXC Technology Company

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Juniper Networks, Inc.

- Microsoft

- Broadcom (Symantec Corporation)

- Oracle

- Others