Isothermal Nucleic Acid Amplification Technology Market By Product (Reagent and Instruments) By Technology (LAMP, HDA, NASBA, NEAR, SDA, SPIA, and Others) By Application (Infectious Disease Diagnostics, Blood Screening, Cancer, and Others) By End-use (Hospitals, Central & Reference Labs, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156459

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

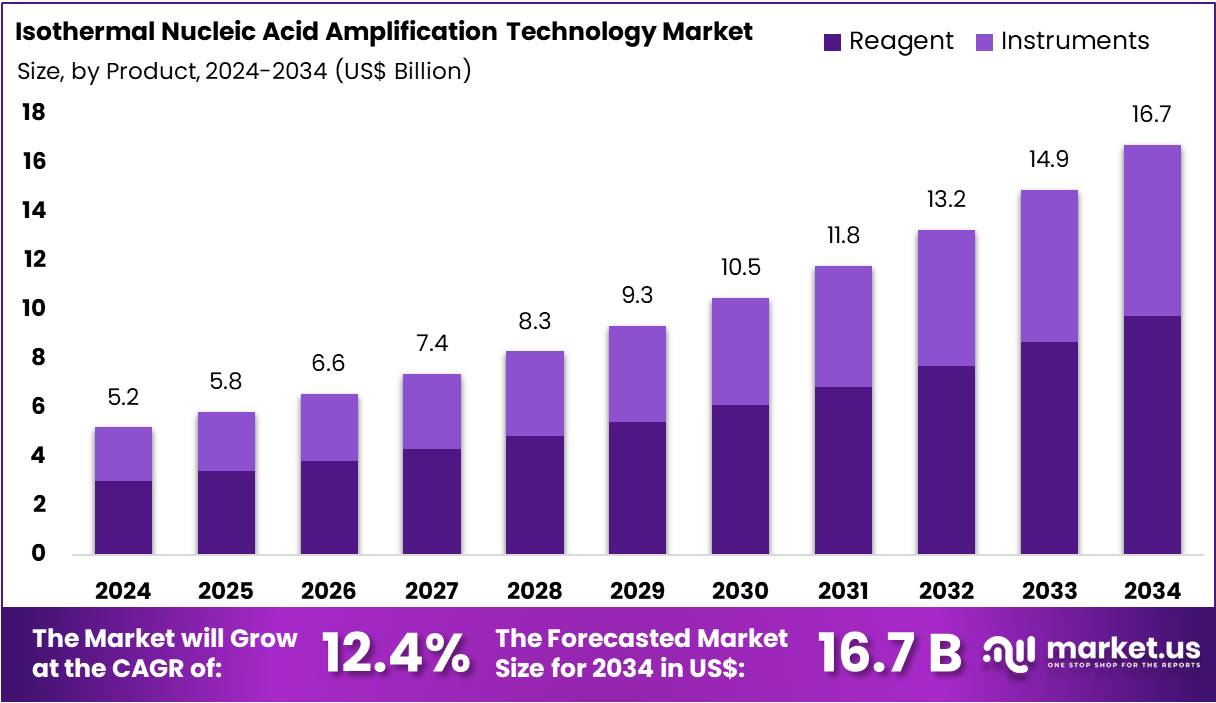

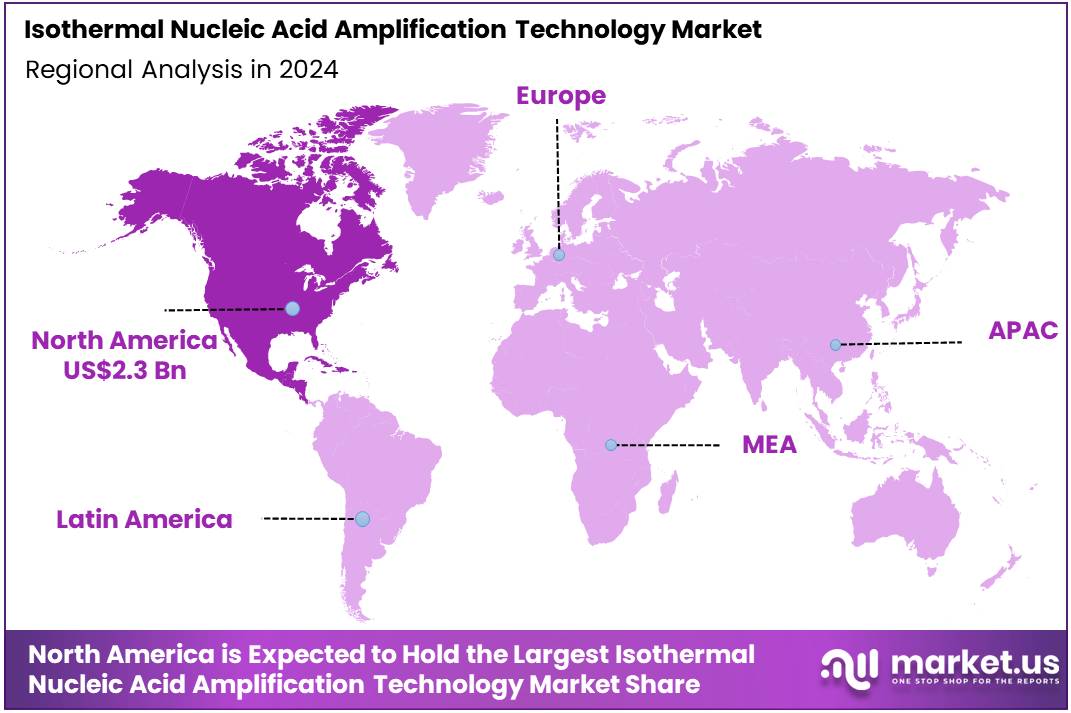

The Isothermal Nucleic Acid Amplification Technology Market size is expected to be worth around US$ 16.7 billion by 2034 from US$ 5.2 billion in 2024, growing at a CAGR of 12.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.5% share and holds US$ 2.3 Billion market value for the year.

Rising demand for rapid and decentralized diagnostics is a fundamental driver of the isothermal nucleic acid amplification technology (INAAT) market. Unlike conventional PCR methods that require expensive thermal cycling equipment, INAAT allows for the exponential amplification of genetic material at a constant temperature. This simplifies the process, making it suitable for point-of-care (POC) and at-home testing, which is particularly critical for infectious disease surveillance and outbreak management. With the World Health Organization (WHO) reporting that lower respiratory infections alone claimed over 2.5 million lives in 2021, the need for rapid, accessible diagnostics to address such widespread communicable diseases is immense and ongoing.

Growing technological advancements are opening new application areas and enhancing the market’s capabilities. The development of advanced techniques, such as Loop-Mediated Isothermal Amplification (LAMP) and Recombinase Polymerase Amplification (RPA), is improving assay specificity and sensitivity. These innovations, coupled with the miniaturization of hardware, are enabling the creation of portable, battery-powered diagnostic devices. A prime example of this trend is the February 2023 emergency use authorization granted by the U.S. Food and Drug Administration (FDA) for the first over-the-counter (OTC) diagnostic test capable of detecting both influenza A and B, as well as SARS-CoV-2. This landmark approval highlights the potential of INAAT to transform consumer-facing diagnostics.

Increasing focus on high-throughput screening and multi-analyte testing is creating significant opportunities for market expansion. The Centers for Disease Control and Prevention (CDC) provides data on the rise of multi-analyte assays, which can test for multiple pathogens from a single sample, an approach that is gaining favor in both clinical and public health settings. This capability is vital for differentiating between co-circulating respiratory viruses with similar symptoms, like influenza and COVID-19. Furthermore, the integration of INAAT with digital health platforms is improving data management and real-time monitoring of disease outbreaks. The CDC’s own modeling efforts, which track the time-varying reproductive number for various illnesses, rely on timely data to inform public health strategies, a need that rapid INAAT-based tests are uniquely positioned to meet.

Key Takeaways

- In 2024, the market for isothermal nucleic acid amplification technology generated a revenue of US$ 5.2 billion, with a CAGR of 12.4%, and is expected to reach US$ 16.7 billion by the year 2034.

- The product segment is divided into reagent and instruments, with reagent taking the lead in 2023 with a market share of 58.3%.

- Considering technology, the market is divided into LAMP, HDA, NASBA, NEAR, SDA, SPIA, and others. Among these, LAMP held a significant share of 46.4%.

- Concerning the application segment, the infectious disease diagnostics sector stands out as the dominant player, holding the largest revenue share of 56.7% in the isothermal nucleic acid amplification technology market.

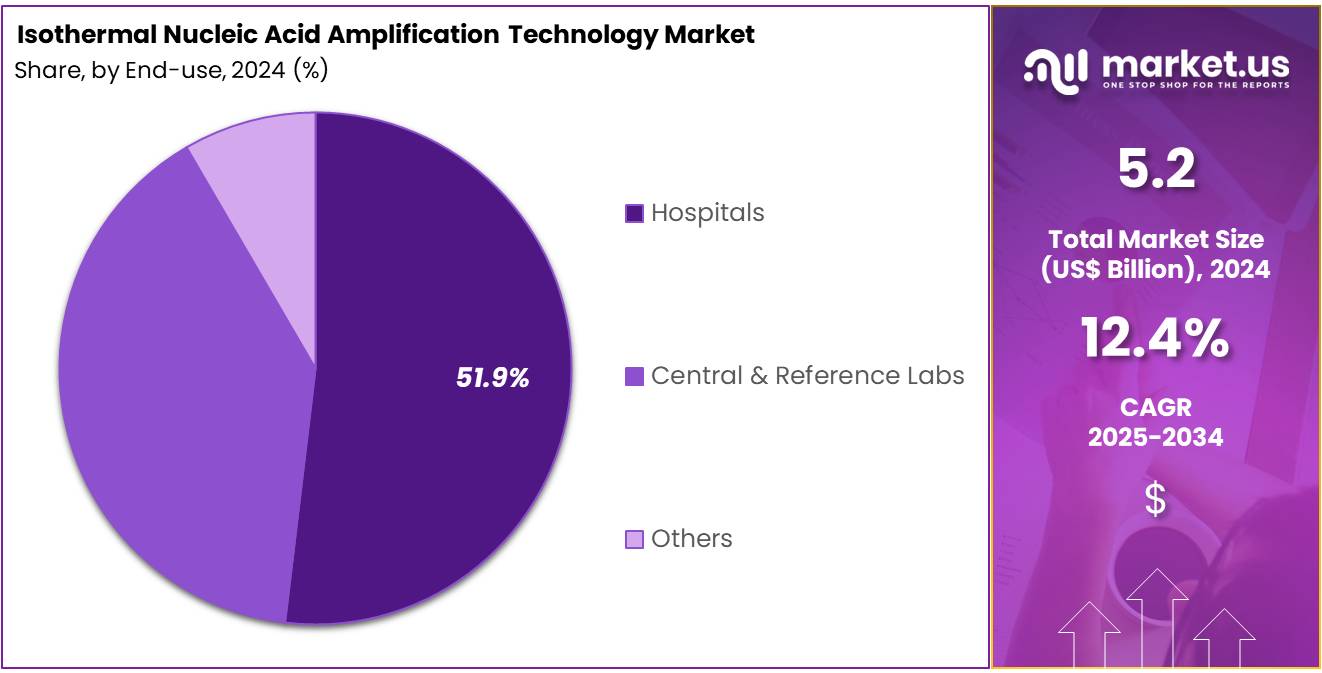

- The end-use segment is segregated into hospitals, central & reference labs, and others, with the hospitals segment leading the market, holding a revenue share of 51.9%.

- North America led the market by securing a market share of 43.5% in 2023.

Product Analysis

Reagents account for 58.3% of the product segment in the isothermal nucleic acid amplification technology market. This growth is expected to continue as reagents play a crucial role in nucleic acid amplification procedures, particularly in rapid diagnostic tests. The increasing prevalence of infectious diseases, such as COVID-19, tuberculosis, and hepatitis, is likely to drive the demand for reagents used in diagnostic testing. As the focus on point-of-care diagnostics and self-testing solutions rises, the demand for easy-to-use reagents that facilitate quick and accurate results is projected to increase.

Additionally, advancements in reagent formulations, such as more sensitive and specific molecular probes, will likely enhance their adoption in molecular diagnostics. The growing preference for isothermal amplification methods, such as LAMP, which do not require thermal cycling equipment, will further boost reagent demand. Reagents’ ability to be used in various diagnostic applications, including infectious diseases and cancer, will continue to fuel their growth in the market.

Technology Analysis

LAMP (Loop-mediated Isothermal Amplification) accounts for 46.4% of the technology segment in the isothermal nucleic acid amplification technology market. This growth is expected to continue due to LAMP’s advantages, including its rapid processing time, simplicity, and the ability to perform without specialized equipment. LAMP is increasingly used in point-of-care diagnostics, where quick results are crucial.

As the demand for molecular diagnostics grows globally, particularly for infectious disease detection, LAMP is anticipated to become more widely adopted. Its ability to detect pathogens in resource-limited settings without the need for complex laboratory infrastructure makes it particularly suitable for use in developing regions. Furthermore, LAMP’s broad application scope, from diagnosing infectious diseases to detecting cancer biomarkers, is likely to contribute to its sustained growth. The cost-effectiveness and versatility of LAMP technology are expected to drive its continued expansion in the diagnostics market.

Application Analysis

Infectious disease diagnostics account for 56.7% of the application segment in the isothermal nucleic acid amplification technology market. This growth is expected to continue as the global incidence of infectious diseases, including viral, bacterial, and parasitic infections, rises. The demand for rapid, accurate, and cost-effective diagnostic tools is projected to grow, especially in low-resource settings. Isothermal amplification technologies, such as LAMP, are increasingly used in infectious disease diagnostics because they can provide results in a short amount of time without the need for sophisticated equipment.

The ongoing focus on global health issues, including the need for effective detection methods for emerging infectious diseases, is likely to drive the expansion of this segment. Additionally, the growing adoption of point-of-care testing solutions for diseases like COVID-19, malaria, and tuberculosis is anticipated to contribute significantly to the market’s growth. Governments and healthcare organizations are increasingly investing in rapid diagnostics, further fueling the growth of this segment.

End-Use Analysis

Hospitals represent 51.9% of the end-user segment in the isothermal nucleic acid amplification technology market. This growth is expected to continue as hospitals remain the primary settings for molecular diagnostic testing, especially for critical and emergency care. The increasing incidence of infectious diseases and the need for precise, rapid diagnostics in hospitals are expected to drive the demand for isothermal amplification technologies.

Hospitals are likely to adopt advanced molecular diagnostics to improve patient outcomes, particularly in the early detection of infectious diseases and cancer. As healthcare providers continue to prioritize fast, accurate testing, especially in emergency and intensive care units, the demand for technologies like LAMP and other isothermal amplification methods is projected to rise.

Furthermore, the increasing focus on hospital-based point-of-care testing, along with the growing trend toward personalized medicine, will likely drive further adoption of isothermal nucleic acid amplification technology in hospitals.

Key Market Segments

By Product

- Reagent

- Instruments

By Technology

- LAMP

- HDA

- NASBA

- NEAR

- SDA

- SPIA

- Others

By Application

- Infectious Disease Diagnostics

- Blood Screening

- Cancer

- Others

By End-use

- Hospitals

- Central & Reference Labs

- Others

Drivers

The increasing demand for rapid and decentralized diagnostics is driving the market

The market for isothermal nucleic acid amplification technology (INAAT) is experiencing significant growth, primarily driven by a global shift toward rapid, accurate, and decentralized diagnostic testing. Unlike traditional methods like PCR, which require complex and costly thermal cycling equipment, these technologies operate at a constant temperature, enabling their use in simpler, portable devices. This makes them ideal for point-of-care (POC) settings, such as clinics, emergency rooms, and even at-home testing.

The need for this speed and accessibility has been particularly acute in the context of infectious disease outbreaks. For instance, according to the U.S. Centers for Disease Control and Prevention (CDC), the U.S. saw 9,521 reported cases of foodborne illness in 2023 alone. The ability to perform rapid, on-site testing for such pathogens is crucial for timely treatment and containment. This technology is also finding a strong foothold in veterinary diagnostics and agricultural applications, where quick results in the field can prevent the spread of disease and protect livestock and crops.

Restraints

High manufacturing costs and a lack of awareness are restraining the market

A significant restraint on the market is the relatively high cost of developing and manufacturing the complex reagents and specialized diagnostic platforms required for this technology. While the end-user device may be simpler than a PCR machine, the proprietary enzymes and primers necessary for the isothermal reaction contribute to a higher cost per test. This can be a barrier to widespread adoption in resource-constrained settings, where budgets for diagnostic services are limited.

Additionally, while the technology is gaining traction, there remains a lack of widespread awareness and familiarity among some clinicians and lab personnel who are more accustomed to the established PCR workflow. While there is growing interest in decentralized testing, traditional lab-based systems remain the dominant force, with a high volume of testing still concentrated in large facilities.

Opportunities

The expansion into non-clinical applications is creating growth opportunities

The market is presented with significant opportunities from its increasing adoption in non-clinical applications, such as food safety, environmental monitoring, and agriculture. This technology offers a robust solution for on-site, rapid detection of pathogens, genetically modified organisms, and environmental contaminants, all without the need for sophisticated laboratory infrastructure.

For example, a food processing facility can use this technology to quickly test for bacterial contamination, preventing costly product recalls and protecting public health. This expansion is driven by both regulatory pressures and a business need to ensure quality control throughout the supply chain. The U.S. Department of Agriculture (USDA) is increasingly promoting the use of rapid diagnostics for field-based testing to detect plant and animal diseases early. The ability to perform these tests outside of a traditional lab setting is a key differentiator for the technology, opening up new, large-scale markets that are not accessible to conventional methods.

Latest Trends

The development of integrated, all-in-one diagnostic platforms is a recent trend

A significant trend in 2024 is the shift toward developing integrated, all-in-one diagnostic platforms that combine sample preparation, amplification, and detection into a single, user-friendly device. These new platforms are designed to be “sample-to-answer” systems, minimizing the need for manual handling and technical expertise. The goal is to make sophisticated molecular diagnostics as simple as possible for use at the point-of-care, eliminating the need for separate instruments and multiple procedural steps. This trend is evident in the number of new integrated devices that have received regulatory clearance.

For instance, the U.S. Food and Drug Administration (FDA) has granted several Emergency Use Authorizations (EUAs) for multi-analyte, integrated systems that use isothermal amplification to detect respiratory viruses. This shows a clear regulatory and market acceptance of these advanced, streamlined platforms. This integration is poised to accelerate the adoption of the technology, as it addresses a key logistical barrier to widespread implementation.

Impact of Macroeconomic / Geopolitical Factors

The Isothermal Nucleic Acid Amplification Technology (INAAT) market is facing macroeconomic headwinds that directly influence its operational costs and a geopolitical landscape that threatens supply chain stability. Global inflation has put upward pressure on the price of key materials like specialized enzymes and reagents, making the manufacturing process more expensive. Geopolitical tensions, particularly those impacting global trade routes and fostering protectionist policies, can disrupt the flow of essential components from international suppliers.

For example, US tariffs on some medical devices and supplies from certain countries raise procurement costs for American healthcare providers. Despite these challenges, the market’s fundamental drivers remain strong. The persistent global demand for rapid, point-of-care diagnostics for infectious diseases fuels continued investment and innovation in INAAT platforms. Companies are responding by diversifying their sourcing strategies and investing in domestic manufacturing capabilities, which helps build a more resilient and secure supply chain to meet future demand.

Regional Analysis

North America is leading the Isothermal Nucleic Acid Amplification Technology Market

The North American isothermal nucleic acid amplification technology (INAAT) market holds a commanding 43.5% share of the global market in 2024. This dominant position is a direct result of the region’s sophisticated healthcare infrastructure, high disease burden, and a strong impetus for decentralized diagnostics.

The U.S., in particular, experiences a significant number of infectious disease cases annually, driving a consistent and critical need for rapid molecular testing. According to the Centers for Disease Control and Prevention’s (CDC) latest available data, there were approximately 31,800 new HIV infections in the U.S. in 2022, a figure that underscores the persistent public health challenges that require rapid, accurate diagnostic tools.

The market is further propelled by the U.S. Food and Drug Administration’s (FDA) proactive approach, with a number of INAAT-based tests receiving Emergency Use Authorizations (EUAs) that have streamlined their clinical adoption and deployment in non-laboratory settings. This robust ecosystem of public health needs, regulatory support, and an advanced healthcare network collectively reinforces North America’s leadership in this diagnostic segment.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific market for isothermal nucleic acid amplification technology is anticipated to experience the fastest growth during the forecast period. This is largely a result of rapidly improving healthcare infrastructure, a vast and aging population, and a significant increase in government and private sector investment in disease diagnostics.

The region faces a substantial and growing burden from infectious diseases. The World Health Organization (WHO) has consistently highlighted the high prevalence of diseases such as tuberculosis, which affects millions of people each year, creating an immense and ongoing demand for efficient diagnostic tools. A shift towards patient-centric care is also projected to increase the need for rapid, on-site testing solutions, which this technology is uniquely positioned to provide.

Governments throughout the region are dedicating more capital to public health and research, which is likely to support the establishment of new diagnostic clinics and laboratories. These efforts, combined with a rising awareness of advanced diagnostic benefits, are projected to propel the market forward, allowing it to address the immense healthcare needs of the region’s population.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the nucleic acid amplification market are primarily driving growth through a strategic focus on portability, automation, and expanding their application into new fields. Companies are actively developing smaller, more user-friendly diagnostic platforms that do not require complex thermal cycling, which allows for their use in point-of-care and field settings. They are also investing in automation and data integration to streamline workflows and enhance the accuracy of their tests.

Furthermore, manufacturers are diversifying the use of their technology beyond traditional infectious disease diagnostics to include applications in oncology, genetic screening, and food safety, addressing a wider range of market needs. This approach positions them as essential partners in the evolving landscape of decentralized diagnostics.

Hologic, Inc., an American medical technology company, is a prominent player in the diagnostic and medical imaging sectors, with a core focus on women’s health. The company is well-regarded for its molecular diagnostics and provides a wide array of products, including tests that utilize isothermal amplification. Hologic consistently strengthens its market position through strategic acquisitions and a commitment to research and development, particularly in areas that improve disease detection and treatment. The company’s strategic emphasis on its molecular diagnostics franchise enables it to deliver high-throughput systems and assays to laboratories and healthcare facilities worldwide.

Top Key Players in the Isothermal Nucleic Acid Amplification Technology Market

- BD

- bioMerieux SA

- Hologic Inc

- Lucigen

- Meridian Bioscience, Inc

- OptiGene Limited

- QIAGEN

- Quidel Corporation

- Thermo Fisher Scientific, Inc.

- Ustar Biotechnologies Ltd

Recent Developments

- In March 2024: BD, a global leader in medical technology, initiated the enrollment of its first patient in the “AGILITY” study. This investigational device exemption (IDE) study aims to evaluate the safety and efficacy of the BD Vascular Covered Stent in treating Peripheral Arterial Disease (PAD).

- In March 2024: Thermo Fisher Scientific Inc., a global leader in science services, launched its CorEvitas syndicated clinical registry fo cusing on generalized pustular psoriasis (GPP). This new registry, now open for enrollment, is the 10th in the series, providing essential real-world evidence (RWE) on clinical outcomes and patient-reported experiences for GPP.

Report Scope

Report Features Description Market Value (2024) US$ 5.2 billion Forecast Revenue (2034) US$ 16.7 billion CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Reagent and Instruments) By Technology (LAMP, HDA, NASBA, NEAR, SDA, SPIA, and Others) By Application (Infectious Disease Diagnostics, Blood Screening, Cancer, and Others) By End-use (Hospitals, Central & Reference Labs, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BD, bioMerieux SA, Hologic Inc, Lucigen, Meridian Bioscience, Inc, OptiGene Limited, QIAGEN, Quidel Corporation, Thermo Fisher Scientific, Inc., Ustar Biotechnologies Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Isothermal Nucleic Acid Amplification Technology MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Isothermal Nucleic Acid Amplification Technology MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BD

- bioMerieux SA

- Hologic Inc

- Lucigen

- Meridian Bioscience, Inc

- OptiGene Limited

- QIAGEN

- Quidel Corporation

- Thermo Fisher Scientific, Inc.

- Ustar Biotechnologies Ltd