Global Isononanoic Acid Market Size, Share, And Business Benefits By Product Type (Synthetic Isononanoic Acid, Natural Isononanoic Acid), By Purity (Up to 90%, 90% to 95%, 95% to 97%, Above 97%), By Application (Lubricants, Plasticizers, Coatings, Adhesives, Others), By End-use Industry (Automotive, Construction, Electronics, Personal care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153986

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

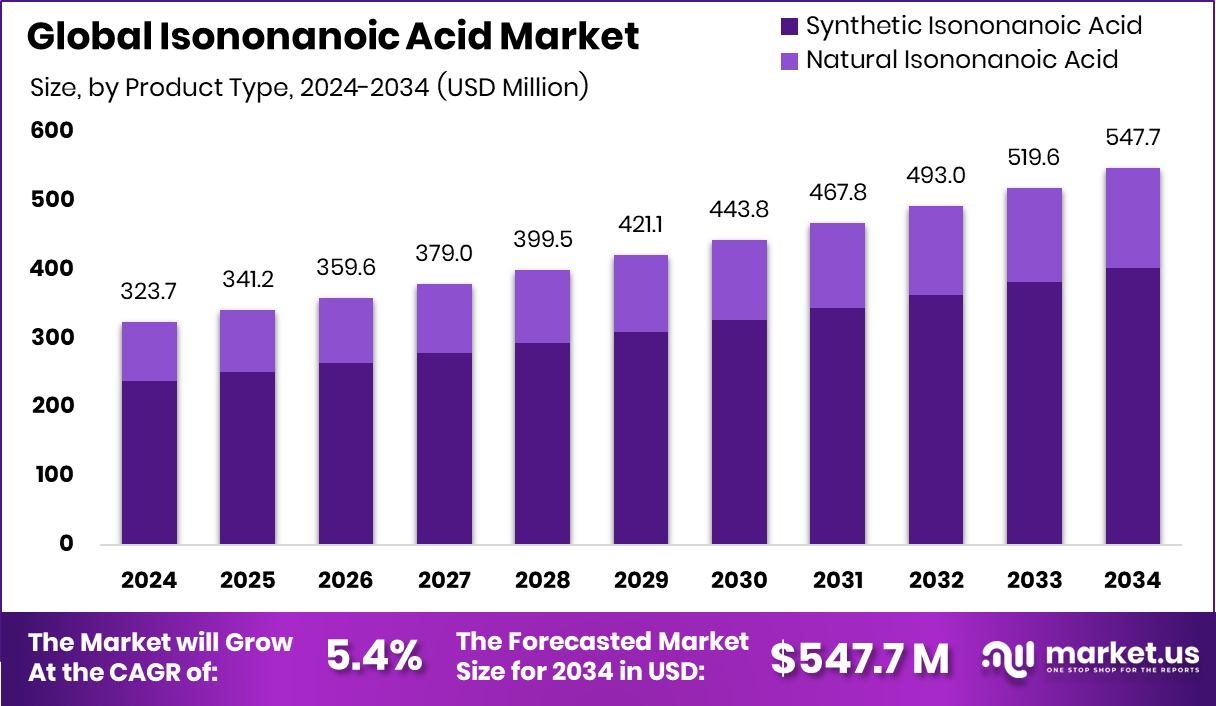

The Global Isononanoic Acid Market is expected to be worth around USD 547.7 million by 2034, up from USD 323.7 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. Asia-Pacific dominated with USD 156.0 Mn, driven by rising lubricant applications regionally.

Isononanoic acid is a branched-chain synthetic carboxylic acid primarily derived from isononyl alcohol through oxidation. It is a colorless, low-volatility liquid that exhibits excellent thermal and hydrolytic stability. Its molecular structure makes it particularly useful as a building block in the production of esters, which are commonly used in lubricants, coatings, adhesives, and plasticizers. Due to its stable chemical nature and resistance to oxidation, it finds wide applications in both industrial and specialty chemical formulations.

The isononanoic acid market refers to the global trade, production, and application of this compound across various industries. It plays a critical role in sectors like automotive, construction, electronics, and personal care due to its use in high-performance lubricants, corrosion inhibitors, and cosmetic formulations. The demand is closely tied to trends in industrial manufacturing, infrastructure development, and synthetic lubricant production.

One of the primary growth factors for the isononanoic acid market is its increasing use in synthetic lubricants. With growing demand for high-efficiency engines and machines, industries are shifting towards synthetic and high-performance lubricants, where isononanoic acid-based esters are essential for stability under extreme conditions.

Rising demand is also being driven by the electronics and coatings sectors. The compound is used in corrosion-resistant formulations for electrical components and advanced coatings, especially in environments with high temperature and humidity. This is particularly relevant as electronics become more compact and sensitive, requiring reliable protection.

Key Takeaways

- The Global Isononanoic Acid Market is expected to be worth around USD 547.7 million by 2034, up from USD 323.7 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Synthetic isononanoic acid dominated the isononanoic acid market with a 73.6% share in 2024.

- The above 97% purity segment captured 38.5% of the Isononanoic Acid Market due to high-performance needs.

- Lubricants accounted for 37.1% of the Isononanoic Acid Market, driven by demand for synthetic fluids.

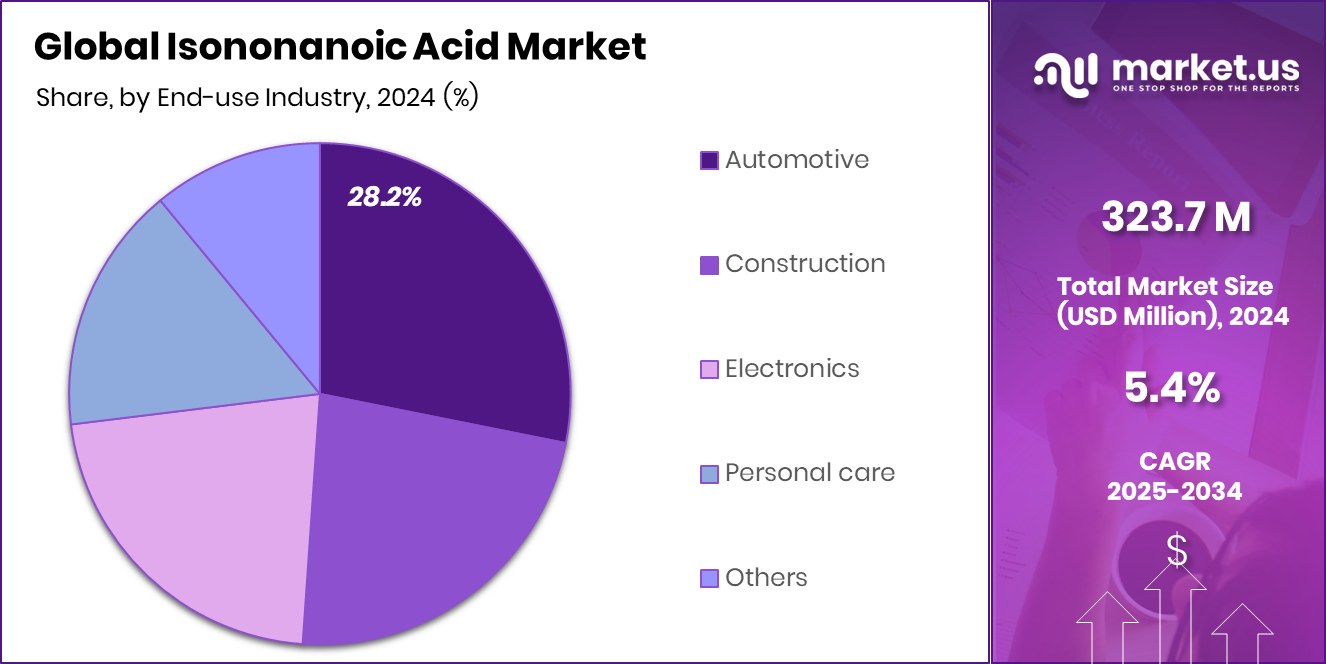

- The automotive industry led the Isononanoic Acid Market’s end-use segment with a 28.2% contribution in 2024.

- Strong industrial growth in Asia-Pacific fueled demand, contributing 48.20% market share.

By Product Type Analysis

Synthetic Isononanoic Acid dominates 73.6% in the global market share.

In 2024, Synthetic Isononanoic Acid held a dominant market position in the By Product Type segment of the Isononanoic Acid Market, with a 73.6% share. This significant share can be attributed to its consistent quality, high purity levels, and suitability for industrial-scale applications.

Synthetic isononanoic acid is widely preferred in sectors such as lubricants, coatings, and personal care, where precise formulation standards and stable performance are essential. Its chemical stability under high temperatures and oxidation resistance make it ideal for use in high-performance lubricants and specialty esters.

The synthetic variant also offers enhanced compatibility with a wide range of base materials, improving its effectiveness in both functional and additive applications. The ability to scale production efficiently has further supported its widespread adoption across regions, especially in industries that demand uniformity and compliance with regulatory standards.

Moreover, as industries continue to emphasize durability, thermal stability, and longer product lifespans, synthetic isononanoic acid is expected to maintain its leadership in this segment. The robust growth in end-use sectors such as automotive, electronics, and industrial manufacturing has contributed to its strong market positioning in 2024, reinforcing synthetic isononanoic acid’s role as a key component in modern industrial formulations.

By Purity Analysis

Above 97% purity leads with 38.5% market share segment.

In 2024, Above 97% held a dominant market position in the By Purity segment of the Isononanoic Acid Market, with a 38.5% share. This purity grade is widely preferred in applications that demand high-performance characteristics and precise chemical composition.

Industries such as lubricants, coatings, and personal care formulations often rely on isononanoic acid with purity levels above 97% due to its superior thermal stability, low volatility, and consistent molecular structure. These qualities are essential for maintaining product performance, especially under demanding environmental or operational conditions.

The preference for above 97% purity also reflects stringent quality standards adopted by manufacturers and end-users across various sectors. This level of purity ensures reduced impurities, enhanced reaction control, and improved shelf life of finished products. As a result, it is particularly suited for high-end formulations where consistency and reliability are non-negotiable.

The segment’s dominance in 2024 also indicates growing end-user demand for materials that meet strict compliance and quality requirements. With industrial operations increasingly shifting towards precision and high efficiency, the demand for higher-purity raw materials like isononanoic acid is likely to remain strong, reinforcing the segment’s leading market position.

By Application Analysis

Lubricants hold a 37.1% share in the isononanoic acid market application.

In 2024, Lubricants held a dominant market position in the By Application segment of the Isononanoic Acid Market, with a 37.1% share. This strong market presence is mainly attributed to the growing use of isononanoic acid-based esters in the formulation of high-performance synthetic lubricants.

The compound offers excellent thermal and oxidative stability, making it a preferred ingredient for lubricants used in automotive, industrial machinery, and precision equipment. These lubricants help reduce friction, enhance operational efficiency, and extend equipment lifespan, which aligns with industry demands for reliability and long-term performance.

The increasing adoption of energy-efficient systems and low-viscosity lubricants has further supported the use of isononanoic acid in this segment. It enables the development of lubricants that perform well across a wide range of temperatures, ensuring smooth equipment operation even under extreme conditions.

Its compatibility with other base oils and additives also makes it a versatile component in lubricant formulations. The segment’s 37.1% share in 2024 reflects the rising demand for advanced lubrication solutions, driven by the need for improved fuel economy, reduced maintenance, and compliance with stricter emission norms.

By End-use Industry Analysis

The automotive industry captures 28.2% of the end-use isononanoic acid market.

In 2024, Automotive held a dominant market position in the By End-use Industry segment of the Isononanoic Acid Market, with a 28.2% share. This leadership is driven by the increasing demand for high-performance lubricants and coolant additives used in modern vehicles.

Isononanoic acid plays a crucial role in the production of synthetic esters that enhance the thermal and oxidative stability of automotive lubricants, which are essential for ensuring fuel efficiency, reducing wear and tear, and extending engine life.

The automotive industry’s shift toward more efficient and durable engines has increased the need for advanced chemical components that can perform under high-temperature and high-stress conditions. Isononanoic acid meets these requirements, making it a key material in formulating lubricants for internal combustion engines, electric vehicles, and transmission systems.

Additionally, its role in enhancing corrosion resistance and fluid longevity further supports its widespread use in automotive maintenance products. The segment’s 28.2% share in 2024 reflects the industry’s continued focus on performance, emissions reduction, and long-term operational efficiency. With vehicle manufacturers and service providers prioritizing advanced material inputs, the automotive sector remains a primary driver of demand within the isononanoic acid market.

Key Market Segments

By Product Type

- Synthetic Isononanoic Acid

- Natural Isononanoic Acid

By Purity

- Up to 90%

- 90% to 95%

- 95% to 97%

- Above 97%

By Application

- Lubricants

- Plasticizers

- Coatings

- Adhesives

- Others

By End-use Industry

- Automotive

- Construction

- Electronics

- Personal care

- Others

Driving Factors

Rising Use of Synthetic Lubricants in Industries

One of the main driving factors for the isononanoic acid market is the increasing demand for synthetic lubricants across various industries. Isononanoic acid is widely used to produce high-performance esters that enhance the quality of lubricants. These lubricants are important in automotive engines, industrial machinery, and heavy equipment where heat, pressure, and wear are common.

As industries seek longer equipment life, better fuel efficiency, and lower maintenance costs, they prefer synthetic lubricants made with stable compounds like isononanoic acid. Its thermal and chemical stability ensures smooth performance even under extreme conditions. This growing industrial shift toward efficient and advanced lubrication solutions is playing a strong role in increasing the market demand for isononanoic acid globally.

Restraining Factors

High Production Costs Limit Widespread Market Adoption

A key restraining factor in the isononanoic acid market is the high cost of production. Manufacturing isononanoic acid involves complex chemical processes and requires advanced facilities, which increases operational expenses. In addition, maintaining high purity levels and consistent quality further raises costs. These high production costs are often passed on to end-users, making products containing isononanoic acid more expensive compared to alternatives.

As a result, some industries—especially in cost-sensitive regions—may hesitate to adopt it widely. This pricing challenge affects market penetration, particularly in developing markets where budget constraints influence material choices. Until more cost-efficient production methods are developed, the growth of the isononanoic acid market may face limitations due to its relatively high price point.

Growth Opportunity

Growing Demand for Eco-Friendly Industrial Chemicals Globally

A major growth opportunity for the isononanoic acid market lies in the rising global demand for environmentally friendly and sustainable industrial chemicals. Governments and industries are becoming more focused on reducing environmental impact, leading to stricter regulations on emissions, waste, and chemical safety. Isononanoic acid, known for its thermal stability and potential for use in low-toxicity formulations, fits well into this trend.

It can be used in biodegradable lubricants and coatings that meet eco-label requirements, making it attractive to manufacturers seeking greener alternatives. As more companies invest in sustainable production and eco-compliant products, the need for safe, high-performance ingredients like isononanoic acid is expected to grow, opening new opportunities in green chemistry and cleaner industrial solutions.

Latest Trends

Increasing Adoption of High-Efficiency Synthetic Lubricants

A key recent trend in the isononanoic acid market is the increasing use of high-efficiency synthetic lubricants. Advances in lubricant formulations have placed greater emphasis on durability, thermal resilience, and energy efficiency. Isononanoic acid is a preferred ingredient in the creation of synthetic esters that deliver stable performance under extreme temperatures and high-pressure conditions.

This trend is evident in industries such as automotive, aerospace, and heavy machinery, where robust lubrication solutions offer significant benefits in reducing wear, improving fuel economy, and extending service intervals. As equipment technology advances toward higher performance standards, the demand for advanced lubricant formulations is rising.

Regional Analysis

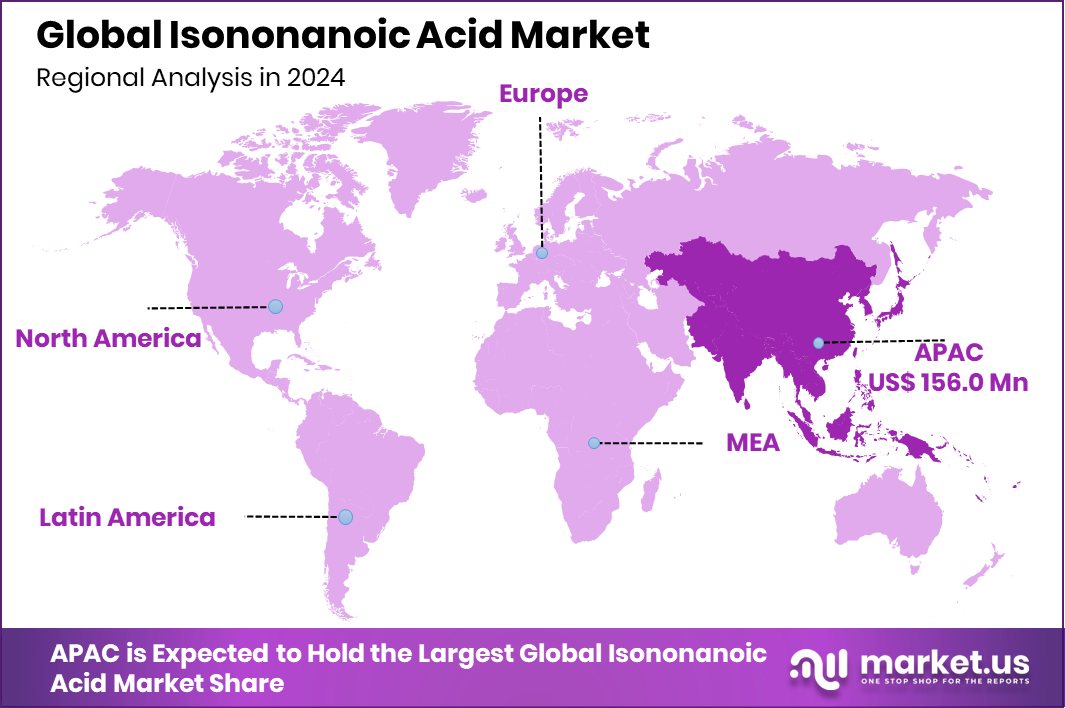

In 2024, Asia-Pacific held a 48.20% share, reaching USD 156.0 million.

In 2024, Asia-Pacific emerged as the leading region in the Isononanoic Acid Market, capturing 48.20% of the total market share and reaching a valuation of USD 156.0 million. This dominance is attributed to the region’s expanding industrial base, strong manufacturing activity, and increasing demand for high-performance lubricants and coatings.

Countries in Asia-Pacific are witnessing steady growth in automotive production, electronics manufacturing, and construction, all of which contribute to the rising use of isononanoic acid in synthetic lubricants and corrosion-resistant formulations.

Other regions, including North America, Europe, Latin America, and the Middle East & Africa, held comparatively smaller shares during the same year. However, these regions are gradually showing interest in eco-friendly chemical formulations and industrial efficiency, which aligns with the applications of isononanoic acid. While adoption is steady across these regions, the scale of demand remains highest in Asia-Pacific due to infrastructure development and industrial expansion.

The region’s large-scale consumption and production capabilities have solidified its position as the most significant market for isononanoic acid in 2024. This trend is expected to continue as end-use industries invest further in high-performance materials for long-term operational and environmental benefits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF SE maintained its leadership in the global isononanoic acid market through strategic consolidation and investment in upstream integration. In May 2025, BASF signed an agreement to acquire the remaining 49% stake in its Alsachimie joint venture with DOMO Chemicals, solidifying 100% ownership of the Chalampé production facility. This move is expected to enhance BASF’s backward integration into carboxylic acids, including isononanoic acid, used in synthetic lubricants and plasticizer formulations.

Evonik Industries AG remained a prominent supplier of specialty and high-purity carboxylic acids, including isononanoic acid, focusing on performance materials used across lubrication, plastic additives, and coatings sectors. Evonik leveraged its expertise in C9-C13 oxo carboxylic acids, optimizing its product portfolio for demanding applications in automotive and industrial lubricants. The company has continued expanding its capacity in high-margin specialty chemicals, reinforcing its global footprint and long-term competitiveness in isononanoic derivatives.

OXEA GmbH, as a key player in oxo intermediates, sustained its position through strong integration with downstream chemical products. The company focused on enhancing production efficiency and meeting growing demand for branched-chain carboxylic acids such as isononanoic acid. OXEA’s value proposition remained centered on reliability of supply, flexibility in application-specific grades, and a well-diversified geographic presence.

Top Key Players in the Market

- BASF SE

- Evonik Industries AG

- OXEA GmbH

- KH Neochem Co., Ltd.

- Dow Chemical Company

- Eastman Chemical Company

- Perstorp Holding AB

- Lanxess AG

- Huntsman Corporation

Recent Developments

- In May 2025, BASF SE agreed to acquire the remaining 49% stake in Alsachimie JV, gaining full ownership to strengthen its European presence and secure raw materials like isononanoic acid for synthetic lubricants and plasticizer applications.

- In October 2024, Evonik announced a strategic review and restructuring of its keto and pharma amino acid business at sites in Ham (France) and Wuming (China). This moves toward focusing on core growth areas, while the production of keto acids in Hanau, Germany, is planned to be discontinued by the end of 2025. These acids are part of Evonik’s broader carboxylic acid portfolio, a category that includes compounds such as isononanoic acid.

Report Scope

Report Features Description Market Value (2024) USD 323.7 Million Forecast Revenue (2034) USD 547.7 Million CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Synthetic Isononanoic Acid, Natural Isononanoic Acid), By Purity (Up to 90%, 90% to 95%, 95% to 97%, Above 97%), By Application (Lubricants, Plasticizers, Coatings, Adhesives, Others), By End-use Industry (Automotive, Construction, Electronics, Personal care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Evonik Industries AG, OXEA GmbH, KH Neochem Co., Ltd., Dow Chemical Company, Eastman Chemical Company, Perstorp Holding AB, Lanxess AG, Huntsman Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Evonik Industries AG

- OXEA GmbH

- KH Neochem Co., Ltd.

- Dow Chemical Company

- Eastman Chemical Company

- Perstorp Holding AB

- Lanxess AG

- Huntsman Corporation