Global Intelligent Power Distribution Unit Market Size, Share Analysis Report By Type (Metered, Monitored, Dual Circuit, Automatic Transfer Switch, Basic PDU, Switched and Hot Swap), By Power Phase (Single Phase, Three Phase), By Application (Datacenters, Educational Labs, Commercial Applications And Network Closets, Industrial Power Solutions, VoIP Phone Systems, Others), By End User (Energy, Telecom And IT, BFSI, Transportation, Industrial Manufacturing, Government, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170005

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

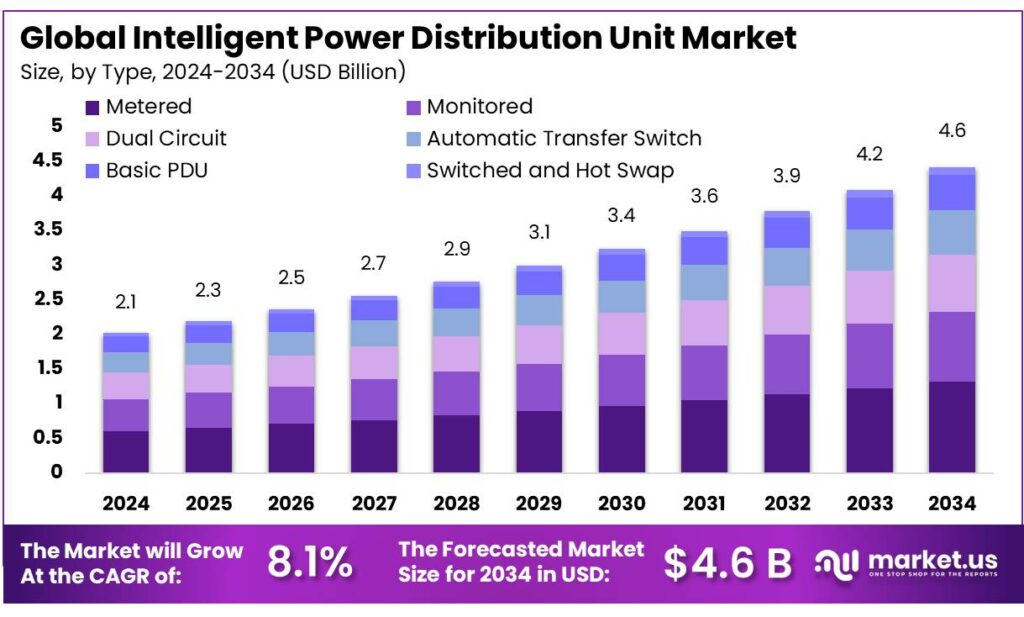

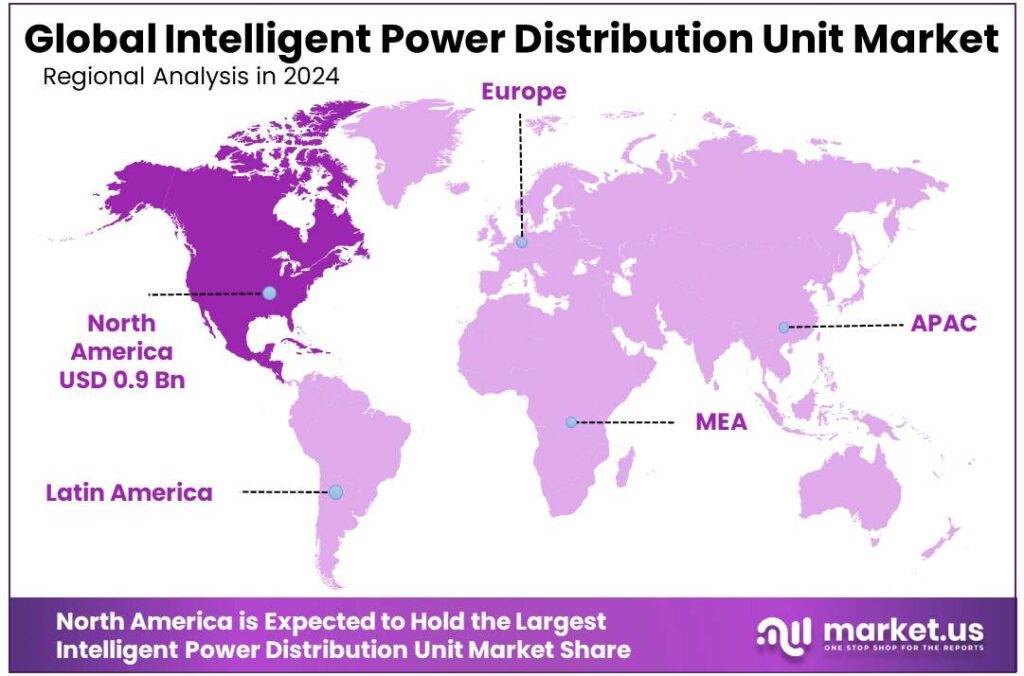

The Global Intelligent Power Distribution Unit Market size is expected to be worth around USD 4.6 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 45.90% share, holding USD 0.9 Million revenue.

Intelligent Power Distribution Units (iPDUs) are advanced, networked versions of traditional PDUs that combine outlet-level metering, switching, and environmental sensing with software, analytics, and remote control. They are increasingly used in data centers, telecom hubs, and energy-intensive manufacturing such as food and beverage processing to improve uptime and energy efficiency. The broader power context is becoming more demanding: the International Energy Agency (IEA) estimates that global electricity demand grew by 4.3% in 2024, up from 2.5% in 2023, as electrification accelerates across sectors.

From an industrial perspective, iPDUs sit at the intersection of digitalisation and energy management. In the European Union, industry accounted for 24.6% of final energy consumption in 2023, with electricity representing 32.6% of industrial energy use, underlining the importance of smarter electrical distribution in factories and process plants. Data centres are another crucial demand pocket: IEA analysis shows data centres used about 415 TWh of electricity in 2024, roughly 1.5% of global electricity consumption, and their power use has grown around 12% per year since 2017.

Regulation and policy are major structural drivers for intelligent PDUs. The EU Energy Efficiency Directive requires Member States to deliver new final-energy savings of 0.8% per year from 2021–2030, pushing operators toward granular monitoring and control of IT power. A separate EU communication sets a target to cut final energy consumption by at least 11.7% by 2030 versus 2020 projections, reinforcing pressure on large digital infrastructure owners.

From May 2024, data centres above 500 kW in the EU must report metrics such as installed power, energy consumption, PUE and renewable share under the revised EED, which in practice requires rack-level metering that iPDUs provide. In addition, the Climate Neutral Data Centre Pact commits signatories to match 75% of electricity use with renewable or hourly carbon-free energy by end-2025 and 100% by 2030, increasing demand for intelligent power chains that can prove compliance.

Government and regulatory initiatives are reinforcing this direction and creating clear growth opportunities for the iPDU industry. The EU’s updated energy-efficiency framework requires at least an 11.7% reduction in final energy consumption by 2030 versus 2020 projections, and explicitly targets “highly energy-efficient and sustainable data centres” by 2030. The EU Code of Conduct for Data Centres now involves 350+ participating sites and publishes best-practice lists that emphasise metering, power-path visibility and monitoring—areas where iPDUs are central.

Key Takeaways

- Intelligent Power Distribution Unit Market size is expected to be worth around USD 4.6 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.1%.

- Metered held a dominant market position, capturing more than a 28.9% share.

- Single Phase held a dominant market position, capturing more than a 63.2% share.

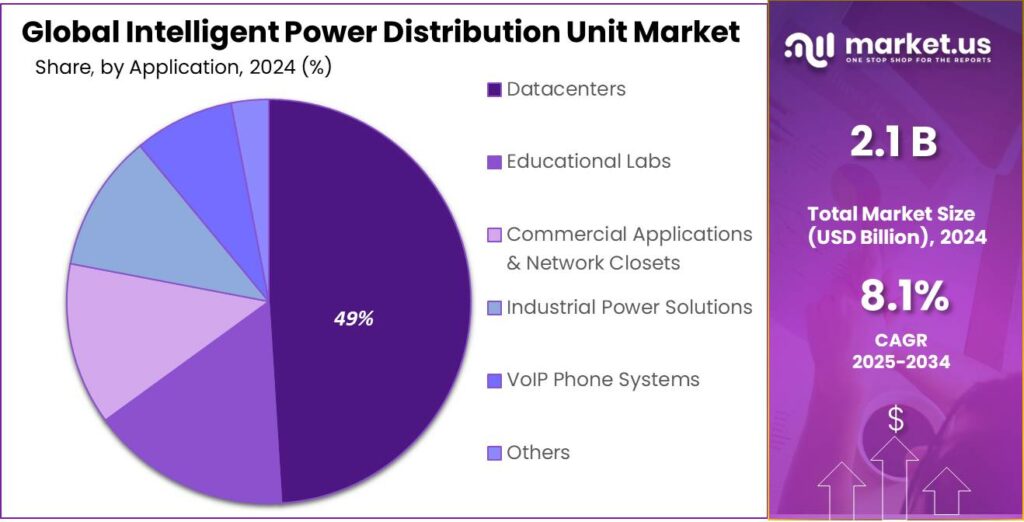

- Datacenters held a dominant market position, capturing more than a 49.7% share.

- Telecom & IT held a dominant market position, capturing more than a 31.5% share.

- North America held the largest regional share in the intelligent power distribution unit (PDU) market, accounting for 45.90%, with market revenues valued around USD 0.9 billion.

By Type Analysis

Metered type leads the market with 28.9% share in 2024

In 2024, Metered held a dominant market position, capturing more than a 28.9% share. The growth of this segment was supported by the rising need for precise power usage tracking across data centers, telecom facilities, and industrial automation environments. The adoption of digital monitoring systems increased, and the demand for real-time load measurement strengthened the preference for metered units. The segment continued to benefit from the shift toward energy-efficient infrastructure, and its uptake is expected to remain strong in 2025 as organizations prioritize better power visibility and cost optimization.

By Power Phase Analysis

Single Phase dominates with 63.2% owing to its wide suitability for small and medium deployments.

In 2024, Single Phase held a dominant market position, capturing more than a 63.2% share. This dominance can be attributed to the frequent presence of single-phase supply in offices, retail sites, and edge data centres, where lower upfront cost and simpler installation are prioritized. Adoption was further supported by the need for compact, energy-efficient distribution units that integrate easily with existing electrical infrastructure. Demand for single-phase PDUs was driven by upgrades of legacy racks and the growth of decentralized computing resources. The segment is expected to retain its leadership into 2025 as organizations continue to favour straightforward, cost-effective power distribution for smaller-scale deployments.

By Application Analysis

Datacenters dominate with 49.7% as large-scale compute demand drives adoption.

In 2024, Datacenters held a dominant market position, capturing more than a 49.7% share. This strength was driven by the expansion of large-scale cloud and hyperscale facilities requiring reliable, high-density power distribution and advanced monitoring capabilities. Investments in redundancy, uptime assurance, and efficient rack-level power management supported uptake of intelligent PDUs across new and upgraded datacenter deployments. The focus on energy efficiency and capacity planning further elevated demand for solutions that deliver precise load balancing and remote management. The segment’s leading position is expected to remain evident into 2025 as cloud growth and enterprise migration to hosted infrastructures continue to prioritise resilient, scalable power distribution.

By End User Analysis

Telecom & IT leads with 31.5% as network expansion and digital services increase power needs.

In 2024, Telecom & IT held a dominant market position, capturing more than a 31.5% share. The segment’s leadership can be attributed to continual investments in network infrastructure, the rollout of 5G sites, and the expansion of enterprise IT footprints that required reliable rack-level power distribution and remote monitoring. Adoption was supported by the need for high availability, improved energy management, and compact solutions for edge sites and central offices. Procurement decisions were influenced by the priority given to uptime, predictable operating costs, and ease of integration with network management tools.

Key Market Segments

By Type

- Metered

- Monitored

- Dual Circuit

- Automatic Transfer Switch

- Basic PDU

- Switched and Hot Swap

By Power Phase

- Single Phase

- Three Phase

By Application

- Datacenters

- Educational Labs

- Commercial Applications & Network Closets

- Industrial Power Solutions

- VoIP Phone Systems

- Others

By End User

- Energy

- Telecom & IT

- BFSI

- Transportation

- Industrial Manufacturing

- Government

- Healthcare

- Others

Emerging Trends

Cloud-Connected iPDUs Turn Food and Cold-Chain Power into Visible, Actionable Data

One of the most striking new trends in Intelligent Power Distribution Units is that they are no longer treated as “just hardware”. In food factories, pack houses and cold stores, iPDUs are turning into data devices that feed the cloud, ESG dashboards and even traceability reports. The big idea is simple: make every kilowatt visible, in real time, so energy use, emissions and food losses can be managed instead of guessed.

The pressure for this transparency is huge. The Food and Agriculture Organization (FAO) estimates that global agrifood systems emitted about 16.5 billion tonnes of CO₂-equivalent in 2023, representing roughly 32% of total human-made emissions. When one third of emissions come from food systems, governments and retailers start asking tough questions: “Where exactly is the energy going?” and “Can you show year-on-year reductions?” That kind of evidence is hard to provide with basic power strips, but natural for intelligent PDUs that log per-outlet loads, voltage and events.

Food loss adds another reason to wire iPDUs into the data spine. FAO and the UN report that around 14% of food produced worldwide is lost between harvest and retail, valued at roughly USD 400 billion every year. Behind that number are very practical stories: a cold room lost power overnight, a blast freezer ran at the wrong set-point, or a control panel tripped and nobody saw the alarm in time. Modern iPDUs, with outlet-level metering and network alerts, support teams in catching those problems early instead of reading about them in a loss report.

Drivers

Rising Energy Demand in Food Processing & Cold-Chain Facilities Drives Strong Need for Intelligent PDUs

One of the most powerful forces shaping the Intelligent Power Distribution Unit (iPDU) market today comes from an unexpected but hugely important sector: the global food and cold-chain industry. Food manufacturing, refrigeration, and storage facilities run thousands of energy-hungry machines—compressors, conveyors, chillers, dryers, automated lines, and packaging systems—that depend on steady, clean, and continuously monitored power. As these facilities become more automated and digitally connected, the old model of unmonitored power strips is no longer enough. Operators now need intelligent PDUs that can track every watt, alert teams when loads spike, and prevent failures that could destroy temperature-sensitive food.

- According to the Food and Agriculture Organization (FAO), global agri-food systems consume over 30% of the world’s total energy, with food processing and distribution representing a significant share of this load. As more countries industrialize their food sectors, electricity use inside factories and cold-chain hubs grows even faster than agricultural output itself. This puts enormous pressure on operators to improve energy monitoring and reduce waste—something iPDUs are uniquely designed to solve.

Cold-chain facilities, in particular, are becoming one of the largest users of stable electrical power. The International Energy Agency (IEA) reports that global cooling demand—driven heavily by food storage—already exceeds 2,000 TWh annually and is expected to rise sharply as developing countries expand their refrigerated distribution systems. Each cold room must maintain strict temperature controls, and even a 15–20 minute power disruption can spoil large quantities of perishable goods. Intelligent PDUs provide real-time load balancing, remote switching, and high-accuracy metering that help these facilities keep compressors and chillers stable even during peak-load stress.

- Governments are also reinforcing this shift. The U.S. Department of Agriculture (USDA) recently announced USD 1.2 billion in investments to modernize food-supply infrastructure and expand cold-chain reliability in rural communities. At the same time, the European Commission’s energy-efficiency directives urge food manufacturers and distributors to adopt digital monitoring tools to cut electricity losses and improve equipment uptime.

Restraints

High Upfront Cost and Complexity Limit Intelligent PDU Adoption in Food and Cold-Chain Facilities

One of the biggest brakes on the roll-out of Intelligent Power Distribution Units (iPDUs) is the simple question many food and cold-chain operators ask: “Where will the money come from?” Agrifood systems are huge employers but often run on tight budgets and thin margins, which makes any non-essential capital project hard to justify. The Food and Agriculture Organization (FAO) estimates that agrifood systems employ close to 1.3 billion people, or 39.2% of the global workforce as of 2021.

- The International Energy Agency (IEA) notes that in advanced economies, direct and indirect energy costs can account for 40–50% of total variable cropping costs. When electricity and fuel already swallow half of variable costs, managers naturally focus on paying bills and keeping production running, rather than investing in smart PDUs, network switches, sensors and software licences. Even if iPDUs may reduce downtime and improve efficiency, the benefits feel distant compared with the next month’s energy invoice.

Cold-chain operations face similar trade-offs. Research on the food sector’s cold supply chains shows that cooling and freezing alone account for about 30% of the electricity consumption in the food sector. In practice, that means a refrigerated warehouse might be spending most of its electricity budget just to keep compressors and evaporators running. Upgrading to intelligent PDUs is often seen as an extra layer of cost on top of already expensive refrigeration and insulation projects, even though smarter power control could make those same systems more efficient.

Global climate pressure actually cuts both ways. FAO’s latest agrifood emissions brief reports that global agrifood systems emissions reached 16.5 billion tonnes of CO₂-equivalent in 2023, around 30–32% of total anthropogenic emissions. Governments respond with stricter requirements on reporting, energy efficiency and refrigeration standards.

Opportunity

Smart Food Cold Chains Create a Powerful New Growth Wave for Intelligent PDUs

A big, and sometimes overlooked, growth opportunity for Intelligent Power Distribution Units (iPDUs) sits inside food factories, warehouses and cold rooms. These facilities are under pressure to cut waste, cut emissions and still keep prices reasonable for consumers. That mix of goals is pushing them towards smarter, more connected electrical infrastructure – and iPDUs fit exactly into that gap.

Global agrifood systems are now a major climate focus. The Food and Agriculture Organization (FAO) reports that agrifood systems emitted about 16.5 billion tonnes of CO₂-equivalent in 2023, roughly 32% of total human-made emissions. Governments know they cannot reach climate targets unless food production, processing and distribution become more efficient. That is exactly where fine-grained power monitoring and control through iPDUs becomes valuable.

- FAO estimates that around 14% of all food produced is lost between post-harvest and retail, worth roughly USD 400 billion each year. A lot of this loss links to poor temperature control, power quality issues, or equipment failures in storage and transport. When a cold room loses power or runs at the wrong load for a few hours, entire batches of meat, dairy or fruit can be written off. For operators, an iPDU is not just a power strip; it becomes a tool to protect product value.

Public funding is already flowing into this space, which quietly creates budget room for iPDU projects. In the United States, the Department of Agriculture’s Resilient Food Systems Infrastructure (RFSI) program has made up to USD 420 million available to strengthen local and regional food-supply infrastructure. States are using this money for new processing, aggregation and cold-chain investments. Each new cold room, processing line or regional hub that is built with public money is a candidate site for digital power distribution instead of basic PDUs.

Regional Insights

North America remains the powerhouse with 45.90% (~ USD 0.9 Billion) due to strong data-centre and cloud infrastructure demand

In 2024, North America held the largest regional share in the intelligent power distribution unit (PDU) market, accounting for 45.90%, with market revenues valued around USD 0.9 billion. This leading position was underpinned by a dense concentration of hyperscale and enterprise-class data centres, advanced cloud and telecom infrastructure, and early adoption of smart power management technologies.

The high prevalence of digital infrastructure across the United States and Canada drove demand for intelligent PDUs that deliver features such as real-time load monitoring, remote management, and energy optimization. Enterprises in the region prioritized uptime reliability, energy efficiency, and regulatory compliance, which further catalyzed uptake of intelligent PDUs over legacy power distribution solutions.

The maturity of the North American market was also reflected in a broad adoption across end-user segments including data centres, telecom, IT, healthcare, and industrial facilities — though data centres and IT sectors accounted for a major portion of demand. Vendors servicing this region benefited from well-established distribution networks, strong customer awareness, and preference for integrated, high-reliability systems. As a result, deployment of intelligent PDUs in new data-centre builds and retrofits increased significantly in 2024.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Ltd. — ABB is a leading provider of electrification and automation solutions; its global presence was reflected in reported group revenues near USD 33.0 billion for 2024 and a workforce exceeding 105,000 employees. The company’s intelligent-PDU relevance is supported by broad electrification portfolios and large installed base across utilities, industry, and data-centre infrastructure.

Eaton Corp. Plc — Eaton’s power-management portfolio was backed by revenues of about USD 23.2 billion in 2023 and nearly USD 25.0 billion in 2024, serving customers across 160+ countries. The firm’s PDU solutions are positioned within its electrical and industrial segments, with emphasis on reliability, safety, and energy optimisation for enterprise and industrial deployments.

Raritan Inc — Raritan is a specialist in intelligent PDUs, DCIM software, and KVM solutions, with products deployed in over 76 countries and 50,000+ locations. The company was acquired by Legrand (completed 2015), and its technology now complements Legrand’s data-centre product suite, enabling integrated hardware/software power management.

Top Key Players Outlook

- ABB Ltd.

- Eaton Corp. Plc

- Legrand SA

- Schneider Electric SE

- Vertiv Group Corp

- Raritan Inc

- Rittal GmbH & Co. KG

Recent Industry Developments

In 2024, ABB reported revenues of USD 32.9 billion and orders of USD 33.7 billion, supported by a global workforce of ~110,000 employees and R&D investment of USD 1.5 billion, figures that illustrate scale and capacity for product development.

In 2024, Eaton reported revenue of USD 24.9 billion, delivered record EPS of USD 9.50, and employed around 94,000 people, figures that underline the company’s scale and investment capacity in power-management technologies.

In 2024, Schneider Electric reported €38.15 billion in group revenues and €4.3 billion net income, figures that underline the company’s scale and capacity to support intelligent power distribution solutions for data centres and commercial clients.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 4.6 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Metered, Monitored, Dual Circuit, Automatic Transfer Switch, Basic PDU, Switched and Hot Swap), By Power Phase (Single Phase, Three Phase), By Application (Datacenters, Educational Labs, Commercial Applications And Network Closets, Industrial Power Solutions, VoIP Phone Systems, Others), By End User (Energy, Telecom And IT, BFSI, Transportation, Industrial Manufacturing, Government, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Eaton Corp. Plc, Legrand SA, Schneider Electric SE, Vertiv Group Corp, Raritan Inc, Rittal GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intelligent Power Distribution Unit MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Intelligent Power Distribution Unit MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Eaton Corp. Plc

- Legrand SA

- Schneider Electric SE

- Vertiv Group Corp

- Raritan Inc

- Rittal GmbH & Co. KG