Global Insurance Analytics Market By Component (Tools, Services), By Business Application (Claims Management, Risk Management, Fraud Detection and Prevention, Process Optimization, Customer Management and Personalization), By Deployment Mode (On-Premise, Cloud), By End-User (Insurance Companies, Government Agencies, Third-Party Administrators, Brokers and Consultancies), By Insurance Line (Life and Health, Property and Casualty, Auto, Specialty Lines), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164401

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Insurance Analytics Adoption Trends

- By Component

- By Business Application

- By Deployment Mode

- By Organization Size

- By End-User

- By Insurance Line

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

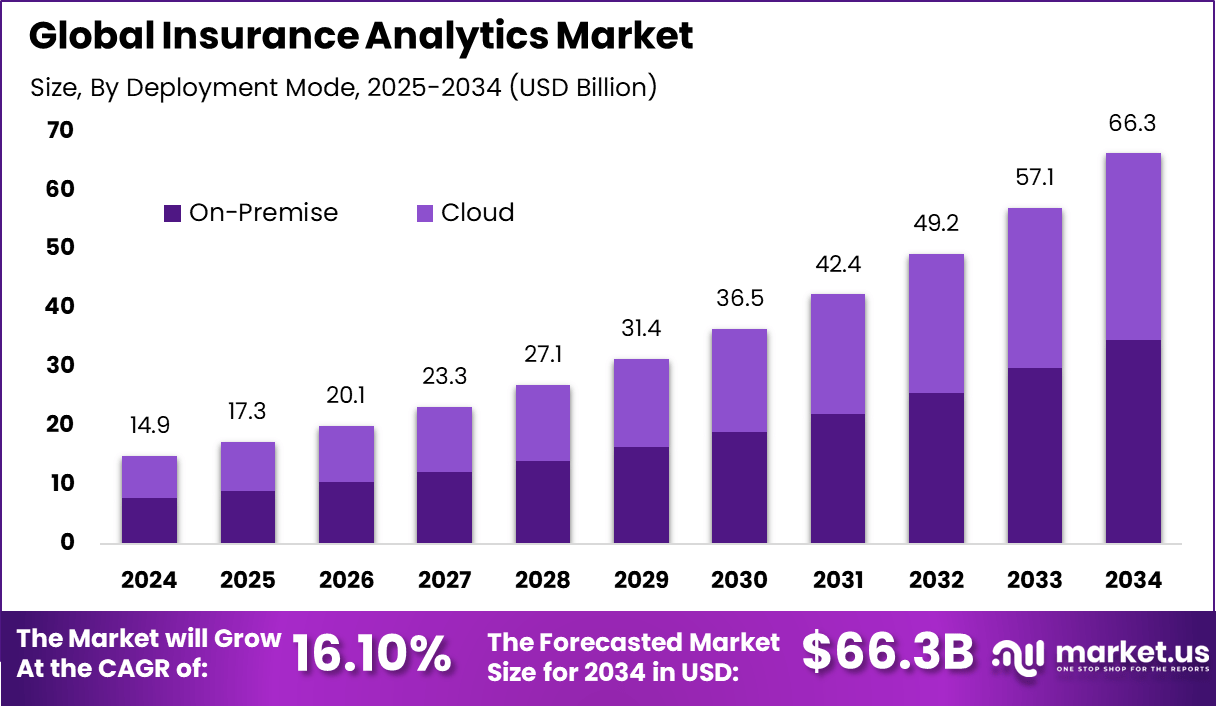

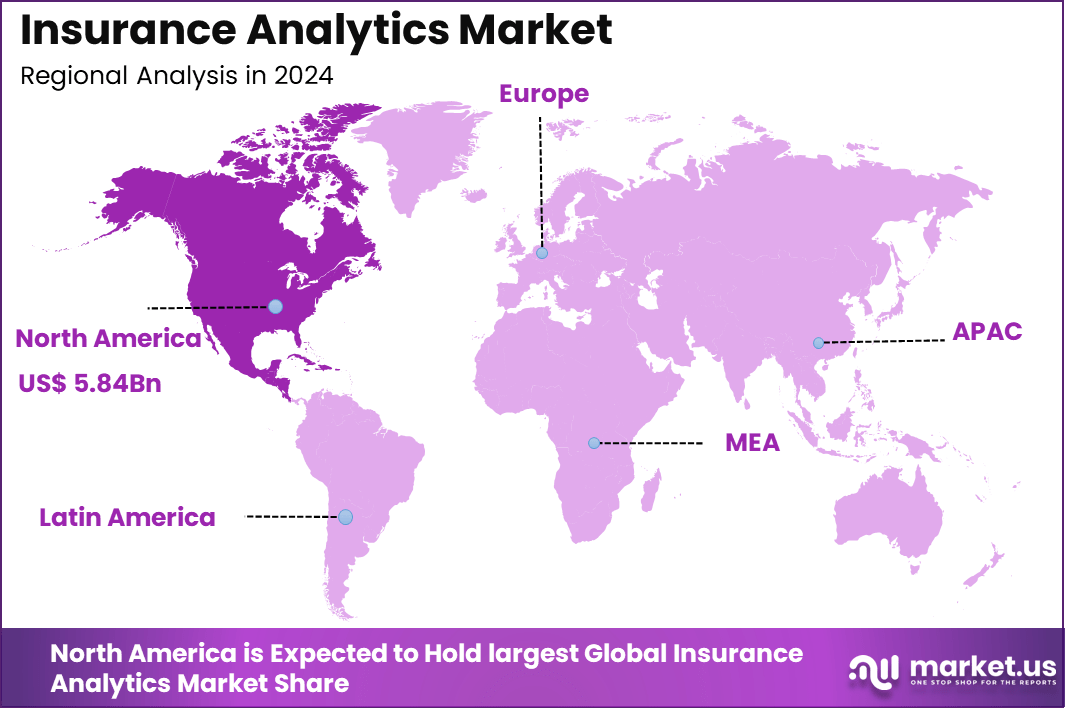

The Global Insurance Analytics Market generated USD 14.09 billion in 2024 and is predicted to register growth from USD 17.3 billion in 2025 to about USD 66.3 billion by 2034, recording a CAGR of 16.10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.2% share, holding USD 5.84 Billion revenue.

The Insurance Analytics Market is gradually transforming the insurance sector by leveraging data insights to drive smarter decisions. In recent years, insurers have shifted focus from traditional methods towards analytics that help identify risks, detect fraud, and enhance customer offerings. By analyzing vast amounts of structured and unstructured data, insurers gain a much clearer understanding of customer behavior and potential exposures.

In 2024, over 70% of demand came from insurers themselves looking to optimize underwriting and claims processes using advanced analytics tools. One key driver is increasing insurance complexity. The rise in competition, regulatory requirements, and customer expectations is pushing insurers to make data-driven choices rather than rely on intuition alone.

Analytics helps improve precision in risk evaluation, fraud detection, pricing, and claims management. In fact, companies that use analytics report a 20-30% improvement in fraud detection accuracy, saving billions annually. Another factor is the growing volume of data generated from digital channels and IoT devices, which demands powerful tools to convert raw information into actionable insights.

The demand for insurance analytics is especially strong in regions with mature insurance markets such as North America and Europe. Around 80% of insurers now prioritize analytics in their operational strategies to personalize product offerings and keep up with customer preferences. Cloud computing and AI advancements have also made it easier for smaller insurers to adopt these technologies.

Top Market Takeaways

- Tools dominated the market by component with 67.3%, reflecting insurers’ increasing reliance on advanced analytics platforms for data visualization, risk modeling, and performance tracking.

- Claims Management led business applications with 31.7%, supported by growing adoption of predictive analytics to detect fraud, improve claim accuracy, and shorten settlement cycles.

- On-premise deployment accounted for 52.2%, underscoring ongoing demand for secure, locally hosted solutions to safeguard sensitive customer and policyholder data.

- Insurance Companies represented 73.4% of end-user share, highlighting their heavy investment in analytics to enhance underwriting precision, pricing strategies, and customer retention.

- Property and Casualty Insurance held 42.1% of the market, driven by the need for real-time analytics to manage risk exposure and optimize claims outcomes.

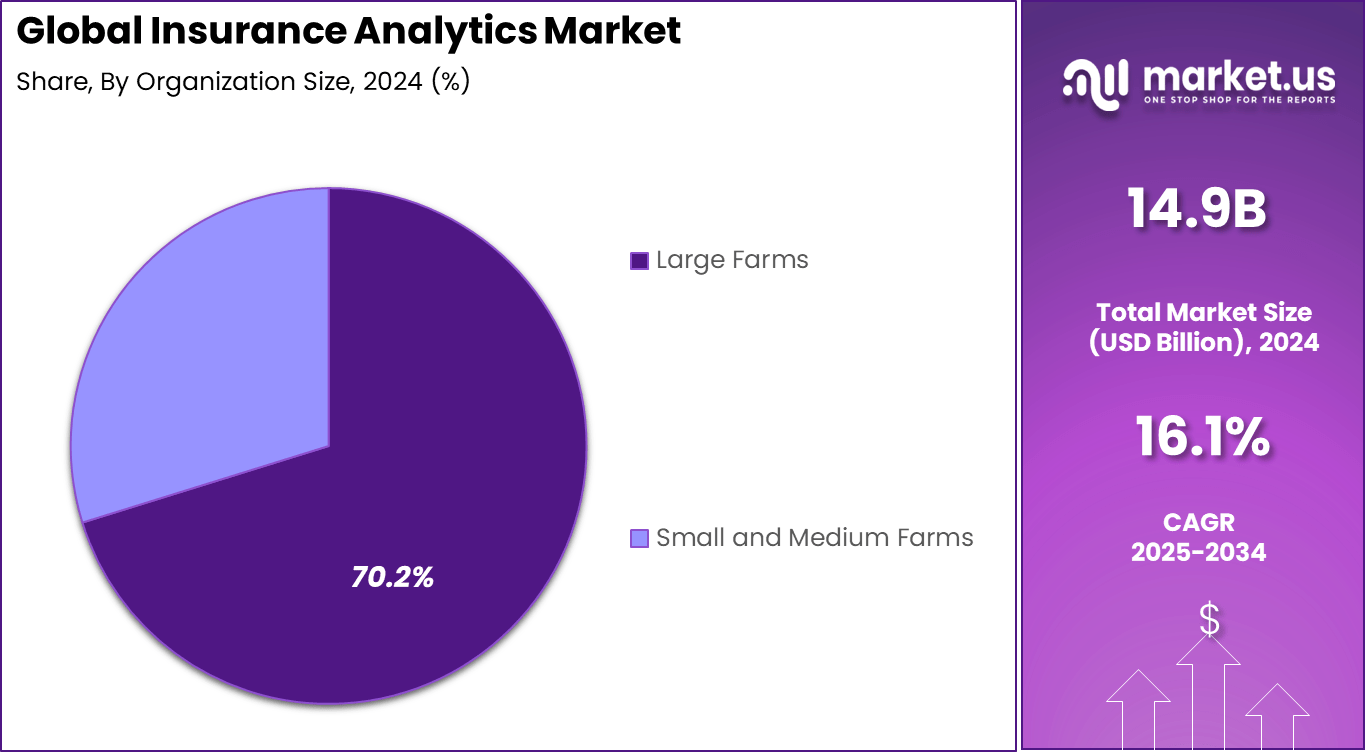

- Large Enterprises dominated with 70.2%, as they possess greater capacity to integrate AI, big data, and machine-learning-driven analytics across diverse operations.

- North America captured 39.2% of the global market, supported by advanced insurance ecosystems, strong regulatory frameworks, and rapid adoption of digital analytics technologies.

Insurance Analytics Adoption Trends

Insurance Analytics Adoption Rates

- Overall adoption: Data analytics has become an integral part of insurance operations, with about 86% of insurance firms using analytics to support core business decisions. However, a clear gap remains between basic data use and the advanced application of predictive analytics for strategic innovation.

- Perception of importance: A 2023 Deloitte survey found that 76% of insurance executives consider data analytics critical for business modernization and competitive advantage.

- Maturity levels: Despite widespread adoption, only 6% of insurers have reached advanced analytics maturity, where insights consistently influence decision-making and innovation across all departments.

- Investment intentions: Future commitment is strong. Around 70% of insurers plan to deploy AI models capable of making real-time predictive decisions within the next two years.

Key Usage Statistics by Function

Application Area Usage and Adoption Statistics Underwriting & Risk About 42% of insurers use predictive analytics to shift from static to dynamic risk models. Claims Processing Claims management is a leading area for AI automation. Fraud Detection A primary analytics application due to high fraud exposure. Customer Experience & Retention Analytics support churn prevention and personalized engagement. Usage-Based Insurance (UBI) Adoption is rising, supported by connected vehicles and data sharing. Participation in some programs exceeds 20%. Technology Adoption

- AI and machine learning: The Global AI in Insurance Market size is expected to be worth around USD 91 Billion by 2033, from USD 5 Billion in 2023, growing at a CAGR of 32.7% during the forecast period from 2024 to 2033.

- Cloud deployment: Cloud-based analytics solutions are the preferred choice for their flexibility and scalability. Small and medium-sized enterprises (SMEs) are experiencing the fastest growth in cloud adoption.

- IoT and telematics data: Insurers are increasingly using IoT and telematics to obtain real-time behavioral insights. Growth in the telematics market continues to strengthen the expansion of usage-based insurance programs worldwide.

By Component

In 2024, Tools formed around 67.3% of the insurance analytics market, showing their importance in supporting digital insurance operations. These include data visualization platforms, predictive algorithms, and AI-based dashboards used to improve underwriting and pricing accuracy.

Insurers prefer structured analytics tools to handle customer data more efficiently and identify fraudulent claims early. The rising complexity of policy management and market regulations has strengthened the need for integrated data systems that support decision-making in real time. Several insurers are now shifting from manual reporting models to automated analytics built on simplified interfaces.

Machine learning capabilities within these tools help refine risk assessment and streamline claim prediction. The focus is on using data interpretation tools not just for reports but for risk prevention and product design. As data quality improves across organizations, these tools continue to drive operational clarity and transparency across multiple insurance processes.

By Business Application

In 2024, Claims management led the market with 31.7%, remaining the main area of analytics deployment. Predictive analytics supports insurers in identifying fraudulent patterns, assessing damage costs, and reducing settlement delays.

The method has helped establish a stronger link between customer service performance and operational efficiency. Real-time dashboards also allow claims teams to analyze recurring problems before they affect long-term profitability.

Automation in claims verification has improved response time and accuracy while lowering administrative costs. Analytics makes it easier for insurers to handle sudden peaks in claim volumes without compromising speed or quality. The ability to draw instant insights from historical claim data supports better allocation of resources during high-demand periods. This results in a more organized, cost-effective, and transparent claims process.

By Deployment Mode

In 2024, On-premise solutions kept a 52.2% share, mainly due to stricter data governance needs. Insurance regulators require companies to maintain control of sensitive policyholder information, which makes local servers a preferred choice.

The on-premises setup is also favored by large enterprises that run complex financial software and legacy systems. Its reliability and customized configuration options continue to appeal to insurers focused on long-term data ownership.

Even as cloud services expand, a hybrid model is becoming common, allowing data storage on internal servers with analytical processing on secure external networks. This combination offers safer management of personal data along with flexible handling of non-confidential reports. The trend supports tighter compliance while giving space for innovation in analytics scalability.

By Organization Size

In 2024, Large enterprises made up 70.2% of the market, supported by their extensive customer databases and higher technology budgets. These organizations employ centralized analytics units that contribute to business forecasting and product strategy. Their investments in advanced computing resources and internal development centers have widened the gap in analytical maturity within the industry.

Mid-sized and small insurers are increasingly adopting lighter analytics software as competition grows. These firms use subscription-based solutions to benefit from predictive insights without heavy infrastructure costs. This has helped smaller organizations modernize their operations and compete more efficiently against larger, data-rich competitors.

By End-User

In 2024, Insurance companies held 73.4% of market activity, as they are the main users of analytics for customer profiling, premium calculation, and fraud management. The ability to connect various datasets across claims, underwriting, and operations has made analytics the central part of everyday insurance work. Predictive modeling helps insurers increase renewal rates and assess loss likelihood with better accuracy.

Larger insurers now operate with embedded analytics within their main process tools, making real-time insights available to teams across regions. The approach has reduced dependence on manual data sorting and increased accountability. With the use of telematics and IoT-based data, insurers can now track risk behavior patterns and offer policies that better suit customer needs.

By Insurance Line

In 2024, Property and casualty insurance captured 42.1%, relying heavily on analytics to calculate exposure and risk values. Advanced data models are applied to manage damages from natural disasters, thefts, and accidents more precisely. Analytics plays a crucial role in predicting claim clusters and assessing regional vulnerabilities based on weather and economic trends.

The property and casualty segment also benefits from geospatial data integration, which allows location-based risk mapping for more accurate underwriting. Recent technological improvement enables insurers to process satellite and property data faster. These capabilities help in developing flexible coverage plans that factor in real-time environmental and structural data.

Emerging Trends

Emerging trends in insurance analytics highlight a growing reliance on artificial intelligence and machine learning to drive decision-making across underwriting, claims, and customer engagement. About 80% of insurers now deploy AI-enhanced analytics to personalize offerings, detect fraud, and improve operational efficiency.

Automation is increasing speeds in claims processing and fraud detection with accuracy improvements surpassing 90% in some cases. Additionally, integration of cloud technology is enabling insurers to access scalable, real-time analytics, supporting dynamic pricing models and personalized insurance products. Growing adoption of embedded insurance models, where coverage is seamlessly integrated into customer experiences, is reshaping distribution channels and enhancing convenience for policyholders.

Growth Factors

Growth factors are largely fueled by the increasing complexity of insurance processes and rising competition that demand more precise risk assessment and operational agility. The industry shift from intuition-led decision making to advanced data-driven insight emphasizes the role of predictive modeling in underwriting, risk mitigation, and fraud reduction.

Customer expectations for personalized products and seamless digital interactions are pushing insurers to adopt sophisticated analytics solutions widely. For example, uptake of AI-based underwriting systems has improved risk assessment accuracy by over 25%, contributing significantly to market expansion.

Key Market Segments

By Component

- Tools

- Services

By Business Application

- Claims Management

- Risk Management

- Fraud Detection and Prevention

- Process Optimization

- Customer Management and Personalization

By Deployment Mode

- On-Premise

- Cloud

By End-User

- Insurance Companies

- Government Agencies

- Third-Party Administrators, Brokers and Consultancies

By Insurance Line

- Life and Health

- Property and Casualty

- Auto

- Specialty Lines

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Regional Analysis

North America accounted for 39.2% of the overall market, benefiting from advanced IT infrastructure and regulatory consistency. The region’s insurers have been among the earliest to deploy AI-based analytics for risk control and pricing. The trend is supported by strong partnerships between technology vendors and established insurance players, leading to faster deployment of automated systems.

The presence of a mature data environment in the United States and Canada fosters widespread adoption of analytical applications. As customers move toward digital-first interactions, insurers in this region focus on faster claim settlement and personalized plans. Continued regulation support and high data literacy ensure that North America remains a leader in insurance analytics innovation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Need for Data-Driven Decision Making

The insurance industry has seen a major shift from relying on intuition to embracing data-driven decision making. Insurers nowadays face rising competition, more complex risks, and higher customer expectations. Using insurance analytics enables companies to make better predictions for risk assessment, detect fraud more effectively, and tailor policies to customer needs.

This shift to analyzing large volumes of structured and unstructured data improves operational efficiency and customer satisfaction, making analytics essential for staying competitive. As a result, many insurers now prioritize investments in analytics tools to gain insights that help them manage risks while improving pricing and claims handling. This growing reliance on data-backed decisions is a key factor driving the strong growth of the insurance analytics market globally.

Restraint

High Cost and Complexity of Implementation

One of the main barriers to wider adoption of insurance analytics is the high cost and the complexity involved in deploying these solutions. Many insurance companies still operate on legacy IT systems that are not easily compatible with modern analytic platforms. To implement advanced analytics, firms often need to invest heavily in upgrading infrastructure, hiring skilled professionals, and ensuring robust cybersecurity measures.

These upfront costs and technological challenges can be overwhelming, especially for smaller insurers with limited budgets. Integration efforts can also cause operational delays and disruptions, further restraining some companies from adopting analytics despite its benefits.

Opportunity

Advancements in Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) technologies present a huge opportunity to transform insurance analytics. These technologies allow insurers to analyze massive amounts of data in real-time for fraud detection, risk prediction, and personalized policy pricing. AI-driven analytics can uncover patterns that humans might miss, enabling faster and more accurate decision-making.

Using AI/ML, insurance companies can automate routine tasks such as claims processing and customer inquiry handling, improving operational efficiency. Additionally, AI enables better targeted marketing and product personalization, increasing customer loyalty and opening new revenue streams. This opportunity to enhance analytics with AI is expected to drive significant market growth.

Challenge

Data Privacy and Regulatory Compliance

Data privacy and regulatory pressure remain a critical challenge for the insurance analytics market. Insurance companies handle very sensitive personal and financial information, and any data breach or misuse can lead to severe legal penalties and damage to reputation.

Governments worldwide have introduced stringent data protection laws that insurers must strictly follow. Complying with complex regulations such as GDPR requires careful management of data storage, processing, and sharing.

This compliance burden adds cost and complexity to analytics initiatives and may slow down their implementation. Additionally, companies must ensure transparency in AI-based decision models to maintain trust with customers and regulators, making privacy and compliance ongoing challenges for analytics adoption.

Competitive Analysis

The competitive landscape of the insurance analytics market is characterized by a blend of established technology giants and specialized software providers. IBM Corporation stands out with its Watsonx platform, leveraging partnerships with Oracle and NVIDIA to deliver comprehensive, regulatory-ready analytics solutions tailored to insurers.

LexisNexis Risk Solutions focuses on advanced risk assessment tools, including life insurance underwriting innovations, enhancing decision-making speed and accuracy. Hexaware Technologies Limited emphasizes customer base expansion and operational efficiency via strategic partnerships and acquisitions.

Guidewire Software Inc. differentiates itself through cloud-native integrations and marketplace connectivity for property and casualty insurance carriers, enhancing claims and underwriting workflows. Applied Systems Inc. delivers targeted software solutions improving insurer operational processes and customer engagement.

Overall, the market is moderately concentrated, with success increasingly defined by the ability to provide AI-driven insights that meet strict compliance, automate risk documentation, and offer rapid deployment, as well as forge cross-industry collaboration to create new revenue streams. These companies face competition from emerging niche players focused on specific pain points like sub-minute claims adjudication and embedded insurance orchestration, driving a dynamic and evolving competitive environment.

Top Key Players in the Market

- IBM Corporation

- LexisNexis Risk Solutions

- Hexaware Technologies Limited

- Guidewire Software Inc.

- Applied Systems Inc.

- Others

Recent Developments

- October, 2025: Applied Systems announced a new wave of innovations within its Applied Insurance AI platform aimed at embedding AI-driven intelligence into agency workflows. The focus is on increasing productivity and profitability by providing connected, intelligent workflows across sales, policy management, and financial operations.

- May, 2025: IBM was identified as a leader in insurance services by a major industry research firm. Their strength lies in modernizing platforms, applying AI, and working with partners to help insurers handle regulatory demands, fight fraud, and improve data use. IBM focuses on updating old systems and applying AI to boost business results for property, casualty, and life insurance.

Report Scope

Report Features Description Market Value (2024) USD 14.9 Bn Forecast Revenue (2034) USD 66.3 Bn CAGR(2025-2034) 16.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Tools, Services), By Business Application (Claims Management, Risk Management, Fraud Detection and Prevention, Process Optimization, Customer Management and Personalization), By Deployment Mode (On-Premise, Cloud), By End-User (Insurance Companies, Government Agencies, Third-Party Administrators, Brokers and Consultancies), By Insurance Line (Life and Health, Property and Casualty, Auto, Specialty Lines), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, LexisNexis Risk Solutions, Hexaware Technologies Limited, Guidewire Software Inc., Applied Systems Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Insurance Analytics MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Insurance Analytics MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- LexisNexis Risk Solutions

- Hexaware Technologies Limited

- Guidewire Software Inc.

- Applied Systems Inc.

- Others