Global Inferior Vena Cava IVC Filter Market By Product Type (Retrievable and Permanent), By Material (Metallic and Non-Metallic), By Application (Pulmonary Embolism, Deep Vein Thrombosis, Trauma & Surgical Procedures, and Others), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140340

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

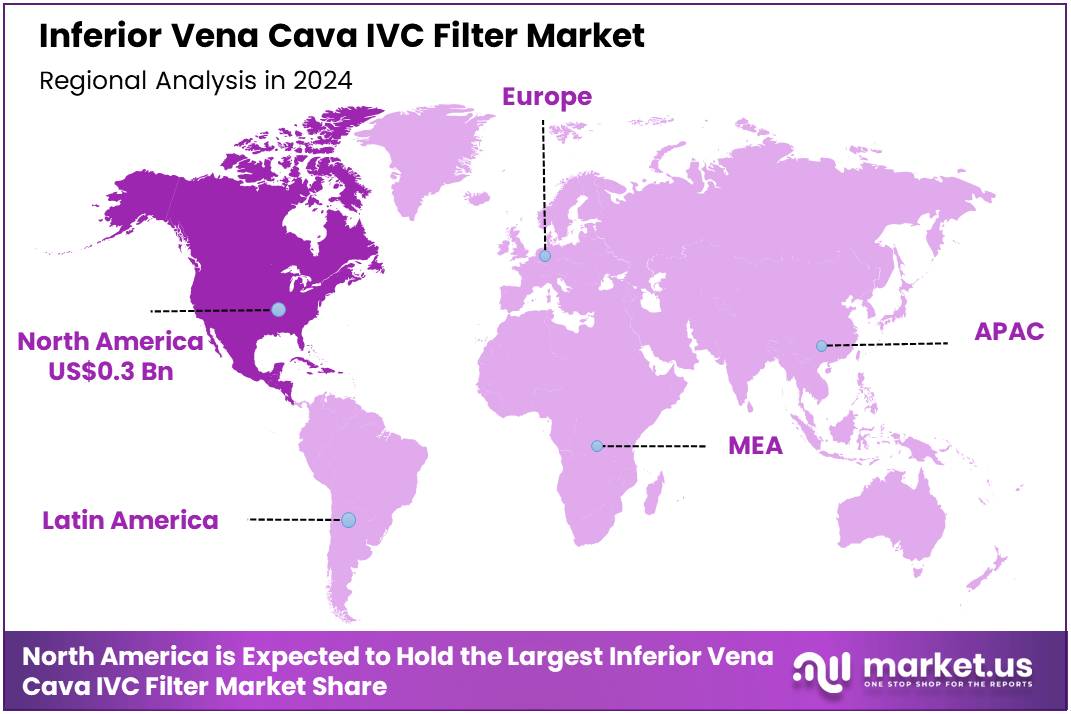

Global Inferior Vena Cava IVC Filter Market size is expected to be worth around US$ 1.9 billion by 2034 from US$ 0.8 billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.6% share with a revenue of US$ 0.3 Billion.

Increasing prevalence of pulmonary embolism (PE) and deep vein thrombosis (DVT) is driving the growth of the inferior vena cava (IVC) filter market. IVC filters are used to prevent pulmonary embolism by trapping blood clots before they can reach the lungs, offering a crucial solution for patients who cannot undergo anticoagulation therapy.

The rising incidence of cardiovascular diseases, along with the increasing number of surgical procedures and trauma cases, further fuels the demand for IVC filters. According to a study published by Lung India in November 2021, research conducted in India and South Korea revealed that the prevalence of pulmonary embolism was 2% in India and 5% in South Korea.

The study also found that the risk of developing PE was notably higher among patients experiencing tachypnea, tachycardia, and respiratory alkalosis, highlighting the growing need for effective prevention strategies. Recent trends show a shift toward the development of retrievable IVC filters, which offer greater flexibility by allowing removal once the risk of clot formation has subsided.

Additionally, advancements in filter design, such as reduced size and improved durability, present new opportunities for the market. As patient safety and outcomes remain a key focus, the demand for more efficient, minimally invasive IVC filters continues to rise, creating opportunities for further growth in the market.

Key Takeaways

- In 2024, the market for Inferior Vena Cava IVC Filter generated a revenue of US$ 8 billion, with a CAGR of 8.8%, and is expected to reach US$ 1.9 billion by the year 2034.

- The product type segment is divided into retrievable and permanent, with retrievable taking the lead in 2024 with a market share of 68.5%.

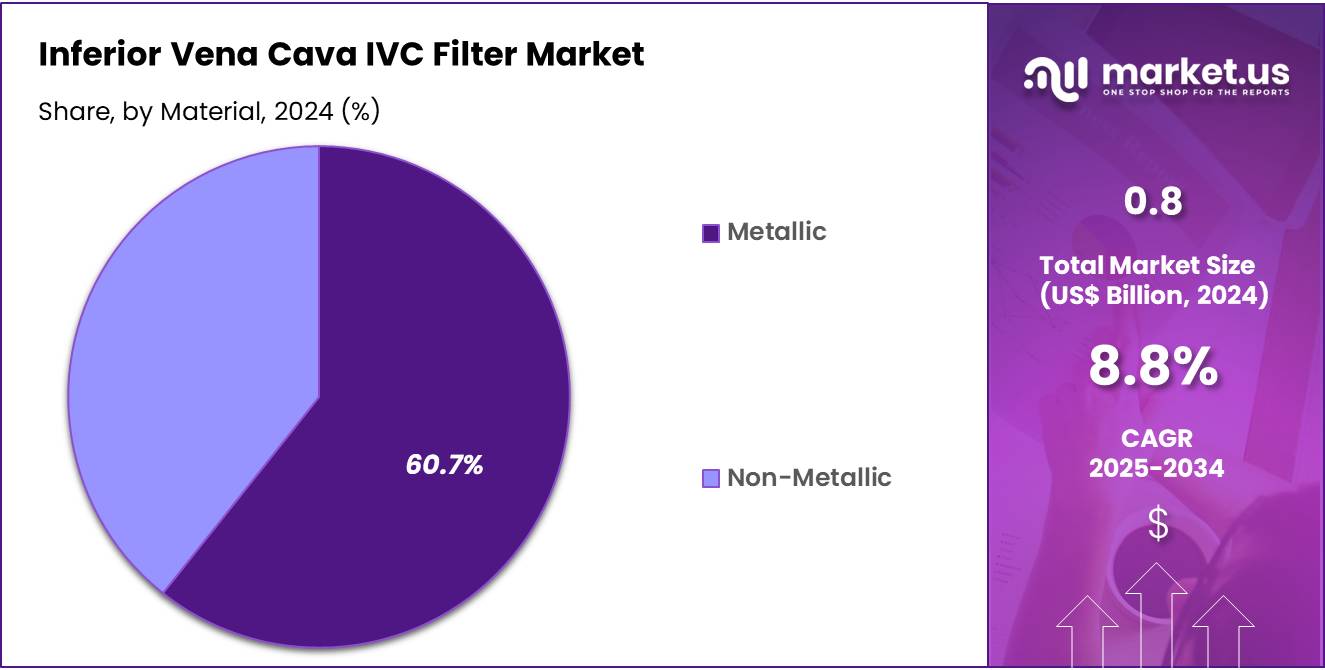

- Considering material, the market is divided into metallic and non-metallic. Among these, metallic held a significant share of 60.7%.

- Furthermore, concerning the application segment, the market is segregated into pulmonary embolism, deep vein thrombosis, trauma & surgical procedures, and others. The pulmonary embolism sector stands out as the dominant player, holding the largest revenue share of 44.2% in the Inferior Vena Cava IVC Filter market.

- The end user segment is segregated into hospitals, specialty clinics, ambulatory surgical centers, and others, with the hospitals segment leading the market, holding a revenue share of 56.3%.

- North America led the market by securing a market share of 40.6% in 2024.

Product Type Analysis

The retrievable segment led in 2024, claiming a market share of 68.5% owing to the increasing preference for filters that can be removed after their purpose is fulfilled. Retrievable IVC filters offer a significant advantage in terms of patient safety, as they can be extracted once the risk of embolism has passed.

This feature is anticipated to drive demand as healthcare providers focus on reducing long-term complications associated with permanent filters, such as migration or perforation. As clinical guidelines continue to emphasize the importance of filter retrieval in reducing complications, the retrievable segment is projected to grow, particularly in the management of short-term pulmonary embolism risk.Material Analysis

The metallic held a significant share of 60.7% due to the increasing use of metallic materials, which offer superior durability and strength for long-term implantation. Metallic IVC filters are projected to continue being favored due to their ability to withstand physiological conditions over extended periods.

The growth of this segment is likely to be supported by advancements in metallic materials such as nitinol, which provides flexibility and resistance to fracture while maintaining structural integrity. As the medical community continues to prioritize patient safety and the long-term effectiveness of filters, metallic IVC filters are expected to see sustained demand in clinical applications.

Application Analysis

The pulmonary embolism segment had a tremendous growth rate, with a revenue share of 44.2% owing to the rising incidence of pulmonary embolism (PE), which often requires IVC filter insertion for prevention in high-risk patients. PE is a life-threatening condition that occurs when a blood clot travels to the lungs, blocking blood flow, and is one of the primary indications for IVC filter use.

As the global population ages and the incidence of cardiovascular diseases increases, the demand for IVC filters in preventing pulmonary embolism is anticipated to rise. Healthcare providers are likely to continue using IVC filters as a preventative measure for patients with deep vein thrombosis (DVT) or other risk factors for PE, contributing to the growth of this segment.

End-User Analysis

The hospitals segment grew at a substantial rate, generating a revenue portion of 56.3% as hospitals remain the primary end-users of IVC filters due to their role in critical care and high-risk procedures. Hospitals are likely to continue adopting IVC filters as part of their standard treatment protocols for patients with a high risk of pulmonary embolism or deep vein thrombosis.

The increasing prevalence of conditions such as cancer, cardiovascular diseases, and trauma is projected to contribute to the growing demand for IVC filters in hospital settings. Additionally, the adoption of advanced technologies and the growing focus on patient safety will further drive hospitals to invest in IVC filters, making them a key end-user segment in the market.

Key Market Segments

Product Type

- Retrievable

- Permanent

Material

- Metallic

- Non-Metallic

Application

- Pulmonary Embolism

- Deep Vein Thrombosis

- Trauma & Surgical Procedures

- Others

End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

Drivers

Rise in Global Geriatric Population Driving the Inferior Vena Cava IVC Filter Market

Rising global geriatric population is anticipated to drive the inferior vena cava (IVC) filter market significantly. According to the United Nations Population Fund, the proportion of individuals aged 65 and older is expected to grow from 10.3% in 2024 to 20.7% by 2074. This demographic shift increases the prevalence of conditions like deep vein thrombosis (DVT) and pulmonary embolism, which are more common among older individuals.

IVC filters play a crucial role in preventing life-threatening complications by capturing blood clots before they reach the lungs. Healthcare providers increasingly recommend these devices for high-risk patients who cannot tolerate anticoagulants. Technological advancements in retrievable and biocompatible filters enhance safety and efficacy, driving adoption rates. Expanding awareness about the benefits of early intervention fosters the demand for minimally invasive solutions like IVC filters.

Aging populations in developed and developing regions amplify the need for effective preventive measures against thromboembolic disorders. Collaboration between medical device companies and healthcare providers ensures broader access to these advanced solutions. These trends underscore the critical role of IVC filters in addressing the rising healthcare challenges associated with aging populations globally.

Restraints

High Costs Are Restraining the Inferior Vena Cava IVC Filter Market

High costs associated with inferior vena cava filters are restraining the market. Advanced devices incorporating innovative designs and biocompatible materials require significant research and development investments, increasing product prices. Healthcare providers in low- and middle-income countries face challenges in adopting these filters due to financial constraints.

Patients without comprehensive insurance coverage often find the procedures involving IVC filters unaffordable, limiting their accessibility. Maintenance and replacement of older devices add to the financial burden for healthcare institutions. Variability in reimbursement policies across regions creates additional challenges for manufacturers and healthcare providers.

Training requirements for medical professionals to perform filter placements increase overall costs for hospitals. Addressing these affordability issues requires cost-effective manufacturing techniques and supportive policies to make IVC filters more accessible globally.

Opportunities

Increasing Innovation as an Opportunity for the Inferior Vena Cava IVC Filter Market

Increasing innovation is anticipated to create significant opportunities for the inferior vena cava (IVC) filter market. In July 2021, Royal Philips announced that its laser-assisted device for IVC filter removal received FDA Breakthrough Device Designation. This innovation provides a safer solution for removing filters when traditional techniques fail, addressing a critical gap in patient care.

Companies focus on developing next-generation filters with enhanced retrievability, reduced complications, and improved patient outcomes. Research investments in biocompatible materials and advanced designs enhance device performance and safety. Miniaturization and integration of imaging technologies allow for precise placement, making procedures more efficient and less invasive.

Expanding government funding for research accelerates the commercialization of innovative devices. Collaborative efforts between medical institutions and manufacturers support the adoption of cutting-edge solutions. These advancements highlight the transformative potential of innovation in addressing the challenges of thromboembolic disorders and advancing the IVC filter market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the inferior vena cava (IVC) filter market. On the positive side, rising global healthcare expenditures and the growing prevalence of venous thromboembolism (VTE) contribute to increasing demand for IVC filters as a preventive solution in at-risk patients. As awareness of the benefits of early intervention in high-risk surgeries and procedures grows, adoption of IVC filters expands.

However, economic downturns can limit healthcare spending, reducing the availability of advanced medical devices, particularly in developing countries. Geopolitical issues, such as trade restrictions and regulatory discrepancies, may disrupt the supply chain and increase costs for manufacturers, further slowing market growth.

Moreover, changing healthcare policies and reimbursement structures can affect the affordability and accessibility of these devices. Despite these challenges, ongoing technological advancements, increased adoption by healthcare systems, and the growing global focus on improving patient outcomes ensure a promising future for the IVC filter market.

Latest Trends

Surge in Partnerships and Collaborations Driving the Inferior Vena Cava (IVC) Filter Market

Rising partnerships and collaborations are driving substantial growth in the inferior vena cava (IVC) filter market. High levels of cooperation between medical device manufacturers, healthcare providers, and research organizations are expected to result in more advanced and accessible solutions for venous thromboembolism prevention and treatment. These partnerships facilitate the development of innovative filter designs, improved manufacturing processes, and wider distribution.

In May 2022, Argon Medical announced a strategic partnership with Terumo India, a leading global medical technology company. This collaboration aims to expand the availability of their products in India, offering a comprehensive range of solutions for interventional radiology, vascular surgery, interventional cardiology, and clinical oncology. As collaborations continue to grow, the market is expected to see enhanced product offerings and increased penetration in underserved regions, further driving the adoption of IVC filters worldwide.

Regional Analysis

North America is leading the Inferior Vena Cava IVC Filter Market

North America dominated the market with the highest revenue share of 40.6% owing to the increasing prevalence of conditions like deep vein thrombosis (DVT) and pulmonary embolism (PE), especially among the aging population. The demand for IVC filters, which are used to prevent blood clots from traveling to the lungs, has surged as more patients undergo preventive treatments for venous thromboembolism.

According to Statistics Canada, as of July 2022, approximately 7.3 million people in Canada were aged 65 or older, representing 18.8% of the total population. This growing aging demographic, combined with the rising incidence of age-related conditions, has heightened the need for medical devices like IVC filters. Furthermore, advancements in filter designs, such as retrievable IVC filters, have enhanced the effectiveness and safety of the procedures, contributing to the market’s growth.

With healthcare systems adapting to cater to the aging population, the IVC filter market in North America is expected to continue expanding, driven by both increasing medical awareness and the rising demand for advanced venous thromboembolism management solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising incidence of venous thromboembolism, improving healthcare infrastructure, and increasing medical awareness. Countries such as China and India are likely to see a rise in demand for IVC filters as the prevalence of lifestyle diseases like hypertension, diabetes, and obesity continues to increase, leading to a higher risk of DVT and PE.

In December 2022, Zylox-Tonbridge Medical Technology Co., Ltd. received approval from China’s National Medical Products Administration for its ZYLOX Octoplus TM Retrievable Inferior Vena Cava Filter. This advancement offers an innovative solution for preventing PE caused by DVT, signaling the region’s growing focus on improving peripheral vascular care.

As healthcare access expands and more patients are diagnosed with venous thromboembolism-related conditions, the demand for IVC filters is expected to increase. Moreover, the growing emphasis on enhancing patient outcomes through advanced medical devices, along with the rising adoption of retrievable filters for better clinical management, is anticipated to drive the IVC filter market’s expansion in the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the inferior vena cava (IVC) filter market focus on developing advanced devices with improved retrievability and reduced complications to enhance patient outcomes. Companies invest in R&D to create innovative filter designs tailored for different patient profiles and clinical needs. Collaborations with healthcare providers and institutions drive the adoption of these solutions in venous thromboembolism management.

Geographic expansion into regions with rising incidences of deep vein thrombosis and pulmonary embolism supports market growth. Many players also emphasize regulatory compliance and affordability to ensure broad accessibility and trust.

Boston Scientific Corporation is a leading company in this market, offering advanced IVC filter solutions like the Greenfield filter. The company focuses on innovation, integrating precision engineering with robust safety features to improve patient care. Boston Scientific’s global presence and dedication to advancing interventional medicine solidify its position as a key player in the industry.

Top Key Players

- Philips

- Medtronic

- Johnson and Johnson

- Invatec

- Cordis-X

- Cook Medical

- Braun

- Boston Scientific

Recent Developments

- In June 2022, Cordis-X committed US$ 11.5 million to Adient Medical, a company specializing in the development of advanced absorbable inferior vena cava (IVC) filters. These next-generation filters are designed to offer enhanced protection against pulmonary embolisms (PE), aiming to improve patient safety and outcomes.

- In December 2021, the US Food and Drug Administration approved the Philips CavaClear Laser Sheath, the first device of its kind that utilizes laser technology to facilitate the removal of inferior vena cava (IVC) filters. These filters, which are used to capture blood clots, often need to be removed when traditional extraction methods prove ineffective, and the new device offers a safer, more efficient option for their removal.

Report Scope

Report Features Description Market Value (2024) US$ 0.8 billion Forecast Revenue (2034) US$ 1.9 billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Retrievable and Permanent), By Material (Metallic and Non-Metallic), By Application (Pulmonary Embolism, Deep Vein Thrombosis, Trauma & Surgical Procedures, and Others), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Philips, Medtronic, Johnson & Johnson, Invatec, Cordis-X, Cook Medical, Braun, and Boston Scientific. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Inferior Vena Cava IVC Filter MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Inferior Vena Cava IVC Filter MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Philips

- Medtronic

- Johnson and Johnson

- Invatec

- Cordis-X

- Cook Medical

- Braun

- Boston Scientific