Global Inertial Navigation System Market Size, Share, Growth Analysis By Component (Accelerometers, Gyroscopes, Magnetometers, Inertial Measurement Units (IMU), Others), By Technology (Mechanical Gyro, Ring Laser Gyro (RLG), Fiber-Optic Gyro (FOG), Micro-Electro-Mechanical Systems (MEMS), Hemispherical Resonator Gyro (HRG)), By Platform (Airborne, Land, Naval, Space), By End-user (Aerospace and Defense, Marine, Automotive, Agriculture, Mining and Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173036

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

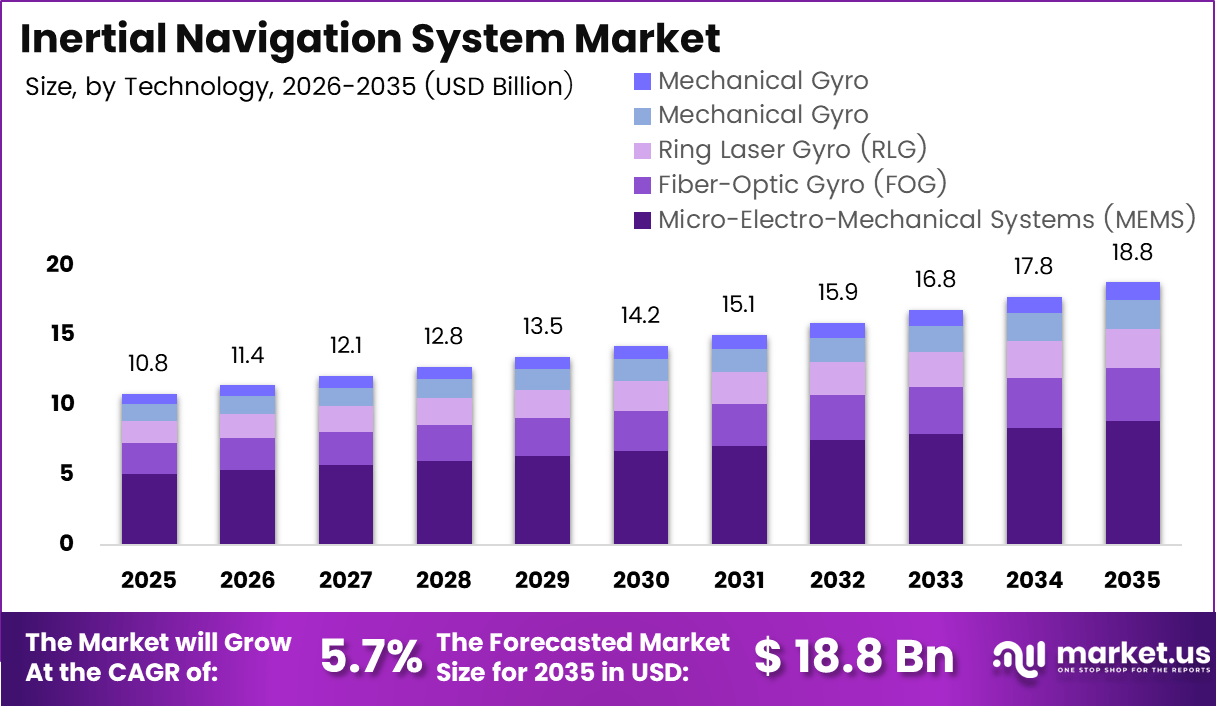

The Global Inertial Navigation System Market size is expected to be worth around USD 18.8 billion by 2035, from USD 10.8 billion in 2025, growing at a CAGR of 5.7% during the forecast period from 2026 to 2035.

The inertial navigation system market refers to technologies that calculate position, orientation, and velocity using motion sensors without external signals. These systems support navigation in air, land, sea, and space platforms. Therefore, inertial navigation enables continuous positioning where satellite signals are unreliable, denied, or unavailable, supporting mission critical operations.

Inertial navigation systems increasingly underpin autonomous mobility, precision defense platforms, and advanced industrial automation. Moreover, adoption accelerates as navigation accuracy, system robustness, and real time responsiveness become strategic priorities. Consequently, inertial navigation integrates deeply into guidance, control, and safety architectures across commercial and government programs.

Market growth remains supported by rising demand for resilient navigation in contested and GPS denied environments. Additionally, defense modernization programs and aerospace expansion reinforce long term demand visibility. Governments prioritize inertial navigation for submarines, missiles, unmanned systems, and aircraft, as regulatory frameworks emphasize operational continuity, redundancy, and national security resilience.

Opportunities continue expanding through miniaturization, sensor fusion, and software defined navigation architectures. As a result, inertial navigation systems increasingly combine with AI algorithms, advanced gyroscopes, and edge processing. Furthermore, smart infrastructure, offshore exploration, and deep sea operations benefit from high precision navigation capabilities beyond satellite dependent systems.

Government investments further strengthen market momentum through funding of defense electronics, space missions, and indigenous navigation capabilities. Regulatory emphasis on safety certification, export controls, and compliance standards also shapes procurement behavior. Therefore, suppliers align product development with long lifecycle reliability, qualification testing, and secure manufacturing requirements.

According to Inertial Sense disclosures, over 30,000 inertial systems have been deployed globally across defense and commercial applications, demonstrating large scale operational trust. The same source indicates navigation accuracy down to 6000 meters, highlighting suitability for deep sea and high precision environments.

From an industry consolidation standpoint, included a 110,000 square foot production facility and associated assets, reinforcing manufacturing scale and vertical integration within navigation supply chains. Collectively, these developments indicate a structurally growing inertial navigation system market driven by resilience, precision, and strategic autonomy.

Key Takeaways

- The Global Inertial Navigation System Market is projected to reach USD 18.8 billion by 2035, rising from USD 10.8 billion in 2025, at a CAGR of 5.7% during 2026 to 2035.

- By component, Inertial Measurement Units dominate the market with a share of 39.4%, reflecting strong demand for integrated sensing solutions.

- By technology, Micro Electro Mechanical Systems lead adoption with 47.2%, supported by scalability and compact system requirements.

- By platform, airborne applications account for the largest share at 43.3%, driven by aviation, UAV, and defense navigation needs.

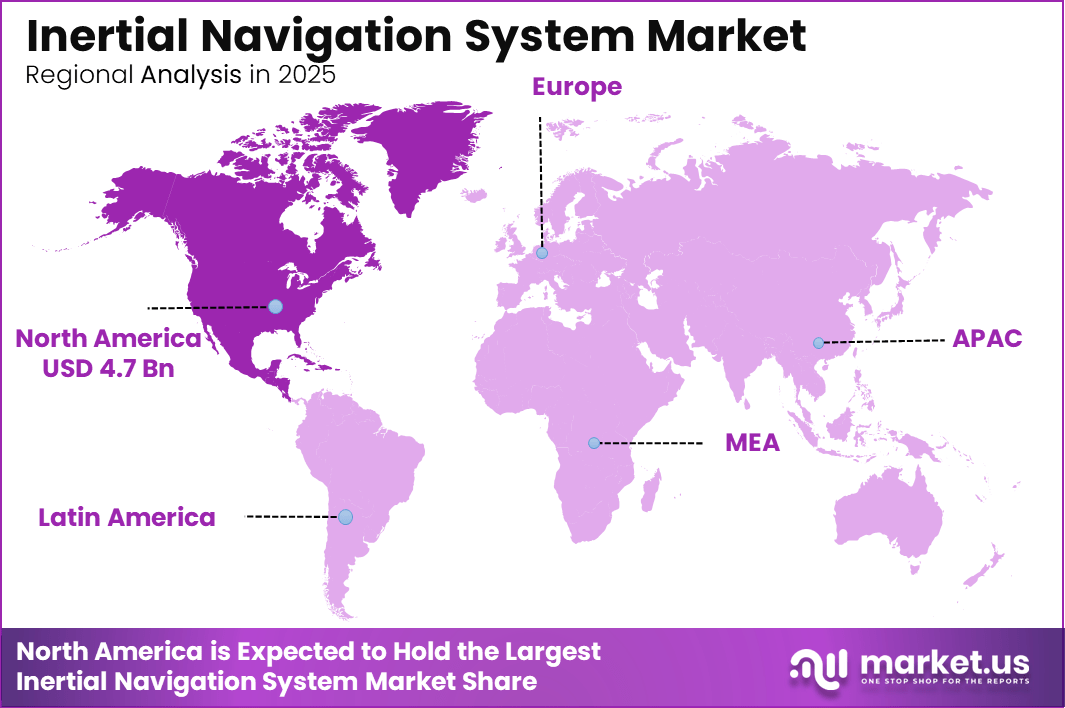

- By region, North America dominates the market with 43.9% share, valued at USD 4.7 billion, supported by defense and aerospace investments.

By Component Analysis

Inertial Measurement Units (IMU) dominates with 39.4% due to its integrated sensing and easier system level deployment.

In 2025, Inertial Measurement Units (IMU) held a dominant market position in the By Main Segment Analysis segment of Inertial Navigation System Market, with a 39.4% share. Moreover, IMUs bundle multiple sensors in one module, improving packaging efficiency and simplifying calibration, which supports faster integration across mission critical navigation and guidance architectures.

Additionally, accelerometers remain essential for measuring linear motion and vibration, supporting stabilization and dead reckoning when external signals degrade. Therefore, demand stays linked to platform safety, control loops, and ruggedized designs, where consistent performance across temperature and shock conditions influences procurement and long term reliability planning.

Meanwhile, gyroscopes enable angular rate sensing for precise orientation and attitude control. Consequently, platforms requiring tight pointing accuracy and smoother control benefit from improved drift management and signal processing. Also, modernization programs prioritize compact gyros to reduce size and power while maintaining dependable navigation continuity.

Furthermore, magnetometers support heading reference by sensing Earth’s magnetic field and aiding sensor fusion. As a result, they improve orientation correction in cost sensitive systems and complementary navigation stacks. However, deployments emphasize calibration and magnetic interference mitigation to sustain stable performance in complex operational environments.

Finally, others include supporting electronics and auxiliary sensors that enhance redundancy, diagnostics, and environmental robustness. Thus, adoption aligns with lifecycle cost optimization, maintainability, and compliance needs. Integration choices increasingly emphasize modularity and interoperability so upgrades remain manageable across diverse platforms and mission profiles.

By Technology Analysis

Micro Electro Mechanical Systems (MEMS) dominates with 47.2% due to scalability, compact form factors, and broad multi platform adoption.

In 2025, Micro Electro Mechanical Systems (MEMS) held a dominant market position in the By Main Segment Analysis segment of Inertial Navigation System Market, with a 47.2% share. Moreover, MEMS supports high volume production and small, power efficient designs, enabling wider adoption across unmanned, tactical, and industrial navigation use cases.

Additionally, mechanical gyro technology continues serving legacy and rugged applications where proven architectures matter. Therefore, upgrades focus on reliability, consistent accuracy, and maintainability across long service cycles. Programs using established supply chains value predictable performance, especially when integration risk and qualification timelines remain strict for defense grade deployments.

Meanwhile, Ring Laser Gyro (RLG) technology remains important for high accuracy navigation in premium platforms. Consequently, RLG adoption ties to requirements for low drift and strong stability, supporting aircraft and strategic systems. Integration emphasizes quality control and calibration discipline to preserve precision throughout extended mission profiles.

Furthermore, Fiber Optic Gyro (FOG) technology supports accurate performance with robust shock tolerance and flexible configurations. As a result, FOG fits naval, airborne, and land platforms needing dependable attitude sensing. Developers increasingly pair FOG with advanced filtering and fusion to sustain accuracy in dynamic, signal challenged environments.

Finally, Hemispherical Resonator Gyro (HRG) targets high end applications prioritizing extreme stability and durability. Thus, adoption aligns with missions demanding long run accuracy and low maintenance. Procurement often reflects strict qualification requirements, and suppliers emphasize consistent manufacturing control to protect performance in critical guidance systems.

By Platform Analysis

Airborne dominates with 43.3% due to high navigation accuracy needs across aviation, UAVs, and defense flight missions.

In 2025, Airborne held a dominant market position in the By Main Segment Analysis segment of Inertial Navigation System Market, with a 43.3% share. Moreover, airborne missions demand continuous positioning, attitude control, and stabilization, which raises the value of robust inertial performance, sensor fusion readiness, and reliable operation during GPS challenged conditions.

Additionally, land platforms depend on inertial navigation for convoy movement, autonomous mobility, and industrial positioning. Therefore, demand grows with requirements for rugged durability, vibration tolerance, and dependable dead reckoning in urban canyons, tunnels, and remote terrain. Integration increasingly supports modular upgrades for mixed fleet Management planning.

Meanwhile, naval platforms prioritize resilient navigation under limited external signal availability and harsh maritime conditions. Consequently, inertial systems support submarines, surface vessels, and maritime patrol needs, emphasizing long endurance stability and alignment accuracy. Programs often value redundancy and environmental sealing to sustain performance across corrosion and shock exposure.

Furthermore, space platforms require extreme reliability, radiation tolerance, and precision attitude determination. As a result, inertial navigation supports launch, orbit control, and spacecraft pointing requirements. Qualification remains stringent, and suppliers focus on validated performance, fault tolerance, and long mission life stability aligned with space system assurance expectations.

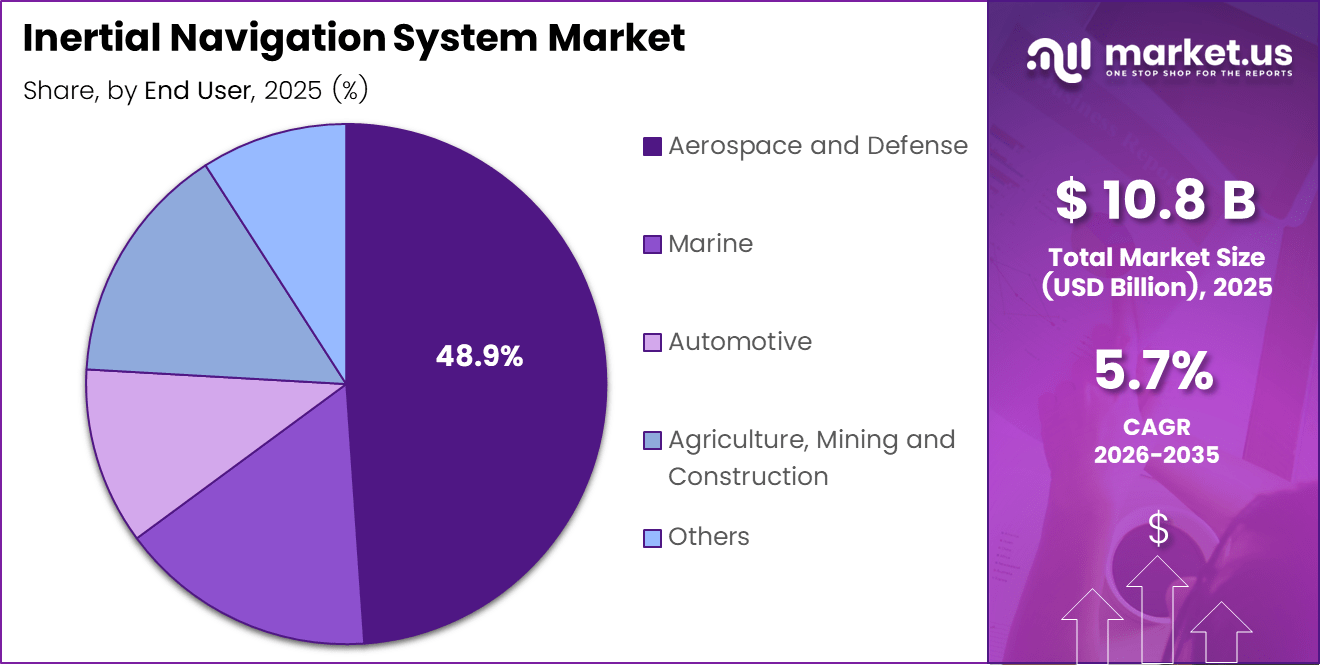

By End user Analysis

Aerospace and Defense dominates with 48.9% due to modernization programs and sustained demand for resilient navigation in contested environments.

In 2025, Aerospace and Defense held a dominant market position in the By Main Segment Analysis segment of Inertial Navigation System Market, with a 48.9% share. Moreover, defense platforms require assured navigation for aircraft, missiles, and unmanned systems, reinforcing demand for accuracy, robustness, and integration readiness across guidance and control stacks.

Additionally, marine end users adopt inertial navigation to support vessel positioning, dynamic stabilization, and reliable heading in complex maritime environments. Therefore, procurement emphasizes long endurance stability, shock tolerance, and corrosion resistant packaging. Operators increasingly value integrated monitoring features that simplify maintenance planning and sustain performance across demanding sea states.

Meanwhile, automotive end users focus on inertial sensing for advanced driver assistance, autonomy functions, and vehicle localization when external signals weaken. Consequently, compact designs and efficient power use matter, alongside reliable fusion with cameras and GNSS chip. Development priorities include consistent performance across temperature swings and high vibration road profiles.

Furthermore, agriculture, mining and construction rely on inertial navigation for machine control, surveying support, and precision operations in remote sites. As a result, systems prioritize ruggedization, dust resistance, and steady accuracy under heavy equipment dynamics. Adoption strengthens where productivity gains depend on repeatable positioning and reduced rework.

Finally, others include industrial automation, surveying, and specialized robotics where dependable motion tracking improves operational continuity. Thus, adoption aligns with safety, efficiency, and uptime goals. Buyers often favor modular solutions that simplify integration and enable upgrades as processing, fusion, and calibration requirements mature across evolving deployments.

Key Market Segments

By Component

- Accelerometers

- Gyroscopes

- Magnetometers

- Inertial Measurement Units (IMU)

- Others

By Technology

- Mechanical Gyro

- Ring Laser Gyro (RLG)

- Fiber-Optic Gyro (FOG)

- Micro-Electro-Mechanical Systems (MEMS)

- Hemispherical Resonator Gyro (HRG)

By Platform

- Airborne

- Land

- Naval

- Space

By End-user

- Aerospace and Defense

- Marine

- Automotive

- Agriculture, Mining and Construction

- Others

Drivers

Increasing Demand for Precise Navigation in GPS Denied Environments Drives Market Growth

Defense forces and aerospace operators increasingly deploy autonomous navigation across aircraft, missiles, submarines, and unmanned platforms, which raises demand for inertial navigation that keeps systems stable even when external signals drop. As autonomy scales, inertial navigation supports reliable guidance, control, and targeting by continuously tracking motion and orientation.

Demand also rises because many missions operate in GPS tracking denied and contested environments where jamming and spoofing risks remain high. In these conditions, inertial navigation acts as a resilient backbone that maintains navigation continuity and improves mission safety during signal interruptions.

Commercial aviation expansion and higher space activity strengthen adoption as airlines, launch providers, and satellite operators prioritize dependable positioning for route accuracy, attitude control, and flight safety. In parallel, industrial automation and robotics adopt advanced motion sensing to support precise movement, factory navigation, and smoother robotic operations in complex indoor settings.

Restraints

Increasing Demand for Precise Navigation in GPS Denied Environments Creates Key Market Restraints

High system cost remains a primary restraint, especially for tactical and strategic grade solutions that require high performance sensors, robust enclosures, and specialized components. Many buyers also face calibration complexity, where achieving low drift and long term stability demands controlled testing, skilled engineering, and careful integration.

Long development cycles further limit speed to market, particularly in defense and aerospace programs where qualification takes time. Safety critical applications also require stringent certification and documentation, which increases compliance effort, extends timelines, and raises program risk when specifications change mid cycle.

Growth Factors

Increasing Demand for Precise Navigation in GPS Denied Environments Unlocks New Growth Opportunities

Integration of INS with AI enabled sensor fusion and edge computing creates a major opportunity because it improves accuracy by blending inertial data with cameras, radar, LiDAR, and GNSS when available. This approach supports smarter navigation decisions in real time while reducing dependence on any single sensor.

Demand is also rising for compact and low power INS in drones, wearables, and smart mobility systems where size, weight, and power limits remain strict. Suppliers that optimize miniaturized designs and efficient processing are anticipated to gain stronger adoption across consumer and enterprise devices.

Space exploration investments expand opportunities in launch vehicles, lunar missions, and deep space navigation where inertial capability supports attitude determination and autonomous guidance. Smart infrastructure and geospatial mapping also expand use cases, as inertial navigation improves surveying, mobile mapping accuracy, and positioning continuity in urban canyons.

Emerging Trends

Increasing Demand for Precise Navigation in GPS Denied Environments Shapes Key Market Trends

Miniaturization continues accelerating through MEMS innovation and photonic gyroscope advancements, which supports smaller form factors while improving stability and reducing drift. This trend helps suppliers address high volume markets that need scalable manufacturing and consistent performance.

Hybrid GNSS INS architectures gain wider use because they provide continuous high accuracy positioning by combining satellite signals with inertial continuity during outages. This approach strengthens navigation reliability for aviation, maritime, surveying, and autonomous systems operating in challenging terrain.

INS adoption in electric and autonomous vehicles grows as navigation stacks require smooth localization for lane level guidance and safety functions. Collaboration also increases between defense contractors and commercial navigation technology providers, which speeds technology transfer and expands dual use solutions across defense, aviation, robotics, and mobility.Regional Analysis

North America Dominates the Inertial Navigation System Market with a Market Share of 43.9%, Valued at USD 4.7 Billion

North America leads the inertial navigation system market, accounting for a dominant 43.9% share and a market value of USD 4.7 billion. This dominance is supported by strong defense spending, aerospace modernization programs, and early adoption of advanced navigation technologies. Moreover, sustained investments in autonomous systems and GPS-denied navigation capabilities continue reinforcing regional demand. The presence of mature aviation, space, and defense ecosystems further strengthens long-term market stability.

Europe Inertial Navigation System Market Trends

Europe represents a significant regional market, driven by growing defense collaboration programs and expanding aerospace manufacturing activities. Additionally, increased focus on border security, naval modernization, and satellite independent navigation supports adoption. Regulatory emphasis on safety and precision also encourages integration of inertial systems across civil aviation and industrial platforms. As a result, demand remains steady across both defense and commercial applications.

Asia Pacific Inertial Navigation System Market Trends

Asia Pacific demonstrates strong growth momentum due to rising defense budgets, expanding space programs, and rapid industrial automation. Countries across the region prioritize indigenous navigation capabilities, supporting broader deployment of inertial systems. Moreover, increasing use of unmanned platforms and advanced transportation infrastructure accelerates adoption. Manufacturing scale and technology localization further contribute to regional market expansion.

Middle East and Africa Inertial Navigation System Market Trends

The Middle East and Africa market benefits from defense modernization initiatives and growing investments in aerospace and border security. Inertial navigation systems support military aviation, naval operations, and critical infrastructure protection in the region. Additionally, harsh operating environments increase reliance on robust navigation solutions. Consequently, demand aligns closely with national security and surveillance priorities.

Latin America Inertial Navigation System Market Trends

Latin America shows gradual adoption of inertial navigation systems, supported by defense upgrades, mining operations, and infrastructure development. Regional demand emphasizes reliability and durability for land and maritime platforms. Furthermore, increasing interest in autonomous and precision guided systems contributes to market traction. Growth remains moderate but consistent as modernization initiatives progress.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Bharat Electronic Limited (BEL) benefits from its deep alignment with India’s defense modernization priorities, where inertial navigation supports missiles, aircraft upgrades, naval platforms, and mobile ground systems. In 2025, its positioning across indigenous programs strengthens qualification cycles and long term volumes, while localized production reduces supply risk and supports lifecycle sustainment needs.

Gladiator Technologies stays relevant through a focused portfolio in compact, rugged IMUs and tactical grade INS solutions used in unmanned systems, precision pointing, and industrial navigation tasks. In 2025, demand increasingly favors suppliers that can balance accuracy with size, weight, and power constraints, and Gladiator’s specialization supports quicker integration for OEMs seeking shorter design iterations.

Honeywell International Inc. continues to anchor high assurance navigation requirements where reliability, redundancy, and certification readiness matter most, including aerospace and defense platforms operating in GPS challenged conditions. In 2025, Honeywell’s strength links to mature manufacturing quality, extensive field heritage, and strong systems integration capabilities that support multi platform deployments and sustainment contracts.

Northrop Grumman Corporation remains influential in higher end inertial navigation, particularly where strategic grade performance and survivability drive procurement decisions. In 2025, its advantage ties to advanced sensor technologies, resilient guidance architectures, and strong defense customer access, supporting programs that prioritize precision, mission continuity, and electronic warfare tolerance.

Top Key Players in the Market

- Bharat Electronic Limited (BEL)

- Gladiator Technologies

- Honeywell International Inc.

- Northrop Grumman Corporation

- Parker Hannifin Corporation

- RTX Corporation

- Safran S.A.

- Teledyne Technologies Incorporated

- Thales Group

- Trimble Inc.

- VectroNav Technologies LLC.

Recent Developments

- In November 2025, Hexagon announced an agreement to acquire Inertial Sense to expand its positioning portfolio, strengthening capabilities in tactical grade GNSS+INS solutions across defense, industrial, and autonomous navigation applications.

- In February 2024, Sapura acquired eight units of Exail Rovins Nano Inertial Navigation Systems, integrating them into its ROV fleet to enhance offshore subsea installation accuracy and operational performance.

- In December 2024, Viavi Solutions Inc. signed a definitive agreement to acquire Inertial Labs, Inc. for an initial consideration of $150 million, with up to $175 million in contingent payments over four years, funded through cash on hand.

Report Scope

Report Features Description Market Value (2025) USD 10.8 billion Forecast Revenue (2035) USD 18.8 billion CAGR (2026-2035) 5.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Accelerometers, Gyroscopes, Magnetometers, Inertial Measurement Units (IMU), Others), By Technology (Mechanical Gyro, Ring Laser Gyro (RLG), Fiber-Optic Gyro (FOG), Micro-Electro-Mechanical Systems (MEMS), Hemispherical Resonator Gyro (HRG)), By Platform (Airborne, Land, Naval, Space), By End-user (Aerospace and Defense, Marine, Automotive, Agriculture, Mining and Construction, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bharat Electronic Limited (BEL), Gladiator Technologies, Honeywell International Inc., Northrop Grumman Corporation, Parker Hannifin Corporation, RTX Corporation, Safran S.A., Teledyne Technologies Incorporated, Thales Group, Trimble Inc., VectroNav Technologies LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Inertial Navigation System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Inertial Navigation System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bharat Electronic Limited (BEL)

- Gladiator Technologies

- Honeywell International Inc.

- Northrop Grumman Corporation

- Parker Hannifin Corporation

- RTX Corporation

- Safran S.A.

- Teledyne Technologies Incorporated

- Thales Group

- Trimble Inc.

- VectroNav Technologies LLC.