Global Industrial Catalyst Market Size, Share, And Enhanced Productivity By Type (Heterogeneous Catalyst, Homogeneous Catalyst), By Material (Chemicals, Metals, Zeolites, Organometallic Materials, Others), By Application (Petroleum Refinery, Chemical Synthesis, Petrochemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177155

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

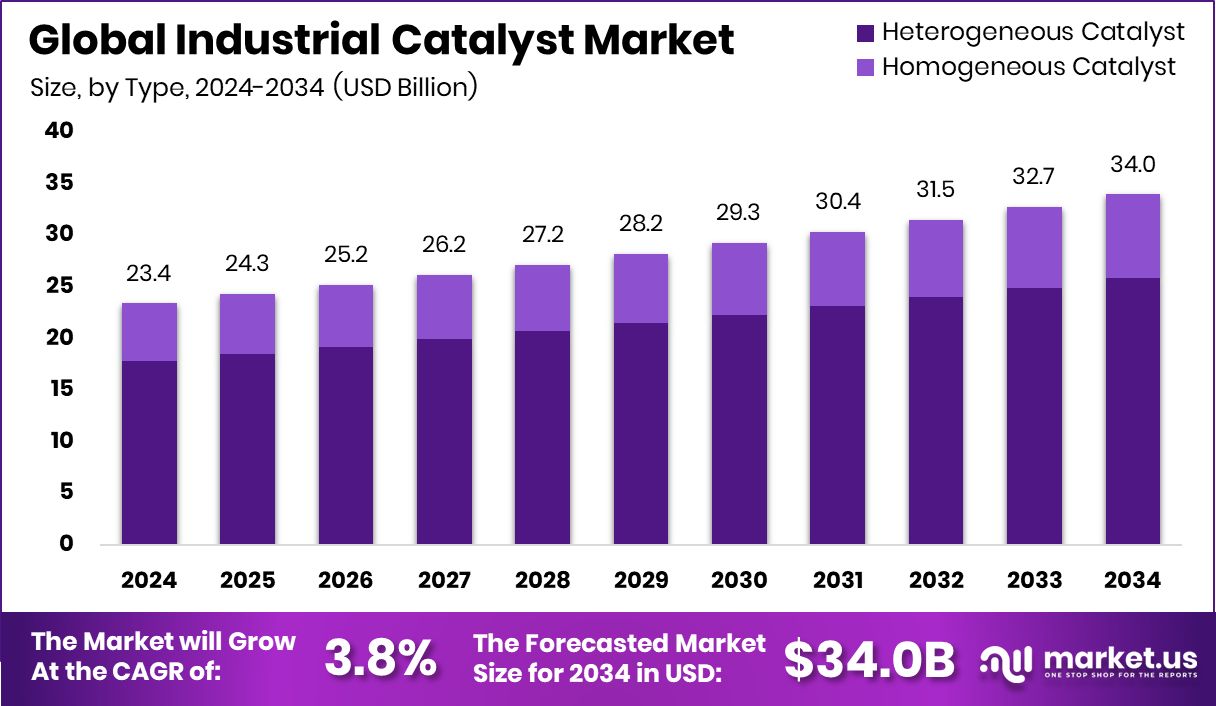

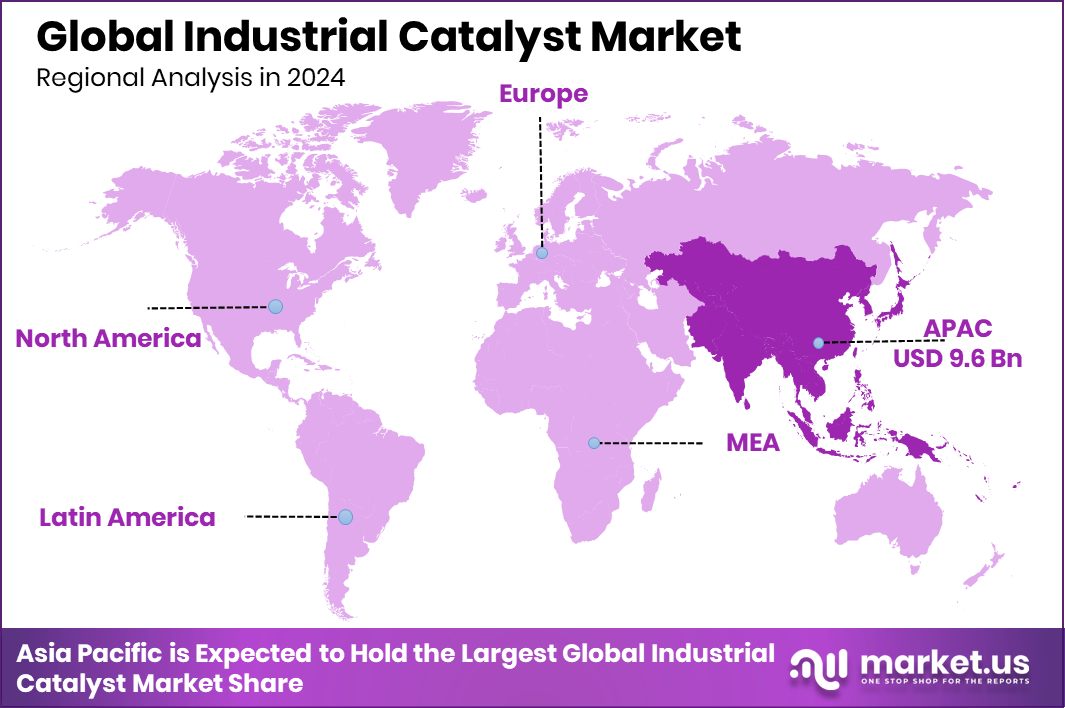

The Global Industrial Catalyst Market is expected to be worth around USD 34.0 billion by 2034, up from USD 23.4 billion in 2024, and is projected to grow at a CAGR of 3.8% from 2025 to 2034. Driven by rapid industrial growth, the Asia Pacific held 41.4% and USD 9.6 Bn.

Industrial catalysts are substances that speed up chemical reactions without being consumed, helping industries achieve faster processing, lower energy use, and higher product quality. They play a critical role in refining, petrochemicals, chemical synthesis, plastics, and environmental treatment. The Industrial Catalyst Market covers the production, use, and advancement of these catalyst materials, including heterogeneous, homogeneous, metal-based, chemical, organometallic, and zeolite catalysts used across petroleum refinery, petrochemicals, and broader industrial applications.

Growth in this market is supported by rising industrial output, the need for cleaner processes, and ongoing energy-efficiency initiatives. Significant funding activities also influence momentum. For example, Germany is using its recently raised €6.3 million incentive program to cut industrial energy costs, directly encouraging industries to adopt efficient catalytic systems.

Demand is influenced by the push toward sustainable production, expanding fuel upgrading needs, and modernized chemical synthesis. Challenges also shape market restructuring, as seen when Catalyst defaulted on $97.3M in loans in the Granary District, highlighting financial risks that can slow project execution.

New opportunities continue to emerge globally. European Union–focused innovation grew as UP Catalyst raised €18 million to boost critical raw material production. Similarly, Egypt secured $135 million for a bioethanol project supporting green energy, while the Grangemouth chemicals plant remained operational after receiving £120 million in government funding. These developments collectively reinforce the expanding role of catalysts in energy transition and industrial modernization.

Key Takeaways

- The Global Industrial Catalyst Market is expected to be worth around USD 34.0 billion by 2034, up from USD 23.4 billion in 2024, and is projected to grow at a CAGR of 3.8% from 2025 to 2034.

- The Industrial Catalyst Market sees strong momentum as heterogeneous catalysts dominate global demand with 76.2%.

- In the Industrial Catalyst Market, metals lead as the primary material choice with 36.7% adoption.

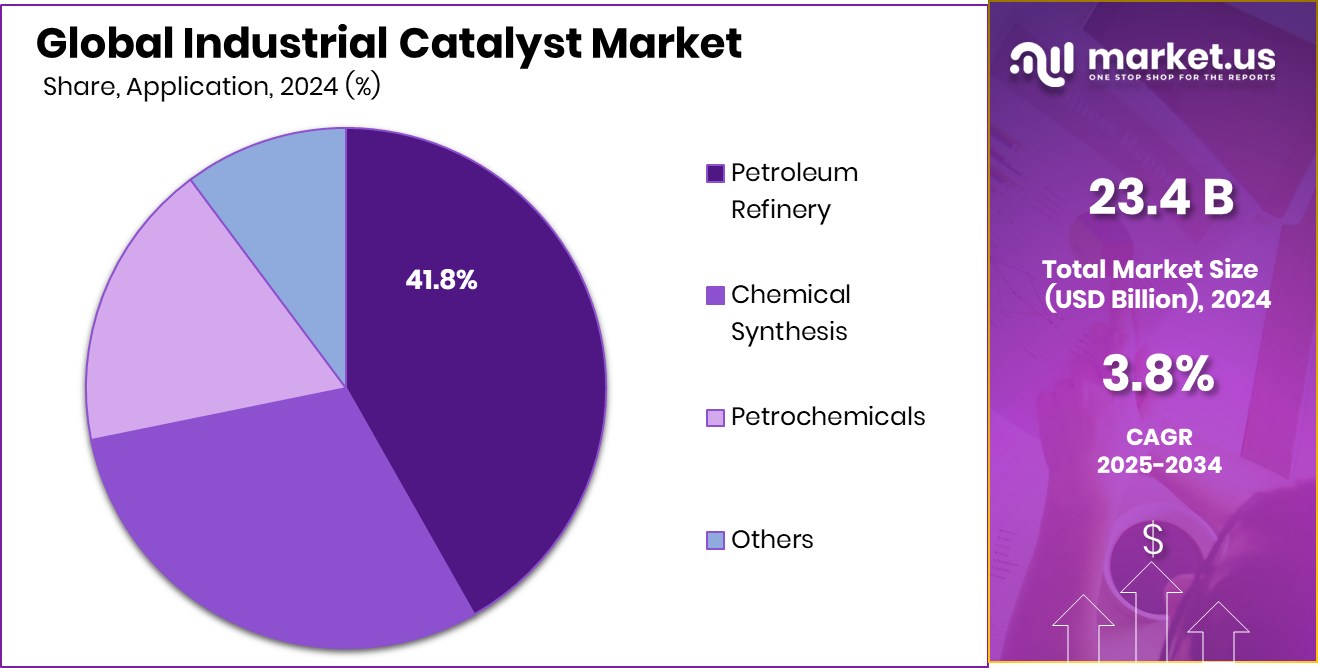

- The Industrial Catalyst Market expands steadily as petroleum refinery applications account for 41.8% overall usage.

- Asia Pacific maintained Industrial Catalyst Market leadership with 41.4% share and USD 9.6 Bn valuation.

By Type Analysis

Heterogeneous catalyst dominated the Industrial Catalyst Market segment with a 76.2% share.

In 2024, the Industrial Catalyst Market was strongly shaped by the dominance of heterogeneous catalysts, which accounted for a 76.2% share due to their wide acceptance in large-scale industrial processes. Their solid physical form, ease of separation, and high thermal stability made them the preferred option for refining, chemical synthesis, and pollution-control reactions.

Industries favored these catalysts because they reduce environmental impact, enhance reaction efficiency, and lower operational downtime. The rising global demand for cleaner fuels and advanced petrochemical processing further increased their usage. Additionally, ongoing investments in renewable energy technologies and green chemistry supported the shift toward durable, reusable catalyst systems, ensuring heterogeneous catalysts remained the backbone of industrial catalytic operations in 2024.

By Material Analysis

Metals dominated the Industrial Catalyst Market materials segment with a 36.7% share.

In 2024, the Industrial Catalyst Market saw metal-based catalysts leading the material segment with a 36.7% share, supported by their unmatched efficiency in accelerating complex chemical transformations. Metals such as platinum, palladium, nickel, and copper continued to be integral in petroleum refining, chemical manufacturing, automotive exhaust control, and polymer production. Their superior catalytic activity, high selectivity, and ability to withstand harsh reaction conditions made them indispensable for industries seeking higher productivity and energy savings.

The shift toward cleaner industrial processes also boosted adoption, as metallic catalysts help reduce harmful emissions and optimise resource consumption. Despite their higher cost, industries prioritised metal catalysts for their long operational life and innovative applications in emerging green-energy technologies.

By Application Analysis

Petroleum refinery dominated the industrial catalyst market segment with a 41.8% share.

In 2024, the petroleum refinery segment dominated the industrial catalyst market with a 41.8% share, driven by continuous demand for fuel upgrading, desulfurization, and cracking processes. Catalysts played a crucial role in enhancing refinery efficiency, improving fuel quality, and meeting increasingly strict environmental standards worldwide. As global transportation and logistics networks expanded, the need for cleaner and more efficient fuels pushed refineries to adopt advanced catalyst technologies.

The transition toward low-sulfur diesel, improved gasoline yield, and optimized hydroprocessing operations further strengthened the segment’s leadership. Investments in refinery modernisation, coupled with rising energy consumption in developing economies, positioned catalysts as a core technological asset, reinforcing petroleum refining as the largest application area in 2024.

Key Market Segments

By Type

- Heterogeneous Catalyst

- Homogeneous Catalyst

By Material

- Chemicals

- Metals

- Zeolites

- Organometallic Materials

- Others

By Application

- Petroleum Refinery

- Chemical Synthesis

- Petrochemicals

- Others

Driving Factors

Rising demand for natural sweeteners globally

The Industrial Catalyst Market continues to grow as industries prioritize cleaner and more efficient processing systems. The rising demand for cleaner industrial processes has encouraged manufacturers to adopt catalysts that lower emissions and support energy-efficient operations. This momentum is further strengthened by large-scale financial activity supporting industrial upgrades.

A major example is Afreximbank signing a US$1.35 billion financing agreement as Lead Arranger in a USD 4 billion syndicated facility to refinance Dangote Refinery construction, demonstrating how significant capital commitments can accelerate the shift toward advanced catalytic technologies. Such sizable investments signal increased confidence in improved refining capabilities, environmental compliance, and sustainable process optimization, ultimately pushing industries to adopt catalysts that enhance performance and modernize production infrastructure.

Restraining Factors

Limited sourcing of premium date varieties

Despite strong market potential, high catalyst costs continue to limit broader adoption across several industries. Many mid-scale manufacturers struggle to integrate advanced catalytic systems due to elevated production, installation, and operational expenses. These financial pressures are further highlighted by ongoing regional funding commitments that reveal the scale required to sustain industrial growth.

For instance, Afreximbank’s allocation of a $1.35 billion loan for the Dangote Refinery underscores how substantial capital is often needed to support large-scale refining and catalytic operations. When such heavy financing becomes essential, smaller players face constraints in accessing high-performance catalysts. As a result, cost barriers remain one of the most notable limitations for companies seeking to modernize equipment and meet rising efficiency expectations.

Growth Opportunity

Expanding use in functional food formulations

Opportunities in the Industrial Catalyst Market continue to expand as governments and organizations invest in cleaner, more efficient industrial capacity. Growing investments support sustainable catalyst development by encouraging upgrades in refining, petrochemicals, and chemical processing facilities. A clear example is the strategic expansion of refinery-linked financing in Africa, where a leading African financier revealed its role in Dangote’s oil refinery and disclosed over $4 billion in investment.

Such large-scale commitments create fertile ground for catalyst manufacturers to introduce new technologies that minimize emissions and improve process yields. As more economies push toward energy transition and resource efficiency, catalysts become essential tools for unlocking higher productivity, enabling companies to modernize operations while aligning with long-term sustainability goals.

Latest Trends

Increasing shift toward instant date powder

The Industrial Catalyst Market is experiencing a rapid shift toward low-emission catalyst technologies as regions intensify their focus on cleaner energy and improved refining performance. This trend is amplified by global funding activities supporting new refinery developments and modernization efforts.

A recent example is Uganda turning to a Bahrain-based financier for $2 billion to accelerate refining plans, an investment expected to stimulate the adoption of updated catalytic systems. These emerging financial commitments reflect a broader industry movement toward environmentally responsible processing and enhanced operational efficiency.

As nations upgrade or expand refineries, they increasingly rely on catalysts designed to reduce pollutants, improve conversion rates, and comply with stricter environmental frameworks shaping the next wave of industrial transformation.

Regional Analysis

The industrial catalyst market in the Asia Pacific reached 41.4%, valued strongly at USD 9.6 Bn.

In the Industrial Catalyst Market, Asia Pacific emerged as the dominating region, holding a 41.4% share valued at USD 9.6 Bn, supported by strong refinery operations, expanding chemical manufacturing, and rising industrial output across major economies. The region’s growing energy demand and continuous investments in production facilities further reinforced its leading position.

North America demonstrated steady adoption of advanced catalyst technologies due to stringent emission norms and the presence of established refining capacities. Europe showed consistent demand driven by its mature chemical sector and ongoing transition toward cleaner industrial processes. Latin America experienced moderate growth, largely influenced by refinery expansions and increasing petrochemical activities in select countries.

Meanwhile, the Middle East & Africa region continued to benefit from large-scale refining infrastructures and rising integration of catalytic systems to enhance fuel quality. Across all regions, catalysts played a critical role in strengthening process efficiency and supporting industrial modernisation, with the Asia Pacific maintaining clear leadership in both scale and market value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Albemarle Corporation strengthened its presence in the global Industrial Catalyst Market by leveraging its deep expertise in catalyst-based solutions used across refining and chemical transformation processes. The company focused on performance-driven formulations that support cleaner fuel production, process efficiency, and reduced operational burdens for large industrial users. Its portfolio diversity and long-term customer relationships enabled Albemarle to maintain strong relevance in catalyst-intensive industries.

Arkema S.A. continued to prioritize specialty catalyst technologies aligned with industrial sustainability needs. Its focus on engineered materials and chemical intermediates allowed the company to support customers seeking higher productivity and environmental compliance. Analysts note that Arkema’s approach of combining material science innovation with targeted industrial solutions positioned it as a flexible and adaptive contributor to catalytic applications globally.

BASF Corporation remained a prominent player due to its long-standing expertise in catalyst development, particularly for refining, petrochemical, and emission-control applications. Its emphasis on process optimization and durability helped clients improve efficiency while meeting industry-specific standards. BASF’s integrated manufacturing capabilities and technical support frameworks contributed to its consistent influence across multiple industrial catalyst end-use segments in 2024.

Top Key Players in the Market

- Albemarle Corporation

- Arkema S.A.

- BASF Corporation

- Clariant Ag

- Evonik Industries Ag

- Exxon Mobil Chemical Co

- Akzo Nobel N.V.

- Chevron Phillips Chemical Company

- The DOW Chemical Company

Recent Developments

- In December 2025, BASF introduced Lupragen® N 208, a new low-VOC amine catalyst for making polyurethane foams. This product helps manufacturers meet strict low-VOC standards, reducing harmful emissions during foam production used in mattresses, automotive interiors, and more.

- In November 2024, Clariant introduced improved versions of its syngas catalysts called ReforMax LDP Plus, ShiftMax 217 Plus, and AmoMax 10 Plus to help customers make hydrogen, ammonia, and methanol more efficiently with lower emissions. These advanced catalysts improve energy use and sustainability for industrial syngas plants.

Report Scope

Report Features Description Market Value (2024) USD 23.4 Billion Forecast Revenue (2034) USD 34.0 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Heterogeneous Catalyst, Homogeneous Catalyst), By Material (Chemicals, Metals, Zeolites, Organometallic Materials, Others), By Application (Petroleum Refinery, Chemical Synthesis, Petrochemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Albemarle Corporation, Arkema S.A., BASF Corporation, Clariant Ag, Evonik Industries Ag, Exxon Mobil Chemical Co, Akzo Nobel N.V., Chevron Phillips Chemical Company, The DOW Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Catalyst MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Industrial Catalyst MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Albemarle Corporation

- Arkema S.A.

- BASF Corporation

- Clariant Ag

- Evonik Industries Ag

- Exxon Mobil Chemical Co

- Akzo Nobel N.V.

- Chevron Phillips Chemical Company

- The DOW Chemical Company