Global Impact Modifier Market Size, Share, And Business Benefit By Type (AIM, ABS, MBS, CPE, EPDM, ASA, Others), By Application (PVC, Engineering Plastics, PBT, Nylon, Others), By End Use (Construction, Packaging, Consumer Goods, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162647

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

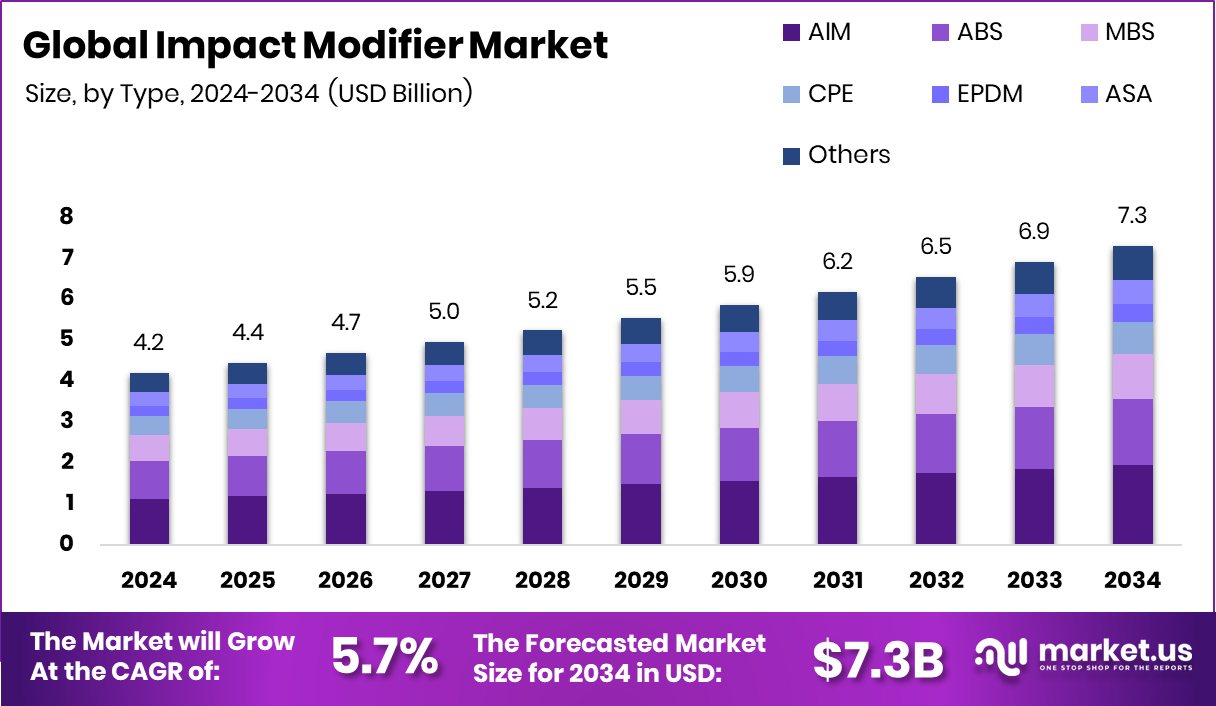

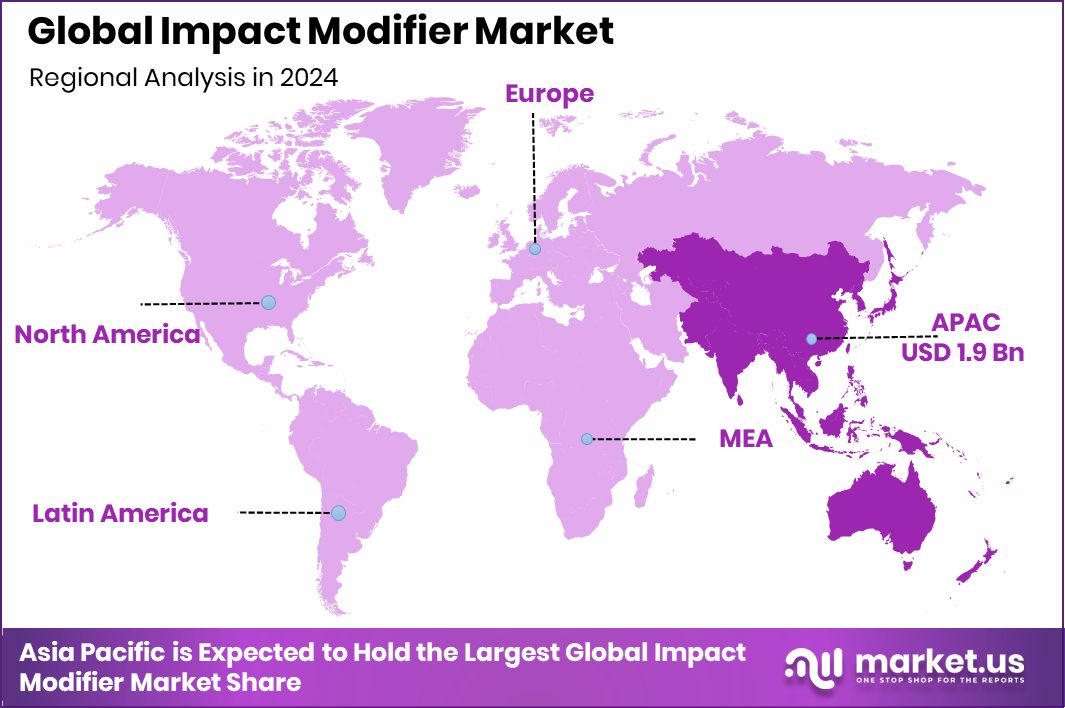

The Global Impact Modifier Market is expected to be worth around USD 7.3 billion by 2034, up from USD 4.2 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034. With a USD 1.9 Bn value, Asia-Pacific captured a 45.70% share in the Impact Modifier Market.

In polymer compounding, an impact modifier is a specially formulated additive that’s blended into a plastic resin to improve its ability to resist sudden shocks, drops, or cracking. These modifiers are typically elastomeric (rubber-like) particles or core-shell structures that absorb and dissipate impact energy, thereby improving toughness, especially in brittle or highly filled plastics.

The impact modifier market refers to the global trade and value chain of these additives and their incorporation into various resin systems (e.g., PVC, polyolefins, engineering plastics) for applications across automotive, construction, consumer goods, and packaging. Their demand is driven by evolving performance requirements such as low-temperature toughness, recycling compatibility, lightweighting, and cost-efficiency.

One major growth factor is the increasing adoption of lightweight, high-performance plastics in automotive, electrical, and appliance industries. As manufacturers push to replace metals or heavier materials with plastics, there is a greater need for resins that maintain durability and safety under impact, so impact modifiers become more essential. funding: ADIA, Motilal Oswal MF, others buy 2.9% stake in Shaily Engineering Plastics for ₹284 crore.

The demand for impact modifiers is rising because end-users require plastics that withstand harsh conditions (low temperature, repeated use, outdoor exposure) without failure. As construction materials, white goods, electronic housings, and packaging increasingly use filled or recycled resins, the base polymer’s intrinsic toughness falls and needs to be compensated. Hence, demand is pulled by those performance gaps being filled. funding: UNSW plastics recycling project awarded $4.99 m grant.

A significant opportunity lies in the recycling and sustainability trend. When recycled or blended resins are used, performance often drops (toughness, clarity, strength), and so there is a market opening for impact modifiers tailored for recycled systems or bio-based polymers. As regulators and consumers focus on circularity, the modifier suppliers who can service recycled-content or bio-resin programs stand to benefit. funding: Small-cap stock jumps 7% after mutual fund buys 3.14 Lakh shares in the company

Key Takeaways

- The Global Impact Modifier Market is expected to be worth around USD 7.3 billion by 2034, up from USD 4.2 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- In 2024, AIM held a 26.7% share in the Impact Modifier Market, boosting product toughness significantly.

- The PVC segment accounted for a 45.8% share in the Impact Modifier Market, driven by construction uses.

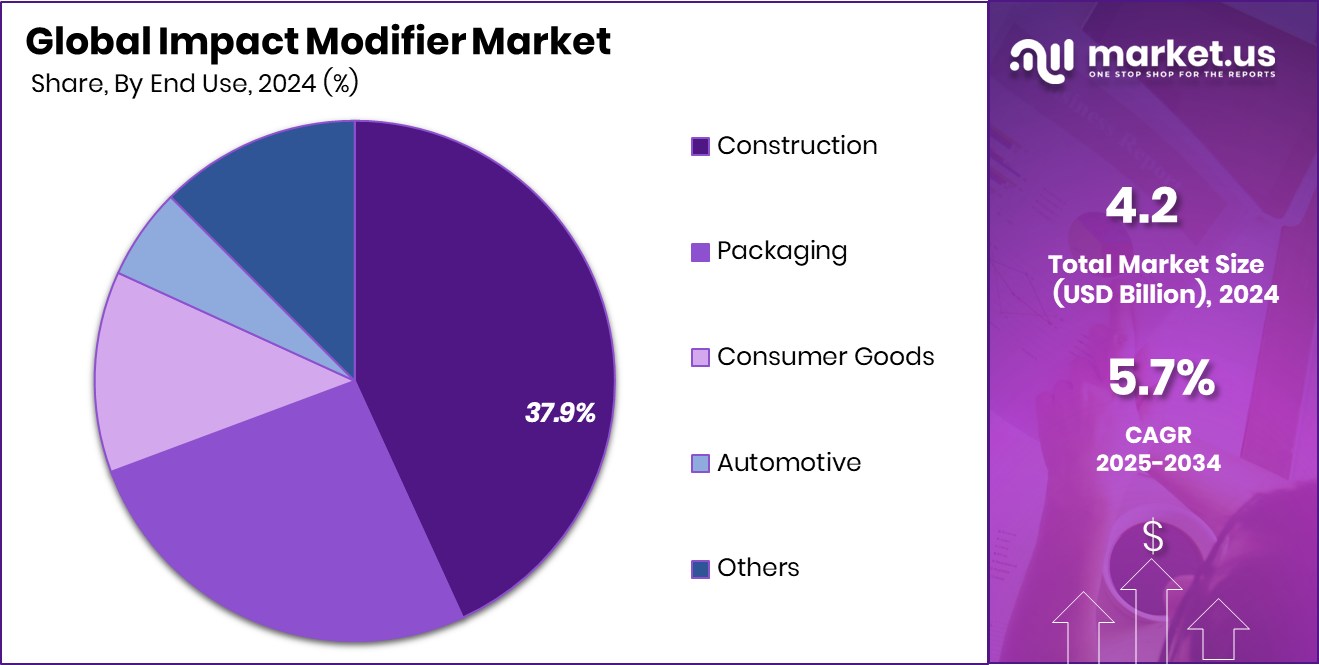

- The construction sector dominated with a 37.9% share in the Impact Modifier Market, emphasizing material durability needs.

- The Asia-Pacific region’s 45.70% share reflects strong demand worth USD 1.9 Bn.

By Type Analysis

In 2024, AIM held a 26.7% share in the Impact Modifier Market.

In 2024, AIM held a dominant market position in the By Type segment of the Impact Modifier Market, with a 26.7% share. Acrylonitrile-butadiene-styrene (AIM) impact modifiers are widely used to enhance toughness and weather resistance in rigid plastics such as PVC and engineering resins. Their excellent compatibility and ability to maintain optical clarity make them a preferred choice for high-performance applications.

Industries like automotive, construction, and consumer goods increasingly rely on AIM-modified polymers to improve impact resistance without compromising processability. The rising trend toward durable and lightweight materials has reinforced AIM’s strong foothold in this category, securing its leadership position in the impact modifier market throughout 2024.

By Application Analysis

PVC accounted for a 45.8% share in the Impact Modifier Market.

In 2024, PVC held a dominant market position in the By Application segment of the Impact Modifier Market, with a 45.8% share. The dominance of PVC is attributed to its extensive use in pipes, fittings, profiles, sheets, and film products that require superior toughness and impact resistance. Impact modifiers enhance PVC’s durability, making it suitable for applications exposed to mechanical stress and outdoor conditions.

The demand for modified PVC has grown significantly in the construction and infrastructure sectors, where materials must withstand environmental pressure and physical impact. This steady utilization across multiple industrial and consumer applications firmly established PVC as the leading segment in the global impact modifier market in 2024.

By End Use Analysis

Construction captured a 37.9% share in the Impact Modifier Market.

In 2024, Construction held a dominant market position in the By End Use segment of the Impact Modifier Market, with a 37.9% share. The construction sector’s leadership is driven by the extensive use of impact-modified plastics in profiles, pipes, fittings, and sheets that require enhanced toughness and weatherability. Impact modifiers improve the performance of PVC and other polymers used in building materials, ensuring longer life and resistance to cracking or deformation under stress.

Growing urban infrastructure projects and the preference for durable, lightweight, and low-maintenance materials further strengthened the use of modified plastics. This consistent demand from the global construction industry solidified its top position in the overall impact modifier market during 2024.

Key Market Segments

By Type

- AIM

- ABS

- MBS

- CPE

- EPDM

- ASA

- Others

By Application

- PVC

- Engineering Plastics

- PBT

- Nylon

- Others

By End Use

- Construction

- Packaging

- Consumer Goods

- Automotive

- Others

Driving Factors

Rising Demand for Durable and High-Performance Plastics

One of the main driving factors for the Impact Modifier Market is the rising demand for durable and high-performance plastics across industries. As modern applications in construction, automotive, and packaging require materials that can withstand heavy stress and impact, the need for modifiers that enhance toughness and flexibility has surged. Impact modifiers help plastics resist cracking, breaking, and temperature variations, improving their lifespan and reliability.

Growing investments in polymer recycling and sustainability initiatives also boost innovation in this field. For example, Samsara Eco funding climbs above $100 million, supporting advancements in recycled polymer technology. This funding reflects a global shift toward developing impact modifiers compatible with recycled and eco-friendly resins, fueling long-term market growth.

Restraining Factors

High Production Costs and Complex Manufacturing Processes

One major restraining factor for the Impact Modifier Market is the high production cost and complexity involved in manufacturing these additives. Producing high-quality impact modifiers requires advanced technology, precise formulation, and costly raw materials, which increase the overall production expenses. Many manufacturers face challenges in maintaining consistent product performance while keeping costs competitive.

Additionally, fluctuating prices of petrochemical-based feedstocks add further uncertainty to pricing and profitability. Small and medium enterprises often find it difficult to invest in such technologies, limiting their entry into the market. These factors collectively slow down large-scale adoption, especially in price-sensitive regions, restraining the overall growth potential of the global impact modifier market.

Growth Opportunity

Expanding Opportunities in Sustainable and Recycled Polymers

A major growth opportunity in the Impact Modifier Market lies in the rapid expansion of sustainable and recycled polymer applications. As industries move toward eco-friendly materials, the demand for impact modifiers compatible with recycled plastics and bio-based resins is growing. These modifiers help maintain strength and toughness in recycled products, ensuring durability equal to virgin materials.

Governments and companies are increasingly investing in circular economy initiatives to reduce plastic waste and carbon footprints. For instance, Syntetica raises €4.2M to close the loop in nylon recycling, supporting innovation in recycled polymer technologies. Such initiatives open new possibilities for impact modifier producers to develop specialized solutions for sustainable materials, driving long-term market growth.

Latest Trends

Rising Adoption of Bio-Based Impact Modifiers

A leading trend in the Impact Modifier Market is the growing adoption of bio-based and eco-friendly additives. Manufacturers are shifting from petroleum-derived modifiers to plant-based or renewable alternatives to meet sustainability goals and environmental regulations. These bio-based impact modifiers offer similar toughness and flexibility while reducing carbon emissions and dependency on fossil resources. The trend aligns with global efforts to promote green materials and circular manufacturing.

Additionally, advancements in polymer chemistry have improved the performance and compatibility of bio-based modifiers across applications like construction materials, packaging, and automotive plastics. This transition toward sustainable additives marks a key shift in the market, encouraging innovation and responsible material development worldwide.

Regional Analysis

In 2024, Asia-Pacific held a 45.70% share, valued at USD 1.9 Bn, dominating globally.

In 2024, Asia-Pacific held a dominant position in the global Impact Modifier Market with a 45.70% share, valued at USD 1.9 Bn. The region’s strong growth is driven by rapid industrialization, expanding construction activities, and increasing adoption of high-performance plastics across automotive and packaging sectors.

Countries such as China, India, and Japan are witnessing significant demand for durable polymer materials, supporting the dominance of Asia-Pacific in this market. North America follows with steady demand from advanced manufacturing industries and infrastructure upgrades, while Europe shows consistent growth supported by sustainability-driven innovations in polymer modification.

The Middle East & Africa and Latin America regions are gradually expanding their market presence due to growing investments in industrial materials and construction, contributing to global market diversification.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dow focused on developing advanced polymer modifiers aimed at improving performance and recyclability across multiple industries. Its emphasis on enhancing product toughness and flexibility has strengthened its influence in the automotive and packaging sectors.

LG Chem showcased notable progress by integrating high-impact polymer solutions within construction and consumer goods applications. The company’s continuous research in durable polymer additives allowed it to cater to varying industrial standards and environmental regulations. Its strategic focus on green chemistry and value-added materials positioned it as a strong player in Asia-Pacific markets.

BASF SE demonstrated leadership by expanding its range of impact modifiers designed for high-performance applications. The company’s product advancements emphasized compatibility with recycled plastics and bio-based materials, aligning with the industry’s sustainability goals. BASF’s consistent innovation and global distribution capabilities reinforced its presence in Europe and North America.

Top Key Players in the Market

- Arkema

- Dow

- LG Chem

- BASF SE

- Mitsubishi Chemical Group Corporation

- Evonik Industries AG

- KANEKA CORPORATION

- Solvay

- Akzo Nobel N.V.

- Shandong Ruifeng Chemical Co., Ltd.

- Wacker Chemie AG

Recent Developments

- In June 2025, Dow announced a signed agreement to sell its 50% interest in the joint venture DowAksa Advanced Composites Holdings BV (DowAksa) to its partner in the venture, for proceeds expected at approximately $125 million.

- In December 2024, Arkema finalised the acquisition of Dow’s flexible packaging laminating adhesives business (enterprise value ~US $150 million). This move strengthens Arkema’s portfolio in high-value adhesives and broadens its capabilities in packaging, which ties into additives and modifier applications thanks to overlap in performance materials.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Billion Forecast Revenue (2034) USD 7.3 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (AIM, ABS, MBS, CPE, EPDM, ASA, Others), By Application (PVC, Engineering Plastics, PBT, Nylon, Others), By End Use (Construction, Packaging, Consumer Goods, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, Dow, LG Chem, BASF SE, Mitsubishi Chemical Group Corporation, Evonik Industries AG, KANEKA CORPORATION, Solvay, Akzo Nobel N.V., Shandong Ruifeng Chemical Co., Ltd., Wacker Chemie AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arkema

- Dow

- LG Chem

- BASF SE

- Mitsubishi Chemical Group Corporation

- Evonik Industries AG

- KANEKA CORPORATION

- Solvay

- Akzo Nobel N.V.

- Shandong Ruifeng Chemical Co., Ltd.

- Wacker Chemie AG