Immunochemistry Analyzer Market By Product Type (Chemiluminescence Immunoassay, Radioimmunoassay, Immunofluorescence Analysers, Enzyme-Linked Immunoassay, and Consumables and Accessories), By Application (Infectious Disease Testing, Oncology, Cardiology, Allergy Testing, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168112

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

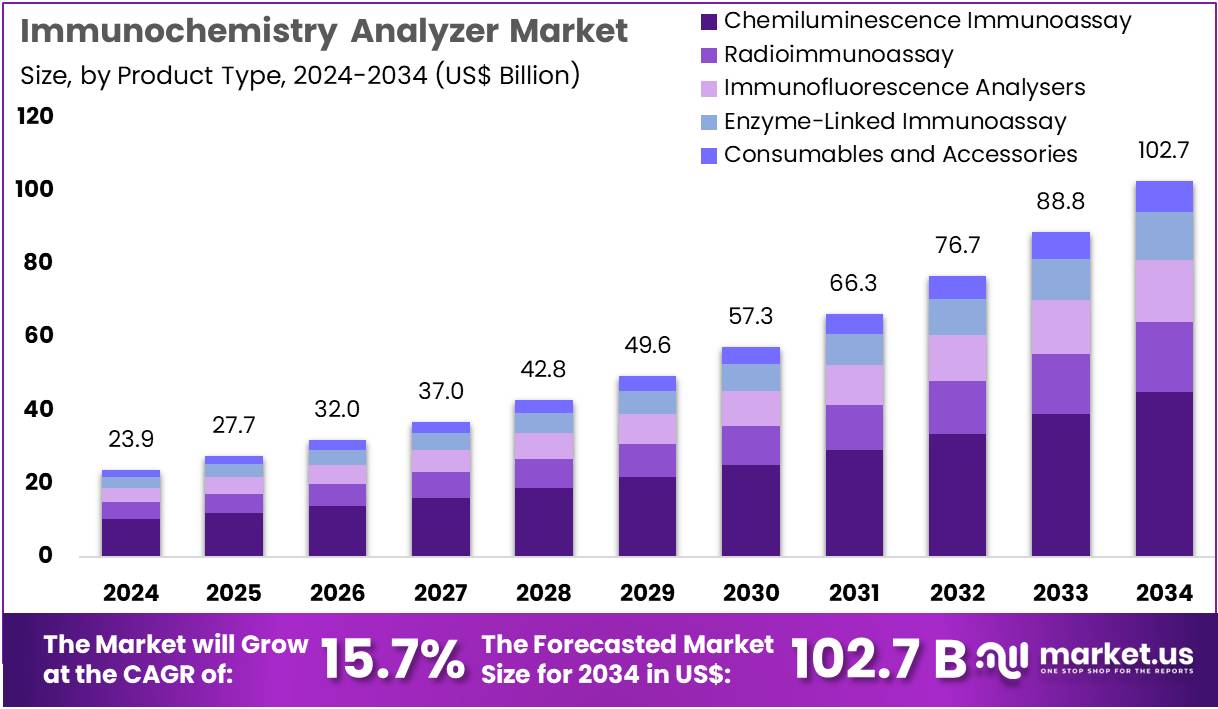

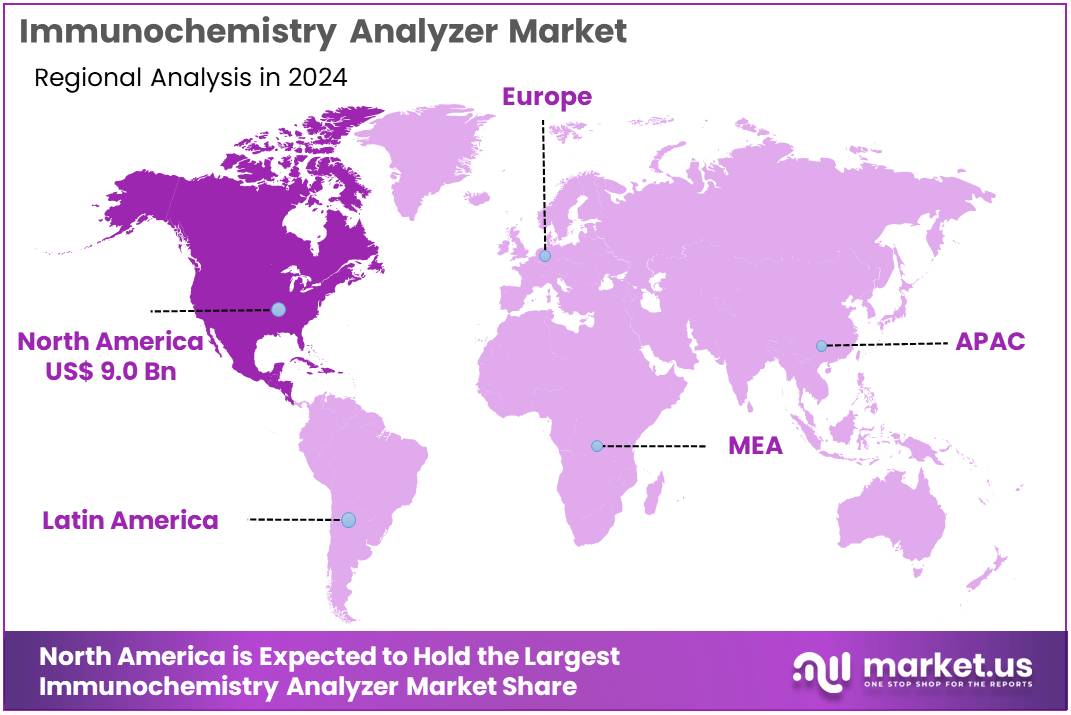

The Immunochemistry Analyzer Market Size is expected to be worth around US$ 102.7 billion by 2034 from US$ 23.9 billion in 2024, growing at a CAGR of 15.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.6% share and holds US$ 9.0 Billion market value for the year.

Increasing demand for high-throughput hormone and tumor marker testing propels the Immunochemistry Analyzer market, as clinical laboratories consolidate workloads onto fully automated platforms that deliver rapid, reproducible results. Manufacturers integrate chemiluminescent, electrochemiluminescent, and fluorescence detection technologies to achieve ultra-low detection limits across diverse analyte classes. These systems perform critical applications in thyroid function panels for free T4 and TSH quantification, fertility assessments through anti-Müllerian hormone measurement, oncology monitoring via CA 125 and PSA kinetics, and cardiac risk stratification using high-sensitivity troponin assays.

Strategic CDMO partnerships create opportunities for custom reagent development and seamless technology transfer to emerging diagnostic players. Fujirebio partnered with Agappe in January 2024 to expand CLIA-based immunoassay capabilities, reinforcing end-to-end manufacturing support and accelerating specialized assay commercialization. This alliance directly enhances the ecosystem for innovative immunochemistry solutions.

Growing emphasis on infectious disease serology and autoimmune profiling accelerates the Immunochemistry Analyzer market, as healthcare providers expand testing menus to include multiplex cytokine panels and autoantibody arrays on single platforms. Instrument designers incorporate random-access functionality and bidirectional LIS connectivity to minimize turnaround times in acute care settings.

Applications encompass hepatitis seromarker confirmation through HBsAg and anti-HCV detection, SARS-CoV-2 antibody quantitation for immunity status, rheumatoid factor alongside anti-CCP for arthritis diagnosis, and celiac disease screening via tissue transglutaminase IgA levels. Menu consolidation opens avenues for integrated core lab operations and cost-effective reagent rental models. Clinical chemistry networks increasingly adopt scalable analyzers that evolve with emerging biomarker needs.

Rising adoption of point-of-care and near-patient immunochemistry testing invigorates the Immunochemistry Analyzer market, as emergency departments and outpatient clinics deploy compact, cartridge-based systems for immediate therapeutic decisions. Technology providers engineer microfluidic designs that maintain central laboratory accuracy in decentralized environments. These analyzers support rapid D-dimer measurement for venous thromboembolism rule-out, procalcitonin guidance in antibiotic stewardship, beta-hCG confirmation in early pregnancy evaluation, and myoglobin alongside CK-MB for acute coronary syndrome triage.

Portable formats create opportunities for critical care expansion and remote clinic empowerment. Continuous innovation in assay sensitivity and workflow automation positions immunochemistry analyzers as cornerstone tools across the entire care continuum.

Key Takeaways

- In 2024, the market generated a revenue of US$ 23.9 billion, with a CAGR of 15.7%, and is expected to reach US$ 102.7 billion by the year 2034.

- The product type segment is divided into chemiluminescence immunoassay, radioimmunoassay, immunofluorescence analysers, enzyme-linked immunoassay, and consumables and accessories, with chemiluminescence immunoassay taking the lead in 2024 with a market share of 43.9%.

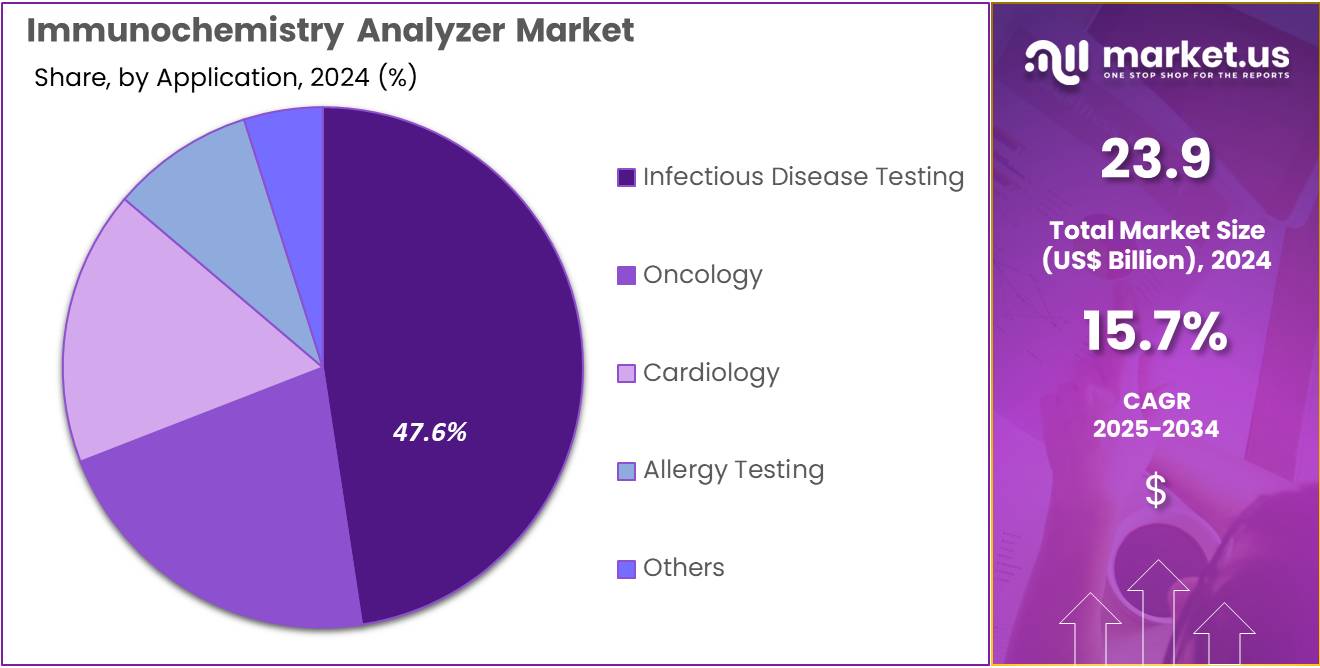

- Considering application, the market is divided into infectious disease testing, oncology, cardiology, allergy testing, and others. Among these, infectious disease testing held a significant share of 47.6%.

- North America led the market by securing a market share of 37.6% in 2024.

Product Type Analysis

Chemiluminescence immunoassay, holding 43.9%, is expected to dominate due to its high analytical sensitivity, faster turnaround times, and suitability for large-scale automated testing. Laboratories adopt this technology for hormone analysis, infectious disease panels, tumor markers, and specialized biomarkers, creating strong recurring demand. Manufacturers integrate advanced detection systems that offer improved signal stability and reproducibility, attracting high-throughput clinical labs. The technology supports wide assay menus, and this flexibility strengthens its growth across diverse diagnostic settings.

Rising chronic and infectious disease burdens across Asia, Europe, and North America increase testing volumes. Automation trends support seamless integration into centralized labs, enhancing productivity. Pharmaceutical companies use chemiluminescent platforms for biomarker verification studies. Continuous innovation in reagents and system architecture boosts accuracy and operational efficiency. Its reliability across routine and advanced tests keeps chemiluminescence immunoassay anticipated to remain the leading product type.

Application Analysis

Infectious disease testing, holding 47.6%, is anticipated to remain the dominant application as global health systems prioritize early detection and continuous surveillance. Diagnostic labs depend on immunochemistry analyzers for high-sensitivity detection of viral, bacterial, and parasitic infections.

Rising incidence of respiratory, gastrointestinal, and vector-borne diseases increases assay utilization. Hospitals expand infectious-disease panels and rely on rapid, automated systems to support clinical decision-making. Public-health programs emphasize screening for HIV, hepatitis, and emerging pathogens, increasing daily test volumes.

Pharmaceutical companies investigate immune-response biomarkers during vaccine development, strengthening demand for infectious-disease assays. Advancements in reagent design improve detection accuracy and reduce cross-reactivity. Expansion of decentralized laboratories across developing regions raises adoption of automated systems. Strong global investments in preparedness and surveillance keep infectious disease testing projected to remain the most influential application segment.

Key Market Segments

By Product Type

- Chemiluminescence Immunoassay

- Radioimmunoassay

- Immunofluorescence Analysers

- Enzyme-Linked Immunoassay

- Consumables and Accessories

By Application

- Infectious Disease Testing

- Oncology

- Cardiology

- Allergy Testing

- Others

Drivers

Increasing Prevalence of Autoimmune Diseases is Driving the Market

The escalating prevalence of autoimmune diseases has emerged as a key driver for the immunochemistry analyzer market, as these analyzers are essential for detecting autoantibodies and inflammatory markers in routine diagnostics. This rise prompts healthcare providers to adopt high-throughput systems for efficient screening of conditions like rheumatoid arthritis and systemic lupus erythematosus. Laboratories are upgrading to fully automated platforms to handle increased test volumes, ensuring rapid turnaround for therapeutic monitoring.

Regulatory bodies emphasize the role of immunochemistry in early intervention, supporting guideline updates that mandate regular antibody profiling. Manufacturers respond by developing multiplex assays that simultaneously evaluate multiple biomarkers, enhancing diagnostic precision. Collaborative efforts between immunology societies and device developers accelerate validations for clinical utility. The driver aligns with public health priorities to reduce disease burden through timely diagnosis, influencing procurement budgets in hospital networks.

Educational programs for clinicians highlight analyzer benefits in personalizing treatments, boosting adoption rates. Economic analyses demonstrate cost savings from prevented complications, justifying investments in advanced instrumentation. This momentum fosters innovation in reagent stability, extending analyzer lifespan in diverse settings. More than 15 million individuals in the United States—around 4.6% of the population—received a diagnosis of at least one autoimmune condition during the period from January 2011 to December 2022. This expanding patient pool creates a steady and long-term foundation of demand for the market.

Restraints

High Initial Investment Costs are Restraining the Market

The substantial capital required for acquiring immunochemistry analyzers continues to pose a major restraint, particularly for smaller laboratories and emerging market facilities. Advanced models demand significant outlays for installation, calibration, and maintenance, deterring upgrades from legacy systems. This financial hurdle limits access in under-resourced regions, where budget allocations favor essential over specialized equipment. Reimbursement structures often lag behind technology costs, creating cash flow challenges for providers. The restraint exacerbates diagnostic delays, as facilities postpone expansions amid economic uncertainties.

Developers must navigate pricing pressures, balancing features with affordability to penetrate constrained segments. Policy discussions advocate for financing incentives, yet rollout remains uneven across jurisdictions. Training expenses for operators add to the overall burden, prolonging return-on-investment timelines. These factors collectively suppress market penetration, favoring large-scale operators. International aid initiatives seek to mitigate impacts, but coverage is limited. Addressing this requires innovative leasing models to democratize access.

Opportunities

Expansion of Point-of-Care Immunochemistry Applications is Creating Growth Opportunities

The broadening application of point-of-care immunochemistry analyzers is unlocking considerable growth prospects, enabling bedside testing for cardiac and infectious biomarkers in decentralized settings. These portable devices reduce dependency on central labs, supporting rapid decision-making in emergency departments. Opportunities emerge in integrating analyzers with digital connectivity for real-time data sharing across health networks.

Regulatory clearances for new menus expand utility to endocrine and oncology markers, diversifying end-user bases. Partnerships between diagnostic firms and telemedicine platforms facilitate remote validations, enhancing rural outreach. The shift toward ambulatory care models amplifies demand for compact, user-friendly systems. Economic evaluations highlight efficiencies from minimized transport and wait times, appealing to cost-conscious payers. Global trials validate performance in diverse populations, paving the way for international tenders. These developments position the market for hybrid solutions combining immunochemistry with biosensors. Sustained R&D in miniaturization promises further scalability.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces propel the Immunochemistry Analyzer market forward as healthcare providers worldwide ramp up investments in advanced diagnostics to address chronic diseases and aging populations. Companies seize these opportunities by developing faster, more accurate analyzers that streamline laboratory workflows and improve patient outcomes. Yet, inflationary pressures and economic slowdowns squeeze margins for mid-tier manufacturers, forcing them to cut R&D spending or delay product launches in emerging markets.

Geopolitical conflicts, notably escalating US-China trade frictions, unravel supply chains for critical reagents and optical components, compelling firms to navigate export restrictions and volatile shipping routes. These disruptions inflate lead times and expose operations to sudden shortages that ripple through global distribution networks. Current US tariffs on imported medical equipment compound these hurdles by hiking procurement costs for immunoassay systems, which laboratories then offset through higher service fees and reduced purchasing volumes.

Manufacturers, however, respond proactively by shifting assembly lines to domestic facilities, which builds supply resilience and unlocks government incentives for local innovation. In the end, this market’s core strengths in technological adaptability and collaborative partnerships ensure robust expansion and deliver reliable tools for next-generation healthcare delivery.

Latest Trends

FDA Clearance for Advanced IHC Probes is a Recent Trend

The U.S. Food and Drug Administration’s clearance of innovative immunohistochemistry probes has defined a significant trend in the immunochemistry analyzer market in 2024, advancing precision in pathology workflows. These dual in situ hybridization probes enable simultaneous detection of kappa and lambda light chains, aiding B-cell lymphoma diagnosis. The trend emphasizes high-sensitivity reagents compatible with automated analyzers, streamlining tissue processing.

Developers are prioritizing multiplex capabilities to profile multiple targets in single runs, aligning with trend-driven efficiencies. Clinical adoption surges in hematopathology labs, where probes reduce interpretive errors. This evolution intersects with AI-assisted image analysis, enhancing objectivity in stain evaluation. Regulatory focus on companion diagnostics ties probes to targeted therapies, spurring co-development initiatives. Competitive advancements include probe stability for extended shelf life, supporting high-volume centers.

The trend extends to solid tumor applications, adapting protocols for prognostic markers. Broader implications include integration with digital pathology platforms for teleconsultations. Roche received FDA clearance for the VENTANA Kappa and Lambda Dual ISH mRNA Probe in 2024, marking a milestone in lymphoma diagnostics. This clearance exemplifies the trend’s impact on analytical accuracy.

Regional Analysis

North America is leading the Immunochemistry Analyzer Market

The percentage share of North America in the Immunochemistry Analyzer market stands at 37.6%, affirming its pivotal dominance propelled by escalating integration into automated laboratory workflows during 2024. Healthcare facilities accelerated procurement of chemiluminescent platforms to expedite hormone and tumor marker profiling, addressing surging caseloads in endocrinology and oncology departments.

Biotechnology enterprises forged alliances with analyzer manufacturers to customize reagent kits for point-of-care settings, enhancing turnaround for infectious disease surveillance in urban clinics. The Centers for Disease Control and Prevention emphasized standardized protocols for viral antigen detection, stimulating upgrades in regional reference laboratories across the Midwest and Northeast.

Pharmaceutical developers prioritized high-sensitivity assays for pharmacokinetic monitoring, incorporating them into bioavailability studies for biologics under accelerated approval pathways. Educational consortia in Texas and Ontario disseminated training modules on maintenance-free analyzers, empowering mid-sized hospitals to transition from legacy systems.

Reimbursement expansions under the Affordable Care Act covered expanded panels for autoimmune diagnostics, incentivizing capital investments in consolidated testing hubs. Innovations in microfluidic integration minimized sample volumes, appealing to pediatric and geriatric care units amid demographic shifts. In support of this expansion, the National Institutes of Health awarded a $3 million Phase IIB SBIR grant in 2024 to Enable Biosciences for advancing autoantibody detection through agglutination-PCR immunoassay technology.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Diagnostic firms project dynamic escalation for automated protein quantification tools in Asia Pacific over the forecast period, ignited by infrastructure upgrades in urban polyclinics throughout Thailand and the Philippines. Health authorities invest aggressively in luminescence-based systems for endocrine screening, optimizing resource allocation in national tuberculosis control programs.

Innovation clusters anticipate broader deployment of cartridge-style platforms for allergen identification, fulfilling demands in pediatric allergy management across metropolitan areas. Regulators estimate streamlined validations for domestically engineered devices, embedding them into universal coverage schemes for cardiovascular risk evaluation. Entrepreneurs likely amplify production of bead-based arrays, curbing expenses for widespread hepatitis surveillance in coastal provinces.

Collaborative networks in Taiwan propel algorithm-enhanced readouts for therapeutic drug monitoring, refining protocols in oncology infusion centers. Philanthropic initiatives project inclusive rollout via mobile units, focusing on rheumatoid factor assays in underserved agrarian communities. Policymakers channel subsidies toward faculty development, inspiring curriculum integrations for biomarker validation in veterinary extensions. Trade pacts expedite component sourcing, fortifying resilience against supply volatilities for electrolyte profiling in emergency responses. Reinforcing this outlook, India’s bioeconomy attained $165.7 billion in 2024, according to the Press Information Bureau.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent firms in the diagnostics arena aggressively execute mergers and acquisitions to acquire cutting-edge immunoassay capabilities, thereby fortifying their assay menus and accelerating entry into underserved therapeutic segments like endocrinology and cardiology. They channel substantial resources into research and development, unveiling automated platforms that integrate electrochemiluminescence detection for superior assay precision and reduced processing times in high-volume settings.

Executives cultivate alliances with biotech innovators and healthcare networks to co-develop companion diagnostics, enhancing interoperability with lab information systems and streamlining regulatory pathways. Market leaders also spearhead expansions into emerging economies, tailoring modular configurations to accommodate varying throughput demands from small clinics to large hospitals.

Abbott Laboratories exemplifies this dynamism; this Chicago-headquartered global healthcare giant, established in 1888, boasts an expansive diagnostics arm that delivers over 400 immunoassay tests annually via its ARCHITECT and Alinity series, sustaining annual revenues surpassing $40 billion through relentless focus on innovation and worldwide distribution. Such calculated advancements collectively amplify competitive advantages in a landscape propelled by precision diagnostics imperatives.

Top Key Players in the Immunochemistry Analyzer Market

- Abbott Laboratories

- F. Hoffmann‑La Roche Ltd

- Siemens Healthineers AG

- Danaher Corporation (Beckman Coulter)

- Thermo Fisher Scientific Inc.

- Ortho Clinical Diagnostics

- DiaSorin S.p.A.

- Sysmex Corporation

- bioMérieux SA

- Randox Laboratories Ltd

Recent Developments

- In January 2025: Anbio Biotechnology introduced its Dry CLIA Solution ADL-1000, positioning it as a next-generation platform aimed at improving diagnostic speed, consistency, and affordability. The system is tailored for diverse clinical environments, reflecting the growing industry shift toward streamlined workflows and high-output testing capabilities.

- In April 2024: Mindray unveiled a new lineup designed for mid-volume laboratories, including two independent analyzers and two integrated configurations. The launch showcases Mindray’s focus on compact, efficient systems that enhance chemiluminescence immunoassay performance and support the evolving operational needs of modern clinical laboratories.

Report Scope

Report Features Description Market Value (2024) US$ 23.9 billion Forecast Revenue (2034) US$ 102.7 billion CAGR (2025-2034) 15.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Chemiluminescence Immunoassay, Radioimmunoassay, Immunofluorescence Analysers, Enzyme-Linked Immunoassay, and Consumables and Accessories), By Application (Infectious Disease Testing, Oncology, Cardiology, Allergy Testing, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, F. Hoffmann‑La Roche Ltd, Siemens Healthineers AG, Danaher Corporation (Beckman Coulter), Thermo Fisher Scientific Inc., Ortho Clinical Diagnostics, DiaSorin S.p.A., Sysmex Corporation, bioMérieux SA, Randox Laboratories Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Immunochemistry Analyzer MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Immunochemistry Analyzer MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- F. Hoffmann‑La Roche Ltd

- Siemens Healthineers AG

- Danaher Corporation (Beckman Coulter)

- Thermo Fisher Scientific Inc.

- Ortho Clinical Diagnostics

- DiaSorin S.p.A.

- Sysmex Corporation

- bioMérieux SA

- Randox Laboratories Ltd