Global Ice Cream Powder Market Size, Share Analysis Report By Nature (Organic, Conventional), By Product Type (Soft Ice Cream Powder, Pre-Mixed Ice Cream Powder, Green Tea Soft Serve Ice Cream Powder, Mix Frozen Yogurt Ice Cream Powder, Others), By Application (Bakery, Confectioneries, Desserts, Others), By End Users (Commercial, Household), By Distribution Channel (Wholesale Outlets, Supermarkets/Hypermarkets, Retail Outlets, Online Outlets, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152881

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

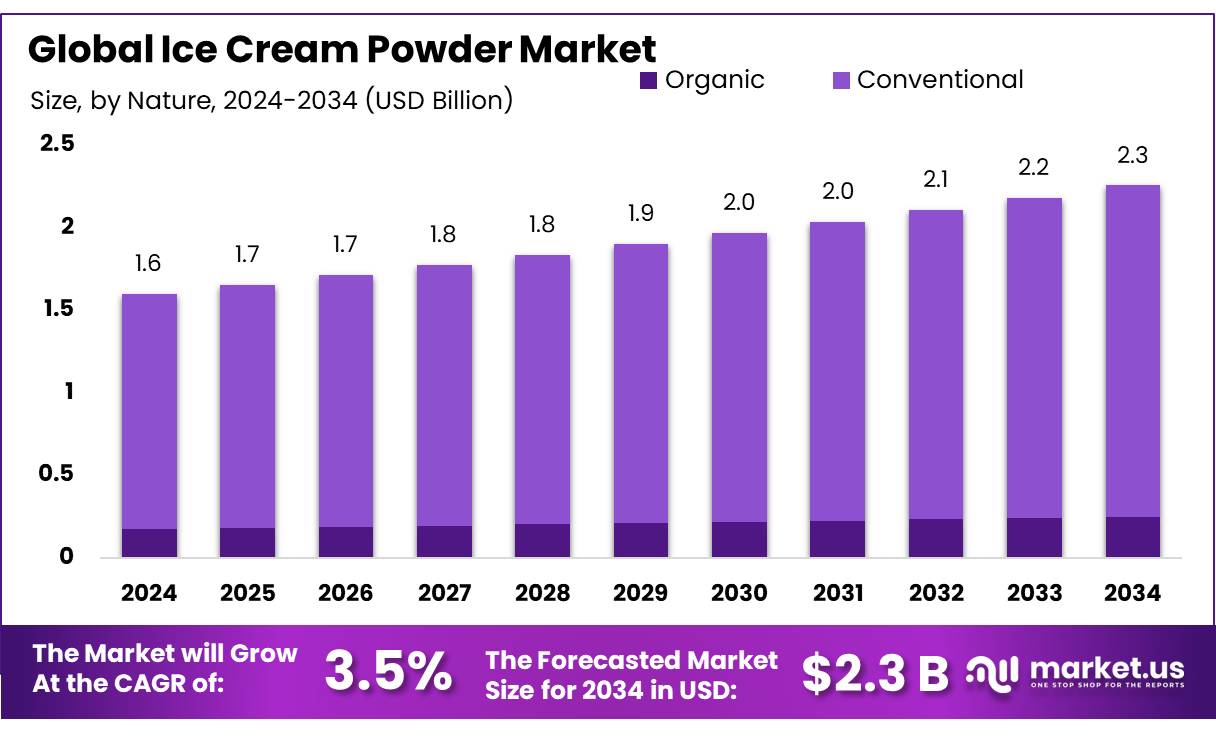

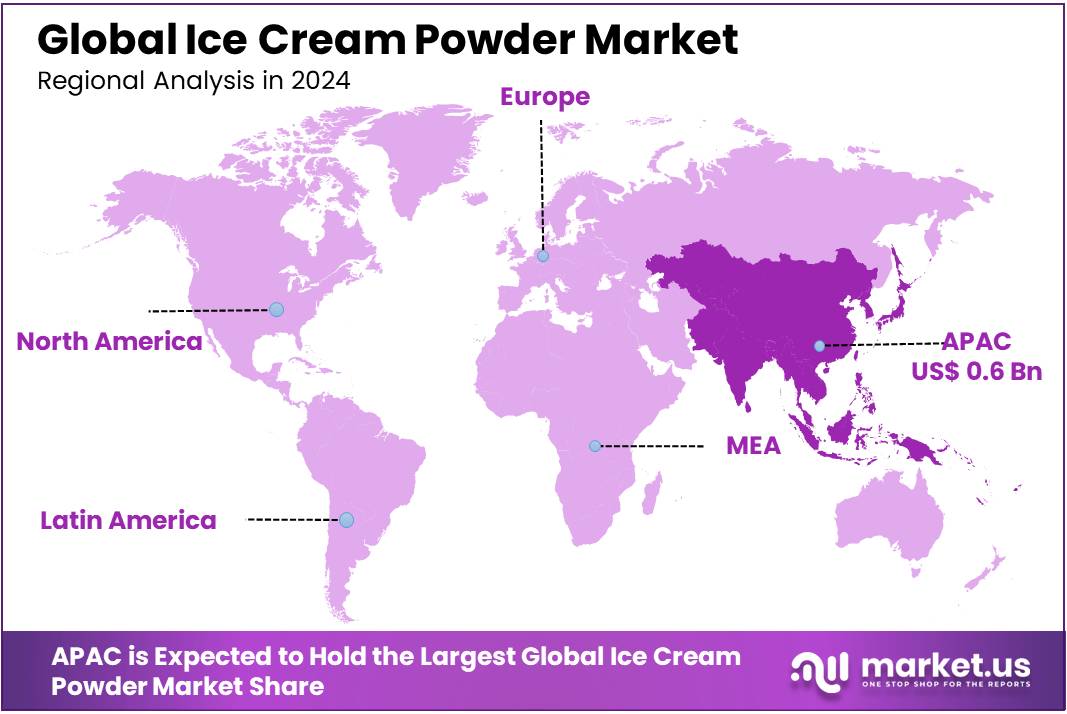

The Global Ice Cream Powder Market size is expected to be worth around USD 2.3 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) held a dominant market position, capturing more than a 42.8% share, holding USD 0.6 Billion revenue.

Ice cream powder concentrates are dry formulations used to produce ice cream by rehydration and blending with fats, sweeteners, and stabilizers. These concentrated powders enable standardization, extended shelf-life, and reduced logistics costs, especially in regions lacking robust cold chains. Their flexibility and ease of transport have rendered them a preferred input for both industrial ice cream manufacturers and artisanal producers.

Government initiatives and regulatory frameworks have further supported this sector. Under the US–Mexico–Canada Agreement (USMCA), Canada must cap exports of skim milk powder and milk protein concentrates at 55,000 MT in year one, decreasing to 35,000 MT in year two, promoting stable domestic availability. In the U.S., the Innovation Center for U.S. Dairy reports that the dairy sector contributed $41.6 billion in direct wages in 2021–22, and sustain‑ability investments are underway across all 50 states.

Health driven policy shifts have also occurred; for instance, in July 2025, the U.S. dairy industry committed to eliminating synthetic dyes in ice cream and utilizing plant‑based alternatives—supported by FDA approval of “gardenia blue,” and voluntary agreements with over 40 companies.

The driving factors behind this market’s growth include consumer demand for convenience and product consistency, particularly in emerging economies where rising disposable incomes are facilitating the consumption of processed foods. The increase in demand for ice cream products in countries like India and China, where young populations are highly inclined toward frozen desserts, is expected to drive market growth.

According to the Food Safety and Standards Authority of India (FSSAI), the Indian ice cream market saw a year-on-year growth rate of 9% in 2023, demonstrating the expanding consumer base for ice cream-related products. Additionally, growing health consciousness among consumers has led to the development of low-fat, low-sugar, and plant-based ice cream products, further diversifying the market for ice cream powder concentrates.

Key Takeaways

- Ice Cream Powder Market size is expected to be worth around USD 2.3 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 3.5%.

- Conventional held a dominant market position, capturing more than an 89.4% share of the global ice cream powder market.

- Soft Ice Cream Powder held a dominant market position, capturing more than a 36.5% share of the global ice cream powder market.

- Desserts held a dominant market position, capturing more than a 57.7% share of the global ice cream powder market.

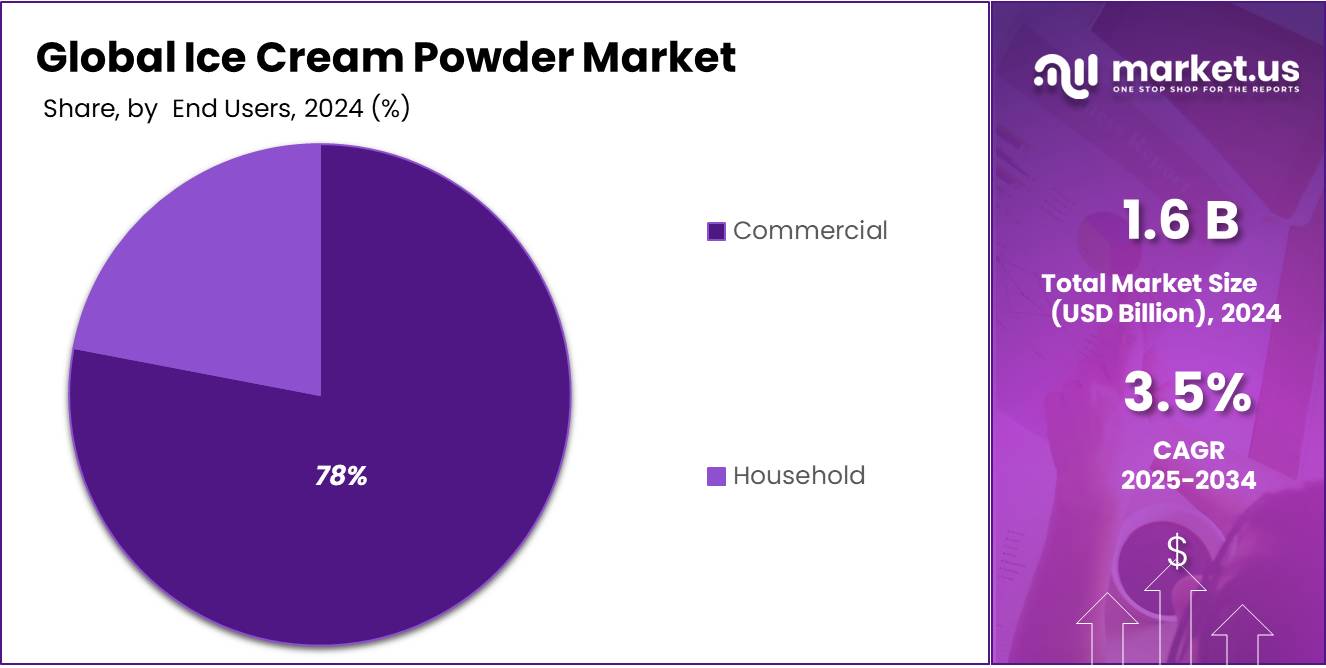

- Commercial held a dominant market position, capturing more than a 78.3% share of the global ice cream powder market.

- Wholesale Outlets held a dominant market position, capturing more than a 38.2% share of the global ice cream powder market.

- Asia Pacific (APAC) region emerged as the dominant market for ice cream powder, capturing a significant 42.8% share of the global revenue, equivalent to approximately USD 0.6 billion.

By Nature Analysis

Conventional Ice Cream Powder dominates with 89.4% due to its widespread use in bulk production.

In 2024, Conventional held a dominant market position, capturing more than an 89.4% share of the global ice cream powder market. This strong preference can be attributed to its long-standing use across commercial ice cream manufacturers, small-scale parlors, and foodservice operators. Conventional ice cream powder, often made using regular dairy ingredients and standard additives, continues to be favored for its cost-effectiveness, extended shelf life, and ease of preparation. Unlike organic or specialty variants, conventional formulations meet the high-volume needs of producers without requiring premium raw materials.

By Product Type Analysis

Soft Ice Cream Powder leads with 36.5% share, driven by its smooth texture and easy preparation.

In 2024, Soft Ice Cream Powder held a dominant market position, capturing more than a 36.5% share of the global ice cream powder market. This strong performance reflects the rising demand for soft-serve products in quick-service restaurants, cafés, and dessert outlets. Soft ice cream powders are popular because they are easy to store, quick to prepare, and deliver a consistently creamy texture that appeals to a broad consumer base. These powders are especially favored in high-traffic locations due to their compatibility with soft-serve machines and their ability to serve large volumes efficiently. The affordability and versatility of soft ice cream mixes also allow for customization with different flavors and toppings, which supports their continued popularity across diverse markets.

By Application Analysis

Desserts dominate with 57.7% share, supported by high demand for sweet indulgences.

In 2024, Desserts held a dominant market position, capturing more than a 57.7% share of the global ice cream powder market. This strong share is largely driven by the increasing consumption of frozen desserts, puddings, sundaes, and blended treats across restaurants, hotels, and home kitchens. Ice cream powder serves as a convenient base for a wide variety of dessert recipes, making it a preferred choice for chefs and foodservice providers who prioritize speed, consistency, and cost-efficiency. Its long shelf life and easy mixability with milk or water have also made it popular among manufacturers creating ready-to-eat or frozen dessert packs.

By End Users Analysis

Commercial segment leads with 78.3% share, fueled by bulk demand in foodservice and retail.

In 2024, Commercial held a dominant market position, capturing more than a 78.3% share of the global ice cream powder market. This overwhelming share reflects the consistent demand from ice cream parlors, restaurants, cafés, catering services, and food manufacturing companies. Commercial users favor ice cream powder due to its convenience, cost-efficiency, and ease of storage, especially when producing frozen desserts in large quantities. It allows businesses to maintain product consistency, control portion sizes, and reduce wastage, which are critical factors in high-volume operations. The growing number of quick-service restaurants and dessert chains globally, especially in urban centers, has further expanded the usage of ice cream powder in commercial settings.

By Distribution Channel Analysis

Wholesale Outlets dominate with 38.2% share, driven by bulk buying from commercial users.

In 2024, Wholesale Outlets held a dominant market position, capturing more than a 38.2% share of the global ice cream powder market. This leading position is mainly due to the steady demand from commercial end users such as ice cream manufacturers, hotels, restaurants, and caterers who prefer purchasing in bulk.

Wholesale channels offer competitive pricing, larger pack sizes, and consistent supply, making them a practical choice for businesses that require regular and high-volume stock. The presence of dedicated dairy wholesalers, foodservice distributors, and cooperative supply chains has further supported the widespread distribution of ice cream powders through this channel. In addition, the reliability and long-term relationships built between suppliers and commercial buyers enhance loyalty and repeat purchasing.

Key Market Segments

By Nature

- Organic

- Conventional

By Product Type

- Soft Ice Cream Powder

- Pre-Mixed Ice Cream Powder

- Green Tea Soft Serve Ice Cream Powder

- Mix Frozen Yogurt Ice Cream Powder

- Others

By Application

- Bakery

- Confectioneries

- Desserts

- Others

By End Users

- Commercial

- Household

By Distribution Channel

- Wholesale Outlets

- Supermarkets/Hypermarkets

- Retail Outlets

- Online Outlets

- Others

Emerging Trends

Expanding Cold Chain Infrastructure

A significant growth opportunity for the ice cream powder concentrate industry in India lies in the development and expansion of cold chain infrastructure. Despite being one of the world’s largest producers of milk, India faces challenges in efficiently transporting and storing perishable dairy products due to inadequate cold chain facilities. This gap results in substantial losses and limits the industry’s growth potential.

The National Centre for Cold-chain Development (NCCD) has identified a shortfall of approximately 3.2 million metric tonnes in cold storage capacity, alongside deficits in packhouses, reefer vehicles, and ripening chambers. This infrastructure gap presents a substantial opportunity for investment and development in the cold chain sector, which is essential for maintaining the quality and safety of ice cream products throughout the supply chain. Addressing these deficiencies would not only reduce wastage but also enhance the efficiency of the distribution network, ensuring that ice cream products reach consumers in optimal condition.

To support this growth, the Indian government has implemented several initiatives aimed at improving cold chain infrastructure. The Ministry of Food Processing Industries (MoFPI) offers financial assistance through schemes like the Pradhan Mantri Kisan SAMPADA Yojana, which provides subsidies for the establishment of cold storage and processing units. Additionally, the government has opened the cold chain sector to 100% Foreign Direct Investment (FDI) under the automatic route, encouraging private investment and technological advancements in the sector.

Drivers

Government Support and Infrastructure Development

The Indian ice cream powder concentrate industry has been significantly bolstered by proactive government initiatives aimed at enhancing the food processing and dairy sectors. These efforts have not only improved infrastructure but also streamlined regulations, fostering a conducive environment for industry growth.

A pivotal initiative is the Pradhan Mantri Kisan SAMPADA Yojana, launched by the Ministry of Food Processing Industries. This scheme provides financial assistance for the creation of modern infrastructure for food processing and cold storage, directly benefiting ice cream manufacturers by improving shelf life and reducing wastage. Such infrastructure developments are crucial for maintaining the quality and availability of ice cream products across the country.

Furthermore, the Food Safety and Standards Authority of India (FSSAI) plays a critical role in regulating the food safety standards in India. Manufacturers are required to adhere to these guidelines, ensuring quality and safety standards, including hygiene practices and labeling requirements. This regulatory framework instills consumer confidence and ensures that ice cream products meet the necessary safety criteria.

These government initiatives have created a robust foundation for the ice cream industry, facilitating its expansion and modernization. As a result, the industry is witnessing increased production capacities, improved product quality, and enhanced distribution networks, all contributing to the growing demand for ice cream powder concentrates in India.

Restraints

Cold Chain Infrastructure Challenges

One of the significant challenges hindering the growth of the ice cream powder concentrate industry in India is the inadequate cold chain infrastructure. Despite being the world’s largest producer of milk, India faces considerable obstacles in maintaining a consistent and efficient cold storage and transportation network for dairy products. This deficiency impacts the quality and shelf life of ice cream products, leading to increased wastage and reduced consumer confidence.

According to a report by the Food and Agriculture Organization (FAO), the slowdown in India’s dairy sector growth is partly attributed to the decline in investment in dairy infrastructure, including cold storage facilities. The report highlights that the demand for milk is expected to reach 180 million tonnes by 2022, necessitating an average incremental increase of 5 million tonnes per annum over the next 15 years to meet the market needs. However, the existing infrastructure may not suffice to support this demand, potentially affecting the competitiveness of the dairy sector.

The Indian Ice Cream Manufacturers Association (IICMA) has also raised concerns regarding the lack of adequate cold chain infrastructure. During the COVID-19 pandemic, many ice cream outlets faced closures due to power failures and the absence of proper refrigeration, leading to significant financial losses. The IICMA has advocated for government support in the form of subsidies and infrastructure development to mitigate these challenges.

To address these issues, the Indian government has allocated $1.32 billion over five years (2021–2026) to facilitate the growth of the dairy sector through special schemes and programs. The Department of Animal Husbandry and Dairying’s budget for the fiscal year 2023–2024 was increased by 40% to 52.8 million, focusing on enhancing dairy infrastructure, including cold storage facilities. These initiatives aim to improve the efficiency of the cold chain and support the growth of the ice cream powder concentrate industry.

Opportunity

Government Initiatives and Infrastructure Development

A significant growth opportunity for the ice cream powder concentrate industry in India lies in the government’s initiatives aimed at enhancing the dairy sector’s infrastructure. The Indian government has recognized the importance of strengthening the cold chain infrastructure to reduce food wastage and improve the efficiency of the food supply chain. For instance, the National Centre for Cold-chain Development (NCCD) has been instrumental in promoting the development of cold-chain facilities across the country.

Established in 2012, NCCD serves as a nodal body to guide and coordinate various cold-chain initiatives undertaken by different government arms and the private industry. The center focuses on developing standards, protocols, and training programs to improve the cold chain’s efficiency and effectiveness. This initiative is crucial for the ice cream industry, as it ensures the maintenance of product quality and safety during storage and transportation.

Furthermore, the government’s focus on the food processing sector has led to the introduction of schemes like the Pradhan Mantri Kisan SAMPADA Yojana. This scheme provides financial assistance for the creation of modern infrastructure for food processing and cold storage, directly benefiting ice cream manufacturers by improving shelf life and reducing wastage. Such infrastructure developments are crucial for maintaining the quality and availability of ice cream products across the country.

Additionally, the government’s relaxation of licensing rules and approval of 100% foreign direct investment (FDI) in single-brand retail stores have opened new avenues for global companies to establish their presence in the Indian market. The implementation of the Goods and Services Tax (GST) reduced tax rates to 5% on most processed food items, including ice cream, thereby boosting consumption and making it more affordable for consumers.

Regional Insights

Asia Pacific dominates the global ice cream powder market with 42.8% share, valued at USD 0.6 billion in 2024.

In 2024, the Asia Pacific (APAC) region emerged as the dominant market for ice cream powder, capturing a significant 42.8% share of the global revenue, equivalent to approximately USD 0.6 billion. This strong regional presence is largely driven by the rapidly growing food and beverage sector across countries such as China, India, Indonesia, Japan, and South Korea.

Rising disposable incomes, changing lifestyles, and increasing urbanization have significantly influenced the consumption of convenience-based food products, including ice cream and related dessert items. The demand for shelf-stable ingredients like ice cream powder has been particularly strong in regions where cold-chain infrastructure is still developing, as powders offer longer storage life and reduced dependency on refrigeration.

India, as one of the largest dairy producers globally, has contributed heavily to the regional supply of milk-based ingredients. According to the Department of Animal Husbandry and Dairying, India produced over 230 million tonnes of milk in 2023–2024, supporting the local manufacturing of dairy derivatives such as ice cream powders.

Additionally, government-backed dairy cooperatives like Amul and state-level players such as Nandini and Aavin have been expanding their processed dairy offerings, further boosting regional supply chains. The growing popularity of quick-service restaurants and dessert chains across Asia, along with a young, experimental consumer base, has further supported the increased adoption of ice cream powder. As these trends continue through 2025, APAC is expected to retain its leading position in the global market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in 2004, Shandong Tianjiao has positioned itself as a leading food ingredients supplier with a monthly capacity of approximately 10,000 tonnes of ice cream powder and related dairy-derived powders. The company holds certifications including ISO 9001, HACCP, Halal, and FDA, and exports to over 30 countries across Asia, Africa, the Middle East, and Europe. Its ice cream powder portfolio spans hard and soft serve varieties, maltodextrin blends, creamer bases, and functional protein enrichments, supporting both home-use and industrial customers.

Established in 1996, Shenzhen Oceanpower is a vertically integrated manufacturer of ice cream machines and powder concentrates, operating a 44 000 m² facility with over 800 employees. It is recognized for developing national standards for soft‑serve machines and powders, holding certifications such as CE, CB, ETL, RoHS, NSF, and GOST. Oceanpower produces both soft and hard ice cream powders under brands like IceKing and Gelinao, exporting globally across Southeast Asia, Europe, Africa, and the Americas.

Pelwatte Dairy, a key player in Sri Lanka’s dairy sector, operates as a state-owned enterprise producing milk powder and dairy blends. Its ice cream powder offerings support both domestic food processing and export demands. Although specific figures are not publicly disclosed, Pelwatte’s integration with local dairy cooperatives enables streamlined raw milk supply and processing. The company’s ice cream powders are designed for institutional users and public consumption, contributing to industrial protein and dairy intake in South Asian markets.

Top Key Players Outlook

- Shandong Tianjiao

- Shenzhen Ocean Power Corporation

- Pelwatte Dairy Industries Limited

- Braziltrade SA/Tangara Foods

- Revala Ltd

- Gourmet Foods of New Zealand Ltd

- Bigatton Produzione Snc

- Amul

- Snowberry

- Laverstoke Park Farm

- Grandplace Vietnam Ltd

Recent Industry Developments

Shandong Tianjiao Biotech, founded in 2004, is a major Chinese food-ingredient manufacturer specializing in ice cream powder among other dairy derivatives. In 2024, the company maintained a monthly production capacity of approximately 5,000 tonnes, or around 60,000 tonnes annually, serving both consumer and industrial segments.

In 2024, Braziltrade SA/Tangará Foods, headquartered in São Paulo, reported approximately USD 60 million in revenue, positioning itself as a notable player in the ice cream powder sector.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 2.3 Bn CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Product Type (Soft Ice Cream Powder, Pre-Mixed Ice Cream Powder, Green Tea Soft Serve Ice Cream Powder, Mix Frozen Yogurt Ice Cream Powder, Others), By Application (Bakery, Confectioneries, Desserts, Others), By End Users (Commercial, Household), By Distribution Channel (Wholesale Outlets, Supermarkets/Hypermarkets, Retail Outlets, Online Outlets, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Shandong Tianjiao, Shenzhen Ocean Power Corporation, Pelwatte Dairy Industries Limited, Braziltrade SA/Tangara Foods, Revala Ltd, Gourmet Foods of New Zealand Ltd, Bigatton Produzione Snc, Amul, Snowberry, Laverstoke Park Farm, Grandplace Vietnam Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Shandong Tianjiao

- Shenzhen Ocean Power Corporation

- Pelwatte Dairy Industries Limited

- Braziltrade SA/Tangara Foods

- Revala Ltd

- Gourmet Foods of New Zealand Ltd

- Bigatton Produzione Snc

- Amul

- Snowberry

- Laverstoke Park Farm

- Grandplace Vietnam Ltd