Global Hydrogensulfide (Cas 7783-06-4) (Hydrogen Sulfide) Market Size, Share, And Business Benefits By Production Method (Chemical Synthesis, Biological Production, Thermal Decomposition), By Concentration (40%-60%, 60%-80%, 80% -99.9%), By Application (Petrochemical, Chemical Manufacturing, Pulp and Paper, Water Treatment, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160439

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

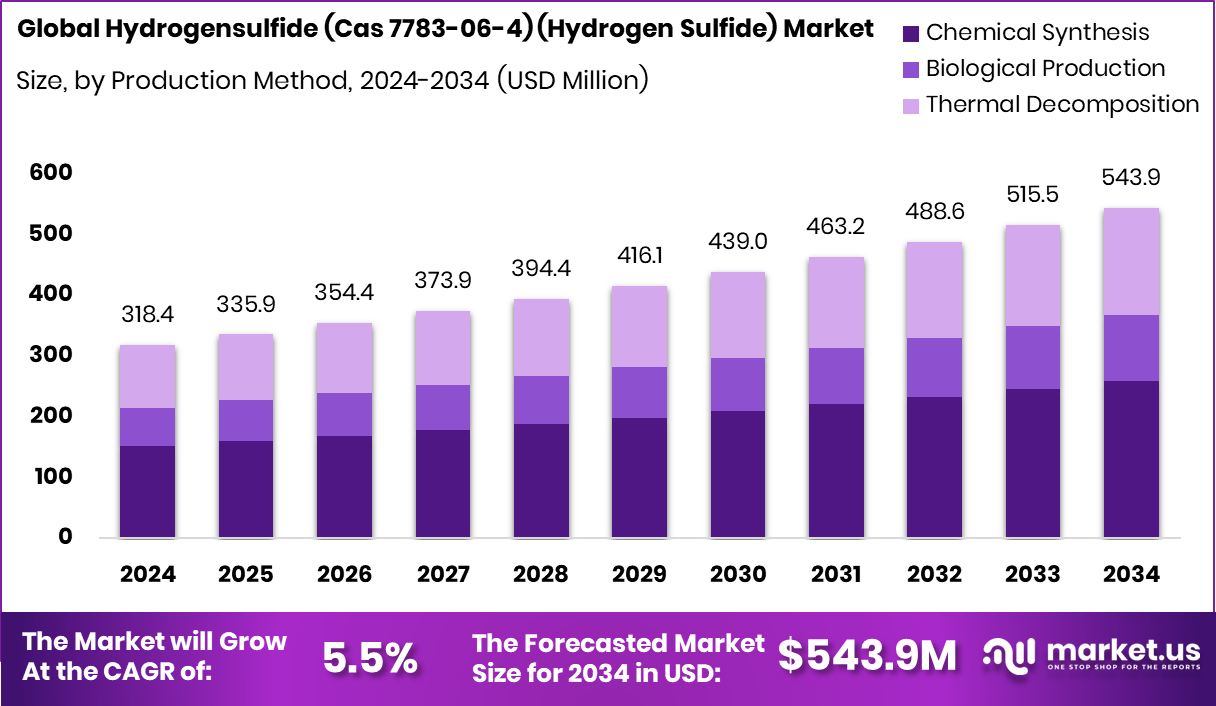

The Global Hydrogensulfide (Cas 7783-06-4) (Hydrogen Sulfide) Market is expected to be worth around USD 543.9 Million by 2034, up from USD 318.4 Million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. The growing petrochemical and water treatment industries in North America 45.90% significantly supported this market expansion.

Hydrogen sulfide (chemical formula H₂S, CAS 7783-06-4) is a colorless, flammable, and highly toxic gas with a characteristic smell of rotten eggs. It forms naturally during the breakdown of organic material under anaerobic conditions and is also a by-product of petroleum refining, natural gas processing, and other industrial activities. In the petrochemical sector, it’s an important feedstock for producing elemental sulfur and sulfuric acid, and it plays a role in desulfurization processes.

Hydrogen sulfide demand is influenced by rising petrochemical production and the growing need for sulfur recovery systems in oil refineries and gas plants. As governments tighten emission norms, industries are investing in better treatment technologies, indirectly boosting H₂S handling and recovery equipment. Large capital flows—such as Buffett’s Berkshire Hathaway nearing a $10 billion deal for Occidental’s petrochemical unit—signal ongoing expansion of facilities that generate or utilize H₂S, reinforcing long-term growth prospects.

Demand is also tied to the expansion of low-carbon petrochemical projects and LNG terminals. Petronet’s seeking a $1.4 billion loan to fund a petrochemical plant and LNG terminal reflects a wave of infrastructure that requires efficient sulfur management. The scaling up of these projects means more hydrogen sulfide to be processed or recovered, which keeps the market active and technologically evolving.

Opportunities are emerging in sustainable and low-emission production. Pengerang Energy Complex securing US$3.5 billion in financing for a low-carbon petrochemical project and two petrochemical companies receiving €60 million in financing from Mubadala Center show capital is flowing into cleaner, integrated plants. These projects drive demand for H₂S treatment, safety systems, and conversion technologies that can turn liabilities into valuable sulfur products.

QatarEnergy securing $4.4 billion in financing for its Ras Laffan petrochemicals project underlines a regional push for large-scale, diversified production hubs. With such mega-projects underway, hydrogen sulfide management becomes central to operational efficiency and environmental compliance. This creates ongoing opportunities for technology suppliers, infrastructure developers, and service providers in the H₂S market to grow alongside the petrochemical industry’s expansion.

Key Takeaways

- The Global Hydrogensulfide (Cas 7783-06-4) (Hydrogen Sulfide) Market is expected to be worth around USD 543.9 Million by 2034, up from USD 318.4 Million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In 2024, chemical synthesis dominated the Hydrogen Sulfide market, accounting for 47.7% production share globally.

- The 80%–99.9% concentration segment held a 47.8% market share, ensuring high efficiency in applications.

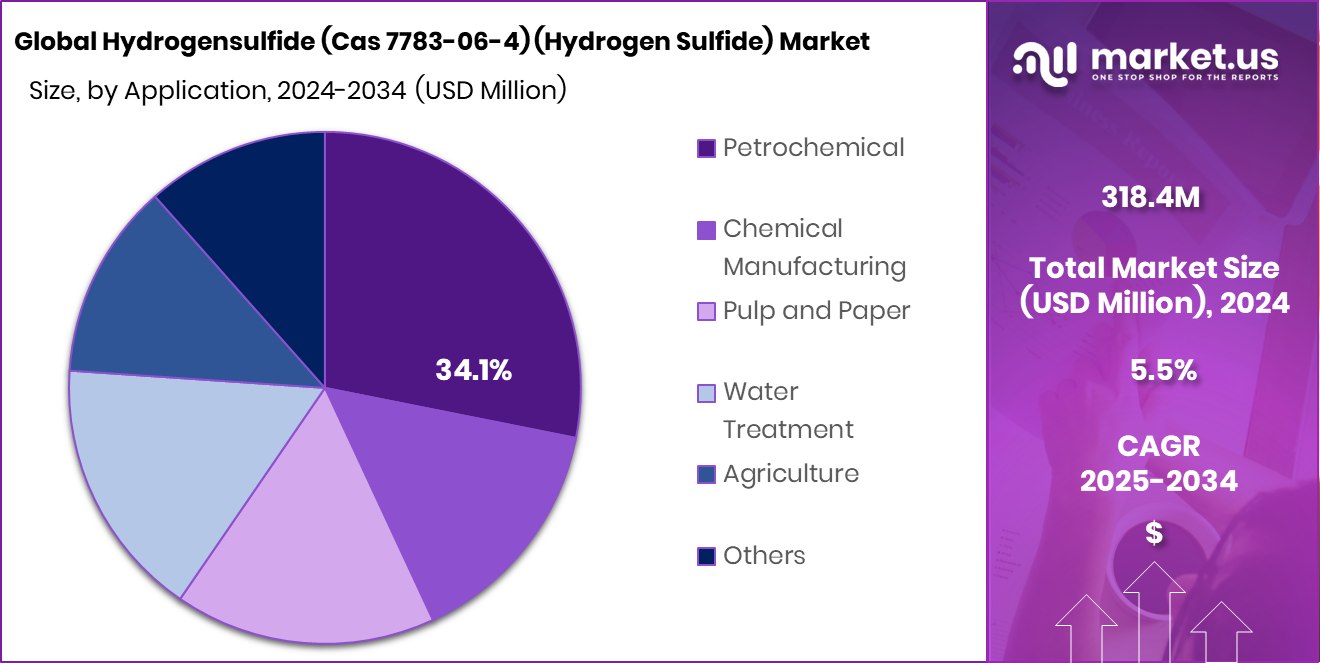

- The petrochemical sector led with 34.1% share, reflecting hydrogen sulfide’s crucial role in refining processes.

- North America recorded a strong market value of around USD 145.9 million.

By Production Method Analysis

In 2024, chemical synthesis dominated the hydrogen sulfide market with 47.7%.

In 2024, Chemical Synthesis held a dominant market position in the By Production Method segment of the Hydrogen Sulfide (CAS 7783-06-4) Market, with a 47.7% share. The process remains widely adopted due to its high efficiency in producing hydrogen sulfide through direct chemical reactions involving sulfur and hydrogen. Its controlled synthesis enables consistent purity levels required for industrial applications such as sulfur recovery, laboratory reagents, and specialty chemicals.The method’s ability to support large-scale operations with lower impurity levels compared to biological or natural generation processes continues to strengthen its use across refineries and petrochemical plants. Moreover, stable feedstock availability and improved process safety have further reinforced its leading position within the market.

By Concentration Analysis

The 80%–99.9% concentration segment held a 47.8% market share.

In 2024, 80%–99.9% held a dominant market position in the By Concentration segment of the Hydrogen Sulfide (CAS 7783-06-4) Market, with a 47.8% share. This concentration range is widely preferred in industrial processes that demand high reactivity and controlled purity, such as sulfur recovery, metal processing, and laboratory synthesis. Its balance of concentration and stability makes it suitable for both large-scale and precision-based applications.

The segment’s dominance is supported by consistent adoption across petrochemical operations and refining facilities where efficiency and cost-effectiveness are crucial. Additionally, handling advancements and safer containment technologies have encouraged broader utilization of 80%–99.9% hydrogen sulfide in production environments, reinforcing its leadership position in the global market.

By Application Analysis

The petrochemical sector accounted for 34.1% of total hydrogen sulfide usage.

In 2024, Petrochemical held a dominant market position in the By Application segment of the Hydrogen Sulfide (CAS 7783-06-4) Market, with a 34.1% share. The segment’s strength stems from hydrogen sulfide’s essential role in producing sulfur and sulfuric acid, which are critical feedstocks in petrochemical manufacturing. It is also used in hydrodesulfurization processes to remove impurities from crude oil and natural gas, ensuring cleaner fuel outputs.

The consistent expansion of refinery operations and petrochemical complexes has sustained high demand for hydrogen sulfide. Furthermore, ongoing investments in modern refining infrastructure and sulfur recovery systems have reinforced its application dominance, making petrochemicals the leading consumer of hydrogen sulfide in the global industrial landscape.

Key Market Segments

By Production Method

- Chemical Synthesis

- Biological Production

- Thermal Decomposition

By Concentration

- 40%-60%

- 60%-80%

- 80%-99.9%

By Application

- Petrochemical

- Chemical Manufacturing

- Pulp and Paper

- Water Treatment

- Agriculture

- Others

Driving Factors

Rising Industrial Demand Driven by Water Treatment Investments

One of the key driving factors for the Hydrogen Sulfide (CAS 7783-06-4) Market is the growing use of hydrogen sulfide in water treatment and purification processes. The compound plays a vital role in sulfur-based treatment systems used to control metal ions and purify water in industrial and municipal facilities. Increasing global investments in sustainable and efficient water infrastructure are supporting this trend.

For instance, the Thompson-Nicola Regional District (TNRD) has voted to move ahead with preliminary work on an $11 million Savona water treatment plant, dependent on grant funding. Similarly, water treatment projects have been selected among winners of a £42 million funding round from regulators in the UK. These developments highlight the rising demand for hydrogen sulfide in water purification and industrial process management.

Restraining Factors

Strict Safety Rules and Environmental Handling Costs Rising

A major restraining factor for the Hydrogen Sulfide (CAS 7783-06-4) market is the stringent safety and environmental regulations surrounding its use, storage, and transportation. Hydrogen sulfide is highly toxic and flammable, requiring specialized containment systems, continuous monitoring, and worker safety measures. These requirements increase operational costs for industries using or producing the gas. Compliance with environmental standards also limits large-scale adoption in smaller facilities due to expensive treatment and emission control equipment.

However, rising government funding for cleaner water and environmental management highlights the global focus on safety and sustainability. For example, New York has unveiled $78 million in funding for water quality improvements, supporting projects that ensure safer handling and reduced contamination risks from hazardous gases like hydrogen sulfide.

Growth Opportunity

Expanding Sanitation and Water Infrastructure Fuel Growth

A major growth opportunity for the Hydrogen Sulfide (CAS 7783-06-4) Market lies in the expansion of global sanitation and water treatment infrastructure. Hydrogen sulfide plays an important role in water purification and wastewater treatment systems, where it is managed and converted during chemical and biological processes. As nations invest more in modernizing sanitation networks and improving clean water access, demand for treatment solutions involving hydrogen sulfide will rise.

Recent funding initiatives highlight this opportunity — Iraq has secured €130 million in French funding for sanitation projects, while a city council has approved $146 million in state funding for a water treatment plant. These investments signal strong growth potential for hydrogen sulfide applications in large-scale water and waste management facilities worldwide.

Latest Trends

Growing Shift Toward Sustainable Water Infrastructure Development

One of the latest trends in the Hydrogen Sulfide (CAS 7783-06-4) Market is the increasing focus on sustainable water infrastructure and environmental safety. Hydrogen sulfide management has become an important part of modern wastewater and treatment plant operations, where advanced control systems are being used to reduce emissions and improve worker safety. This trend aligns with the global movement toward cleaner and more resilient water systems.

Recent government initiatives are further driving this shift — 23 water infrastructure projects across Australia have received AUD 85.9 million in National Water Grid funding, supporting upgrades in treatment efficiency and environmental performance. Such funding encourages broader adoption of hydrogen sulfide monitoring and control technologies within the water treatment and industrial sectors.

Regional Analysis

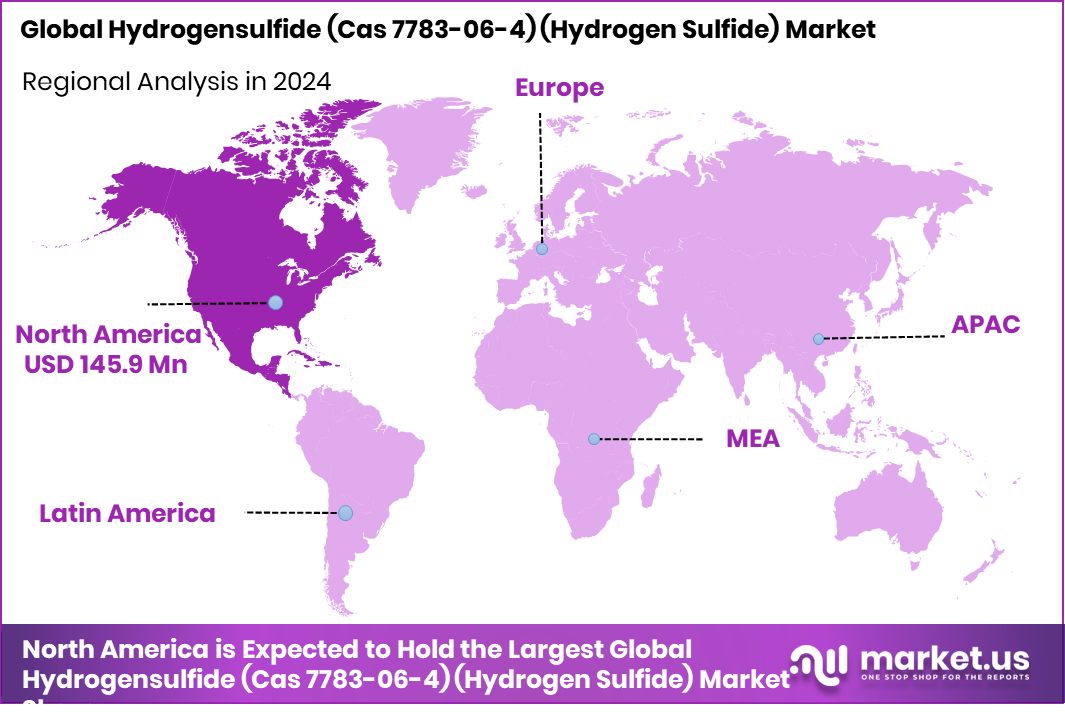

In 2024, North America dominated the Hydrogen Sulfide Market with a 45.90% share.

In 2024, North America held a dominant position in the global Hydrogen Sulfide (CAS 7783-06-4) Market, accounting for 45.90% of the total market share, valued at approximately USD 145.9 million. The region’s leadership is supported by extensive petrochemical and natural gas operations across the United States and Canada, where hydrogen sulfide plays a key role in refining, sulfur recovery, and gas treatment processes.

Europe followed with steady demand driven by industrial and environmental regulations supporting controlled hydrogen sulfide usage in wastewater treatment and chemical production. Asia Pacific showed strong growth potential due to expanding refining capacities and the rise of manufacturing activities in countries like China and India.

Meanwhile, the Middle East & Africa benefited from increasing petrochemical investments and energy diversification projects, contributing to moderate but consistent demand. Latin America maintained gradual market progress, supported by ongoing oil and gas infrastructure development.

Together, these regions highlight a balanced yet regionally diverse market landscape, with North America setting the pace through advanced industrial infrastructure, environmental compliance, and strong integration of hydrogen sulfide into large-scale refining and energy operations, solidifying its position as the leading regional market in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to play a key role through its extensive expertise in specialty and inorganic chemicals. The company’s focus on optimizing sulfur-based production and recovery processes aligns with industrial demand for high-purity hydrogen sulfide used in refining, chemical synthesis, and environmental applications. BASF’s strong manufacturing network and sustainable operational practices reinforce its position within the global supply chain.

Linde plc, a global leader in industrial gases and engineering, demonstrates strong capabilities in hydrogen and sulfur gas management. Its advanced gas processing technologies and integrated plant solutions support industries requiring safe handling and efficient use of hydrogen sulfide. Linde’s focus on emission control, purification systems, and customized gas delivery has enhanced its reliability across key industrial sectors, particularly in refining and petrochemicals.

Matheson Tri-Gas Inc. contributes to market stability through its expertise in specialty gas production and distribution. The company maintains a robust portfolio serving laboratories, manufacturing units, and industrial applications requiring hydrogen sulfide of varying concentrations. Matheson’s commitment to safety, precision, and purity positions it as a trusted supplier in both domestic and international markets.

Top Key Players in the Market

- Air Liquide

- Air Products and Chemicals Inc

- Alfred Krcher SE & Co. KG

- BASF SE

- Linde plc

- Matheson Tri-Gas Inc

- Messer Group GmbH

- Nippon Gases

- Praxair Technology Inc.

- SGS SA

- Tessenderlo Group

- The Linde Group

Recent Developments

- In September 2024, Air Products completed the sale of its LNG process technology and equipment business to Honeywell for USD 1.81 billion as part of its strategy to focus on its core industrial gases and clean hydrogen offerings.

- In June 2024, Air Liquide announced that it would invest up to USD 850 million to build, own, and operate four large modular air-separation units and related infrastructure in the Americas for low-carbon oxygen production

Report Scope

Report Features Description Market Value (2024) USD 318.4 Million Forecast Revenue (2034) USD 543.9 Million CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Production Method (Chemical Synthesis, Biological Production, Thermal Decomposition), By Concentration (40%-60%, 60%-80%, 80% -99.9%), By Application (Petrochemical, Chemical Manufacturing, Pulp and Paper, Water Treatment, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Liquide, Air Products and Chemicals Inc, Alfred Krcher SE & Co. KG, BASF SE, Linde plc, Matheson Tri-Gas Inc, Messer Group GmbH, Nippon Gases, Praxair Technology Inc., SGS SA, Tessenderlo Group, The Linde Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrogensulfide (Cas 7783-06-4) (Hydrogen Sulfide) MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Hydrogensulfide (Cas 7783-06-4) (Hydrogen Sulfide) MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Air Liquide

- Air Products and Chemicals Inc

- Alfred Krcher SE & Co. KG

- BASF SE

- Linde plc

- Matheson Tri-Gas Inc

- Messer Group GmbH

- Nippon Gases

- Praxair Technology Inc.

- SGS SA

- Tessenderlo Group

- The Linde Group