Global Hydro Turbine Market Size, Share, And Enhanced Productivity By Type (Reaction Turbine (Kaplan Turbine, Bulb Turbine, Francis Turbine), Impulse Turbine (Cross Flow Turbine, Pelton Turbine)), By Head (2-25 m, Greater Than 25-70 m,Greater Than 70 m), By Capacity (Medium (10–100MW), Small (Less than 10MW), Large (Greater than 100MW)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168604

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

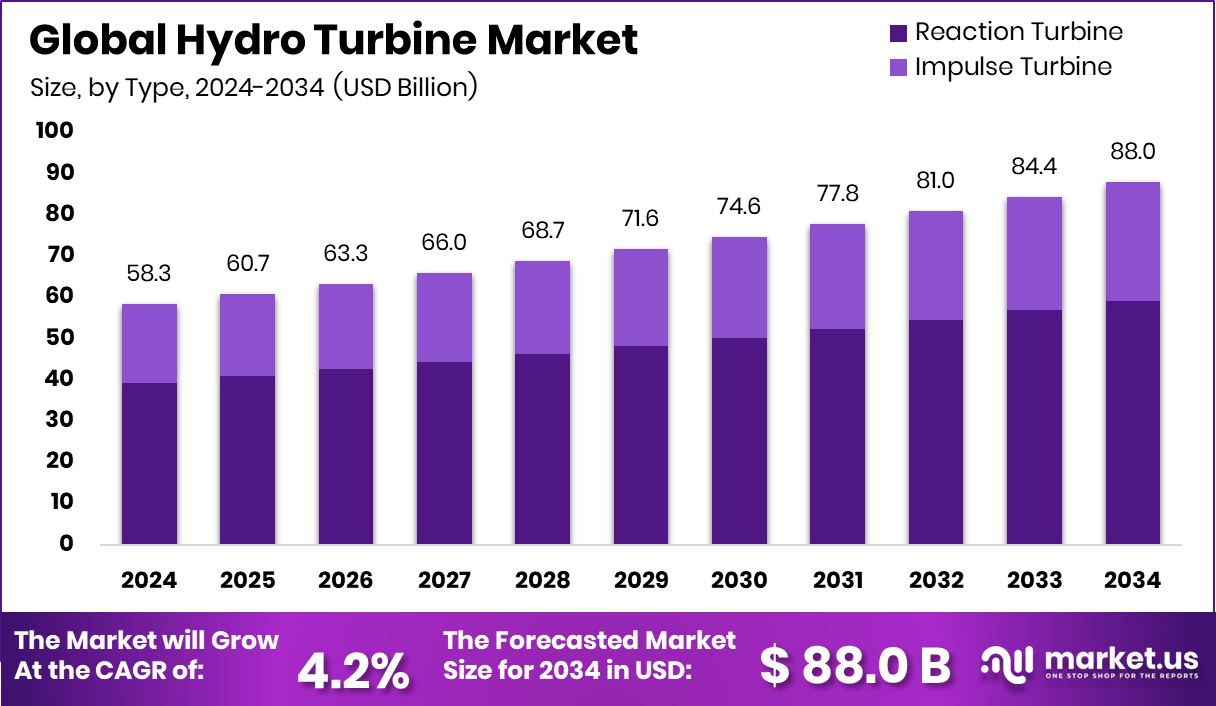

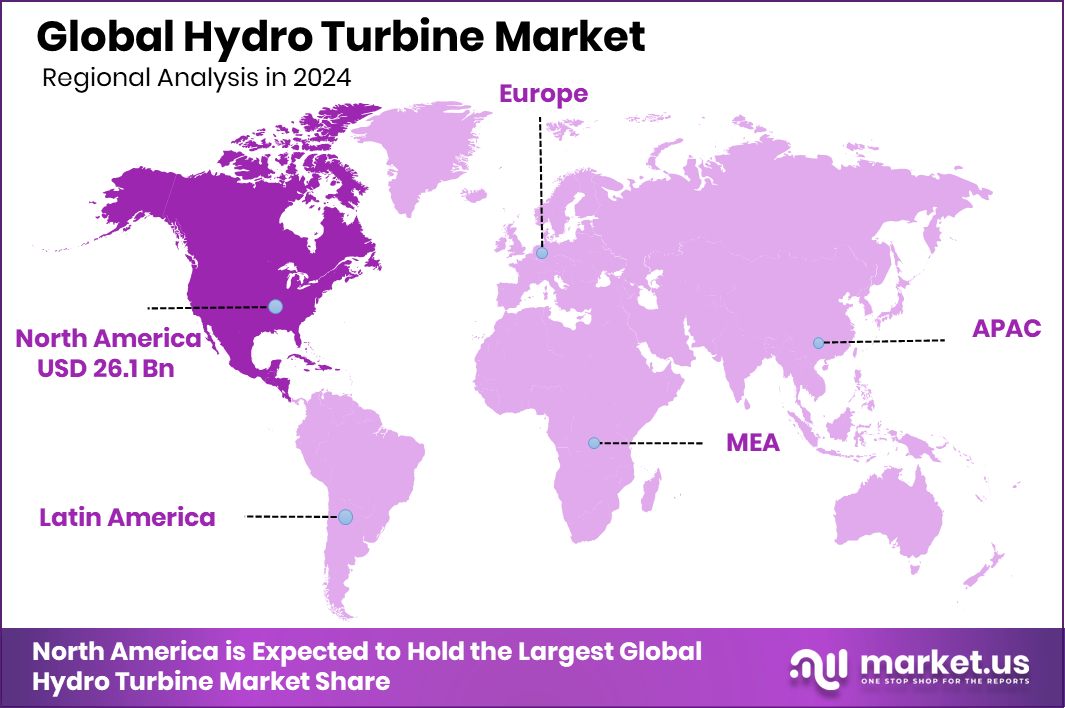

The Global Hydro Turbine Market is expected to be worth around USD 88.0 billion by 2034, up from USD 58.3 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034. North America hydro turbine market leads at 44.90% generating USD 26.1 Bn globally.

A hydro turbine is a mechanical system that converts the energy of flowing or falling water into rotational power, which is then used to generate electricity. Its performance depends on water head, flow rate, and turbine design, making it suitable for dams, rivers, and canal-based projects.

The hydro turbine market represents the demand for these systems across large hydro plants, small hydro, and run-of-river projects. It covers new installations as well as refurbishment of aging assets that require efficiency upgrades and digital control improvements.

One major growth factor is rising public investment in clean and resilient energy infrastructure. Even amid debates around offshore wind, funding such as the $426 million federal grant targeted at the Port of Humboldt Bay and the $8 million awarded by the U.S. Department of Energy to strengthen Los Angeles grid infrastructure signals broader long-term support for renewable power systems.

Demand for hydro turbines continues to rise because they provide stable, dispatchable electricity that supports grid reliability. Planning funds, including $3 million for a California coastal town to prepare for an offshore energy port, also reflect growing emphasis on integrated renewable power hubs.

Clear opportunities exist in grid-supportive renewables and energy transition financing. Large-scale clean-energy funding trends, including multiple fusion startups raising over $100 million, indicate investor appetite for advanced power technologies, indirectly supporting hydro turbine upgrades and hybrid renewable projects.

Key Takeaways

- The Global Hydro Turbine Market is expected to be worth around USD 88.0 billion by 2034, up from USD 58.3 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- Reaction turbines dominate hydro turbine markets, holding a 67.3% share due to efficiency across varied flows.

- Projects with 2–25 m head lead adoption, capturing 44.9% share for flexible, low-head installations globally.

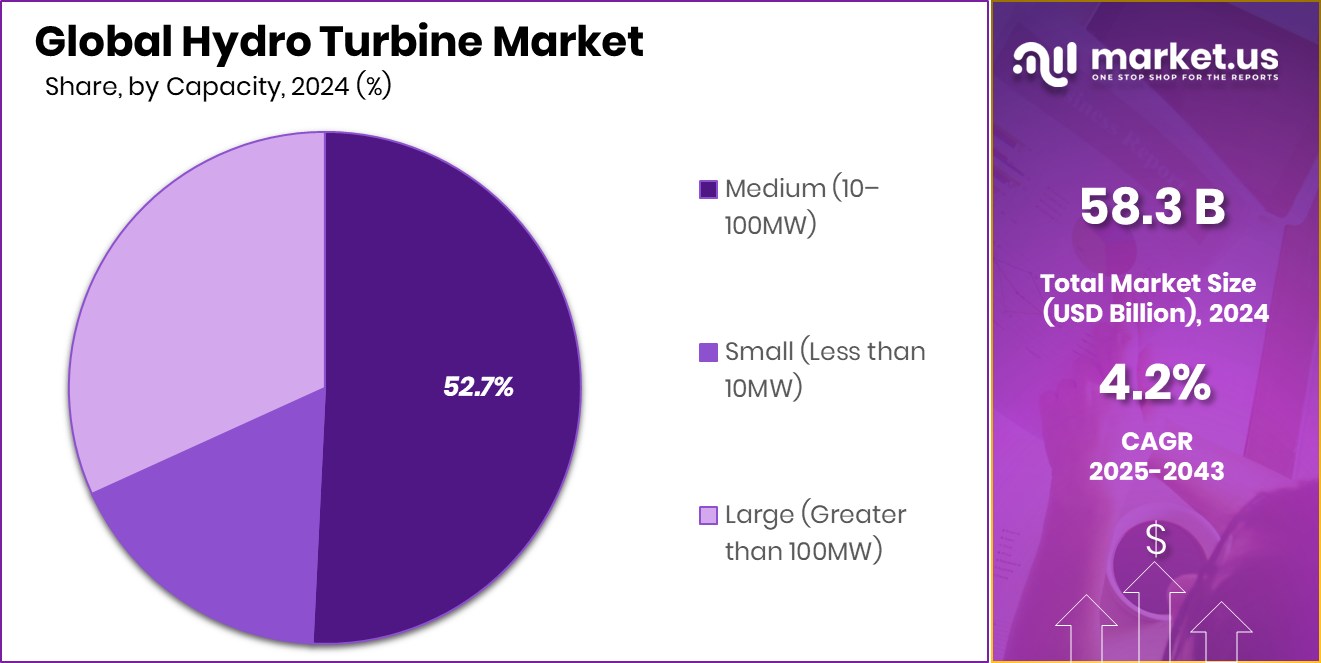

- Medium-capacity 10–100 MW hydro plants command a 52.7% share, balancing scalability, cost, and grid reliability needs today.

- In North America hydro turbine demand holds 44.90% reaching USD 26.1 Bn market.

By Type Analysis

Reaction turbines dominated hydro turbine market due to advantages, holding 67.3% share.

In 2024, Reaction Turbine held a dominant market position in the By Type segment of the Hydro Turbine Market, with a 67.3% share. This strong position reflects its widespread use in projects where steady water flow and medium to low head conditions are common.

Reaction turbines are preferred because they operate efficiently under continuous flow, making them suitable for large-scale and long-life hydropower installations. Their design allows smooth energy conversion, which supports consistent power generation and stable grid supply.

The high 67.3% share also indicates strong acceptance in modernization and capacity-expansion projects, where performance reliability is a key requirement. Overall, the dominance of reaction turbines in 2024 shows their importance as a dependable and mature technology within the hydro turbine landscape, particularly for utility-driven power generation needs.

By Head Analysis

Hydro turbines designed for 2–25 m head dominated market with 44.9% share.

In 2024, 2–25 m held a dominant market position in the By Head segment of the Hydro Turbine Market, with a 44.9% share. This dominance reflects the strong deployment of hydro turbines designed for low to medium head conditions, where water availability is steady and infrastructure requirements are manageable.

Projects within the 2–25 m range are widely adopted because they balance power output with lower construction complexity, supporting reliable electricity generation over long operating periods. The 44.9% share highlights consistent demand from installations focused on efficient energy capture without heavy structural modifications.

Overall, the leading position of the 2–25 m head segment in 2024 underlines its role as a practical and scalable choice within the hydro turbine market, supporting stable performance and long-term operational efficiency.

By Capacity Analysis

Medium capacity hydro turbines between 10–100 MW dominated market holding 52.7% share.

In 2024, Medium (10–100 MW) held a dominant market position in the By Capacity segment of the Hydro Turbine Market, with a 52.7% share. This leadership reflects the strong preference for capacity ranges that balance efficient power generation with manageable project scale.

Medium-capacity hydro turbines are widely used where consistent electricity output is required without the complexity associated with very large installations. The 52.7% share shows that this capacity range fits well with regional power requirements and long-term operational planning.

Systems in the 10–100 MW range support grid stability while maintaining favorable operating efficiency over extended lifecycles. Overall, the dominance of the Medium capacity segment in 2024 highlights its role as a reliable and flexible category within the hydro turbine market, meeting steady demand for dependable renewable power generation.

Key Market Segments

By Type

- Reaction Turbine

- Kaplan Turbine

- Bulb Turbine

- Francis Turbine

- Impulse Turbine

- Cross Flow Turbine

- Pelton Turbine

By Head

- 2-25 m

- >25-70 m

- > 70 m

By Capacity

- Medium (10–100MW)

- Small (Less than 10MW)

- Large (Greater than 100MW)

Driving Factors

Growing Demand for Reliable Renewable Power Generation

One of the key driving factors for the hydro turbine market is the increasing need for reliable and clean electricity. Hydropower delivers steady energy output compared to many other renewable sources, as it is not dependent on daily weather changes.

Hydro turbines support continuous power generation, which helps maintain grid stability and manage peak demand effectively. Many regions rely on hydropower plants to balance electricity supply during high-load periods and reduce dependence on fossil-fuel-based generation. In addition, hydro turbines operate for long lifespans with relatively low maintenance needs, making them attractive for long-term energy planning.

Their ability to generate power efficiently over decades strengthens confidence among utilities and project owners. Overall, the growing focus on dependable renewable energy sources continues to push demand for hydro turbines across both existing and new hydropower installations.

Restraining Factors

High Project Costs and Complex Installation Process

A major restraining factor for the hydro turbine market is the high cost and complexity involved in project development. Installing hydro turbines often requires large civil works such as dams, channels, and supporting infrastructure, which increases upfront investment. Long construction timelines and the need for skilled engineering also add to overall costs.

In many locations, suitable water resources are limited, making site selection difficult and time-consuming. Environmental clearances and water-use regulations can further delay projects, affecting return expectations. These challenges make hydro turbine projects less flexible compared to some other power technologies.

As a result, smaller developers and utilities may hesitate to invest despite long-term benefits. Overall, high initial costs and complex implementation remain key barriers to faster adoption in the hydro turbine market.

Growth Opportunity

Expanding Investment Support for Clean Hydropower Projects

A major growth opportunity for the hydro turbine market comes from increasing investment activity focused on clean energy technologies. Growing interest from financial institutions and asset managers is helping unlock capital for renewable power projects, including hydropower. For example, BNP Paribas Asset Management raised USD 179 million for a cleantech venture fund, reflecting strong confidence in long-term clean energy solutions.

Such dedicated funds improve access to financing for upgrading existing hydro plants and developing new turbine installations, especially in regions seeking stable renewable power. Improved funding availability also supports technology improvements that enhance turbine efficiency and lifespan.

As more capital flows into cleantech-focused investments, hydro turbine projects gain better financial backing. This trend creates strong growth opportunities by lowering investment barriers and encouraging wider adoption of hydropower systems globally.

Latest Trends

Rising Large-Scale Hydropower Project Financing Momentum Global

A clear latest trend in the hydro turbine market is the growing focus on large, coordinated hydropower projects backed by strong financial commitment. Banks and financial institutions are increasingly supporting utility-scale projects that can deliver stable, long-term electricity.

A key example is the pledge by ten banks to invest Rs 70 billion for the 341 MW Budhigandaki Hydropower Project, showing renewed confidence in hydropower development. Such projects require advanced and high-capacity hydro turbines to ensure reliable performance over decades.

This trend highlights a shift toward fewer but larger projects with higher efficiency and long operating life. As infrastructure-backed investments increase, demand grows for durable hydro turbines suited for long-term, baseload power generation.

Regional Analysis

North America dominates hydro turbine market with 44.90% share at USD 26.1 Bn.

North America held a dominant position in the hydro turbine market, accounting for 44.90% share and reaching a market value of USD 26.1 Bn. This leadership reflects the region’s strong base of installed hydropower infrastructure and continued focus on upgrading aging turbines to improve efficiency and reliability. Mature grid systems and long operational histories of hydropower facilities support steady replacement and modernization demand, reinforcing North America’s leading market position.

Europe represents a stable and technology-driven hydro turbine market. The region focuses strongly on efficiency improvement and long-term asset optimization, with emphasis on extending turbine lifespan and improving operational performance. Modernization of existing hydropower assets plays a central role in sustaining consistent demand across European countries.

Asia Pacific shows steady market activity supported by expanding energy needs and long-term power planning. Hydropower remains an important part of the region’s electricity mix, encouraging continuous adoption of hydro turbines for both grid stability and base-load generation.

The Middle East & Africa region reflects gradual development, where hydro turbine demand is shaped by selective water resource utilization and infrastructure projects aimed at energy diversification and supply reliability.

Latin America demonstrates consistent adoption of hydropower technologies, supported by favorable natural conditions and long-term reliance on hydroelectric generation to meet regional electricity requirements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ANDRITZ AG holds a strong position in the global hydro turbine market through its long-standing focus on engineering-led hydropower solutions. In 2024, the company continues to emphasize turbine efficiency, durability, and refurbishment capabilities. Its strength lies in handling complex hydro projects, including upgrades of existing plants where performance optimization and lifecycle extension are critical. ANDRITZ’s ability to support both new installations and modernization projects makes it highly relevant in markets focused on improving output from established hydropower assets.

Canyon Industries Inc. is recognized for its specialized role in hydro turbine manufacturing and field services. In 2024, the company’s value is driven by its hands-on expertise in turbine installation, maintenance, and repair for hydropower facilities. Canyon Industries benefits from close collaboration with plant operators, offering customized solutions that improve operational reliability. Its practical experience across different operating conditions supports demand for performance restoration and plant efficiency improvement.

Gilbert Gilkes & Gordon Ltd. maintains a clear focus on precision-engineered hydro turbines suited for long-life operation. In 2024, the company stands out for its emphasis on robust design, consistent performance, and adaptability across varying site conditions. Its strong engineering heritage supports applications where reliability, efficiency, and operational stability are essential, reinforcing its position in the global hydro turbine landscape.

Top Key Players in the Market

- ANDRITZ AG

- Canyon Industries Inc.

- Gilbert Gilkes & Gordon Ltd.

- Toshiba Energy

- Kirloskar Brothers Ltd.

- Siemens AG

- Harbin Electric Machinery

- WWS Wasserkraft GmbH

- Cornell Pump Co.

- General Electric Co.

Recent Developments

- In November 2025, ANDRITZ was awarded a modernization contract for the Rajjaprabha hydropower plant in Thailand. The scope involves renovating all three of the plant’s 80-MW generating units including turbine components, generators, installation supervision, testing, and commissioning.

- In 2024, Gilkes supplied twin-jet Pelton turbines along with associated hydropower equipment (generators, control systems, inlet valves, transformers) for the hydroelectric station at Mount Mulanje, reflecting the company’s active role in new installations and upgrades in emerging-market projects.

Report Scope

Report Features Description Market Value (2024) USD 58.3 Billion Forecast Revenue (2034) USD 88.0 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Reaction Turbine (Kaplan Turbine, Bulb Turbine, Francis Turbine), Impulse Turbine (Cross Flow Turbine, Pelton Turbine)), By Head (2-25 m, >25-70 m, > 70 m), By Capacity (Medium (10–100MW), Small (Less than 10MW), Large (Greater than 100MW)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ANDRITZ AG, Canyon Industries Inc., Gilbert Gilkes & Gordon Ltd., Toshiba Energy, Kirloskar Brothers Ltd., Siemens AG, Harbin Electric Machinery, WWS Wasserkraft GmbH, Cornell Pump Co., General Electric Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ANDRITZ AG

- Canyon Industries Inc.

- Gilbert Gilkes & Gordon Ltd.

- Toshiba Energy

- Kirloskar Brothers Ltd.

- Siemens AG

- Harbin Electric Machinery

- WWS Wasserkraft GmbH

- Cornell Pump Co.

- General Electric Co.