Global Hybrid Seeds Market Size, Share, And Enhanced Productivity By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Treatment (Treated, Untreated), By Farm (Indoor, Outdoor), By Cultivation Type (Open Field Cultivation, Protected Cultivation), By Application (Commercial, Residential), By Distribution Channel (Direct to Farmers, Cooperatives, Mediators), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 175491

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Crop Type Analysis

- By Treatment Analysis

- By Farm Analysis

- By Cultivation Type Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

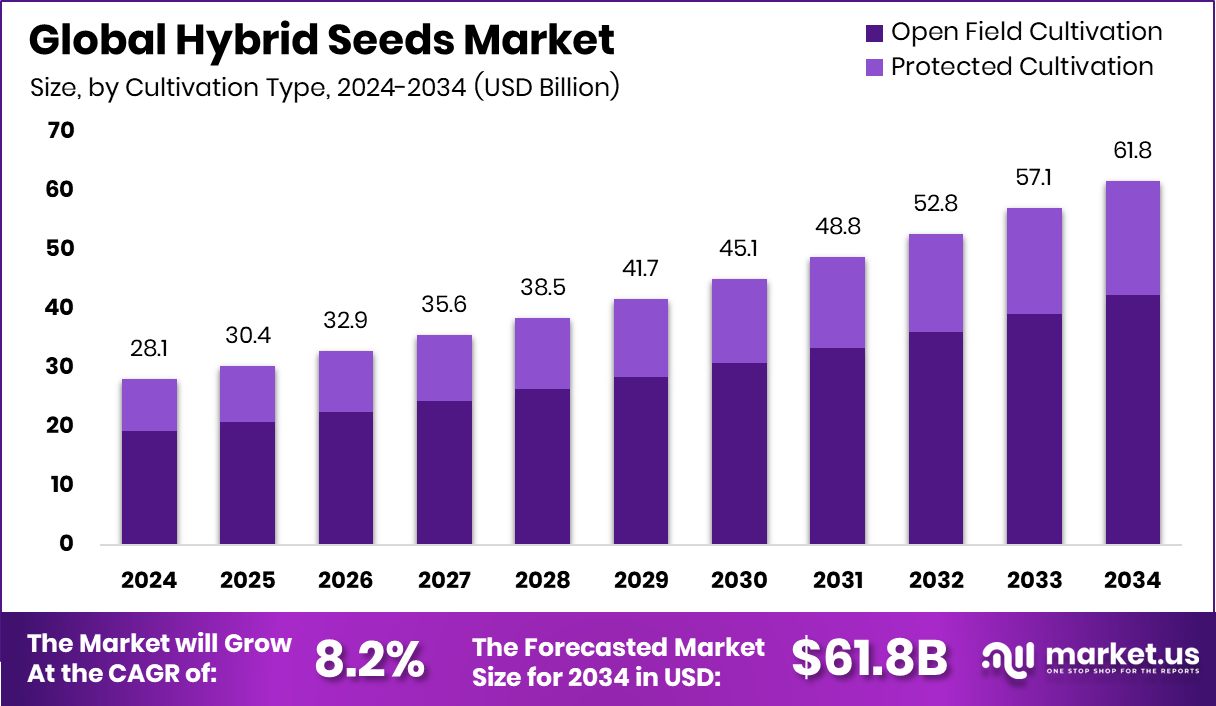

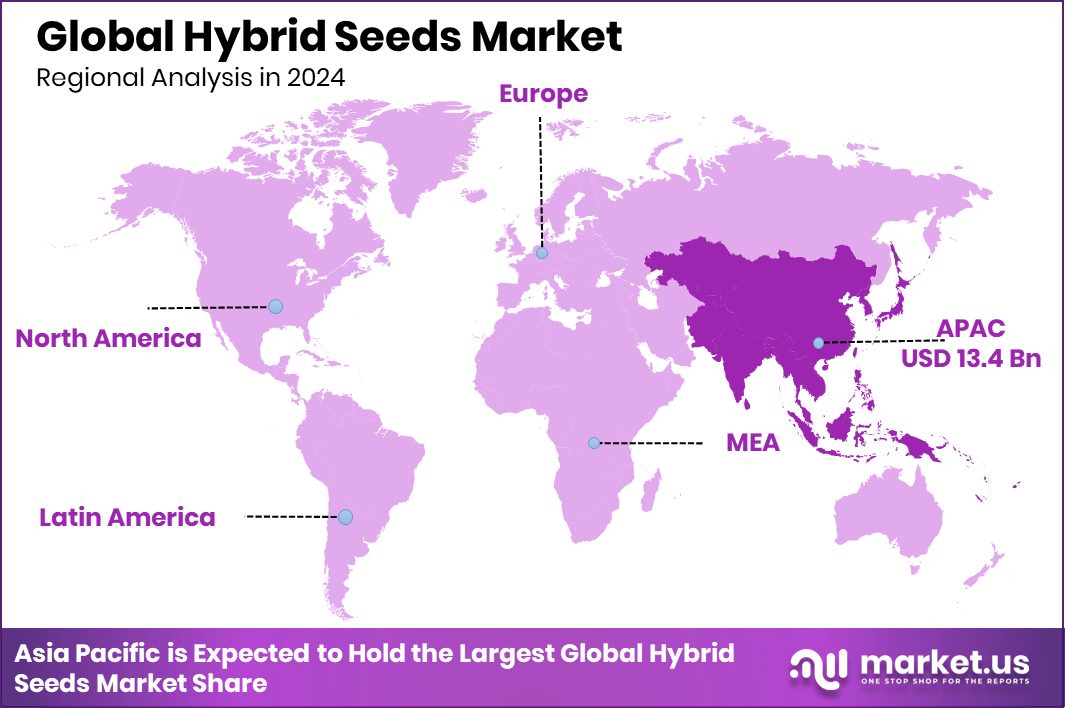

The Global Hybrid Seeds Market is expected to be worth around USD 61.8 billion by 2034, up from USD 28.1 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034. The Hybrid Seeds Market in the Asia Pacific holds 47.8% share, valued at USD 13.4 Bn.

Hybrid seeds are developed by cross-breeding two genetically distinct parent plants to produce crops with stronger traits such as higher yield, better disease resistance, improved uniformity, and stronger adaptability to different climates. They have become essential for modern farming, especially across cereals and grains, oilseeds, pulses, fruits, vegetables, and other diversified crop groups. The Hybrid Seeds Market covers a full ecosystem that includes treated and untreated seeds, indoor and outdoor farming, open-field and protected cultivation, as well as distribution channels such as direct-to-farmer sales, cooperatives, and mediators.

Growing factors for this market include rising global demand for reliable crop output and improved seed quality. Increased government and institutional support also plays a role, reflected in initiatives like Manitoba boosting its stake in the cereals centre to $23.5 million and the African Development Fund approving an additional $5.6 million grant to enhance food security in Mozambique. These contributions strengthen breeding programs and farmer access to improved seeds.

Demand continues to rise as farmers adopt hybrid varieties to deal with climate stress, soil limitations, and rising food system pressures. Expanding consumer interest in better food quality is also visible, as seen in the $85 million raised by Magic Spoon to scale healthier cereal products.

Opportunities are widening with new agri-tech and training platforms emerging. Startups such as Mesta, securing $5.5 million, and ExtraMile Play raising $500K, show how digital and engagement tools are entering the agricultural space, while hybrid-focused wellness and lifestyle brands like RoxFit, attracting £800,000 investment, highlight broader investment confidence. Together, these developments support innovation and long-term growth within the Hybrid Seeds Market.

Key Takeaways

- The Global Hybrid Seeds Market is expected to be worth around USD 61.8 billion by 2034, up from USD 28.1 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034.

- In the Hybrid Seeds Market, cereals and grains dominated with a strong 39.2% share globally.

- The Hybrid Seeds Market saw treated seeds dominate with a significant 72.3% share worldwide.

- Outdoor farms dominated the Hybrid Seeds Market landscape, securing a notable 78.4% market share.

- Open-field cultivation dominated the Hybrid Seeds Market segment, holding an impressive 68.5% share.

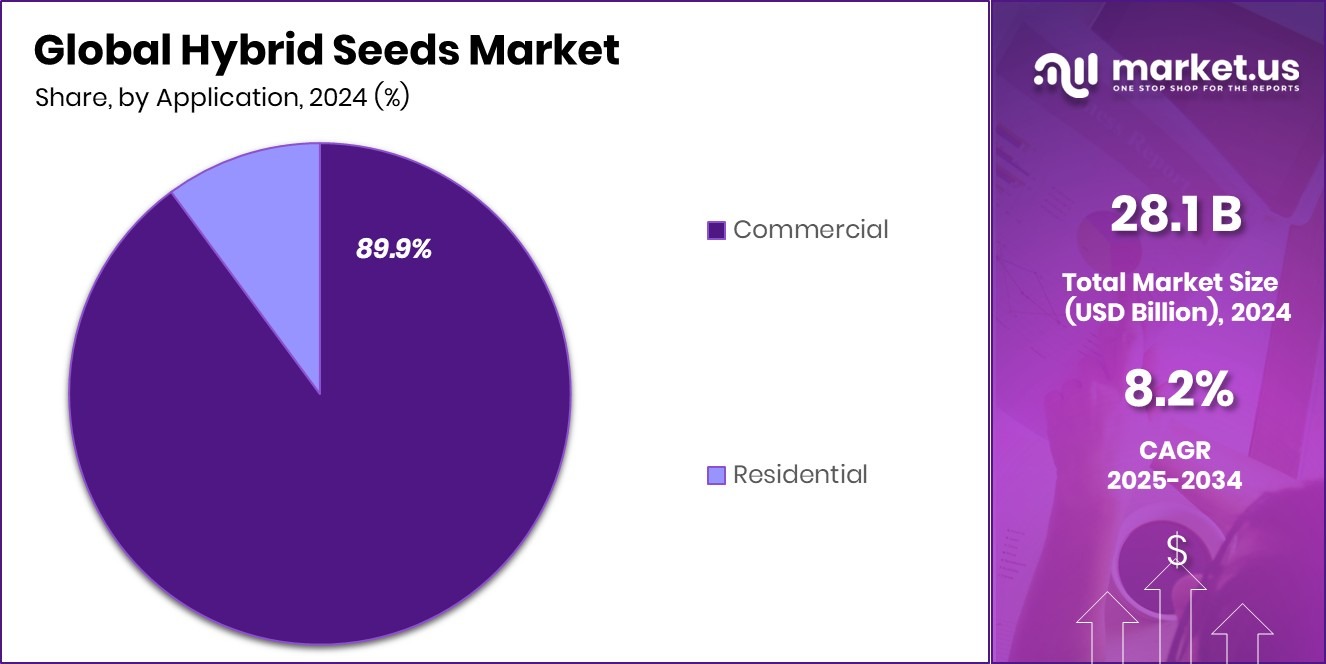

- Commercial applications dominated the Hybrid Seeds Market by capturing a leading 89.9% market share.

- Direct-to-farmers distribution dominated the Hybrid Seeds Market segment with a solid 48.6% share.

- Asia Pacific leads the Hybrid Seeds Market with 47.8%, reaching USD 13.4 Bn.

By Crop Type Analysis

Hybrid Seeds Market is dominated by cereals and grains with 39.2% share.

In 2024, the Hybrid Seeds Market saw Cereals and Grains emerge as the leading crop type, accounting for a significant 39.2% share. This dominance reflects the rising global need for higher-yielding varieties of rice, wheat, corn, and barley as countries push to strengthen food security. Climate variability, shrinking farmland, and population growth continue to push farmers toward hybrid seed varieties that offer better stress tolerance, improved disease resistance, and stable productivity.

Governments in emerging economies also intensified programs supporting hybrid cereal adoption through subsidies and farmer training campaigns. The segment’s growth further benefited from advanced breeding technologies, which enabled quicker development of resilient varieties tailored to diverse soil and climatic conditions across key agricultural regions.

By Treatment Analysis

Hybrid Seeds Market shows the treated segment dominated strongly with a 72.3% share.

In 2024, the Hybrid Seeds Market experienced strong momentum in the Treated Seeds category, which held a dominant 72.3% share. Farmers increasingly preferred treated hybrid seeds due to their enhanced protection against soil-borne diseases, pests, and fungal infections. The shift is also driven by rising awareness about early-stage crop protection and the need to reduce chemical use during the growing season.

Treated seeds offer improved germination rates and stronger initial plant establishment, supporting better yields even in challenging environments. Seed companies continued investing in advanced coating technologies that integrate micronutrients and biological agents, making treated hybrids more efficient and sustainable. As environmental regulations tightened worldwide, treated seeds became a practical and cost-effective solution for both small and large farms.

By Farm Analysis

Hybrid Seeds Market is dominated by outdoor farms, holding a 78.4% share.

In 2024, the Hybrid Seeds Market was largely driven by Outdoor Farming, which accounted for an impressive 78.4% share. Outdoor farms remain the backbone of global crop production, especially in developing nations where open land availability and traditional farming methods remain widespread. Hybrid seeds designed for outdoor conditions offer strong resistance to climatic fluctuations such as drought, heat stress, and irregular rainfall, making them valuable for large-scale cultivation.

Many governments supported outdoor farming through subsidy programs and access to high-quality hybrid seeds to boost yield stability. Increasing mechanization and improved irrigation systems also strengthened the segment’s growth. As farmers shift toward hybrid varieties to overcome productivity gaps, outdoor farms will continue to anchor market expansion.

By Cultivation Type Analysis

Hybrid Seeds Market sees open field cultivation dominating with a 68.5% share.

In 2024, Open Field Cultivation secured a substantial 68.5% share in the Hybrid Seeds Market, reflecting its long-standing importance in global agriculture. Open-field systems remain popular among farmers due to their scalability, cost-effectiveness, and suitability for a wide range of hybrid crops, including cereals, vegetables, and oilseeds. Hybrid seeds used in open fields deliver benefits such as improved tolerance to temperature stresses, enhanced root strength, and superior nutrient-use efficiency.

Regions across Asia, Africa, and Latin America continued expanding open-field hybrid farming as governments emphasized food production self-sufficiency. Despite the rise of greenhouse and controlled-environment agriculture, open-field hybrid cultivation remains essential for meeting the high-volume demands of domestic and export markets globally.

By Application Analysis

Hybrid Seeds Market is dominated by commercial applications, capturing an 89.9% share.

In 2024, the Commercial Application segment dominated the Hybrid Seeds Market, holding a remarkable 89.9% share. The commercial farming sector has rapidly adopted hybrid seeds to maximize yield, reduce crop losses, and secure consistent quality for large-scale supply chains. Growing export opportunities, contract farming models, and food processing requirements have pushed commercial growers to rely on hybrids for higher uniformity and resilience. These seeds help commercial farms manage risks associated with pests, diseases, and unpredictable climate challenges.

Large agribusinesses also increased investments in hybrid crop trials, performance testing, and rapid adoption programs. As demand for reliable and high-volume agricultural output rises globally, commercial users continue to drive the widespread use of hybrid seed technologies.

By Distribution Channel Analysis

Hybrid Seeds Market observes a direct-to-farmers channel, with a 48.6% share overall.

In 2024, Direct-to-Farmer sales captured 48.6% of the Hybrid Seeds Market, highlighting the growing importance of personalized seed distribution models. Companies are increasingly focused on direct engagement with farmers through local representatives, digital platforms, and village-level demonstrations. This approach builds trust, offers tailored recommendations, and ensures the timely delivery of high-quality hybrid seeds.

Direct channels reduce dependency on intermediaries and allow seed producers to communicate accurate product information, agronomic practices, and performance data. The rise of rural e-commerce, mobile advisory apps, and agri-focused fintech services further accelerated direct purchases. As farmers seek reliable and cost-effective hybrid seeds, direct-to-farm distribution is becoming a preferred route, strengthening transparency and improving adoption rates across diverse regions.

Key Market Segments

By Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

By Treatment

- Treated

- Untreated

By Farm

- Indoor

- Outdoor

By Cultivation Type

- Open Field Cultivation

- Protected Cultivation

By Application

- Commercial

- Residential

By Distribution Channel

- Direct to Farmers

- Cooperatives

- Mediators

Driving Factors

Growing adoption of climate-resilient varieties

In the Hybrid Seeds Market, one of the strongest driving forces is the growing adoption of climate-resilient varieties as farmers look for seeds that can withstand unpredictable weather patterns. This interest aligns with broader agricultural efforts to strengthen fruit and vegetable systems, reflected in calls such as the G’s Growers chairman seeking renewal of a £40 million fruit and veg fund, a signal of ongoing investment interest.

Similarly, programs like Idaho elementary schools becoming eligible for $3 million in fruit and vegetable grants highlight the rising institutional emphasis on improving crop quality and encouraging better produce accessibility. These funding initiatives reinforce the value of hybrid seeds that offer stronger tolerance, better stability, and dependable output, making climate-resilient hybrids more essential in modern farming.

Restraining Factors

Limited awareness reduces hybrid seed usage

A major restraint in the Hybrid Seeds Market is the limited awareness among small and mid-scale farmers, which slows adoption despite growing demand for improved seeds. While funding is flowing into adjacent sectors, such as the $2.2 million grant for Sydney’s alt-protein centre, such investments do not directly address hybrid seed education gaps.

Additionally, industry-focused programs like USDA funding packaging innovations for the $143B specialty crop export industry emphasize value-chain improvements rather than farmer-level knowledge of hybrid seeds. Without targeted awareness programs, many growers remain unfamiliar with the long-term benefits of hybrid varieties. This lack of technical understanding continues to restrict market penetration, especially in regions where advisory systems and extension services remain underdeveloped.

Growth Opportunity

Expansion of protected cultivation boosts hybrids

In the Hybrid Seeds Market, the expansion of protected cultivation—such as greenhouses, shade nets, and controlled-environment farming—creates powerful growth opportunities. Protected environments allow hybrid seeds to perform more efficiently, offering improved yield stability and better disease control. This opportunity aligns with ongoing agricultural development projects, including EPOSEA’s $312,000 AGRA-backed initiative to boost pulses and oilseed exports, which shows increasing investment in crops that often benefit from hybrid and protected-cultivation approaches.

Similarly, policy discussions like Budget 2025, where growers seek a €200,000 TAMS ceiling per tillage farm, indicate rising interest in infrastructure upgrades and farm modernization. These developments collectively strengthen the market outlook, making hybrid varieties more viable and scalable under protected cultivation systems.

Latest Trends

Increasing focus on nutrient-efficient hybrids

A key trend shaping the Hybrid Seeds Market is the increasing focus on nutrient-efficient hybrids, designed to deliver better output with optimized nutrient use. Governments are also providing supportive signals, such as the Rs 9.9 lakh grant offered to FPOs and cooperatives for setting up 10-tonne oil extraction units, highlighting the push toward better crop processing and efficiency.

Another major policy decision, the Union Cabinet’s approval of Rs 35,000 crore for the continuation of PM-AASHA schemes, aims to stabilize farmer incomes and reduce price volatility. These initiatives complement the industry’s shift toward nutrient-efficient hybrids that help growers reduce input costs while improving crop quality. The trend reflects a wider movement toward sustainable and resource-balanced agriculture, making nutrient-efficient hybrid seeds increasingly relevant.

Regional Analysis

Hybrid Seeds Market in the Asia Pacific holds 47.8% share, valued at USD 13.4 Bn.

In 2024, Asia Pacific dominated the Hybrid Seeds Market, holding a leading 47.8% share valued at USD 13.4 Bn, driven by large-scale crop production, strong reliance on hybrid varieties, and growing adoption among commercial farms. North America followed with steady growth supported by advanced seed technologies, higher productivity expectations, and widespread use of improved hybrid traits across cereals, vegetables, and oilseeds.

Europe maintained consistent expansion as farmers prioritized high-quality hybrid seeds to address climate shifts, improve disease resistance, and meet stringent regional agricultural standards. In the Middle East & Africa, rising food security needs and expanding cultivated land supported the demand for hybrid seeds across major crops, particularly in developing agricultural economies.

Latin America showed stable adoption, backed by increasing hybrid usage in soybean, maize, and horticulture sectors as growers focused on yield improvement and resilience. Across all regions, hybrid seeds continued to support higher farm output, better stress tolerance, and more reliable harvest performance, with Asia Pacific clearly emerging as the strongest market contributor by both share and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bayer CropScience remained a central player, leveraging its long-standing expertise in crop genetics and hybrid breeding to support farmers seeking higher yields and climate-resilient varieties. Its focus on improving seed vigour, disease resistance, and performance stability across cereals, vegetables, and oilseeds helped reinforce its position among growers transitioning to more reliable hybrid choices.

Corteva Agriscience continued expanding its hybrid seed offerings by integrating advanced breeding techniques with traits that support uniform growth, stronger stress tolerance, and adaptability across diverse environments. The company’s emphasis on farmer-centric seed development and broader regional applicability enabled it to contribute meaningfully to market improvement, especially in regions undergoing rapid agricultural modernization.

Syngenta maintained strong engagement in hybrid seed innovation by strengthening breeding pipelines and enhancing early-stage crop performance traits. Its work in improving germination quality, pest resistance, and hybrid consistency supported the needs of both commercial and mid-scale farms. With each of these companies advancing hybrid seed development in their own strategic directions, the overall market benefited from greater variety, improved crop resilience, and more dependable yield outcomes in 2024.

Top Key Players in the Market

- Bayer CropScience

- Corteva Agriscience

- Syngenta

- Limagrain

- KWS

- Sakata seed

- DLF

- Longping High-tech

- Euralis Semences

- Advanta

Recent Developments

- In June 2025, Limagrain Vegetable Seeds (LVS) entered exclusive discussions with ADQ (an Abu Dhabi sovereign investor) for ADQ to acquire a 35% strategic stake in LVS, which is the vegetable seed division of Limagrain. Under this proposed collaboration, LVS and Silal (an ADQ agri-food technology company) planned a research and development partnership aimed at creating climate-adapted vegetable seed varieties, especially for heat, drought, and salinity resilience. This move highlights Limagrain’s focus on strengthening its global seed innovation and expanding into markets with extreme environmental conditions.

- In June 2025, KWS signed a binding agreement to sell its 50% stake in the North American seed joint venture AgReliant Genetics, which produced corn and soybean hybrid seeds, to GDM. This step ended KWS’s direct seed operations in North America’s corn segment, allowing the company to realign its seed business toward Europe and other global markets. The deal includes licensing rights for select corn breeding material from collaborative programs.

Report Scope

Report Features Description Market Value (2024) USD 28.1 Billion Forecast Revenue (2034) USD 61.8 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Treatment (Treated, Untreated), By Farm (Indoor, Outdoor), By Cultivation Type (Open Field Cultivation, Protected Cultivation), By Application (Commercial, Residential), By Distribution Channel (Direct to Farmers, Cooperatives, Mediators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer CropScience, Corteva Agriscience, Syngenta, Limagrain, KWS, Sakata Seed, DLF, Longping High-tech, Euralis Semences, Advanta Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bayer CropScience

- Corteva Agriscience

- Syngenta

- Limagrain

- KWS

- Sakata seed

- DLF

- Longping High-tech

- Euralis Semences

- Advanta