Global High Fructose Corn Syrup Market Size, Share Analysis Report By Type (HFCS 42, HFCS 55, Others), By Application (Food and Beverages, Household Seasonings, Daily Chemicals, Pharmaceutical, Others), By Distribution Channel (Offline, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152693

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

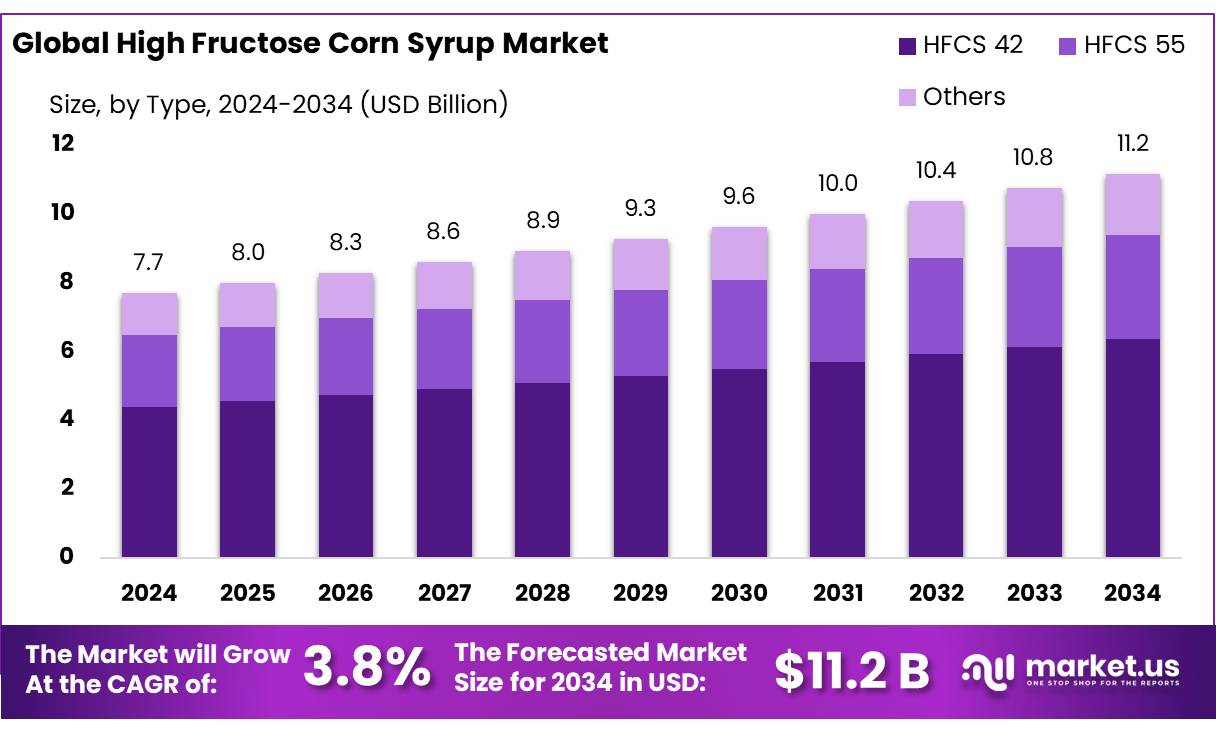

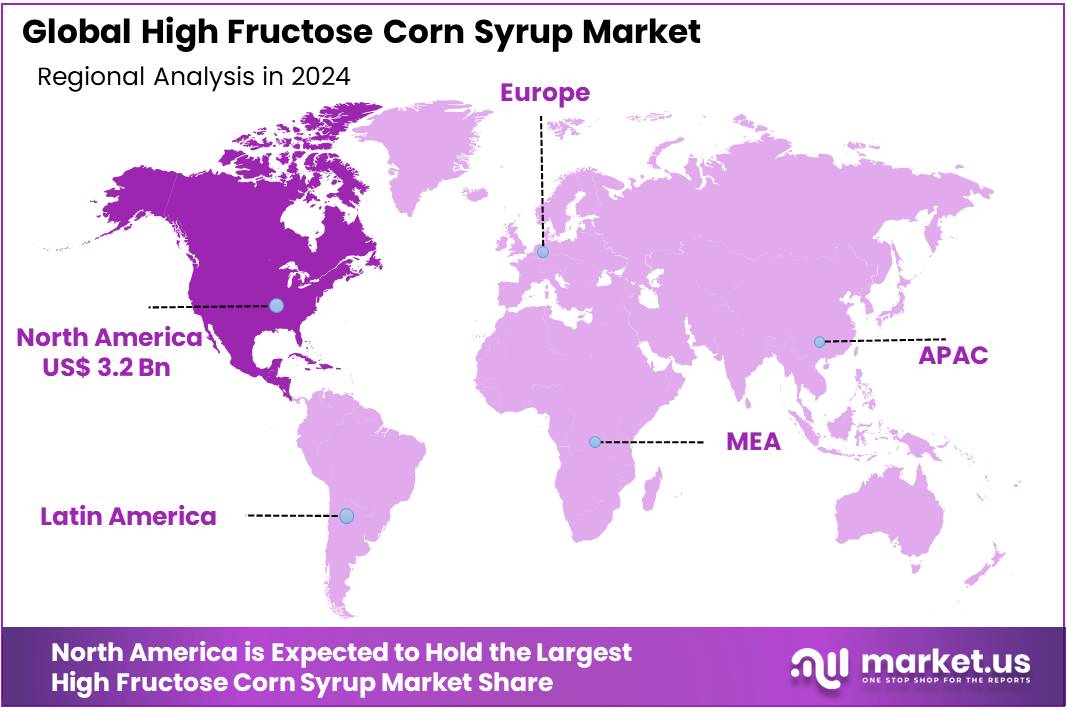

The Global High Fructose Corn Syrup Market size is expected to be worth around USD 11.2 Billion by 2034, from USD 7.7 Billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.8% share, holding USD 3.2 Billion revenue.

High Fructose Corn Syrup (HFCS) is a liquid sweetener produced by converting corn-derived glucose into fructose via enzymatic processes. Since its introduction in the 1970s, HFCS has become a dominant sweetener in North America due to its cost-effectiveness, liquid form (easier transportation and blending), and functionality in acidic beverages, baked goods, and processed foods. HFCS variants like HFCS 42 and HFCS 55 offer 42% and 55% fructose respectively, enabling manufacturers to adjust sweetness and stability based on application.

Government initiatives are also shaping future trajectories. Ongoing U.S. corn‑subsidy reforms, regulatory reviews of HFCS under SNAP and school‑lunch guidelines, as referenced in recent policy proposals, may reduce domestic use but also encourage innovation in concentrated formulations for industrial use. In addition, research into concentrated formulations such as HFCS‑65 and HFCS‑70 highlights trends toward specialized applications in confectionery and pharmaceuticals.

A primary driver of HFCS consumption has been the significant federal support underpinning U.S. corn production—estimated at USD 4.9 billion per year—paired with tariffs and quotas on imported sugar such as cane and beet, which collectively maintain HFCS’s competitive cost position. Economies of scale and subsidies contribute to HFCS being approximately 10%–30% cheaper than sugar in the U.S., which makes it particularly attractive to soft drink manufacturers and processed food producers. Technological improvements in wet milling and enzymatic conversion have also reduced production costs and enhanced quality.

Domestic consumption trends reflect complex dynamics: in the U.S., per capita HFCS intake declined from a peak of 65.9 lb/year in 1999 to approximately 39.5 lb in 2021. Similarly, total U.S. HFCS production and use decreased by around 0.8% in fiscal 2014/15 to 7.2 million short tons, continuing a two decade decline tied to shifting consumer preferences and public health guidance. However, global consumption remains stable, influenced by rising processed food demand in emerging markets.

Key Takeaways

- High Fructose Corn Syrup Market size is expected to be worth around USD 11.2 Billion by 2034, from USD 7.7 Billion in 2024, growing at a CAGR of 3.8%.

- HFCS 42 held a dominant market position, capturing more than a 57.2% share in the High Fructose Corn Syrup market.

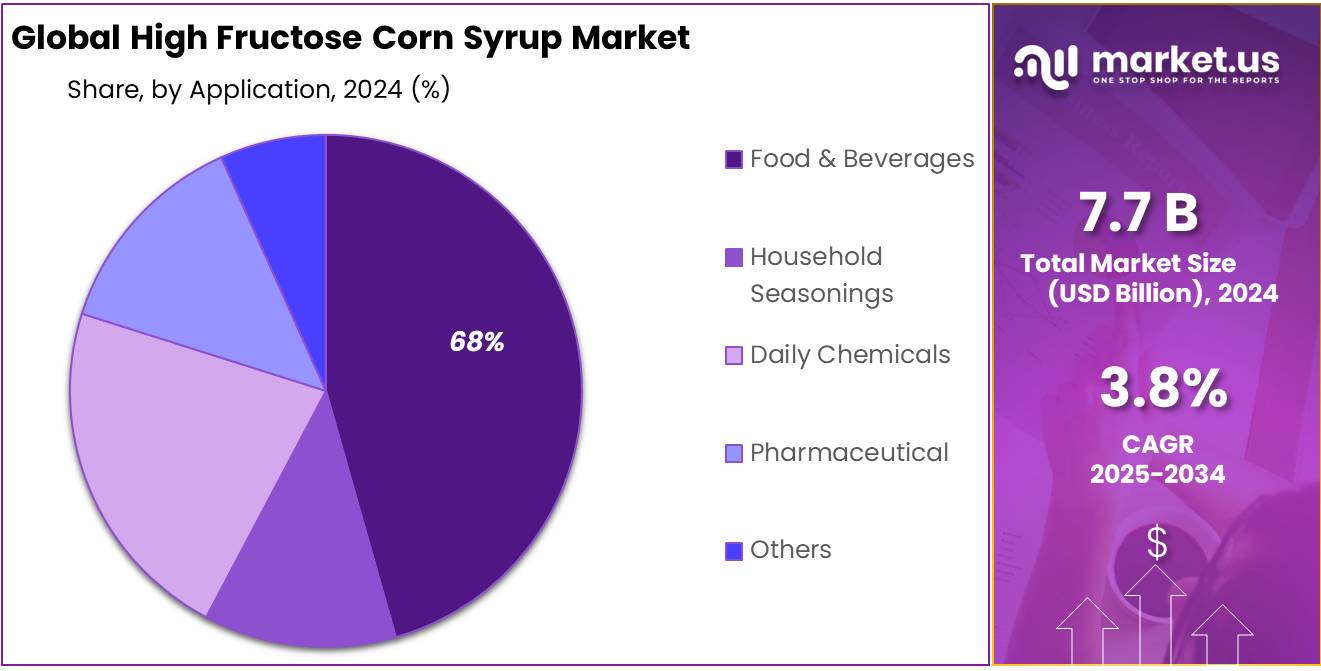

- Food & Beverages held a dominant market position, capturing more than a 68.8% share in the High Fructose Corn Syrup (HFCS) market.

- Offline held a dominant market position, capturing more than an 89.3% share in the High Fructose Corn Syrup (HFCS) market.

- North America held a leading position in the global high fructose corn syrup (HFCS) market, accounting for a significant 41.8% share, with an estimated market value of USD 3.2 billion.

By Type Analysis

HFCS 42 dominates with 57.2% share in 2024 due to its wide use in processed foods and beverages.

In 2024, HFCS 42 held a dominant market position, capturing more than a 57.2% share in the High Fructose Corn Syrup market by type. This specific type is widely used in a variety of processed food products and soft drinks due to its moderate sweetness and cost-efficiency. Its liquid form makes it easy to mix into beverages, baked goods, sauces, and dairy products, helping manufacturers reduce production costs while maintaining the desired taste and texture. The high adoption rate of HFCS 42, especially in regions like North America and Asia-Pacific, can be linked to its versatility and better shelf-life performance in food and beverage applications. As demand for convenience and packaged foods continues to rise globally, the use of HFCS 42 remains strong.

By Application Analysis

Food & Beverages dominates with 68.8% share in 2024 due to high demand for sweeteners in processed products.

In 2024, Food & Beverages held a dominant market position, capturing more than a 68.8% share in the High Fructose Corn Syrup (HFCS) market by application. This strong presence is mainly driven by the increasing demand for ready-to-eat meals, carbonated soft drinks, fruit juices, confectionery, and baked goods, all of which rely heavily on HFCS for sweetness, texture, and preservation. Food manufacturers prefer HFCS because it blends easily in liquid form, is stable in acidic foods and beverages, and is more affordable than traditional sugar. Its consistent performance across various temperature and pH ranges makes it ideal for mass production in the food industry. The beverage sector, especially soft drinks, accounts for a significant portion of this demand, especially in countries like the United States, China, and Mexico.

By Distribution Channel Analysis

Offline distribution dominates with 89.3% share in 2024 due to strong industry relationships and bulk purchasing.

In 2024, Offline held a dominant market position, capturing more than an 89.3% share in the High Fructose Corn Syrup (HFCS) market by distribution channel. This large share reflects the continued preference of food and beverage manufacturers for direct, in-person transactions with established suppliers and distributors. Bulk purchasing, better price negotiation, and the ability to build long-term supply agreements are key advantages of offline channels. Industrial buyers often prefer offline sourcing for large-scale orders, especially in regions where infrastructure supports efficient logistics and warehousing. The offline segment also ensures quality checks, timely delivery, and strong after-sales support, which are important factors for businesses relying on HFCS for food processing.

Key Market Segments

By Type

- HFCS 42

- HFCS 55

- Others

By Application

- Food & Beverages

- Household Seasonings

- Daily Chemicals

- Pharmaceutical

- Others

By Distribution Channel

- Offline

- Online

Emerging Trends

Clean-Label Reformulation and HFCS Removal

One of the most significant new trends shaking up the high fructose corn syrup (HFCS) market is the shift toward “clean‑label” and HFCS‑free products. Consumers today want simple, transparent ingredient lists, and more food manufacturers are responding. As a result, HFCS—once a go‑to sweetener—is increasingly being phased out in favor of more recognizable alternatives.

A striking illustration of this shift comes from a global product-scan: in the year reviewed, 146 new food and beverage launches worldwide explicitly advertised themselves as HFCS free—up sharply from just 6 similar launches in 2003 and 54 in 2006. That’s nearly a 27 fold increase over two decades, showing how HFCS avoidance has gone from niche to mainstream.

Big names in food have noticed. Brands including Kraft, Dannon, and Del Monte have added “no HFCS” labels to some of their lines. What started with smaller, regional brands is now reaching large, established manufacturers who don’t want to be left behind. This movement isn’t just marketing fluff. It reflects consumer demand: in Europe and North America, more than a quarter of new packaged foods now boast clean-label credentials such as natural ingredients and simple sweeteners. At the same time, HFCS volumes in the U.S. have dropped dramatically—from about 48.4-lb per person in 2010 down to 36.7-lb by 2019—a nearly 25% decline.

Governments and regulatory bodies are also helping push this trend. The U.S. FDA’s “Added Sugars” labelling requirement shines a light on hidden sweeteners including HFCS, prompting manufacturers to either reformulate or be up‑front. In the EU, food‑label transparency campaigns are nudging producers to adopt cleaner labels.

Drivers

Growing Demand from the Food and Beverage Industry

One of the most important reasons behind the rising use of high fructose corn syrup (HFCS) is the growing demand from the food and beverage industry, especially for processed and ready-to-eat items. HFCS is used widely as a sweetener because it blends easily into foods, extends shelf life, and is cheaper than cane sugar. It’s now found in everything from soft drinks and fruit-flavored beverages to breakfast cereals, bakery goods, and condiments.

In 2023, the U.S. Department of Agriculture (USDA) reported that over 5.8 million short tons of HFCS were consumed domestically in the United States, showing how strong the demand remains within food manufacturing sectors.

A major driver of this demand is the beverage segment. According to the USDA’s breakdown, soft drink production alone accounted for nearly 65% of total HFCS-55 usage, which is the variant used in beverages. As global soft drink sales continue to grow, especially in developing markets across Asia and Latin America, the use of HFCS is expected to grow along with it. In fact, the USDA also notes that per capita consumption of caloric sweeteners in the U.S. was about 120 pounds per person in 2022, with HFCS forming a large portion of that total.

Additionally, government policies supporting corn farming indirectly keep HFCS prices competitive. For instance, the U.S. corn subsidies and price support mechanisms have helped maintain stable input costs for HFCS producers. This price advantage makes HFCS more attractive to food companies aiming to cut costs in mass production.

Restraints

Rising Health Concerns and Regulatory Pushbacks

One of the biggest challenges facing the high fructose corn syrup (HFCS) market is the growing concern about its health effects. Over the past decade, more people around the world have started paying close attention to what they eat—and HFCS often finds itself at the center of criticism. It’s commonly linked to obesity, type 2 diabetes, fatty liver disease, and other metabolic disorders. This shift in public perception is making both consumers and governments take action.

According to the Centers for Disease Control and Prevention (CDC), the adult obesity rate in the U.S. has increased dramatically—from 30.5% in 2000 to 41.9% in 2020. With obesity-related conditions such as heart disease and diabetes becoming more common, attention has turned to dietary causes, including excessive sugar and HFCS intake.

In response, several governments are stepping in with sugar reduction strategies. For example, the U.S. Food and Drug Administration (FDA) has implemented new labeling requirements that make it mandatory for food producers to clearly list “Added Sugars,” including HFCS, on nutrition labels. This helps consumers make informed choices and puts pressure on manufacturers to reformulate products.

Internationally, the World Health Organization (WHO) has also recommended reducing free sugar intake to less than 10% of total daily energy. Many countries, including the UK and Mexico, have introduced sugar taxes, which directly impact products that contain HFCS. In Mexico, after the sugary beverage tax was introduced in 2014, soft drink sales dropped by nearly 12% in the first year alone.

Opportunity

Expanding Processed Food Consumption in Emerging Markets

A major growth opportunity for the high fructose corn syrup (HFCS) market lies in the fast-growing demand for processed and packaged foods in developing countries. As incomes rise and urban lifestyles become more common, especially in Asia, Africa, and Latin America, more people are turning to ready-to-eat meals, carbonated drinks, and convenience snacks—many of which rely on HFCS as a key sweetener.

According to the Food and Agriculture Organization (FAO) of the United Nations, global processed food consumption is expected to grow by more than 40% by 2030, with most of this demand coming from low- and middle-income nations. Take India, for example. The Indian Brand Equity Foundation (IBEF) reported that the Indian packaged food market was valued at US$ 78.4 billion in 2020 and is projected to reach US$ 200 billion by 2025. This rapid expansion creates a major opening for HFCS manufacturers to supply local food companies with affordable sweeteners that extend product shelf life.

Meanwhile, in Southeast Asia and parts of Africa, the food processing sector is receiving strong government backing. Countries like Vietnam, Indonesia, and Nigeria have launched programs to increase domestic food production and attract foreign investment in the agri-food sector. As these nations work to build up their food supply chains, demand for cost-effective ingredients like HFCS is expected to rise significantly.

Another factor supporting this growth is trade. The U.S. Grains Council continues to promote the use of corn-based products, including HFCS, in global markets. In 2022, the U.S. exported nearly 960,000 metric tons of HFCS to Mexico alone.

Regional Insights

North America Dominates HFCS Market with 41.8% Share, Valued at USD 3.2 Billion

In 2024, North America held a leading position in the global high fructose corn syrup (HFCS) market, accounting for a significant 41.8% share, with an estimated market value of USD 3.2 billion. This dominance can be largely attributed to the region’s deep-rooted processed food and beverage industry, where HFCS continues to serve as a widely adopted sweetener across soft drinks, baked goods, sauces, dairy items, and frozen foods. The United States is the primary contributor to this regional leadership, driven by an extensive corn supply chain, well-established wet milling infrastructure, and long-term manufacturer reliance on cost-effective sweeteners.

Canada and Mexico also contribute to regional HFCS demand, particularly in the beverage sector, where the sweetener is preferred for its blending ease and long shelf life. While policy developments around sugar reduction may influence future consumption trends, North America’s strong manufacturing base, agricultural policies, and retail distribution channels position it as the dominant region in the HFCS market through 2025 and beyond.

The U.S. government’s ongoing support of corn production through subsidies—totaling approximately USD 3.2 billion in 2024, according to usafacts.org—has helped keep corn-derived products like HFCS competitively priced. This has sustained the product’s usage despite rising consumer health concerns and shifts in nutritional awareness. In 2024, per capita HFCS consumption in the U.S. stood at approximately 39.5 pounds, which, although lower than the peak in the late 1990s, still reflects notable dependence in the food industry.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGRANA Beteiligungs AG is a major European player in the high fructose corn syrup (HFCS) market, operating primarily in Central and Eastern Europe. The company produces HFCS through its starch division, focusing on supplying the beverage and processed food industries. AGRANA’s facilities in Austria, Hungary, and Romania enable it to serve key regional markets efficiently. The company emphasizes sustainable production and value-added processing, aligning with rising demand for cost-effective sweeteners in Europe and international markets.

Archer Daniels Midland Company is one of the largest producers of high fructose corn syrup globally. Based in the United States, ADM operates an extensive network of corn processing plants that serve major food and beverage manufacturers. The company benefits from vertically integrated operations, offering competitive pricing, consistent quality, and large-scale supply capabilities. ADM also focuses on innovation and sustainability, including clean label solutions and sugar-reduction technologies to adapt to changing consumer health preferences.

Cargill, Incorporated is a global agribusiness leader and a key producer of HFCS, particularly in North America and Asia. The company supplies HFCS to a broad range of sectors, including beverages, confectionery, and bakery. Cargill’s strength lies in its vast corn sourcing operations, advanced wet milling technology, and global logistics. The company is actively investing in responsible sourcing, water efficiency, and product reformulation to meet growing demand for clean label and sustainable sweetener solutions.

Top Key Players Outlook

- AGRANA Beteilgungs AG

- Archer Daniels Midland Company

- Cargill, Incorporated

- COFCO

- DAESANG Corporation

- Global Sweeteners Holdings Limited

- HUNGRANA KFT.

- Ingredion Incorporated

- Japan Corn Starch Co., Ltd.

- Kasyap

- Kerry Group Plc.

- Roquette Frères

- Showa Sangyo

- Sinofi Ingredients

- Tate & Lyle PLC

Recent Industry Developments

In 2024, AGRANA Beteiligungs‑AG, headquartered in Vienna, generated approximately €3 514 million in total revenue, down from €3 787 million in the previous year.

In 2024, Archer Daniels Midland (ADM) continued to assert its position as a global powerhouse in starch-based solutions, including high fructose corn syrup. The company’s Carbohydrate Solutions segment—which houses HFCS operations—posted an operating profit of $1,376 million, effectively flat compared to $1,375 million in 2023.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Bn Forecast Revenue (2034) USD 11.2 Bn CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (HFCS 42, HFCS 55, Others), By Application (Food and Beverages, Household Seasonings, Daily Chemicals, Pharmaceutical, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGRANA Beteilgungs AG, Archer Daniels Midland Company, Cargill, Incorporated, COFCO, DAESANG Corporation, Global Sweeteners Holdings Limited, HUNGRANA KFT., Ingredion Incorporated, Japan Corn Starch Co., Ltd., Kasyap, Kerry Group Plc., Roquette Frères, Showa Sangyo, Sinofi Ingredients, Tate & Lyle PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Fructose Corn Syrup MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

High Fructose Corn Syrup MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGRANA Beteilgungs AG

- Archer Daniels Midland Company

- Cargill, Incorporated

- COFCO

- DAESANG Corporation

- Global Sweeteners Holdings Limited

- HUNGRANA KFT.

- Ingredion Incorporated

- Japan Corn Starch Co., Ltd.

- Kasyap

- Kerry Group Plc.

- Roquette Frères

- Showa Sangyo

- Sinofi Ingredients

- Tate & Lyle PLC