Global Helium Market Size, Share Analysis Report By Phase (Gas, Liquid), By Application (Cryogenics, Breathing Mixes, Leak Detection, Pressurizing And Puring, Welding, Controlled Atmosphere, Others), By End Use (Medical And Healthcare, Aerospace And Defense, Electronics And Electrical, Energy) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162457

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

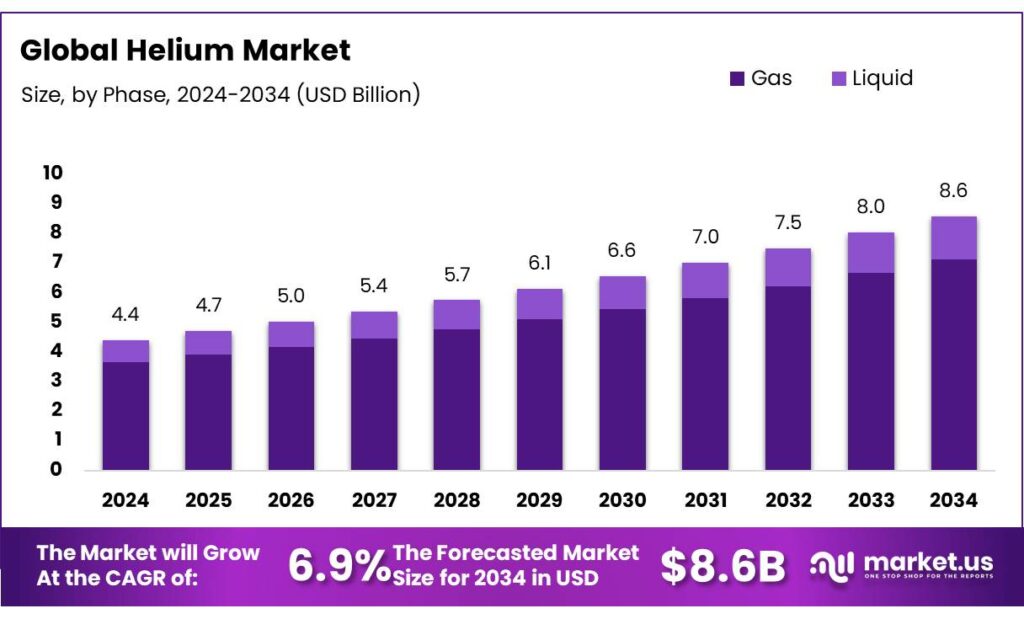

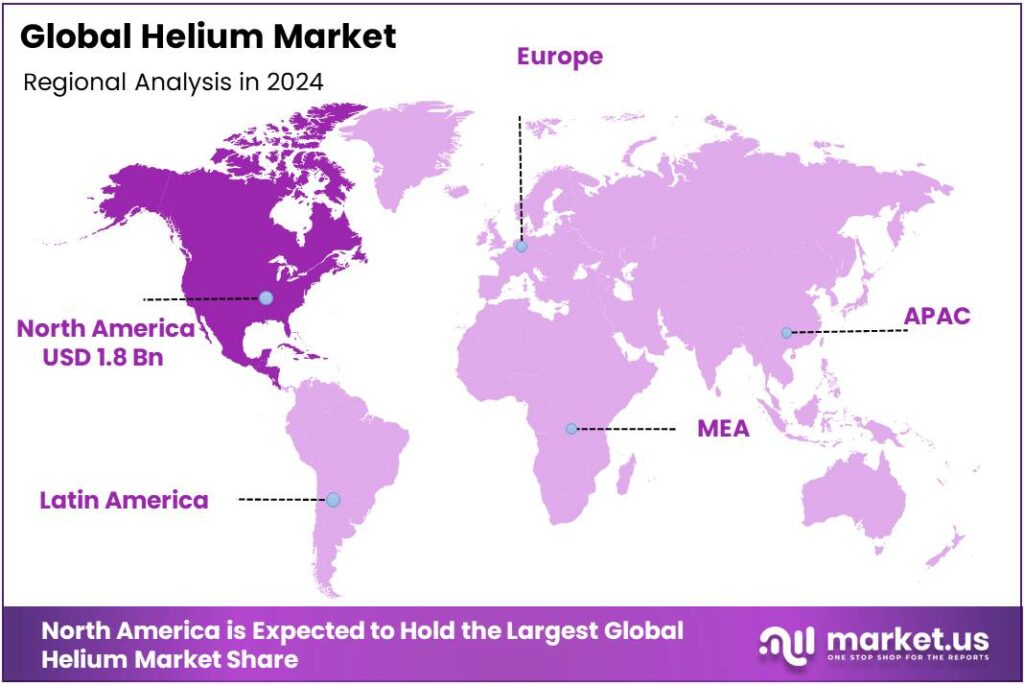

The Global Helium Market size is expected to be worth around USD 8.6 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 41.5% share, holding USD 1.8 Billion in revenue.

Helium is a critical, non-renewable industrial gas valued for its extreme cryogenic properties, inertness, and low density. In 2024, U.S. sales of Grade-A and gaseous helium were 81 million m³ (≈2.9 Bcf), valued at $1.1 billion, with apparent domestic consumption at 56 million m³. End-use shares were led by analytical/engineering/specialty gases (22%), lifting (18%), MRI (17%), controlled atmospheres/fiber optics/semiconductors (15%), and welding (8%). The estimated base price averaged about $14 per m³.

Key demand drivers are the expansion of semiconductor capacity, MRI fleet growth in healthcare, fiber-optic build-outs, and aerospace/space launch activity—segments where helium’s inertness and cryogenic properties are essential. USGS shows tech-heavy uses collectively account for >50% of U.S. consumption. Additional macro pull stems from electrification and digitalisation; the IEA projects rapid growth in energy-intensive digital infrastructure, reinforcing upstream specialty gas demand across electronics supply chains.

The policy backdrop is shifting. The U.S. Federal Helium System (including storage at the Cliffside Field and associated assets) was sold on January 25, 2024 and transferred to private ownership on June 27, 2024; in December 2024 the BLM confirmed $460 million in proceeds to the U.S. Treasury. These steps conclude nearly a century of federal involvement and move the U.S. toward a market-led supply model. Meanwhile, the EU’s June 25, 2024 sanctions package introduced an import ban on helium from Russia effective September 26, 2024, tightening European supply optionality.

Demand fundamentals remain robust. Healthcare is a structural anchor: Japan reports ~55 MRI units per million population, among the highest densities globally, signaling sustained cryogen needs across advanced health systems. Each MRI typically requires ~2,000 liters of liquid helium for magnet cooling, with periodic refills over equipment life. Semiconductor fabrication, fiber optics, and aerospace also underpin growth; the U.S. import mix for 2020–2023 shows reliance on Qatar (40%), Canada (36%), and Algeria (10%), highlighting the strategic nature of cross-border flows.

Key Takeaways

- Helium Market size is expected to be worth around USD 8.6 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 6.9%.

- Gas held a dominant market position, capturing more than a 82.8% share in the global helium market.

- Cryogenics held a dominant market position, capturing more than a 32.2% share in the global helium market.

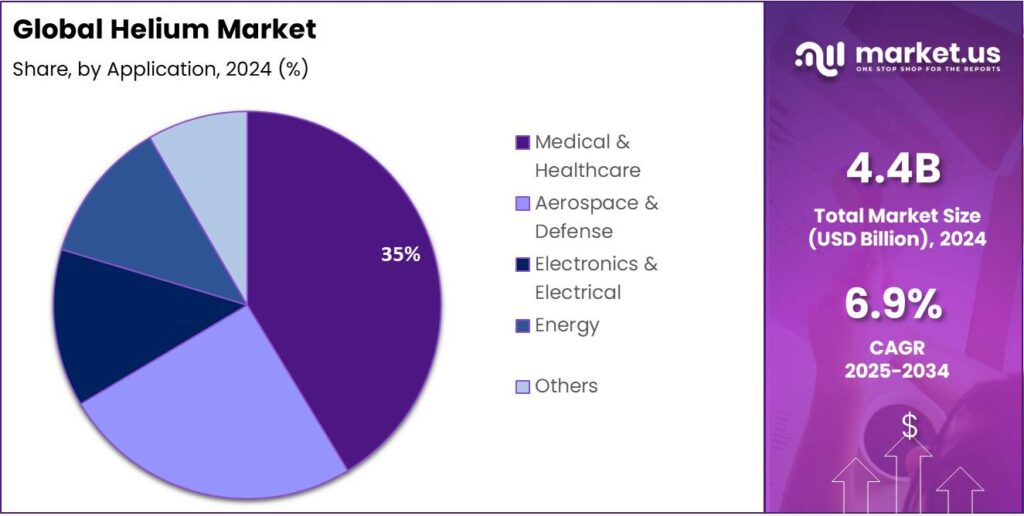

- Medical & Healthcare held a dominant market position, capturing more than a 34.5% share in the global helium market.

- North American region held a dominant position in the global helium market, accounting for approximately 41.50% of market revenue, translating into an estimated USD 1.8 billion.

By Phase Analysis

Gaseous Helium dominates with 82.8% share due to its extensive industrial and commercial applications

In 2024, Gas held a dominant market position, capturing more than a 82.8% share in the global helium market. The predominance of gaseous helium can be attributed to its wide utilization across diverse industries such as electronics, healthcare, aerospace, and research laboratories. In its gaseous form, helium is extensively employed in welding applications, leak detection systems, pressurizing and purging operations in rocket propulsion, and as a protective atmosphere in semiconductor and fiber-optic manufacturing. The gas phase is preferred in these sectors due to its ease of handling, stability, and compatibility with high-precision processes.

Demand for gaseous helium continued to strengthen, supported by the rising consumption from the semiconductor industry and the growing number of magnetic resonance imaging (MRI) systems in medical facilities worldwide. Industries have increasingly relied on gaseous helium for maintaining controlled and inert environments, which are essential for ensuring product quality and safety in sensitive manufacturing operations. The steady expansion of cryogenic technologies and space exploration projects has further contributed to consistent demand in this segment.

By Application Analysis

Cryogenics dominates with 32.2% share driven by its critical role in MRI systems and superconducting technologies

In 2024, Cryogenics held a dominant market position, capturing more than a 32.2% share in the global helium market. This strong position is largely due to helium’s unmatched capability to achieve extremely low temperatures, making it an essential element in cryogenic applications. The gas is widely used to cool superconducting magnets in magnetic resonance imaging (MRI) scanners, particle accelerators, and nuclear magnetic resonance (NMR) instruments. Its ability to maintain stable cryogenic environments without reacting chemically has made it indispensable in both medical and research sectors.

The demand for cryogenic-grade helium remained steady, supported by the growing number of MRI installations in hospitals and the expansion of scientific laboratories focusing on quantum computing and high-energy physics. The medical sector continued to be a major consumer, as helium ensures the continuous operation of imaging equipment that requires temperatures close to absolute zero. Moreover, the development of advanced superconducting materials and the rising use of cryogenic cooling in space exploration projects further strengthened the application share of this segment.

By End Use Analysis

Medical & Healthcare dominates with 34.5% share due to its extensive use in MRI systems and respiratory treatments

In 2024, Medical & Healthcare held a dominant market position, capturing more than a 34.5% share in the global helium market. The strong presence of this segment is primarily driven by the critical role of helium in magnetic resonance imaging (MRI) systems, where it serves as a cooling agent for superconducting magnets. The ability of helium to reach temperatures close to absolute zero enables stable and continuous MRI operation, ensuring high-resolution medical imaging. The growing global demand for advanced diagnostic services, combined with the rising number of hospital installations, has significantly supported helium consumption in this sector.

Medical-grade helium also found increasing application in respiratory therapies, particularly in treating patients with asthma, chronic obstructive pulmonary disease (COPD), and other lung disorders. Its low density allows for easier breathing, making it a vital component in therapeutic gas mixtures such as heliox. In addition, the expansion of healthcare infrastructure and the rising investments in medical technology in both developed and emerging economies further reinforced demand throughout the year.

Key Market Segments

By Phase

- Gas

- Liquid

By Application

- Cryogenics

- Breathing Mixes

- Leak Detection

- Pressurizing & Puring

- Welding

- Controlled Atmosphere

- Others

By End Use

- Medical & Healthcare

- Aerospace & Defense

- Electronics & Electrical

- Energy

- Others

Emerging Trends

Rapid shift to helium conservation and circular use across hospitals and labs

A clear latest trend in the helium ecosystem is the fast move toward conservation, recovery, and reliquefaction—especially in healthcare imaging suites and research labs. The signal is strong on both demand and policy. On the demand side, the installed MRI base continues to grow and remains uneven globally, which implies continued helium needs where legacy magnets dominate. OECD tracks MRI density, a health-system metric that highlights this uneven access and the long replacement cycle that will keep helium relevant for years.

At the same time, hospitals are adopting “low-helium” MRI platforms that radically shrink lifetime helium exposure. Philips’ BlueSeal magnet encloses just 7 liters of helium—less than 0.5% of a conventional fill—by sealing the coolant in the magnet so it never needs refilling. Newer BlueSeal materials (2025 brochures) reiterate the 7 liter sealed design and the ability to discharge and recharge the magnet without helium loss, minimizing risk and downtime. This is a step-change from traditional systems that historically required on the order of ~1,500–2,000 liters at installation.

Where replacement is slower, users are closing the loop. Universities and national labs are installing recovery and liquefaction systems that capture boil-off helium and return it as liquid, cutting purchases and shielding operations from supply spikes. At the University of Edinburgh, a closed-loop system now produces >22 liters/day of liquid helium from recovered gas and has captured >15,000 m³ to date—about 95% of the facility’s usage. In the U.S., Wayne State University reports a 95% cut in helium consumption after commissioning its NSF-supported recovery system in 2024, showing how quickly savings materialize once collection and reliquefaction are in place.

Vendors and integrators are scaling solutions for bigger campuses, too. At NIST, a multi-instrument networked recovery installation was commissioned to serve >100 instruments and produce roughly 300 liters/day of liquid helium—evidence that industrial-scale circularity is viable when users aggregate demand. These site-level systems create new service markets and help stabilize end-user budgets by smoothing the impact of upstream volatility.

Drivers

Growing Application in Magnetic Resonance Imaging (MRI) Drives Helium Demand

One major driving factor for the increased demand for helium is its essential role in the healthcare sector—particularly in cooling superconducting magnets used in magnetic resonance imaging (MRI) machines. Globally, the healthcare industry accounts for about 32% of total helium consumption. To put it simply: every time a hospital runs an MRI scan, helium is quietly doing a vital job behind the scenes.

To illustrate, a standard 1.5-Tesla MRI scanner typically requires approximately 2,000 litres of liquid helium to maintain its superconducting magnet at the required low temperature. That’s quite a lot of helium for just one machine. And because some of that helium gradually “boils off” or escapes over the life of the magnet, refills are necessary. According to estimates, over the lifetime of the machine the total helium used may sum up to around 10,000 litres.

Government and regulatory frameworks also contribute to reinforcing that factor. For instance, in many countries MRI machines are legislated or regulated medical equipment, driving adoption. In parallel, strategic concerns about helium supply—given that it is a non-renewable by-product of natural gas, and that the major geographical sources are limited—have led government agencies to treat helium as a critical mineral/resource. The result is a strong policy backdrop supporting stable demand in healthcare, which in turn strengthens the role of MRI usage as a key demand pillar for helium.

The expanding number of MRI installations globally, combined with each machine’s significant helium requirement (≈2,000 litres per unit) and the limited alternatives to helium for superconducting magnet cooling, constitutes a major driving force behind helium demand.

Restraints

Supply Constraints Limit Helium Growth

A key factor restraining the growth of the helium industry is the tight and increasingly fragile supply situation. The inert gas is not only rare but also often a by-product of natural-gas extraction, which means its availability is closely tied to the economics and infrastructure of the upstream gas sector. According to the U.S. Geological Survey (USGS), a public call was made in January 2023 to request comments on “helium supply risk,” underscoring that helium is subject to supply vulnerability because it is obtained in limited deposits and counts on a small number of producers.

For instance, one review pointed out that helium is found in very low concentrations in natural-gas reservoirs (typically less than 0.5 %) and only a handful of fields around the world can economically recover it. That means if one major field faces disruption—say through maintenance, geopolitical issues, or natural-gas production decline—the entire downstream industry (MRI cooling, semiconductors, aerospace) can feel the squeeze. The United States International Trade Commission (USITC) document notes that in 2021-22 supply interruptions already triggered allocations in some markets.

On the regulatory side, because helium is increasingly recognised as a strategic resource, the U.S. government shifted policy: the federal reserve system (which used to hold large stocks) has been largely wound down, meaning less buffer stock in the system. The USGS explicitly flagged helium as having supply risk. With fewer safety cushions, supply shocks can translate more directly into price rises or tighter access for users.

That means if one major field faces disruption—say through maintenance, geopolitical issues, or natural-gas production decline—the entire downstream industry (MRI cooling, semiconductors, aerospace) can feel the squeeze. The United States International Trade Commission (USITC) document notes that in 2021-22 supply interruptions already triggered allocations in some markets.

Opportunity

Semiconductor build-outs and MRI modernization open multi-year helium opportunities

A powerful growth opening for helium lies at the intersection of surging semiconductor capacity and a global refresh of MRI technology. Both ecosystems are expanding under public-policy tailwinds and each requires ultra-high-purity helium for cooling, leak-checking, and inert environments—sustaining structural demand while also creating new markets for purification, reliquefaction, and recovery systems. The U.S. Geological Survey reports that total world helium production increased ~4% in 2024 vs. 2023, signaling tight but growing supply—an important backdrop as downstream capacity comes online.

On the chip side, government programs are translating into concrete fabs. In the United States, the Department of Commerce has reached preliminary terms to provide up to $8.5 billion in direct funding to Intel for projects in AZ, OH, NM, and OR, complemented by $11 billion in loans—supporting advanced logic nodes that use helium throughout tool install, purge, and leak-test cycles. Separately, the Administration announced proposed terms of up to $6.4 billion for Samsung’s Texas cluster, alongside >$40 billion in private capex—investments that will increase steady helium consumption and create local demand for reclaim/reliquefaction solutions near fabs.

Europe is moving in parallel. The European Chips Act targets >€43 billion in policy-driven investment through 2030, with expectations of substantial private co-investment. In 2024, the EU also committed €2.5 billion to a leading-edge pilot line led by imec to accelerate sub-2 nm research—another helium-intensive domain. These programs collectively point to dozens of new or expanded facilities across regions, each representing multi-year helium offtake plus adjacent opportunities.

Healthcare adds a second, durable growth flywheel. MRI access continues to expand globally, and installed-base growth remains a dependable driver of cryogenic helium demand. OECD tracking shows Japan with about 55 MRI units per million population, while many countries—particularly in emerging markets—operate at far lower densities, implying runway for new installations and replacement cycles. Each conventional 1.5 T system historically required on the order of ~1,500–2,000 liters of liquid helium, anchoring recurring demand over its life. Even as vendors roll out low-helium designs, the installed base is large and will take years to rotate.

Regional Insights

North America leads strongly with a 41.50% share valued at USD 1.8 billion

In 2024, the North American region held a dominant position in the global helium market, accounting for approximately 41.50% of market revenue, translating into an estimated USD 1.8 billion in value. This commanding share reflects the region’s deep-rooted helium infrastructure, which includes extensive natural-gas-associated reserves in the United States and Canada, well-developed logistics for helium extraction and purification, and high-demand industries such as healthcare imaging, semiconductors, aerospace and scientific research.

These structural factors underpinned the region’s lead in volume and value. Additionally, end-use growth in sectors such as advanced medical MRI systems, quantum computing research and semiconductor manufacturing further fuelled helium demand in the region. The combination of upstream supply capability and downstream demand gave North America an effective leverage that translated into the high market share.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Linde plc: The global industrial gas company operates helium production and purification facilities across North America, Europe and the Middle East. In 2025 it commissioned a helium storage cavern in Texas with capacity over three billion cubic feet, enhancing supply resilience. Linde’s access to helium-rich reserves and advanced purification technology places it among the few companies with major downstream and upstream helium capabilities.

Messer Group: As the largest privately-held industrial gas company worldwide, Messer has been active in helium supply infrastructure, including the acquisition of the U.S. federal helium system assets from the Bureau of Land Management (BLM) and securing long-term helium supply agreements with major producers. Its global industrial-gas network and specialty-gas offerings support its strategic role in helium logistics and market flexibility.

Taiyo Nippon Sanso India: The Indian subsidiary of a Japanese global gases group, this company is the leading supplier of helium in India, operating transfilling facilities, cryogenic bulk liquid plants and specialty-gas production units. Its local focus and integration with a global parent allow it to meet industrial, electronics, medical and research customers in the Indian market, thereby contributing regionally to the helium value chain.

Top Key Players Outlook

- Air Products and Chemicals, Inc.

- Linde Plc

- Air Liquide

- Messer Group

- Taiyo Nippon Sanso India

- MESA Specialty Gases & Equipment

- Matheson Tri-Gas Inc.

- Iwatani Corporation

- Gazprom PJSC

- Gulf Cryo S.A.L.

Recent Industry Developments

In 2024, Air Liquide’s Electronics business line, which encompasses semiconductor-grade helium, generated €2.51 billion in revenue, underscoring the critical demand for high-purity helium in advanced manufacturing processes.

In 2024, Linde reported a robust operating income of USD 8.635 billion and a net income of USD 6.565 billion, underscoring its financial strength and operational efficiency.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 8.6 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Phase (Gas, Liquid), By Application (Cryogenics, Breathing Mixes, Leak Detection, Pressurizing And Puring, Welding, Controlled Atmosphere, Others), By End Use (Medical And Healthcare, Aerospace And Defense, Electronics And Electrical, Energy) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Products and Chemicals, Inc., Linde Plc, Air Liquide, Messer Group, Taiyo Nippon Sanso India, MESA Specialty Gases & Equipment, Matheson Tri-Gas Inc., Iwatani Corporation, Gazprom PJSC, Gulf Cryo S.A.L. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Products and Chemicals, Inc.

- Linde Plc

- Air Liquide

- Messer Group

- Taiyo Nippon Sanso India

- MESA Specialty Gases & Equipment

- Matheson Tri-Gas Inc.

- Iwatani Corporation

- Gazprom PJSC

- Gulf Cryo S.A.L.