Global Heat Resistant Alloy Conductor Market Size, Share Analysis Report By Product Type (Aluminum Alloy, Copper Alloy, Others), By Application (Power Transmission, Power Distribution, Others), By End-User (Utilities, Industrial, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171390

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

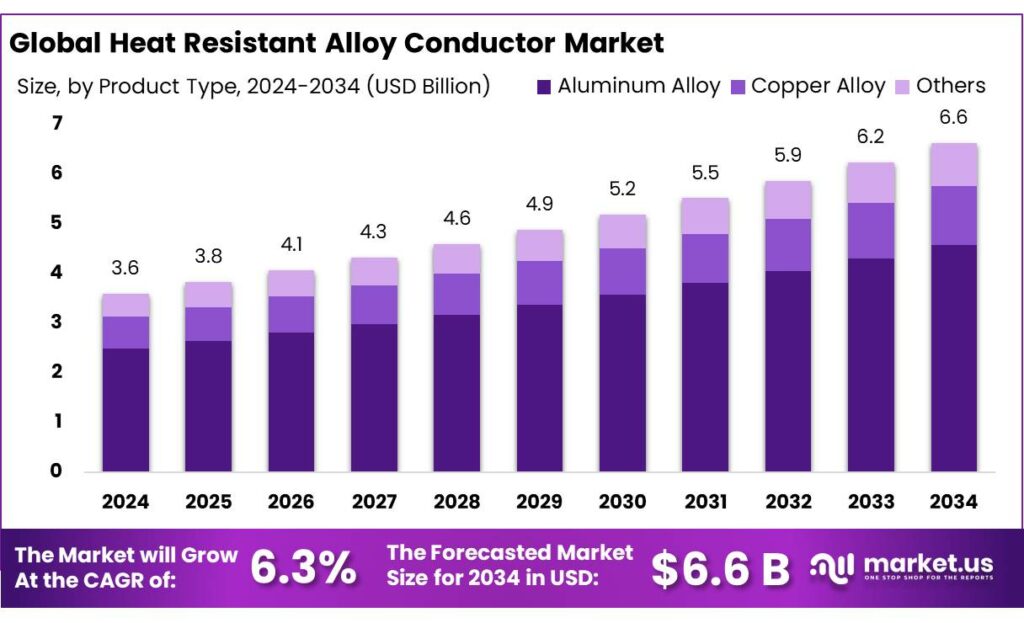

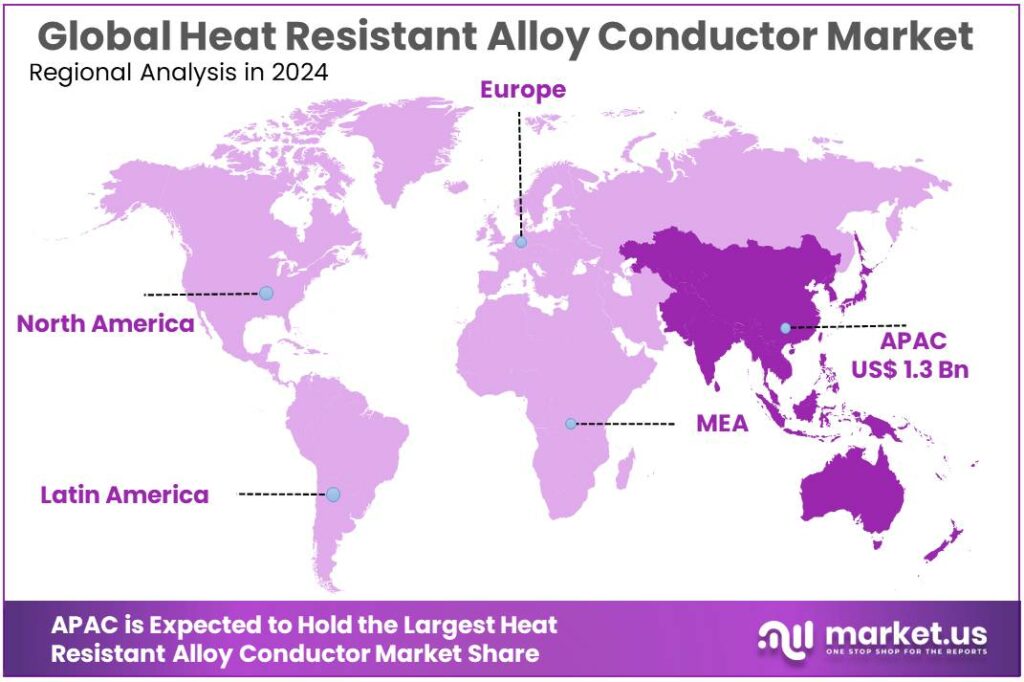

The Global Heat Resistant Alloy Conductor Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 37.4% share, holding USD 1.3 Billion in revenue.

Heat resistant alloy conductors are designed to carry more current on existing transmission corridors without forcing utilities to rebuild towers or buy new right-of-way. In practice, they use heat-tolerant aluminium alloys and/or advanced cores so the conductor can run safely at much higher operating temperatures while controlling sag. Industry references commonly contrast HTLS operating temperatures up to ~210°C versus ~80–90°C for standard conductors, which directly expands thermal ampacity and short-term overload capability.

The industrial scenario is being shaped by a grid expansion and “make-more-capacity-from-what-we-already-have” mindset. Leading energy institutions estimate electricity-grid investment must average around USD 600 billion per year through 2030, versus “around USD 300 billion per year” currently—highlighting the scale of upgrades needed for reliability and clean-energy integration. In parallel, transmission specifically is under pressure: the IEA notes that, under today’s policy settings, spending on transmission would need to exceed USD 200 billion per year by the mid-2030s, and reach USD 250–300 billion in more ambitious emissions-aligned scenarios.

The International Energy Agency (IEA) estimates electricity-grid investment needs to average around USD 600 billion per year through 2030 in its Net Zero pathway—almost double today’s level of about USD 300 billion per year. In parallel, IEA analysis has highlighted the scale of build-out required: adding or refurbishing about 80 million kilometres of power lines by 2040, and a queue of roughly 1,500 GW of advanced renewable projects waiting for grid connection approval—both of which reinforce the business case for faster uprating options such as reconductoring with high-temperature conductors.

Policy and public funding are also accelerating the industrial scenario. In the United States, DOE’s Grid Deployment Office states that across the first and second rounds of its Grid Resilience and Innovation Partnerships (GRIP) program, it has announced $7.6 billion for 105 selected projects across all 50 states and Washington, D.C. While GRIP is not “only” a conductor program, its focus on resilience and capacity upgrades strengthens the investment case for reconductoring packages where heat-resistant/HTLS conductors are a core component.

- In Europe, transmission build-out needs are being framed at very large scale, and that supports both new-build and upgrade pathways. ENTSO-E’s grid package messaging (based on TYNDP 2024) indicates Europe needs over €800 billion in transmission grid investment by 2050, and it also states that every €1 invested in the grid translates into €2 saved in system costs by 2040.

Key Takeaways

- Heat Resistant Alloy Conductor Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 6.3%.

- Aluminum Alloy held a dominant market position, capturing more than a 68.9% share in the heat resistant alloy conductor market.

- Power Transmission held a dominant market position, capturing more than a 59.4% share in the heat resistant alloy conductor market.

- Utilities held a dominant market position, capturing more than a 63.2% share in the heat resistant alloy conductor market.

- Asia Pacific region held a leading position in the heat resistant alloy conductor market, capturing 37.4% of the global share and generating approximately USD 1.3 billion.

By Product Type Analysis

Aluminum Alloy dominates with a 68.9% share due to its balance of strength, weight, and heat resistance.

In 2024, Aluminum Alloy held a dominant market position, capturing more than a 68.9% share in the heat resistant alloy conductor market. This leadership was mainly driven by its high thermal stability, lower sag at elevated temperatures, and lighter weight compared to conventional conductors, which made it suitable for long-span and high-load transmission lines. Aluminum alloy conductors were widely preferred for grid upgradation projects, as they allowed higher current flow without major tower modifications. During 2024, utilities focused on improving transmission efficiency and reducing line losses, which supported steady demand for aluminum alloy-based solutions.

By Application Analysis

Power Transmission leads with a 59.4% share due to rising grid expansion and capacity upgrades.

In 2024, Power Transmission held a dominant market position, capturing more than a 59.4% share in the heat resistant alloy conductor market. This dominance was supported by increasing investments in high-voltage transmission networks and the replacement of aging conductors with advanced heat resistant options. Utilities widely adopted these conductors to carry higher power loads without expanding right-of-way, which reduced project time and cost. During 2024, growing electricity demand from urbanization and renewable energy integration further strengthened this segment.

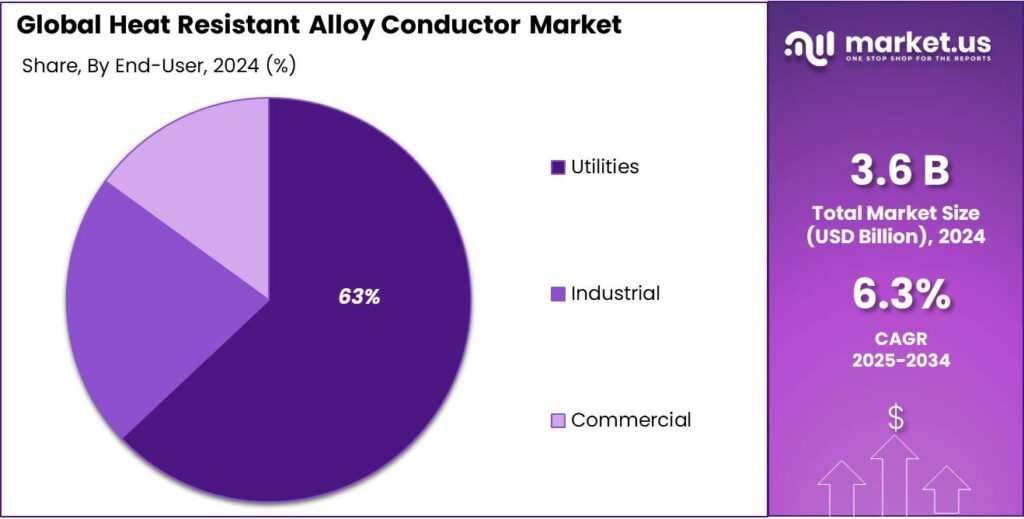

By End-User Analysis

Utilities lead with a 63.2% share driven by continuous grid upgrades and rising power demand.

In 2024, Utilities held a dominant market position, capturing more than a 63.2% share in the heat resistant alloy conductor market. This strong position was mainly supported by large-scale investments in transmission and distribution network upgrades to handle higher electricity loads. Utilities increasingly preferred heat resistant alloy conductors as they allow higher current capacity without changing existing tower structures, which helped reduce capital and installation costs. During 2024, growing renewable energy connections and cross-border power flow requirements further increased adoption across utility-owned networks.

Key Market Segments

By Product Type

- Aluminum Alloy

- Copper Alloy

- Others

By Application

- Power Transmission

- Power Distribution

- Others

By End-User

- Utilities

- Industrial

- Commercial

Emerging Trends

Utilities are pairing advanced conductors with dynamic ratings

A clear latest trend around heat resistant alloy conductors is that utilities are no longer treating the conductor upgrade as a “stand-alone” project. Instead, they are combining reconductoring with dynamic or ambient-adjusted line ratings, so the grid can safely use extra capacity when real weather conditions allow it. This pairing matters because many lines are rated conservatively for worst-case heat and low wind, even though real conditions are often better. When operators uprate the line with a heat-resistant alloy conductor and then apply dynamic ratings, the upgraded circuit gets used more hours of the year, not just during peaks.

Europe gives a practical example of what dynamic ratings can deliver. ENTSO-E’s Technopedia case information reports that, on average, a Dynamic Line Rating (DLR) system offered higher transmission capacity 92%–96% of the time, with a median increase of 15%–20% compared with nominal capacity in that case context. This is exactly why heat-resistant alloy conductors are increasingly sold as part of a broader “uprate + digital rating” package: utilities want a measurable, bankable uplift and a way to run lines closer to real limits without compromising safety.

Government and public-sector programs are reinforcing the same trend by funding both grid upgrades and enabling technologies. In the U.S., DOE’s Grid Resilience and Innovation Partnerships (GRIP) program totals $10.5 billion, and DOE has announced $7.6 billion for 105 selected projects through early rounds. These projects vary, but the common theme is improving resilience and flexibility—exactly the environment where advanced conductors plus better line ratings can be justified as a near-term capacity tool.

- The IEA has highlighted the growing strain from grid congestion and the need to unlock capacity faster, including through operational and digital measures such as dynamic line rating. In parallel, the scale of the renewable connection queue keeps rising—IEA tracking shows “advanced development” renewables waiting for grid connection growing from about 1,500 GW in 2023 to 1,650 GW by July 2024—so system operators have a strong reason to squeeze more throughput from existing corridors while longer build projects move through permitting.

Drivers

Grid congestion is forcing utilities to uprate lines

Across power networks, the biggest push behind heat-resistant alloy conductors is simple: the grid is full, but demand and new generation keep rising. Utilities are under pressure to move more electricity through existing corridors without waiting years for a new transmission line. Heat-resistant alloy conductors help because they can carry higher current at higher operating temperatures while keeping sag and clearances under control, so operators can add capacity on the same towers and right-of-way.

- The International Energy Agency (IEA) reports that investment in electricity grids needs to average around USD 600 billion per year through 2030 in the Net Zero Scenario—nearly double the current level of roughly USD 300 billion per year. When grid investment lags this far behind the system’s needs, reconductoring becomes a practical answer because it can unlock capacity faster than building entirely new lines.

Congestion is also visible in connection queues for renewables, and that directly drives conductor uprating projects. IEA notes that total wind, solar PV, and hydropower capacity in advanced development stages waiting for grid connections increased from around 1,500 GW in 2023 to 1,650 GW by July 2024. That is a huge pipeline of projects that can only earn revenue when the grid can accept and transmit their output, so utilities and system operators are pushed toward quicker upgrades, including HTLS and heat-resistant alloy conductor reconductoring on constrained paths.

- Government initiatives reinforce this driver by putting real money into grid modernization, which typically turns into procurement for conductors, hardware, and reconductoring services. In the United States, DOE’s Grid Resilience and Innovation Partnerships (GRIP) program was created as a $10.5 billion initiative, and DOE’s Grid Deployment Office notes it has announced $7.6 billion for 105 selected projects through the first and second rounds.

Restraints

High upfront cost and utility budget pressure slow adoption

One major restraining factor for heat resistant alloy conductors is their high upfront cost compared with conventional aluminium conductors. While these conductors deliver long-term benefits through higher ampacity and lower sag, utilities must first justify higher material, installation, and system-integration expenses. In many regions, power utilities still operate under strict capital budgets and regulated tariff structures, which makes it difficult to approve higher initial spending even when lifecycle benefits are clear.

- According to the International Energy Agency, global electricity grid investment today is close to USD 300 billion per year, while required investment needs to rise to around USD 600 billion per year by 2030 to meet reliability and clean-energy goals. This funding gap of nearly USD 300 billion annually means utilities are forced to prioritize projects with the lowest short-term capital outlay, often delaying advanced conductor upgrades.

In developing and emerging economies, the restraint is even more visible. The World Bank estimates that power utilities in low- and middle-income countries face annual financing shortfalls of more than USD 100 billion to maintain and expand electricity infrastructure. When utilities struggle to fund basic grid expansion and loss reduction, premium solutions such as heat resistant alloy conductors are frequently postponed in favor of lower-cost conventional lines.

Government funding programs help, but they do not fully remove this barrier. In India, the government has released about ₹37,000 crore under the Revamped Distribution Sector Scheme (RDSS), representing roughly 38% of the approved central support. While this improves distribution networks, utilities still need significant additional capital for upstream transmission upgrades, including advanced conductors, which are not always fully covered by scheme allocations.

Opportunity

Reconductoring existing lines to unlock fast capacity

The biggest growth opportunity for heat resistant alloy conductors is reconductoring—upgrading existing overhead lines to carry more power without building a brand-new corridor. Utilities like this route because it uses the same towers and right-of-way, so projects can move faster and face fewer land and permitting hurdles. In plain terms, this opportunity expands when the grid is congested, renewables are waiting to connect, and operators need a “quick capacity lift” that still keeps clearances safe at higher temperatures.

- The International Energy Agency (IEA) reports that renewable projects sitting in grid connection queues are massive: at least 3,000 GW of renewable power projects are waiting in connection queues globally, including 1,500 GW in advanced stages. That queue represents years of generation that cannot fully come online unless transmission and distribution capacity is improved. Reconductoring with heat resistant alloy conductors is one of the practical tools utilities use to increase ampacity on existing routes and move more energy from renewable-heavy regions to demand centers.

IEA also published a 2024 chart update showing the “advanced development” waiting capacity rising from around 1,500 GW in 2023 to 1,650 GW by July 2024. When so much capacity is stuck waiting, grid owners face political and commercial pressure to clear bottlenecks quickly. That pressure often translates into tenders for uprating and reconductoring packages, where heat resistant alloy conductors can be specified to deliver more current capacity while keeping sag controlled.

Capital spending trends also point to a long runway for this upgrade market. IEA’s grid analysis highlights that global grid investment needs to rise to around USD 600 billion per year by 2030, to stay aligned with clean-energy and reliability targets. That gap signals a decade where every dollar must work harder—so solutions that add capacity faster and cheaper than building new lines gain attention. Reconductoring fits that logic because it can deliver capacity upgrades with less civil work than new transmission corridors.

Regional Insights

Asia Pacific leads with 37.4% share and USD 1.3 Bn in 2024, driven by grid expansion and renewable integration

In 2024, the Asia Pacific region held a leading position in the heat resistant alloy conductor market, capturing 37.40% of the global share and generating approximately USD 1.3 billion in value. This dominant position was supported by rapid electrification efforts, substantial investments in transmission infrastructure, and strong renewable energy integration across major economies such as China, India, Japan, and Southeast Asian nations.

The region’s utilities focused on expanding high-voltage transmission networks to connect growing generation capacity—especially from solar and wind—with urban load centers, which increased demand for advanced conductors capable of carrying higher currents at elevated temperatures. In 2024, several large-scale projects targeting cross-regional interconnections and grid reliability improvements further strengthened conductor demand. China alone maintained its leadership in power transmission growth, commissioning thousands of circuit kilometres of extra-high-voltage (EHV) lines to support coal-to-clean energy transitions and export of surplus renewable generation to adjacent provinces.

India’s grid expansion programmes similarly prioritized efficient long-distance corridors for renewable power delivery, which favored heat resistant alloy conductors for their improved thermal performance and reduced sag characteristics. Investment focus on smart grid technologies also helped accelerate conductor upgrades in distribution networks, where thermal tolerance and operational stability are critical. Throughout 2024, developers and utilities emphasized solutions that reduce line losses and increase system resilience to seasonal load fluctuations, driving conductor specification trends toward alloys that support higher operational temperatures with minimal degradation.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Top Key Players Outlook

- Southwire Company, LLC

- Nexans S.A.

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- Apar Industries Ltd.

- Hengtong Group Co., Ltd.

- KEI Industries Limited

- Jiangsu Zhongtian Technology Co., Ltd.

Recent Industry Developments

In 2024, Nexans S.A. continued to strengthen its role in the heat resistant alloy conductor and wider power transmission market with advanced cable and conductor solutions tailored for high-temperature and high-load applications. The French-headquartered company reported annual revenue of approximately €8.55 billion in 2024, reflecting solid growth as demand for reliable electrification infrastructure expanded across Europe, North America, and emerging markets.

In 2024, Furukawa Electric Co., Ltd. continued to support the heat resistant alloy conductor and wider energy infrastructure space through its diversified electrical and materials solutions that contribute to efficient power transmission and distribution systems. The Japan-based company reported consolidated net sales of ¥1,201.8 billion for fiscal 2024, marking a 13.7% year-on-year increase as infrastructure and energy products saw sustained demand.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 6.6 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Aluminum Alloy, Copper Alloy, Others), By Application (Power Transmission, Power Distribution, Others), By End-User (Utilities, Industrial, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Southwire Company, LLC, Nexans S.A., Prysmian Group, Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., LS Cable & System Ltd., Apar Industries Ltd., Hengtong Group Co., Ltd., KEI Industries Limited, Jiangsu Zhongtian Technology Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Heat Resistant Alloy Conductor MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Heat Resistant Alloy Conductor MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Southwire Company, LLC

- Nexans S.A.

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- Apar Industries Ltd.

- Hengtong Group Co., Ltd.

- KEI Industries Limited

- Jiangsu Zhongtian Technology Co., Ltd.