Global Halogen Free Flat Cables Market Size, Share Analysis Report By Types (Single-Core Cable, Multi-Core Cable), By Application (Energy and Power, Communications, Metallurgy and Petrochemical, Military/Aerospace, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165227

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

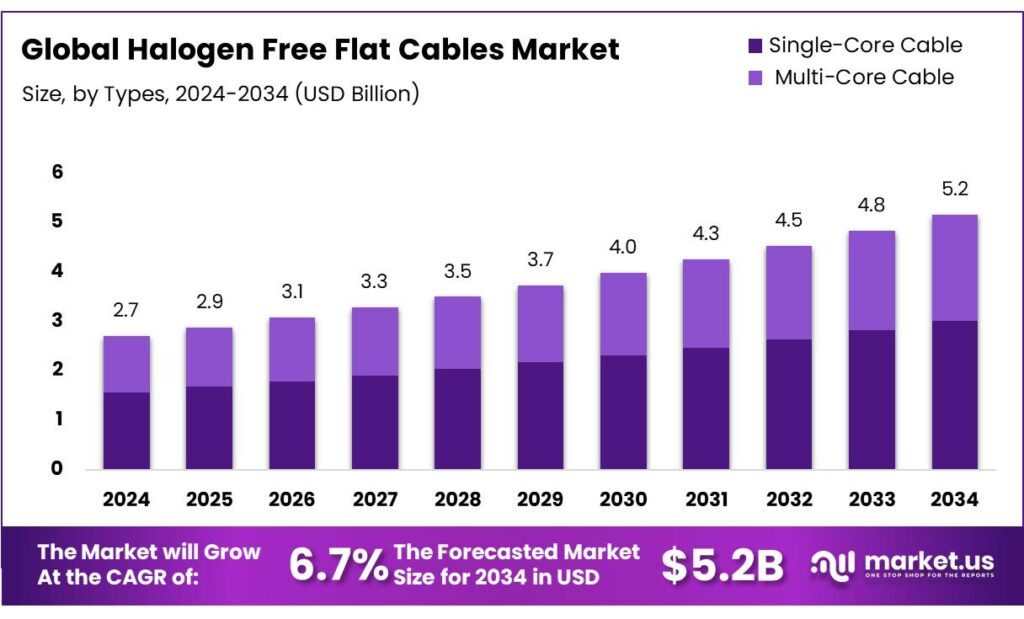

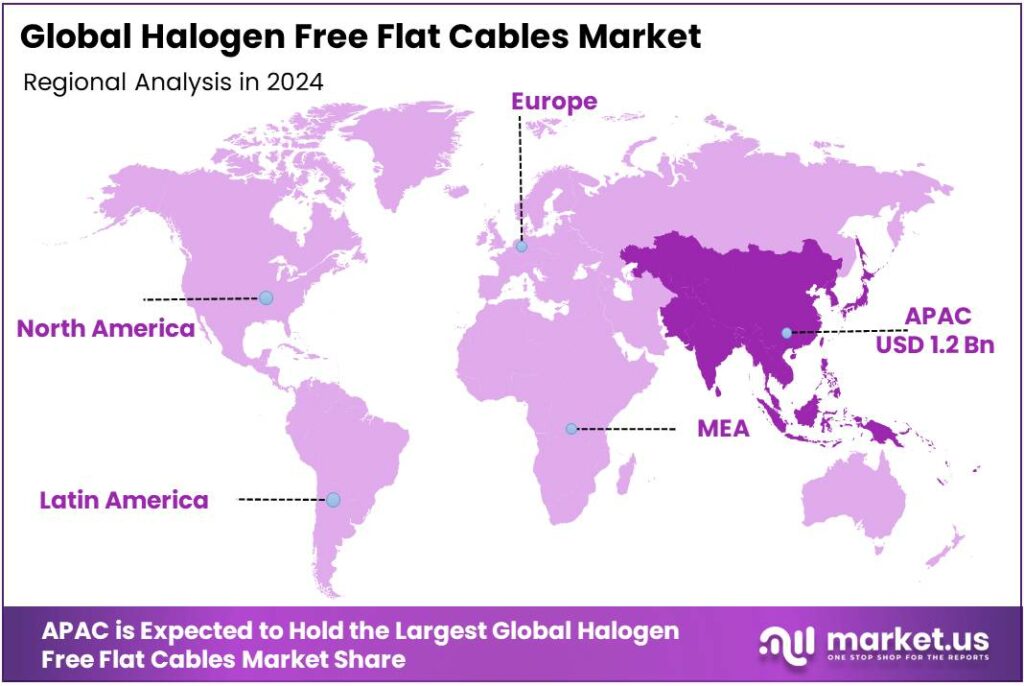

The Global Halogen Free Flat Cables Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 45.9% share, holding USD 1.2 Billion in revenue.

Halogen-free flat cables (often HFFR/LSZH constructions) are engineered for tight routing in trays, lifts, robotics and data centers where smoke toxicity and corrosive gas release must be minimized during a fire. Their low-smoke, zero-halogen jackets and flame-retardant compounds help maintain circuit integrity and visibility for evacuation. The safety case is compelling: in the United States alone, 2023 saw an estimated 470,000 structure fires causing 3,070 civilian deaths, underscoring why asset owners in high-occupancy buildings and tunnels specify LSZH cabling.

Regulation is reinforcing this shift. In Europe, the Construction Products Regulation (CPR) / EN 50575 classifies building cables by fire reaction (Euroclasses) and explicitly values low acid formation and low smoke generation—a natural fit for halogen-free designs used in construction planning and certification.

- Internationally, performance is assessed through IEC 60332 (flame spread), IEC 60754 (halogen acid gas), and IEC 61034 (smoke density) test series. India has formalized supply via BIS IS 17048:2018 covering Halogen Free Flame Retardant (HFFR) cables, including flat types, with licensing and inspection schemes that elevate quality assurance. These frameworks are expanding the qualified vendor base and de-risking adoption in public projects.

Electrification and renewables are the prime industrial demand drivers. The International Renewable Energy Agency reports a record 585 GW of renewable power capacity added in 2024, taking global capacity to 4,448 GW and keeping solar- and wind-rich balance-of-plant works—cable trays, combiner boxes, inverters—on a steep build-out path where LSZH cabling limits corrosive damage and downtime if faults occur. Looking ahead, the IEA expects global electricity demand growth to average 3.3% in 2025 and 3.7% in 2026, sustaining grid and industrial project pipelines that favor safer cable specifications in substations, battery energy storage, and process electrification.

Transportation electrification adds another growth leg. The IEA’s latest outlook shows electric car sales reached 17 million in 2024, up >25% year-on-year. As OEMs scale high-density assembly lines, and cities deploy enclosed charging depots and rail assets, operators seek cabling that limits toxic smoke in confined spaces, supports repeated flexing in moving equipment, and meets elevated flame-spread thresholds—attributes aligned with halogen-free flat constructions used in carriers, gantries, automated storage and retrieval systems, and EV busways.

Government spending on grid resilience also supports LSZH in substations, data centers and underground corridors. The U.S. Department of Energy’s GRIP program announced $3.46 billion for grid resilience and smart-grid projects in October 2023, followed by ~$4.2 billion in additional selections in October 2024; utilities are hardening assets against extreme weather, often specifying low-smoke cables for tunnels and transit-adjacent sites.

Key Takeaways

- Halogen Free Flat Cables Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 6.7%.

- Single-Core Cable held a dominant market position, capturing more than a 58.2% share of the global halogen-free flat cables market.

- Energy and Power held a dominant market position, capturing more than a 32.9% share of the global halogen-free flat cables market.

- Asia-Pacific (APAC) region held a dominant position in the global halogen-free flat cables market, accounting for 45.9% of total revenue, valued at approximately USD 1.2 billion.

By Types Analysis

Single-Core Cable dominates with 58.2% share driven by its high efficiency and safety performance

In 2024, Single-Core Cable held a dominant market position, capturing more than a 58.2% share of the global halogen-free flat cables market. The growth of this segment has been strongly supported by its extensive use in residential, industrial, and commercial power distribution systems where reliability and fire safety are essential. These cables are designed with a single conductor that ensures efficient current transmission with minimal interference, making them a preferred choice in high-performance electrical applications.

During 2025, demand for single-core halogen-free flat cables is expected to continue rising steadily, supported by the growing focus on eco-friendly infrastructure and the replacement of conventional PVC-insulated wires with non-toxic alternatives. Energy-efficient construction projects, renewable power installations, and government initiatives promoting fire-retardant materials are contributing significantly to this segment’s expansion. The adoption of single-core cables in solar power systems, electric vehicle charging infrastructure, and automation lines has also strengthened their market position.

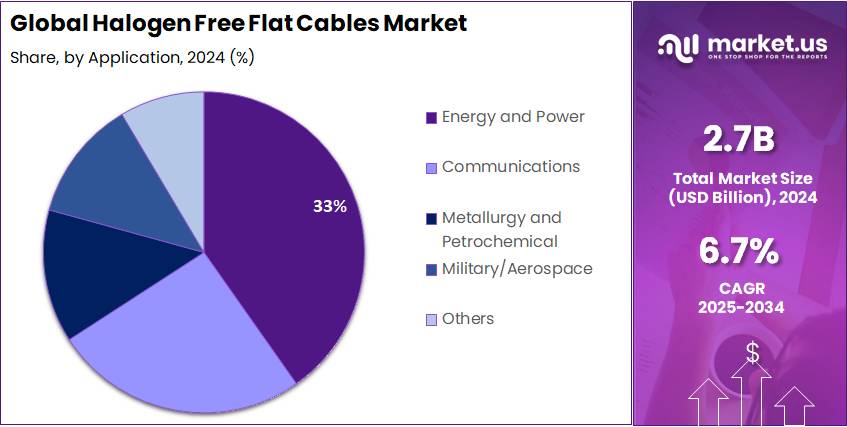

By Application Analysis

Energy and Power dominates with 32.9% share owing to strong adoption in transmission and safety-critical systems

In 2024, Energy and Power held a dominant market position, capturing more than a 32.9% share of the global halogen-free flat cables market. The segment’s leadership is attributed to the growing replacement of traditional PVC-insulated cables with halogen-free variants across power generation and transmission networks. Utilities and grid operators are increasingly prioritizing low-smoke, non-toxic, and flame-retardant materials to enhance operational safety and environmental compliance.

In 2025, the demand for halogen-free flat cables within the energy and power segment is projected to continue rising, supported by global efforts to modernize electrical grids and integrate sustainable materials into power infrastructure. Many countries are enforcing stricter electrical safety standards, which has encouraged utilities to adopt cables that limit halogen gas emissions during fire exposure. Additionally, the expansion of smart grid projects and the growing construction of underground cabling networks have strengthened the market’s preference for halogen-free flat cables due to their mechanical durability and environmental safety.

Key Market Segments

By Types

- Single-Core Cable

- Multi-Core Cable

By Application

- Energy and Power

- Communications

- Metallurgy and Petrochemical

- Military/Aerospace

- Others

Emerging Trends

Hygienic, washdown-ready cabling across food plants and cold chains

A clear, current trend is the shift to hygienic, washdown-ready halogen-free flat cables in food manufacturing and cold-chain facilities. Flat LSZH constructions fit tight conveyor galleries, spiral freezers, and lift systems, while cutting corrosive and opaque fumes if a fault escalates—an important safety layer during evacuations and post-incident cleanups. The move aligns with modern fire-performance frameworks that owners increasingly ask vendors to meet when renovating high-occupancy or enclosed spaces in processing halls and distribution centers.

The scale of the food industry’s installed base makes this trend material. In the European Union, food and drink manufacturing generated €1,196 billion turnover and €249 billion value added in 2021, sustaining multi-year capex programs that pair automation with safety upgrades—prime contexts for halogen-free flat control and power cables along conveyors, robots, and packaging lines. Continuous audits by retailers and insurers are pushing standardized low-smoke wiring for people-dense areas such as packing cells and inspection lanes, so spec changes ripple through every new line and major retrofit.

Cold-chain capacity expansion is a powerful accelerator. India reported 402.18 lakh metric tonnes of cold storage capacity across 8,815 facilities as of June 30, 2025, with government support flowing via programs like PMKSY; separately, the Ministry of Food Processing Industries notes 1,608 sanctioned PMKSY projects and ₹6,198.76 crore in disbursed grants through Feb 28, 2025.

Trade flows add another push. The United States recorded a record $213 billion in agricultural imports in 2024, reflecting year-round demand for higher-value foods and sustained investment in port-proximate inspection, packaging, and cold storage hubs. Facility owners are standardizing low-smoke wiring in enclosed inspection galleries, mezzanines, and service tunnels to protect both staff and sensitive equipment.

Drivers

Fire-safety compliance amid rapid electrification

A single force is pushing halogen-free flat cables into the mainstream: the need to keep people and equipment safe as electrification surges across buildings, transport, and factories. Low-smoke, zero-halogen (LSZH) constructions reduce corrosive and toxic gases in a fire, so owners and regulators are writing them into specifications for tight spaces—elevator shafts, railcars, data-center galleries, offshore platforms, battery lines.

- Europe’s harmonised building code framework under the Construction Products Regulation and the EN 50575/EN 45545 family has raised the bar on “reaction to fire” and smoke/toxicity performance; for rolling stock, EN 45545-2 defines material behaviour by hazard level, which LSZH cable compounds are designed to meet.

The electrification wave is measurable and sustained. The International Energy Agency estimates global renewable additions at 666 GW in 2024, rising to ~935 GW by 2030, with solar and wind providing ~95% of new capacity—each gigawatt means kilometres of on-site control, array and balance-of-plant cabling where low smoke and acid-gas performance are often required by EPCs and insurers.

Global Wind Energy Council reports 117 GW of new wind capacity in 2024, and projects ~1 TW of additional installations by 2030. Offshore wind has reached 83 GW installed, with annual additions expected to climb from 8 GW in 2024 to 34 GW by 2030—offshore substations, nacelles and cable trays are precisely the confined environments where halogen-free flat cables mitigate smoke density and corrosion risk.

Safety demand is not abstract; it is reinforced by fire-loss data and public programs. In the United States, 3,070 civilian fire deaths occurred in 2023, with 470,000 structure fires estimated—numbers that keep attention on smoke toxicity and evacuation visibility in buildings and transit hubs. Governments are also spending to harden electric assets. Under the U.S. Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) program, about $4.2 billion in Round-2 awards and additional targeted allocations fund substation upgrades, underground corridors and smart-grid retrofits where LSZH specifications reduce secondary damage during incidents.

Restraints

Cost and design burden under tight end-user budgets

A practical brake on halogen-free flat cable adoption is the total installed cost that comes with meeting strict low-smoke, zero-halogen performance while keeping flexibility, size, and electrical ratings. Halogen-free flame-retardant (HFFR) compounds often rely on aluminum trihydrate (ATH) and similar fillers at very high loadings—typically 50–80 wt%—to pass flame tests. Those filler levels increase compound cost, raise cable diameter for a given rating, and can reduce bendability in moving applications, which pushes up tray space and installation effort.

Meeting fire-safety test thresholds adds further complexity: for example, low-acid-gas standards specify evolved-gas pH > 4.3 and conductivity < 100 µS/cm, and smoke-density tests under IEC 61034 must also be satisfied. Achieving all three concurrently (flame spread, smoke, toxicity) drives iterative compounding, lab time, and certification runs before volume builds can start.

That engineering burden lands in industries that are watching every rupee or dollar. Food manufacturers, a major user base for flat, flexible control and conveyor cables, have operated through volatile input costs. The FAO Food Price Index averaged 126.4 points in October 2025, only slightly below October 2024 and still far from pre-2021 levels. This makes plant managers prioritize throughput and hygiene investments first, delaying optional electrical retrofits such as LSZH conversions unless mandated by codes or insurers.

The scale of the potential retrofit challenge is large: the United States had 42,708 food and beverage processing establishments in 2022, many of them small and mid-sized, where a few percentage points of cost premium on cable and installation can be the difference between proceeding now or deferring a project.

In developing markets, public programs are building capacity in food processing, but grants tend to flow to core processing and cold-chain assets before wiring upgrades. India’s Ministry of Food Processing Industries reports 1,608 sanctioned projects with ₹6,198.76 crore disbursed under PMKSY as of 28 February 2025. For many beneficiaries, budget sequences hygiene, refrigeration, and packaging; halogen-free cable changes usually follow a later safety or insurance audit, slowing near-term LSZH penetration.

Opportunity

Hygiene-driven retrofits in a fast-scaling food economy

In the United States, food and beverage plants accounted for $1.019 trillion (16.8%) of all manufacturing sales in 2021, showing how large the modern, automation-ready installed base already is. As these lines add sensors, HMIs, servo axes and washdown enclosures, routing space shrinks and the argument for thin, halogen-free flat control and power cables grows.

Cold-chain expansion is a second catalyst. India’s National Centre for Cold-chain Development notes roughly 395 lakh metric tonnes (~39.5 Mt) of cold-storage capacity as of May 2024, with planning documents still identifying gap-closure needs. Every new or refurbished cold room, blast chiller and high-bay freezer adds cable meters in trays, lift systems and service corridors, where LSZH helps protect people and product during incidents. The earlier national baseline even projected a need to double capacity to curb losses, underscoring how much build remains.

Loss reduction targets also pull upgrades forward. FAO’s State of Food and Agriculture highlights that about 14% of food output is lost between post-harvest and retail. Cutting that loss matters for margins and sustainability, and it drives investment in better handling, sorting, and packaging—exactly the stations packed with moving cable chains and tight shafts that benefit from halogen-free flat designs.

In parallel, EU food manufacturers remain large, formal purchasers: the sector recorded €1,196 billion in turnover and €249 billion in value added (both 2021), with ~290,000 SMEs that systematically retrofit lines to meet retailer standards and insurance clauses. As retailers tighten technical specifications in logistics hubs and processing plants, LSZH cabling becomes an easy way to de-risk evacuations and corrosion damage without re-engineering entire lines.

Policy and trade trends add momentum. The U.S. value of agricultural imports reached a record $213 billion in 2024, reflecting year-round demand for higher-value foods; importers and co-packers scale inspection, sorting and packaging capacity close to ports to handle that flow, and many now pre-emptively specify low-smoke cabling in enclosed spaces to protect equipment and staff.

Regional Insights

Asia-Pacific leads the Halogen-Free Flat Cables Market with 45.9% share, valued at USD 1.2 billion

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global halogen-free flat cables market, accounting for 45.9% of total revenue, valued at approximately USD 1.2 billion. The regional growth is primarily driven by rapid industrialization, urban expansion, and large-scale investments in clean energy and smart infrastructure projects. Countries such as China, Japan, South Korea, and India have been at the forefront of adopting halogen-free flat cables, supported by stringent fire safety regulations and government mandates encouraging the use of low-smoke, non-toxic materials in public and industrial facilities.

According to the International Energy Agency (IEA), electricity demand in the Asia-Pacific region is projected to rise by over 3.4% annually through 2026, creating a strong need for reliable, fire-safe cabling systems in energy and power applications. In China alone, ongoing grid modernization and the rapid development of solar and wind power installations have significantly increased cable requirements. Similarly, India’s focus on expanding smart cities and digital infrastructure has boosted the adoption of halogen-free flat cables in residential and commercial construction.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Prysmian Group: Based in Milan, the Prysmian Group is a global-leader in electrical cables and systems, operating more than 100 facilities worldwide and investing heavily in low-smoke, halogen-free (LSZH) portfolios including its “17 FREE®” and “GenFREE®” lines. The company addresses high-risk environments such as offshore, rail and infrastructure with flat LSZH cable variants (e.g., H05ZZH6-F).

3M Company: 3M offers a range of halogen-free, low-smoke flat and round cables such as the HF319 and HF539 series, engineered for high-flex life, wide temperature range (-40 °C to +105 °C), and zippable branching capability. These products are targeted toward electronics, data-centres, and industrial interconnects requiring LSZH safety.

Furukawa Electric Co., Ltd.: Furukawa Electric’s cable portfolio includes ECOACEPLUS and ECOSOFLEX halogen-free electric wires, and flame-retardant cables for industrial wiring (EM-LMFC series) with heat resistance up to ~110 °C+. Their material development is oriented toward equipment, automotive, and high-temperature wiring markets.

Top Key Players Outlook

- Prysmian Group

- Nexans

- Sumitomo Electric

- LS Cable Group

- 3M

- Furukawa Electric

- Southwire

- Fujikura

- Walsin Technology

- Far East Holding

Recent Industry Developments

In 2024, Prysmian Group reported an adjusted EBITDA of €1,927 million, an increase of 18.4 % compared with €1,628 million in 2023, and net profit of €748 million, up from €547 million in 2023.

In 31, 2024 Furukawa Electric Co Ltd, recorded net sales of ¥1,056.5 billion and operating profit of ¥11.17 billion.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 5.2 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (Single-Core Cable, Multi-Core Cable), By Application (Energy and Power, Communications, Metallurgy and Petrochemical, Military/Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Prysmian Group, Nexans, Sumitomo Electric, LS Cable Group, 3M, Furukawa Electric, Southwire, Fujikura, Walsin Technology, Far East Holding Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Halogen Free Flat Cables MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Halogen Free Flat Cables MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Prysmian Group

- Nexans

- Sumitomo Electric

- LS Cable Group

- 3M

- Furukawa Electric

- Southwire

- Fujikura

- Walsin Technology

- Far East Holding