Global Ground Calcium Carbonate Market Size, Share Analysis Report By Purpose (Filler, Extender, Pigment, Neutralizer), By Morphology (Crystalline, Amorphous, Granular), By Particle Size (Coarse, Fine, Superfine), By Application (Automotive, Building And Construction, Pharmaceutical, Agriculture, Pulp And Paper, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173208

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

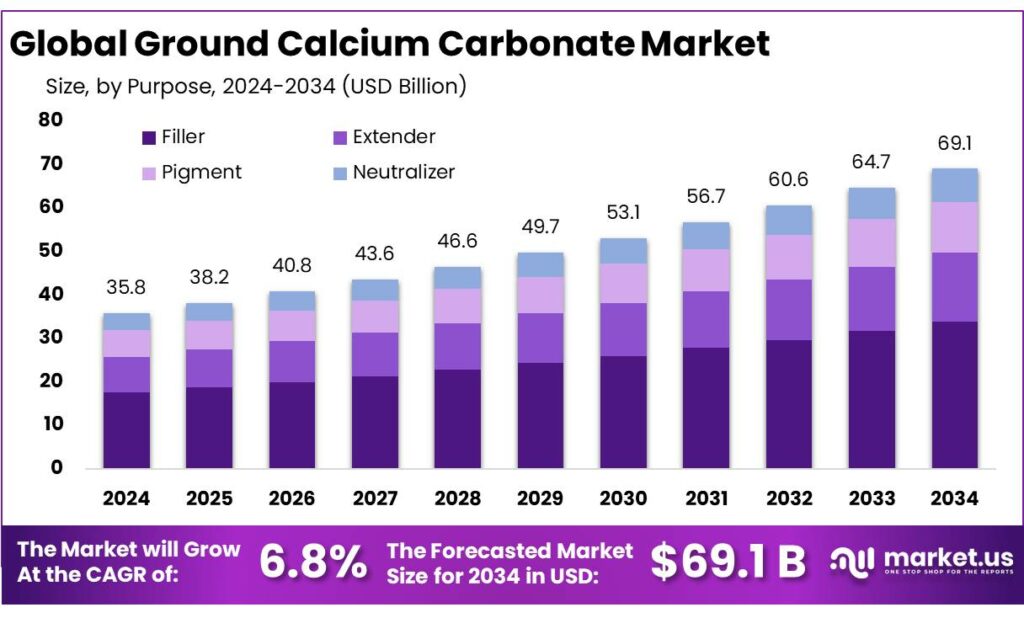

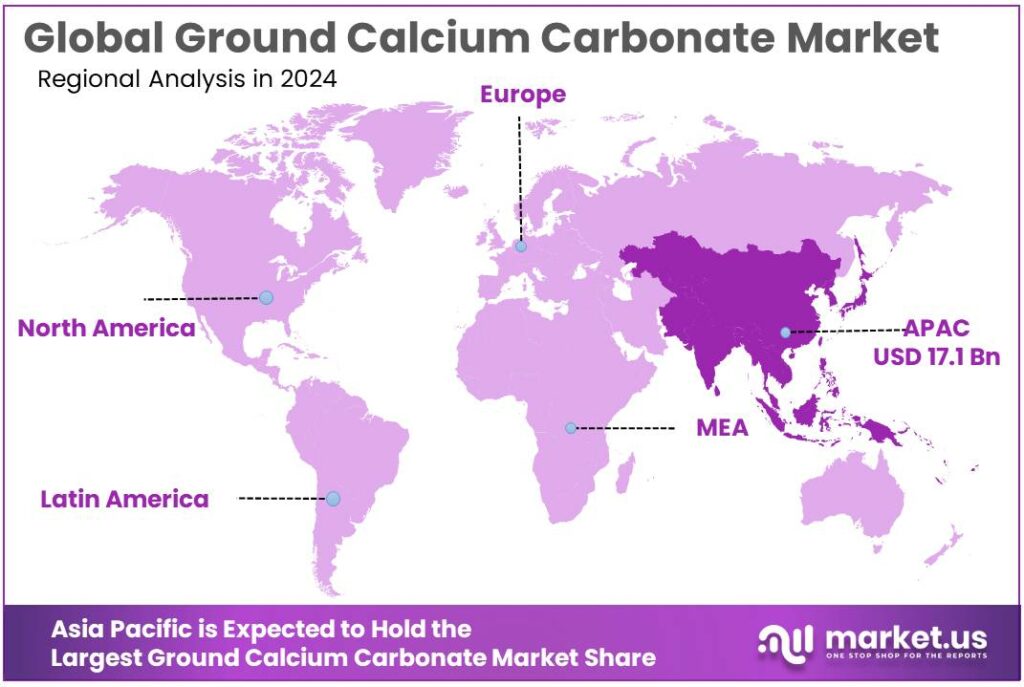

The Global Ground Calcium Carbonate Market size is expected to be worth around USD 69.1 Billion by 2034, from USD 35.8 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 47.9% share, holding USD 17.1 Billion in revenue.

Ground Calcium Carbonate (GCC) is a naturally sourced mineral product made by mechanically grinding high-purity limestone into controlled particle sizes for use as a functional filler and extender across paper, plastics, paints/coatings, adhesives, sealants, and selected food and pharma applications.

From an industrial scenario perspective, GCC demand is closely tied to the broader limestone-based materials economy. In the United States alone, the broader crushed-stone industry produced an estimated 1.5 billion tons in 2024, valued at about $26 billion, supported by roughly 1,400 companies operating around 3,500 quarries—and about 70% of that crushed stone output was limestone and dolomite, underscoring the depth of the upstream resource base that feeds GCC supply chains. The same USGS dataset also shows an average unit value of $17.50 per metric ton (2024e) and quarry/mill employment of about 71,600, highlighting GCC’s role within a capital-intensive, logistics-heavy, domestically anchored minerals industry.

Key driving factors for GCC consumption are performance economics, scale effects in manufacturing, and policy-backed infrastructure and construction activity that keeps the limestone ecosystem active. USGS notes that 72% of crushed stone is used as construction aggregate, and it explicitly links long-term aggregates demand to public/private construction and infrastructure improvements; notably, it references the U.S. Infrastructure Investment and Jobs Act, authorizing $1.2 trillion in funding, including $118 billion to the Highway Trust Fund. While GCC is a different, higher-spec product than aggregates, its economics benefit from this same quarrying/transport backbone and permitting environment.

Demand-side pull is shaped by both materials engineering needs and sustainability rules in packaging and product design. In paper and paperboard, GCC supports opacity, printability, and stiffness, and the sector’s scale remains significant even after structural shifts in graphics paper: world paper production dropped to 401 million tonnes in 2023, keeping mineral fillers relevant to large tonnage converting systems. In Europe, packaging policy is also pushing material redesign: the EU highlights that 40% of plastics used in the EU are in packaging and that packaging waste reached 186.5 kg per person in 2022, while the Packaging and Packaging Waste Regulation entered into force on 11 February 2025 and targets all packaging to be recyclable by 2030, with an economy-wide direction toward climate neutrality by 2050.

In food and nutrition systems, calcium carbonate is also relevant as a regulated additive and processing aid. Codex/FAO’s GSFA listings show specific numeric conditions in certain standards—for instance, calcium carbonate is permitted as an anticaking agent at 10,000 mg/kg in certain dried whey and related applications, and 4,400 mg/kg limits are referenced in specific edible casein contexts. These guardrails push demand toward tight specification control and encourage investment in consistent milling, classification, and QA systems. In the United States, calcium carbonate is listed as Generally Recognized as Safe (GRAS) under 21 CFR §184.1191, supporting applications such as anticaking, pH adjustment, and calcium fortification in compliant formulations.

Key Takeaways

- Ground Calcium Carbonate Market size is expected to be worth around USD 69.1 Billion by 2034, from USD 35.8 Billion in 2024, growing at a CAGR of 6.8%

- Filler held a dominant market position, capturing more than a 49.8% share in the Ground Calcium Carbonate Market.

- Crystalline held a dominant market position, capturing more than a 52.4% share in the Ground Calcium Carbonate Market.

- Fine held a dominant market position, capturing more than a 44.2% share in the Ground Calcium Carbonate Market.

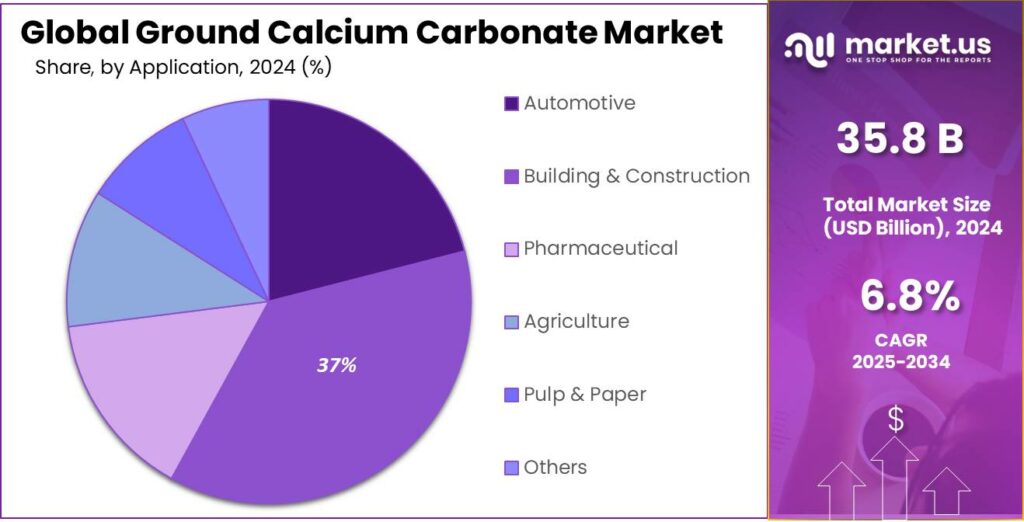

- Building & Construction held a dominant market position, capturing more than a 37.1% share in the Ground Calcium Carbonate Market.

- Asia Pacific stood out as the largest region in the Ground Calcium Carbonate Market, capturing a dominant 47.9% share and generating approximately USD 17.1 billion.

By Purpose Analysis

Filler applications lead with a 49.8% share in 2024 due to broad use across paper, plastics, and construction materials.

In 2024, Filler held a dominant market position, capturing more than a 49.8% share in the Ground Calcium Carbonate Market by purpose. This strong share was supported by the wide use of ground calcium carbonate as a cost-effective filler that improves volume, surface finish, and processing efficiency in end products. Industries such as paper, plastics, paints, and construction materials continued to rely on filler-grade GCC to enhance product consistency while keeping production costs under control.

This segment maintained steady demand as manufacturers focused on material optimization and performance balance rather than complete material substitution. The year-wise trend indicates that filler applications benefited from stable consumption patterns in packaging, infrastructure, and everyday consumer products. As a result, filler-based use of ground calcium carbonate remained the largest and most stable segment, reinforcing its central role in the overall market structure.

By Morphology Analysis

Crystalline morphology leads with a 52.4% share in 2024 due to consistent structure and wide industrial suitability.

In 2024, Crystalline held a dominant market position, capturing more than a 52.4% share in the Ground Calcium Carbonate Market by morphology. This dominance was supported by the material’s stable crystal structure, which provides reliable brightness, hardness, and particle size control across multiple applications. Crystalline ground calcium carbonate is widely used in paper, plastics, paints, and construction materials where uniform performance and surface quality are essential.

The year-wise trend indicates that crystalline morphology benefited from established processing methods and consistent supply, helping it remain the preferred choice for large-scale industrial use. As a result, this morphology maintained its leading position, reinforcing its importance within the overall ground calcium carbonate market.

By Particle Size Analysis

Fine particle size leads with a 44.2% share in 2024 due to smooth finish and better dispersion performance.

In 2024, Fine held a dominant market position, capturing more than a 44.2% share in the Ground Calcium Carbonate Market by particle size. This leadership was driven by the ability of fine particles to deliver improved surface smoothness, better opacity, and uniform dispersion in end products. Industries such as paper, coatings, plastics, and adhesives continued to prefer fine ground calcium carbonate to enhance appearance and processing consistency.

The segment maintained stable demand as manufacturers focused on quality enhancement and formulation efficiency rather than higher material volumes. The year-wise trend shows that fine particle grades benefited from steady usage in premium and mid-range applications where visual quality and performance balance are critical. As a result, the fine particle size segment remained the most widely adopted option, reinforcing its strong position in the overall market.

By Application Analysis

Building & Construction leads with a 37.1% share in 2024 driven by steady infrastructure and housing demand.

In 2024, Building & Construction held a dominant market position, capturing more than a 37.1% share in the Ground Calcium Carbonate Market by application. This strong share was supported by the widespread use of ground calcium carbonate in cement, concrete, wall putty, adhesives, and construction coatings, where it improves strength, workability, and cost efficiency. The material continued to be preferred for large-volume construction uses due to its availability and consistent performance.

Moving into 2025, the segment maintained stable demand as ongoing residential, commercial, and infrastructure projects sustained material consumption. The year-wise trend indicates that building and construction applications benefited from long-term development activities rather than short-term cycles. As a result, this application segment remained the largest consumer of ground calcium carbonate, reinforcing its central role in the overall market structure.

Key Market Segments

By Purpose

- Filler

- Extender

- Pigment

- Neutralizer

By Morphology

- Crystalline

- Amorphous

- Granular

By Particle Size

- Coarse

- Fine

- Superfine

By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

Emerging Trends

Food-Grade GCC Moves Toward “Nano-Proven” Compliance

A clear latest trend for Ground Calcium Carbonate (GCC) in food uses is the shift from “it’s a traditional ingredient” to “it must be proven, batch by batch, to meet modern particle-characterisation expectations.” Regulators are not questioning why calcium carbonate exists in food. The focus is on what the material physically looks like at very small sizes, and whether the data package is strong enough for today’s safety frameworks. That trend is pushing food-grade GCC suppliers to upgrade analytical testing, tighten milling controls, and document their products more like regulated specialty ingredients than simple minerals.

In the European Union, the direction is strongly influenced by EFSA’s updated nano-related expectations. EFSA’s 2021 scientific guidance on technical requirements for regulated products introduced practical screening logic. It describes a key threshold where a material can be treated as “non-nano” for risk assessment if the applicant demonstrates the particle size is ≥ 500 nm, along with suitable evidence and methodology. In parallel training and regulatory communication, EFSA has also stressed detection capability—showing that the chosen methods can convincingly demonstrate that < 10% of particles (number-based) have at least one dimension smaller than 500 nm in certain screening contexts.

Another part of the trend is that “nano” itself has become more formally defined in the policy ecosystem. The European Commission’s nanomaterials information for food points to the 100 nm scale and highlights an EU approach where a material may be classified as a nanomaterial if 50% or more of the total particles have one or more external dimensions below 100 nm.

Drivers

Calcium Intake Gaps Push Fortification Demand

One major driving factor for Ground Calcium Carbonate (GCC) is the steady push to close calcium-intake gaps through food fortification and supplementation, especially in countries where dairy intake is limited or diets are heavily cereal-based. A large global modelling analysis published in The Lancet Global Health estimated that 66% of the world’s population has inadequate calcium intake from diet, putting calcium among the most common micronutrient shortfalls measured in the study.

This health-driven demand connects directly to GCC because calcium carbonate is already embedded in mainstream food-safety systems. In the European Union, it is recognised as the mineral-derived additive E 170, and EFSA’s 2023 re-evaluation concluded there is “no need for a numerical ADI” and that there is no safety concern “per se” at the reported uses and use levels across age groups (including infants), which supports continued permitted use where applicable.

The U.S. National Institutes of Health Office of Dietary Supplements summarises recommended amounts that commonly fall in the 1,000–1,200 mg/day range for many adults, with higher needs in specific life stages. When everyday diets do not reliably meet these ranges—especially for price-sensitive households—manufacturers often respond by building “calcium added” propositions into affordable formats. That, in turn, pulls demand for consistent, food-grade calcium carbonate with controlled particle size, low contaminants, and stable supply.

Government and public-health initiatives amplify this driver most clearly in maternal health. The World Health Organization recommends daily calcium supplementation of 1.5–2.0 g elemental calcium for pregnant women in populations with low dietary calcium intake, specifically to reduce the risk of pre-eclampsia.

Restraints

Stricter Nano-Characterization Rules Slow Food-Grade Adoption

One major restraining factor for Ground Calcium Carbonate (GCC)—especially when suppliers target food-grade uses—is the rising compliance burden around particle-size and potential nanoscale fractions. The issue is not that calcium carbonate is “new” to food. It is widely permitted, but regulators now expect better proof of what the material looks like at very small sizes, and that adds time, testing cost, and paperwork before a producer can confidently sell into regulated food applications.

In Europe, calcium carbonate is authorised as the food additive E 170, and its specifications are set in the EU’s food additive specifications framework (Commission Regulation (EU) No 231/2012). Over the last few years, EFSA has repeatedly highlighted that suppliers need solid analytical evidence on particle size and particle size distribution. In 2018, EFSA ran a formal “call for data” requesting particle size and particle size distribution information for calcium carbonate (E 170), aligned with EFSA’s nanotechnology risk-assessment guidance.

The nano angle matters because regulators define “nanoscale” using a clear threshold: particles with at least one dimension < 100 nm. EFSA communications around when conventional risk assessment is sufficient explicitly recommend revising EU specifications so they include particle size distribution plus the percentages of particles in the nanoscale present in the food additive material. For GCC suppliers, this can mean investing in advanced analytical capability to quantify not just an average particle size, but also the “tail” of very small particles.

Opportunity

Staple Food Fortification Creates a Clear Upgrade Path

A major growth opportunity for Ground Calcium Carbonate (GCC) is expanding staple food fortification—especially wheat flour—because it turns calcium delivery into something people get “by default” in daily diets. The public-health need is real and measurable. A large global assessment in The Lancet Global Health estimated that 66% of the world’s population has inadequate calcium intake from diet, making calcium one of the most widespread micronutrient gaps tracked. Separate nutrition reviews also estimate that 3.5 billion people are at risk of inadequate calcium intake, and that about 90% of those at risk live in Africa and Asia—regions where affordable fortified staples can make the biggest difference.

The commercial story becomes stronger when intake targets are put next to those gap numbers. The U.S. NIH Office of Dietary Supplements lists recommended intakes that commonly sit around 1,000 mg/day for many adults, rising to 1,200 mg/day for older adults and some women. When everyday diets do not reliably hit these levels, food companies and governments often prefer scalable options like fortified flour rather than relying only on supplements, which can be unevenly adopted across income groups.

The United Kingdom shows why this opportunity can be “policy locked-in.” UK guidance and regulations require the addition of calcium carbonate to most non-wholemeal wheat flour, with typical specified levels commonly described in the 235–390 mg per 100 g flour range in official and industry compliance guidance. In Wales, updated regulations also set a defined requirement for calcium carbonate, shown as at least 300 mg/100 g and not more than 455 mg/100 g of flour in the legal text.

For GCC producers, the practical growth play is to treat staple fortification as a premium lane: invest in low-contaminant sourcing, tight particle-size control, and strong documentation so they can serve mills and fortified-food brands with fewer interruptions. With 66% of the global population still not meeting calcium needs and adult targets anchored around 1,000–1,200 mg/day, the scale is there; the winners will be the suppliers that make compliance feel easy for food businesses.

Regional Insights

Asia Pacific Ground Calcium Carbonate Market – Leading Region with 47.9 % Share and $17.1 Bn in 2024

In 2024, Asia Pacific stood out as the largest region in the Ground Calcium Carbonate Market, capturing a dominant 47.9 % share and generating approximately USD 17.1 billion in revenue. This regional leadership was supported by strong industrial activity and rapid urbanisation in major economies such as China, India, and Southeast Asian nations, where ground calcium carbonate is widely used as a cost-effective filler and coating ingredient in paper, plastics, paints, and construction materials.

These markets benefited from abundant limestone reserves and increasingly efficient grinding and processing infrastructure, which helped suppliers meet both domestic and export demand. Moving into 2025, Asia Pacific continued to retain its commanding position as demand remained resilient across multiple end-use industries, including building materials and plastics manufacturing, where calcium carbonate enhances strength and process performance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GCCP Resources Limited: GCCP Resources Limited is a Malaysia-based mining and processing company engaged in quarrying and crushing limestone into calcium carbonate products that serve industries such as construction, agriculture, automotive, glass, and water treatment. In 2024, the company reported revenue of approximately SGD 1.55 million, reflecting its operations in ground and precipitated calcium carbonate supply.

Gulshan Polyols Limited: Gulshan Polyols Limited is a leading Indian producer of calcium carbonate products with an integrated capacity exceeding 170,400 MTPA, offering diverse grades such as ground natural, wet ground, PCC, and specialty carbonates to industries like paints, pharmaceuticals, PVC, paper, and construction.

Imerys: Imerys is a major diversified minerals company that supplies ultra-fine and specialty ground calcium carbonate across paper, plastics, coatings, and adhesives markets. Its R&D focus on tailored particle size and surface treatment enhances performance in high-brightness and high-opacity applications, reinforcing its competitive position in technical carbonate solutions globally.

Top Key Players Outlook

- Carmeuse

- GCCP Resources Limited

- Imerys

- GLC Minerals

- Gulshan Polyols Limited

- US Aggregates

- J.M. Huber Corporation

- Omya AG

- Mississippi Lime Company

Recent Industry Developments

In 2024, GCCP Resources recorded annual revenue of MYR 1.13 million (approximately observed in local currency), marking a notable recovery with over 50 % growth compared to 2023 and reflecting stronger sales of calcium carbonate products.

In 2024, Imerys delivered €3,605 million in total revenue, with its Performance Minerals segment, which includes calcium carbonate products, contributing approximately €2,204 million and showing positive volume growth driven by plastics, coatings and consumer goods demand.

Report Scope

Report Features Description Market Value (2024) USD 35.8 Bn Forecast Revenue (2034) USD 69.1 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purpose (Filler, Extender, Pigment, Neutralizer), By Morphology (Crystalline, Amorphous, Granular), By Particle Size (Coarse, Fine, Superfine), By Application (Automotive, Building And Construction, Pharmaceutical, Agriculture, Pulp And Paper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Carmeuse, GCCP Resources Limited, Imerys, GLC Minerals, Gulshan Polyols Limited, US Aggregates, J.M. Huber Corporation, Omya AG, Mississippi Lime Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ground Calcium Carbonate MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Ground Calcium Carbonate MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

Carmeuse GCCP Resources Limited Imerys GLC Minerals Gulshan Polyols Limited US Aggregates J.M. Huber Corporation Omya AG Mississippi Lime Company