Global Greeting Cards Market Size, Share, Growth Analysis By Type (Traditional Card, E-card),By Type (Folded, Flat),By Product (Personalized, Thank You, Farewell),By End-User (Women, Men),By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167203

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

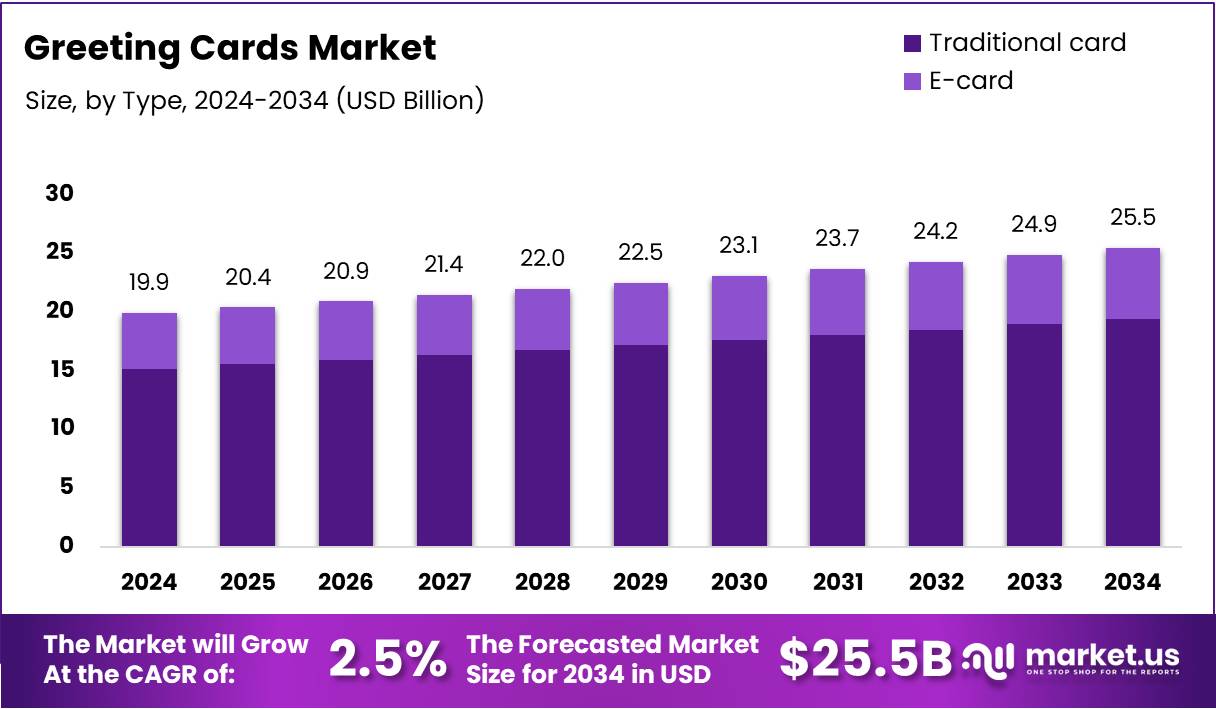

The Global Greeting Cards Market size is expected to be worth around USD 25.5 Billion by 2034, from USD 19.9 Billion in 2024, growing at a CAGR of 2.5% during the forecast period from 2025 to 2034.

The global Greeting Cards Market represents a traditional yet evolving communication channel centered on emotional expression, cultural celebrations, and personal connections. It includes physical cards, digital cards, and customized formats used for birthdays, festivals, anniversaries, and corporate communication. The market continues to transition toward value-added designs, personalization, and premium storytelling formats appealing to diverse age groups.

Moving forward, the Greeting Cards industry shows steady growth driven by rising gifting culture, expanding retail networks, and increasing demand for personalized card formats. Consumers continue valuing tangible emotional expression, allowing physical cards to retain strong relevance despite digital alternatives. The sector also benefits from occasion-based spending and seasonal buying behaviors across global markets.

Additionally, new opportunities are emerging as brands adopt digital-print hybrids, QR-enabled messages, and eco-friendly materials. These innovations support higher margins and encourage younger consumers to reconsider physical greeting cards. Furthermore, the increasing preference for custom artwork, handcrafted cards, and sustainable paper solutions continues strengthening category appeal in premium buyer segments.

Moreover, government initiatives supporting sustainable packaging, small craft businesses, and creative industries indirectly stimulate Greeting Cards Market development. Investments in digital infrastructure also support online card sales. Regulations encouraging use of recycled materials and proper sourcing further boost responsible production practices across manufacturing clusters.

As a result, analysts observe expanding prospects for creators, printers, and online platforms offering curated card collections. Growth is supported by rising corporate gifting programs, tourism-linked purchases, and rising interest in emotion-driven consumer goods. These trends collectively enhance market penetration across both developed and emerging regions, especially during festive cycles.

According to industry sources, the United Kingdom spends nearly one billion pounds annually on greeting cards, with an average consumer sending 55 cards each year. Meanwhile, 80% of greeting cards in the U.S. are purchased by women, indicating strong gender-driven buying behavior that continues shaping product preferences and purchase channels.

Furthermore, according to European retail surveys, Germany sells nearly 600 million greeting cards annually, highlighting sustained physical-card demand. Buyer insights also show that 30% of shoppers prefer humorous or custom music cards, while 72% of adults under 30 years prefer digital communication—indicating long-term shifts requiring hybrid engagement strategies within the Greeting Cards Market.

Key Takeaways

By Type Analysis

Traditional Card dominates with 76.3% due to its strong emotional appeal and physical gifting value.

In 2024, Traditional Card held a dominant market position in the By Type segment of the Greeting Cards Market, with a 76.3% share. This segment benefits from consumers’ preference for tangible cards that convey personal sentiments. The physical touch, printed aesthetics, and keepsake value continue to strengthen its demand.

Meanwhile, the E-card segment shows steady adoption as users shift toward digital communication. This category gains traction due to instant delivery, customization flexibility, and cost efficiency. Additionally, rising digital gifting trends encourage younger audiences to explore virtual card formats, supporting a consistent, albeit smaller, contribution within the overall market landscape.

By Type Analysis (Folded vs Flat)

Folded Cards dominate with 67.7% due to premium presentation and multi-page design appeal.

In 2024, Folded cards held a dominant market position in the By Type Analysis segment of the Greeting Cards Market, with a 67.7% share. Consumers prefer this format for its layered design, spacious message area, and higher perceived value. Folded cards also align with celebratory gifting occasions requiring expressive personalization.

The Flat card segment continues to attract attention as a simple and cost-efficient alternative. These cards maintain stable demand in bulk gifting, corporate messaging, and casual greetings. Their lightweight structure, faster printing cycles, and economical pricing ensure relevance despite the strong preference for folded formats.

By Product Analysis

Personalized Cards dominate with 44.9% due to rising customization trends across consumer groups.

In 2024, Personalized cards held a dominant market position in the By Product segment of the Greeting Cards Market, with a 44.9% share. Buyers increasingly seek custom messages, photos, and unique templates, making personalization a preferred option for emotional gifting and special celebrations.

The Thank You card segment remains essential for expressing gratitude across personal and professional interactions. These cards gain demand through frequent use in events, customer appreciation efforts, and personal acknowledgments, maintaining consistent relevance in the overall product mix.

The Farewell card segment also contributes steadily as workplaces, communities, and social groups continue traditional practices of acknowledging transitions. This category benefits from steady demand during job changes, retirements, and relocations, helping sustain its position in the product landscape.

By End-User Analysis

Women dominate with 59.1% due to higher gifting participation and emotional engagement.

In 2024, Women held a dominant market position in the By End-User segment of the Greeting Cards Market, with a 59.1% share. Women traditionally participate more actively in gifting occasions, sentimental purchases, and celebration planning, supporting strong demand for diverse and expressive greeting card options.

The Men segment shows steady growth as gifting awareness expands across categories. Increasing involvement in celebratory events, personal milestones, and workplace interactions supports rising purchases. Simplified designs and direct messaging formats help strengthen their preference for straightforward greeting card selections.

By Distribution Channel Analysis

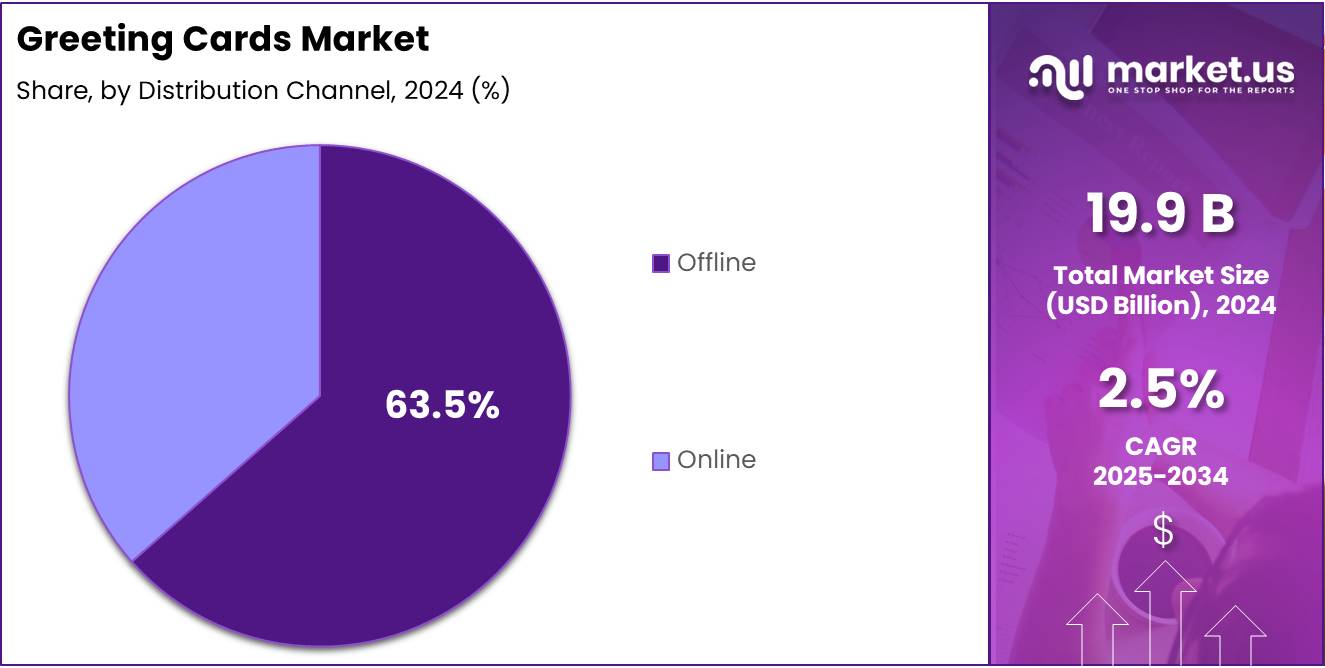

Offline dominates with 63.5% due to physical browsing experience and immediate product availability.

In 2024, Offline retail held a dominant market position in the By Distribution Channel segment of the Greeting Cards Market, with a 63.5% share. Consumers value in-store browsing, tactile evaluation, and instant purchase convenience. Brick-and-mortar stores remain influential in seasonal gifting and last-minute card purchases.

The Online channel continues to expand as digital platforms offer wider assortments and doorstep delivery. This segment benefits from customizable templates, easy design tools, and global access. Growing e-commerce usage and digital shopping comfort further drive online purchases across both casual and festive greeting card categories.

Key Market Segments

By Type

- Traditional Card

- E-card

By Type

- Folded

- Flat

By Product

- Personalized

- Thank You

- Farewell

By End-User

- Women

- Men

By Distribution Channel

- Offline

- Online

Drivers

Strong Cultural Importance of Seasonal & Festive Gifting Occasions Drives Market Growth

The greeting cards market continues to grow as seasonal and festive celebrations remain an important part of social traditions. Consumers rely on cards to express goodwill during festivals, birthdays, and personal milestones. This cultural habit strengthens demand throughout the year and ensures stable market activity across regions.

Moreover, rising consumer interest in emotional, heartfelt communication supports the use of physical greeting cards. Many buyers value the personal touch and lasting sentiment that tangible cards provide. This emotional connection encourages people to choose printed cards over digital messages, boosting long-term market relevance.

Additionally, expanding online platforms are making it easier for customers to explore a wide range of card designs. These digital storefronts offer convenience, faster delivery, and greater customization, attracting both new and returning users. As a result, online availability is increasing overall accessibility and supporting higher sales volumes.

Together, these factors create a strong foundation for the market’s continued growth. Cultural traditions sustain consistent demand, emotional preferences enhance product value, and digital platforms broaden reach. This combination positions the greeting cards market for steady expansion in the coming years.

Restraints

Declining Consumer Footfall in Physical Card Stores Limits Market Expansion

The greeting cards market is facing steady pressure as fewer consumers visit physical stores. This decline mainly comes from the shift toward online shopping, where convenience and wider product choices attract buyers. As store traffic drops, traditional retailers struggle to maintain sales volume, reducing overall market momentum. This trend continues to impact growth, especially in regions where brick-and-mortar outlets still play a major role.

Moreover, reduced in-store engagement limits impulse purchases, which historically contributed significantly to greeting card sales. Without consistent footfall, retailers face challenges in stocking diverse card collections, further narrowing consumer interest. This situation creates a cycle in which shrinking store activity weakens brand visibility and retail presence.

Another major restraint comes from limited interest among younger, digitally-native consumers. Many of them prefer online messaging, social media posts, or e-cards instead of physical greeting cards. This shift in communication habits reduces the relevance of traditional cards for everyday and seasonal occasions. As a result, brands struggle to connect with younger audiences who favor digital over printed formats.

Additionally, younger consumers often value personalization and immediacy, which digital formats deliver more easily. Their lower engagement creates long-term concerns for market sustainability, as future demand may gradually decline without targeted innovation or hybrid digital-print strategies.

Growth Factors

Expansion of AI-Personalized and Customizable Card Designs Drives Market Growth

The Greeting Cards Market is witnessing new opportunities as consumers increasingly look for personalized and unique gifting options. The rise of AI-powered design tools allows users to create cards that reflect personal emotions, styles, and messages. This shift supports stronger customer engagement and encourages repeat purchases across various festive and personal occasions.

Moreover, the growing preference for eco-friendly products is opening fresh avenues for sustainable card collections. Brands offering recycled paper cards and biodegradable materials are attracting environmentally conscious buyers. This trend also helps companies strengthen their green branding while meeting rising consumer expectations for responsible and planet-friendly choices.

In addition, the corporate sector is driving a new growth wave through demand for branded appreciation and holiday cards. Many businesses are now focusing on improving employee morale and client relations through thoughtful, customized messages. This creates a consistent demand base, especially during peak festive seasons and milestone celebrations.

Emerging Trends

Surge in Digital-Print Hybrid Cards with QR-Based Video Messages Drives Market Trends

The Greeting Cards Market is witnessing strong traction as digital-print hybrid cards gain popularity. These cards allow users to scan QR codes and access personalized video messages, offering a modern way to express emotions. This trend is attracting tech-savvy consumers who want a more meaningful and memorable gifting experience.

At the same time, interactive cards featuring pop-ups and 3D elements are becoming more common. These formats create a tactile and visually appealing experience, helping brands stand out in a competitive market. Their novelty factor encourages higher consumer engagement, especially during festive and celebratory occasions.

Additionally, limited-edition designer cards and artist collaborations are expanding rapidly. These premium collections appeal to consumers who value creativity, exclusivity, and artistic design. The trend supports the growing demand for unique, collectible cards that offer both emotional and aesthetic value.

Regional Analysis

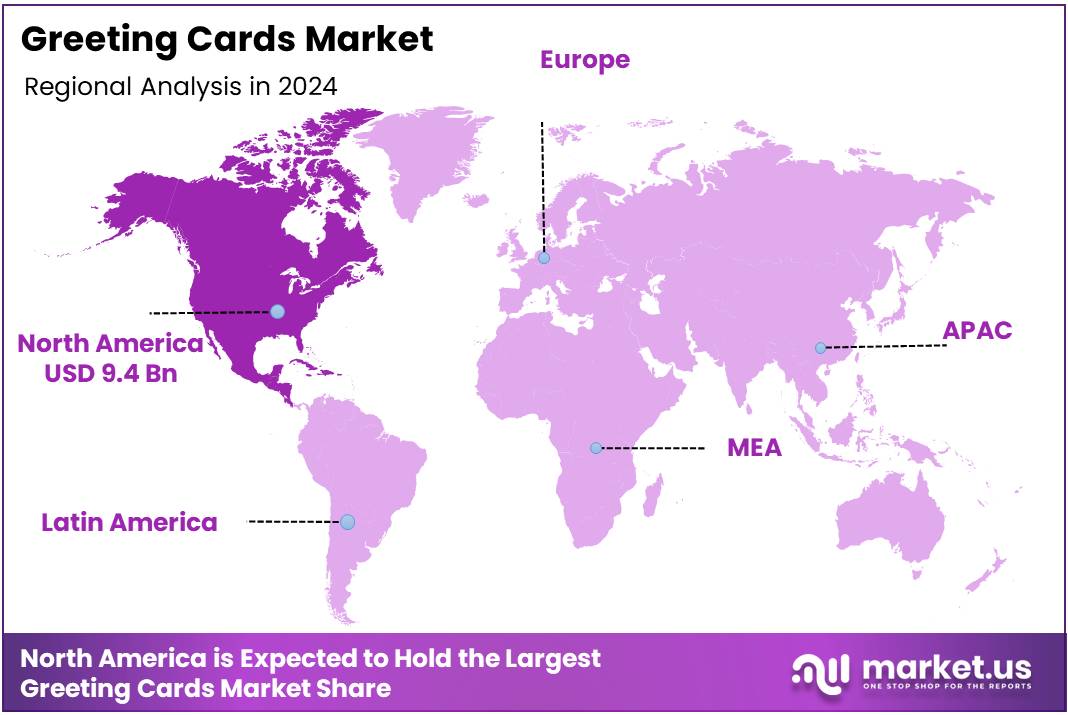

North America Dominates the Greeting Cards Market with a Market Share of 47.3%, Valued at USD 9.4 Billion

North America held the leading position in the global greeting cards market, capturing 47.3% share and generating USD 9.4 Billion in revenue. The region benefits from strong cultural traditions around seasonal gifting and a well-established retail infrastructure. Additionally, the rising adoption of premium, personalized, and occasion-specific cards continues to strengthen regional demand.

Europe Greeting Cards Market Trends

Europe maintains a steady demand for greeting cards due to its strong gifting culture and popularity of festive celebrations. The region shows increasing interest in sustainable, recycled paper cards as consumer preference shifts toward eco-friendly formats. Growth is further supported by expanding online distribution channels offering wider design choices.

Asia Pacific Greeting Cards Market Trends

Asia Pacific is emerging as a fast-growing market driven by rising disposable incomes and the expanding influence of Western gifting practices. Digital-print hybrid cards and customizable designs are gaining popularity, especially among younger consumers. The rapid expansion of e-commerce platforms also enhances accessibility across urban and semi-urban areas.

Middle East & Africa Greeting Cards Market Trends

The Middle East & Africa region shows increasing demand supported by cultural celebrations, religious festivals, and growing interest in premium-format greeting cards. Urbanization and expanding retail networks are driving the adoption of modern card designs. The rising penetration of online gifting platforms further contributes to market growth.

Latin America Greeting Cards Market Trends

Latin America exhibits stable market growth backed by strong emotional gifting traditions and rising celebration-based spending. Consumers are increasingly drawn to vibrant, themed, and handcrafted card designs. Growing retail modernization and digital gifting channels also support wider product availability across the region.

U.S. Greeting Cards Market Trends

The U.S. remains one of the most influential national markets due to high spending on holiday, birthday, and special-occasion cards. Growth in personalized and limited-edition designs continues to attract consumers across age groups. Strong online and store-based distribution networks further support consistent market demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Greeting Cards Company Insights

American Greeting Corporation remains a market stalwart in 2024, leveraging broad retail partnerships and diversified product lines to sustain revenue. As an analyst, I note their pragmatic mix of licensed content and seasonal innovation, which cushions cyclicality. However, they face margin pressure from raw material costs and growing digital alternatives.

Archies Limited continues to dominate several regional segments through strong brand recognition and extensive offline retail reach. They have cautiously expanded digital channels while preserving localized designs that resonate culturally. Still, scaling e-commerce profitably amid discount-driven competition is a strategic challenge.

Avanti Press Inc. differentiates through niche licensing and vibrant pop-culture tie-ins, enabling premium price points in specialty channels. Their agile design pipeline and focus on quality printing drive repeat buyers. Yet, limited global distribution constrains rapid top-line growth compared with larger peers.

Budget Greeting Cards Ltd. competes on value, occupying price-sensitive segments with high SKU turnover and broad mass-market distribution. Their strength lies in cost-efficient manufacturing and fast replenishment cycles, which support everyday volume. Conversely, reliance on low margins makes investment in premiumization and sustainability initiatives more difficult.

Overall, these four players illustrate varied strategic approaches: scale and licensing, regional brand strength, niche premiumization, and cost leadership. As market dynamics shift toward hybrid digital-print products and eco-friendly materials, successful firms will be those that balance operational efficiency with targeted innovation and channel diversification.

Top Key Players in the Market

- American Greeting Corporation

- Archies Limited

- Avanti Press Inc.

- Budget Greeting Cards Ltd.

- Card Factory plc

- Carlton Cards Ltd.

- Crane & Co.

- Galison Publishing LLC

- Hallmark Cards, Inc.

- IG Design Group Plc

- John Sands Ltd.

Recent Developments

- In November 2025, a leading online greeting card platform launched an AI image generator that enables users to create fully unique and highly personalized card designs, enhancing creative freedom. This update strengthens digital customization and improves user engagement across key festive and everyday occasions.

- In July 2025, a major U.S. publisher announced the acquisition of a boutique design brand, integrating its signature silkscreen-inspired and art-focused styles. This move expands the company’s premium creative portfolio and supports growth in the high-value artistic card segment.

- In October 2024, a global greeting card leader expanded its digital gifting line by introducing combined physical cards with digital gift cards for more meaningful personal gifting. This innovation improves convenience for consumers while strengthening hybrid physical-digital engagement.

- In July 2024, a major photo-product platform launched its new Card Studio to enhance personalized card creation on both mobile and web. The feature improves user experience by offering more templates, customization tools, and seamless design workflows.

Report Scope

Report Features Description Market Value (2024) USD 19.9 Billion Forecast Revenue (2034) USD 25.5 Billion CAGR (2025-2034) 2.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Traditional Card, E-card),By Type (Folded, Flat),By Product (Personalized, Thank You, Farewell),By End-User (Women, Men),By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape American Greeting Corporation, Archies Limited, Avanti Press Inc., Budget Greeting Cards Ltd., Card Factory plc, Carlton Cards Ltd., Crane & Co., Galison Publishing LLC, Hallmark Cards, Inc., IG Design Group Plc, John Sands Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Greeting Corporation

- Archies Limited

- Avanti Press Inc.

- Budget Greeting Cards Ltd.

- Card Factory plc

- Carlton Cards Ltd.

- Crane & Co.

- Galison Publishing LLC

- Hallmark Cards, Inc.

- IG Design Group Plc

- John Sands Ltd.