Glycated Albumin Assay Market By Product Type (Human-based and Animal-based) By Application (Type 2 Diabetes, Type 1 Diabetes, and Prediabetes) By End-User (Hospitals & Diabetic Care Centers, Diagnostic Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156443

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

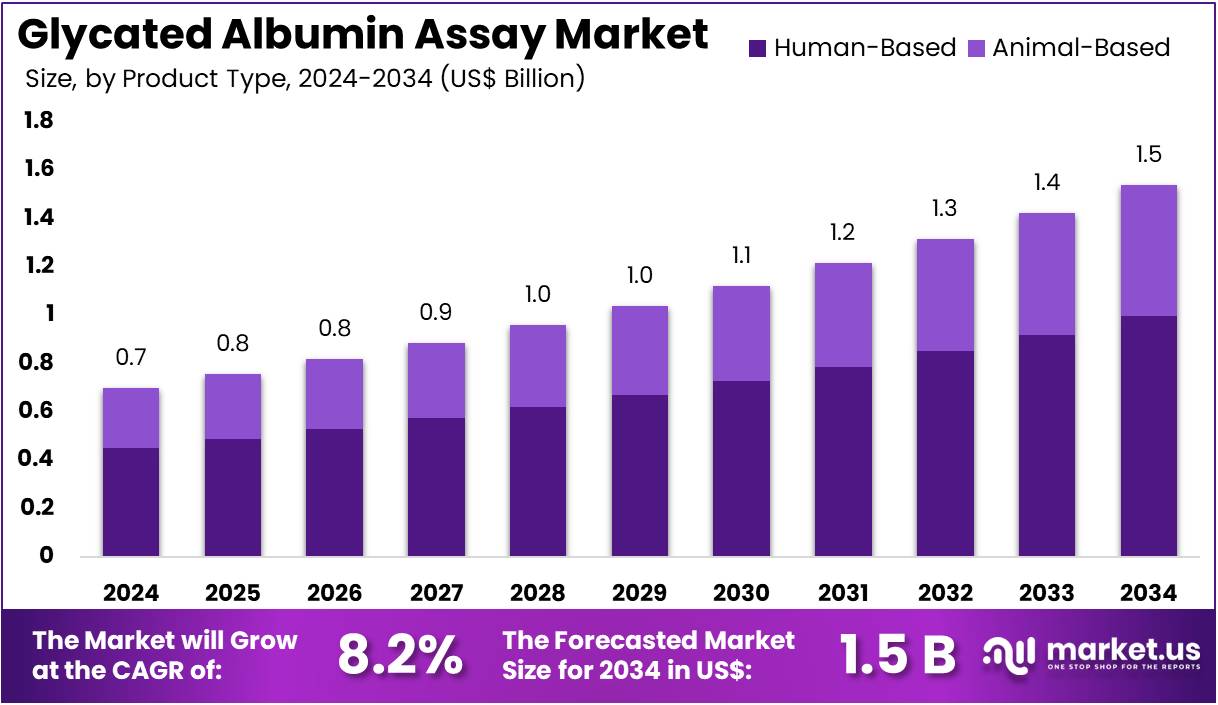

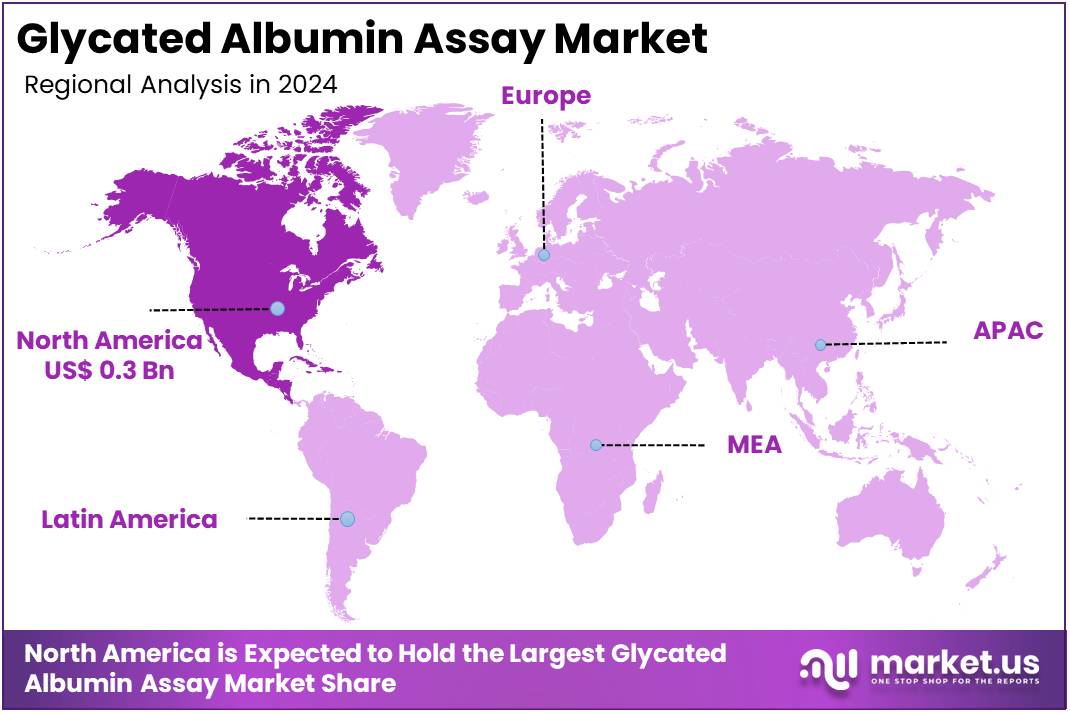

The Glycated Albumin Assay Market Size is expected to be worth around US$ 1.5 billion by 2034 from US$ 0.7 billion in 2024, growing at a CAGR of 8.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.1% share and holds US$ 0.3 Billion market value for the year.

Rising global prevalence of diabetes is a primary driver for the glycated albumin assay market, as healthcare professionals require more accurate and timely diagnostic tools. With over 800 million people worldwide now living with diabetes, cases have quadrupled since 1990, according to the World Health Organization (WHO), creating an immense demand for effective monitoring.

While the HbA1c test remains the gold standard for long-term glycemic control, its limitations in patients with conditions affecting red blood cell turnover—such as anemia, chronic kidney disease, or pregnancy—are driving the adoption of glycated albumin assays. This specialized test provides a more accurate picture of average blood glucose levels over a two-to-three-week period, which is crucial for assessing the effectiveness of recent treatment adjustments and guiding clinical decisions.

Growing applications of glycated albumin assays in high-risk patient populations and clinical research are creating new opportunities for market expansion. The glycated albumin assay is gaining traction for its utility in monitoring patients with gestational diabetes, who require frequent and precise glucose checks to ensure the health of both mother and baby.

The Centers for Disease Control and Prevention (CDC) reports that gestational diabetes affects up to 10% of pregnancies in the United States each year, underscoring this significant clinical need. The assay is also a valuable tool for monitoring diabetic patients on hemodialysis and those with hemoglobinopathies, where HbA1c results are unreliable. Furthermore, the National Institutes of Health (NIH) is increasingly funding research that explores the role of glycated albumin as a predictor of diabetes complications, highlighting its importance beyond simple glucose monitoring.

Increasing technological advancements in assay development and automation are making these tests more accessible and widely adopted. The shift towards enzymatic methods that are simpler to operate and can be integrated into existing automated laboratory equipment is lowering the barrier for entry for many clinical laboratories. The development of more sensitive and specific assays, coupled with ongoing clinical validation, is building confidence among healthcare professionals.

The International Diabetes Federation (IDF) estimates that diabetes was responsible for 3.4 million deaths in 2024, or one every nine seconds, emphasizing the urgent need for tools that can facilitate rapid and effective patient management. This robust demand, combined with the continuous innovation in the diagnostic space, ensures a strong and sustained growth trajectory for the glycated albumin assay market.

Key Takeaways

- In 2024, the market for glycated albumin assay generated a revenue of US$ 0.7 billion, with a CAGR of 8.2%, and is expected to reach US$ 1.5 billion by the year 2034.

- The product type segment is divided into human-based and animal-based, with human-based taking the lead in 2023 with a market share of 64.7%.

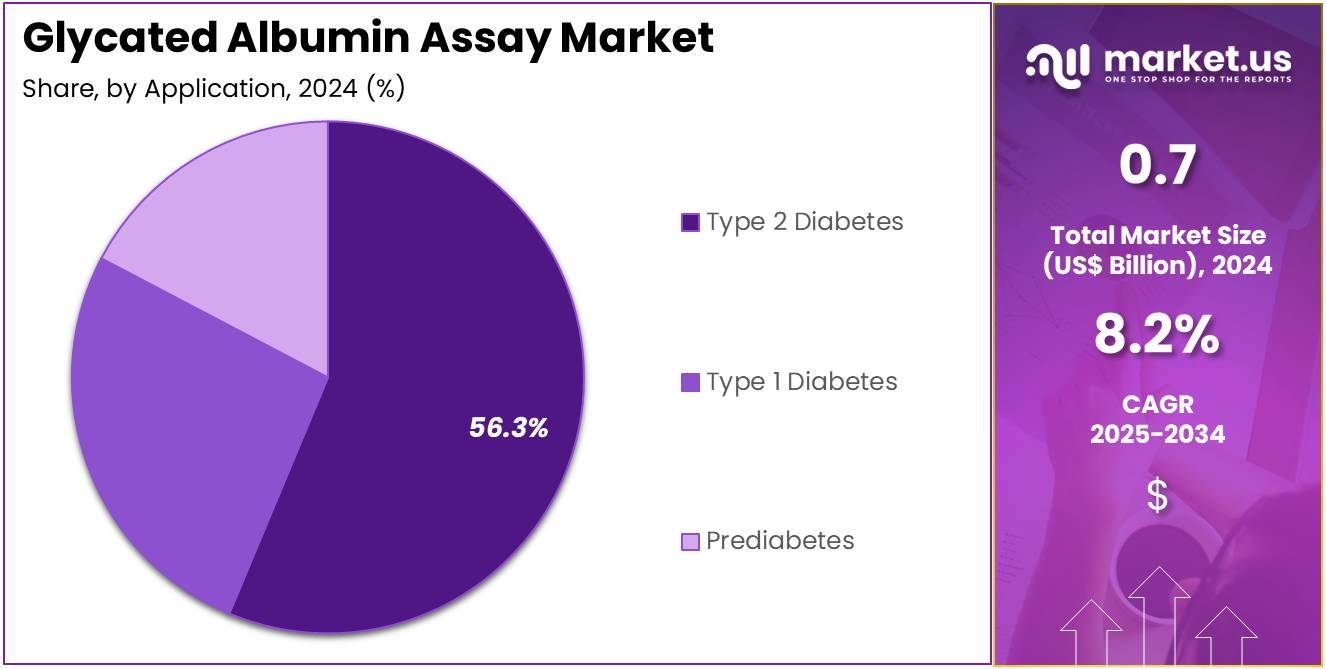

- Considering application, the market is divided into type 2 diabetes, type 1 diabetes, and prediabetes. Among these, type 2 diabetes held a significant share of 56.3%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & diabetic care centers, diagnostic laboratories, and others. The hospitals & diabetic care centers sector stands out as the dominant player, holding the largest revenue share of 62.2% in the glycated albumin assay market.

- North America led the market by securing a market share of 39.1% in 2023.

Product Type Analysis

Human-based glycated albumin assays hold the largest share of 64.7% in the market. This growth is expected to continue due to the increasing demand for more accurate and reliable diagnostic tools for diabetes and prediabetes. Human-based assays are preferred for their closer correlation with human physiology, offering better diagnostic accuracy compared to animal-based alternatives. As the global incidence of diabetes continues to rise, particularly type 2 diabetes, the demand for human-based assays is anticipated to increase.

Additionally, human-based assays are expected to see wider adoption in hospitals and diabetic care centers, where precision in monitoring glycated albumin levels is critical for effective patient management. Advances in assay technology, including the development of more sensitive and rapid testing methods, are likely to drive the continued growth of the human-based glycated albumin assay segment. The increasing focus on personalized medicine and improved diabetes management is also projected to contribute to the growth of this segment.

Application Analysis

Type 2 diabetes accounts for 56.3% of the application segment in the glycated albumin assay market. The segment’s growth is expected to continue as the global prevalence of type 2 diabetes increases, particularly due to lifestyle changes, aging populations, and rising obesity rates. The demand for effective diagnostic tests to monitor diabetes and assess long-term complications is projected to rise, with glycated albumin assays playing a key role in providing accurate short-term glycemic control measurements.

As the awareness of diabetes management improves, healthcare providers are expected to increasingly rely on glycated albumin assays for early diagnosis and ongoing monitoring of diabetic patients. Advances in assay technology, coupled with a growing focus on improving diabetes care outcomes, will likely enhance the demand for type 2 diabetes diagnostic tools. The rise in the adoption of point-of-care testing devices is expected to drive further market growth, particularly in outpatient and remote settings. Additionally, healthcare reforms aimed at improving the diagnosis and management of diabetes are anticipated to boost the adoption of these assays.

End-User Analysis

Hospitals and diabetic care centers represent 61.2% of the end-user segment in the glycated albumin assay market. This growth is expected to continue as hospitals remain the primary settings for diabetes diagnosis and management. Hospitals play a crucial role in managing patients with diabetes, and the increasing demand for accurate and timely testing is expected to drive the adoption of glycated albumin assays. The rising global prevalence of diabetes, particularly type 2 diabetes, is likely to further expand the market for these diagnostic tools.

Hospitals and diabetic care centers are expected to prioritize the adoption of advanced diagnostic tests, such as glycated albumin assays, to improve patient outcomes, enhance disease monitoring, and reduce healthcare costs in the long term. With the growing focus on early detection and the management of diabetes-related complications, these facilities are projected to continue to be key contributors to the growth of the market. Furthermore, the integration of glycated albumin assays with digital health platforms for real-time monitoring is expected to accelerate the adoption of these tests in clinical settings.

Key Market Segments

Bu Product Type

- Human-based

- Animal-based

By Application

- Type 2 Diabetes

- Type 1 Diabetes

- Prediabetes

By End-user

- Hospitals & Diabetic Care Centers

- Diagnostic Laboratories

- Others

Drivers

The rising prevalence of diabetes and a growing need for intermediate-term glycemic monitoring are driving the market

The glycated albumin assay market is experiencing significant growth, primarily driven by the escalating global prevalence of diabetes and the need for more nuanced diagnostic tools. While the HbA1c test remains the standard for long-term monitoring, its limitations in certain patient populations are creating a critical need for alternative biomarkers. For example, individuals with conditions affecting red blood cell turnover, such as chronic kidney disease or anemia, have inaccurate HbA1c readings.

According to the US Centers for Disease Control and Prevention (CDC), an estimated 35.5 million adults in the US had chronic kidney disease in 2023, representing a substantial patient base for whom glycated albumin is a more reliable monitoring tool. Additionally, glycated albumin provides a critical two to three-week snapshot of glycemic control, making it ideal for evaluating the effectiveness of a recent change in medication or diet. This ability to provide faster feedback is essential for clinicians who must make timely treatment adjustments, thereby supporting a more dynamic and personalized approach to diabetes management.

Restraints

The high cost and lack of widespread clinical awareness are restraining the market

A significant restraint on the market is the relatively higher cost of the assay compared to the universally adopted HbA1c test, which limits its routine use in many healthcare systems. Since HbA1c testing is often less expensive and has well-established reimbursement codes, healthcare providers and payers may favor it over the more specialized glycated albumin assay.

Additionally, while the clinical utility of glycated albumin is well-documented in certain niches, there is a lack of widespread awareness and consensus among general practitioners regarding its regular use. Many clinicians are not fully familiar with the specific patient populations for whom this assay is most beneficial, leading to its underutilization. This is a common challenge for new diagnostic methods that compete with a long-standing, ingrained standard. Until its clinical guidelines are more broadly integrated and a consensus on its use in routine practice is established, the market is likely to experience resistance to full-scale adoption.

Opportunities

The growing patient population with conditions that invalidate HbA1c testing is creating growth opportunities

The market is presented with significant opportunities from the growing number of patients with underlying health conditions that make HbA1c measurements unreliable. As the prevalence of comorbidities like chronic kidney disease, gestational diabetes, and hemolytic anemia continues to rise, clinicians are actively searching for alternative diagnostic tools. For example, a 2024 analysis presented at an American Society of Nephrology meeting highlighted that the number of chronic kidney disease cases among women around the globe nearly tripled in the last three decades, with significant increases particularly in North America.

Glycated albumin serves as a precise and independent marker of glycemic control in this specific patient cohort, making it an indispensable tool for their diabetes management. The same is true for pregnant women with gestational diabetes, where rapid changes in physiology make HbA1c an unsuitable marker. The World Health Organization (WHO) reported that in 2024, the number of people with diabetes exceeded 800 million, and a growing percentage of this population is projected to develop comorbidities that will necessitate more accurate short-term glycemic markers.

Latest Trends

The development of automated testing platforms is a recent trend

A significant trend in 2024 is the shift toward more automated and accessible testing platforms, which is revolutionizing how these assays are performed in clinical settings. Historically, these assays required specialized laboratory procedures, which limited their use to large, centralized labs. However, recent advancements in automated clinical chemistry analyzers now permit the efficient and high-throughput measurement of glycated albumin, making it a more practical option for hospitals and diagnostic laboratories of all sizes.

The ability to integrate this test into existing automated workflows has significantly reduced the time and labor required per test, thereby lowering the effective cost for the end-user. This automation trend is driven by the broader push for laboratory efficiency and faster turnaround times for patient results. The development of these automated platforms is also anticipated to pave the way for increased adoption in a wider range of clinical settings, democratizing access to this valuable biomarker and enabling more responsive patient care.

Impact of Macroeconomic / Geopolitical Factors

The glycated albumin market is navigating a complex macroeconomic and geopolitical environment, where economic trends and trade policies significantly influence operational costs and market access. Persistent global inflation has directly elevated the cost of critical reagents, enzymes, and specialized laboratory equipment, squeezing profit margins for manufacturers of these diagnostic tests. According to a recent report by the American Hospital Association (AHA), tariffs on imported medical devices and reagents have risen substantially, with duties of up to 54% on certain Chinese-origin products and 20% on imports from the European Union. These duties are forcing US-based diagnostic labs and hospitals to grapple with increased procurement costs.

Geopolitical risks, particularly those affecting key global shipping lanes, also create supply chain volatility, causing delays and potential shortages of essential raw materials. Despite these headwinds, the market demonstrates remarkable resilience. The rising global prevalence of diabetes, which the WHO projects will affect over 700 million people by 2045, ensures sustained and growing demand for advanced diabetes management tools. Furthermore, US tariff policies, while challenging, are increasingly spurring domestic investment, fostering a more resilient and secure national supply chain for critical diagnostics.

Regional Analysis

North America is leading the Glycated Albumin Assay Market

The glycated albumin assay market in North America held a significant 39.1% share of the global market in 2024. This leadership is directly tied to the high and rising prevalence of diabetes and prediabetes in the region, coupled with a sophisticated healthcare infrastructure. For instance, the Centers for Disease Control and Prevention (CDC) estimated that 38.4 million Americans, or 11.6% of the US population, had diabetes in 2021, with an additional 97.6 million adults having prediabetes.

The market’s growth is also a result of the limitations of the traditional HbA1c test in certain patient populations, such as those with chronic kidney disease or anemia. Glycated albumin assays provide a more accurate and reliable measure of short-term glycemic control for these patients. The emphasis on personalized medicine and the development of advanced diagnostic technologies by key players further propel market expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific glycated albumin assay market is anticipated to experience robust growth during the forecast period. This is largely a result of the region’s rapidly growing population and a significant increase in the prevalence of diabetes. The International Diabetes Federation (IDF) projects that the number of people with diabetes in the Asia Pacific region will reach 589 million by 2050, highlighting a substantial patient pool requiring advanced monitoring tools. This region’s growth is also a result of improving healthcare infrastructure and increasing government initiatives focused on diabetes management.

For instance, the World Health Organization’s (WHO) Regional Committee for South-East Asia endorsed the SEAHEARTS program in 2023, which aims to place 100 million people with diabetes and hypertension on protocol-based management by 2025. These initiatives are likely to increase the adoption of glycated albumin assays, which provide a more dynamic measure of glycemic control than traditional methods.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market for glycated albumin assays are driving growth by implementing a strategic focus on product innovation, geographical expansion, and automation. Companies are developing more precise and user-friendly enzymatic assays and reagents compatible with high-throughput clinical analyzers, which enhances efficiency in diagnostic laboratories.

They are also actively expanding their commercial presence into emerging economies, where the rising prevalence of diabetes and improving healthcare infrastructure create new opportunities for rapid and effective diagnostic tools. Furthermore, manufacturers are increasingly creating point-of-care testing solutions and integrating their data with digital health platforms to support real-time monitoring and personalized diabetes care.

Asahi Kasei Pharma, a subsidiary of the global Japanese conglomerate Asahi Kasei Corporation, is a key player in the healthcare sector. The company focuses on developing world-class drugs in therapeutic fields such as orthopedics and critical care, but its healthcare segment also produces diagnostic reagents. Asahi Kasei has a strong presence in the glycated albumin market, providing innovative assay solutions and consistently introducing new diagnostic products to improve diabetes management worldwide.

Top Key Players in the Glycated Albumin Assay Market

- Tosoh Bioscience

- Randox Laboratories

- Ortho Clinical Diagnostics

- Life Span Bio Sciences

- Fujirebio

- EKF Diagnostics

- Diazyme Laboratories

- Biocompare

- Beckman Coulter

- Asahi Kasei Pharma

- ARKRAY

- Abnova

Recent Developments

- On February 2, 2023: Biocompare, a prominent life science product directory, revealed its collaboration with Scilan, a key player in AI and machine learning solutions for life science tool providers. This partnership aims to enhance Biocompare’s development of innovative artificial intelligence-driven glycated albumin assays.

- On January 24, 2023: Diazyme Laboratories, Inc., a certified medical device manufacturer, announced a strategic alliance with Carolina Liquid Chemistries Corp, a leading supplier of chemistry instruments and reagents, to advance their product offerings and expand their reach in the healthcare sector.

Report Scope

Report Features Description Market Value (2024) US$ 0.7 billion Forecast Revenue (2034) US$ 1.5 billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Human-based and Animal-based) By Application (Type 2 Diabetes, Type 1 Diabetes, and Prediabetes) By End-User (Hospitals & Diabetic Care Centers, Diagnostic Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tosoh Bioscience, Randox Laboratories, Ortho Clinical Diagnostics, Life Span Bio Sciences, Fujirebio, EKF Diagnostics, Diazyme Laboratories, Biocompare, Beckman Coulter, Asahi Kasei Pharma, ARKRAY, Abnova. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glycated Albumin Assay MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Glycated Albumin Assay MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tosoh Bioscience

- Randox Laboratories

- Ortho Clinical Diagnostics

- Life Span Bio Sciences

- Fujirebio

- EKF Diagnostics

- Diazyme Laboratories

- Biocompare

- Beckman Coulter

- Asahi Kasei Pharma

- ARKRAY

- Abnova