Global Gluten-Free Pasta Market Size, Share, And Enhanced Productivity By Raw Material (Chickpeas, Brown Rice, Multigrain, Lentil, Others), By Product Type (Dried, Instant, Canned and Frozen), By Shape (Spaghetti, Penne, Fusilli, Macaroni, Other), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience/Grocery Stores, E-commerce), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169263

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

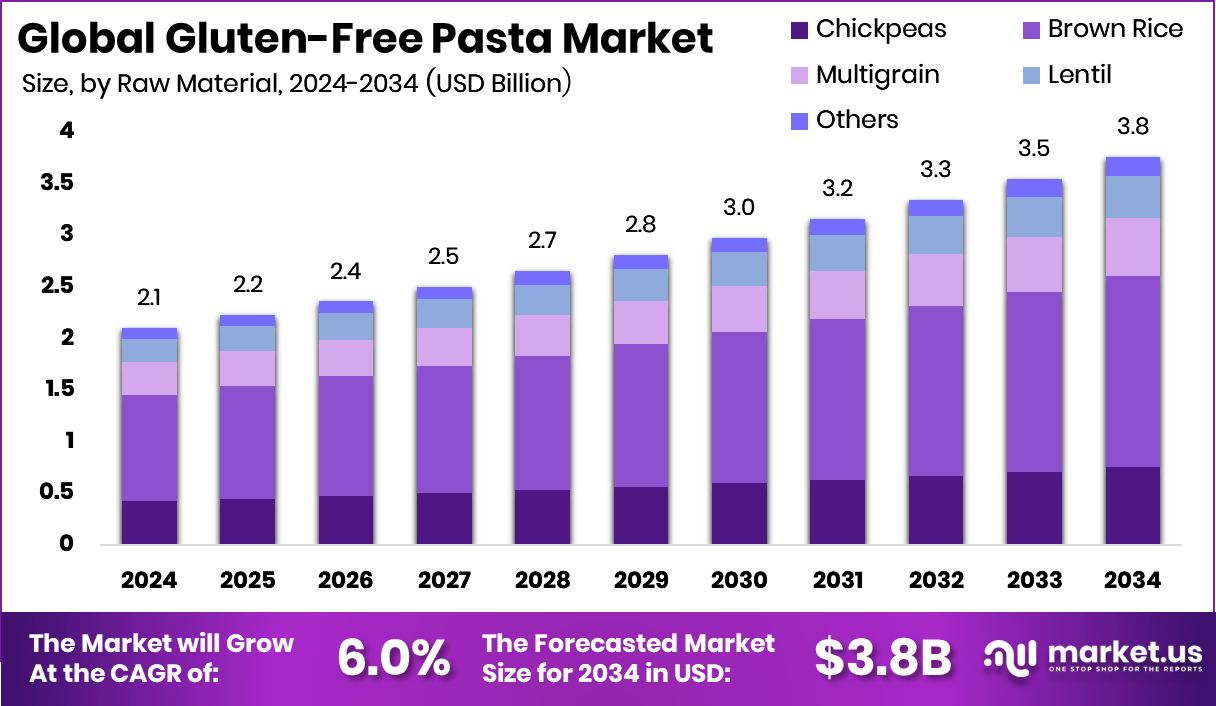

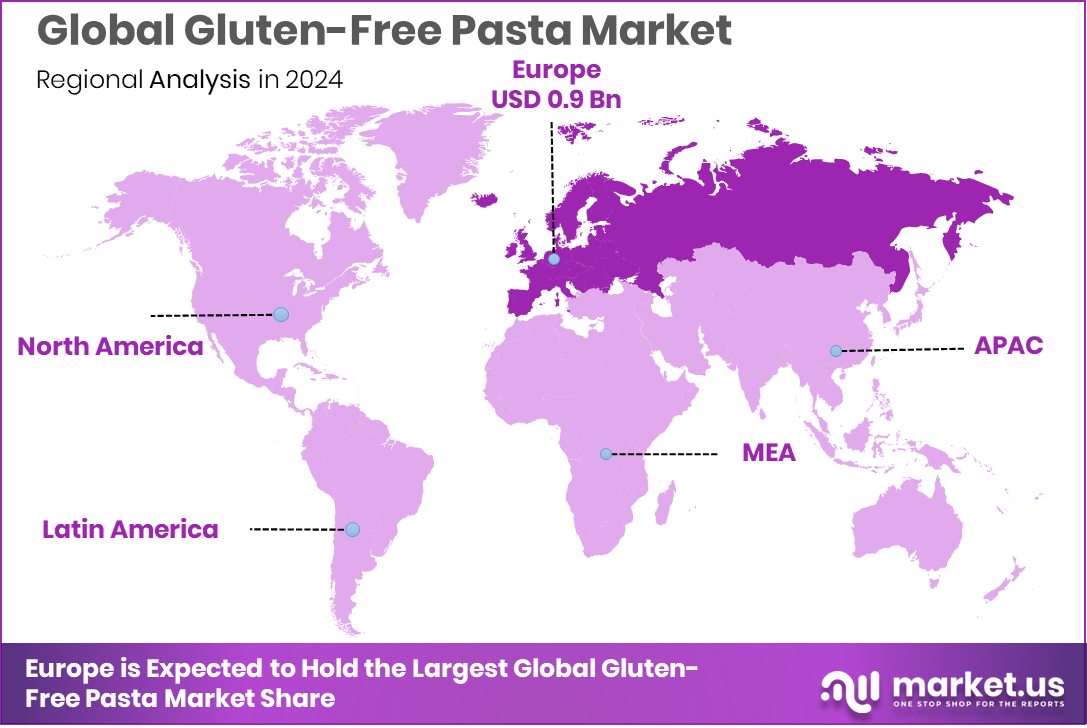

The Global Gluten-Free Pasta Market is expected to be worth around USD 3.8 billion by 2034, up from USD 2.1 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034. The European Gluten-Free Pasta Market achieved 45.9% dominance, generating USD 0.9 Bn in value.

Gluten-free pasta is a type of pasta made without wheat or other gluten-containing grains. It is commonly produced using rice, corn, lentils, chickpeas, quinoa, or blends of these ingredients. The goal is to deliver a texture and taste close to traditional pasta while remaining safe for people with gluten intolerance or those choosing gluten-free diets for lifestyle reasons.

The gluten-free pasta market represents the production and sale of these wheat-free pasta products across retail, foodservice, and online channels. The market has moved beyond medical needs and is now part of everyday eating habits, driven by interest in clean labels, plant-based foods, and higher-protein grain alternatives.

A key growth factor is rising investment activity that helps scale production and product innovation. Start-ups and manufacturers have secured funding rounds of $11.5 million, $20 million, and multiple early-stage investments of $1.3 million, supporting high-protein pulses, new product formats, and wider geographic reach. In Europe, a traditional pasta producer plans a UK manufacturing plant backed by $1.5 million in regional funding.

Demand is increasing as consumers seek pasta options that are easier to digest, rich in protein and fiber, and suitable for flexitarian and health-focused diets. Retail shelves now treat gluten-free pasta as a mainstream choice rather than a niche substitute.

Opportunities remain strong in foodservice, private labels, and fortified recipes. Continued funding into pulse crops and local manufacturing is expected to improve affordability, taste, and availability, helping gluten-free pasta become a regular pantry staple.

Key Takeaways

- The Global Gluten-Free Pasta Market is expected to be worth around USD 3.8 billion by 2034, up from USD 2.1 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- In the Gluten-Free Pasta Market, brown rice dominates raw materials, accounting for a 49.2% share globally today.

- Within the Gluten-Free Pasta Market, dried products lead product types, representing 69.4% of overall demand worldwide currently.

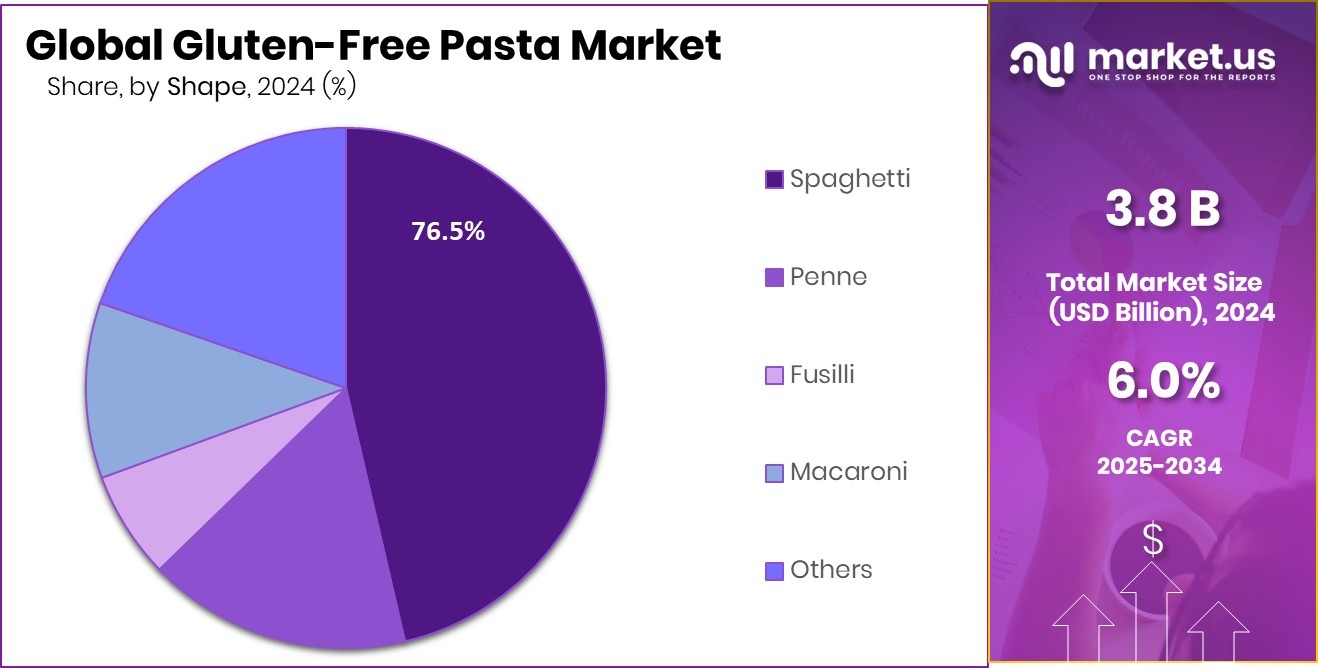

- Spaghetti remains the most preferred shape in the Gluten-Free Pasta Market, holding 76.5% market share globally.

- Supermarkets and hypermarkets dominate distribution channels in the Gluten-Free Pasta Market, capturing 52.6% of sales volume worldwide.

- Growing health awareness across Europe supported the Gluten-Free Pasta Market at 45.9% share and USD 0.9 Bn.

By Raw Material Analysis

In the Gluten-Free Pasta Market, brown rice dominates raw materials, holding a 49.2% share.

In 2024, Brown Rice held a dominant market position in the By Raw Material segment of the Gluten-Free Pasta Market, with a 49.2% share. This leadership reflects the strong consumer preference for simple, well-known gluten-free ingredients that deliver both nutrition and familiarity.

Brown rice is widely accepted due to its neutral taste, smooth texture after cooking, and natural gluten-free profile, making it suitable for households seeking everyday meal options. Its whole-grain nature also aligns well with clean-label and balanced-diet trends, supporting its widespread adoption across retail and foodservice channels.

Manufacturers continue to rely on brown rice as a core raw material because it offers a consistent supply, stable processing characteristics, and predictable quality. As gluten-free foods become part of regular diets rather than specialized purchases, brown rice-based pasta remains a trusted and preferred choice, reinforcing its strong share within the raw material segmentation of the gluten-free pasta market.

By Product Type Analysis

The Gluten-Free Pasta Market favors dried products, accounting for 69.4% of total consumption.

In 2024, Dried held a dominant market position in the By Product Type segment of the Gluten-Free Pasta Market, with a 69.4% share. This strong position is driven by the broad acceptance of dried pasta as a pantry staple among consumers seeking convenience and longer shelf life.

Dried gluten-free pasta fits well into everyday cooking habits, offering ease of storage, simple preparation, and consistency in texture when cooked properly. Its compatibility with home kitchens and foodservice operations alike supports steady demand across multiple distribution channels.

Producers also favor dried formats due to efficient transportation, reduced spoilage risk, and flexibility in packaging sizes. As gluten-free eating becomes more routine rather than occasional, dried gluten-free pasta continues to meet practical needs for affordability, reliability, and familiarity, reinforcing its leading share within the product type segmentation of the market.

By Shape Analysis

Spaghetti shapes lead the Gluten-Free Pasta Market, representing a strong 76.5% share globally.

In 2024, Spaghetti held a dominant market position in the By Shape segment of the Gluten-Free Pasta Market, with a 76.5% share. This dominance reflects the strong familiarity and everyday use of spaghetti across global cuisines, making it an easy transition point for consumers moving away from traditional wheat-based pasta.

Gluten-free spaghetti closely matches the cooking behavior and serving versatility expected from conventional pasta, supporting wide household acceptance. Its simple shape allows consistent results when made with gluten-free raw materials, helping maintain texture and appearance during cooking. Retailers and foodservice outlets also favor spaghetti due to its high turnover and broad consumer appeal.

As gluten-free diets become part of regular eating habits, spaghetti remains the most trusted and preferred shape, securing its leading position within the shape-based segmentation of the gluten-free pasta market.

By Distribution Channel Analysis

Supermarkets and hypermarkets drive sales in the Gluten-Free Pasta Market with a 52.6% share.

In 2024, Spaghetti held a dominant market position in the By Distribution Channel segment of the Gluten-Free Pasta Market, with a 52.6% share. This leadership highlights the strong presence and consistent availability of spaghetti-style gluten-free pasta across key sales channels that prioritize high-demand formats.

Its familiar appeal makes it a preferred option for both first-time and repeat buyers, supporting steady volume movement at the point of sale. The format’s standardized packaging and easy shelf placement also improve visibility and consumer access, reinforcing its dominance within distribution networks.

Regular purchasing behavior further strengthens its position, as consumers often rely on spaghetti as a staple item in their gluten-free pantry. As demand for reliable, everyday gluten-free options continues to grow, spaghetti maintains a strong foothold within the distribution channel segmentation of the market.

Key Market Segments

By Raw Material

- Chickpeas

- Brown Rice

- Multigrain

- Lentil

- Others

By Product Type

- Dried

- Instant

- Canned and Frozen

By Shape

- Spaghetti

- Penne

- Fusilli

- Macaroni

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience/Grocery Stores

- E-commerce

Driving Factors

Investment Boosts Innovation And Ingredient Supply Growth

One major driving factor of the gluten-free pasta market is rising investment in better raw materials and ingredient innovation. Funding is helping companies improve crop quality, protein content, and consistency, which directly benefits gluten-free pasta made from pulses and legumes.

For example, NuCicer raised $11.5 million to scale high-protein chickpeas and speed up its predictive breeding platform, supporting stronger and more nutritious base ingredients for gluten-free foods. In addition, chickpea snack maker Biena secured $8 million to drive brand growth, reflecting growing investor confidence in pulse-based food categories. These investments improve farming efficiency, ingredient availability, and product quality.

As a result, gluten-free pasta producers gain access to better raw materials, improved taste, and higher nutritional value, making gluten-free pasta more appealing to everyday consumers and accelerating overall market growth.

Restraining Factors

High Production Costs Limit Wider Consumer Access

One major restraining factor in the gluten-free pasta market is the high cost of production compared to regular wheat pasta. Producing gluten-free pasta requires special raw materials, dedicated processing facilities, and strict contamination controls, all of which increase manufacturing expenses. These costs are often passed on to consumers, making gluten-free pasta less affordable for price-sensitive buyers. Even as companies invest to improve efficiency, scaling remains a challenge.

For example, Chickapea raised C$4.25 million to support growth and expand its operations, highlighting the need for continued capital just to manage production complexity and supply stability.

While such funding helps companies improve processes and ingredient sourcing, it also shows that gluten-free pasta still depends heavily on external investment to overcome cost barriers, which slows mass adoption and limits penetration in value-focused markets.

Growth Opportunity

Expanding Protein-Rich Gluten-Free Pasta Product Lines

A major growth opportunity in the gluten-free pasta market lies in the expansion of high-protein and nutrition-focused product lines. Consumers are no longer looking only for gluten-free labels; they also want better protein content, fiber, and balanced nutrition in everyday foods. This shift creates strong space for pasta made from pulses and advanced ingredient blends. Business growth is supported by leadership and capital aimed at scaling such innovation.

For instance, ChickP completed an $8 million Series A funding round alongside the appointment of a new CEO, signaling a clear focus on expansion and product development. This funding supports broader production, improved formulations, and wider market reach.

As protein-rich diets gain popularity, gluten-free pasta brands that meet both health and taste expectations are well-positioned to capture new consumers and expand their footprint across retail and foodservice channels.

Latest Trends

Community Engagement Strengthens Trust In Gluten-Free Brands

A key latest trend in the gluten-free pasta market is the growing focus on community involvement and local impact alongside product quality. Brands are increasingly building trust by supporting local communities, farmers, and social initiatives rather than relying only on marketing. This approach helps create a stronger emotional connection with consumers who value responsible business practices.

An example of this trend is Chickpea Group donating £20,000 to community groups in Wiltshire, showing how food-focused businesses are investing in social value. Such actions improve brand perception and encourage long-term customer loyalty.

Consumers today prefer gluten-free products from companies that demonstrate care beyond profits, including social well-being and regional support. As community-centered efforts gain importance, this trend is shaping how gluten-free pasta brands position themselves and engage with customers in a more genuine and people-focused way.

Regional Analysis

Europe dominated the Gluten-Free Pasta Market with a 45.9% share, reaching a USD 0.9 Bn value.

The Gluten-Free Pasta Market shows varied development across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, shaped mainly by dietary habits, health awareness, and food accessibility. Among all regions, Europe emerged as the dominating regional market, holding a 45.9% share and reaching a value of USD 0.9 Bn. This leadership reflects strong consumer adoption of gluten-free diets, wide product availability, and established demand across household and foodservice consumption.

North America represents a mature market where gluten-free foods are widely accepted as part of daily diets. Consumers in this region actively seek alternatives to traditional wheat-based products, supporting steady demand for gluten-free pasta across retail channels.

The Asia Pacific region shows growing interest, driven by changing food preferences and increasing awareness of food sensitivities. Urbanization and exposure to global eating habits are gradually supporting gluten-free pasta adoption.

In the Middle East & Africa, demand remains emerging, supported by niche consumer groups seeking specialty and health-oriented foods. Market presence is limited but expanding slowly in urban centers.

Latin America reflects early-stage growth, where gluten-free pasta is gaining visibility primarily through premium retail offerings. Across all regions, Europe maintains clear leadership with 45.9% dominance and USD 0.9 Bn market value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024. Barilla brings strong manufacturing discipline and long-standing pasta expertise into the gluten-free segment. Its approach focuses on maintaining familiar taste and cooking performance, which helps conventional pasta consumers transition more easily to gluten-free options. This reliability supports repeat purchases and mainstream acceptance.

Jovial Foods Inc. stands out for its emphasis on ingredient transparency and traditional processing methods. The company’s gluten-free pasta portfolio reflects a deep focus on simplicity, heritage grains, and clean formulation. This positions Jovial well with consumers who prioritize digestive comfort, authenticity, and minimal processing in their daily diets.

Banza LLC represents the nutrition-forward direction of the market. By emphasizing legume-based pasta with higher protein and fiber content, Banza appeals strongly to health-conscious and younger consumers. Its branding and product innovation align gluten-free needs with modern lifestyle goals such as balanced nutrition and plant-based eating.

Top Key Players in the Market

- Barilla G. e R. F.lli S.p.A.

- Jovial Foods Inc.

- Banza LLC

- Doves Farm Foods Ltd

- Rummo S.p.A

- The Kraft Heinz Company

- ZENB

- Cappello’s

Recent Developments

- In December 2025, Barilla unveiled its new global innovation center in Parma, Italy — named Barilla Innovation & Technology Experience (BITE). This state-of-the-art facility invests in research and development across pasta, sauces, and bakery lines — a move that could accelerate improvements in gluten-free pasta formulation, quality control, and new product development.

- In May 2024, Jovial Foods’ brand Bionaturae — associated with Jovial — received a 2024 NEXTY Award for its “Sourdough Pasta.” While this pasta appears to come from fermenting traditional grains rather than gluten-free pulses, the award signals continued innovation in their pasta portfolio.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 3.8 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Chickpeas, Brown Rice, Multigrain, Lentil, Others), By Product Type (Dried, Instant, Canned and Frozen), By Shape (Spaghetti, Penne, Fusilli, Macaroni, Other), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience/Grocery Stores, E-commerce) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Barilla G. e R. F.lli S.p.A., Jovial Foods Inc., Banza LLC, Doves Farm Foods Ltd, Rummo S.p.A, The Kraft Heinz Company, ZENB, Cappello’s Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Gluten-Free Pasta MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Gluten-Free Pasta MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Barilla G. e R. F.lli S.p.A.

- Jovial Foods Inc.

- Banza LLC

- Doves Farm Foods Ltd

- Rummo S.p.A

- The Kraft Heinz Company

- ZENB

- Cappello's