Global Glufosinate Ammonium Market Size, Share, And Business Benefits By Form (Solid, Liquid, Water-soluble), By Application (Weed Control, Crop Desiccant, Glufosinate-tolerant Crop), By End-Use (Food Crops (Wheat, Rice, Pulses, Others), Cash Crops (Sugarcane, Cotton, Oilseeds, Others), Horticulture Crops (Fruits, Vegetables, Plantation Crops, Tea, Coffee, Others), Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155612

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

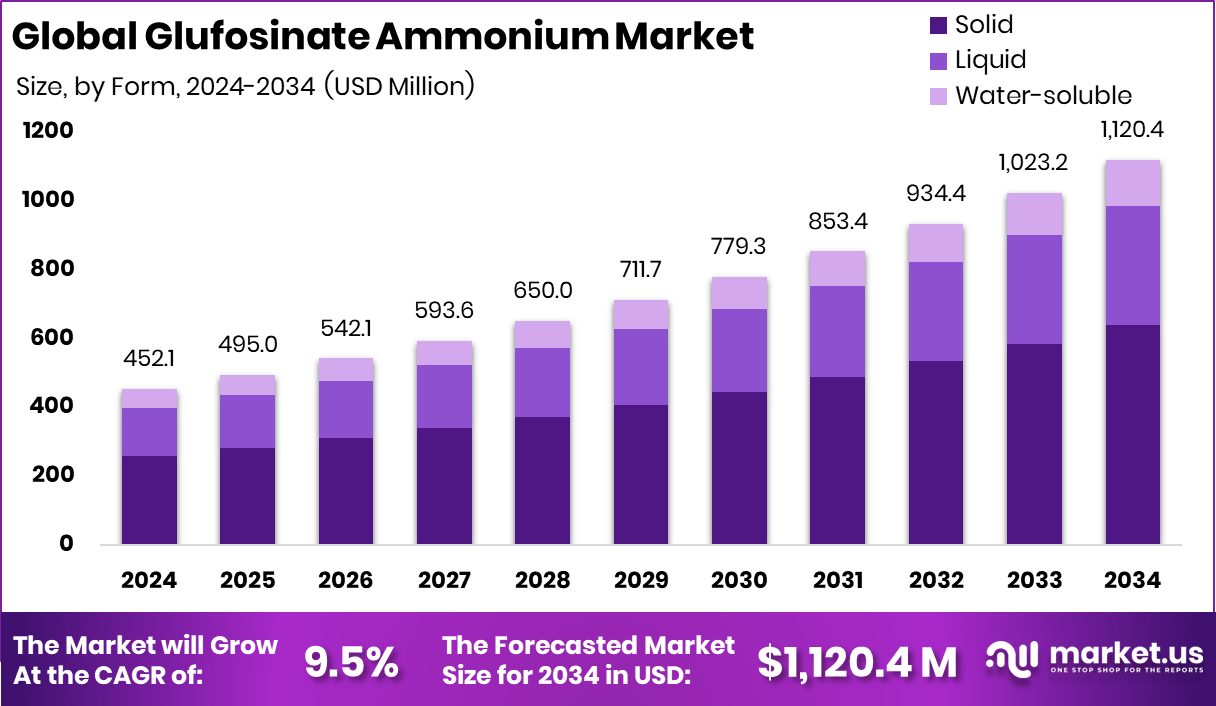

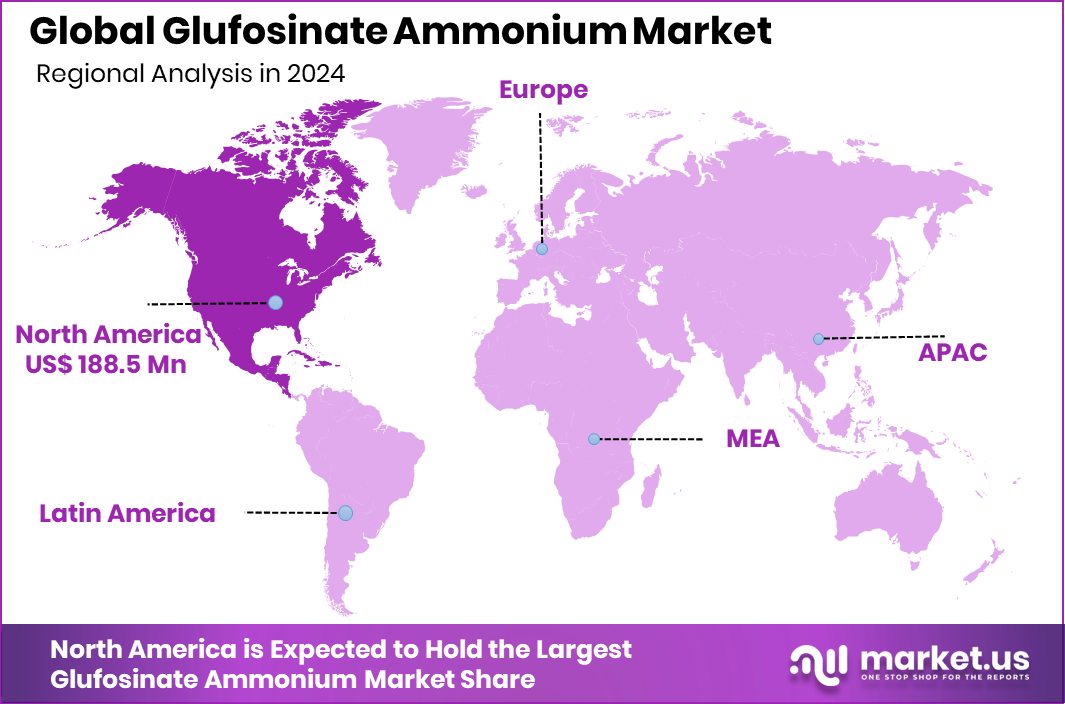

The Global Glufosinate Ammonium Market is expected to be worth around USD 1,120.4 million by 2034, up from USD 452.1 million in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034. Expanding herbicide-tolerant crop cultivation drove North America’s 41.7% Glufosinate Ammonium Market, totaling USD 188.5 Mn.

Glufosinate ammonium is a broad-spectrum herbicide that works by inhibiting the enzyme glutamine synthetase in plants, leading to an accumulation of ammonia and ultimately causing plant death. It is widely used in agriculture to control a variety of weeds in both pre- and post-emergence stages, especially in crops that are genetically modified to tolerate this herbicide.

Farmers prefer it because of its effectiveness on resistant weeds and its role in sustainable crop production systems. In support of such practices, USDA commits nearly $121M to specialty crop research and organic farming initiatives, ensuring farmers gain access to advanced weed-control solutions in sustainable systems.

The Glufosinate Ammonium market refers to the global trade and usage of this herbicide across different agricultural regions. Its demand is tied to rising food production needs, weed resistance issues, and the growing cultivation of genetically engineered crops. The market spans usage in row crops, fruits, vegetables, and plantation crops, with increasing importance in regions facing herbicide resistance challenges. For example, $72.9M allocated under the Specialty Crop Block Grant Program is driving adoption of modern crop protection inputs across fruits and vegetables.

One major growth factor for this market is the steady increase in weed resistance to other herbicides, pushing farmers toward alternatives like glufosinate ammonium. Its proven effectiveness in managing tough weeds ensures stable adoption in large-scale farming. In this direction, India obtains a $98M loan from the Asian Development Bank to improve horticulture productivity with certified planting materials, strengthening the market outlook in Asia.

On the demand side, the rising global population and the need for higher agricultural productivity are driving usage. Farmers are under pressure to maximize yields from limited farmland, and effective weed control with glufosinate helps secure crop output. Supporting this, Sahyadri Farms secures $47.8M to boost climate-resilient crops and expand processing capacity, reinforcing the need for efficient weed management solutions to safeguard production.

Key Takeaways

- The Global Glufosinate Ammonium Market is expected to be worth around USD 1,120.4 million by 2034, up from USD 452.1 million in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034.

- In the Glufosinate Ammonium Market, the solid form dominates with 57.1% due to storage stability.

- Weed control applications lead the Glufosinate Ammonium Market, holding 68.7% share because of broad-spectrum effectiveness.

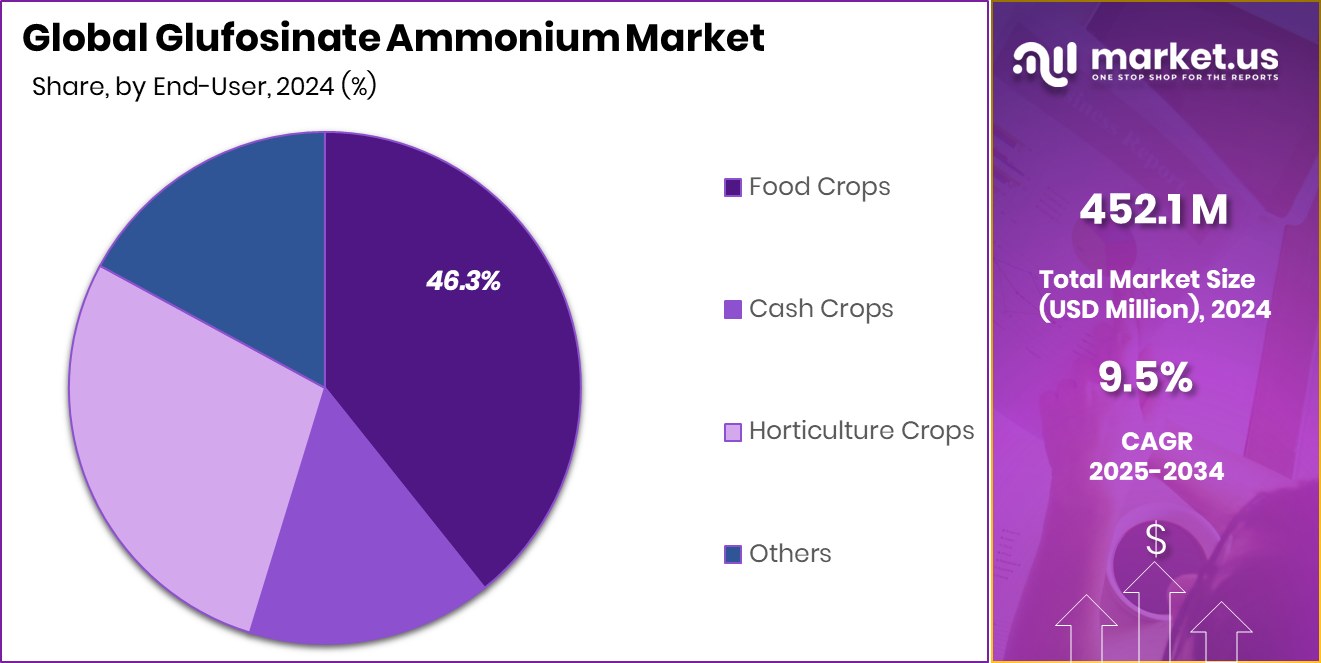

- Food crops drive the Glufosinate Ammonium Market, accounting for 46.3% as farmers prioritize higher yield protection.

- Strong demand for effective weed control solutions supported North America’s 41.7% market share, reaching USD 188.5 Mn.

By Form Analysis

The glufosinate ammonium market in solid form leads with a 57.1% share.

In 2024, Solid held a dominant market position in the By Form segment of the Glufosinate Ammonium Market, with a 57.1% share. This strong presence is mainly driven by its convenience in storage, transportation, and application, making it the preferred choice among farmers and distributors. Solid formulations, such as granules and water-soluble powders, are valued for their longer shelf life, ease of handling, and reduced risk of spillage compared to liquid forms.

The dominance of the solid form is further supported by its compatibility with different application methods, including broadcast spraying and soil treatments, which makes it suitable across diverse cropping systems. Farmers also favor solids for their precise dosing and reduced wastage, leading to cost-effective usage in weed management programs. Additionally, the ability to maintain chemical stability during extended storage and under varying climatic conditions strengthens its demand, particularly in regions with high seasonal variability.

With a 57.1% share in 2024, the solid form has firmly established itself as the leading segment, benefiting from its practical advantages and reliable performance. Looking ahead, its adoption is expected to remain steady as agriculture continues to prioritize effective weed control solutions.

By Application Analysis

Glufosinate Ammonium Market: Weed control dominates applications at a 68.7% share.

In 2024, Weed Control held a dominant market position in the By Application segment of the Glufosinate Ammonium Market, with a 68.7% share. This leadership is driven by the herbicide’s strong effectiveness against a wide range of broadleaf and grassy weeds, which remain a major challenge for farmers across diverse cropping systems. Weed control is central to sustaining agricultural productivity, as uncontrolled weed growth competes with crops for nutrients, water, and sunlight, leading to significant yield losses.

Farmers favor its use in both pre- and post-emergence stages, allowing flexibility in application and better management of weed pressure throughout the growing season. The strong adoption in staple crops such as corn, soybeans, and cotton further reinforces its commanding share, as these crops are highly vulnerable to weed infestations. Moreover, its role in supporting herbicide-tolerant crop cultivation has amplified its importance in modern farming practices.

Holding 68.7% of the application market in 2024, weed control remains the key driver for glufosinate ammonium demand. Its effectiveness, adaptability, and reliability position it as an essential tool for farmers seeking higher yields and improved crop quality.

By End-Use Analysis

Glufosinate Ammonium Market food crop usage holds 46.3% of the global share.

In 2024, Food Crops held a dominant market position in the by-end-use segment of the glufosinate ammonium market, with a 46.3% share. The large share is supported by the rising global demand for cereals, grains, fruits, and vegetables, where effective weed management directly impacts food security and farm profitability. Farmers growing food crops face continuous pressure from invasive weeds that reduce yields and compromise crop quality, making the use of glufosinate ammonium an essential part of their cultivation practices.

The dominance of food crops as an end-use segment is also tied to population growth and the increasing demand for higher agricultural output from limited farmland. With more than 46% share in 2024, the segment highlights how crucial efficient herbicides are for feeding expanding populations. Glufosinate ammonium is especially valued in food crops for its flexibility in application and proven performance in maintaining crop health and productivity.

As food crops remain central to human consumption, their reliance on reliable herbicide solutions will continue to support glufosinate ammonium demand. This segment’s strong position reflects its vital role in securing global food supply chains.

Key Market Segments

By Form

- Solid

- Liquid

- Water-soluble

By Application

- Weed Control

- Crop Desiccant

- Glufosinate-tolerant Crop

By End-Use

- Food Crops

- Wheat

- Rice

- Pulses

- Others

- Cash Crops

- Sugarcane

- Cotton

- Oilseeds

- Others

- Horticulture Crops

- Fruits

- Vegetables

- Plantation Crops

- Tea

- Coffee

- Others

- Others

Driving Factors

Rising Weed Resistance Boosts Glufosinate Ammonium Demand

One of the biggest driving factors for the Glufosinate Ammonium market is the rising problem of weed resistance. Over the years, continuous and heavy use of certain herbicides has made many weed species resistant, making it harder for farmers to control them with traditional solutions.

Glufosinate Ammonium has become a preferred choice because it is highly effective against resistant weeds, including both broadleaf and grassy types. Its ability to manage weeds that no longer respond to other herbicides has given it an edge in modern farming.

As resistant weeds spread across farmlands worldwide, more farmers are turning to Glufosinate Ammonium to protect crop yields, reduce losses, and ensure sustainable food production for growing populations.

Restraining Factors

Health and Environmental Concerns Limit Wider Adoption

A key restraining factor for the Glufosinate Ammonium market is the growing concern over its impact on health and the environment. While it is effective in weed control, studies have raised questions about possible risks to human health and non-target organisms when used in large amounts.

Environmental regulators in some regions are becoming stricter, imposing tighter rules on usage and residue limits in food crops. These restrictions slow down wider adoption, especially in countries with strong environmental policies.

Farmers also face pressure to reduce chemical usage and adopt safer or more eco-friendly solutions. As awareness about sustainable farming grows, concerns over long-term soil health, biodiversity, and potential health hazards act as barriers to its market growth.

Growth Opportunity

Expansion of Herbicide-Tolerant Crops Creates New Opportunities

A major growth opportunity for the Glufosinate Ammonium market lies in the rising adoption of herbicide-tolerant crops. These genetically modified crops are designed to withstand herbicide applications without being harmed, allowing farmers to manage weeds more effectively and with less labor.

As more countries approve and expand the cultivation of such crops, the demand for Glufosinate Ammonium is set to increase. Food security concerns, higher yield requirements, and limited farmland are pushing governments and farmers to adopt advanced crop technologies.

This trend not only supports sustainable farming but also ensures consistent crop protection against weeds. The expansion of herbicide-tolerant farming practices will create long-term opportunities for Glufosinate Ammonium in global agricultural systems.

Latest Trends

Shift Toward Integrated Weed Management Practices Globally

One of the latest trends in the Glufosinate Ammonium market is the growing shift toward integrated weed management practices. Farmers are no longer relying on a single herbicide but are combining chemical solutions with crop rotation, mechanical weeding, and biological methods to ensure long-term effectiveness.

This approach reduces the chances of weed resistance while improving soil health and sustainability. Glufosinate Ammonium plays an important role in these integrated systems because of its broad-spectrum action and reliability against resistant weeds.

The trend reflects a global move toward more responsible and balanced farming methods, where chemical herbicides like Glufosinate are used in combination with other practices to achieve higher productivity while protecting the environment.

Regional Analysis

In 2024, North America held a 41.7% share of the Glufosinate Ammonium Market, worth USD 188.5 Mn.

In 2024, North America held a dominant position in the Glufosinate Ammonium Market, capturing 41.7% share valued at USD 188.5 million. The region’s strong presence is primarily driven by large-scale cultivation of genetically modified crops such as corn, soybeans, and cotton, where effective weed management is essential to secure high yields. Farmers in North America increasingly rely on Glufosinate Ammonium due to its proven performance against resistant weeds, which have become a major challenge for agricultural productivity.

Supportive agricultural policies, advanced farming practices, and higher adoption of precision agriculture further reinforce its use across the region. The strong demand is also tied to the rising need for sustainable crop protection solutions, as growers aim to balance efficiency with environmental safety.

While other regions such as Europe, Asia Pacific, and Latin America are also contributing to global market expansion, North America remains at the forefront due to its advanced farming systems and higher herbicide-tolerant crop acreage. This clear dominance highlights the region’s critical role in shaping global demand trends and ensuring consistent adoption of Glufosinate Ammonium as a key herbicide for food security and sustainable farming practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Glufosinate Ammonium market reflected strong momentum, shaped by the active participation of leading agrochemical companies.

Bayer AG maintained a strategic focus on enhancing sustainable crop solutions, leveraging Glufosinate’s effectiveness in managing resistant weeds. Its role in supporting herbicide-tolerant crop systems underlined the company’s broader commitment to addressing food security challenges.

Syngenta emphasized innovation and digital integration, where Glufosinate products were increasingly linked with precision agriculture tools. This approach not only improved application efficiency but also reinforced the company’s position as a technology-driven leader in modern farming solutions.

BASF SE, meanwhile, remained focused on strengthening its crop protection portfolio, ensuring a reliable supply of Glufosinate-based products to global markets while promoting integrated weed management practices.

In India, Bharat Certis AgriScience Ltd emerged as an important regional player, expanding access to Glufosinate formulations tailored for local farming needs. Its efforts supported smallholder farmers in managing weed challenges effectively, highlighting its role in strengthening agricultural productivity across emerging markets.

Top Key Players in the Market

- Bayer AG

- Syngenta

- BASF SE

- Bharat Certis AgriScience Ltd

- Fargro

- Lier Chemical

- Sumitomo Chemical

- Adama Agricultural Solutions

- Corteva Agriscience

- Nufarm

Recent Developments

- In October 2024, BASF gained EPA approval for Liberty ULTRA herbicide with Glu-L™ technology. Containing L-glufosinate-ammonium, it provides 20% better weed control than generics, covers 33% more acres per gallon, and delivers nearly three times more herbicide into weed leaves, boosting efficiency for major crops.

- In July 2024, Sumitomo Chemical gained registration in Argentina for Rapidicil®, a new PPO-inhibitor herbicide. Effective at low doses, it targets broadleaf and grassy weeds and supports no-till farming. Sumitomo plans a 2024 launch while seeking approvals in the U.S., Canada, and Brazil to expand its global reach.

Report Scope

Report Features Description Market Value (2024) USD 452.1 Million Forecast Revenue (2034) USD 1,120.4 Million CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid, Water-soluble), By Application (Weed Control, Crop Desiccant, Glufosinate-tolerant Crop), By End-Use (Food Crops (Wheat, Rice, Pulses, Others), Cash Crops (Sugarcane, Cotton, Oilseeds, Others), Horticulture Crops (Fruits, Vegetables, Plantation Crops, Tea, Coffee, Others), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer AG, Syngenta, BASF SE, Bharat Certis AgriScience Ltd, Fargro, Lier Chemical, Sumitomo Chemical, Adama Agricultural Solutions, Corteva Agriscience, Nufarm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glufosinate Ammonium MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Glufosinate Ammonium MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bayer AG

- Syngenta

- BASF SE

- Bharat Certis AgriScience Ltd

- Fargro

- Lier Chemical

- Sumitomo Chemical

- Adama Agricultural Solutions

- Corteva Agriscience

- Nufarm