Global Glucuronolactone Market Size, Share, And Business Benefits By Form, Powder (Liquid, Tablet and Capsules), By End Use (Energy Drinks, Dietary Supplements, Pharmaceuticals, Cosmetics, Functional Foods, Others), By Distribution channel (Supermarkets and Hypermarkets, Online Retail, Pharmacies and Drugstores, Specialty Health Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157003

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

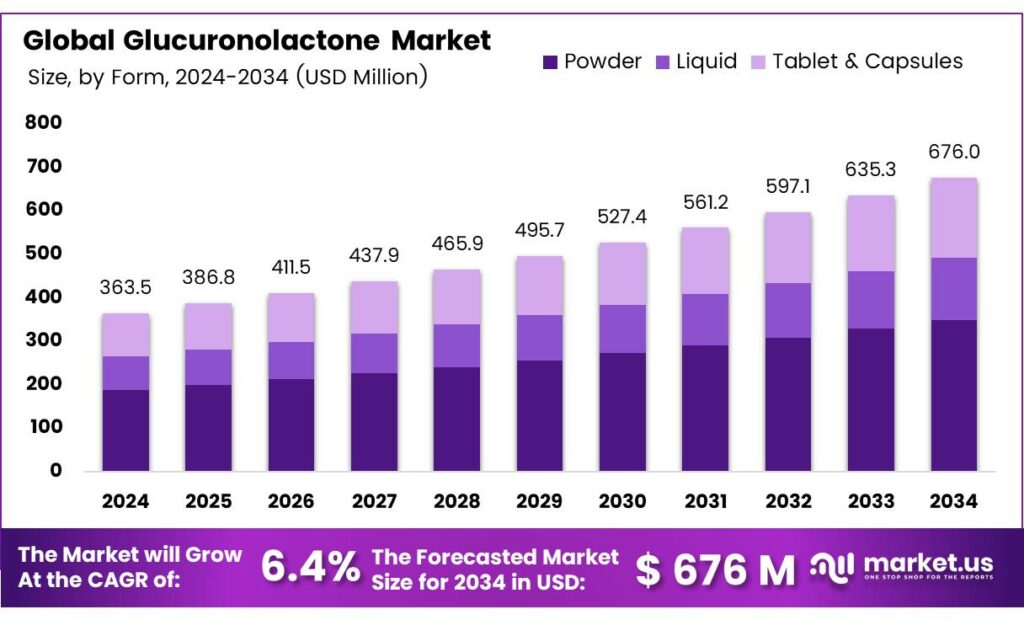

The Global Glucuronolactone Market size is expected to be worth around USD 676.0 Million by 2034, from USD 363.5 Million in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Glucuronolactone, a glucose metabolite, is naturally produced in the body and forms part of fibrous connective tissue. The typical dietary intake of glucuronolactone is low, ranging from 1 to 2 mg/day. When taken orally, it is fully absorbed, broken down, and excreted in urine as glucuronic acid, xylitol, and L-xylulose. Glucuronolactone administration led to improved swimming performance, elevated blood sugar levels, and increased liver glycogen levels, effects not observed with other sugars.

The global consumption of energy drinks (EDs) is on the rise, accompanied by growing concerns about potential health risks. Energy drinks typically contain caffeine (approximately 32 mg/100 mL), taurine (around 4000 mg/L), and D-glucuronolactone (about 2400 mg/L) as their primary active ingredients. This study evaluates exposure to these components across various consumption scenarios and consumer profiles, assessing risks by comparing caffeine and taurine intakes to reference values and calculating the margin of safety (MOS) for D-glucuronolactone.

Exposure assessments revealed that caffeine intake from EDs ranges from 80 to 160 mg (1.14–4 mg/kg body weight) depending on the scenario. Risk characterization indicates potential health concerns that could be mitigated through consumption guidelines. For instance, to avoid sleep disturbances, individuals weighing 40, 60, and 80 kg should limit ED consumption to 175, 262.5, and 350 mL, respectively. To prevent broader caffeine-related adverse health effects, the limits are 375, 562.5, and 750 mL for the same weight groups.

Dietary exposure to D-glucuronolactone from EDs ranges from 600 to 1200 mg (7.5–30 mg/kg body weight). A safe MOS (≥100) for D-glucuronolactone is achieved only when consumption is restricted to 250 mL for individuals weighing over 60 kg, with risks identified in some scenarios for higher intakes. Similarly, taurine exposure from EDs varies from 1000 to 2000 mg (12.5–50 mg/kg body weight), with intakes exceeding reference values when consumption exceeds 500 mL.

Key Takeaways

- The Global Glucuronolactone Market is projected to grow from USD 363.5 million in 2024 to USD 676.0 million by 2034, with a CAGR of 6.4%.

- Powder form dominated the market in 2024, holding a 51.7% share due to its versatility in energy drinks, supplements, and pharmaceuticals.

- Supermarkets and Hypermarkets led distribution channels in 2024, capturing a 34.5% share due to their accessibility in health product purchases.

- Energy Drinks were the top application in 2024, with a 43.8% market share driven by demand for functional beverages.

- The Asia-Pacific region held the largest market share in 2024 at 42.8%, generating USD 155.5 million in revenue.

Analyst Viewpoint

The Glucuronolactone Market, I see a compelling investment case, driven by the ingredient’s growing popularity in energy drinks, dietary supplements, and pharmaceuticals. The global demand for functional beverages and health-focused products is surging, particularly among millennials and Gen Z, who prioritize quick energy boosts and wellness solutions.

Glucuronolactone, known for its role in enhancing energy, mental clarity, and detoxification, is well-positioned to capitalize on this trend. Opportunities lie in developing innovative formulations, such as clean-label or plant-based products, and tapping into emerging markets like Asia-Pacific, where rising disposable incomes and health consciousness are fueling demand.

Recent developments, such as major brands like PepsiCo investing heavily in functional beverages, signal strong market confidence, but investors must navigate a competitive landscape where differentiation is key. Balancing innovation with regulatory compliance and consumer trust will be critical for capitalizing on glucuronolactone’s growth potential.

By Form

Powder Leads Glucuronolactone Market with 51.7% Share

In 2024, Powder held a dominant market position, capturing more than a 51.7% share in the global glucuronolactone market. This strong presence is linked to its higher adaptability in industries such as energy drinks, dietary supplements, and pharmaceuticals, where powdered ingredients allow for easy blending and precise formulation.

The powdered form is preferred by manufacturers due to its stability, longer shelf life, and cost-effectiveness in bulk production. The demand for powdered glucuronolactone is expected to remain steady, as it continues to be widely used in functional beverages and sports nutrition products.

Consumers showing a growing inclination toward supplements that boost energy and support detoxification, powders are expected to retain their lead in formulations. Additionally, the ease of transport and storage further strengthens its position in both developed and emerging markets.

By Distribution channel

Supermarkets and Hypermarkets Lead with 34.5% Share

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 34.5% share in the global glucuronolactone market. Their strong presence stems from being the most accessible shopping destinations where consumers prefer to purchase functional ingredients and health-oriented products alongside their regular groceries.

With clear visibility on shelves and attractive product placements, supermarkets and hypermarkets created a trusted platform for glucuronolactone-based products such as energy drinks, supplements, and functional foods. This channel is expected to remain a preferred choice as urbanization continues and organized retail expands across emerging economies.

Supermarkets and hypermarkets are projected to strengthen their role by offering dedicated health and wellness sections, making it easier for consumers to identify and choose glucuronolactone products. The convenience of one-stop shopping, combined with frequent promotional campaigns, supports their steady dominance in distribution.

By End Use

Energy Drinks Dominate with 43.8% Market Share

In 2024, Energy Drinks held a dominant market position, capturing more than a 43.8% share in the global glucuronolactone market. This strong presence is largely linked to the rising demand for functional beverages that boost energy, focus, and endurance among consumers across all age groups.

Glucuronolactone, known for its detoxifying properties and role in enhancing mental performance, has become a key additive in popular energy drink formulations. The trend is particularly visible among young adults, athletes, and professionals seeking quick performance-enhancing solutions.

The segment is expected to maintain its momentum as energy drinks continue to evolve with sugar-free, plant-based, and fortified versions appealing to health-conscious consumers. With increasing consumer lifestyles centered around work, sports, and active recreation, energy drinks remain the largest and most influential end-use channel for glucuronolactone.

Key Market Segments

By Form

- Powder

- Liquid

- Tablet and Capsules

By Distribution channel

- Supermarkets and Hypermarkets

- Online Retail

- Pharmacies and Drugstores

- Specialty Health Stores

- Others

By End Use

- Energy Drinks

- Dietary Supplements

- Pharmaceuticals

- Cosmetics

- Functional Foods

- Others

Drivers

Energy-drink adoption under clear safety rules

A single, powerful driver for glucuronolactone demand is the steady mainstreaming of energy drinks—especially among teens and young adults under clear government safety guardrails. Public-health sources consistently report substantial consumption.

The CDC notes that 30%–50% of adolescents consume energy drinks, a range that keeps these beverages part of everyday routines in schools, sports, and late-night study culture. In Europe, surveys cited in public-health literature have found similarly high reach, up to 68% of adolescents reported consumption, reinforcing that this is not a niche habit.

Crucially for glucuronolactone, EFSA has explicitly assessed energy-drink ingredients and flagged D-glucurono-γ-lactone as a common constituent. EFSA’s panel reviewed its use alongside caffeine and taurine and reported no evidence of problematic interactions, which has helped underpin ongoing acceptance of standard formulations across the EU.

Restraints

Safety Uncertainty Due to Limited Long-Term Data

When it comes to glucuronolactoneespecially in the amounts found in energy drinks big restraint is simply that we don’t really know enough yet. Regulators and respected health bodies note that the doses people get from energy‑drink use can be many times higher than what people get in ordinary dietsbut unfortunately, we lack enough science to say it’s completely safe long‑term.

The European Food Safety Authority (EFSA) points out that glucuronolactone in energy drinks can be consumed at levels up to two orders of magnitude above what a normal diet provides. In other words, you could be drinking 100 times or more than what you’d get from everyday foodsand yet there’s very little information available for risk assessment at such high doses. That’s a red flag in itself.

Adding to this uncertainty, a detailed risk study looked at real consumption scenarios. It is estimated that someone drinking the typical high‑end formulation of energy drinks (2,400 mg glucuronolactone per liter), in amounts between 250 ml and 500 ml daily, could lead to glucuronolactone exposure of around 600 to 1,200 mg total. In body‑weight terms, that works out to roughly 7.5 to 30 mg per kg of body weightdepending on whether the person weighs 40, 60, or 80 kg.

Opportunity

Rising Demand in Energy Drinks & Functional Beverages

A major growth driver for glucuronolactone today is the booming demand within the energy drink and functional beverage sector. For instance, in energy drinks containing glucuronolactone at 2400 mg per liter, the average daily intake in Austria among regular consumers is about 108 mg/day, with 90th percentile intake reaching up to 1,200 mg/day.

These figures illustrate how integral glucuronolactone has become as an ingredient in energy drinks, significantly exceeding intake from other foods like wine, which is up to 2.3 mg/day. Glucuronolactone is a natural compound that humans produce from glucose metabolism.

It’s widely used by manufacturers in energy drinks for reputed benefits like enhanced alertness and mild detox support. That rising usage aligns with people’s growing interest in products that boost energy and performance, making this ingredient highly appealing to both brands and health-conscious consumers.

Trends

Emerging Popularity in Sports Nutrition and Clean-Label Supplements

Glucuronolactone is increasingly appearing in clean-label sports and wellness supplements, particularly in fitness powders, pre-workout blends, and energy mixes. Health-conscious consumers are more intentional about their choices, preferring simple formulations with transparent ingredients.

Manufacturers are responding by reformulating products to highlight glucuronolactone alongside other science-backed compounds. This shift is driving steady growth for the ingredient, not through flashy marketing, but through consumer trust and transparency.

Adding to this clarity, the Food Safety and Standards Authority of India (FSSAI) has set a maximum daily limit of 1,200 mg for glucuronolactone in energy drinks and similar products. This regulation gives consumers a clear benchmark, helping them better evaluate supplement labels.

Regional Analysis

Asia‑Pacific (APAC) leads with a 42.8% share and a USD 155.5 Million market value.

The Asia‑Pacific (APAC) region stands out as the dominant market in the global Glucuronolactone landscape, accounting for approximately 42.8% of total market share and registering an estimated USD 155.5 million in revenue. This commanding lead reflects the region’s dynamic growth trajectory, underpinned by surging demand in energy‑boosting and health‑oriented applications.

APAC’s leadership stems from several synergistic factors: rapid urbanization, burgeoning disposable incomes, and heightened consumer awareness around wellness and preventive health. Countries like China and India have emerged as both production powerhouses and high‑demand hubs, driven by a flourishing food & beverage sector, expanding pharmaceutical use cases, and a swelling middle class open to functional and fortified products.

Moreover, APAC’s expansion is further evidenced by regional revenue; APAC accounted for approximately, surpassing both North America and Europe, signaling its critical role in market revenue generation. Comparatively, North America led previously, but APAC’s accelerated pace and combination of consumption and production advantage underscore its rising prominence.

APAC not only dominates today’s Glucuronolactone market, but also exhibits the strongest growth fundamentals: economic expansion, evolving health and wellness trends, robust manufacturing ecosystems, and strategic positioning as both a demand and supply fulcrum. This makes APAC the undisputed leader and growth engine in the global Glucuronolactone industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aceto Corporation is a key supplier of pharmaceutical ingredients and specialty chemicals, including glucuronolactone. Leveraging its extensive distribution network and strong industry relationships, the company effectively serves the nutraceutical and energy drink sectors. Its strategic focus on quality assurance and regulatory compliance solidifies its position as a reliable source for high-purity ingredients in a competitive international market.

Roquette Frères, a French company, is a global leader in plant-based ingredients and a significant producer of glucuronolactone. Roquette leverages its expertise in starch and derivative products, offering high-purity ingredients primarily for the food, nutrition, and pharmaceutical markets. Their commitment to sustainable sourcing and significant investment in research and development ensures a consistent.

Cargill is a powerful force in the glucuronolactone market. Its immense production scale, integrated supply chain, and global footprint allow it to efficiently meet large-volume demand from the food, beverage, and supplement industries. Cargill’s focus on innovation and customer-specific solutions strengthens its role as a crucial supplier for manufacturers seeking reliable, scalable ingredient sourcing for energy and wellness products.

Top Key Players in the Market

- Aceto Corporation

- Anhui Fubore Pharmaceutical and Chemical Co., Ltd.

- Hubei Yitai Pharmaceutical Co., Ltd.

- Foodchem International Corporation

- Shandong Fuyang Bio-Tech Co., Ltd.

- Roquette Freres

- Jungbunzlauer Suisse AG

- Suzhou Fifth Pharmaceutical Factory Co.

- Cargill

Recent Developments

- In 2024, Aceto Corporation transitioned into Actylis, a new entity focused on manufacturing and sourcing raw materials and ingredients for life sciences and specialty chemicals. Actylis emphasizes a hybrid model of manufacturing and sourcing, including pharmaceuticals, biopharmaceuticals, nutrition, and cosmetics.

- In 2024, Cargill is a key player in the glucose excipient market. Glucuronolactone, derived from glucose, could be part of this market, particularly in pharmaceutical applications as a stabilizer or detoxifying agent. Cargill’s competitive strategies include new product development and acquisitions, which may support glucuronolactone-related innovations.

Report Scope

Report Features Description Market Value (2024) USD 363.5 Million Forecast Revenue (2034) USD 676.0 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form, Powder (Liquid, Tablet, and Capsules), By End Use (Energy Drinks, Dietary Supplements, Pharmaceuticals, Cosmetics, Functional Foods, Others), By Distribution channel (Supermarkets and Hypermarkets, Online Retail, Pharmacies and Drugstores, Specialty Health Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aceto Corporation, Anhui Fubore Pharmaceutical and Chemical Co., Ltd., Hubei Yitai Pharmaceutical Co., Ltd., Foodchem International Corporation, Shandong Fuyang Bio-Tech Co., Ltd., Roquette Freres, Jungbunzlauer Suisse AG, Suzhou Fifth Pharmaceutical Factory Co., Cargill Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Glucuronolactone MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Glucuronolactone MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aceto Corporation

- Anhui Fubore Pharmaceutical and Chemical Co., Ltd.

- Hubei Yitai Pharmaceutical Co., Ltd.

- Foodchem International Corporation

- Shandong Fuyang Bio-Tech Co., Ltd.

- Roquette Freres

- Jungbunzlauer Suisse AG

- Suzhou Fifth Pharmaceutical Factory Co.

- Cargill