Global Glass Mat Market Size, Share Analysis Report By Mat Type (Chopped Strand and Continuous Filament), By Glass Type (E-Glass, ECR-Glass, and Others), By Binder Type (Emulsion, Powder, Polyester, and Others), By Manufacturing Method (Wet-Laid and Dry-Laid), By End-Use (Construction, Automotive, Industrial, Marine, and Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170435

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

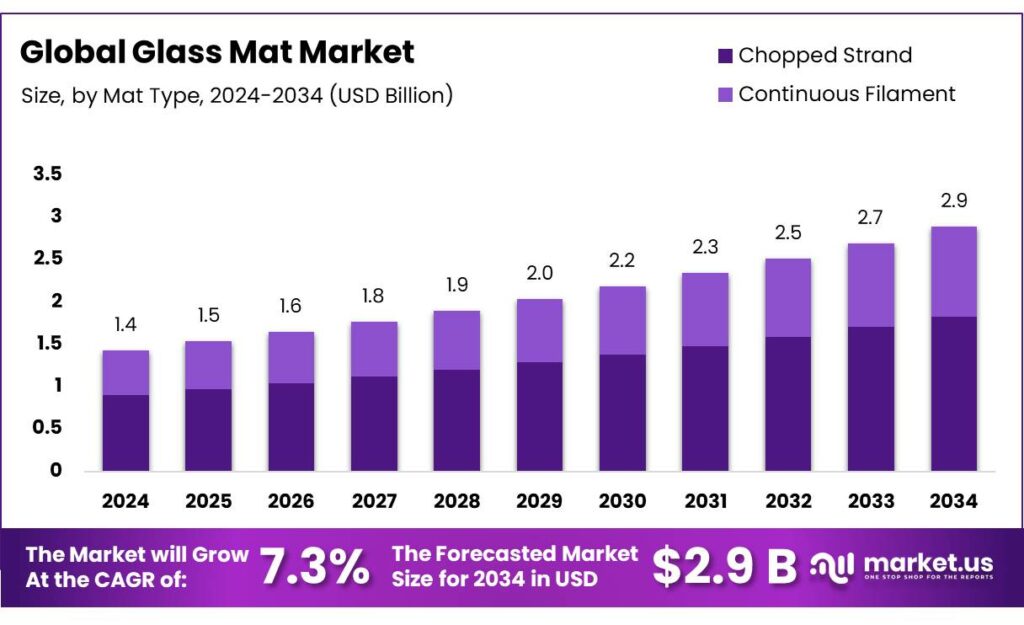

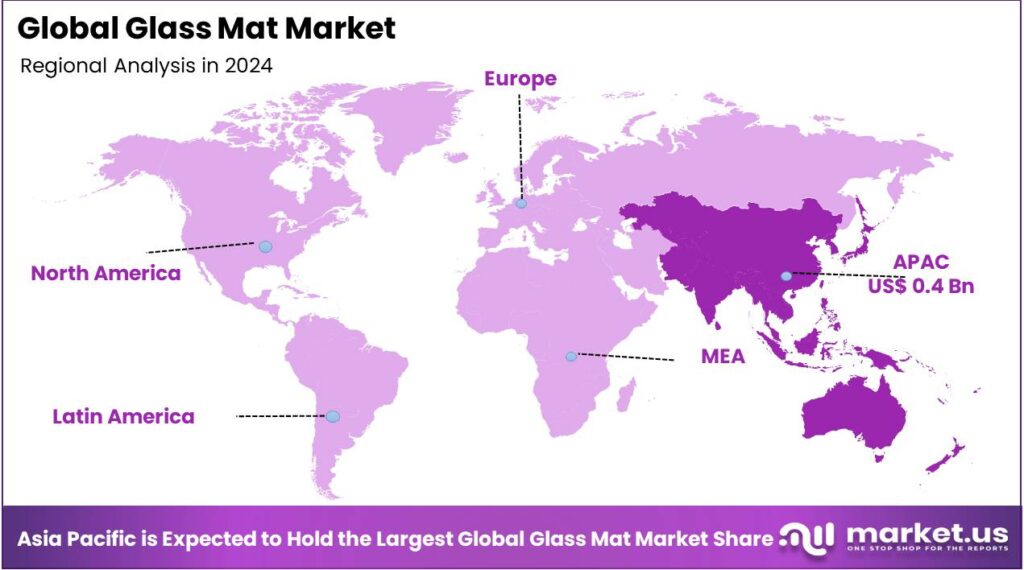

The Global Glass Mat Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 34.3% share, holding USD 0.4 Billion revenue.

A glass mat is a non-woven composite material of glass fibers used for reinforcement. It is composed of short fiberglass filaments that are uniformly distributed and bonded together by a polymer resin. The glass mat market is driven by its widespread use across various industries, particularly construction, automotive, and renewable energy. Glass mats, often made from E-glass, offer excellent mechanical strength and durability, making them ideal for applications such as insulation, roofing, and structural reinforcement in buildings.

In the automotive sector, they are used to reduce vehicle weight while enhancing performance, meeting environmental and fuel efficiency standards. Their application in renewable energy, particularly in wind turbine blades, has gained momentum due to the need for lightweight, strong materials that can withstand harsh conditions. The wet-laid manufacturing process is preferred to manufacture these glass mats as the process can produce consistent and high-quality mats at scale.

- Among the 1222 products traded in 2023, glass fibers ranked 296 in global trade value, accounting for 0.06% of world trade. According to the product complexity index (PCI), it was the 322nd most complex product out of 1053, with a PCI value of 0.63.

- In 2023, the leading exporters of glass fibers were China, the United States, and Germany, and the top importers were the United States, Germany, and France.

Key Takeaways

- The global glass mat market was valued at USD 1.4 billion in 2024.

- The global glass mat market is projected to grow at a CAGR of 7.3% and is estimated to reach USD 2.9 billion by 2034.

- Based on types of mats, chopped strand dominated the glass mat market, constituting 63.3% of the total market share.

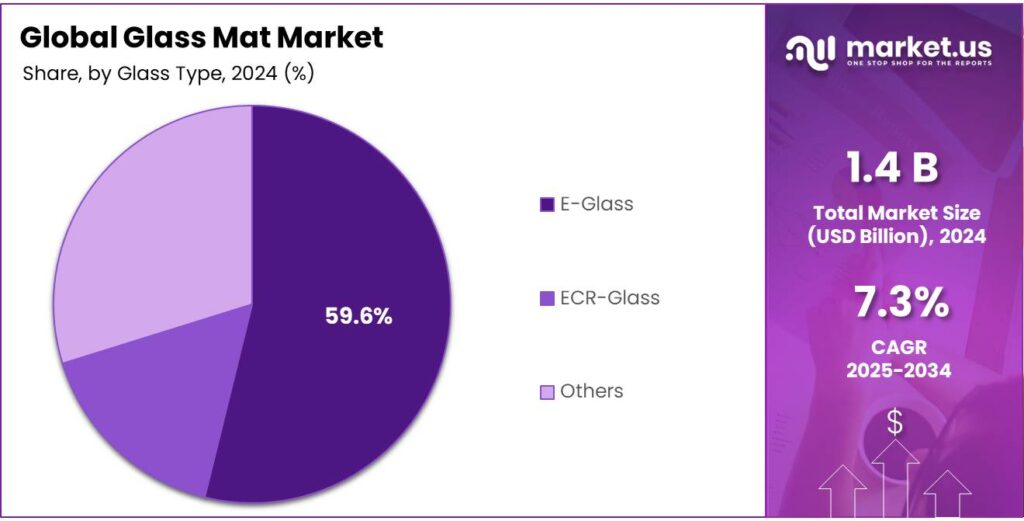

- Based on the types of glass, E-glass dominated the glass mat market, with a substantial market share of around 59.6%.

- Based on the types of binder, powdered binders led the glass mat market, comprising 46.9% of the total market.

- Among the manufacturing methods, wet-laid held a major share in the glass mat market, 60.1% of the market share.

- Among the end-uses of the glass mats, the construction industry is the most considerable end-use of the product, accounting for around 48.5% of the revenue.

- In 2024, the Asia Pacific was the most dominant region in the glass mat market, accounting for 34.3% of the total global consumption.

Mat Type Analysis

Chopped Strand Mats are a Prominent Segment in the Glass Mat Market.

The glass mat market is segmented based on types of mats into chopped strand and continuous filament. The chopped strand mats led the glass mat market, comprising 63.3% of the market share, due to their cost-effectiveness and versatility.

Chopped strands are made from short glass fibers that are randomly distributed, making them easier and less expensive to manufacture compared to continuous filaments, which require more specialized production processes. The shorter fibers in chopped strand mats allow for better impregnation with resins, making them ideal for a wide range of applications, such as in boats, automotive parts, and bath equipment.

Additionally, chopped strand mats offer excellent uniformity and multi-directional (isotropic) strength, making them suitable for mass production. While continuous filament mats offer superior strength and higher performance, they are used in more specialized applications, often at a higher cost, limiting their broader adoption.

Glass Type Analysis

Mats Manufactured from E-Glass Dominated the Glass Mat Market.

On the basis of the types of glass, the glass mat market is segmented into E-glass, ECR-glass, and others. The E-glass dominated the glass mat market, comprising 59.6% of the market share, due to its balance of cost, performance, and availability. E-glass, or electrical glass, is highly versatile, offering good mechanical strength, electrical insulation, and resistance to alkalis and acids.

It is relatively inexpensive to produce and widely available, making it the preferred choice for many industries, including automotive, construction, and general composites. While ECR-glass, corrosion-resistant glass, offers better resistance to chemical environments, it is more expensive and less commonly used in applications that do not require such specialized properties. E-glass provides a practical solution for most applications where cost-efficiency is essential, while still delivering the required strength and durability.

Binder Type Analysis

Powdered Binders Are Most Widely Used for the Glass Mats.

The powdered binders dominated the glass mat market, with a notable market share of 46.9%. Powder binders are more commonly used for glass mats than emulsions, polyester, or other binders due to their superior handling characteristics, cost-effectiveness, and efficient application. Powder binders offer easier and more precise control over the bonding process, providing consistent quality and uniformity in the final product.

They can be applied in a dry form, simplifying the production process and reducing the need for additional solvents or water, which is often required with emulsion-based or polyester binders. This makes powder binders particularly advantageous for large-scale manufacturing, where speed and cost efficiency are critical. Furthermore, powder binders typically provide better adhesion properties and mechanical performance, contributing to the durability and strength of the glass mats in various applications. The powder binders offer a practical solution for producing high-quality glass mats with enhanced performance at a lower cost.

Manufacturing Method Analysis

Wet-Laid Manufacturing Method Held a Major Share of the Glass Mat Market.

Based on the manufacturing methods, the glass mats market is segmented into wet-laid and dry-laid. Among the manufacturing methods, 60.1% of the glass mats consumed globally are produced through the wet-laid method, due to its ability to produce mats with uniformity, consistency, and higher quality at scale. The wet-laid process involves dispersing glass fibers in a slurry and then laying them out on a conveyor to form a mat, which ensures even distribution of fibers and better bonding of the strands.

In addition, this method allows for easy incorporation of binders, which help to stabilize the mat. The wet-laid process is more adaptable to large production volumes, making it more efficient for manufacturing glass mats used in a variety of applications, such as automotive and construction. In contrast, the dry-laid method is more labor-intensive and difficult to control, often leading to less uniformity and lower strength properties in the final product.

End-Uses Analysis

Glass Mat Products Are Mostly Utilized in the Construction Sector.

Among the end-uses of the glass mats, 48.5% of the total global consumption of glass mats is utilized in the construction sector. Most glass mats are used in the construction industry due to their versatility and ability to enhance the strength and durability of building materials. In construction, glass mats are primarily used for applications such as roofing, insulation, and flooring, where their lightweight yet strong properties provide structural stability and thermal efficiency.

Additionally, they are highly resistant to moisture and corrosion, making them ideal for applications exposed to harsh environmental conditions. The demand for affordable, durable, and sustainable materials further drives the widespread use of glass mats. While the automotive, industrial, and marine sectors utilize glass mats, their applications tend to be more specialized and require higher-performance materials, often at a higher cost.

Key Market Segments

By Mat Type

- Chopped Strand

- Continuous Filament

By Glass Type

- E-Glass

- ECR-Glass

- Others

By Binder Type

- Emulsion

- Powder

- Polyester

- Others

By Manufacturing Method

- Wet-Laid

- Dry-Laid

By End-Use

- Construction

- Roofing & Waterproofing

- Flooring

- Walls & Ceilings

- Gypsum

- Insulation

- Others

- Automotive

- Interior

- Exterior

- Industrial

- Marine

- Other

Drivers

Rapid Growth in the Construction Industry Drives the Glass Mat Market.

According to the United Nations, in 2024, the population of around 4.7 billion individuals in the world resided in urban areas. The construction industry needs to build 13,000 buildings each day, globally, between 2025 and 2050, to support an expected population of 7 billion people living in cities. This rapid expansion of the construction industry has significantly contributed to the growing demand for glass mats, owing to their robust properties and sustainability advantages. Glass mats, made from glass fibers, are increasingly favored for their exceptional strength, durability, and resistance to weathering, which are crucial qualities in construction applications.

Additionally, the growing emphasis on environmentally conscious construction materials has further bolstered the popularity of glass mats, as they are recyclable and offer improved thermal and acoustic insulation. For instance, in residential and commercial buildings, glass mats are widely used in roofing systems for their ability to improve energy efficiency.

- According to the US Green Building Council, in 2024, there were 111,397 LEED-certified projects worldwide. As construction projects increasingly prioritize sustainability and long-term performance, the demand for glass mats continues to rise, catering to a broad consumer base seeking reliable, eco-friendly materials.

Restraints

Competition from Alternative Materials Might Pose a Challenge to the Glass Mat Market.

The glass mat market faces increasing competition from alternative materials, which could present challenges in sustaining growth. One of the primary alternatives to glass mats is carbon fiber, which offers superior strength and lighter weight in some applications, particularly in high-performance industries such as aerospace and automotive. While carbon fiber tends to be more expensive than glass mats, its advanced properties may appeal to sectors where performance is a critical factor.

Additionally, natural fibers, such as flax and hemp, are gaining traction in construction due to their sustainability and lower environmental impact. These materials are biodegradable and offer lower production costs, making them attractive to manufacturers seeking eco-friendly alternatives. The rise of such alternatives could reduce the market share for glass mats, particularly as companies continue to prioritize both sustainability and cost-efficiency.

Opportunity

Demand for Lightweight Materials in Transportation Creates Opportunities in the Glass Mat Market.

The demand for lightweight materials in the transportation sector, including automotive, marine, and other industries, has opened significant opportunities for the glass mat market. Lightweight materials are crucial in reducing fuel consumption and improving the overall efficiency of vehicles and vessels. Glass mats, known for their high strength-to-weight ratio, are increasingly being used in the production of composite materials, offering durability without compromising on weight. In the automotive industry, glass mats are used in the manufacturing of body panels, underbody shields, and structural components, helping manufacturers meet stringent fuel efficiency and emission standards.

Similarly, in the marine industry, glass mats are utilized in boat construction for their ability to resist corrosion while maintaining a lightweight structure.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), approximately 93 million vehicles were produced globally in 2024, a significant increase from 77.7 million units in 2020. Similarly, according to the National Marine Manufacturers Association, in 2024, total powerboat retail unit sales were about 230-240 thousand units in the US alone.

As regulatory pressures to reduce carbon footprints continue to intensify and the transportation industry continues to expand, the adoption of glass mats in these sectors is expected to grow, meeting the need for both performance and sustainability in modern transportation designs.

Trends

Application of Glass Mats in Renewable Energy Production.

The application of glass mats in renewable energy production, particularly in wind power infrastructure, is becoming an increasingly prominent trend. Glass mats are utilized in the production of wind turbine blades, where their lightweight, high-strength properties are essential for improving both performance and longevity. Wind turbine blades must be strong enough to withstand harsh environmental conditions, yet lightweight to ensure efficiency in energy production. Glass mats provide an ideal solution due to their superior mechanical properties and resistance to wear and tear.

In addition, they offer excellent resistance to corrosion, which is crucial for wind turbines exposed to outdoor elements. In the construction of large-scale wind turbines, the integration of glass mats in composite materials helps to reduce the weight of the blades, thereby enhancing the overall efficiency and power output of the turbines.

- According to a report by the International Energy Agency (IEA), in 2024, renewable energy saw significant capacity additions of around 585 GW, primarily solar and wind. Similarly, in 2023, wind electricity generation increased by 216 TWh, up 10%, reaching more than 2330 TWh. As global efforts toward renewable energy intensify, the demand for glass mats in wind energy applications is expected to grow, supporting sustainable energy production worldwide.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Increased Prices of Glass Mats.

The geopolitical tensions have a notable impact on the glass mat market, primarily affecting supply chains, production costs, and global trade dynamics. Ongoing trade conflicts, particularly between major economies such as the United States and China, have led to disruptions in the availability of raw materials, such as glass fibers, which are critical for producing glass mats.

Additionally, China’s restrictions on critical minerals have created a bottleneck for clean energy tech and the automotive sectors, influencing composite material costs. These disruptions have caused delays in production timelines and increased costs for manufacturers, ultimately impacting the price and availability of glass mat products.

Similarly, geopolitical instability in regions that are key suppliers of raw materials or manufacturing hubs for composite materials, such as parts of Europe and Asia, has further strained the market. For instance, the recent conflicts in Eastern Europe have affected the supply chains of various industries, including those related to construction and automotive, which rely heavily on glass mats.

In contrast, in some regions, geopolitical tensions have spurred innovation, as companies seek alternative supply sources or develop more efficient, localized production methods to mitigate the risks associated with global instability.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Glass Mat Market.

In 2024, the Asia Pacific dominated the global glass mat market, holding about 34.3% of the total global consumption. The region held the largest share of the global glass mat market, driven by rapid industrialization, significant infrastructure development, and a growing emphasis on renewable energy projects. Countries such as China, India, and Japan are key manufacturing hubs, where the demand for durable, lightweight, and sustainable materials such as glass mats is rising. In the automotive sector, manufacturers in these countries are increasingly adopting glass mats in composite materials to enhance vehicle performance while meeting environmental regulations.

China is the world’s largest vehicle manufacturer, producing over 30 million units in 2023, accounting for roughly a third of global output. Additionally, the growing adoption of renewable energy, particularly wind power, in countries like China, which is the world leader in wind energy production, further boosts the demand for glass mats in infrastructure projects. According to the World Wind Energy Association, China accounts for 72% of the global market for new wind turbines. Furthermore, the expanding construction industry contributes to the growth of the market, making the region a dominant player in the global market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the glass mat market employ several strategic activities to enhance product sales and maintain a competitive edge. The major focus of many companies is on innovation in product development, such as enhancing the strength, durability, and sustainability of glass mats, which appeals to industries such as construction and automotive.

Additionally, companies focus on mergers and acquisitions to enhance their product portfolio. Similarly, many major players emphasize partnerships with manufacturers in high-demand sectors, such as renewable energy and automotive, which allow companies to tap into emerging markets. Furthermore, they focus on expanding production capabilities to cater to the growing demand for the product.

The Major Players in The Industry

- Saint-Gobain

- Owens Corning.

- China Beihai Fiberglass Co., Ltd.

- Johns Manville

- Composites One

- Nippon Electric Glass Co., Ltd.

- TAIWAN GLASS IND. CORP.

- China Jushi Co., Ltd.

- Wbcomposites

- GarCo Manufacturing Co., Inc.

- Tremco CPG Inc.

- Malarkey Roofing Products

- Asia Composite Materials (Thailand) Co., Ltd

- 3B – The Fiberglass Company

- Steinbach AG

- Superior Huntingdon Composites, LLC

- Other Key Players

Key Development

- In December 2024, Owens Corning, a global residential and commercial building products leader, began production on its high-performance glass nonwoven production line in Fort Smith, Texas.

- In July 2025, Saint-Gobain announced a major investment of US$167 million for a glass mat manufacturing facility on its existing CertainTeed Roofing campus in Oxford, North Carolina. A significant investment to vertically integrate the production of fiberglass mats for shingles.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Mat Type (Chopped Strand and Continuous Filament), By Glass Type (E-Glass, ECR-Glass, and Others), By Binder Type (Emulsion, Powder, Polyester, and Others), By Manufacturing Method (Wet-Laid and Dry-Laid), By End-Use (Construction, Automotive, Industrial, Marine, and Other) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Saint-Gobain, Owens Corning, China Beihai Fiberglass Co., Ltd., Johns Manville, Composites One, Nippon Electric Glass Co., Taiwan Glass Ind. Corp., China Jushi Co., Ltd., Wbcomposites, GarCo Manufacturing Co., Inc., Tremco CPG Inc., Malarkey Roofing Products, Asia Composite Materials (Thailand) Co., Ltd., 3B – The Fibreglass Company, Steinbach AG, Superior Huntingdon Composites, LLC, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Saint-Gobain

- Owens Corning.

- China Beihai Fiberglass Co., Ltd.

- Johns Manville

- Composites One

- Nippon Electric Glass Co., Ltd.

- TAIWAN GLASS IND. CORP.

- China Jushi Co., Ltd.

- Wbcomposites

- GarCo Manufacturing Co., Inc.

- Tremco CPG Inc.

- Malarkey Roofing Products

- Asia Composite Materials (Thailand) Co., Ltd

- 3B - The Fiberglass Company

- Steinbach AG

- Superior Huntingdon Composites, LLC

- Other Key Players