Global Gibberellins Market Size, Share, And Business Benefits By Form (Liquid, Powder, Granules), By Function (Fruit Ripening, Seed Germination, Root Growth, Dormancy of Buds, Cell Elongation, Flower Development, Others), By Type (Gibberellic Acid (GA3), Gibberellins A4/A7), By Crop Type (Fruits and Vegetables, Cereals and Grains, Sugarcane, Others), By Application (Seed Treatment,Foliar Spray), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156133

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

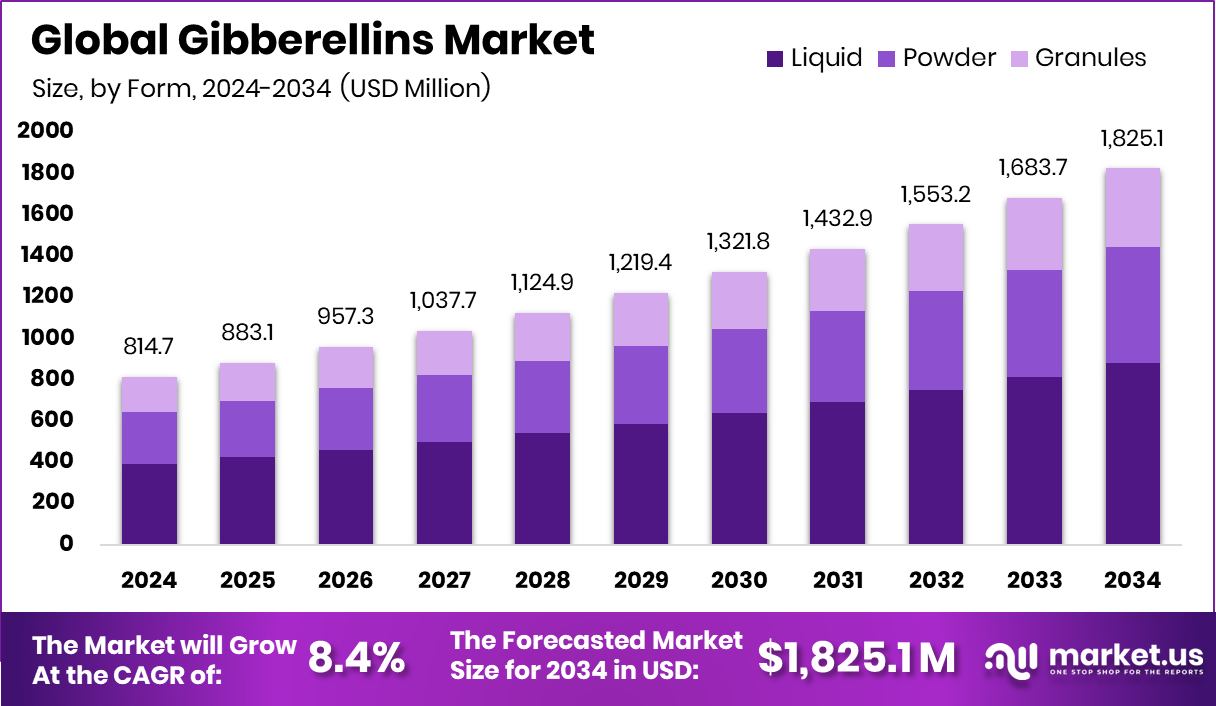

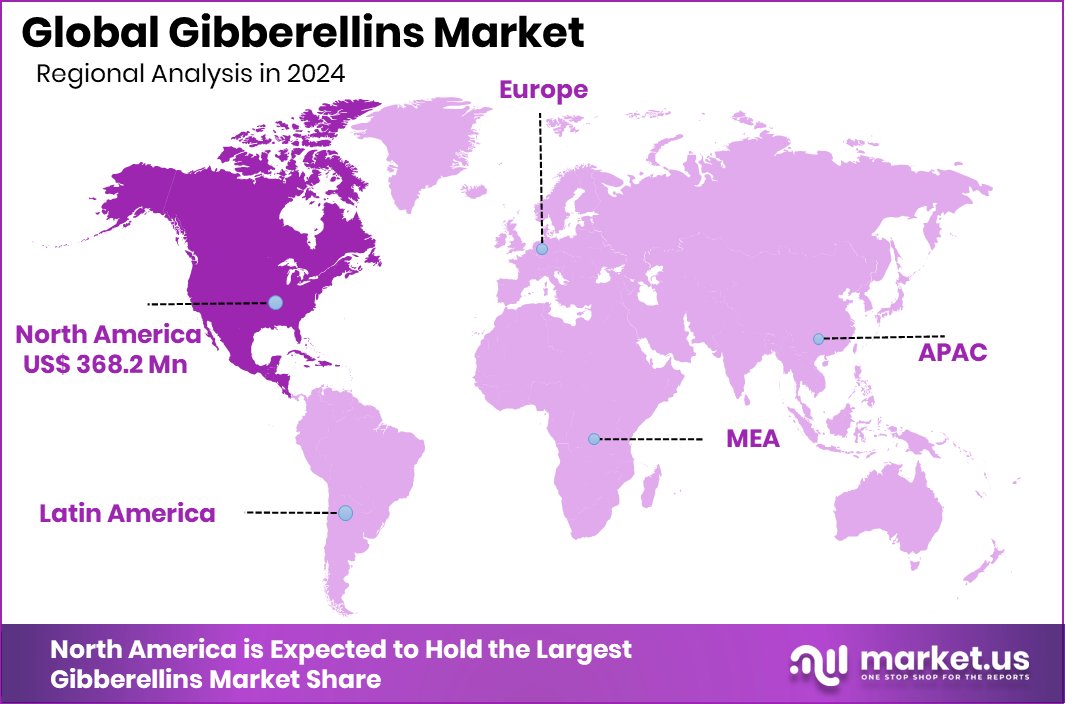

The Global Gibberellins Market is expected to be worth around USD 1,825.1 million by 2034, up from USD 814.7 million in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034. North America’s 45.20% share reflects strong adoption of gibberellins worth USD 368.2 Mn.

Gibberellins are a group of naturally occurring plant hormones that regulate growth and development. They play a vital role in seed germination, stem elongation, leaf expansion, and flowering. By influencing cell division and elongation, gibberellins help crops achieve better yield and improve overall plant physiology, making them essential in modern agriculture.

The gibberellins market refers to the global trade and usage of these plant growth regulators in farming, horticulture, and research applications. With agriculture shifting toward higher efficiency and sustainability, the demand for gibberellins is expanding, as they are used to enhance crop productivity, improve fruit quality, and ensure uniform growth under varying conditions. According to an industry report, Finom, a challenger bank focused on serving SMBs, secured $105 million in growth funding from General Catalyst.

A major growth factor driving this market is the increasing need for higher agricultural yields to meet rising food demand. Population growth, shrinking arable land, and climate challenges are pushing farmers to adopt plant hormones like gibberellins that improve crop resilience and productivity without heavy dependence on synthetic chemicals. According to an industry report, Lamark Biotech has raised ₹6.5 crore in a growth funding round supported by the IAN Group.

On the demand side, the rise of horticulture and specialty crop cultivation is creating strong momentum. Fruits, vegetables, and ornamental plants benefit significantly from gibberellin applications, boosting their adoption in both commercial farming and greenhouse production systems worldwide. According to an industry report, Oprah and Katy Perry partnered with GIC to help Apeel Sciences secure $250 million, pushing the company to unicorn status.

Key Takeaways

- The Global Gibberellins Market is expected to be worth around USD 1,825.1 million by 2034, up from USD 814.7 million in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034.

- In the Gibberellins Market, the Liquid form holds 48.2% share, highlighting its widespread agricultural application.

- The Gibberellins Market shows Fruit Ripening as a key function with 31.6% share, driving horticulture demand.

- In terms of type, Gibberellic Acid (GA3) dominates with a 78.9% share, reflecting its critical crop role.

- By crop category, the Fruits and Vegetables segment leads with a 48.4% share, showcasing strong consumption demand.

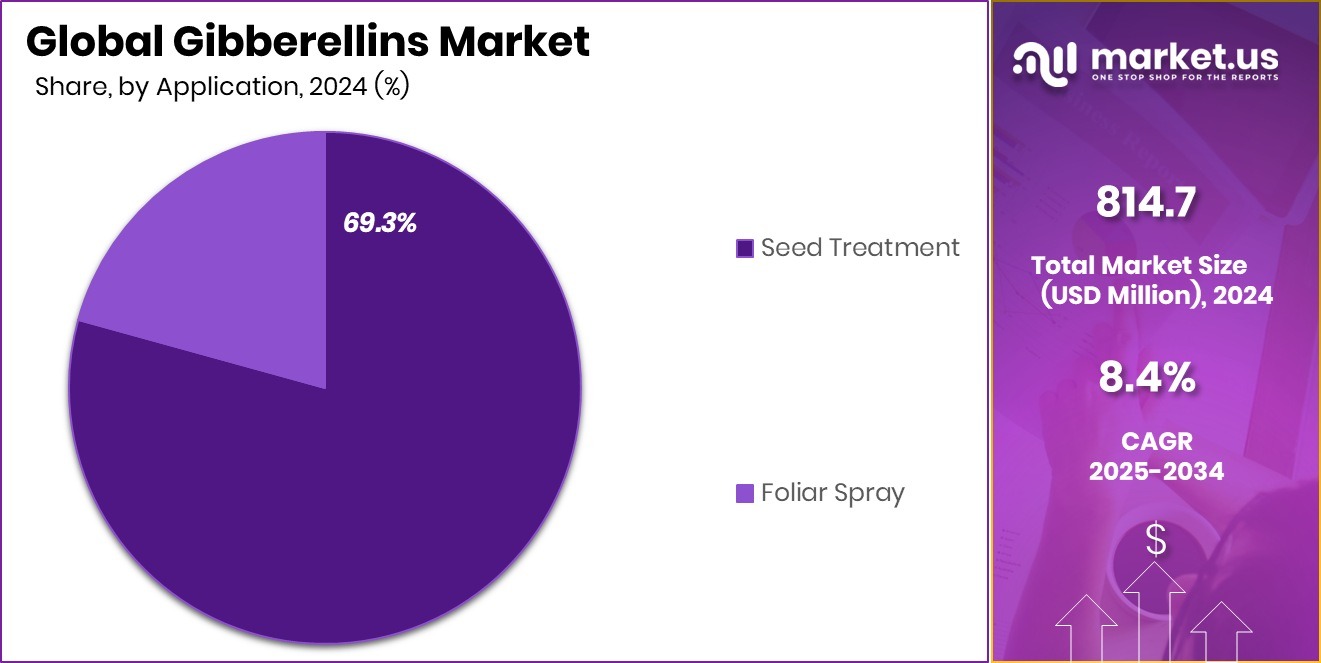

- Within applications, seed treatment accounts for a 69.3% share in the Gibberellins Market, emphasizing enhanced germination practices.

- The North American market value reached USD 368.2 Mn, driven by advanced agriculture.

By Form Analysis

The Gibberellins Market in liquid form holds a 48.2% dominant share.

In 2024, Liquid held a dominant market position in the By Form segment of the Gibberellins Market, with a 48.2% share. The preference for liquid formulations is strongly tied to their ease of application and higher absorption efficiency, making them a practical choice for both large-scale farming and controlled horticulture environments.

Liquid gibberellins allow for uniform distribution when applied through foliar sprays or irrigation systems, ensuring better penetration into plant tissues compared to solid forms. This efficiency translates directly into improved crop growth outcomes, such as enhanced stem elongation, improved fruit set, and better overall yield quality.

The popularity of liquid gibberellins is also supported by their compatibility with modern farming practices. Farmers increasingly rely on precision agriculture and integrated crop management systems, where liquid formulations can be seamlessly applied alongside fertilizers and micronutrients.

This reduces labor costs and saves time while delivering consistent results. Furthermore, liquid gibberellins offer flexibility in dosage adjustments, allowing growers to tailor applications according to crop type, growth stage, and environmental conditions. As the demand for higher productivity and quality in crops such as fruits, vegetables, and cereals continues to rise, liquid gibberellins are expected to maintain their leading position in the market.

By Function Analysis

Fruit ripening applications drive 31.6% of demand in the Gibberellins Market globally.

In 2024, Fruit Ripening held a dominant market position in the By Function segment of the Gibberellins Market, with a 31.6% share. This leadership stems from the crucial role gibberellins play in accelerating and regulating the ripening process of various fruits, ensuring timely harvests and improved marketability.

Farmers and horticulturists widely adopt gibberellins to promote uniform color development, enhance sweetness, and improve size consistency in fruits such as grapes, bananas, and citrus. These benefits not only support better quality standards but also extend shelf life, making fruits more appealing for both domestic consumption and export markets.

The rising global demand for fresh and high-quality fruits is a key driver for this segment’s dominance. With shifting consumer preferences toward healthier diets and natural produce, fruit producers are under pressure to deliver a consistent supply throughout the year. Gibberellins in liquid form are particularly effective in managing the post-harvest period by reducing losses and enhancing storage stability.

Moreover, the growth of organized retail and international trade in fruits further amplifies the need for reliable ripening solutions. As fruit production expands in emerging economies and export-driven markets, the use of gibberellins for ripening is expected to sustain its strong position in the coming years.

By Type Analysis

Gibberellic Acid (GA3) accounts for 78.9% of the Gibberellins Market.

In 2024, Gibberellic Acid (GA3) held a dominant market position in the By Type segment of the Gibberellins Market, with a 78.9% share. This dominance is attributed to the wide-ranging applications of GA3 in agriculture, horticulture, and plant tissue culture, where it is recognized as the most widely used gibberellin for crop enhancement.

GA3 effectively stimulates stem elongation, promotes seed germination, improves flowering, and enhances fruit set, making it indispensable for farmers aiming to increase both yield and quality. Its proven efficacy across a broad spectrum of crops, including cereals, fruits, and vegetables, reinforces its strong demand in both developed and emerging agricultural markets.

The popularity of GA3 also stems from its role in commercial horticulture, particularly in fruit enlargement and uniform ripening, which are critical for export-oriented production. Its compatibility with modern agricultural practices, such as foliar sprays and seed treatments, makes it highly adaptable and easy to integrate into existing crop management systems.

Furthermore, the rising need for sustainable solutions that can reduce chemical fertilizer dependence has boosted the adoption of GA3 as a natural plant growth regulator. With its established effectiveness, cost-efficiency, and broad acceptance among growers, GA3 is expected to maintain its commanding position in the market.

By Crop Type Analysis

Fruits and vegetables represent 48.4% of the crop type demand in the Gibberellins Market.

In 2024, Fruits and Vegetables held a dominant market position in the By Crop Type segment of the Gibberellins Market, with a 48.4% share. This leadership is driven by the extensive use of gibberellins in enhancing fruit set, improving size, accelerating ripening, and ensuring uniform development in a wide range of horticultural crops.

Farmers and producers rely on gibberellins to achieve higher market value, as fruits and vegetables treated with these growth regulators often display better color, improved sweetness, and longer shelf life. These qualities not only meet consumer expectations for premium produce but also reduce post-harvest losses, which is critical for both local markets and international trade.

The dominance of this segment is also linked to the growing global demand for fresh and high-quality fruits and vegetables, supported by shifting dietary habits toward healthier and natural foods. Export-driven production further fuels the adoption of gibberellins, as they help maintain consistency in size and quality required by global buyers.

Additionally, the expansion of greenhouse farming and precision horticulture has boosted the application of gibberellins, since controlled environments maximize their effectiveness. With rising consumption and export opportunities, fruits and vegetables are expected to remain the strongest driver of gibberellin usage in agriculture.

By Application Analysis

Seed treatment dominates with a 69.3% share in the global gibberellins market.

In 2024, Seed Treatment held a dominant market position in the By Application segment of the Gibberellins Market, with a 69.3% share. This strong position reflects the critical role gibberellins play in improving seed germination, breaking dormancy, and ensuring uniform seedling emergence.

Farmers and seed producers rely on gibberellin-based treatments to enhance early plant vigor, which directly contributes to higher yields and better crop establishment under varied environmental conditions. By accelerating germination and promoting healthier root and shoot development, seed treatment with gibberellins provides growers with a reliable tool to maximize productivity right from the planting stage.

The dominance of seed treatment is further supported by the rising focus on efficiency and sustainability in modern agriculture. With limited arable land and increasing demand for food, farmers are turning to technologies that optimize every stage of crop production. Gibberellins in seed treatment not only improve crop performance but also reduce the need for excessive fertilizers and chemical inputs, aligning with eco-friendly farming practices.

Moreover, the method is cost-effective, as small quantities of gibberellins can deliver significant improvements in seed performance. Given the rising global emphasis on seed quality and agricultural resilience, seed treatment is expected to sustain its leading position in the market.

Key Market Segments

By Form

- Liquid

- Powder

- Granules

By Function

- Fruit Ripening

- Seed Germination

- Root Growth

- Dormancy of Buds

- Cell Elongation

- Flower Development

- Others

By Type

- Gibberellic Acid (GA3)

- Gibberellins A4/A7

By Crop Type

- Fruits and Vegetables

- Cereals and Grains

- Sugarcane

- Others

By Application

- Seed Treatment

- Foliar Spray

Driving Factors

Rising Food Demand and Need for Higher Yields

One of the top driving factors for the Gibberellins Market is the growing global demand for food, which is pushing farmers to increase crop yields and efficiency. With the world population continuing to rise, agricultural land is becoming more limited, and farmers must find ways to produce more from less. Gibberellins play a key role here, as they help seeds germinate faster, improve plant growth, and enhance fruit development.

This ensures higher productivity and better-quality harvests, which directly meet consumer demand. At the same time, they allow crops to adapt better to changing climates and soil conditions. As a result, gibberellins are becoming essential in modern farming practices aimed at feeding a larger population sustainably.

Restraining Factors

High Production Costs Limit Wider Market Adoption

A key restraining factor for the Gibberellins Market is the high cost of production and formulation, which makes these plant growth regulators less accessible to many farmers, especially in developing regions. The manufacturing process of gibberellins is complex, often involving fermentation and purification steps that add to the final product cost. This results in higher prices compared to other conventional growth enhancers or fertilizers.

For small and medium-scale farmers, affordability becomes a challenge, limiting large-scale adoption. While commercial farming and export-oriented horticulture can absorb these costs due to higher returns, price sensitivity in staple crop farming remains a barrier. Unless production costs decrease or subsidies are introduced, wider usage of gibberellins could face limitations.

Growth Opportunity

Expanding Role of Gibberellins in Organic Farming

A major growth opportunity for the Gibberellins Market lies in their increasing adoption within organic and sustainable farming systems. As consumers around the world demand healthier and chemical-free food, farmers are turning toward natural solutions to boost crop productivity. Gibberellins, being plant-derived growth regulators, fit well into organic practices since they enhance seed germination, fruit ripening, and crop quality without the heavy use of synthetic chemicals.

Governments and agricultural bodies are also encouraging eco-friendly farming methods through subsidies and support programs, creating a favorable environment for wider adoption. With organic food sales growing steadily year after year, the use of gibberellins in organic crop production presents a strong opportunity for long-term market expansion.

Latest Trends

Integration of Gibberellins with Precision Agriculture Practices

One of the latest trends in the Gibberellins Market is their integration with precision agriculture techniques. Farmers are increasingly using advanced tools like drip irrigation, foliar sprays, and sensor-based systems to apply gibberellins more accurately and efficiently. This trend ensures that the right amount of growth regulator is delivered to crops at the right time, reducing waste and improving effectiveness.

Precision use of gibberellins not only enhances crop yield and quality but also lowers input costs, making farming more sustainable. With the global push toward smart farming and digital agriculture, the combination of gibberellins with precision technologies is gaining momentum and shaping the future of modern crop management.

Regional Analysis

In 2024, North America held a 45.20% share of the Gibberellins Market.

The Gibberellins Market demonstrates significant regional variation, with North America emerging as the leading region in 2024. North America accounted for 45.20% of the market, valued at USD 368.2 million, highlighting its strong adoption of plant growth regulators across commercial agriculture and horticulture.

The region’s dominance is largely driven by advanced farming practices, widespread use of controlled-environment agriculture, and a strong focus on enhancing crop yields to meet rising consumer demand for high-quality produce. Favorable regulatory support and higher awareness among farmers have also encouraged the use of gibberellins in fruit, vegetable, and cereal production.

Europe follows closely with steady adoption supported by its focus on sustainable agriculture and strict regulations promoting eco-friendly crop inputs. Asia Pacific, meanwhile, is showing rapid growth potential due to large-scale cultivation, expanding horticultural exports, and rising population-driven food demand.

Latin America and the Middle East & Africa represent emerging markets where increasing adoption of modern farming technologies is expected to strengthen demand over the coming years. However, it is North America’s established agricultural infrastructure, technological integration, and strong emphasis on productivity that position it as the dominant regional market, setting the tone for global growth in gibberellins adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aroxa Crop Science Private Limited is increasingly recognized for its focused portfolio of crop protection and plant growth solutions, with gibberellins playing a central role in its offerings. The company has built its presence by catering to the needs of farmers seeking effective growth regulators to improve germination, fruit development, and yield quality, especially in regions where horticulture and cash crops are vital. Its strategy highlights affordability and accessibility, making it relevant in both domestic and export-driven markets.

Biosynth AG brings a strong scientific foundation to the market, with its expertise in biochemical and specialty ingredient production. By leveraging research-driven development, the company ensures high-quality gibberellin formulations that are widely accepted in precision farming and modern agricultural practices. Its focus on reliability and purity makes it a trusted supplier for industries that demand consistent performance.

Fine Americas, Inc. has established itself as a leading supplier of plant growth regulators, with gibberellins being a critical part of its portfolio. The company’s emphasis lies in addressing high-value crops, particularly fruits and vegetables, where gibberellins deliver measurable improvements in marketability and shelf life. Collectively, these players underline the importance of innovation, reliability, and targeted crop solutions, ensuring that gibberellins continue to serve as a cornerstone of advanced agriculture in 2024.

Top Key Players in the Market

- Aroxa Crop Science Private Limited

- Biosynth AG

- Fine Americas, Inc.

- Jiangsu Fengyuan Bioengineering Co., Ltd.

- Nufarm Ltd.

- SePRO Corporation

- Valent U.S.A. Corporation

Recent Developments

- In February 2025, Jiangsu Fengyuan announced a significant ramp-up in its manufacturing capabilities. The company reported it can now produce 80 tons of Gibberellic Acid technical grade (GA‑Tech) and 5 tons of Gibberellic Acid A₄/A₇ Tech annually, alongside other bio-chemical products. This marks a clear enhancement in its core operations around plant growth regulators.

- In May 2024, the company formerly known as VIO Biosynth officially rebranded to Biosynth, following its integration into the Biosynth Group in late 2023. While this change reflects an organizational shift, it doesn’t specifically pertain to any new gibberellin products or acquisitions focused on that segment.

Report Scope

Report Features Description Market Value (2024) USD 814.7 Million Forecast Revenue (2034) USD 1,825.1 Million CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder, Granules), By Function (Fruit Ripening, Seed Germination, Root Growth, Dormancy of Buds, Cell Elongation, Flower Development, Others), By Type (Gibberellic Acid (GA3), Gibberellins A4/A7), By Crop Type (Fruits and Vegetables, Cereals and Grains, Sugarcane, Others), By Application (Seed Treatment,Foliar Spray) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aroxa Crop Science Private Limited, Biosynth AG, Fine Americas, Inc., Jiangsu Fengyuan Bioengineering Co., Ltd., Nufarm Ltd., SePRO Corporation, Valent U.S.A. Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aroxa Crop Science Private Limited

- Biosynth AG

- Fine Americas, Inc.

- Jiangsu Fengyuan Bioengineering Co., Ltd.

- Nufarm Ltd.

- SePRO Corporation

- Valent U.S.A. Corporation