Global Generator Market By Type (Diesel, Gas, Propane, Dual Fuel, Hybrid), By Voltage Rating (Below 100 kVA, 100kva to 350 kVA, 350 kva to 1000 kVA, Above 1,000 kVA), By Design (Portable, Stationary), By Application (Backup Power, Continuous Power, Peak Shaving Power), By End Use (Industrial, Residential, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150120

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

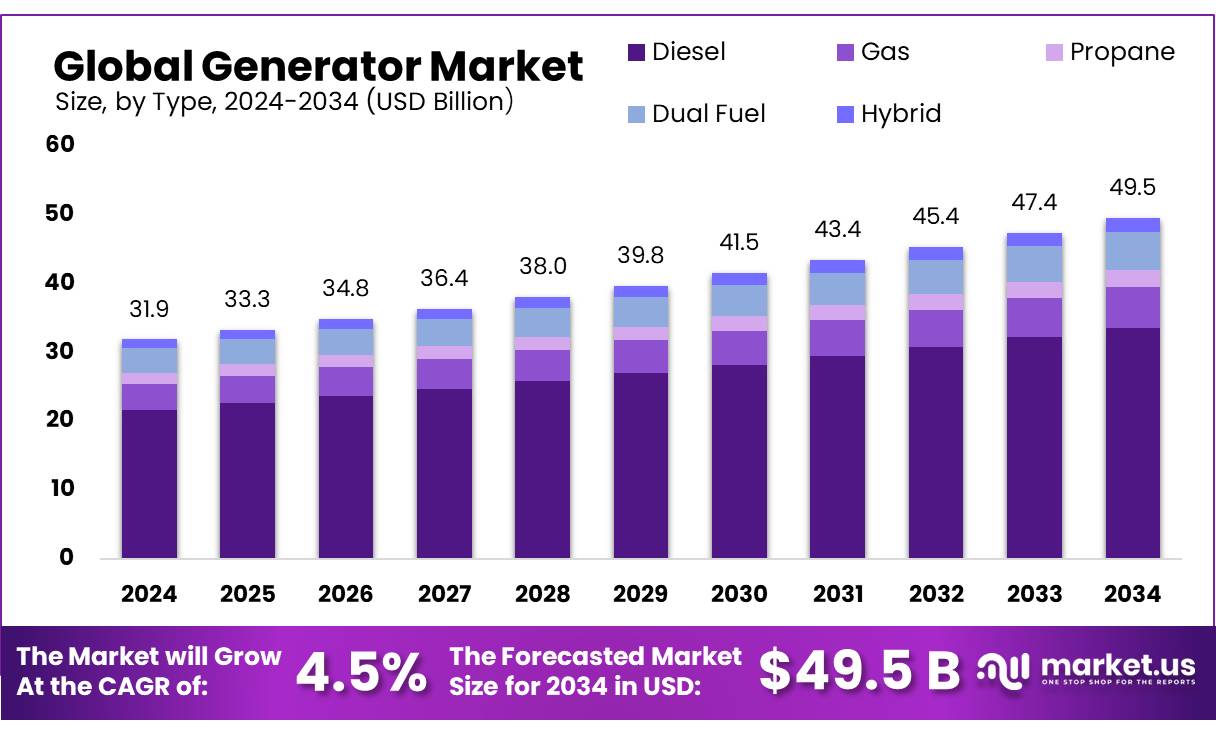

The Global Generator Market size is expected to be worth around USD 49.5 Billion by 2034, from USD 31.9 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Generator Upgrading Cellulose Concentrates (GUCC) industry is emerging as a significant segment within the broader cellulose market, driven by increasing demand for sustainable and biodegradable materials across various sectors. Cellulose concentrates, derived from natural sources such as wood pulp and cotton linters, are being utilized in applications ranging from textiles to bioplastics, aligning with global sustainability goals.

The production of viscose staple fiber (VSF), a primary form of cellulosic fiber, has shown notable figures. According to the Office of the Textile Commissioner, India’s VSF production reached 45.2 million kilograms in September 2018, reflecting the industry’s capacity to produce substantial quantities of cellulosic fibers. The Ministry of Textiles has also released reports highlighting the importance of man-made fibers, including cellulosic fibers, in the Indian textile industry.

The government’s Production-Linked Incentive (PLI) Scheme for Textiles, launched in 2021, aims to enhance the production of man-made fibers (MMF) and technical textiles. With an allocation of ₹10,683 crore (approximately USD 1.44 billion), the scheme incentivizes investments in MMF apparel, fabrics, and technical textiles over five years. This initiative is expected to bolster the domestic manufacturing of cellulose-based fibers and promote sustainable practices in the textile industry.

Key Takeaways

- Generator Market size is expected to be worth around USD 49.5 Billion by 2034, from USD 31.9 Billion in 2024, growing at a CAGR of 4.5%.

- Diesel held a dominant market position, capturing more than a 67.9% share in the global generator market.

- Below 100 kVA held a dominant market position, capturing more than a 36.4% share in the generator market.

- Stationary held a dominant market position, capturing more than a 73.1% share in the generator market.

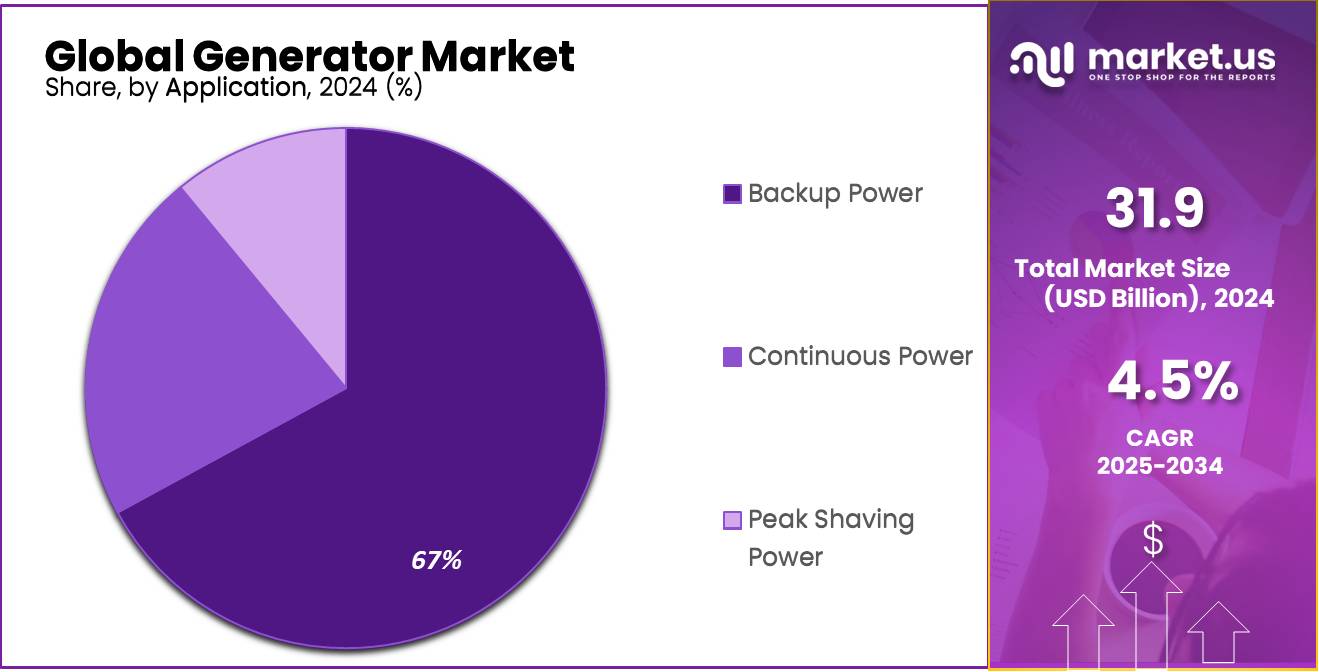

- Backup Power held a dominant market position, capturing more than a 67.2% share in the generator market.

- Industrial held a dominant market position, capturing more than a 56.5% share in the generator market.

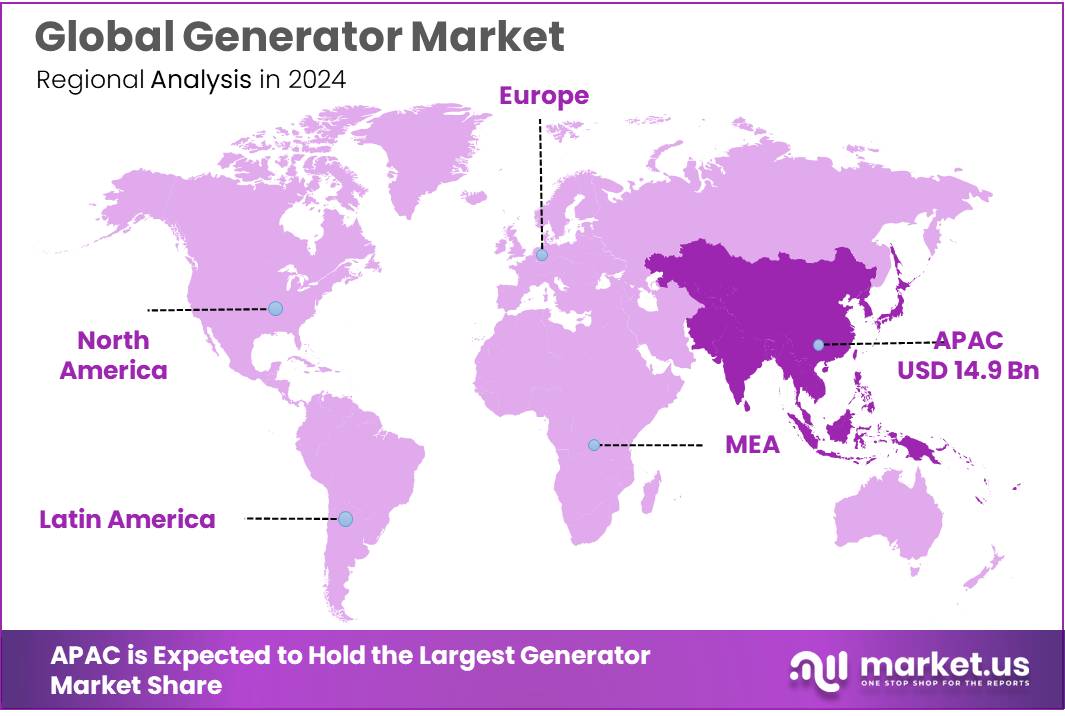

- Asia-Pacific (APAC) region solidified its position as the dominant force in the global generator market, commanding a substantial 46.8% share, equivalent to a market value of $14.9 billion.

By Type

Diesel Generators Lead with 67.9% Share in 2024 Owing to Their High Reliability and Established Infrastructure

In 2024, Diesel held a dominant market position, capturing more than a 67.9% share in the global generator market. This significant lead can be attributed to diesel generators’ long-standing presence, robust performance under heavy load conditions, and lower maintenance requirements compared to other fuel types. They remain the preferred choice across sectors such as construction, manufacturing, mining, and remote-area electrification—especially in regions with inconsistent grid connectivity. In emerging economies like India and several African nations, diesel-based generators continue to be widely deployed in rural electrification and backup power applications.

Additionally, diesel units are heavily used during power outages caused by grid failures or natural disasters. Despite rising environmental concerns and stricter emission norms, the diesel generator segment continues to perform steadily due to its mature supply chain, ready fuel availability, and higher energy efficiency under prolonged use. As of 2025, diesel generators are expected to maintain their leadership position, especially in standby and prime power applications, unless stricter regulations or large-scale renewable integration significantly alter demand patterns.

By Voltage Rating

Below 100 kVA Generators Lead with 36.4% Share in 2024 Driven by Strong Demand in Homes and Small Businesses

In 2024, Below 100 kVA held a dominant market position, capturing more than a 36.4% share in the generator market by voltage rating. This strong foothold is mainly due to the high demand from residential users, small commercial units, mobile shops, clinics, and rural setups where low power backup is sufficient and cost-effective. These generators are compact, easier to install, and ideal for short-term or emergency power needs, especially in countries facing frequent power cuts or lacking stable grid connections.

In urban areas, they serve as reliable backup sources for small offices, apartment complexes, and essential services like ATMs and telecom towers. The segment’s popularity in developing countries has also been supported by government programs promoting energy access in off-grid regions. As of 2025, the below 100 kVA category is expected to remain in strong demand, particularly in fast-growing urban outskirts and Tier II–III cities, where infrastructure is still catching up with electricity demand.

By Design

Stationary Generators Dominate with 73.1% Share in 2024 Due to Their Long-Term Power Support Capabilities

In 2024, Stationary held a dominant market position, capturing more than a 73.1% share in the generator market by design. This clear lead is mainly due to the widespread use of stationary generators in large commercial buildings, hospitals, data centers, industrial plants, and utility backup systems where continuous or long-duration power support is essential. These systems are permanently installed and often integrated into a facility’s electrical infrastructure, offering reliable and automatic backup during grid failures.

Their ability to deliver higher power outputs and operate for extended hours without interruption makes them the preferred choice in mission-critical environments. In regions prone to natural disasters or frequent outages, stationary generators are considered vital infrastructure. As of 2025, demand for stationary units is expected to remain strong, supported by investments in healthcare, manufacturing, and IT services, especially in economies modernizing their energy reliability standards.

By Application

Backup Power Generators Lead with 67.2% Share in 2024 Owing to Rising Power Outages and Critical Infrastructure Needs

In 2024, Backup Power held a dominant market position, capturing more than a 67.2% share in the generator market by application. This dominance reflects the increasing need for uninterrupted electricity across homes, hospitals, commercial buildings, and industrial units. With growing power demand and unstable grid performance in many developing and disaster-prone regions, backup generators have become a necessity rather than a luxury.

Sectors like healthcare, banking, telecom, and data centers depend heavily on backup systems to avoid service disruption and financial losses. Even in developed economies, backup generators are installed as a safeguard against blackouts caused by extreme weather events or equipment failures. By 2025, the backup power segment is expected to maintain its lead, with installations rising across critical infrastructure and smart buildings focused on resilience and reliability.

By End Use

Industrial Sector Leads Generator Market with 56.5% Share in 2024 Due to High Power Needs and Continuous Operations

In 2024, Industrial held a dominant market position, capturing more than a 56.5% share in the generator market by end use. This lead comes from the heavy power demands of industries such as manufacturing, mining, oil & gas, and construction, where even a short power interruption can lead to major production losses. Industrial facilities often require large-capacity generators for both standby and continuous operations, especially in remote or grid-limited areas.

In energy-intensive sectors, generators are not just backup systems—they’re essential components of daily functioning. The growing push for operational efficiency and round-the-clock production schedules further drives generator installations across industrial sites. As of 2025, this segment is expected to remain strong, supported by infrastructure expansion, rapid urbanization, and industrialization in developing countries, where grid power still remains inconsistent or inadequate for heavy-load operations.

Key Market Segments

By Type

- Diesel

- Gas

- Propane

- Dual Fuel

- Hybrid

By Voltage Rating

- Below 100 kVA

- 100kva to 350 kVA

- 350 kva to 1000 kVA

- Above 1,000 kVA

By Design

- Portable

- Stationary

By Application

- Backup Power

- Continuous Power

- Peak Shaving Power

By End Use

- Industrial

- Residential

- Commercial

Drivers

Rising Power Outages and Grid Instability Drive Generator Market Growth

In recent years, the increasing frequency of power outages has emerged as a significant driving factor for the generator market. Aging infrastructure, extreme weather events, and escalating energy demands have collectively strained power grids, leading to more frequent and prolonged outages. For instance, in the United States, the number of major power outages has more than doubled over the past two decades, with an average of over 200 significant outages annually in recent years. These disruptions have underscored the critical need for reliable backup power solutions across residential, commercial, and industrial sectors.

The impact of power outages is particularly pronounced in sectors where continuous power is essential. Hospitals, data centers, and manufacturing facilities cannot afford downtime, as it can lead to severe operational and financial consequences. As a result, there has been a substantial uptick in the adoption of generators to ensure uninterrupted power supply. For example, the healthcare industry has increasingly invested in high-capacity generators to maintain critical operations during grid failures.

Government initiatives have also played a pivotal role in bolstering the generator market. In India, the government has launched several programs aimed at improving energy infrastructure and promoting the use of backup power solutions. The Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), for instance, focuses on strengthening rural electrification and has led to increased deployment of generators in remote areas to ensure consistent power availability. Similarly, the Saubhagya scheme aims to provide electricity connections to all households, indirectly boosting the demand for generators as supplementary power sources in regions with unreliable grid access.

Restraints

Shift to Renewable Energy Slows Generator Market with 40% Renewable Use by Food & Beverage Sector

In many industries, especially food processing, companies are moving toward renewable energy sources, which restrains reliance on traditional generators. According to the CDP India Report 2023, the food, beverage, and agriculture sector sources 40% of its total energy consumption from renewables, leaving only 60% to non-renewable means such as diesel generators.

As more food companies install solar panels, wind turbines, or biomass systems to power their operations, they need fewer backup diesel or gas generators. For example, leading food producers like Haldiram’s have installed a 1.5 MW solar power plant in Nagpur, and PepsiCo India is constructing a plant in Madhya Pradesh that will run entirely on renewable energy sources. These efforts reduce generator purchases and shift capital toward clean-energy infrastructure.

Government policies accelerate this transition. Under India’s National Solar Mission, launched in 2010, the country increased its solar capacity from 2,650 MW in May 2014 to 12,289 MW by March 2017. Subsidy schemes like PM-KUSUM also encourage farmers and agri-businesses to install solar pumps or small solar plants, decreasing the need for diesel generator sets in rural food processing units.

As of 2023, India’s installed renewable capacity stood at 179 GW, including 67 GW of solar and 43 GW of wind energy. Increased renewable adoption means food manufacturers can draw clean grid or captive power rather than run generators, directly limiting generator market expansion.

Opportunity

Growing Energy Needs in Food Processing Create Opportunities for Generator Market

India’s food processing sector is expanding rapidly, and with it, the demand for reliable power sources is increasing. This growth presents a significant opportunity for the generator market, particularly in areas where consistent electricity supply is crucial for operations.

The Indian government has launched several initiatives to support the food processing industry. Programs like the Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) aim to modernize infrastructure and reduce post-harvest losses. These initiatives have led to the establishment of Mega Food Parks and cold chain facilities, which require dependable power to maintain operations. In regions where grid power is unreliable, generators become essential to ensure continuous processing and storage of food products.

Moreover, the Ministry of Food Processing Industries (MoFPI) has been instrumental in promoting the food processing sector through various schemes and financial assistance programs. These efforts aim to modernize infrastructure and encourage the use of sustainable ingredients like cellulose concentrates in food products.

Trends

Hybrid Generators Gain Momentum Amid Food Industry’s Push for Reliable, Cleaner Power

A significant trend shaping the generator market is the growing adoption of hybrid generator systems, particularly within India’s expanding food processing sector. These systems, which combine traditional diesel or gas generators with renewable energy sources like solar power, offer a balanced solution to meet the industry’s increasing demand for reliable and environmentally friendly power.

This rapid development necessitates a dependable power supply to ensure uninterrupted operations in processing units, cold storage facilities, and packaging plants. However, challenges such as inconsistent grid supply and frequent power outages, especially in rural and semi-urban areas, have prompted industry players to seek alternative energy solutions.

Hybrid generators have emerged as a viable option, offering the dual benefits of continuous power supply and reduced carbon emissions. By integrating renewable energy sources, these systems not only ensure operational efficiency but also align with the industry’s sustainability goals. The Indian government’s initiatives, such as the Sustainable Alternative Towards Affordable Transportation (SATAT) and GOBARDhan schemes, further support this transition by promoting the use of renewable energy and biofuels.

Moreover, the Bureau of Energy Efficiency (BEE) has identified energy-efficient technologies applicable to industries like pulp and paper, which share similarities with food processing in terms of energy consumption patterns. These technologies, when integrated with hybrid generator systems, can lead to significant energy savings and operational cost reductions.

Regional Analysis

APAC Leads Global Generator Market with 46.8% Share, Valued at $14.9 Billion in 2024

In 2024, the Asia-Pacific (APAC) region solidified its position as the dominant force in the global generator market, commanding a substantial 46.8% share, equivalent to a market value of $14.9 billion. This dominance is underpinned by rapid industrialization, urban expansion, and persistent challenges in power reliability across several emerging economies.

Furthermore, the region’s emphasis on sustainable energy solutions is reshaping the generator landscape. The integration of renewable energy sources with traditional generators is becoming increasingly prevalent, aligning with global sustainability goals and addressing environmental concerns. This shift is evident in the adoption of hybrid generator systems, which combine conventional fuel-based generators with renewable energy inputs to ensure reliable and eco-friendly power supply.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mitsubishi Heavy Industries Ltd. remains a key player in the global generator market, offering a wide range of diesel and gas-powered generators tailored for industrial, marine, and utility-scale applications. The company emphasizes high-efficiency and low-emission technology, catering to sectors with large-scale power needs. Mitsubishi’s generators are widely deployed in Asia, the Middle East, and Africa. It also supports hybrid systems combining renewables and thermal power, aligning with global clean energy goals and resilience in off-grid environments.

General Electric (GE) continues to be a dominant force in the generator segment, especially in power generation and large-scale industrial installations. Its portfolio includes gas turbines, steam turbines, and generator systems integrated with grid technology. GE’s innovations focus on digital controls, predictive maintenance, and fuel flexibility. With global operations, GE’s generators support critical infrastructure, including power utilities, refineries, and manufacturing plants. The company also plays a role in upgrading power backup systems in renewable-heavy grids and smart cities.

Siemens Energy provides advanced generator systems used across thermal, wind, hydro, and industrial power generation. The company specializes in large-capacity synchronous generators and offers services in maintenance, digital diagnostics, and energy efficiency upgrades. Siemens Energy’s global footprint and integration with smart grids position it well for future-ready applications. It has also been investing in hydrogen-compatible generator technology, aiming to support the transition to low-carbon energy solutions across Europe, Asia, and North America.

Top Key Players in the Market

- Mitsubishi Heavy Industries Ltd.

- General Electric

- Siemens Energy

- Kohler Co.

- ABB Ltd.

- Caterpillar

- Cummins Inc.

- Honda

- Su-kam

- Kirloskar Oil Engines Ltd

- Generac Holdings Inc.

- Rolls Royce

- Wacker Neuson SE

- AB Volvo Penta

- Brigg & Stratton

Recent Developments

In 2024, Mitsubishi Heavy Industries Ltd. (MHI) achieved record-breaking financial results, with total revenue reaching ¥5,027.1 billion, marking a ¥370.0 billion increase from the previous year. The company’s business profit also saw a significant rise, climbing to ¥383.1 billion, which is a ¥100.6 billion year-over-year increase.

In 2024, Siemens Energy reported a revenue of €34.5 billion, marking a 12.8% increase from the previous year. The company’s net income reached €1.335 billion, a significant turnaround from a loss of €4.59 billion in 2023.

Report Scope

Report Features Description Market Value (2024) USD 31.9 Bn Forecast Revenue (2034) USD 49.5 Bn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Diesel, Gas, Propane, Dual Fuel, Hybrid), By Voltage Rating (Below 100 kVA, 100kva to 350 kVA, 350 kva to 1000 kVA, Above 1,000 kVA), By Design (Portable, Stationary), By Application (Backup Power, Continuous Power, Peak Shaving Power), By End Use (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsubishi Heavy Industries Ltd., General Electric, Siemens Energy, Kohler Co., ABB Ltd., Caterpillar, Cummins Inc., Honda, Su-kam, Kirloskar Oil Engines Ltd, Generac Holdings Inc., Rolls Royce, Wacker Neuson SE, AB Volvo Penta, Brigg & Stratton Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mitsubishi Heavy Industries Ltd.

- General Electric

- Siemens Energy

- Kohler Co.

- ABB Ltd.

- Caterpillar

- Cummins Inc.

- Honda

- Su-kam

- Kirloskar Oil Engines Ltd

- Generac Holdings Inc.

- Rolls Royce

- Wacker Neuson SE

- AB Volvo Penta

- Brigg & Stratton