Global Gaming Laptop Market Size, Share, Growth Analysis By Price Range (Entry-Level Laptops, Mid-Range Laptops, High-End Laptops), By End-User (Casual Gamers, Hardcore Gamers, Professional Gamers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173576

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

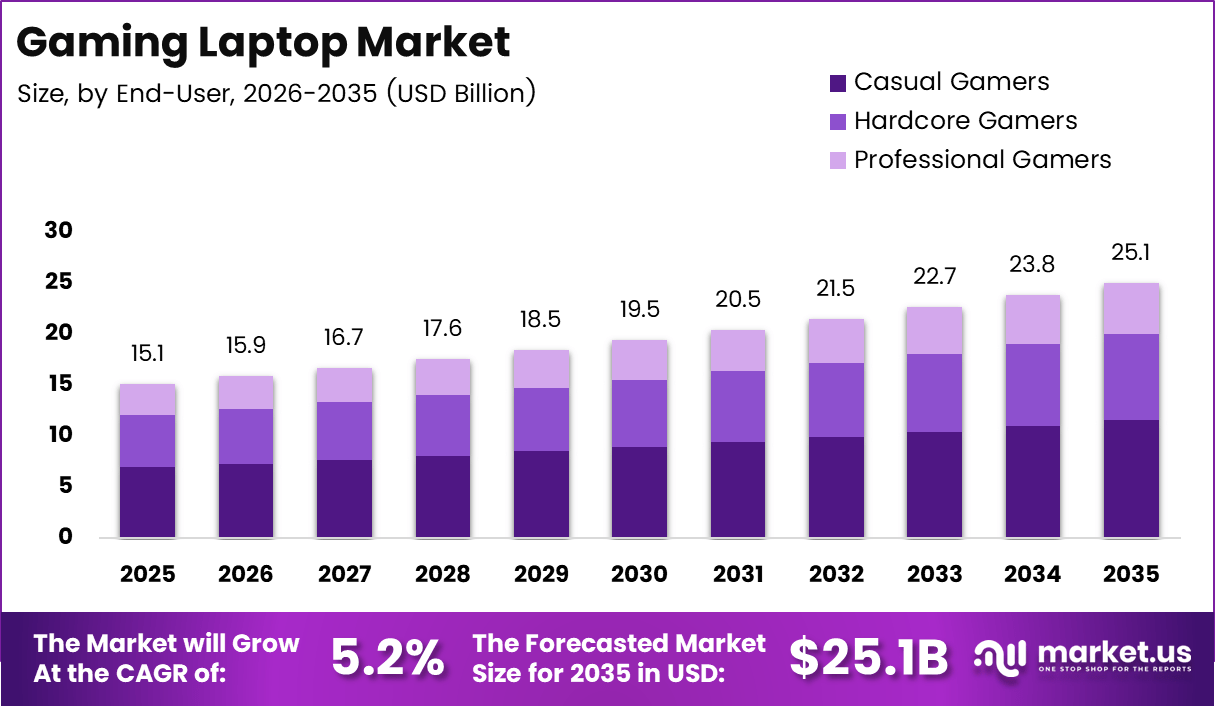

The Global Gaming Laptop Market size is expected to be worth around USD 25.1 billion by 2035, from USD 15.1 billion in 2025, growing at a CAGR of 5.2% during the forecast period from 2026 to 2035.

The gaming laptop market represents the global ecosystem of portable computing devices engineered for high performance gaming workloads. These systems integrate advanced processors, discrete graphics, high refresh rate displays, and enhanced thermal architectures. As digital entertainment demand expands, gaming laptops increasingly address both immersive gaming and performance driven professional computing needs.

From an analyst viewpoint, the gaming laptop category has transitioned from a niche enthusiast segment into a mainstream premium computing class. Consumers increasingly expect portability without compromising performance. As a result, product strategies emphasize performance per dollar, thermal stability, and sustained hardware relevance across longer replacement cycles.

Market growth is supported by rising e-sports participation, expanding creator economies, and remote digital lifestyles. Additionally, hybrid users adopt gaming laptops for content creation, simulation workloads, and AI assisted applications. This convergence broadens addressable demand and supports consistent volume growth across both developed and emerging regions.

Opportunities continue to expand as governments increase investment in digital infrastructure, broadband access, and domestic semiconductor manufacturing. Policy initiatives focused on electronics production incentives and supply chain localization improve availability. Meanwhile, evolving energy efficiency regulations guide design optimization without materially restricting innovation pathways.

Technological differentiation remains a core competitive lever within the gaming laptop market. Advanced cooling architectures, higher GPU power envelopes, and AI based performance tuning increasingly define product value. While many standard laptops remain limited to 60Hz, gaming laptops offer displays reaching 240Hz or higher, reinforcing immersive gameplay advantages.

According to Notebook Check and Tom’s Hardware performance evaluations, flagship configurations now combine Intel Core i9 14900HX processors with NVIDIA GeForce RTX 4090 Laptop GPUs. Parallel platforms integrating AMD Ryzen 9 8945HS processors with RTX 4070 Laptop GPUs demonstrate strong efficiency and thermal balance.

Price to performance optimization is reshaping purchasing behavior. According to PCMag and Laptop Mag retail assessments, select high performance gaming laptops deliver RTX 5080 class performance at nearly 1,000 dollars less than premium alternatives. This pricing shift improves accessibility for value oriented buyers.

Overall, the gaming laptop market continues evolving toward value driven performance leadership. As refresh rate expectations progress from 90Hz and 120Hz toward ultra high standards, buyers prioritize longevity, immersive capability, and multi purpose usability. This trajectory strengthens gaming laptops as strategic assets within the broader personal computing landscape.

Key Takeaways

* The global gaming laptop market is projected to grow from USD 15.1 billion in 2025 to USD 25.1 billion by 2035, registering a 5.2% CAGR.

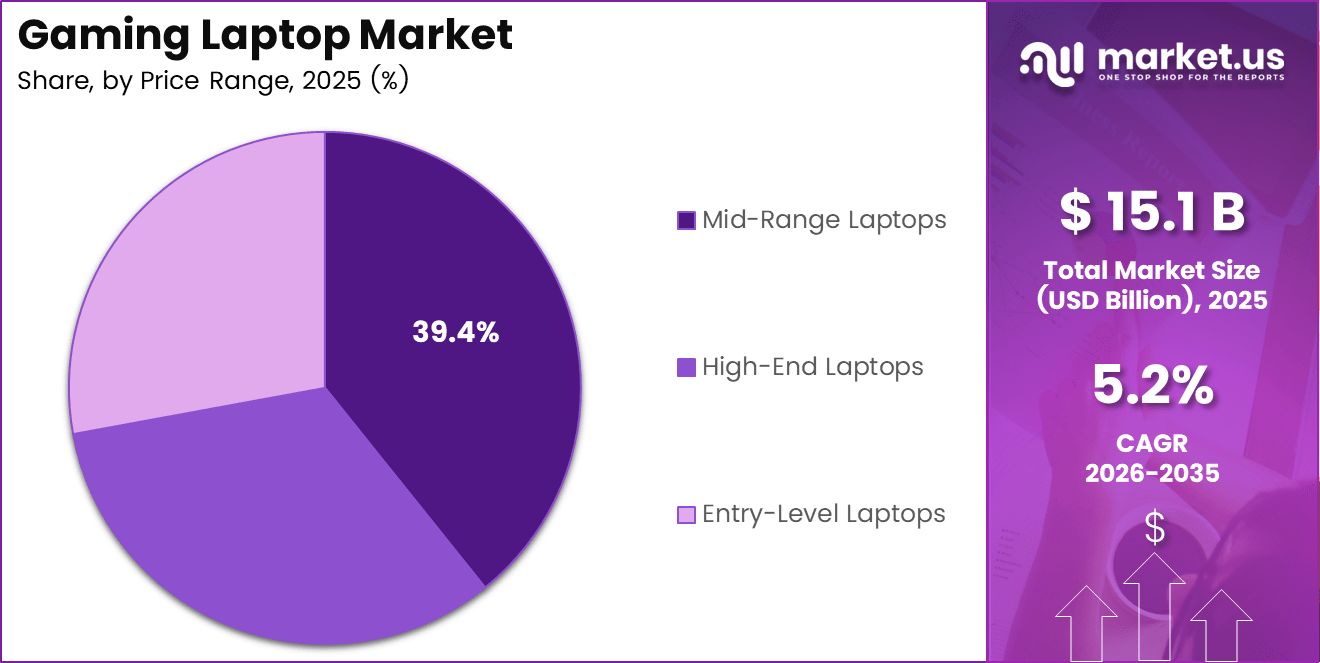

* Mid-range laptops represent the leading price segment, accounting for a 39.4% share of the global gaming laptop market in 2025.

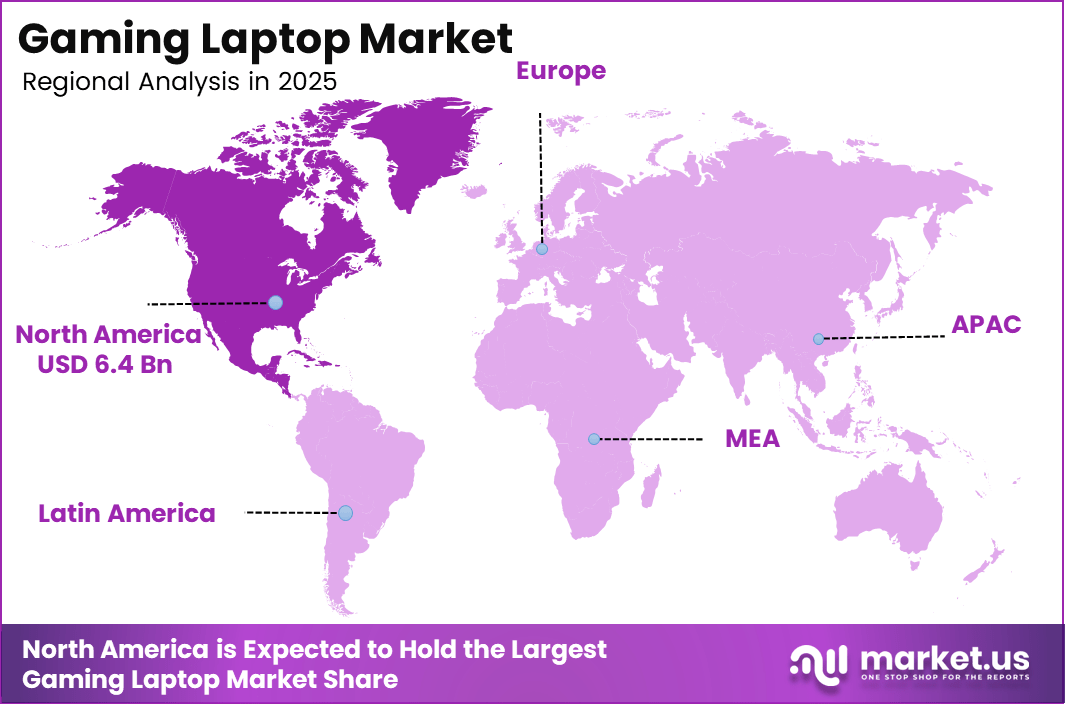

* Casual gamers form the largest end-user group, contributing a dominant 46.2% share of total market demand in 2025. North America dominates the global gaming laptop market with a 42.7% share, valued at USD 6.4 billion.

Entry-level, mid-range, and high-end laptops together define the core price-based segmentation supporting market expansion through 2035.

Asia Pacific emerges as a high-growth regional market, driven by expanding gaming adoption across major economies through the 2026–2035 period.By Price Range Analysis

Mid-Range Laptops dominate with a 39.4% share, driven by balanced performance, affordability, and broad consumer appeal.

In 2025, Mid-Range Laptops held a dominant market position in the By Price Range Analysis segment of Gaming Laptop Market, with a 39.4% share. This segment benefits from optimal price-to-performance ratios. Consequently, consumers increasingly prefer systems that support high refresh rates and capable GPUs without premium pricing.

Entry-Level Laptops continue to play an important role by serving first-time gamers and budget-conscious users. Gradually, these devices support casual gaming through entry-level graphics and improved cooling. As a result, this segment remains relevant in emerging markets and among students upgrading from standard consumer laptops.

High-End Laptops address enthusiasts seeking uncompromised performance and premium build quality. Typically, these models integrate flagship processors, advanced GPUs, and superior thermal designs. Although priced higher, they appeal to users prioritizing immersive gaming experiences, content creation, and future-ready specifications.

Together, price-based segmentation reflects diversified demand patterns. While mid-range systems lead adoption, entry-level models expand accessibility and high-end devices reinforce brand leadership. Therefore, manufacturers strategically balance portfolios to capture volume growth while maintaining technological differentiation across pricing tiers.

By End-User Analysis

Casual Gamers dominate with a 46.2% share, supported by growing mainstream interest in gaming and versatile laptop usage.

In 2025, Casual Gamers held a dominant market position in the By End-User Analysis segment of Gaming Laptop Market, with a 46.2% share. This group values flexibility, using gaming laptops for entertainment, work, and study. Accordingly, demand favors reliable performance and reasonable pricing.

Hardcore Gamers represent a performance-focused segment demanding high frame rates, advanced cooling, and customization. Gradually, this group adopts mid-to-high-tier laptops that sustain competitive gameplay. As e sports visibility increases, their expectations continue shaping hardware innovation and component optimization.

Professional Gamers rely on gaming laptops for tournaments, training, and content streaming. Typically, they require consistent performance, portability, and low-latency displays. Although smaller in volume, this segment influences premium design trends and validates performance claims through real-world competitive use.

Overall, end-user segmentation highlights widening gaming participation. Casual gamers drive volume, while hardcore and professional users accelerate performance benchmarks. Consequently, vendors align product strategies to serve diverse usage intensities, ensuring sustained demand across consumer, competitive, and professional gaming ecosystems.

Key Market Segments

By Price Range

- Entry-Level Laptops

- Mid-Range Laptops

- High-End Laptops

By End-User

- Casual Gamers

- Hardcore Gamers

- Professional Gamers

Drivers

Rising Adoption of Competitive Esports and Professional Gaming Ecosystems Drives Market Growth

The growing popularity of competitive esports plays a major role in driving the gaming laptop market. More users now participate in online tournaments, ranked gaming, and streaming activities that demand reliable high performance hardware. As esports gains mainstream recognition, gamers increasingly seek devices that deliver consistent frame rates and low latency gameplay.

Continuous improvements in GPU and CPU technologies further support market growth. Modern gaming laptops can now deliver near desktop level performance, reducing the traditional gap between stationary and portable gaming systems. This shift encourages gamers to choose laptops that support demanding titles without sacrificing processing power or graphical quality.

Another strong driver is the rising preference for portable high performance computing among younger consumers. Students and professionals value devices that support gaming, content creation, and multitasking in a single platform. Gaming laptops meet this need by combining performance with mobility, making them attractive lifestyle devices.

Additionally, manufacturers increasingly integrate advanced cooling and thermal management technologies. Improved airflow, vapor chambers, and intelligent fan control systems help maintain performance during long gaming sessions. These innovations improve durability and user experience, strengthening overall adoption across multiple user segments.

Restraints

High Upfront Cost Compared to Standard Consumer Laptops Limits Wider Adoption

One of the key restraints in the gaming laptop market is the high initial purchase cost. Gaming laptops include premium components such as discrete graphics cards, advanced processors, and specialized cooling systems. These features significantly increase pricing compared to regular consumer laptops, limiting accessibility for price sensitive buyers.

For many casual users, standard laptops provide adequate performance for everyday tasks. As a result, some consumers delay or avoid upgrading to gaming laptops due to cost concerns. This price gap remains a challenge, particularly in emerging markets where affordability strongly influences purchasing decisions.

Another major restraint is shorter battery life during intensive gaming workloads. High performance components consume substantial power, leading to faster battery drain. Users often need to remain plugged in during gaming sessions, reducing portability benefits.

Although battery technology continues to improve, power demands still outweigh efficiency gains. This limitation affects mobile gaming convenience and can influence buyer decisions, especially for users prioritizing long battery endurance over peak performance.

Growth Factors

Expansion of Cloud Gaming Compatibility Creates New Growth Opportunities

The expansion of cloud gaming presents a strong growth opportunity for the gaming laptop market. As cloud platforms improve, laptops optimized for high refresh rate displays and stable connectivity gain importance. Gaming laptops can serve as ideal access devices for streaming advanced games without relying solely on local hardware.

Another opportunity comes from increasing demand among content creators who combine gaming with professional workloads. Streamers, video editors, and digital artists require systems capable of handling gaming, recording, and editing simultaneously. Gaming laptops offer the processing power and graphics performance needed for these blended use cases.

This overlap between gaming and professional productivity expands the target customer base. Users now view gaming laptops as multi purpose performance machines rather than single use devices. This perception supports broader market adoption.

As software tools become more demanding, performance focused laptops gain relevance. Manufacturers that position gaming laptops for both entertainment and creative productivity can unlock new revenue streams and long term user loyalty.

Emerging Trends

Rapid Adoption of AI Enhanced Performance Tuning Shapes Market Trends

One of the most notable trends in the gaming laptop market is the adoption of AI driven performance tuning. Intelligent software now adjusts power usage, cooling behavior, and frame optimization in real time. These features help users achieve smoother gameplay without manual system adjustments.

AI based optimization improves efficiency by balancing performance and thermal output. This enhances user experience, especially for less technical consumers who prefer automated performance management. As AI capabilities mature, these tools become key differentiators in product offerings.

Another major trend is the growing popularity of ultra thin high performance gaming laptops. Consumers increasingly prefer lighter designs that maintain strong gaming capability. Advances in component efficiency and cooling allow manufacturers to reduce device thickness without sacrificing performance.

This shift reflects changing consumer expectations around portability and design. Sleeker gaming laptops appeal to users seeking professional looking devices that support both gaming and everyday computing needs.

Regional Analysis

North America Dominates the Gaming Laptop Market with a Market Share of 42.7%, Valued at USD 6.4 Billion

North America held the dominant position in the gaming laptop market, accounting for 42.7% of global demand and reaching a market value of USD 6.4 billion. This dominance is driven by strong consumer spending on premium electronics, a mature gaming culture, and high adoption of e-sports and competitive igaming platforms. The region benefits from early adoption of advanced hardware technologies and strong penetration of high performance laptops among both casual and professional gamers.

Europe Gaming Laptop Market Trends

Europe represents a steady and technology driven gaming laptop market, supported by a growing base of PC gamers and increasing interest in organized e-sports. Demand is strengthened by rising disposable incomes in Western Europe and expanding online gaming communities across the region. Energy efficient designs and balanced performance systems are gaining preference among European consumers.

Asia Pacific Gaming Laptop Market Trends

Asia Pacific is emerging as a high growth region for gaming laptops due to a large youth population, expanding internet infrastructure, and rising popularity of online and mobile gaming ecosystems. Increasing participation in competitive gaming and content creation is supporting demand for affordable yet high performance devices. Rapid urbanization and digital lifestyle adoption continue to fuel regional growth.

Middle East and Africa Gaming Laptop Market Trends

The Middle East and Africa gaming laptop market is developing at a moderate pace, supported by improving digital connectivity and growing interest in console and PC based gaming. Rising investments in esports events and gaming zones in select countries are contributing to market expansion. Demand is largely concentrated in urban centers with higher purchasing power.

Latin America Gaming Laptop Market Trends

Latin America is witnessing gradual growth in the gaming laptop market, driven by increasing youth engagement in online gaming and streaming platforms. Improving access to high speed internet and expanding digital entertainment consumption are key supporting factors. Price sensitive consumers are encouraging demand for mid range gaming laptops across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Gaming Laptop Company Insights

From an analyst viewpoint, the global gaming laptop market in 2025 reflects a balance between extreme performance, design differentiation, and ecosystem driven value, with leading players focusing on thermal efficiency, AI assisted optimization, and user centric customization to capture both enthusiast and mainstream demand.

ORIGIN PC Corporation continues to position itself as a niche premium player, emphasizing high end customization and desktop grade performance in portable formats. Its focus on bespoke configurations, advanced cooling layouts, and performance tuning appeals strongly to professional gamers and power users seeking uncompromised specifications. This strategy supports brand loyalty in the ultra premium gaming laptop segment.

Razer Inc. maintains a strong design led and ecosystem oriented approach within the gaming laptop space. The company’s emphasis on sleek form factors, high refresh rate displays, and seamless integration with gaming peripherals strengthens its appeal among style conscious and competitive gamers. Its brand driven positioning supports higher margins and sustained visibility in the premium category.

Hewlett Packard Enterprise Development LP benefits from strong engineering depth and a well established gaming focused product portfolio. The company leverages scalable hardware platforms, performance focused thermals, and software level optimization to address both enthusiast and mid range gaming needs. Its ability to balance volume production with premium features supports consistent global demand.

Lenovo Group Limited. adopts a performance to value driven strategy, targeting a broad gamer base across multiple price points. The company emphasizes efficient power management, reliable build quality, and competitive specifications to address emerging and mature markets alike. This balanced approach positions Lenovo strongly for sustained growth in the global gaming laptop market.

Top Key Players in the Market

- ORIGIN PC Corporation

- Razer Inc.

- Hewlett Packard Enterprise Development LP

- Lenovo Group Limited

- Micro-Star INTL CO.

- Dell Technologies Inc.

- Acer, Inc.

- Giga-byte Technology Co., Ltd.

- ASUSTek Computer Inc

Recent Developments

- In January 2026, HP announced the transition of its Omen gaming PC lineup under the HyperX brand at CES 2026, unifying its gaming hardware and peripherals strategy following the 2021 HyperX acquisition. Alongside the rebranding, the Omen 15, Omen 16, and Omen Max 16 received performance upgrades powered by the latest Intel and AMD processors.

- In January 2026, AMD strengthened its AI ecosystem leadership at CES 2026 by unveiling new Ryzen, Ryzen AI, and AMD ROCm advancements, extending AI capabilities across client PCs, graphics platforms, and software stacks. These announcements highlighted AMD’s focus on scalable AI performance from consumer devices to enterprise and developer environments.

Report Scope

Report Features Description Market Value (2025) USD 15.1 billion Forecast Revenue (2035) USD 25.1 billion CAGR (2026-2035) 5.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Price Range (Entry-Level Laptops, Mid-Range Laptops, High-End Laptops), By End-User (Casual Gamers, Hardcore Gamers, Professional Gamers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ORIGIN PC Corporation, Razer Inc., Hewlett Packard Enterprise Development LP, Lenovo Group Limited, Micro-Star INTL CO., Dell Technologies Inc., Acer, Inc., Giga-byte Technology Co., Ltd., ASUSTek Computer Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ORIGIN PC Corporation

- Razer Inc.

- Hewlett Packard Enterprise Development LP

- Lenovo Group Limited

- Micro-Star INTL CO.

- Dell Technologies Inc.

- Acer, Inc.

- Giga-byte Technology Co., Ltd.

- ASUSTek Computer Inc