Global Functional Mushroom Market Size, Share, And Business Benefits By Product (Reishi, Cordyceps, Lions Mane, Turkey Tail, Shiitake, Chaga, Others), By Form (Fresh, Dried, Powder, Capsules, Extracts), By Application (Food and Beverage, Dietary Supplements, Pharmaceutical, Others), By Distribution Channel (Supermarkets, Online, Specialty Stores, Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154389

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

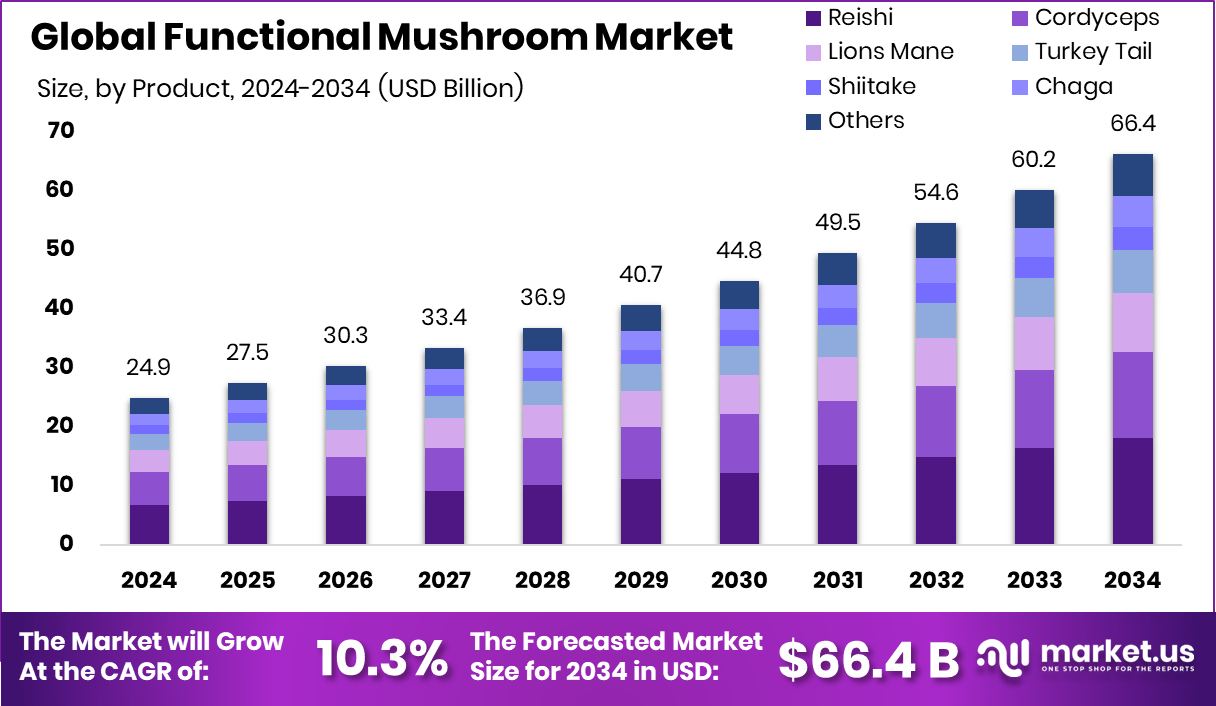

The Global Functional Mushroom Market is expected to be worth around USD 66.4 billion by 2034, up from USD 24.9 billion in 2024, and is projected to grow at a CAGR of 10.3% from 2025 to 2034. Strong demand for natural wellness products helped North America reach USD 10.9 billion.

Functional mushrooms are cultivated not solely for food consumption but for their associated health benefits, including immune-boosting, antioxidant, and adaptogenic properties. These mushrooms are rich in bioactive compounds and nutrients such as β‑glucans, vitamins, and antioxidants, making them a valuable part of functional foods. In agriculture, functional mushrooms are commonly grown on substrates such as paddy straw or composted agricultural waste. Government-backed initiatives have promoted their cultivation using safe, scientific methods, recognizing both their nutritional value and economic potential.

The growth of the functional mushroom market in India has been driven significantly by government support through subsidies and funding. Under the Horticulture Mission for North East and Himalayan States—a sub-scheme of the Mission for Integrated Development of Horticulture (MIDH)—capital assistance of up to ₹20 lakh per unit is offered for mushroom production units, compost units, and spawn making units.

This includes 100% financial support for public sector undertakings and 40% for private sector participants. Furthermore, training programs and extension services have been integrated into these schemes, allowing small-scale cultivators to adopt sustainable and profitable mushroom farming techniques.

Mushroom production in India has shown a strong upward trend. From a modest volume of approximately 40,000 tonnes in the early 2000s, production surged to about 351,100 tonnes by the year 2023–24. This sharp increase highlights the growing role of mushrooms in India’s agricultural economy. Simultaneously, rising consumer preference for high-protein, low-processed, health-promoting food has accelerated the market demand for varieties such as oyster, shiitake, and milky mushrooms.

Key Takeaways

- The Global Functional Mushroom Market is expected to be worth around USD 66.4 billion by 2034, up from USD 24.9 billion in 2024, and is projected to grow at a CAGR of 10.3% from 2025 to 2034.

- In 2024, Reishi held 27.3% share, leading the Functional Mushroom Market by product segment.

- Powder form dominated the Functional Mushroom Market by form, capturing a 31.1% market share in 2024.

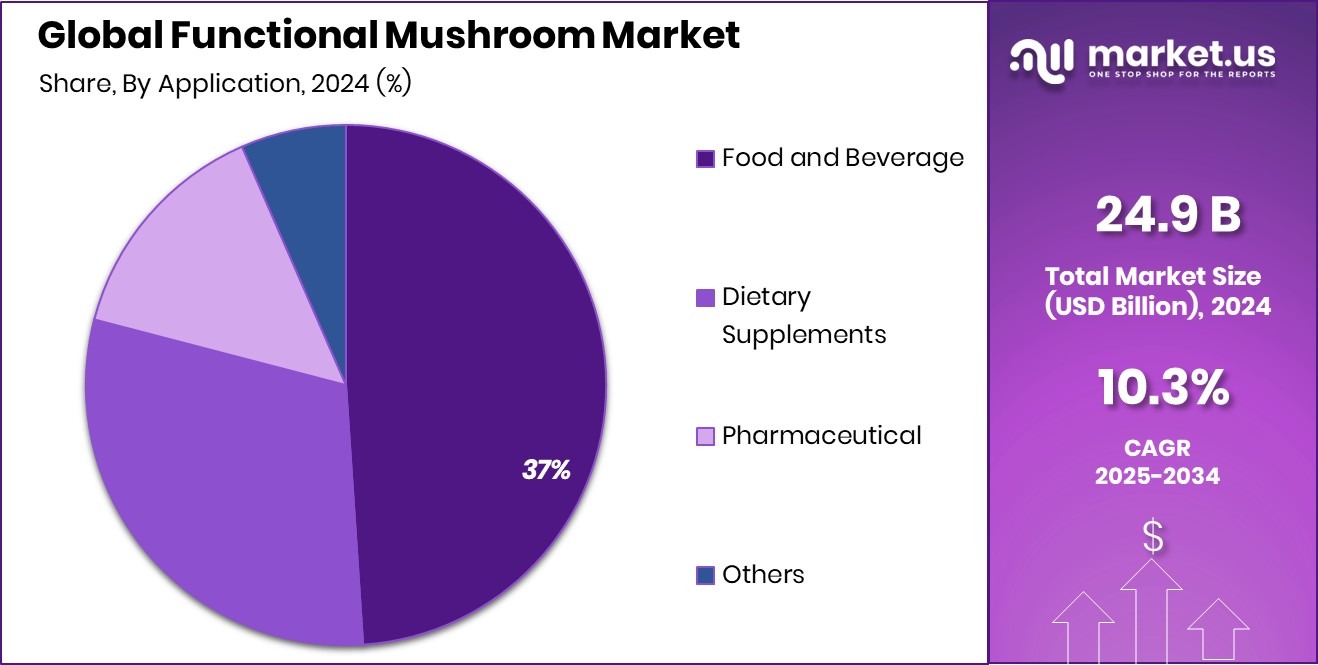

- Food and Beverage application led with 37.4% share, driving functional mushroom demand across consumer products.

- Supermarkets accounted for a 34.2% share, emerging as the dominant distribution channel in functional mushroom sales.

- North America accounted for USD 10.9 billion in market revenue during the year.

By Product Analysis

Reishi dominates the Functional Mushroom Market, capturing 27.3% product share.

In 2024, Reishi held a dominant market position in the By Product segment of the Functional Mushroom Market, with a 27.3% share. This significant share reflects the growing consumer preference for Reishi due to its recognized adaptogenic and immune-supportive properties.

Traditionally used in East Asian medicine, Reishi has gained increasing global traction as a functional ingredient in dietary supplements, teas, powders, and fortified food products. Its popularity has been further supported by expanding awareness among health-conscious consumers regarding the potential benefits of bioactive compounds such as triterpenoids and polysaccharides found in Reishi.

The consistent demand for Reishi-based products has been strengthened by supportive agricultural and cultivation initiatives aimed at boosting the production of high-value mushrooms. Favorable government schemes promoting mushroom farming have indirectly contributed to Reishi’s availability in both raw and processed forms. Additionally, the mushroom’s long shelf life and suitability for various forms of extraction make it commercially viable for large-scale production and distribution.

Owing to these factors, Reishi continues to be a preferred product category within the functional mushroom segment. The high market share captured by Reishi in 2024 indicates not only strong present demand but also potential for further growth as health and wellness trends continue to shape consumer choices globally.

By Form Analysis

Powder form leads with 31.1% in the functional mushroom market.

In 2024, Powder held a dominant market position in the By Form segment of the Functional Mushroom Market, with a 31.1% share. This dominance can be attributed to the high demand for powdered functional mushrooms across dietary supplements, health beverages, and food fortification applications. Powdered mushrooms are widely preferred for their ease of integration into various product formulations without altering the taste or texture significantly, making them a practical option for both manufacturers and consumers.

The powdered form also ensures longer shelf life and better stability compared to fresh or liquid forms, which is a key factor supporting its widespread adoption in health-focused food processing industries. Additionally, the convenience of precise dosage control in powders has made it favorable among nutraceutical companies aiming to deliver standardized mushroom-derived bioactives.

Consumers seeking natural wellness solutions increasingly opt for mushroom powders, which can be easily added to smoothies, teas, and other functional beverages. The growth in popularity of clean-label and organic nutritional products has further strengthened the position of powdered forms in the market. With its practical advantages and high consumer acceptability, the powder form accounted for the highest market share in 2024, confirming its leading role in the functional mushroom product landscape.

By Application Analysis

Food and Beverage applications hold 37.4% Functional Mushroom Market share.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Functional Mushroom Market, with a 37.4% share. This leading position reflects the rising integration of functional mushrooms into mainstream food and beverage products such as energy bars, ready-to-drink beverages, soups, coffee blends, and wellness snacks. The growing consumer focus on natural ingredients and health-supporting foods has driven demand for products that combine nutrition with functionality, positioning functional mushrooms as ideal additives in everyday consumables.

The adaptability of functional mushrooms like Reishi, Lion’s Mane, and Chaga in powdered or extract form has made them suitable for incorporation without compromising the taste or shelf stability of finished food and beverage products. Food manufacturers are leveraging this compatibility to develop innovative offerings targeting immunity, cognitive health, and stress relief, which align with evolving consumer health trends.

This increasing use of functional mushrooms in food and beverages has not only expanded their reach beyond traditional supplement formats but has also contributed to higher consumption rates in regular diets. The 37.4% market share recorded by the Food and Beverage segment in 2024 highlights its prominent role as the primary application area, underscoring strong market penetration and continued product innovation in this space.

By Distribution Channel Analysis

Supermarkets drive sales, accounting for 34.2 of % distribution channel share.

In 2024, Supermarkets held a dominant market position in the By Distribution Channel segment of the Functional Mushroom Market, with a 34.2% share. This substantial share reflects the widespread consumer preference for purchasing health and wellness products through organized retail formats that offer accessibility, variety, and trust. Supermarkets provide a structured and informative shopping environment where functional mushroom products—such as powders, capsules, infused beverages, and snacks—are readily available across health food, organic, and dietary supplement aisles.

The dominance of supermarkets is further supported by their expansive distribution networks and strategic shelf placements, which enhance product visibility and consumer awareness. Promotional campaigns, in-store sampling, and health-focused product labeling have played an important role in influencing consumer buying behavior. The ability to examine physical products, assess certifications, and receive direct assistance from retail staff adds to the credibility and appeal of supermarket purchases.

Additionally, the availability of functional mushroom products in both urban and semi-urban supermarket chains has facilitated broader market penetration. The 34.2% market share in 2024 confirms supermarkets as the leading distribution channel, benefiting from strong consumer footfall, product assortment, and the growing demand for wellness-based functional foods and beverages offered in retail environments.

Key Market Segments

By Product

- Reishi

- Cordyceps

- Lions Mane

- Turkey Tail

- Shiitake

- Chaga

- Others

By Form

- Fresh

- Dried

- Powder

- Capsules

- Extracts

By Application

- Food and Beverage

- Dietary Supplements

- Pharmaceutical

- Others

By Distribution Channel

- Supermarkets

- Online

- Specialty Stores

- Pharmacies

- Others

Driving Factors

Rising Focus on Natural Health Boosting Foods

One of the key driving factors for the growth of the functional mushroom market is the rising focus on natural health-boosting foods. More people are now choosing natural products to support their health, especially after the global health crisis raised awareness about immunity and wellness. Functional mushrooms like Reishi, Lion’s Mane, and Chaga are known for their health benefits, such as improving immunity, reducing stress, and supporting brain function.

These mushrooms are increasingly added to everyday items like teas, coffees, powders, and snacks. As consumers become more careful about what they eat and prefer ingredients they can trust, the demand for natural and functional foods is growing. This trend is strongly supporting the functional mushroom market.

Restraining Factors

High Production Cost Limits Mass Market Reach

A major restraining factor for the functional mushroom market is the high production cost, which limits its reach to a wider audience. Functional mushrooms require controlled environments, specific growing conditions, and longer cultivation times compared to regular mushrooms. This increases the cost of farming, harvesting, and processing.

Additionally, converting these mushrooms into powders, extracts, or supplements adds further expense due to advanced extraction techniques and quality testing. As a result, the final product becomes more expensive for consumers.

This high pricing can discourage middle- and lower-income consumers from buying functional mushroom products regularly. Therefore, despite growing interest, the high production cost is a major barrier to making these products available to everyone at affordable prices.

Growth Opportunity

Expanding Use in Everyday Food and Drinks

A major growth opportunity in the functional mushroom market lies in their expanding use in everyday food and drinks. Functional mushrooms are now being added to products like coffee, tea, protein bars, soups, chocolates, and even bottled beverages.

This makes it easier for people to enjoy the health benefits of mushrooms without changing their eating habits. As consumers become more health-conscious, they are looking for convenient ways to include wellness ingredients in their daily routines.

Food and beverage companies are responding by launching new products with mushroom extracts and powders. This growing trend is expected to open many new opportunities for functional mushroom producers and brands, helping them reach more customers across both health and lifestyle product categories.

Latest Trends

Functional Mushrooms in Ready-to-Drink Beverages Rising

One of the latest trends in the functional mushroom market is the growing popularity of ready-to-drink (RTD) beverages made with mushroom extracts. More companies are launching wellness drinks that include functional mushrooms like Reishi, Cordyceps, or Lion’s Mane.

These drinks promise benefits such as better focus, improved energy, and stronger immunity, all in a convenient bottle or can. Busy consumers, especially younger ones, prefer grab-and-go drinks that support their health without the need for supplements or powders.

This trend combines natural health ingredients with modern lifestyle habits, making functional mushrooms more appealing and easier to consume. As demand for clean-label, plant-based, and functional drinks increases, mushroom-based RTD beverages are quickly gaining space on store shelves.

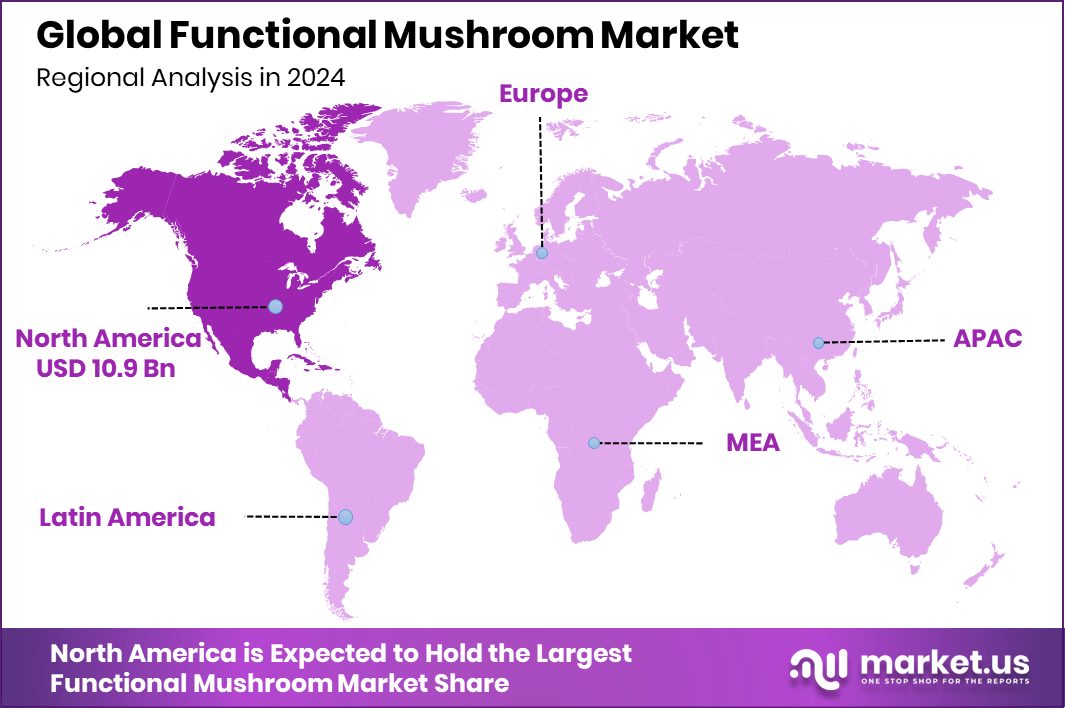

Regional Analysis

In 2024, North America dominated the Functional Mushroom Market with a 43.8% share.

In 2024, North America held the dominant position in the Functional Mushroom Market, capturing 43.8% of the total market share, which equated to a revenue of USD 10.9 billion. This strong market presence is supported by the increasing consumer demand for health-oriented food and beverage products, alongside the region’s well-established dietary supplement industry.

The United States, in particular, has shown robust growth in functional food consumption, driven by rising awareness about natural immunity boosters and stress-relieving products, where mushrooms like Reishi and Lion’s Mane are prominently used.

Other regions such as Europe, Asia Pacific, Latin America, and the Middle East & Africa are also active participants in this market; however, no specific percentage or value data has been provided for them.

While these regions contribute to the global market landscape, North America remains the clear leader based on the provided figures. Its dominance is further reinforced by advanced retail infrastructure, a strong presence of functional food brands, and a higher consumer willingness to spend on wellness products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Asia Pacific Farm Enterprises Inc. (Canada) gained recognition for cultivating high‑quality organic mushrooms—such as Shiitake, Oyster, Pom‑Pom, King, and Reishi—using pesticide‑free processes. Availability of fresh mushrooms year‑round supported its position within the functional mushroom ecosystem.

Concord Farms (USA), one of the larger gourmet mushroom growers and importers, served both fresh and processed functional mushroom markets. Operations in Half Moon Bay and distribution infrastructure positioned the company as a key regional supplier to the retail and foodservice sectors.

Half Hill Farm Inc. (USA), a small organic certified farm in Tennessee, specializes in dual‑extract products of Cordyceps, Lion’s Mane, Turkey Tail, Reishi, and Chaga. Its full‑spectrum extraction process using mature, certified wild or cultivated mushrooms under USDA and FDA oversight strengthened product quality and brand loyalty.

Hokkaido Reishi Co., Ltd. (Japan) was recognized among the key global players in the functional mushroom market, particularly within the Reishi segment. The company’s focus on innovation, partnerships, and scale in extraction and production supported its market visibility and influence in Asia Pacific and export markets.

Top Key Players in the Market

- Asia Pacific Farm Enterprises Inc.

- Concord Farms

- Half Hill Farm Inc.

- Hokkaido Reishi Co. Ltd.

- Lianfeng (Suizhou) Food Co. Ltd.

- M2 Ingredients

- Mitoku Company

- Monaghan Group

- Monterey Mushrooms Inc.

- Nammex

Recent Developments

- In February 2025, M2 Ingredients officially opened a new 155,000-square-foot functional mushroom growing facility in Vista, California. This expansion enabled them to cultivate ten premium organic mushroom species—including Lion’s Mane, Turkey Tail, Reishi, and Cordyceps—and fulfill orders rapidly while maintaining high quality standards.

- In January 2025, Half Hill Farm published findings showing that Chaga mushroom extract (Inonotus obliquus) can suppress oral cancer cell growth by disrupting energy metabolism pathways. The study was backed by the National Research Foundation and highlighted the extract’s action on signaling mechanisms such as AMPK, STAT3, p38 MAPK, and NF‑κB.

Report Scope

Report Features Description Market Value (2024) USD 24.9 Billion Forecast Revenue (2034) USD 66.4 Billion CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Reishi, Cordyceps, Lions Mane, Turkey Tail, Shiitake, Chaga, Others), By Form (Fresh, Dried, Powder, Capsules, Extracts), By Application (Food and Beverage, Dietary Supplements, Pharmaceutical, Others), By Distribution Channel (Supermarkets, Online, Specialty Stores, Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Asia Pacific Farm Enterprises Inc., Concord Farms, Half Hill Farm Inc., Hokkaido Reishi Co. Ltd., Lianfeng (Suizhou) Food Co. Ltd., M2 Ingredients, Mitoku Company, Monaghan Group, Monterey Mushrooms Inc., Nammex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Functional Mushroom MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Functional Mushroom MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Asia Pacific Farm Enterprises Inc.

- Concord Farms

- Half Hill Farm Inc.

- Hokkaido Reishi Co. Ltd.

- Lianfeng (Suizhou) Food Co. Ltd.

- M2 Ingredients

- Mitoku Company

- Monaghan Group

- Monterey Mushrooms Inc.

- Nammex